JLARC Preliminary Report: 2015 Tax Preference Performance Reviews

Fuel Used to Heat Chicken Houses; Chicken Bedding Materials | Sales & Use Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Est. Beneficiary Savings in 2015-17 Biennium |

|---|---|---|

These two preference provide sales and use tax exemptions to farmers that raise chickens to produce meat or eggs for sale for:

|

Sales & Use |

Gas exemption: $4.3 million Bedding exemption: $1 million |

| Public Policy Objective |

|---|

The Legislature did not state the public policy objectives. JLARC staff infer the policy objectives were:

|

| Recommendations |

|---|

| Legislative Auditor’s Recommendation: Review and Clarify

Because the two inferred objectives lead to different conclusions.

The Legislature may want to consider adding reporting or other accountability requirements that would provide better information on the use of this preference. Commissioner Recommendation: Available in October 2015 |

- What is the preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

Farmers who produce chickens for meat or eggs do not pay sales and use tax when they purchase:

- Propane or natural gas used to heat barns, sheds, or other similar structures used to house chickens; and

- Bedding materials such as wood shavings, straw, sawdust, or shredded paper, or other similar products used to collect and help remove chicken manure.

Qualifying farmers must produce the chickens or eggs for sale rather than for their own use.

JLARC staff previously reviewed a sales and use tax exemption provided to poultry farmers for purchases of poultry used in production in 2010.

Pre-2001

Farmers paid sales or use tax on purchases of propane and natural gas used to heat facilities that housed chickens raised as agricultural products. Farmers also paid sales or use tax on purchases of bedding materials used to help remove chicken manure.

2001

The Legislature enacted these two sales and use tax exemptions for: 1) propane and natural gas used to heat facilities that house chickens; and 2) for bedding materials used by chicken farmers to help remove chicken manure. The preferences have not been modified since enactment.

Washington’s Chicken Industry

According to the latest data, Washington was 17th in the nation in production value for eggs in 2013 and 24th in chicken meat production in 2012. The top poultry production area in the country is in the Southeast, with Georgia, Arkansas, Alabama, and the Carolinas being top producers for meat and eggs.

Chicken Meat Production

In 2012, 831 farms in Washington raised at least some chickens for sale. As of April 2015, there are 46 commercial chicken farms. These commercial farms raise birds from day-old chicks until they reach market weight, a 7 to 8 week cycle. These farmers supply two in-state commercial chicken meat processors: Draper Valley Farms in Mount Vernon and Foster Farms in Kelso.

Chicken production in the U.S. operates using a vertically integrated system, in which the processors own or control all of the elements of the supply chain. Chicks are raised on farms that operate under contract with chicken processors. The farms provide housing, equipment, utilities, and labor to grow the chickens. The processors own and provide the chicks, feed, transportation, and veterinary services, and pay the farmers, by the bird or by the pound, depending on the contract.

Washington’s chicken meat is generally sold and distributed fresh (rather than frozen) to large retailers, grocers, and restaurant chains on a regional, and to a lesser degree, a national basis. According to an industry representative, meat from Northwest chicken producers can be differentiated from that produced in the South (e.g., Georgia, Arkansas) in that the Washington product is generally antibiotic-free, organic, and cage-free.

In addition to the large commercial producers, smaller farms may produce chickens for local markets, such as farmers’ markets, butcher shops, and restaurants.

Egg Production

In 2012, 6,276 Washington farms produced eggs for sale. However Washington’s egg production is dominated by seven large commercial producers: Briarwood Farms (Rochester), National Food Corporation (Everett), Oakdell Egg Farms (Pasco), Rock Creek Farms (Bellingham), Stiebrs Farms (Yelm), Wilcox Farms (Roy), and Willamette Egg Farms (Moses Lake).

Washington’s large egg producers sell and distribute to large retailers, grocers, and others on a regional and sometimes a national market. Smaller egg producers might sell at local stores, farmers’ markets, or straight off their farms.

Chicken Meat Producers Use More Propane and Bedding than Egg Producers

Industry representatives note that fuel to heat chicken houses and bedding used to collect chicken manure are generally used by chicken meat producers, not farmers that raise chickens to lay eggs. Farmers raising chickens for meat must raise the chicks in a warm environment, starting at about 90 degrees and dropping to about 70 degrees when they are market weight. Farmers also must keep fresh bedding to ensure the birds’ health.

When these preferences were enacted in 2001, there were about 75 commercial chicken meat producers that supplied the two main Washington production facilities. As of April 2015, there are 46. According to research by the Pew Trust, this consolidation in the industry is occurring on a national level and is a function of economies of size.

What are the public policy objectives that provide a justification for these tax preferences? Is there any documentation on the purpose or intent of the tax preferences?

The Legislature did not state the public policy objectives for these preferences when it enacted them in the same bill. This bill was part of a larger “agricultural package” of bills in 2001.

Based on statements made by bill sponsors and other members during House floor debate and committee hearings, and also on proponent testimony during House committee hearings, JLARC staff infer the public policy objectives are to:

- Help Washington’s agriculture industry during a period when it was struggling.

- Bill sponsors and other members testified on the House floor and in committee hearings that Washington’s agricultural industry was “crippled” and “suffering” during a period of “tough economic times.” This preference, along with other agricultural industry preferences, would provide “immediate relief” to the agricultural industry.

- Industry proponents testified in both House and Senate committee hearings that farm revenues were down while costs were up. They noted that the propane to heat facilities and bedding are a sizable expenditure for their industry.

- Make Washington’s chicken industry more competitive by “leveling the playing field” with other chicken-producing states.

- The prime sponsor testified in a House committee hearing that she was “looking for equitable treatment” for Washington’s chicken industry to stay competitive with other states.

- Chicken meat industry representatives noted in House and Senate committee hearings that costs of production were increasing while their returns were diminishing. They stated Georgia and California, both top chicken producing states, had removed sales tax from propane and bedding in 1998 and 1999, respectively, putting Washington’s chicken producers at a competitive disadvantage due to higher production costs.

What evidence exists to show that the tax preferences have contributed to the achievement of any of these public policy objectives?

1. Help Washington’s agriculture industry when it was struggling

It is unclear whether the preference is meeting the inferred objective.

JLARC staff reviewed historic commodity prices for chicken meat and eggs, as well as historic prices for propane to determine what has happened with production costs and prices received since the preferences were enacted. Industry representatives noted that chicken meat producers use far more heat and bedding to raise their product than do egg producers. They also noted that most chicken producers use propane to heat their chicken houses rather than natural gas, so this review focuses on propane prices.

Propane prices continue to increase; bedding cost data not available

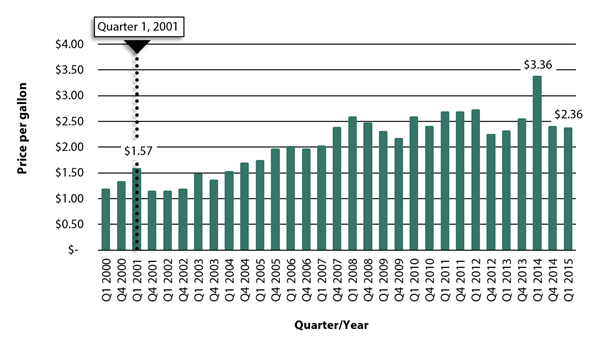

Data specifically for Washington farm propane prices is not available. National consumer-level propane price data reflects the price of propane has increased 50 percent since the preferences were enacted. In contrast, the Washington Consumer Price Index increased 33 percent from the same Quarter 1, 2001, through Quarter 1, 2015, time period. See Exhibit 1, below.

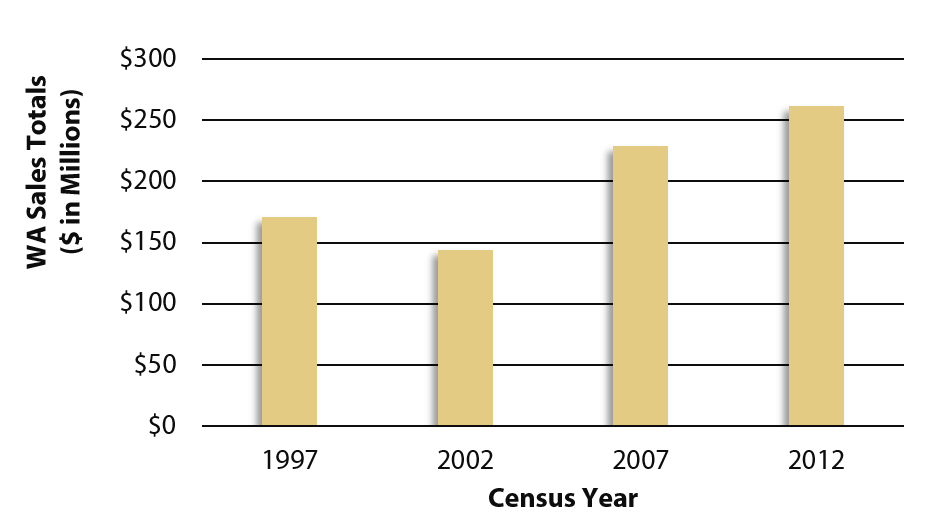

Sale Levels and Prices for Washington Chicken Meat and Eggs Are Up

Sales of Washington-grown chicken meat and eggs declined from 1997 to 2002, and then increased between 2002 to 2012. See Exhibit 2, below. This increase in sales took place at the same time the number of commercial chicken meat producers was declining, from 75 in 2001 to 46 in April 2015.

National data on demand for chicken meat and eggs shows an increased market for both. Annual per capita chicken meat consumption has increased from 76.6 pounds in 2001 to 83.4 in 2014. National egg consumption has also increased, from 253 eggs per person in 2001 to 263 eggs per person in 2014, the highest in 30 years.

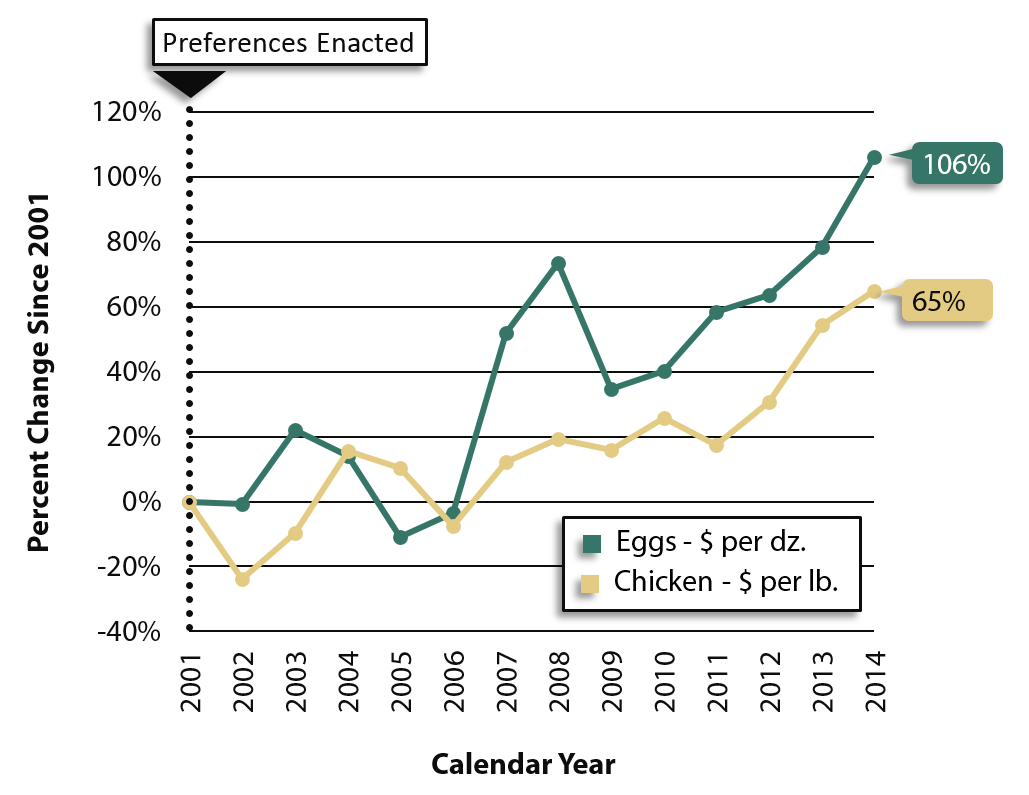

On a national level, the commodity prices received for eggs and chicken meat have both increased since 2001, reflecting an improved market for these commodities. Exhibit 3, below, charts the change in commodity prices for chicken meat and eggs in relation to those commodity prices as of 2001, when the preferences were enacted.

In summary, compared to the time when proponents of the preferences portrayed the industry as struggling, increases in chicken meat and egg sales and commodity prices have been larger than increases in propane costs. Product demand has increased as well, with more consumption of both products.

2. Make Washington’s Chicken Industry More Competitive by Leveling the Playing Field

The preference does make the taxation of propane and natural gas, and bedding materials used by Washington chicken and egg producers consistent with taxation in most major chicken and egg producing states. See Exhibit 7 in the Other States section. However, it is unclear if this makes Washington chicken producers more competitive with other states because of the concentration of large-scale chicken production in other parts of the country.

Unclear to What Degree Washington Eggs and Chickens Compete on the National Market

The most recent national data shows that Washington ranks 24th in chicken meat production and 17th in egg production. While Washington is not a national leader in chicken or egg production, it is a major producer on the West Coast, second to California in both chicken meat and egg production.

Industry representatives and state Department of Agriculture staff noted that most Washington-grown chicken meat and eggs sell in the Northwest regional market (including California). Chicken meat produced in Washington is less likely to be exported overseas. Only one percent of Washington-grown chickens are exported internationally, compared with about 19 percent nationally.

Washington’s annual broiler production is about 30 percent of the state’s estimated annual chicken meat consumption. Thus, the main competition faced by Washington producers is the meat produced in other major poultry production states that is brought into the state to make up the difference.

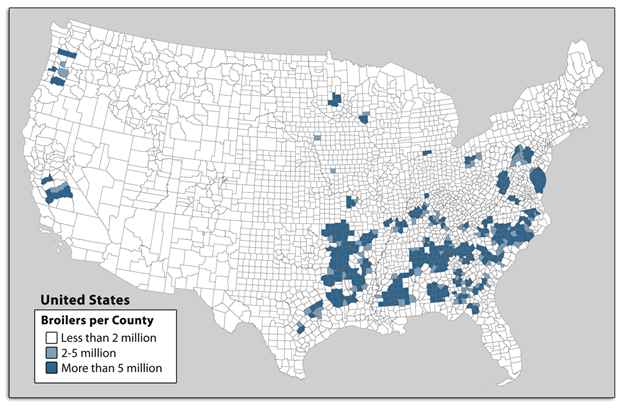

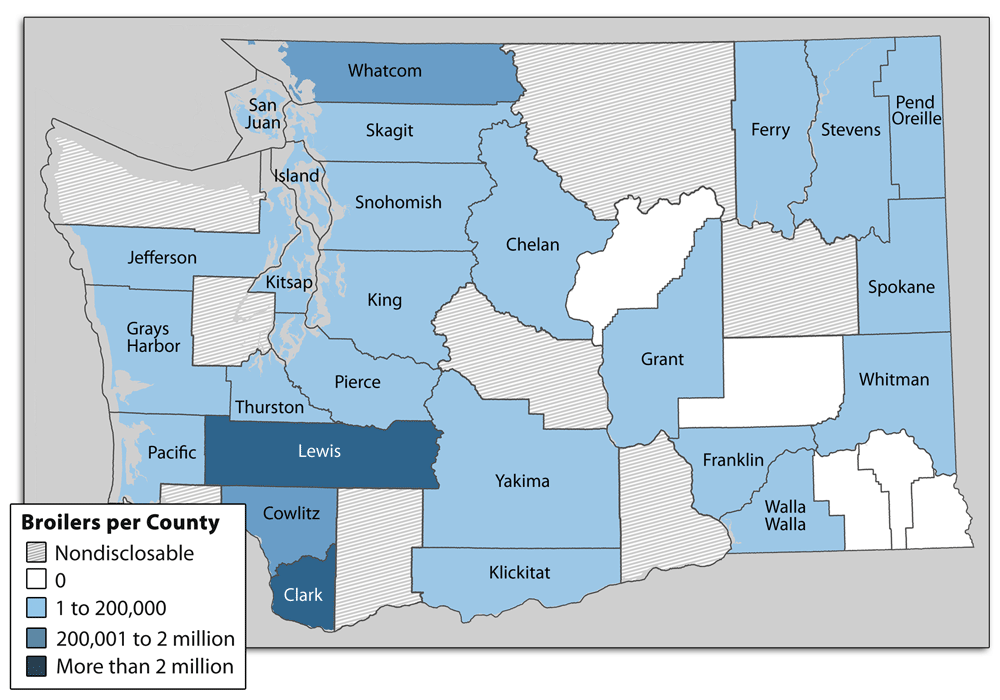

Source: JLARC staff analysis of U.S. Department of Agriculture, National Agricultural Statistics Service.

To what extent will continuation of the tax preference contribute to these public policy objectives?

It is unclear whether continuation of the preference would contribute to the inferred public policy objective of helping Washington’s agricultural industry when it was struggling. Washington’s chicken meat and egg production industry has seen sale and commodity price increases that exceed increases in propane costs.

Maintaining the preference will continue to contribute to the inferred public policy objective of making taxation in Washington consistent with other major poultry production states’ taxation of chicken house heating and bedding. However, it is not clear whether this has helped to make Washington more competitive nationally or regionally.

Who are the entities whose state tax liabilities are directly affected by the tax preferences?

Because there are no accountability reporting requirements, it is not possible to identify the beneficiaries of these preferences. Potential beneficiaries include farmers that raise chickens to produce eggs or chickens for meat, for the purpose of selling the eggs or meat. As shown in Exhibit 5, below, USDA data shows that Washington’s broiler production is concentrated in Western Washington.

While USDA 2012 Census data shows over 6,200 farms producing eggs for sale and about 830 farms producing meat for sale, the largest beneficiaries of these preferences are likely the 46 commercial chicken meat farmers in the state.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

There is no specific accountability reporting required for farmers using either of these tax preferences. JLARC staff estimated the beneficiary savings using industry estimates for expenditures for heating fuel for chicken houses and bedding as a percentage of gross production value.

JLARC staff estimate beneficiaries of the preference for propane and natural gas to heat chicken structures saved $2.3 million in Fiscal Year 2014 and will save $4.3 million in the 2015-17 Biennium. See Exhibit 6, below.

| Fiscal Year | Gas Purchases | State Sales Tax | Local Sales Tax | Total Beneficiary Savings |

|---|---|---|---|---|

| 2012 | $22,763,000 | $1,480,000 | $370,000 | $1,850,000 |

| 2013 | $27,280,000 | $1,773,000 | $460,000 | $2,233,000 |

| 2014 | $27,679,000 | $1,799,000 | $473,000 | $2,272,000 |

| 2015 | $25,330,000 | $1,646,000 | $442,000 | $2,088,000 |

| 2016 | $25,683,000 | $1,669,000 | $448,000 | $2,117,000 |

| 2017 | $25,059,000 | $1,694,000 | $455,000 | $2,148,000 |

| 2015-17 Biennium | $51,742,000 | $3,363,000 | $903,000 | $4,266,000 |

JLARC staff estimate beneficiaries of the preference for bedding materials saved $548,000 in Fiscal Year 2014 and will save over $1 million in the 2015-17 Biennium. See Exhibit 7, below.

| Fiscal Year | Bedding Purchases | State Sales Tax | Local Sales Tax | Total Beneficiary Savings |

|---|---|---|---|---|

| 2012 | $5,516,000 | $358,000 | $90,000 | $448,000 |

| 2013 | $6,551,000 | $426,000 | $110,000 | $436,000 |

| 2014 | $6,670,000 | $434,000 | $114,000 | $548,000 |

| 2015 | $6,180,000 | $402,000 | $108,000 | $510,000 |

| 2016 | $6,293,000 | $409,000 | $110,000 | $529,000 |

| 2017 | $6,413,000 | $417,000 | $112,000 | $529,000 |

| 2015-17 Biennium | $12,706,000 | $826,000 | $221,000 | $1,047,000 |

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the tax preference were terminated, chicken farmers would pay sales and use tax on their purchases of propane and natural gas to heat structures housing chickens and on purchases of bedding materials used to collect and help remove chicken manure.

The effect of these terminations on employment and the economy would depend on the extent to which chicken farmers could absorb the increased costs or pass them along to their customers. Egg and chicken meat farmers may be unable to pass along increased costs to their customers if the prices for their commodities are set in national or international markets. Industry sources note that Northwest (including Washington) producers work to differentiate their products somewhat from other regions in the country and so may not be complete price-takers.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

JLARC staff reviewed sales tax treatment for fuel used to heat chicken houses and bedding materials used to collect chicken manure in states that ranked in the top 20 for either egg or chicken production value in 2013. Because Washington competes on a more regional basis, JLARC staff also reviewed taxation of these items in Idaho and Oregon. As noted in Exhibit 8, below:

- Fuel to heat chicken houses is exempt from sales tax in every comparison state. Texas exempts propane from sales tax, and provides a sales tax exemption for natural gas used in poultry production.

- Bedding materials for use in poultry production are not subject to sales tax in 17 of the 22 states reviewed.

| State | U.S Production Value | Exempt? | ||

|---|---|---|---|---|

| Chicken Meat | Eggs | Fuel to Heat Chicken Houses |

Bedding Materials | |

| Washington | 24 | 17 | Yes | Yes |

| Georgia | 1 | 2 | Yes | Yes |

| Arkansas | 2 | 6 | Yes | Yes |

| North Carolina | 3 | 8 | Yes | Yes |

| Alabama | 4 | 9 | Yes | Yes |

| Mississippi | 5 | 12 | Yes | No |

| Texas | 6 | 7 | Propane not subject to sales tax; Natural gas exempt |

Yes |

| Kentucky | 7 | 18 | Yes | No |

| Maryland | 8 | 32 | Yes | Yes |

| South Carolina | 9 | 19 | Yes | No |

| Delaware | 10 | Not ranked | No sales tax | No sales tax |

| Oklahoma | 11 | 26 | Yes | Yes |

| Virginia | 12 | 25 | Yes | Yes |

| Missouri | 13 | 14 | Yes | Yes |

| Pennsylvania | 14 | 3 | Yes | Yes |

| Tennessee | 15 | 29 | Yes | Yes |

| Ohio | 16 | 4 | Yes | Yes |

| Florida | 17 | 16 | Yes | No |

| West Virginia | 18 | 34 | Yes | Yes |

| Minnesota | 19 | 13 | Yes | Yes |

| Wisconsin | 20 | 20 | Yes | Yes |

| Iowa | 26 | 1 | Yes | Yes |

| Oregon | 25 | 31 | No sales tax | No sales tax |

| Idaho | 44 | Not ranked | Yes | Yes |

RCW 82.08.910

Exemptions - Propane or natural gas to heat chicken structures.

(1) The tax levied by RCW 82.08.020 does not apply to sales to farmers of propane or natural gas used to heat structures used to house chickens. The propane or natural gas must be used exclusively to heat the structures. The structures must be used exclusively to house chickens that are sold as agricultural products.

(2) The exemption is available only when the buyer provides the seller with an exemption certificate in a form and manner prescribed by the department. The seller must retain a copy of the certificate for the seller's files.

(3) The definitions in this subsection apply to this section and RCW 82.12.910.

(a) "Structures" means barns, sheds, and other similar buildings in which chickens are housed.

(b) "Farmer" has the same meaning as provided in RCW 82.04.213.

(c) "Agricultural product" has the same meaning as provided in RCW 82.04.213.

[2001 2nd sp.s. c 25 § 3.]

RCW 82.12.910

Exemptions - Propane or natural gas to heat chicken structures.

(1) The provisions of this chapter do not apply with respect to the use by a farmer of propane or natural gas to heat structures used to house chickens. The propane or natural gas must be used exclusively to heat the structures used to house chickens. The structures must be used exclusively to house chickens that are sold as agricultural products.

(2) The exemption certificate, recordkeeping requirements, and definitions of RCW 82.08.910 apply to this section.

[2001 2nd sp.s. c 25 § 4.]

RCW 82.08.920

Exemptions - Chicken bedding materials.

(1) The tax levied by RCW 82.08.020 does not apply to sales to a farmer of bedding materials used to accumulate and facilitate the removal of chicken manure. The farmer must be raising chickens that are sold as agricultural products.

(2) The exemption is available only when the buyer provides the seller with an exemption certificate in a form and manner prescribed by the department. The seller must retain a copy of the certificate for the seller's files.

(3) The definitions in this subsection apply to this section and RCW 82.12.920.

(a) "Bedding materials" means wood shavings, straw, sawdust, shredded paper, and other similar materials.

(b) "Farmer" has the same meaning as provided in RCW 82.04.213.

(c) "Agricultural product" has the same meaning as provided in RCW 82.04.213.

[2001 2nd sp.s. c 25 § 5.]

RCW 82.12.920

Exemptions - Chicken bedding materials.

(1) The provisions of this chapter do not apply with respect to the use by a farmer of bedding materials used to accumulate and facilitate the removal of chicken manure. The farmer must be raising chickens that are sold as agricultural products.

(2) The exemption certificate, recordkeeping requirements, and definitions of RCW 82.08.920 apply to this section.

[2001 2nd sp.s. c 25 § 6.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor Recommendation: Review and Clarify

The Legislature should review and clarify what the public policy objective is for these tax preferences for chicken farmers because the two inferred objectives lead to different conclusions.

- If the public policy objective was to help chicken farmers at a time when agriculture was struggling, then the Legislature should consider whether assistance is still needed in light of increases in sales, and commodity prices relative to the increase in propane costs.

- If the public policy objective was to make the taxation of Washington chicken farmers more consistent with other states, that objective has been achieved. The taxation of propane and natural gas to heat chicken structures and bedding materials is similar to that of other states with which Washington competes.

The Legislature may want to consider adding reporting or other accountability requirements that would provide better information on the use of this preference.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

Available December 2015.

Available December 2015.

If applicable, will be available December 2015.