An updated version of this report is available.

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

| A tax credit to utilities to offset a portion of the public utility taxes they owe on their total annual sales. Utilities are eligible for the credit if they administer a program that provides payments to their customers who produce their own power with renewable energy systems. The tax credit is equal to the amount the utilities pay their customers for the power they generate, regardless of whether they use the power or it flows back into the power grid.

The preference is scheduled to expire June 30, 2021. |

Public Utility Tax

RCW 82.16.130 |

$55 million |

| Public Policy Objective |

|---|

The Legislature stated its intent for this preference was to provide incentives for:

|

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation

Review and Clarify: While there has been growth in locally made systems and associated opportunities for businesses, this growth is concentrated in a small number of solar energy system manufacturers. As part of the clarification, the Legislature should include targets for how many new local renewable energy systems it hopes to create and how much power capacity it hopes to generate through the use of this preference, as well as which local industries it would like to support. Commissioner Recommendation: Available in October 2016 |

The Legislature intended for this preference to provide an incentive for greater use of locally created renewable energy technologies. It also expressed intent to support and retain existing local industries and create new opportunities for renewable energy industries to develop in Washington.

The preference provides a tax credit to utilities to offset a portion of the public utility taxes (PUT) they owe on their total annual sales. Utilities are eligible for the credit if they administer a program that provides payments to their customers who produce their own power with renewable energy systems. The tax credit is equal to the amount the utilities pay their customers for the power they generate, regardless of whether they use the power or it flows back into the power grid.

There are several restrictions or caps on the amount of credit the utilities can receive:

If requests for payment from customers exceed the amount of funds available for the credit, the utilities must reduce the amount they pay their customers proportionately.

The table below illustrates how these caps would operate on different sized utilities:

|

Utility |

Annual

taxable power sales |

Total

allowable tax credit |

|

Specific

tax credit cap: utility-owned community solar

projects |

Specific

tax credit cap: company-owned community

solar projects |

|

Utility

A |

$5,000,000 |

$100,000 |

|

$25,000

|

$5,000

|

|

Utility

B |

$50,000,000 |

$250,000 |

|

$62,500

|

$12,500

|

|

Utility

C |

$500,000,000 |

$2,500,000 |

|

$625,000

|

$125,000

|

The right of utilities to earn tax credits expires June 30, 2020. This is the last date for customers to benefit from the preference. Credits may not be claimed by the utilities after June 30, 2021.

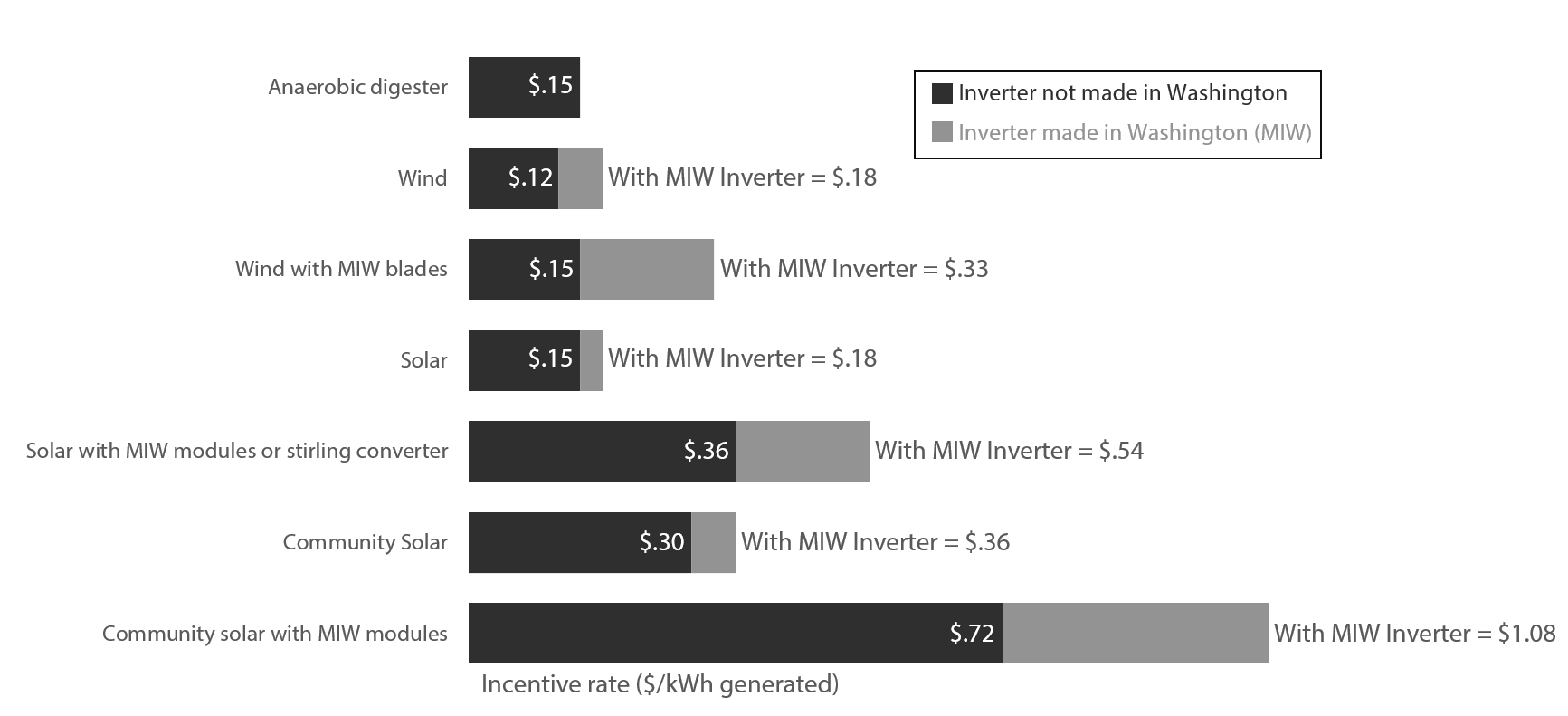

The Legislature established rates for utilities to pay their customers, and these rates vary by the type of renewable energy system and whether it is made in Washington. Eligible customers create their own power using wind, solar or certain anaerobic digesters. The digesters are systems that process manure from livestock into biogas.

Customers are also eligible for payment if they are part of a community solar energy project. These projects may be owned by utilities or companies, or they may be owned by individuals, households, or nonprofit organizations. For utility and company-owned projects, their respective ratepayers or company owners receive a portion of the payments made to the project from the utility. Community solar projects use solar energy to generate up to 75 kilowatts of power.

There are higher payment rates for solar energy than for other types of energy sources. There are also higher rates for certain system components that are certified as Made in Washington (MIW) by the Department of Revenue. These include:

Utility payments to individual customers and community solar project participants are limited to $5,000 per year.

The Legislature enacted two bills to encourage in-state production and use of renewable energy systems: one lowered the costs to consumers, and the other lowered the costs of manufacturing systems. The bill that lowered the costs to consumers is the focus of this review.

The Legislature created this credit for utilities and provided a cap on the amount of the credit equal to 0.25 percent of the utility’s taxable power sales or $25,000, whichever is greater. The Legislature also limited the amount utilities could pay each customer to $2,000 per year.

The credit is intended to offset payments the utility makes to customers who generate their own renewable energy. To qualify for the payments, customers must receive certification from the Department of Revenue (DOR). The certification indicates that their systems meet specified requirements and identifies if they contain parts made in Washington.

The bill also included a provision requiring DOR to report back to the Legislature by 2009 on the number of solar energy system manufacturing companies in the state, any change in the number of companies in the state, and the effect on job creation and the number of jobs created for Washington residents. The Legislature did not include targets for how many renewable energy systems, businesses or jobs it intended to create with the credit.

The bill included a 2015 expiration date for utilities to earn the credit, and a 2016 deadline for using it.

The other bill passed by the Legislature provided a reduced B&O tax rate for businesses manufacturing solar energy systems. JLARC staff is reviewing this tax preference in 2016.

The Legislature made significant changes, including:

The preference was also expanded to include community solar projects. Community solar projects were granted the highest base rate of $0.30 per kilowatt hour (kWh), and could constitute up to 25 percent of a utility’s total allowable credit.

The same year, DOR issued its report to the Legislature on the usage of the program, finding that both the number of participants in the program and the number of employees in the renewable energy sector had increased since the program’s inception.

The Legislature expanded the preference to include additional community solar projects. The expansion was for projects owned by certain kinds of companies. Company-owned community solar projects could constitute up to 5 percent of a utility’s total allowable credit.

At the same time, the Legislature placed limitations on all types of community solar projects, specifying that only systems with a capacity up to 75kW could qualify.

The bill reduced the maximum allowable credit for each utility from 1 percent of the utility’s taxable power sales to 0.5 percent of the utility’s taxable power sales.

Other preferences available for renewable energy generation include:

The Legislature stated its intent for this preference was to provide incentives for:

This preference was enacted prior to the Legislature’s requirement to provide a performance statement for each preference.

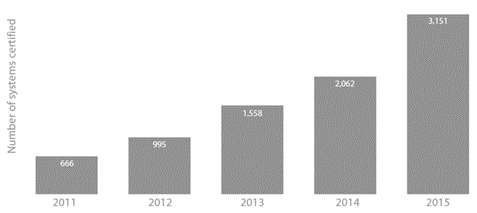

The number of renewable energy systems certified by the Department of Revenue (DOR) each year and the number of systems with Made in Washington components has increased. However, this growth is largely due to solar technologies with no increase in wind or anaerobic digesters.

In addition, since the credit began, four businesses have had their products certified as Made in Washington and one of those has discontinued its production.

There has been an increase in the use of some types of locally created renewable energy technologies since the preference began.

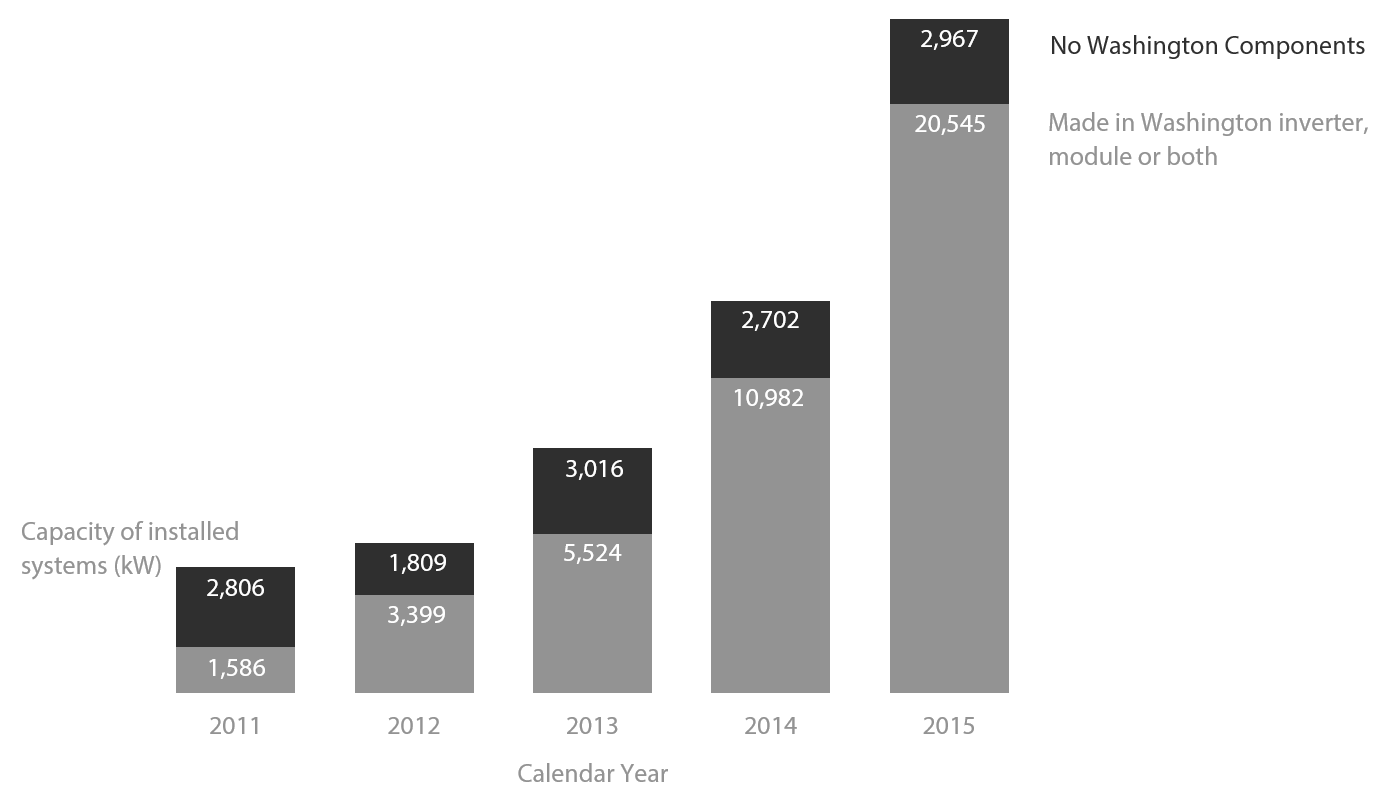

The number of renewable energy systems installed annually by utility customers and community solar project participants has increased nearly five times in the last five years, from 666 in 2011 to 3,151 in 2015. In addition, the average capacity of systems has increased, meaning more power is generated from each system. For residential systems, the average capacity size increased from 4.5 kilowatts in 2011 to 7.1 kilowatts in 2015.

The portion of systems that DOR has certified as “Made in Washington” has also increased each year since 2011. From 2011 through 2015, program participants have installed 55,360 kW (55 megawatts) of capacity. Over three quarters (76 percent) of that capacity is in systems containing components that are certified as Made in Washington. In addition, 79% of the number of systems contain components that are certified as Made in Washington.

The Legislature did not specify a target for the number of renewable energy systems it intends to create or for the amount of energy these systems should produce.

The increase in use of locally created renewable energy technologies is attributable to photovoltaic solar modules. These are devices that convert light directly into electricity using semiconductor material. Wind generation systems currently account for only 0.5 percent of systems installed and 0.4 percent of capacity. Unlike solar energy systems, the number of new wind system certifications has not increased over the time period that the preference has been in effect.

From 2011 through 2015, DOR has certified 195 kW of wind energy system capacity. No manufacturers have produced blades certified as Made in Washington. Customers using wind energy systems receive a lower payment rate from the utilities as well as a smaller benefit from buying Made in Washington certified components.

|

Type of System |

2011 |

2012 |

2013 |

2014 |

2015 |

|

Wind |

20 |

8 |

7 |

0 |

1 |

|

Solar |

646 |

987 |

1551 |

2062 |

3150 |

Since 2011 there have been no new certifications of anaerobic digesters through the program.

While the number of new locally made renewable energy system certifications has increased, it is unclear what type or amount of industry growth is expected.

The number of new system installations with Made in Washington components has grown steadily, from 316 in 2011 to 2,813 in 2015. This growth has provided expanded opportunities to Washington businesses in the renewable energy industry.

However, these opportunities have been almost entirely in solar energy systems, and concentrated in a small number of businesses.

Since the preference was enacted, four businesses have had their products certified as Made in Washington by the Department of Revenue.

No new manufacturers have gained certification since 2012, and there are no certified businesses for wind energy systems.

Continuation of the preference would mean utilities could continue to receive tax credits for payments they make to customers producing renewable energy. However, it is not clear to what extent these credits would continue to encourage new installations of renewable energy technology.

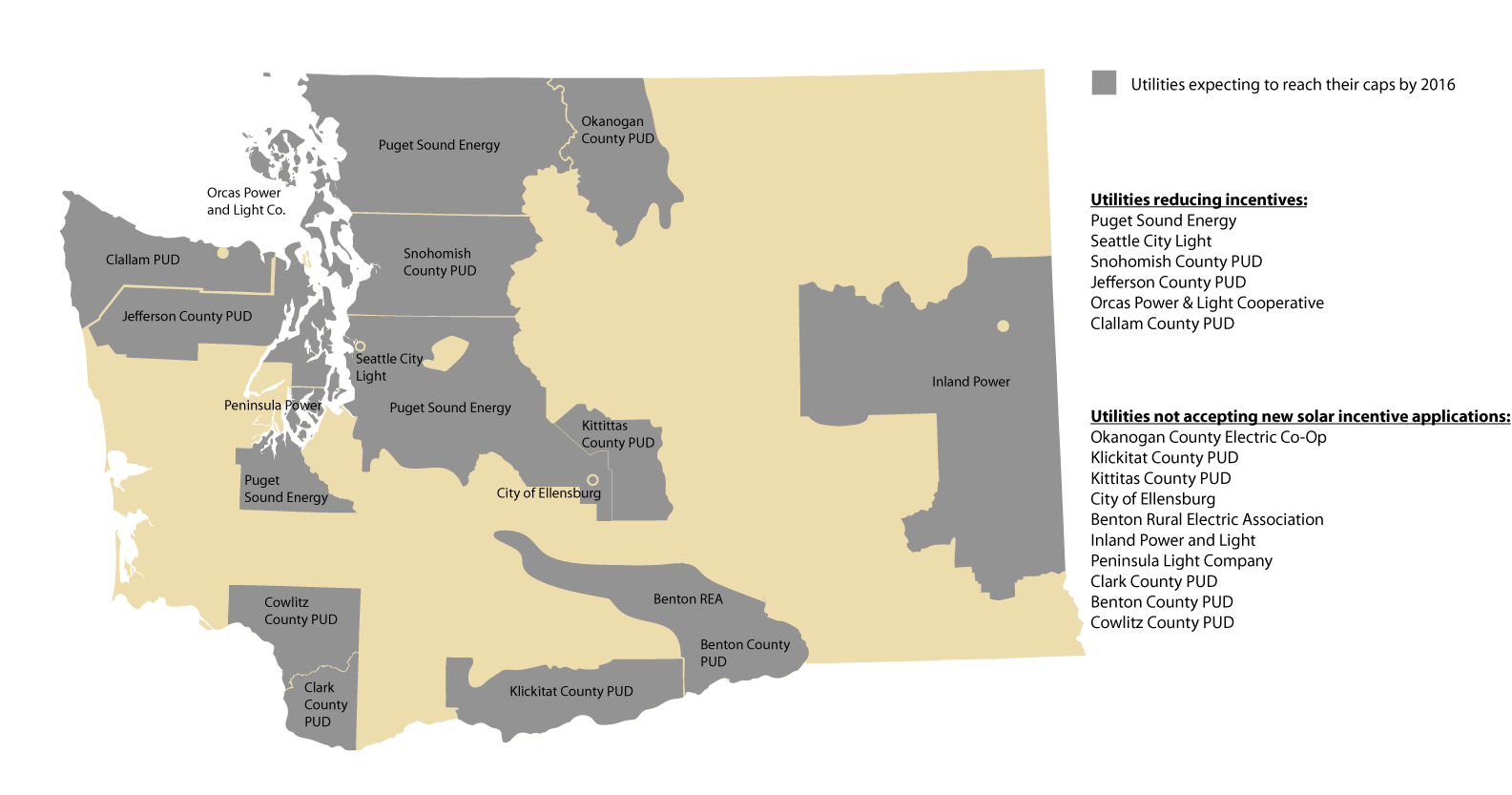

Utilities may claim up to $100,000 or 0.5 percent (whichever is greater) of their taxable sales of power each year as a credit. As of June 2016, the WSU Energy Extension Program reports that 16 of the 39 utilities receiving credits have announced to customers that they have already reached their caps or expect to within the next year. These utilities include four of the five largest in Washington, and serve approximately 71 percent of Washington utility customers. Of these 16 utilities,

The exhibit below shows the service areas of utilities that expect to reach their caps in 2016.

It is unknown what effect these reductions will have on new renewable energy system installations as the program continues.

It is possible there could be other approaches to encouraging the use of locally created renewable energy technology.

Based on the capacity installed from 2011 through 2015, the average incentive rate is about 45 cents per kilowatt hour of electricity generated by customers using their own renewable energy systems. This rate may vary in the future depending on what types of systems are installed and the number of customers affected by reduced payment rates from utilities nearing their cap.

It is difficult to determine if there is a less expensive alternative for encouraging the production of renewable energy because any incentive program will depend on varying factors, such as how long the incentive program will be in effect, how long the renewable energy systems will be in place, and how many consumers will purchase renewable energy regardless of the incentives offered.

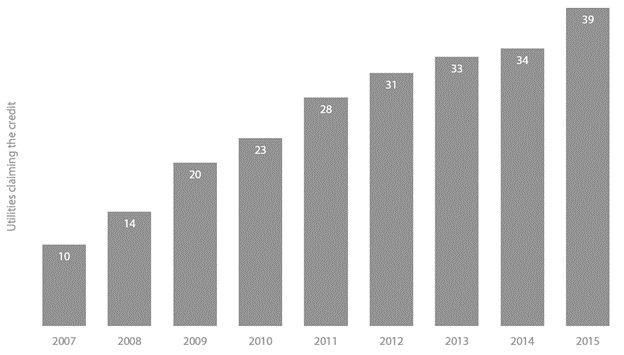

The direct beneficiaries of the preference are utilities that claim the tax credit. In 2015 there were 39 utilities out of approximately 60 statewide that claimed the preference. That number has increased each year since the program began. Three utilities are investor-owned, 12 are member-owned (such as mutuals and cooperatives) and 24 are public (such as cities and public utility districts).

The indirect beneficiaries of the preference are participants in the programs administered by the utilities. Participants receive payments from utilities based on the amount of power their renewable energy systems generate, regardless of whether they use the power or it flows back into the grid. Since 2011, the Department of Revenue (DOR) has certified 8,432 systems with a total capacity of 55,360 kW.

To the extent the preference increases the purchase of Washington-made technologies, the manufacturers of these technologies are also indirect beneficiaries. There are currently three businesses selling products that are certified Made in Washington by DOR.

While the statute did not mention installation work, there are a number of workers in Washington installing solar energy systems who may be indirect beneficiaries. The Solar Foundation estimates in its 2015 solar jobs census that Washington has 1,429 solar installation jobs.

The actual credit claimed by utilities in Fiscal Year 2015 was $8 million. JLARC staff estimate direct beneficiaries will save $55 million in the 2017-2019 Biennium. The amount claimed has increased by at least 78 percent each year since the credit was enacted. Estimates show the growth will slow as utilities reach their caps over the next several years.

|

Fiscal Year |

Estimated Credit amount |

|

2014* |

$4,000,000 |

|

2015* |

$8,000,000 |

|

2016 |

$14,000,000 |

|

2017 |

$22,000,000 |

|

2018 |

$27,000,000 |

|

2019 |

$28,000,000 |

|

2017-2019 Biennium |

$55,000,000 |

If the tax preference were eliminated, utilities would likely cancel their payment programs. The utilities would not incur any losses because the credit they receive is used to cover the cost of payments that would likely cease. Existing participants would no longer receive incentive payments for the renewable energy power they produce. It is unknown the effect this would have on new installations or the local renewable energy technology industry. The preference is currently scheduled to expire in 2020.

No other state offers a tax credit for utilities to encourage utility customers to buy locally created renewable energy technology.

Other states may use different approaches to incentivize these activities. For instance, since 2014, Minnesota has a Made in Minnesota Solar Incentive Program administered by the state’s Department of Commerce. The program has an annual budget of $15 million per year. Applicants are selected by lottery each year and the winners receive payments for each kilowatt-hour produced. Each participant may receive the payments for ten years.

Incentive rates are set by the Department annually and vary by manufacturer. The table below shows the incentive rates for 2016. Residential systems receive the highest rate for each product, and commercial for-profit entities receive the lowest rate.

|

Manufacturer |

Commercial For Profit <40kW |

NonProfit/Government <40kW |

Residential <10kW |

|

Silicon Energy |

$.23/kWh |

$.25/kWh |

$.30/kWh |

|

tenKsolar |

$.13/kWh |

$.15/kWh |

$.23/kWh |

|

Hiliene |

$.13/kWh |

$.15/kWh |

$.23/kWh |

|

Itek Energy |

$.18/kWh |

$.20/kWh |

$.27/kWh |

The Minnesota program is restricted to customers of three investor-owned utilities. The Minnesota Department of Commerce reports that its new projects selected in 2016 represent 5.7 Megawatts of capacity, for a total of 38 Megawatts of solar capacity statewide.

Findings—Intent—2005 c 300: "The legislature finds that the use of renewable energy resources generated from local sources such as solar and wind power benefit our state by reducing the load on the state's electric energy grid, by providing nonpolluting sources of electricity generation, and by the creation of jobs for local industries that develop and sell renewable energy products and technologies.

The legislature finds that Washington state has become a national and international leader in the technologies related to the solar electric markets. The state can support these industries by providing incentives for the purchase of locally made renewable energy products. Locally made renewable technologies benefit and protect the state's environment. The legislature also finds that the state's economy can be enhanced through the creation of incentives to develop additional renewable energy industries in the state.

The legislature intends to provide incentives for the greater use of locally created renewable energy technologies, support and retain existing local industries, and create new opportunities for renewable energy industries to develop in Washington state." [ 2005 c 300 § 1.]

(1) A light and power business shall be allowed a credit against taxes due under this chapter in an amount equal to investment cost recovery incentive payments made in any fiscal year under RCW 82.16.120. The credit shall be taken in a form and manner as required by the department. The credit under this section for the fiscal year may not exceed one-half percent of the businesses' taxable power sales due under RCW 82.16.020(1)(b) or one hundred thousand dollars, whichever is greater. Incentive payments to participants in a utility-owned community solar project as defined in RCW 82.16.110(2)(a)(ii) may only account for up to twenty-five percent of the total allowable credit. Incentive payments to participants in a company-owned community solar project as defined in RCW 82.16.110(2)(a)(iii) may only account for up to five percent of the total allowable credit. The credit may not exceed the tax that would otherwise be due under this chapter. Refunds shall not be granted in the place of credits. Expenditures not used to earn a credit in one fiscal year may not be used to earn a credit in subsequent years.

(2) For any business that has claimed credit for amounts that exceed the correct amount of the incentive payable under RCW 82.16.120, the amount of tax against which credit was claimed for the excess payments shall be immediately due and payable. The department shall assess interest but not penalties on the taxes against which the credit was claimed. Interest shall be assessed at the rate provided for delinquent excise taxes under chapter 82.32 RCW, retroactively to the date the credit was claimed, and shall accrue until the taxes against which the credit was claimed are repaid.

(3) The right to earn tax credits under this section expires June 30, 2020. Credits may not be claimed after June 30, 2021.

[ 2010 c 202 § 3; 2009 c 469 § 506; 2005 c 300 § 4.]

(1)(a) Any individual, business, local governmental entity, not in the light and power business or in the gas distribution business, or a participant in a community solar project may apply to the light and power business serving the situs of the system, each fiscal year beginning on July 1, 2005, for an investment cost recovery incentive for each kilowatt-hour from a customer-generated electricity renewable energy system.

(b) In the case of a community solar project as defined in RCW 82.16.110(2)(a)(i), the administrator must apply for the investment cost recovery incentive on behalf of each of the other owners.

(c) In the case of a community solar project as defined in RCW 82.16.110(2)(a)(iii), the company owning the community solar project must apply for the investment cost recovery incentive on behalf of each member of the company.

(2)(a) Before submitting for the first time the application for the incentive allowed under subsection (4) of this section, the applicant must submit to the department of revenue and to the climate and rural energy development center at the Washington State University, established under RCW 28B.30.642, a certification in a form and manner prescribed by the department that includes, but is not limited to, the following information:

(i) The name and address of the applicant and location of the renewable energy system.

(A) If the applicant is an administrator of a community solar project as defined in RCW 82.16.110(2)(a)(i), the certification must also include the name and address of each of the owners of the community solar project.

(B) If the applicant is a company that owns a community solar project as defined in RCW 82.16.110(2)(a)(iii), the certification must also include the name and address of each member of the company;

(ii) The applicant's tax registration number;

(iii) That the electricity produced by the applicant meets the definition of "customer-generated electricity" and that the renewable energy system produces electricity with:

(A) Any solar inverters and solar modules manufactured in Washington state;

(B) A wind generator powered by blades manufactured in Washington state;

(C) A solar inverter manufactured in Washington state;

(D) A solar module manufactured in Washington state;

(E) A stirling converter manufactured in Washington state; or

(F) Solar or wind equipment manufactured outside of Washington state;

(iv) That the electricity can be transformed or transmitted for entry into or operation in parallel with electricity transmission and distribution systems; and

(v) The date that the renewable energy system received its final electrical permit from the applicable local jurisdiction.

(b) Within thirty days of receipt of the certification the department of revenue must notify the applicant by mail, or electronically as provided in RCW 82.32.135, whether the renewable energy system qualifies for an incentive under this section. The department may consult with the climate and rural energy development center to determine eligibility for the incentive. System certifications and the information contained therein are subject to disclosure under RCW 82.32.330(3)(l).

(3)(a) By August 1st of each year application for the incentive must be made to the light and power business serving the situs of the system by certification in a form and manner prescribed by the department that includes, but is not limited to, the following information:

(i) The name and address of the applicant and location of the renewable energy system.

(A) If the applicant is an administrator of a community solar project as defined in RCW 82.16.110(2)(a)(i), the application must also include the name and address of each of the owners of the community solar project.

(B) If the applicant is a company that owns a community solar project as defined in RCW 82.16.110(2)(a)(iii), the application must also include the name and address of each member of the company;

(ii) The applicant's tax registration number;

(iii) The date of the notification from the department of revenue stating that the renewable energy system is eligible for the incentives under this section; and

(iv) A statement of the amount of kilowatt-hours generated by the renewable energy system in the prior fiscal year.

(b) Within sixty days of receipt of the incentive certification the light and power business serving the situs of the system must notify the applicant in writing whether the incentive payment will be authorized or denied. The business may consult with the climate and rural energy development center to determine eligibility for the incentive payment. Incentive certifications and the information contained therein are subject to disclosure under RCW 82.32.330(3)(l).

(c)(i) Persons, administrators of community solar projects, and companies receiving incentive payments must keep and preserve, for a period of five years, suitable records as may be necessary to determine the amount of incentive applied for and received. Such records must be open for examination at any time upon notice by the light and power business that made the payment or by the department. If upon examination of any records or from other information obtained by the business or department it appears that an incentive has been paid in an amount that exceeds the correct amount of incentive payable, the business may assess against the person for the amount found to have been paid in excess of the correct amount of incentive payable and must add thereto interest on the amount. Interest is assessed in the manner that the department assesses interest upon delinquent tax under RCW 82.32.050.

(ii) If it appears that the amount of incentive paid is less than the correct amount of incentive payable the business may authorize additional payment.

(4) Except for community solar projects, the investment cost recovery incentive may be paid fifteen cents per economic development kilowatt-hour unless requests exceed the amount authorized for credit to the participating light and power business. For community solar projects, the investment cost recovery incentive may be paid thirty cents per economic development kilowatt-hour unless requests exceed the amount authorized for credit to the participating light and power business. For the purposes of this section, the rate paid for the investment cost recovery incentive may be multiplied by the following factors:

(a) For customer-generated electricity produced using solar modules manufactured in Washington state or a solar stirling converter manufactured in Washington state, two and four-tenths;

(b) For customer-generated electricity produced using a solar or a wind generator equipped with an inverter manufactured in Washington state, one and two-tenths;

(c) For customer-generated electricity produced using an anaerobic digester, or by other solar equipment or using a wind generator equipped with blades manufactured in Washington state, one; and

(d) For all other customer-generated electricity produced by wind, eight-tenths.

(5)(a) No individual, household, business, or local governmental entity is eligible for incentives provided under subsection (4) of this section for more than five thousand dollars per year.

(b) Except as provided in (c) through (e) of this subsection (5), each applicant in a community solar project is eligible for up to five thousand dollars per year.

(c) Where the applicant is an administrator of a community solar project as defined in RCW 82.16.110(2)(a)(i), each owner is eligible for an incentive but only in proportion to the ownership share of the project, up to five thousand dollars per year.

(d) Where the applicant is a company owning a community solar project that has applied for an investment cost recovery incentive on behalf of its members, each member of the company is eligible for an incentive that would otherwise belong to the company but only in proportion to each ownership share of the company, up to five thousand dollars per year. The company itself is not eligible for incentives under this section.

(e) In the case of a utility-owned community solar project, each ratepayer that contributes to the project is eligible for an incentive in proportion to the contribution, up to five thousand dollars per year.

(6) If requests for the investment cost recovery incentive exceed the amount of funds available for credit to the participating light and power business, the incentive payments must be reduced proportionately.

(7) The climate and rural energy development center at Washington State University energy program may establish guidelines and standards for technologies that are identified as Washington manufactured and therefore most beneficial to the state's environment.

(8) The environmental attributes of the renewable energy system belong to the applicant, and do not transfer to the state or the light and power business upon receipt of the investment cost recovery incentive.

(9) No incentive may be paid under this section for kilowatt-hours generated before July 1, 2005, or after June 30, 2020.

[ 2011 c 179 § 3. Prior: 2010 c 202 § 2; 2010 c 106 § 103; 2009 c 469 § 505; 2007 c 111 § 101; 2005 c 300 § 3.]

The definitions in this section apply throughout this chapter unless the context clearly requires otherwise.

(1) "Administrator" means an owner and assignee of a community solar project as defined in subsection (2)(a)(i) of this section that is responsible for applying for the investment cost recovery incentive on behalf of the other owners and performing such administrative tasks on behalf of the other owners as may be necessary, such as receiving investment cost recovery incentive payments, and allocating and paying appropriate amounts of such payments to the other owners.

(2)(a) "Community solar project" means:

(i) A solar energy system that is capable of generating up to seventy-five kilowatts of electricity and is owned by local individuals, households, nonprofit organizations, or nonutility businesses that is placed on the property owned by a cooperating local governmental entity that is not in the light and power business or in the gas distribution business;

(ii) A utility-owned solar energy system that is capable of generating up to seventy-five kilowatts of electricity and that is voluntarily funded by the utility's ratepayers where, in exchange for their financial support, the utility gives contributors a payment or credit on their utility bill for the value of the electricity produced by the project; or

(iii) A solar energy system, placed on the property owned by a cooperating local governmental entity that is not in the light and power business or in the gas distribution business, that is capable of generating up to seventy-five kilowatts of electricity, and that is owned by a company whose members are each eligible for an investment cost recovery incentive for the same customer-generated electricity as provided in RCW 82.16.120.

(b) For the purposes of "community solar project" as defined in (a) of this subsection:

(i) "Company" means an entity that is:

(A)(I) A limited liability company;

(II) A cooperative formed under chapter 23.86 RCW; or

(III) A mutual corporation or association formed under chapter 24.06 RCW; and

(B) Not a "utility" as defined in this subsection (2)(b); and

(ii) "Nonprofit organization" means an organization exempt from taxation under 26 U.S.C. Sec. 501(c)(3) of the federal internal revenue code of 1986, as amended, as of January 1, 2009; and

(iii) "Utility" means a light and power business, an electric cooperative, or a mutual corporation that provides electricity service.

(3) "Customer-generated electricity" means a community solar project or the alternating current electricity that is generated from a renewable energy system located in Washington and installed on an individual's, businesses', or local government's real property that is also provided electricity generated by a light and power business. Except for community solar projects, a system located on a leasehold interest does not qualify under this definition. Except for utility-owned community solar projects, "customer-generated electricity" does not include electricity generated by a light and power business with greater than one thousand megawatt hours of annual sales or a gas distribution business.

(4) "Economic development kilowatt-hour" means the actual kilowatt-hour measurement of customer-generated electricity multiplied by the appropriate economic development factor.

(5) "Local governmental entity" means any unit of local government of this state including, but not limited to, counties, cities, towns, municipal corporations, quasi-municipal corporations, special purpose districts, and school districts.

(6) "Photovoltaic cell" means a device that converts light directly into electricity without moving parts.

(7) "Renewable energy system" means a solar energy system, an anaerobic digester as defined in RCW 82.08.900, or a wind generator used for producing electricity.

(8) "Solar energy system" means any device or combination of devices or elements that rely upon direct sunlight as an energy source for use in the generation of electricity.

(9) "Solar inverter" means the device used to convert direct current to alternating current in a solar energy system.

(10) "Solar module" means the smallest nondivisible self-contained physical structure housing interconnected photovoltaic cells and providing a single direct current electrical output.

(11) "Stirling converter" means a device that produces electricity by converting heat from a solar source utilizing a stirling engine.

[ 2011 c 179 § 2. Prior: 2010 c 202 § 1; 2010 c 106 § 225; 2009 c 469 § 504; 2005 c 300 § 2.]

The Legislature should review and clarify the preference because while there has been growth in locally made systems and associated opportunities for businesses, this growth is concentrated in a small number of solar energy system manufacturers. As part of the clarification, the Legislature should include targets for how many new local renewable energy systems it hopes to create and how much power capacity it hopes to generate through the use of this preference, as well as which local industries it would like to support.

Utilities can no longer earn tax credits after June 30, 2020. Credits may not be claimed after June 30, 2021.

Legislation Required: Yes.

Fiscal Impact: Depends on Legislative action.

Available December 2016.

Available December 2016.

If applicable, available December 2016.