An updated version of this report is available.

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

| A sales and use tax exemption for people purchasing services at self-service (coin-operated) laundry facilities.

The preference has no expiration date. |

Sales & Use RCW 82.04.050(2)(a) |

$11.9 million |

| Public Policy Objective |

|---|

The Legislature did not state the public policy objective for this preference. JLARC staff infer two public policy objectives:

|

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation

Continue: It is achieving the inferred public policy objectives of providing consistent tax treatment to all self-service laundry facilities, and helping people with low incomes who may be more likely to use these facilities. Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation. Testimony from owners of coin-operated laundry operations noted that there is an increasing bias towards low-income individuals using their services. That is, because laundry hookups are now standard in many upper- and middle-income apartment units, fewer of these apartment residents need coin-operated laundromats. This has shifted the customer base to a larger share of low-income individuals. As a result, the number of coin-operated laundromats has significantly fallen. |

People who use self-service (e.g., coin-operated) laundry facilities do not pay sales or use tax for those services. The preference is provided by excluding use of these facilities from the definition of “retail sale.”

The preference applies to self-service washers and dryers in stand-alone laundromats, in apartment buildings, and in more transitory lodging establishments such as hotels, motels, and trailer camps.

People who use full-service laundry and dry cleaning businesses do pay sales tax for those services.

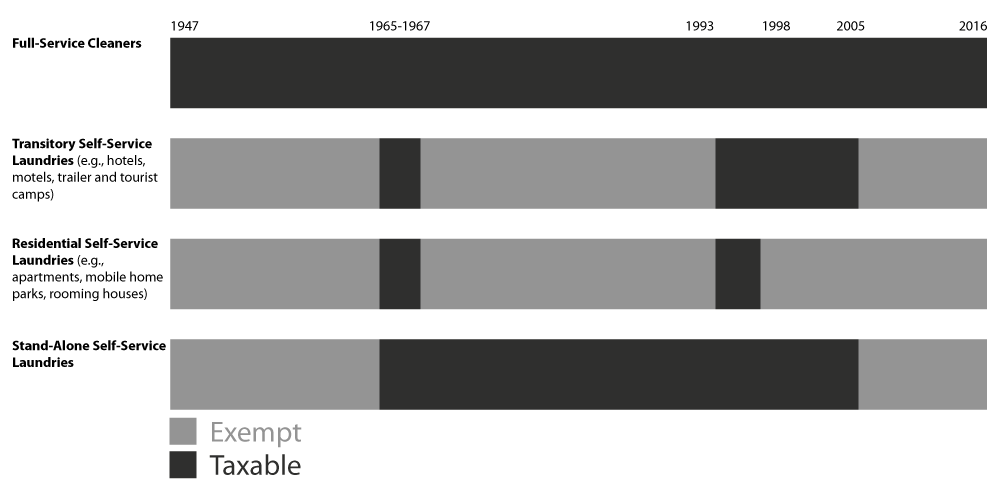

Over many decades, the Legislature and the Tax Commission (predecessor to the Department of Revenue) varied the approach to taxing self-service laundry facilities. During some periods, users of these facilities had to pay sales tax, while during other periods, the Legislature provided exemptions for some types of facilities but not others. In addition, the Tax Commission struggled to administer and enforce the taxation. In 2005, the Legislature extended the sales tax exemption to apply to all self-service laundry facilities.

|

Year |

Action |

|

1947 |

The Tax Commission updated an administrative rule on laundry services, noting self-service washer and dryer use was not subject to sales tax. |

|

Mid 1950s |

Industry practices changed. Self-service laundries where an operator performed or supervised parts of the cleaning process emerged. The Tax Commission updated its administrative rule to note businesses had to collect sales tax on activities where the operator performed or supervised parts of the laundry activity. |

|

1964 |

The Tax Commission issued an advisory to address continuing problems with tax compliance in the laundry services industry. After publishing the advisory, the Commission discovered many self-service laundry businesses that should have collected sales tax had not done so. |

|

1965 |

The Legislature changed the definition of “retail sale,” making all laundry services subject to sales tax. This included self-service (e.g., coin-operated) machines. The Tax Commission stated it had requested the change to clarify and make all laundry and dry cleaning businesses taxed in an equitable manner. |

|

1966 |

The Tax Commission experienced problems enforcing the 1965 law change in apartment buildings with coin-operated machines for tenants. Apartment building owners were generally not required to register with the Commission, and their compliance with the requirement to collect sales tax was inconsistent. |

|

1967 |

The Legislature exempted from sales tax coin-operated laundry facilities for exclusive use by tenants in apartments, hotels, motels, rooming houses, trailer camps, or tourist camps. Stand-alone self-service laundromat facilities continued to be subject to sales tax. The Tax Commission noted it had struggled to identify, register, and collect sales tax from many apartment building owners and others after the 1965 law change. |

|

1971 |

A legislative staff interim report noted that sales tax laws for coin-operated laundry machines put stand-alone self-service laundromat owners at a competitive disadvantage relative to similar machines located in apartments, hotels, etc. |

|

1993 |

As part of a bill intended to increase state revenue, the Legislature extended sales tax to several personal, professional, and business services, including coin-operated laundry facilities located in an apartment, hotel, motel, rooming house, trailer camp, or tourist camp for exclusive use by tenants. |

|

1998 |

The Legislature reestablished a sales tax exemption for coin-operated laundry facilities located in apartments, rooming houses, or mobile home parks for exclusive use by tenants. Laundry facilities in stand-alone laundromats, hotels, motels, trailer, and tourist camps remained subject to sales tax. Legislators and proponents stated the intent was to provide relief to lower-income individuals and families for a basic necessity. |

|

2005 |

The Legislature extended the sales tax exemption to cover all charges for “self-service” laundry facilities, no matter the location of the facilities or who used them, making all self-service laundry facilities exempt from sales tax. |

The Legislature did not state a public policy objective when it provided this preference for use of self-service laundry facilities.

JLARC staff infer two public policy objectives based on testimony by legislators and industry stakeholders on similar bills in previous years and from the variation in taxation of self-service laundry facilities over the years:

This preference was enacted prior to the Legislature’s requirement to provide a performance statement for each preference.

The preference is achieving the inferred public policy objective of providing consistent tax treatment for all self-service laundry facilities.

The preference is achieving the inferred public policy objective of helping people with lower incomes.

U.S. Census and other federal data from 2010 – 2013 indicates that people with lower incomes are more likely to do their laundry outside of their homes. For example, 38 percent of households with annual incomes below $20,000 do not use a clothes washer at home, compared to 13 percent of households earning $20,000 or above. Thus, people with lower incomes are more likely to use self-service laundries and benefit by not paying sales tax on their charges for doing so.

While the evidence shows the tax preference appears to be focused on lower income people, the specific savings by income level is unknown.

Individuals and families who wash and dry their laundry at self-service facilities are direct beneficiaries of the preference. They do not pay sales tax for using self-service washers or dryers.

Businesses that provide self-service laundry machines are indirect beneficiaries of the preference. These include laundromats, apartment buildings, hotels, motels, rooming houses, and trailer or tourist camps that provide self-service laundry facilities. With the preference, these businesses avoid either having to create a mechanism to collect the sales tax or absorbing the sales tax themselves. In testimony, businesses indicated they were willing to pay a higher business and occupation (B&O) tax rate if they could avoid having to absorb the sales tax.

JLARC staff estimate the direct beneficiary savings for Fiscal Year 2015 is $5.0 million. The estimated beneficiary savings for the 2017-2019 Biennium is $11.9 million. JLARC staff estimated the beneficiary savings using DOR tax return data and U.S. Energy Information Administration and Census Bureau information.

|

Fiscal Year |

Estimated Taxable Income |

State Sales Tax |

Local Sales Tax |

Total Beneficiary Savings |

|

2014 |

$ 53,924,000 |

$ 3,505,000 |

$ 1,323,000 |

$ 4,828,000 |

|

2015 |

$ 55,854,000 |

$ 3,630,000 |

$ 1,379,000 |

$ 5,010,000 |

|

2016 |

$ 58,646,000 |

$ 3,812,000 |

$ 1,466,000 |

$ 5,278,000 |

|

2017 |

$ 61,579,000 |

$ 4,002,000 |

$ 1,539,000 |

$ 5,541,000 |

|

2018 |

$ 64,657,000 |

$ 4,203,000 |

$ 1,616,000 |

$ 5,819,000 |

|

2019 |

$ 67,890,000 |

$ 4,413,000 |

$ 1,696,000 |

$ 6,109,000 |

|

2017-19

Biennium |

$ 132,548,000 |

$ 8,616,000 |

$ 3,312,000 |

$ 11,928,000 |

While excluding self-service laundry facilities from the definition of “retail sale” benefits those who use such facilities, it results in a higher business and occupation (B&O) tax rate for the businesses that provide the laundry facilities. Businesses that provide self-service laundry facilities are taxed under the service and other activities classification (rate of 1.5 percent) rather than the retailing classification (rate of 0.471 percent).

If the tax preference were terminated, the owners of self-service laundries would need to establish mechanisms to collect sales tax from their customers. The effects of this are unclear, as it would depend on the extent to which laundry owners increased prices or absorbed the taxes.

While users of self-service laundries would pay more due to sales tax for laundry services, the business B&O tax obligation for facility owners would be reduced, from 1.5 percent (service and other activities rate) to 0.471 percent (retailing B&O tax rate).

The net effect of removing the sales tax exemption for self-service laundry facilities, coupled with a decrease in B&O tax paid by businesses operating these facilities would result in an estimated increase of $4.7 million in state revenue in Fiscal Year 2016 and $10.5 million in the 2017-19 Biennium. The Department of Revenue has previously testified that it is difficult to fully collect tax due on these activities.

The effect of such changes on use and viability of laundry facilities is unknown.

Three states impose sales tax on self-service (e.g., coin-operated) laundry operations: Hawaii, New Mexico, and West Virginia.

South Dakota imposes a special license fee on self-service laundries in lieu of imposing sales tax.

The remaining 41 states and the District of Columbia either do not impose sales tax on any cleaning services or have a special sales and use tax exemption for self-service laundries.

(1)(a) "Sale at retail" or "retail sale" means every sale of tangible personal property (including articles produced, fabricated, or imprinted) to all persons irrespective of the nature of their business and including, among others, without limiting the scope hereof, persons who install, repair, clean, alter, improve, construct, or decorate real or personal property of or for consumers other than a sale to a person who:

(i) Purchases for the purpose of resale as tangible personal property in the regular course of business without intervening use by such person, but a purchase for the purpose of resale by a regional transit authority under RCW 81.112.300 is not a sale for resale; or

(ii) Installs, repairs, cleans, alters, imprints, improves, constructs, or decorates real or personal property of or for consumers, if such tangible personal property becomes an ingredient or component of such real or personal property without intervening use by such person; or

(iii) Purchases for the purpose of consuming the property purchased in producing for sale as a new article of tangible personal property or substance, of which such property becomes an ingredient or component or is a chemical used in processing, when the primary purpose of such chemical is to create a chemical reaction directly through contact with an ingredient of a new article being produced for sale; or

(iv) Purchases for the purpose of consuming the property purchased in producing ferrosilicon which is subsequently used in producing magnesium for sale, if the primary purpose of such property is to create a chemical reaction directly through contact with an ingredient of ferrosilicon; or

(v) Purchases for the purpose of providing the property to consumers as part of competitive telephone service, as defined in RCW 82.04.065; or

(vi) Purchases for the purpose of satisfying the person's obligations under an extended warranty as defined in subsection (7) of this section, if such tangible personal property replaces or becomes an ingredient or component of property covered by the extended warranty without intervening use by such person.

(b) The term includes every sale of tangible personal property that is used or consumed or to be used or consumed in the performance of any activity defined as a "sale at retail" or "retail sale" even though such property is resold or used as provided in (a)(i) through (vi) of this subsection following such use.

(c) The term also means every sale of tangible personal property to persons engaged in any business that is taxable under RCW 82.04.280(1) (a), (b), and (g), 82.04.290, and 82.04.2908.

(2) The term "sale at retail" or "retail sale" includes the sale of or charge made for tangible personal property consumed and/or for labor and services rendered in respect to the following:

(a) The installing, repairing, cleaning, altering, imprinting, or improving of tangible personal property of or for consumers, including charges made for the mere use of facilities in respect thereto, but excluding charges made for the use of self-service laundry facilities, and also excluding sales of laundry service to nonprofit health care facilities, and excluding services rendered in respect to live animals, birds and insects;

(b) The constructing, repairing, decorating, or improving of new or existing buildings or other structures under, upon, or above real property of or for consumers, including the installing or attaching of any article of tangible personal property therein or thereto, whether or not such personal property becomes a part of the realty by virtue of installation, and also includes the sale of services or charges made for the clearing of land and the moving of earth excepting the mere leveling of land used in commercial farming or agriculture;

(c) The constructing, repairing, or improving of any structure upon, above, or under any real property owned by an owner who conveys the property by title, possession, or any other means to the person performing such construction, repair, or improvement for the purpose of performing such construction, repair, or improvement and the property is then reconveyed by title, possession, or any other means to the original owner;

(d) The cleaning, fumigating, razing, or moving of existing buildings or structures, but does not include the charge made for janitorial services; and for purposes of this section the term "janitorial services" means those cleaning and caretaking services ordinarily performed by commercial janitor service businesses including, but not limited to, wall and window washing, floor cleaning and waxing, and the cleaning in place of rugs, drapes and upholstery. The term "janitorial services" does not include painting, papering, repairing, furnace or septic tank cleaning, snow removal or sandblasting;

(e) Automobile towing and similar automotive transportation services, but not in respect to those required to report and pay taxes under chapter 82.16 RCW;

(f) The furnishing of lodging and all other services by a hotel, rooming house, tourist court, motel, trailer camp, and the granting of any similar license to use real property, as distinguished from the renting or leasing of real property, and it is presumed that the occupancy of real property for a continuous period of one month or more constitutes a rental or lease of real property and not a mere license to use or enjoy the same. For the purposes of this subsection, it is presumed that the sale of and charge made for the furnishing of lodging for a continuous period of one month or more to a person is a rental or lease of real property and not a mere license to enjoy the same;

(g) The installing, repairing, altering, or improving of digital goods for consumers;

(h) Persons taxable under (a), (b), (c), (d), (e), (f), and (g) of this subsection when such sales or charges are for property, labor and services which are used or consumed in whole or in part by such persons in the performance of any activity defined as a "sale at retail" or "retail sale" even though such property, labor and services may be resold after such use or consumption. Nothing contained in this subsection may be construed to modify subsection (1) of this section and nothing contained in subsection (1) of this section may be construed to modify this subsection.

(3) The term "sale at retail" or "retail sale" includes the sale of or charge made for personal, business, or professional services including amounts designated as interest, rents, fees, admission, and other service emoluments however designated, received by persons engaging in the following business activities:

(a)(i) Amusement and recreation services including but not limited to golf, pool, billiards, skating, bowling, ski lifts and tows, day trips for sightseeing purposes, and others, when provided to consumers.

(ii) Until July 1, 2017, amusement and recreation services do not include the opportunity to dance provided by an establishment in exchange for a cover charge.

(iii) For purposes of this subsection (3)(a):

(A) "Cover charge" means a charge, regardless of its label, to enter an establishment or added to the purchaser's bill by an establishment or otherwise collected after entrance to the establishment, and the purchaser is provided the opportunity to dance in exchange for payment of the charge.

(B) "Opportunity to dance" means that an establishment provides a designated physical space, on either a temporary or permanent basis, where customers are allowed to dance and the establishment either advertises or otherwise makes customers aware that it has an area for dancing;

(b) Abstract, title insurance, and escrow services;

(c) Credit bureau services;

(d) Automobile parking and storage garage services;

(e) Landscape maintenance and horticultural services but excluding (i) horticultural services provided to farmers and (ii) pruning, trimming, repairing, removing, and clearing of trees and brush near electric transmission or distribution lines or equipment, if performed by or at the direction of an electric utility;

(f) Service charges associated with tickets to professional sporting events; and

(g) The following personal services: Physical fitness services, tanning salon services, tattoo parlor services, steam bath services, turkish bath services, escort services, and dating services.

(4)(a) The term also includes the renting or leasing of tangible personal property to consumers.

(b) The term does not include the renting or leasing of tangible personal property where the lease or rental is for the purpose of sublease or subrent.

(5) The term also includes the providing of "competitive telephone service," "telecommunications service," or "ancillary services," as those terms are defined in RCW 82.04.065, to consumers.

(6)(a) The term also includes the sale of prewritten computer software to a consumer, regardless of the method of delivery to the end user. For purposes of (a) and (b) of this subsection, the sale of prewritten computer software includes the sale of or charge made for a key or an enabling or activation code, where the key or code is required to activate prewritten computer software and put the software into use. There is no separate sale of the key or code from the prewritten computer software, regardless of how the sale may be characterized by the vendor or by the purchaser.

(b) The term "retail sale" does not include the sale of or charge made for:

(i) Custom software; or

(ii) The customization of prewritten computer software.

(c)(i) The term also includes the charge made to consumers for the right to access and use prewritten computer software, where possession of the software is maintained by the seller or a third party, regardless of whether the charge for the service is on a per use, per user, per license, subscription, or some other basis.

(ii)(A) The service described in (c)(i) of this subsection (6) includes the right to access and use prewritten computer software to perform data processing.

(B) For purposes of this subsection (6)(c)(ii), "data processing" means the systematic performance of operations on data to extract the required information in an appropriate form or to convert the data to usable information. Data processing includes check processing, image processing, form processing, survey processing, payroll processing, claim processing, and similar activities.

(7) The term also includes the sale of or charge made for an extended warranty to a consumer. For purposes of this subsection, "extended warranty" means an agreement for a specified duration to perform the replacement or repair of tangible personal property at no additional charge or a reduced charge for tangible personal property, labor, or both, or to provide indemnification for the replacement or repair of tangible personal property, based on the occurrence of specified events. The term "extended warranty" does not include an agreement, otherwise meeting the definition of extended warranty in this subsection, if no separate charge is made for the agreement and the value of the agreement is included in the sales price of the tangible personal property covered by the agreement. For purposes of this subsection, "sales price" has the same meaning as in RCW 82.08.010.

(8)(a) The term also includes the following sales to consumers of digital goods, digital codes, and digital automated services:

(i) Sales in which the seller has granted the purchaser the right of permanent use;

(ii) Sales in which the seller has granted the purchaser a right of use that is less than permanent;

(iii) Sales in which the purchaser is not obligated to make continued payment as a condition of the sale; and

(iv) Sales in which the purchaser is obligated to make continued payment as a condition of the sale.

(b) A retail sale of digital goods, digital codes, or digital automated services under this subsection (8) includes any services provided by the seller exclusively in connection with the digital goods, digital codes, or digital automated services, whether or not a separate charge is made for such services.

(c) For purposes of this subsection, "permanent" means perpetual or for an indefinite or unspecified length of time. A right of permanent use is presumed to have been granted unless the agreement between the seller and the purchaser specifies or the circumstances surrounding the transaction suggest or indicate that the right to use terminates on the occurrence of a condition subsequent.

(9) The term also includes the charge made for providing tangible personal property along with an operator for a fixed or indeterminate period of time. A consideration of this is that the operator is necessary for the tangible personal property to perform as designed. For the purpose of this subsection (9), an operator must do more than maintain, inspect, or set up the tangible personal property.

(10) The term does not include the sale of or charge made for labor and services rendered in respect to the building, repairing, or improving of any street, place, road, highway, easement, right-of-way, mass public transportation terminal or parking facility, bridge, tunnel, or trestle which is owned by a municipal corporation or political subdivision of the state or by the United States and which is used or to be used primarily for foot or vehicular traffic including mass transportation vehicles of any kind.

(11) The term also does not include sales of chemical sprays or washes to persons for the purpose of postharvest treatment of fruit for the prevention of scald, fungus, mold, or decay, nor does it include sales of feed, seed, seedlings, fertilizer, agents for enhanced pollination including insects such as bees, and spray materials to: (a) Persons who participate in the federal conservation reserve program, the environmental quality incentives program, the wetlands reserve program, and the wildlife habitat incentives program, or their successors administered by the United States department of agriculture; (b) farmers for the purpose of producing for sale any agricultural product; (c) farmers for the purpose of providing bee pollination services; and (d) farmers acting under cooperative habitat development or access contracts with an organization exempt from federal income tax under 26 U.S.C. Sec. 501(c)(3) of the federal internal revenue code or the Washington state department of fish and wildlife to produce or improve wildlife habitat on land that the farmer owns or leases.

(12) The term does not include the sale of or charge made for labor and services rendered in respect to the constructing, repairing, decorating, or improving of new or existing buildings or other structures under, upon, or above real property of or for the United States, any instrumentality thereof, or a county or city housing authority created pursuant to chapter 35.82 RCW, including the installing, or attaching of any article of tangible personal property therein or thereto, whether or not such personal property becomes a part of the realty by virtue of installation. Nor does the term include the sale of services or charges made for the clearing of land and the moving of earth of or for the United States, any instrumentality thereof, or a county or city housing authority. Nor does the term include the sale of services or charges made for cleaning up for the United States, or its instrumentalities, radioactive waste and other by-products of weapons production and nuclear research and development.

(13) The term does not include the sale of or charge made for labor, services, or tangible personal property pursuant to agreements providing maintenance services for bus, rail, or rail fixed guideway equipment when a regional transit authority is the recipient of the labor, services, or tangible personal property, and a transit agency, as defined in RCW 81.104.015, performs the labor or services.

(14) The term does not include the sale for resale of any service described in this section if the sale would otherwise constitute a "sale at retail" and "retail sale" under this section.

[2015 3rd sp.s. c 6 § 1104; 2013 2nd sp.s. c 13 § 802; 2011 c 174 § 202. Prior: 2010 c 112 § 14; 2010 c 111 § 201; 2010 c 106 § 202; prior: 2009 c 563 § 301; 2009 c 535 § 301; prior: 2007 c 54 § 4; 2007 c 6 § 1004; prior: 2005 c 515 § 2; 2005 c 514 § 101; prior: 2004 c 174 § 3; 2004 c 153 § 407; 2003 c 168 § 104; 2002 c 178 § 1; 2000 2nd sp.s. c 4 § 23; prior: 1998 c 332 § 2; 1998 c 315 § 1; 1998 c 308 § 1; 1998 c 275 § 1; 1997 c 127 § 1; prior: 1996 c 148 § 1; 1996 c 112 § 1; 1995 1st sp.s. c 12 § 2; 1995 c 39 § 2; 1993 sp.s. c 25 § 301; 1988 c 253 § 1; prior: 1987 c 285 § 1; 1987 c 23 § 2; 1986 c 231 § 1; 1983 2nd ex.s. c 3 § 25; 1981 c 144 § 3; 1975 1st ex.s. c 291 § 5; 1975 1st ex.s. c 90 § 1; 1973 1st ex.s. c 145 § 1; 1971 ex.s. c 299 § 3; 1971 ex.s. c 281 § 1; 1970 ex.s. c 8 § 1; prior: 1969 ex.s. c 262 § 30; 1969 ex.s. c 255 § 3; 1967 ex.s. c 149 § 4; 1965 ex.s. c 173 § 1; 1963 c 7 § 1; prior: 1961 ex.s. c 24 § 1; 1961 c 293 § 1; 1961 c 15 § 82.04.050; prior: 1959 ex.s. c 5 § 2; 1957 c 279 § 1; 1955 c 389 § 6; 1953 c 91 § 3; 1951 2nd ex.s. c 28 § 3; 1949 c 228 § 2, part; 1945 c 249 § 1, part; 1943 c 156 § 2, part; 1941 c 178 § 2, part; 1939 c 225 § 2, part; 1937 c 227 § 2, part; 1935 c 180 § 5, part; Rem. Supp. 1949 § 8370-5, part.]

Legislative Auditor Recommendation

The Legislature should continue the sales and use tax exemptions for self-service laundry facilities because it is achieving the inferred public policy objectives of providing consistent tax treatment to all self-service laundry facilities and helping people with low incomes who may be more likely to use these facilities.

Legislation Required: No.

Fiscal Impact: None.

The Commission endorses the Legislative Auditor’s recommendation.

Testimony from owners of coin-operated laundry operations noted that there is an increasing bias towards low-income individuals using their services. That is, because laundry hookups are now standard in many upper- and middle-income apartment units, fewer of these apartment residents need coin-operated laundromats. This has shifted the customer base to a larger share of low-income individuals. As a result, the number of coin-operated laundromats has significantly fallen.