- About the Committee

- Audits this year

- JLARC Work leads to action

- Tax Preference Studies

- What's Coming in the Future

- View/Print entire report

The Legislature’s Performance Auditor

The Joint Legislative Audit and Review Committee (JLARC) is the Legislature’s performance auditor, working to make state government operations more effective, efficient, and accountable.

JLARC pursues its mission by conducting performance audits, program evaluations, sunset reviews, and other analyses at the direction of the Legislature. Based on these assignments, JLARC’s non-partisan staff auditors, under the direction of the Legislative Auditor, independently seek answers to audit questions and issue recommendations to improve performance.

During 2014, reports were presented by staff to the Committee covering a wide range of topics. This annual report provides examples of that work and work JLARC will undertake in the coming years.

JLARC Members

| Senators | Representatives |

|---|---|

| Randi Becker | Larry Haler |

| John Braun, Vice Chair | Ed Orcutt |

| Annette Cleveland | Gerry Pollet |

| David Frockt | Derek Stanford, Chair |

| Jeanne Kohl-Welles, Secretary | J.T. Wilcox |

| Mark Mullet | Hans Zeiger, Asst. Secretary |

| Ann Rivers |

| Legislative Auditor | Deputy Legislative Auditor |

|---|---|

| Keenan Konopaski | John Woolley |

JLARC’s peers applaud our work

Every three years, our work is reviewed by an external group of our peer professionals. With 72 years of collective experience, audit and evaluation professionals from Utah, Georgia, and Mississippi closely reviewed how we conduct our work and our products. They concluded that our work is professional, reliable, and independent; our conclusions are fair, balanced, and evidence based; and JLARC staff are competent professionals. Read the full peer review here.

Selected Work

DSHS not meeting timelines to determine if defendants are competent to stand trial

Defendants who are not mentally competent to stand trial cannot be prosecuted by the courts. DSHS performs competency evaluations and answers for the courts the competency question. Recognizing that evaluations were taking too long to complete, in 2012 the Legislature established specific targets for DSHS to meet, such as completing the evaluation within 7 days for defendants in jail. JLARC found DSHS is not meeting its targets.

Timely evaluations are important, and individuals awaiting them may face additional challenges if they are detained in jail or not receiving treatment. However, the audit also pointed out that the competency evaluation system involves multiple parties, with courts, jails, and DSHS ultimately responsible for ensuring a timely evaluation.

The Legislative Auditor recommended ways to improve the timeliness of evaluations. This included DSHS reviewing many of its internal procedures, as well as the need to improve collaboration between key system partners.

WSDOT can provide reliable long-term highway pavement cost estimates, but accuracy of bridge estimates is uncertain

JLARC’s analysis found that WSDOT’s cost estimates for long-term pavement needs are reliable. The agency’s cost estimates for bridges need improvement in assessing long-term needs. WSDOT could help ensure stakeholder confidence in its cost estimates for both pavement and bridges by establishing a routine and consistent cost estimating process.

|

|

|

|---|---|---|

Is the data accurate? |

Yes |

Yes |

Estimates include asset deterioration over time? |

Yes |

No |

Predict condition for different funding levels? |

Yes |

No. Predicted condition is not based on validated, quantitative analysis of bridge deterioration and the effectiveness of alternative treatments. |

Practices to minimize life cycle costs? |

Yes |

No |

Is risk included in estimate? |

Yes |

Partial |

Bottom line |

Developed using industry best practices, reliable. |

Not developed using best practices. JLARC’s consultants could not verify its accuracy. WSDOT’s estimate may be:

|

Regulating gas vapor emissions at gas stations: current regulations may be requiring outdated technology

Gasoline vapors that escape when filling up a car pose a risk to health and the environment. A type of gasoline vapor recovery equipment that many Washington gas stations are required to use may be outdated because of vapor recovery equipment that is now installed in cars.

In fact, interaction between the two types of equipment can actually increase emissions. The Environmental Protection Agency (EPA) recommends states analyze when the use of this equipment at gas stations will begin to increase gas vapor emissions.

The Legislative Auditor recommended that the Department of Ecology and the local clean air agencies conduct the EPA recommended analysis to estimate when current requirements will begin to increase emissions and assess any impacts this analysis may have on setting fees.

View all JLARC reports and 2013-15 Work Plan on JLARC's website

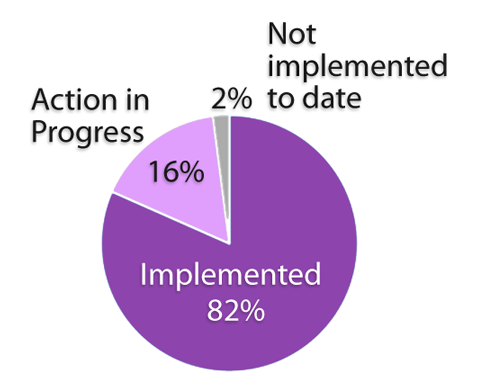

JLARC reports often contain recommendations to agencies to improve the efficiency and effectiveness of their operations. Between 2010 and 2013, JLARC issued 49 recommendations directly to state agencies. 98 percent of these recommendations have been implemented or are in the process of being implemented.

While the focus of JLARC’s work is usually the implementation of the Legislature’s policies by the executive branch, the Legislature may also respond to audits.

Evaluating higher education quality

In response to a JLARC report, the Legislature determined that the best way to evaluate the quality of education provided by the state’s colleges and universities was to look specifically at how many students complete their degrees.

Establishing performance expectations for tax preferences

JLARC’s tax preference analysis helped the Legislature determine that a need exists for clear statements on expected performance. JLARC staff developed a drafting guide for legislators use to help them in defining expectations and establishing ways to measure success.

JLARC staff help other legislators and stakeholders understand our work

JLARC staff are often asked to make presentations to explain our work to other interested groups. Recent topics reviewed with other committees and stakeholder groups included worker’s compensation, the costs of maintaining the state’s highways, and the effectiveness of tax preferences.

View all JLARC reports and 2013-15 Work Plan on JLARC's website

Ongoing Performance Review of Tax Preferences

In 2006, the Legislature charged JLARC and the Citizen Commission for Performance Measurement of Tax Preferences with reviewing the state’s tax preferences. Completed on a ten-year cycle, preferences include tax exemptions, tax deductions, and preferential tax rates.

The Pew Center on the States concluded Washington is one of only four states to integrate the evaluation of preferences into the policy process, ensuring that the investments are regularly reviewed. In its publications, the Pew Center often points to Washington’s efforts as a learning tool for state’s just starting the process of evaluating preferences.

The focus of the 2014 reviews were the preferences provided to the aerospace industry. JLARC analysts found that the policy objectives the Legislature sought when it established the preferences in 2003 are being achieved. However, it is unclear whether or not the preferences themselves actually caused changes in industry location and employment outcomes. Using a state-of-the-art econometric tool, JLARC analysts helped the Legislature evaluate the impacts of its policy choice by looking at three possible outcomes.

| Boeing sites 787 elsewhere and phases future assembly to other states | Boeing stays and adds new jobs for new assembly | Boeing stays but doesn’t add jobs specifically for new assembly | |

|---|---|---|---|

| Legislature does not approve preferences | Legislature approves preferences | Legislature approves preferences | |

| Aerospace job impacts | 47,977 jobs lost | 5,203 jobs gained | 572 jobs gained |

| Other private sector job impacts | 119,674 jobs lost | 10,664 jobs gained | 1,600 jobs lost |

| Public sector job impacts | 23,139 jobs lost | 1,264 jobs lost | 3,613 jobs lost |

| Total Impacts | 190,790 jobs lost | 14,603 jobs gained | 4,641 jobs lost |

View all work completed for the Citizen Commission on the Commission's website

What’s On the Horizon: 2015 and Beyond

At the Legislature’s direction, JLARC’s upcoming work will seek answers to the following topics:

What are Impacts of Public Recreation and Habitat Lands on County Economies?

Questions? Contact Rebecca Connolly: 360-786-5175; rebecca.connolly@leg.wa.gov

Are Worker’s Compensation Claims Managed Fairly, Timely, and Efficiently?

Questions? Contact John Bowden: 360-786-5298; john.bowden@leg.wa.gov

Are Select Tax Preferences Achieving their Intended Public Policy Purposes?

Questions? Contact Mary Welsh: 360-786-5193; mary.welsh@leg.wa.gov

Are K-12 Health Benefits Aligned with Legislative Goals?

Questions? Contact John Bowden: 360-786-5298; john.bowden@leg.wa.gov

What Are Impacts of Merging Part-Time Education Employees into the Health Benefits Exchange?

(Scope and Objectives not yet available)

Questions? Contact Eric Thomas: 360-786-5182; eric.thomas@leg.wa.gov

Is the Unemployment Insurance Training Program Improving Employment Outcomes?

Questions? Contact Ryan McCord: 360-786-5186; ryan.mccord@leg.wa.gov

What are Impacts of Higher Education Tuition on Access, Affordability, and Completions?

Questions? Contact John Bowden: 360-786-5298; john.bowden@leg.wa.gov