JLARC Final Report: 2016 Tax Preference Performance Reviews

Report 17-02, January 2017

Fuel Used by Mint Growers | Sales & Use Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

| A sales and use tax exemption for purchases of propane or natural gas used by mint growers to distill mint on a farm.

The preference is scheduled to expire July 1, 2017. |

Sales & Use RCWs 82.08.220; 82.12.220 |

$210,000 |

| Public Policy Objective |

|---|

| The Legislature stated the public policy objective was to provide an incentive for mint growers to transition from using diesel to cleaner fuels (specifically propane and natural gas) for distilling mint. The Legislature noted this transition, though costly, would improve air quality. |

| Recommendations |

|---|

Legislative Auditor’s Recommendation

|

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Reporting Issues

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

The Legislature established this preference to provide an incentive for mint growers to transition from using diesel to cleaner fuels for distilling mint.

Because of this preference, mint growers do not pay sales or use tax on purchases of propane or natural gas that they use exclusively to distill mint on a farm.

Mint growers must report these tax exempt purchases to the Department of Revenue (DOR) using a Buyer’s Sales and Use Tax Preference Addendum ("Buyer Addendum") when they file their tax returns with DOR unless the growers meet certain criteria that excuse them from completing the Buyer Addendum.

The tax preference became effective October 1, 2013, and is scheduled to expire on July 1, 2017.

2006

The Legislature exempted diesel fuel used in agricultural production from sales and use tax.

2007

The Legislature exempted biodiesel used in agricultural production from sales and use tax.

2013

The Legislature enacted this tax preference to provide an incentive for mint growers to transition from using diesel to cleaner fuels for distilling mint. Mint growers do not pay sales or use tax for propane and natural gas purchased and used for mint distillation on a farm. The Legislature scheduled the preference to expire July 1, 2017.

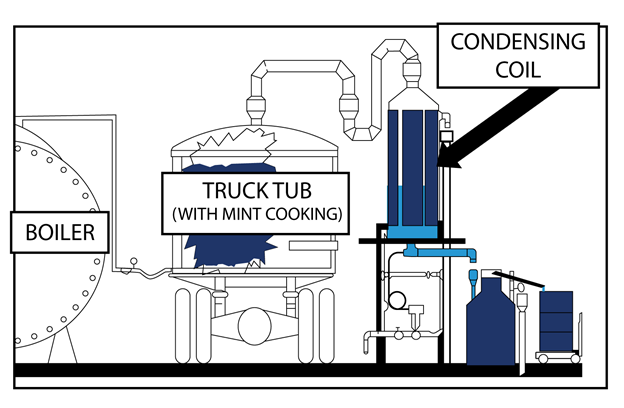

Mint Growers Use Fuel to Distill Mint Oil

Mint growers harvest mint once or twice a year, depending on the variety of plant and the desired characteristics of the oil. The mint grower cuts the mint and leaves it to dry in the field for a day or two. Once dried to the desired level, the mint is chopped and blown into an enclosed trailer (mint tub). The mint tub is pulled to a mint still (usually within a few miles of the field) and hooked to live steam that is used to distill it into oil. The steam is created by boilers that are fueled by diesel, propane, or natural gas.

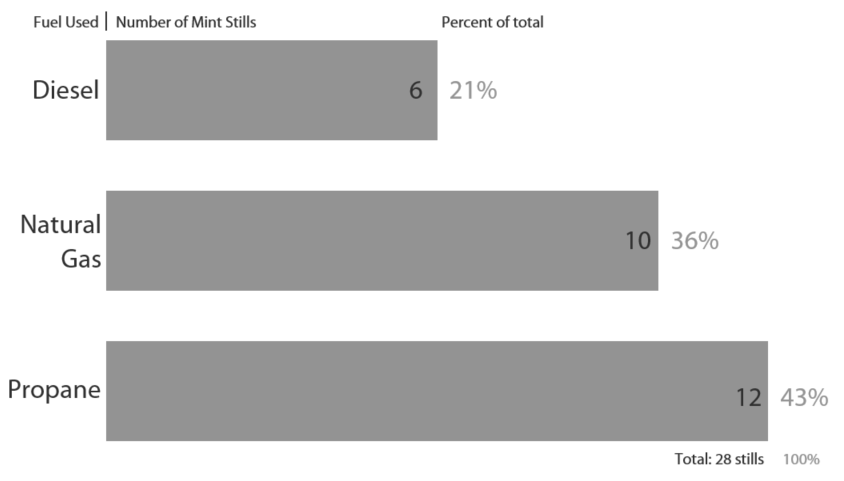

According to industry representatives, 28 mint stills were in use in Washington as of December 2015. Of those, 13 distill mint that their owners grow, while 15 distill mint for both their owners and for other mint growers.

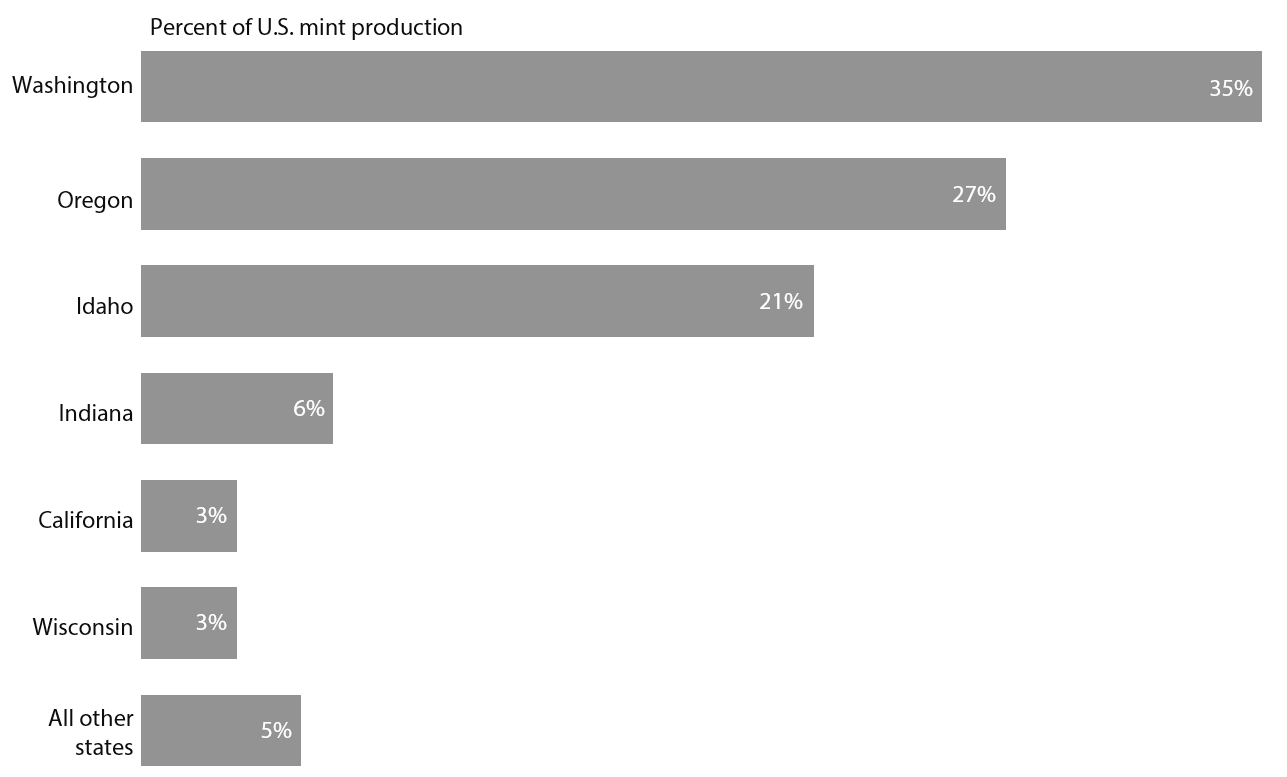

Washington Is a Leader in Mint Production

In 2014, Washington led the nation in mint production, generating 3.5 million pounds of mint oil.

- Washington ranked first in spearmint oil production, valued at $36 million, which is 70 percent of the U.S. production values.

- Washington ranked third in peppermint oil production, valued at $31.5 million, which is 26 percent of the nation’s production value.

- The USDA 2012 Census of Agriculture report notes 72 mint farms in the state with 26,300 acres of mint. One acre of mint produces about 19 gallons of mint oil when distilled.

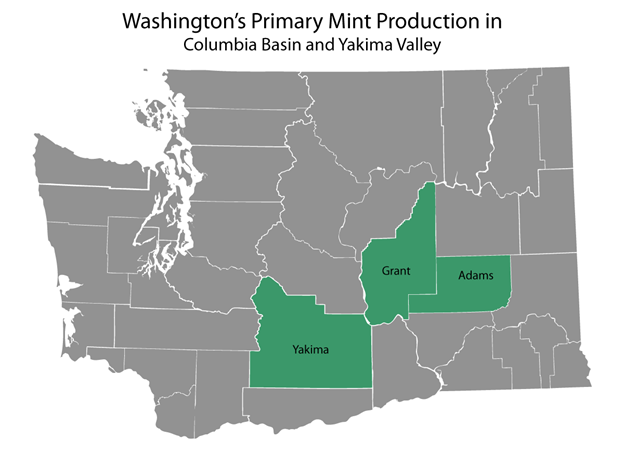

The map below shows the main production areas in Washington, which are in the Yakima Valley and Columbia Basin.

Other Tax Preferences Available to Mint Growers

Mint growers may qualify for several other tax preferences, as noted below, as well as broader tax preferences that are not included in this list.

|

Type of Tax |

Tax Treatment |

Year Enacted |

Notes |

|

Property Tax |

Exemption on value of agricultural crops grown |

1890 |

JLARC staff reviewed in 2007 |

|

Current use reduced valuation on agricultural land |

1973 |

Excluded from JLARC review |

|

|

State personal property tax exemption on farm M&E |

2001 |

Expedited review in 2015 |

|

|

Sales and Use

Taxes |

Purchases of seed, fertilizer, and sprays |

1943 |

JLARC staff reviewed seeds in 2009; fertilizer and

sprays in 2010

|

|

Leased irrigation equipment |

1983 |

Expedited review in 2015 |

|

|

Purchases of horticultural services |

1993 |

JLARC staff reviewed in 2015 |

|

|

Farm replacement parts and repair services |

2006 |

JLARC staff reviewed in 2015 |

|

|

Fuel used on farms (diesel and biodiesel) |

2006 |

JLARC staff reviewed in 2015 |

|

|

B&O Tax |

Agricultural producers |

1935 |

JLARC staff reviewed in 2008 |

What are the public policy objectives that provide a justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature stated in 2013 that the public policy objective was to provide an incentive for mint growers to transition from using diesel to cleaner fuels (specifically propane and natural gas) for distilling mint. The Legislature noted the transition, though costly, would improve air quality.

The Legislature noted that on-farm diesel fuel was already exempt from sales and use tax and that the preference would extend this treatment to propane and natural gas.

What evidence exists to show that the tax preference has contributed to the achievement of any of these public policy objectives?

Most mint growers have transitioned their stills from diesel to cleaner fuels, but it is not clear the tax preference has been the key incentive to make this transition:

- Mint growers using natural gas to fuel their mint stills are generally not receiving benefit from the preference; and

- Even with the preference, propane remains more expensive than diesel for distilling mint, while natural gas is the least expensive of the three fuels.

Air quality has likely improved with the conversions from diesel to cleaner fuels.

22 of 28 Mint Stills Use Cleaner Fuels

Industry sources report that, as of December 2015, 22 of the 28 mint stills are using one of the cleaner fuels, either propane (12 stills) or natural gas (10 stills). JLARC staff do not assert whether there is a causal relationship between this outcome and the tax preference. Industry representatives report that mint growers had converted seven stills to one of the cleaner burning fuels before the preference was enacted, and that mint growers converted six more after the preference was enacted. Some stills started out using one of the cleaner fuels. Six stills continue to use diesel.

Incentive to Transition to Cleaner Fuels is Limited

Growers switching to natural gas do not benefit from the preference, and growers switching to propane have higher fuel costs than using diesel, even with the preference. Therefore, if price is a major determinant for conversion, it is unlikely the preference is providing enough of an incentive to make the conversion to the two cleaner fuels.

Mint distillers using natural gas are not receiving benefit from the preference

The preference is not serving as an incentive for a mint distiller to convert to natural gas because the preference does not reduce the price a mint distiller pays for this fuel. Natural gas purchased through a utility does not qualify for or benefit from this tax preference. This is because natural gas delivered by a utility is not subject to sales or use tax. The sale is instead subject to public utility tax. Industry representatives confirmed that mint distillers choosing natural gas for their fuel are purchasing the gas through a utility.

If a mint distiller purchased natural gas from an out-of-state broker, the purchase would qualify for a use tax exemption under this preference. According to the industry, these sales are not occurring.

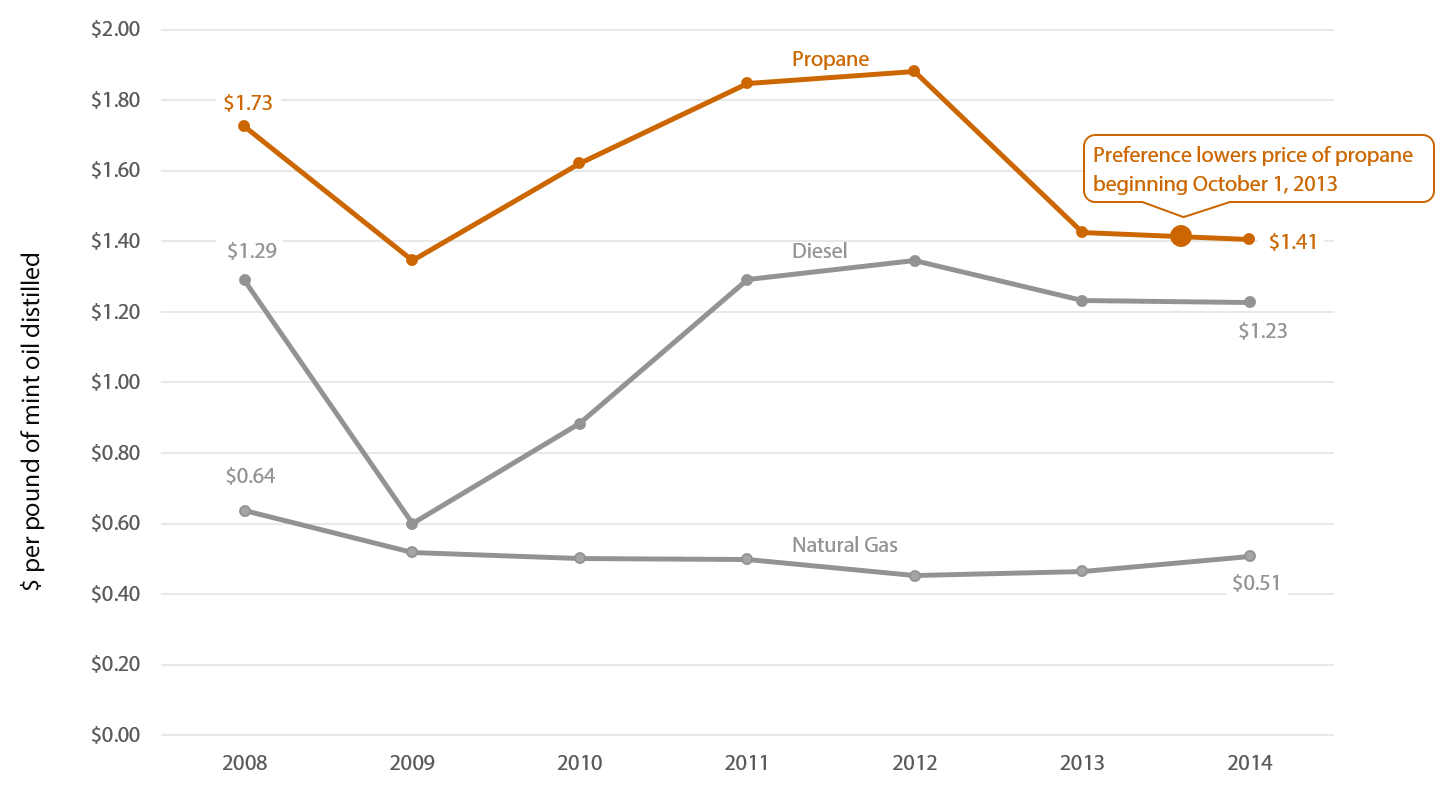

Propane still more expensive than diesel, natural gas the least expensive

It is not clear that the preference provides enough of a financial incentive to persuade a mint distiller to switch from diesel to propane. Even with the preference, propane is more expensive than diesel for distilling mint. Fuel costs may provide some incentive for a mint distiller to switch from diesel to natural gas. This is because natural gas is currently less expensive, but not due to the preference.

For Calendar Years 2008 through 2014, diesel remains a less expensive fuel choice than propane for mint distillation, even when factoring in the effect of the preference. Diesel burns hotter than the other two fuels, so less is needed to distill a pound of mint oil. Natural gas is the least expensive of the fuel choices, and its cost is not affected by the preference.

Air Quality Likely Improves When Switching to Cleaner Fuels

It is not possible to precisely measure the amount of impact to air quality from the mint distillers converting their stills to cleaner fuels. However, air quality officials consistently reported to JLARC staff that such conversions reduce pollutant emissions and their concentrations. The officials explained that diesel is not as refined as other fuels and contains a more diverse mixture of chemicals and toxic components. When farmers use diesel, there is a larger distribution and greater concentration of pollutants (e.g., sulfur dioxide, nitrogen oxide, hydrocarbons, and particulate matter) than with propane and natural gas. For example, natural gas combustion produces less nitrogen oxide and hydrocarbon emissions, virtually no particulate matter, and no sulfur dioxide.

As explained above, it is not clear that the transition to cleaner fuels is the result of the tax preference.

To what extent will continuation of the tax preference contribute to these public policy objectives?

It is not clear that continuing the tax preference would provide enough of an incentive for mint growers to convert the remaining six mint stills using diesel to one of the cleaner fuels:

- Mint growers who converted their stills from diesel to natural gas are not receiving benefit from this sales and use tax exemption. This is because they would likely be buying their natural gas from a utility. Such sales are not subject to sales or use tax, and therefore receive no tax advantage. Instead, these sales are subject to public utility tax.

- Mint growers who converted their stills to propane would continue to pay higher overall fuel costs than for diesel, even with the preference. In addition, JLARC staff estimate it would take between 9 and 15 years of tax preference savings for a grower to recover the costs of converting a mint still from diesel to propane. This calculation is based on conversion costs ranging from $150,000 to $250,000 and a mint distiller’s estimated average annual savings of $16,850.

If the public policy objectives are not being fulfilled, what is the feasibility of modifying the tax preference for adjustment of the tax benefits?

The Legislature could consider adopting a tax preference that would better incent mint distillers to switch from diesel to either one of the cleaner fuels (propane or natural gas). For example, tying preferences more directly to conversion costs or extending them to natural gas users may provide more targeted incentives.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

Direct Beneficiaries

Direct beneficiaries of the preference are mint growers who buy propane to distill mint on a farm. Industry representatives report 12 mint stills in Washington using propane as of December 2015.

Mint growers who purchase natural gas through an out-of-state broker would also be beneficiaries. However, industry sources state this is not currently happening. Instead, mint growers who use natural gas are receiving the product through a utility and are paying the public utility tax instead of sales tax. Mint growers who use natural gas delivered by a utility are not beneficiaries of this preference.

Indirect Beneficiaries

Indirect beneficiaries of the preference may be mint growers who do not own stills and who contract with other growers to distill their mint. Some portion of the savings realized by mint growers who distill mint for others might be passed along through lower contract fees. Industry representatives report 75 mint growers in Washington as of December 2015, some of whom contract with mint still owners to process their product.

Two Reporting Issues

Two reporting issues complicate estimates of the use of this preference:

- Information reported by the mint distillers using this preference is not disclosable; and

- Information from propane sellers making tax-exempt propane sales to the mint distillers appears to be under-reported.

Buyer Addendum Detail Not Disclosable

Buyers using any sales and use tax exemption enacted after August 2013, including this one, must complete a Buyer Addendum detailing their tax exempt purchases if:

- They are required to register with the Department of Revenue (DOR);

- They are required to file monthly or quarterly tax returns with DOR; and

- The tax benefit to the buyer is $1,000 or more per Calendar Year.

Because many Washington farmers (including mint growers) are not required to register or file tax returns with DOR, few Buyer Addenda were expected to be filed for this tax preference. Fewer than three businesses have filed Buyer Addenda for Fiscal Years 2014, 2015, and the first six months of 2016, so this detail is not disclosable.

Tax-Exempt Propane Sales to Mint Growers Appear Under-Reported

JLARC staff reviewed amounts reported by businesses selling propane to mint growers that are exempted from sales tax by the tax preference. The foregone sales tax for these reported sales is well below JLARC staff’s estimated beneficiary savings for propane used by mint growers (see tab on Revenue and Economic Impacts). It is unclear why these sales appear to be under-reported.

|

Fiscal Year |

Estimated Beneficiary Savings |

Foregone Sales Tax Reported by Propane Sellers |

What Portion of Estimated Savings Was Reported? |

|

2014 * |

$167,000 |

$6,786 |

4% of estimate |

|

2015 |

$128,000 |

$9,506 |

7% of estimate |

Source: JLARC staff beneficiary savings analysis; JLARC staff analysis of DOR tax return detail October 2013 – June 2015.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

JLARC staff estimate the direct beneficiary savings at $128,000 in Fiscal Year 2015 and $210,000 for the 2015-17 Biennium.

The estimate was calculated using the projected amount of fuel used by mint farms for stills fueled with propane. The estimate does not include a natural gas component since the preference is not being used for natural gas purchases.

|

Fiscal Year |

Estimated Qualifying Propane Sales |

State Sales Tax |

Local Sales Tax |

Total Beneficiary Savings |

|

2014 * |

$2,038,000 |

$132,000 |

$35,000 |

$167,000 |

|

2015 |

$1,549,000 |

$101,000 |

$27,000 |

$128,000 |

|

2016 |

$1,212,000 |

$79,000 |

$21,000 |

$100,000 |

|

2017 |

$1,335,000 |

$87,000 |

$23,000 |

$110,000 |

|

Tax preference

scheduled to expire July 1, 2017. |

||||

|

2015-17 Biennium |

$2,547,000 |

$166,000 |

$44,000 |

$210,000 |

Source: JLARC staff analysis of USDA 2014 mint production data, information on fuel use from Washington Mint Growers Association, estimated growth using Economic and Revenue Forecast Council IHS forecast for energy growth for Fiscal Years 2016 and 2017.

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the tax preference were terminated, mint growers with mint stills would pay sales or use tax on propane when the fuel is used to distill mint on a farm.

The effect of these terminations on employment and the economy would depend on the extent to which Washington’s mint growing industry could absorb the increased costs or pass them along to their customers. Agricultural producers, including mint growers, may not be able to pass along increased costs to their customers if the prices for their commodities are set in national or international markets.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

JLARC staff reviewed the taxation of fuel by the top mint and/or spearmint producing states and determined they generally do not tax fuel used by mint growers. The six states noted below comprise 95 percent of U.S. mint production.

- Washington exempts diesel used on farms (reviewed by JLARC in 2015) and exempts natural gas and propane used exclusively to distill mint on a farm from sales and use taxes.

- Idaho, Indiana, and Wisconsin exempt any kind of fuel used in agricultural production from sales and use taxes.

- California exempts diesel fuel used in agricultural production from the state (but not the local) portion of sales tax and exempts liquefied petroleum gas (LPG), including propane, used in agricultural production when delivered into tanks holding 30+ gallons. Natural gas is subject to sales or use tax.

- Oregon does not impose sales or use taxes.

Intent Statement

Findings—Intent—2013 2nd sp.s. c 13: "The legislature finds that mint growers utilize fuel to generate heat to extract oil from harvested mint and thereby produce a saleable agricultural product. Diesel fuel is often used as the fuel source that generates heat to distill mint. This on-farm diesel fuel is currently exempt from sales and use tax. The legislature further finds that propane and natural gas are alternative sources of cleaner burning fuel. A transition by mint growers to these alternative fuel sources, though costly, provides air quality benefits as compared to the use of diesel. It is the intent of the legislature to provide an incentive to mint growers to make the transition to cleaner fuels by extending the sales and use tax exemptions to propane and natural gas used by farmers who produce mint oil." [2013 2nd sp.s. c 13 § 1301.]

RCW 82.08.220

Exemptions—Mint growers. (Expires July 1, 2017.)

(1) The tax levied by RCW 82.08.020 does not apply to sales to farmers of propane or natural gas used exclusively to distill mint on a farm.

(2) The exemption is available only when the buyer provides the seller with an exemption certificate in a form and manner prescribed by the department. The seller must retain a copy of the certificate for the seller's files. For sellers who electronically file their taxes, the department must provide a separate line for exemption amounts claimed under this section.

(3) For the purposes of this section, "farmer" has the same meaning as provided in RCW 82.04.213.

(4) This section expires July 1, 2017.

[2013 2nd sp.s. c 13 § 1302.]

RCW 82.12.220

Exemptions—Mint growers. (Expires July 1, 2017.)

(1) The provisions of this chapter do not apply with respect to the use of propane or natural gas by a farmer to exclusively distill mint on a farm.

(2) For the purposes of this section, "farmer" has the same meaning as provided in RCW 82.04.213.

(3) This section expires July 1, 2017.

[2013 2nd sp.s. c 13 § 1303.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor Recommendations

- The Legislature should allow the sales and use tax exemption for propane and natural gas used by mint growers to expire as scheduled on July 1, 2017, because it is likely not providing enough of an incentive for mint growers to convert the remaining six stills from diesel fuel.

Mint growers considering a conversion to natural gas would not benefit from the preference because a utility would be delivering their natural gas. Natural gas purchased through a utility is subject to public utility tax rather than sales or use tax. Mint growers considering a conversion to propane would still pay higher fuel costs than for their current diesel, even with the preference.

Legislation Required: No.

Fiscal Impact: None. -

If the Legislature wants to create an incentive for the remaining six mint stills to convert to one of the cleaner fuels, it may want to consider different types of tax preferences that can apply to both propane and natural gas. For example, tying preferences more directly to conversion costs or extending them to natural gas users may provide more targeted incentives.

Legislation Required: Yes.

Fiscal Impact: Depends on legislation.

The Commission endorses the Legislative Auditor’s recommendation without comment.

Joint Department of Revenue and Office of Financial Management Response