An updated version of this report is available.

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

A sales and use tax exemption to qualifying businesses (data center owners) and tenants located in an eligible data center on their purchases of:

|

Sales & Use Tax

RCWs 82.08.986, and 82.12.986 |

$111.6 million |

| Public Policy Objective |

|---|

The Legislature established a specific public policy objective for this preference: to improve industry competitiveness through increased investment in data center construction in rural Washington counties. The legislation provided metrics for JLARC staff to analyze:

In addition, the Legislature included a “claw back” mechanism so that beneficiaries of the preference must create family-wage jobs or pay back the exempted sales or use taxes. |

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation

Continue: The Legislature should continue the data center sales and use tax exemption because the stated public policy objectives of increased rural property values and rural property taxes from investment in data center construction in rural Washington counties are being achieved. It is too early to tell whether data center businesses will comply with their job creation requirements. Commissioner Recommendation: Available in October 2016 |

The Legislature established this preference to improve industry competitiveness through increased investment in data centers in rural Washington counties.

Data centers are buildings constructed or refurbished to house working computer servers, with features including uninterruptible power supplies, sophisticated fire suppression and prevention systems, and enhanced physical security.

Qualifying businesses (data center owners) and tenants located in an eligible data center do not have to pay sales or use tax on their purchases of:

In order for a computer data center to be eligible, it must:

In order to receive the exemption, the data center owner or tenant must:

The data center owner or tenant may only use the exemption for a specified period of time, with the time period defined either by an end date set in statute or a certain number of years.

The sections below provide more detail on the requirements for the data centers and the owners and tenants, including the window of time these businesses have to use the sales and use tax exemption.

In order to be eligible, a data center must be in a rural county, of a certain size, and under construction by certain dates.

The data center must be in a rural county, which the Legislature defined as a county with a population density of less than 100 persons per square mile or a county smaller than 225 square miles. All Washington counties meet this definition except Benton, Clark, King, Kitsap, Pierce, Snohomish, Spokane, and Thurston counties.

The data center must be at least 100,000 square feet and have at least 20,000 square feet dedicated to housing working servers. The space must not have been previously dedicated for server use.

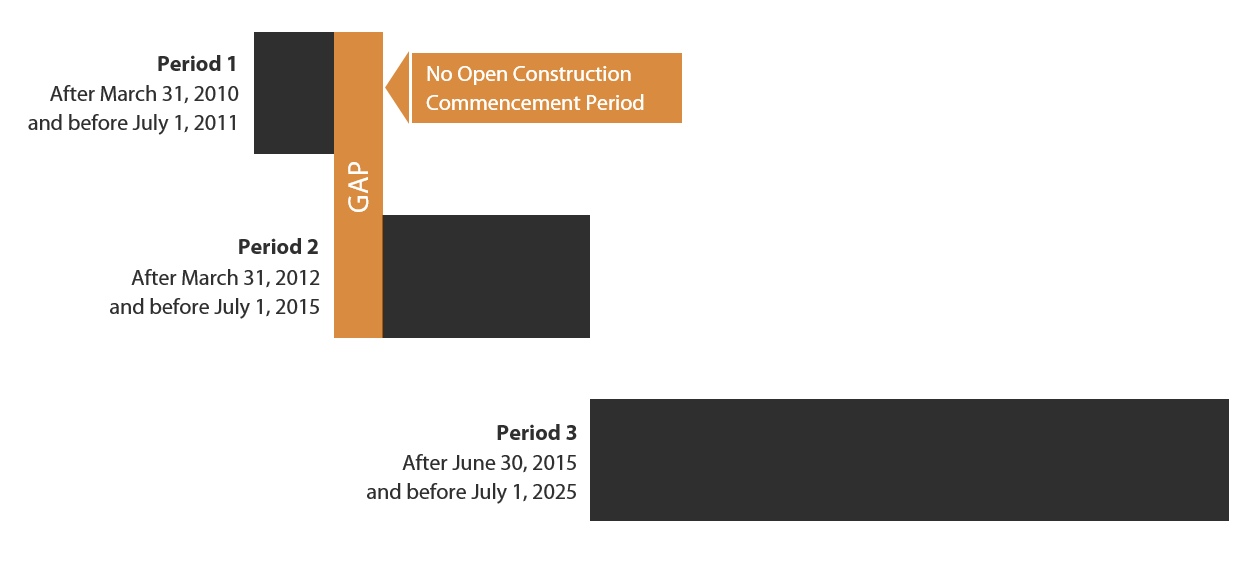

The Legislature created the preference in 2010 and then passed bills in 2012 and 2015 extending the dates for the preference. In each of these three bills, the Legislature established a time period within which construction of a data center has to begin in order for the owner or tenant to receive the preference. There are three time periods established in the three bills.

Note that there is a gap between the end of the first time period and the beginning of the second. A data center that began construction during that nine-month gap is not eligible for the preference.

In order to receive the preference, an owner or tenant must acquire an exemption certificate from DOR, have servers and power infrastructure installed and in use by certain dates, meet job creation requirements, and file reports with DOR.

To claim the exemption, data center owners or tenants must apply to the Department of Revenue for an exemption certificate.

In 2015, the Legislature capped the number of new data centers that may qualify for the preference at 12. The Legislature directed DOR to make the exemption available on a first-in-time basis based on the date the Department receives applications. An exemption certificate expires two years after the date of issuance if construction of the data center has not begun. Applicants must provide the building permit number for the data center and the date the building permit was issued. Applicants must also identify the square footage of the facility dedicated to housing servers or, in the case of tenants, the amount of server space leased.

An owner or tenant may not use this tax preference if the business is already using a different tax preference for its computer data center that allows a tax deferral for investment projects in distressed areas.

Depending on the construction time period, the business may make use of the exemption for only a specified period of time.

|

Construction

Commencement Period |

Data

Center Owner, Original Server Equipment |

Data

Center Owner, Replacement Server Equipment |

Tenant,

Original Server Equipment |

Tenant,

Replacement Server Equipment |

Data

Center Owner, |

|

|

Period 1 |

January 1, 2026* |

April 1, 2018 |

January 1, 2026* |

April 1, 2024 |

January 1, 2026* |

|

|

Period 2 |

January 1, 2026* |

April 1, 2024 |

January 1, 2026* |

April 1, 2024 |

January 1, 2026* |

|

|

Period 3 |

12 years from Date of COO |

12 years from Date of COO |

January 1, 2026* |

12 years from Date of COO |

January 1, 2026* |

|

Within six years after receiving the exemption certificate from DOR, businesses claiming the exemption must establish that net employment at the eligible data center has increased by a minimum of 35 family-wage jobs, or by three family-wage jobs for each 20,000 square feet of space newly dedicated to housing servers.

Statute defines a family-wage job as:

For tenants of a data center, the job creation requirement applies to the server space occupied by the tenant.

Statute includes a “claw back” provision related to the job creation requirement. A data center owner or tenant that does not meet the job creation requirement must pay the previously exempted sales and use taxes.

An owner or tenant claiming the preference must file reports stating beneficiary savings, the purchases that are exempt from sales tax, employment at the facility benefiting from the tax preference, and the wages paid and benefits offered to employees. This information is reported in the Annual Survey, the Annual Report, and a Buyer Addendum with the Department of Revenue.

Companies such as Microsoft, Yahoo, Intuit, and Ask.com located data centers in Grant County. In December, the Attorney General issued an opinion agreeing with DOR’s interpretation that data centers are not allowed to claim a sales tax preference for manufacturers because the companies’ data centers did not produce a product which is sold to the companies’ customers. Yahoo and Microsoft responded by ceasing construction on their data centers.

The Legislature considered a Governor-request bill for a sales and use tax remittance for the state share of the tax paid on replacement computer server equipment and labor and service charges for installation. The prime sponsor and others framed the bill as an economic development opportunity that extends the “new economy” to Eastern Washington. The bill did not pass.

The Legislature passed a bill requested by DOR to create this sales and use tax exemption for eligible server equipment and power infrastructure for eligible computer data centers. One month later, the Legislature amended the preference to also apply to lessees and defined “family wage jobs.”

The Legislature required businesses to commence construction on eligible projects between April 1, 2010, and July 1, 2011 to be eligible for the preference. It also established end dates for original equipment, replacement equipment, and power infrastructure.

Legislation to extend the tax preference was introduced but did not pass. The first construction commencement window ended July 1, 2011.

The Legislature extended the preference by adding a second construction commencement period to cover April 1, 2012 to July 1, 2015, and extending the expiration dates.

The Legislature again extended the preference by adding a third construction commencement period from July 1, 2015 to July 1, 2025.

The bill established a cap of eight for the number of eligible computer data centers commencing construction between June 30, 2015, and June 30, 2019; and a cap of 12 commencing construction between July 1, 2015, and July 1, 2025. The bill clarified that tenants of qualified data centers do not constitute additional data centers under the cap.

The amendment also extended the data center replacement equipment end date to 12 years after the certificate of occupancy.

Data center firms identify a number of factors that influence location decisions, such as energy costs and access to water.

The importance of energy costs is illustrated by power consumption of data centers nationwide. In 2013, data centers consumed an estimated 91 billion kilowatt-hours of electricity, approximately 2.4 percent of total U.S. consumption.

With the idling of Alcoa’s aluminum smelters in Washington, data centers are expected to become the state’s most power-consuming industry. To ensure stability in supply and pricing, data center firms can enter into purchasing agreements with utilities.

Data center cooling systems require large amounts of water – a 15-megawatt data center is estimated to consume 80-130 million gallons of water per year – and access to and cost of this resource is a factor as well. Finally, data centers require access to telecommunications infrastructure.

In addition to the availability of energy and water, there are other cost factors that may drive data center location decisions.

In December 2015, the research division of global real estate firm CBRE released a report comparing how data center cost factors rank across 30 U.S. markets. According to this report, on average, IT hardware and facility construction represent the majority of total data center project costs. Power costs and net state and local taxes are the next largest components, while combined land acquisition and labor costs account for the balance.

Based on these factors, CBRE ranked Quincy, in Grant County, among low-cost markets for data centers. Quincy is home to the majority of the beneficiaries claiming the preference. In its analysis, CBRE assumed before-tax IT-hardware costs to be constant across markets, while the other factors varied.

CBRE noted the availability of inexpensive renewable electricity supplied by two hydroelectric dams contributed to Quincy’s ranking as the lowest-cost power market in the United States, at 7 percent of total project cost. In terms of taxes, Quincy ranked near the national average, with sales taxes, real estate taxes, personal property taxes, and available incentives, representing an estimated 9 percent of total project cost. The tax figure includes the impact of this tax preference.

Although land represents the smallest expense component of data center projects, Quincy ranks on the low end of the markets evaluated, with land acquisition representing 0.5 percent of total project costs.

|

Category |

Percentage of Total

Costs |

|

|

National

Average |

Quincy |

|

|

IT Hardware |

36% |

41% |

|

Construction |

35% |

38% |

|

Power |

13% |

7% |

|

Taxes

(incl. incentives) |

9% |

9% |

|

Staffing |

5% |

6% |

|

Land |

2% |

0.5% |

In 2015, the Legislature established a specific public policy objective for this preference: to improve industry competitiveness through increased investment in data center construction. In addition, the Legislature included a “claw back” mechanism so that beneficiaries of the preference must create family-wage jobs or pay back the exempted sales or use taxes.

The 2015 Legislature included a tax preference performance statement for this preference. The Legislature declared that the public policy objective is to improve industry competitiveness through increased investment in data center construction in rural Washington counties.

The legislation provided metrics for JLARC staff to analyze:

The Legislature also included this direction: if a review finds that the rural county tax base is increased as a result of the construction of data centers eligible for the preference, the Legislature intends to extend the expiration date of the preference.

The 2015 legislation requires data center owners and tenants to create at least a minimum number of family-wage jobs in order to receive the sales and use tax exemption. Within six years after receiving the exemption certificate from the Department of Revenue, the businesses must establish that net employment at the data center has increased by a minimum of 35 family-wage jobs or by three family-wage jobs for each 20,000 square feet of space newly dedicated to housing servers.

The legislation also has requirements for wage levels and benefits. In order to qualify as a “family wage job,” data center employees must receive a wage at least 150 percent of the per capita personal income for the county in which the data center is located. The beneficiaries claiming the tax exemption have data centers in Grant and Douglas Countries, and based on data from the Bureau of Economic Analysis (BEA), family wage jobs in these counties would earn annual wages of approximately $51,600 and $49,900, respectively. Family wage jobs must also include health care coverage.

The Legislature included a “claw back” provision related to the job creation requirement. A data center owner or tenant that does not meet the job creation requirements must pay the previously exempted sales and use taxes.

The objective for increased investment in data centers in rural counties is being met. Businesses are investing in data centers in Grant and Douglas counties.

It is too early to assess whether businesses will comply with the job creation requirements.

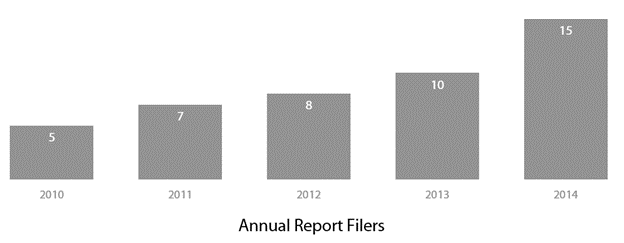

Owners and tenants are investing in data centers in rural counties. The number of businesses claiming the preference has grown from five in 2010 to 15 in 2014. Qualifying data centers reported dedicating nearly 1.24 million square feet of data center space to housing servers.

The Department of Revenue (DOR) reports that, as of February 2016, it has issued exemption certificates to 18 businesses, including two since July 2015. In addition, the same business may invest in more than one data center. Fifteen of these businesses have filed Annual Reports with DOR for 2014, the most recent year for with Annual Report data is available.

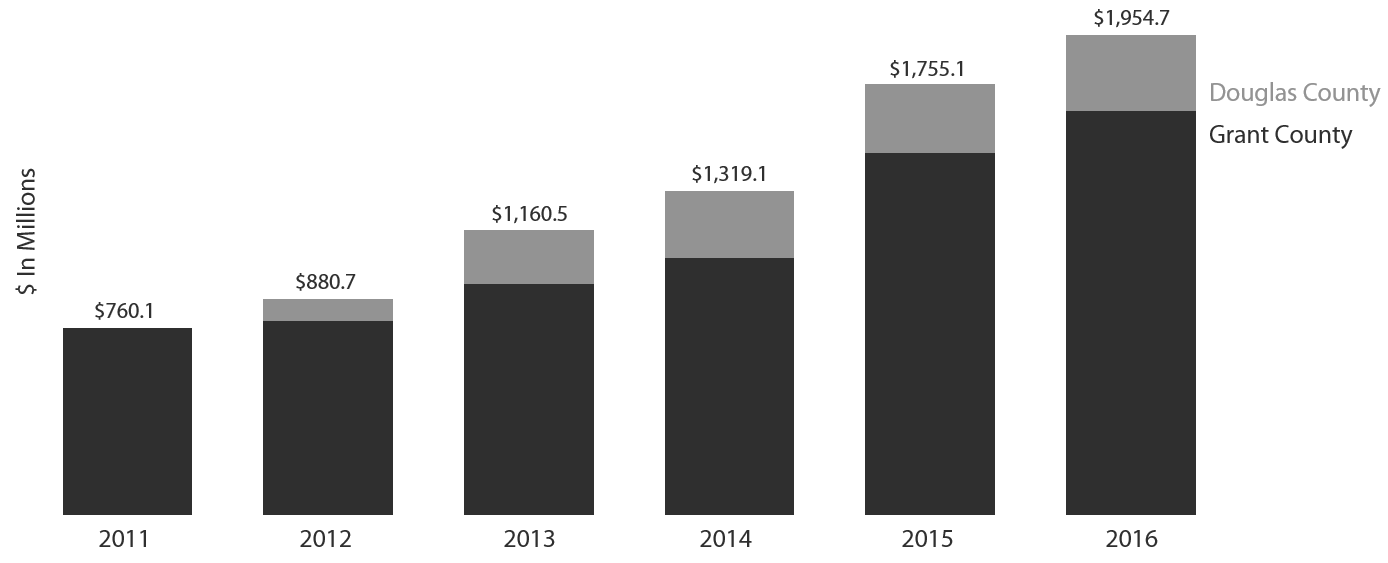

Data from the Grant and Douglas County Assessor’s offices indicates investment in data centers has increased real and personal property tax value in rural counties. Investment in data center properties has added nearly $1.2 billion to assessed tax values since 2011.

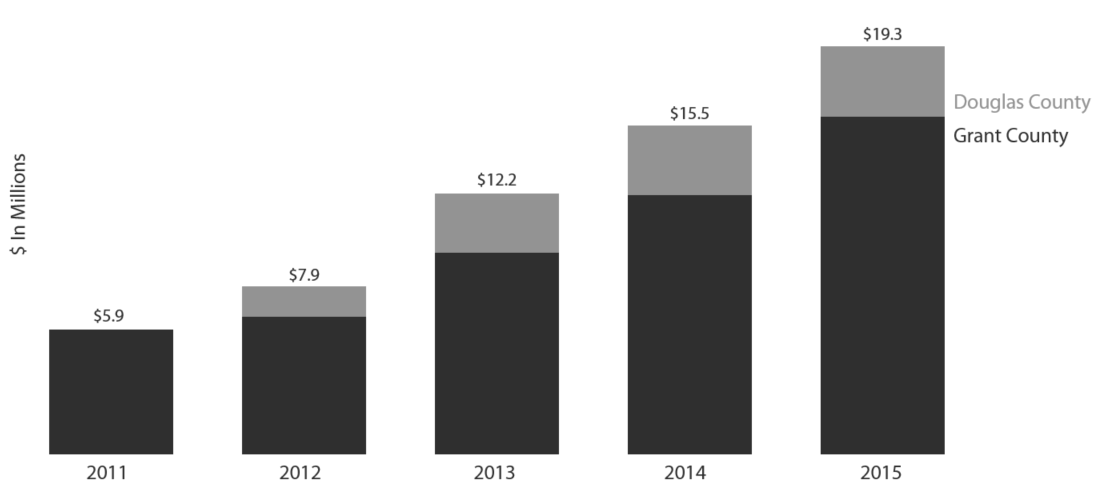

The increase in data center property value corresponds with an increase in property taxes paid on these properties. Property taxes paid on data center properties grew more than $13 million between 2011 and 2015.

JLARC staff estimate that, based on the applications for exemption certificates issued through September 2015, data centers claiming the preference would be required to create 260 jobs. Job creation targets are determined by a formula; beneficiaries must create the lesser of 35 family-wage jobs or three family-wage jobs per 20,000 square feet dedicated to housing servers.

Given the estimated five-year average beneficiary savings of $53.3 million per year, this number of jobs equates to an annual cost of $205,000 per job. It is too early to conclude whether businesses have complied with the job creation requirements.

The businesses have six years from the date DOR issues an exemption certificate to meet the requirements. The earliest that any business will reach the six-year deadline is May 2016.

DOR reports it is developing a process to examine the job, wage, and benefit information for beneficiaries as the six-year deadlines approach to see if each business has met its obligation to create family-wage jobs.

However, DOR considers the date on which the exemption certificates are issued to be confidential information, meaning the date on which a beneficiary must meet its job creation requirement cannot be disclosed.

Data from Annual Reports submitted by some of the beneficiaries allows for some additional limited analysis of job creation at beneficiary data centers. Data from 13 Annual Reports showed between 70 and 127 family-wage jobs, as estimated based on BEA data. The estimated job creation targets for these 13 beneficiaries is 111 jobs.

To the extent that the tax preference influences data centers to locate in rural Washington, continuation of the tax preference will contribute to the public policy objective of increasing investment in data center construction in rural counties. During the years that the tax preference has been available, the taxpayers that have claimed the preference have added to real and personal property tax rolls.

However, in addition to tax incentives, several other factors may affect data center location such as the cost of power and water availability. It is unclear to what extent the non-tax-incentive factors alone make Washington a favorable location for data centers.

Owners and tenants of data centers – buyers of eligible server equipment and eligible power infrastructure for computer data centers – are the direct beneficiaries of the tax preferences.

Through 2014, 15 firms have submitted Annual Reports to DOR as having claimed the tax preference. Eight of these are listed as qualifying businesses (data center owners), while the remaining seven are tenants. Twelve beneficiaries are in Grant County – nine in Quincy and three in Moses Lake. Another three beneficiaries are in East Wenatchee in Douglas County.

Various indirect beneficiaries likely exist, ranging from sellers of eligible equipment to businesses that install and service the equipment. It is also possible that there are indirect beneficiaries of any direct, indirect, and induced effects of the presence and operation of computer data centers in rural Washington counties. These include other property owners in the counties that could see their property tax assessments decline, as well as sellers of resources used by data centers.

The data center sales and use tax exemption is subject to various reporting requirements. In addition to both the Annual Report and the Annual Survey, data centers claiming the preference must submit a Buyer Addendum for any exempted purchases of data center equipment and power infrastructure. However, despite these requirements, several reporting issues complicate the estimate of beneficiary savings and make it more difficult to see if businesses are meeting their job creation requirements.

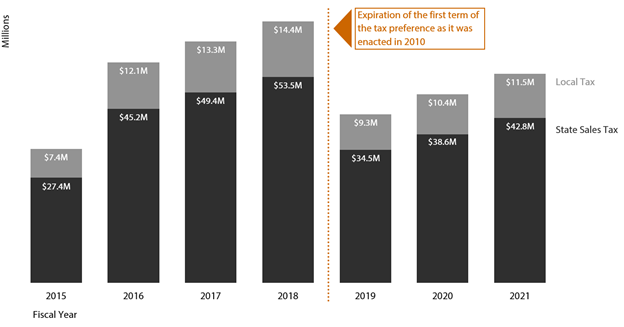

Direct beneficiaries saved an estimated $34.8 million in Fiscal Year 2015 and will save an estimated $111.6 million in the 2017-19 Biennium.

|

Fiscal

Year |

Estimated State Sales and Use Tax |

Estimated Local Sales Tax |

Total Estimated |

|

2015 |

$27,400,000 |

$7,400,000 |

$34,800,000 |

|

2016 |

$45,200,000 |

$12,100,000 |

$57,400,000 |

|

2017 |

$49,400,000 |

$13,300,000 |

$62,600,000 |

|

2018 |

$53,500,000 |

$14,400,000 |

$67,900,000 |

|

2019 |

$34,500,000 |

$9,300,000 |

$43,700,000 |

|

2017-19 Biennium |

$88,000,000 |

$23,600,000 |

$111,600,000 |

The savings estimate is based on the square footage of existing data centers that qualified under the preference as written before the 2015 extension and on the estimated impact of new data centers claiming the preference after the 2015 extension. It also uses assumptions from DOR on the number of servers purchased, replacement cycles and data center growth.

JLARC staff estimate that the data center businesses that have been granted an exemption certificate will have a combined job creation requirement of 260 jobs, based on the square footage of each facility dedicated to housing servers. The average estimated total beneficiary savings for fiscal years 2015-2019 is $53.3 million, which represents a cost of $205,000 per job that must be created.

The reduction in the estimated beneficiary savings in Fiscal Year 2019 results from the expiration of the first term of the tax preference as it was enacted in 2010. The beneficiary savings may resume growing after 2019 until the 2024 expiration date of the 2012 extension of the preference. This growth is illustrated in the out-year estimate of beneficiary savings. The 2015 extension of the tax preference imposed a cap on the number of data centers that may claim the preference, and it is possible that this cap may also limit growth in the beneficiary savings.

During committee hearings concerning the tax preference, proponents discussed the positive impact data centers could have on local economies in central Washington. They testified that such benefits could include increased property values, contributing to increased property tax revenue or lower property tax rates for other property owners.

Opponents of the preference questioned the value of benefiting a single community while forgoing state revenue that might pay for other services across the state.

Based on historic growth rates, JLARC staff estimated property taxes paid on data center properties could reach $22 million in FY 2016. JLARC staff compared this figure with estimated FY 2016 beneficiary savings, representing forgone state and local sales tax revenue.

The preference has resulted in property tax gains, but sales tax losses exceed the gains. For Fiscal Year 2016, the estimated state and local sales tax revenue losses exceed estimated state and local property tax gains by $35.4 million.

|

FY2015 |

FY2016 |

Estimated State Sales Tax

Revenue Loss

|

($27,400,000) |

($45,200,000)

|

Estimated Local Sales Tax

Revenue Loss

|

($7,400,000) |

($12,100,000)

|

Estimated State Property Tax Gain |

$3,400,000 |

$4,200,000

|

Estimated Local Property Tax Gain |

$14,100,000 |

$17,700,000

|

Estimated Net

Revenue Impact

|

($17,300,000) |

($35,400,000)

|

JLARC staff estimate that each data center job would have to support three additional jobs (a multiplier of 4) in order to offset the number of statewide jobs forgone because of the reduction in government sales tax revenues and spending.

Using the REMI model, JLARC staff estimated the net impact of the preference. (See the Technical Appendix for more information about the REMI model.)

Staff modeled a $55 million annual increase in government spending, which was the average of estimated beneficiary savings for fiscal years 2015 through 2027.

JLARC staff approximated various employment multipliers using the REMI model, including for the sector “data processing, hosting, related services, and other information services.” JLARC staff is unable to determine the extent to which this category is representative of the more narrowly defined data center jobs.

Further, the multiplier is approximated using a statewide model, and its applicability to a specific region in Washington is unclear as well.

|

Industry |

Multiplier |

|

Data processing, hosting,

related services, and other information services |

4.5 |

|

Support activities for

agriculture and forestry |

1.5 |

|

Retail trade |

1.9 |

|

Hospitals |

2.6 |

|

Other general purpose

machinery manufacturing |

1.5 |

|

Fruit and vegetable

preserving and specialty food manufacturing |

4.2 |

Terminating the tax preference would reinstate the sales and use tax on purchases of eligible data center equipment and power infrastructure. Purchasers of data center equipment would see an increase in the cost of such equipment.

It is unclear whether the other factors that make Washington a favorable data center location, such as access to inexpensive power and land, would be sufficient to maintain the current level of data center investment in the state.

In testimony to the Legislature, proponents of the tax preference indicated that, without the tax preference, firms may elect to locate data centers in other states that do offer tax preferences.

In its 2012 data center legislation, the Legislature acknowledged interstate competition and specifically mentioned Oregon, Arizona, North Carolina, South Carolina, North Dakota, Iowa, Virginia, Texas, and Illinois. The statement of intent added “[u]nprecedented incentives are available as a result of the desire of these states to attract investments that will serve as a catalyst for additional clusters of economic activity.” The incentives available in these states vary:

North Dakota also exempts the sale of software for use in data center from the sales and use tax. In addition to software purchases, North and South Carolina, and Texas also exempt purchases of electricity by data centers.

Other states may offer tax incentives specific to data centers, or more general economic-development tax incentives.

Finally, data centers can benefit from non-tax incentives such as grants or loans as part of economic development programs. For example, a county in Maryland offered an $810,000 conditional loan to an investment management organization to build a data center. The loan will be forgiven if the company meets employment and investment targets.

JLARC staff used Regional Economic Models, Inc.’s (REMI) Tax-PI software (v 1.7.105) to model the economic impacts for three tax preference reviews in the 2016 report: trade-ins, timber, and data centers.

REMI software is used by 34 state governments and dozens of private sector consulting firms, research universities, and international clients.

Tax-PI is an economic impact tool for evaluating the fiscal and economic effects and the demographic impacts of tax policy change. The software includes various features that make it particularly useful for analyzing the economic and fiscal impacts of tax preferences:

The REMI model accounts for the direct, indirect, and induced effects as they spread through the state’s economy, which allows users to simulate the full impact of tax policy change over time.

The REMI model produces year-by-year estimates of the total statewide effects of a tax policy change. Impacts are measured as the difference between a baseline economic and revenue forecast and the estimated economic and revenue effects after the policy change.

The REMI model is a macroeconomic impact model that incorporates aspects of four major economic modeling approaches: input-output, general equilibrium, econometric, and new economic geography. The foundation of the model, the inter-industry matrices found in the input-output models, captures Washington’s industry structure and the transactions between industries. Layered on top of this structure is a complex set of mathematical equations used to estimate how private industry, consumers, and state and local governments respond to a policy change over time.

While the model is complex and forecasting involves some degree of uncertainty, Tax-PI provides a tool for practitioners to simulate how tax policy and the resulting industry changes affect Washington’s economy, population, and fiscal situation.

This technical appendix describes the JLARC staff analysis of the employment impacts associated with Washington’s data center equipment sales and use tax preference. Staff used REMI’s Tax-PI program to perform a limited analysis of the employment effect of foregone state revenue, and to approximate employment multipliers of several industries that employ workers in central Washington. See Technical Appendix 1 for more detail about the REMI model.

JLARC staff used REMI’s Tax-PI model for two aspects of the analysis of the data centers tax preference. This section of the methodology first provides an overview of REMI’s Tax-PI model that was used in the analysis. The methodology then discusses the two approaches used to estimate potential employment effects of the tax preference. The first approach was to estimate the potential employment losses attributable to foregone government spending resulting from the cost of the tax preference. The second approach was to approximate the employment multipliers assumed within REMI of several economic sectors.

Tax-PI allows users to model policy changes and analyze the estimated impacts to the Washington economy, both in terms of economic activity and government finances. Prior to running modeling scenarios, users must make a series of choices about how to set-up the modeling environment by building a state budget and calibrating the model accordingly. JLARC staff used the November 2015 revenue estimates produced by the Economic and Revenue Forecast Council (ERFC) and budgeted expenditures for FY 2014 and 2015, as reported by the Legislative Evaluation and Accountability Program (LEAP) Committee. These data represent the final year of budget and revenue data in the model and serve as the “jump off” point for Tax-PI’s economic and fiscal estimates. Because Tax-PI is a forecasting tool, JLARC staff was unable to model the economic impact of the tax preference beginning in 2006.

In addition to establishing a budget and inputting expected revenue values, users must specify whether government expenditures are determined by demand or revenue. “By demand” imposes a level of government spending in future years that is necessary to maintain the same level-of-service as the final year in which budget data is entered whereas “by revenue” ties government expenditures to estimated changes in revenue collections.

Users may also elect to impose a balanced budget restriction or leave the model unconstrained. The balanced budget feedback forces revenue and expenditures to be equivalent and thus may impose some limitations on economic activity.

By setting expenditures to be determined by demand, users avoid making assumptions about how policymakers may alter spending priorities in the future. In addition, users essentially establish the current budget allocation as carry-forward levels for each expenditure category.

JLARC staff ran the reported scenario with expenditures set to be determined by demand and with the balanced budget feedback option turned on.

The REMI model comes with historical economic and demographic data back to 1990. Data are from federal government agencies such as the U.S. Census Bureau, U.S. Energy Information Administration, and the Bureau of Economic Analysis. As described above, current revenue and expenditure data for Washington comes from ERFC and LEAP, respectively. The data used to build the modeling scenario described below are from Department of Revenue (DOR) tax records and JLARC staff estimated beneficiary savings.

The first approach assumes that if the tax preference were repealed, the additional revenue that would be collected would be spent in the same proportions of current government spending. A simulation modeling an increase in government spending of $55 million, approximately the average estimated beneficiary savings for Fiscal Years 2015-19, predicts an increase of an average of 1,057 jobs above the baseline forecast. These jobs are split approximately evenly between the public and private sectors. Conversely, this can be viewed as the reduction in statewide employment resulting from the revenue cost of the tax preference.

| Units | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Avg. |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Gov’t Spending Inc. ($ Millions) | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 | $55.0 |

| Jobs | 1192 | 1260 | 1258 | 1223 | 1172 | 1117 | 1063 | 1010 | 964 | 924 | 885 | 851 | 822 | 1057 |

The second approach attempts to approximate the employment multiplier necessary for the jobs created at data centers to support sufficient other jobs in order to break even on an employment basis, when compared with the employment reductions estimated in the approach above. The estimated employment creation target for current approved beneficiaries of the tax preference is 260 jobs.

| Average Employment Change (2015-2027) – Increase Government Spending | 1,057 |

| Required Data Center Jobs based on Square Footage of Data Center Space | 260 |

| “Break-even” Employment Multiplier | 4.07 |

JLARC staff approximated various statewide employment multipliers using the REMI model. The analysis includes an employment multiplier for the sector “data processing, hosting, related services, and other information services.” There are two limitations to be aware of when examining the multiplier for this sector:

The following chart compares this employment multiplier with statewide multipliers approximated using REMI for industries that are major employers in Grant and Chelan/Douglas Counties. These multipliers were approximated by running simulations to increase employment in these sectors by 100. The multiplier is estimated by dividing the total employment increase by the increase in employment in the sector.

|

NAICS |

Industry |

Multiplier |

|

518, 519 |

Data processing, hosting, related services,

and other information services |

4.5 |

|

115 |

Support activities for agriculture and

forestry |

1.5 |

|

44-45 |

Retail trade |

1.9 |

|

622 |

Hospitals |

2.6 |

|

3339 |

Other general purpose machinery manufacturing |

1.5 |

|

3114 |

Fruit and vegetable preserving and specialty

food manufacturing |

4.2 |

This limited REMI analysis used data from the Department of Revenue’s 2016 Tax Exemption Study for the beneficiary savings estimate. Industries that are employers in Grant and Douglas Counties were identified from data reported by the Grant County Economic Development Council and the Port of Chelan County.

Intent—Finding—2012 2nd sp.s. c 6: "(1) It is the legislature's intent to encourage immediate investments in technology facilities that can provide an economic stimulus, sustain long-term jobs that provide living wages, and help build the digital infrastructure that can enable the state to be competitive for additional technology investment and jobs.

(2) There is currently an intense competition for data center construction and operation in many states including: Oregon, Arizona, North and South Carolina, North Dakota, Iowa, Virginia, Texas, and Illinois. Unprecedented incentives are available as a result of the desire of these states to attract investments that will serve as a catalyst for additional clusters of economic activity.

(3) Data center technology has advanced rapidly, with marked increases in energy efficiency. Large, commercial-grade data centers leverage the economies of scale to reduce energy consumption. Combining digitized processes with the economies of scale recognized at these data centers, today's enterprises can materially reduce the energy they consume and greatly improve their efficiency.

(4) The legislature finds that offering an exemption for server and related electrical equipment and installation will act as a stimulus to incent immediate investment. This investment will bring jobs, tax revenues, and economic growth to some of our state's rural areas." [2012 2nd sp.s. c 6 § 301.]

Existing rights, liabilities, or obligations—Effective dates—Contingent effective dates—2012 2nd sp.s. c 6: See notes following RCW 82.04.29005.

Effective date—2010 1st sp.s. c 23: See note following RCW 82.32.655.

Findings—Intent—2010 1st sp.s. c 23: See notes following RCW 82.04.220.

Intent—Finding—2010 1st sp.s. c 1: "(1) It is the legislature's intent to encourage immediate investments in technology facilities that can provide an economic stimulus, sustain long-term jobs that provide living wages, and help build the digital infrastructure that can enable the state to be competitive for additional technology investment and jobs.

(2) There is currently an intense competition for data center construction and operation in many states including: Oregon, Arizona, North and South Carolina, North Dakota, Iowa, Virginia, Texas, and Illinois. Unprecedented incentives are available as a result of the desire of these states to attract investments that will serve as a catalyst for additional clusters of economic activity.

(3) Since the economic downturn, Washington has not succeeded in attracting any private investments in these centers after siting six major data centers between 2004 and 2007.

(4) Data center technology has advanced rapidly, with marked increases in energy efficiency. Large, commercial-grade data centers leverage the economies of scale to reduce energy consumption. Combining digitized processes with the economies of scale recognized at these data centers, today's enterprises can materially reduce the energy they consume and greatly improve their efficiency.

(5) The legislature finds that a fifteen-month window that offers an exemption for server and related electrical equipment and installation will act as a stimulus to incent immediate investment. This investment will bring jobs, tax revenues, and economic growth to some of our state's rural areas." [2010 1st sp.s. c 1 § 1.]

Tax preference performance statement—2015 3rd sp.s. c 6 §§ 302 and 303: "This section is the tax preference performance statement for the sales and use tax exemption contained in sections 302 and 303 of this act. This performance statement is only intended to be used for subsequent evaluation of the tax preferences in sections 302 and 303 of this act. It is not intended to create a private right of action by any party or be used to determine eligibility for preferential tax treatment.

(1) The legislature categorizes this sales and use tax exemption as one intended to improve industry competitiveness, as indicated in RCW 82.32.808(2)(b).

(2) It is the legislature's specific public policy objective to improve industry competitiveness. It is the legislature's intent to provide a sales and use tax exemption on eligible server equipment and power infrastructure installed in eligible computer data centers, charges made for labor and services rendered in respect to installing eligible server equipment, and for construction, installation, repair, alteration, or improvement of eligible power infrastructures in order to increase investment in data center construction in rural Washington counties, thereby adding real and personal property to state and local property tax rolls, thereby increasing the rural county tax base.

(3) If a review finds that the rural county tax base is increased as a result of the construction of computer data centers eligible for the sales and use tax exemption in sections 302 and 303 of this act, then the legislature intends to extend the expiration date of the tax preference.

(4) In order to obtain the data necessary to perform the review in subsection (3) of this section, the joint legislative audit and review committee may refer to data available from the department of revenue regarding rural county property tax assessments." [2015 3rd sp.s. c 6 § 301.]

Effective dates—2015 3rd sp.s. c 6: See note following RCW 82.04.4266.

Exemptions—Eligible server equipment.

(1) An exemption from the tax imposed by RCW 82.08.020 is provided for sales to qualifying businesses and to qualifying tenants of eligible server equipment to be installed, without intervening use, in an eligible computer data center, and to charges made for labor and services rendered in respect to installing eligible server equipment. The exemption also applies to sales to qualifying businesses and to qualifying tenants of eligible power infrastructure, including labor and services rendered in respect to constructing, installing, repairing, altering, or improving eligible power infrastructure.

(2)(a) In order to claim the exemption under this section, a qualifying business or a qualifying tenant must submit an application to the department for an exemption certificate. The application must include the information necessary, as required by the department, to determine that a business or tenant qualifies for the exemption under this section. The department must issue exemption certificates to qualifying businesses and qualifying tenants. The department may assign a unique identification number to each exemption certificate issued under this section.

(b) A qualifying business or a qualifying tenant claiming the exemption under this section must present the seller with an exemption certificate in a form and manner prescribed by the department. The seller must retain a copy of the certificate for the seller's files.

(c) With respect to computer data centers for which the commencement of construction occurs after July 1, 2015, but before July 1, 2019, the exemption provided in this section is limited to no more than eight computer data centers, with total eligible data centers provided under this section limited to twelve from July 1, 2015, through July 1, 2025. Tenants of qualified data centers do not constitute additional data centers under the limit. The exemption is available on a first-in-time basis based on the date the application required under this section is received by the department. Exemption certificates expire two years after the date of issuance, unless construction has been commenced.

(3)(a) Within six years of the date that the department issued an exemption certificate under this section to a qualifying business or a qualifying tenant with respect to an eligible computer data center, the qualifying business or qualifying tenant must establish that net employment at the eligible computer data center has increased by a minimum of:

(i) Thirty-five family wage employment positions; or

(ii) Three family wage employment positions for each twenty thousand square feet of space or less that is newly dedicated to housing working servers at the eligible computer data center. For qualifying tenants, the number of family wage employment positions that must be increased under this subsection (3)(a)(ii) is based only on the space occupied by the qualifying tenant in the eligible computer data center.

(b) In calculating the net increase in family wage employment positions:

(i) The owner of an eligible computer data center, in addition to its own net increase in family wage employment positions, may include:

(A) The net increase in family wage employment positions employed by qualifying tenants; and

(B) The net increase in family wage employment positions described in (c)(ii)(B) of this subsection (3).

(ii)(A) Qualifying tenants, in addition to their own net increase in family wage employment positions, may include:

(I) A portion of the net increase in family wage employment positions employed by the owner; and

(II) A portion of the net increase in family wage employment positions described in (c)(ii)(B) of this subsection (3).

(B) The portion of the net increase in family wage employment positions to be counted under this subsection (3)(b)(ii) by each qualifying tenant must be in proportion to the amount of space in the eligible computer data center occupied by the qualifying tenant compared to the total amount of space in the eligible computer data center occupied by all qualifying tenants.

(c)(i) For purposes of this subsection, family wage employment positions are new permanent employment positions requiring forty hours of weekly work, or their equivalent, on a full-time basis at the eligible computer data center and receiving a wage equivalent to or greater than one hundred fifty percent of the per capita personal income of the county in which the qualified project is located. An employment position may not be counted as a family wage employment position unless the employment position is entitled to health insurance coverage provided by the employer of the employment position. For purposes of this subsection (3)(c), "new permanent employment position" means an employment position that did not exist or that had not previously been filled as of the date that the department issued an exemption certificate to the owner or qualifying tenant of an eligible computer data center, as the case may be.

(ii)(A) Family wage employment positions include positions filled by employees of the owner of the eligible computer data center and by employees of qualifying tenants.

(B) Family wage employment positions also include individuals performing work at an eligible computer data center as an independent contractor hired by the owner of the eligible computer data center or as an employee of an independent contractor hired by the owner of the eligible computer data center, if the work is necessary for the operation of the computer data center, such as security and building maintenance, and provided that all of the requirements in (c)(i) of this subsection (3) are met.

(d) All previously exempted sales and use taxes are immediately due and payable for a qualifying business or qualifying tenant that does not meet the requirements of this subsection.

(4) A qualifying business or a qualifying tenant claiming an exemption under this section or RCW 82.12.986 must complete an Annual Report with the department as required under RCW 82.32.534.

(5)(a) The exemption provided in this section does not apply to:

(i) Any person who has received the benefit of the deferral program under chapter 82.60 RCW on: (A) The construction, renovation, or expansion of a structure or structures used as a computer data center; or (B) machinery or equipment used in a computer data center; and

(ii) Any person affiliated with a person within the scope of (a)(i) of this subsection (5).

(b) If a person claims an exemption under this section and subsequently receives the benefit of the deferral program under chapter 82.60 RCW on either the construction, renovation, or expansion of a structure or structures used as a computer data center or machinery or equipment used in a computer data center, the person must repay the amount of taxes exempted under this section. Interest as provided in chapter 82.32 RCW applies to amounts due under this section until paid in full.

(6) The definitions in this subsection apply throughout this section unless the context clearly requires otherwise.

(a) "Affiliated" means that one person has a direct or indirect ownership interest of at least twenty percent in another person.

(b) "Building" means a fully enclosed structure with a weather resistant exterior wall envelope or concrete or masonry walls designed in accordance with the requirements for structures under chapter 19.27 RCW. This definition of "building" only applies to computer data centers for which commencement of construction occurs on or after July 1, 2015.

(c)(i) "Computer data center" means a facility comprised of one or more buildings, which may be comprised of multiple businesses, constructed or refurbished specifically, and used primarily, to house working servers, where the facility has the following characteristics: (A) Uninterruptible power supplies, generator backup power, or both; (B) sophisticated fire suppression and prevention systems; and (C) enhanced physical security, such as: Restricted access to the facility to selected personnel; permanent security guards; video camera surveillance; an electronic system requiring passcodes, keycards, or biometric scans, such as hand scans and retinal or fingerprint recognition; or similar security features.

(ii) For a computer data center comprised of multiple buildings, each separate building constructed or refurbished specifically, and used primarily, to house working servers is considered a computer data center if it has all of the characteristics listed in (c)(i)(A) through (C) of this subsection (6).

(iii) A facility comprised of one building or more than one building must have a combined square footage of at least one hundred thousand square feet.

(d) "Electronic data storage and data management services" include, but are not limited to: Providing data storage and backup services, providing computer processing power, hosting enterprise software applications, and hosting web sites. The term also includes providing services such as email, web browsing and searching, media applications, and other online services, regardless of whether a charge is made for such services.

(e)(i) "Eligible computer data center" means a computer data center:

(A) Located in a rural county as defined in RCW 82.14.370;

(B) Having at least twenty thousand square feet dedicated to housing working servers, where the server space has not previously been dedicated to housing working servers; and

(C) For which the commencement of construction occurs:

(I) After March 31, 2010, and before July 1, 2011;

(II) After March 31, 2012, and before July 1, 2015; or

(III) After June 30, 2015, and before July 1, 2025.

(ii) For purposes of this section, "commencement of construction" means the date that a building permit is issued under the building code adopted under RCW 19.27.031 for construction of the computer data center. The construction of a computer data center includes the expansion, renovation, or other improvements made to existing facilities, including leased or rented space. "Commencement of construction" does not include soil testing, site clearing and grading, site preparation, or any other related activities that are initiated before the issuance of a building permit for the construction of the foundation of a computer data center.

(iii) With respect to facilities in existence on April 1, 2010, that are expanded, renovated, or otherwise improved after March 31, 2010, or facilities in existence on April 1, 2012, that are expanded, renovated, or otherwise improved after March 31, 2012, or facilities in existence on July 1, 2015, that are expanded, renovated, or otherwise improved after June 30, 2015, an eligible computer data center includes only the portion of the computer data center meeting the requirements in (e)(i)(B) of this subsection (6).

(f) "Eligible power infrastructure" means all fixtures and equipment owned by a qualifying business or qualifying tenant and necessary for the transformation, distribution, or management of electricity that is required to operate eligible server equipment within an eligible computer data center. The term includes generators; wiring; cogeneration equipment; and associated fixtures and equipment, such as electrical switches, batteries, and distribution, testing, and monitoring equipment. The term does not include substations.

(g) "Eligible server equipment" means:

(i) For a qualifying business whose computer data center qualifies as an eligible computer data center under (e)(i)(C)(I) of this subsection (6), the original server equipment installed in an eligible computer data center on or after April 1, 2010, and replacement server equipment. For purposes of this subsection (6)(g)(i), "replacement server equipment" means server equipment that:

(A) Replaces existing server equipment, if the sale or use of the server equipment to be replaced qualified for an exemption under this section or RCW 82.12.986; and

(B) Is installed and put into regular use before April 1, 2018.

(ii) For a qualifying business whose computer data center qualifies as an eligible computer data center under (e)(i)(C)(II) of this subsection (6), "eligible server equipment" means the original server equipment installed in an eligible computer data center on or after April 1, 2012, and replacement server equipment. For purposes of this subsection (6)(g)(ii), "replacement server equipment" means server equipment that:

(A) Replaces existing server equipment, if the sale or use of the server equipment to be replaced qualified for an exemption under this section or RCW 82.12.986; and

(B) Is installed and put into regular use before April 1, 2024.

(iii)(A) For a qualifying business whose computer data center qualifies as an eligible computer data center under (e)(i)(C)(III) of this subsection (6), "eligible server equipment" means the original server equipment installed in a building within an eligible computer data center on or after July 1, 2015, and replacement server equipment. Server equipment installed in movable or fixed stand-alone, prefabricated, or modular units, including intermodal shipping containers, is not "directly installed in a building." For purposes of this subsection (6)(g)(iii)(A), "replacement server equipment" means server equipment that replaces existing server equipment, if the sale or use of the server equipment to be replaced qualified for an exemption under this section or RCW 82.12.986; and

(B) Is installed and put into regular use no later than twelve years after the date of the certificate of occupancy.

(iv) For a qualifying tenant who leases space within an eligible computer data center, "eligible server equipment" means the original server equipment installed within the space it leases from an eligible computer data center on or after April 1, 2010, and replacement server equipment. For purposes of this subsection (6)(g)(iv), "replacement server equipment" means server equipment that:

(A) Replaces existing server equipment, if the sale or use of the server equipment to be replaced qualified for an exemption under this section or RCW 82.12.986;

(B) Is installed and put into regular use before April 1, 2024; and

(C) For tenants leasing space in an eligible computer data center built after July 1, 2015, is installed and put into regular use no later than twelve years after the date of the certificate of occupancy.

(h) "Qualifying business" means a business entity that exists for the primary purpose of engaging in commercial activity for profit and that is the owner of an eligible computer data center. The term does not include the state or federal government or any of their departments, agencies, and institutions; tribal governments; political subdivisions of this state; or any municipal, quasi-municipal, public, or other corporation created by the state or federal government, tribal government, municipality, or political subdivision of the state.

(i) "Qualifying tenant" means a business entity that exists for the primary purpose of engaging in commercial activity for profit and that leases space from a qualifying business within an eligible computer data center. The term does not include the state or federal government or any of their departments, agencies, and institutions; tribal governments; political subdivisions of this state; or any municipal, quasi-municipal, public, or other corporation created by the state or federal government, tribal government, municipality, or political subdivision of the state. The term also does not include a lessee of space in an eligible computer data center under (e)(i)(C)(I) of this subsection (6), if the lessee and lessor are affiliated and:

(i) That space will be used by the lessee to house server equipment that replaces server equipment previously installed and operated in that eligible computer data center by the lessor or another person affiliated with the lessee; or

(ii) Prior to May 2, 2012, the primary use of the server equipment installed in that eligible computer data center was to provide electronic data storage and data management services for the business purposes of either the lessor, persons affiliated with the lessor, or both.

(j) "Server equipment" means the computer hardware located in an eligible computer data center and used exclusively to provide electronic data storage and data management services for internal use by the owner or lessee of the computer data center, for clients of the owner or lessee of the computer data center, or both. "Server equipment" also includes computer software necessary to operate the computer hardware. "Server equipment" does not include personal computers, the racks upon which the server equipment is installed, and computer peripherals such as keyboards, monitors, printers, and mice.

[2015 3rd sp.s. c 6 § 302; 2012 2nd sp.s. c 6 § 302; 2010 1st sp.s. c 23 § 1601; 2010 1st sp.s. c 1 § 2.]

NOTES:

Reviser's note: Pursuant to RCW 43.135.041, chapter 6, Laws of 2012 2nd special session was subject to an advisory vote of the people in the November 2012 general election on whether the tax increase in such session law should be maintained or repealed. The advisory vote was in favor of repeal.

Effective date—2010 1st sp.s. c 1: "This act is necessary for the immediate preservation of the public peace, health, or safety, or support of the state government and its existing public institutions, and takes effect April 1, 2010." [2010 1st sp.s. c 1 § 4.]

Exemptions—Eligible server equipment.

(1) An exemption from the tax imposed by RCW 82.12.020 is provided for the use by qualifying businesses or qualifying tenants of eligible server equipment to be installed, without intervening use, in an eligible computer data center, and to the use of labor and services rendered in respect to installing such server equipment. The exemption also applies to the use by a qualifying business or qualifying tenant of eligible power infrastructure, including labor and services rendered in respect to installing, repairing, altering, or improving such infrastructure.

(2) A qualifying business or a qualifying tenant is not eligible for the exemption under this section unless the department issued an exemption certificate to the qualifying business or a qualifying tenant for the exemption provided in RCW 82.08.986.

(3)(a) The exemption provided in this section does not apply to:

(i) Any person who has received the benefit of the deferral program under chapter 82.60 RCW on: (A) The construction, renovation, or expansion of a structure or structures used as a computer data center; or (B) machinery or equipment used in a computer data center; and

(ii) Any person affiliated with a person within the scope of (a)(i) of this subsection (3).

(b) If a person has received the benefit of the exemption under this section and subsequently receives the benefit of the deferral program under chapter 82.60 RCW on either the construction, renovation, or expansion of a structure or structures used as a computer data center or machinery or equipment used in a computer data center, the person must repay the amount of taxes exempted under this section. Interest as provided in chapter 82.32 RCW applies to amounts due under this subsection (3)(b) until paid in full. A person is not required to repay taxes under this subsection with respect to property and services for which the person is required to repay taxes under RCW 82.08.986(5).

(4) The definitions and requirements in RCW 82.08.986 apply to this section.

[2015 3rd sp.s. c 6 § 303; 2012 2nd sp.s. c 6 § 304; 2010 1st sp.s. c 23 § 1602; 2010 1st sp.s. c 1 § 3.]

The Legislature should continue the data center sales and use tax exemption because the stated public policy objectives of increased rural property values and rural property taxes from investment in data center construction in rural Washington counties are being achieved.

The tax preference performance statement stated that the Legislature intends to extend the expiration date of the tax preference if a review finds that the rural county tax base is increased as a result of the construction of data centers eligible for the tax preference. This review finds that the tax base has increased.

It is too early to tell whether data center businesses will comply with their job creation requirements. The date by which beneficiaries must establish they have increased employment by the required amount of jobs depends on when the Department of Revenue issued the exemption certificates, and the first such date will not occur until May 2016.

Legislation Required: No

Fiscal Impact: None

Available December 2016.

Available December 2016.

If applicable, will be available December 2016.