JLARC Final Report: 2016 Tax Preference Performance Reviews

Report 17-02, January 2017

Syrup Taxes Paid | B&O Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

Overview

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

| Businesses that sell soft drinks they make using carbonated beverage syrup may take a credit against their B&O tax for the amount of syrup tax they have paid on their purchases of carbonated beverage syrup.

The syrup tax rate is $1 per gallon of carbonated beverage syrup. The preference has no expiration date. |

B&O RCW 82.04.4486 |

$10 million |

| Public Policy Objective |

|---|

| The Legislature did not state the public policy objective for this preference. JLARC staff infer the public policy objective was to provide tax relief to the restaurant industry by offsetting their syrup tax liability while maintaining funding for the Violence Reduction and Drug Enforcement (VRDE) account. |

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation

Repeal: the syrup tax and the associated B&O tax credit should be repealed because:

The Commission recommends repealing the B&O tax credit contingent upon also repealing the underlying syrup tax. |

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

This preference is a business and occupation (B&O) tax credit for businesses selling soft drinks made using carbonated beverage syrup.

Businesses pay a separate syrup tax of $1 per gallon on the soft drink syrup they purchase. Businesses are eligible to take a B&O tax credit for the amount of syrup tax they pay if the syrup is used to make soft drinks sold to customers.

Examples of this include restaurants selling glasses of soft drinks to customers, or fast food establishments and convenience stores selling drinks from a drink dispenser. The preference does not apply to pre-bottled soft drinks.

Washington’s Syrup Tax

1989

The Legislature passed the “Omnibus Alcohol and Controlled Substances Act,” which added new or additional taxes to sales of wine, beer, spirits, cigarettes, carbonated beverages, and syrups used to make carbonated beverages. Revenue from these taxes was to be deposited in a special account and directed toward programs to combat youth and adult alcohol and drug abuse.

The carbonated beverage tax originally applied to canned or bottled carbonated drinks at a rate of 0.084 cents per ounce (about one cent per 12 ounce container) and a syrup tax of $0.75 per gallon applied to sales of syrup used to make such drinks. Both taxes were scheduled to expire July 1, 1995.

1994

In March, the Legislature made a number of changes to the carbonated beverage and syrup taxes, then referred the proposed law (Referendum 43) to voters for ratification or rejection in the November 1994 general election. The changes included:

- Eliminating the carbonated beverage tax (0.084 cents per ounce);

- Increasing the syrup tax rate from $0.75 to $1 per gallon;

- Repealing the July 1, 1995, expiration date for the syrup tax and the other remaining taxes imposed by the 1989 Omnibus Act; and

- Renaming the fund into which the syrup tax receipts were deposited to the “Violence Reduction and Drug Enforcement (VRDE) Account.”

In November, Washington voters approved Referendum 43 and enacted all of the above changes.

1997, 1998

For two successive years, the Legislature passed bills that would have reduced syrup taxes on restaurants. The 1997 bill cut the syrup tax rate in half (to $0.50 per gallon) and made up the difference with an appropriation from the State General Fund to the VRDE account. The 1998 bill created a B&O tax credit equal to 50 percent of the syrup tax paid by businesses.

In both cases, the Governor vetoed the portion of the bill reducing their taxes, noting the legislation was not consistent with voters’ wishes in Referendum 43 to fund programs to address youth violence and drug enforcement.

2006

The Legislature enacted this preference, a B&O tax credit for syrup taxes paid by businesses that purchased syrup and sold carbonated beverages made with it. All businesses that bought syrup to make carbonated drinks continued to pay the $1.00 per gallon syrup tax, with the syrup tax revenues deposited into the VRDE account. However, businesses that sold the carbonated beverages they made with the syrup could claim a credit against their B&O tax equal to the amount of syrup tax they had previously paid.

The B&O tax credit was phased in over four years, beginning July 1, 2006 (see below). The preference has not been altered since enacted.

|

Percent

Syrup Tax Paid Credited Against B&O Tax |

Effective

Period |

|

25% |

7/01/2006 through 6/30/2007 |

|

50% |

7/01/2007 through 6/30/2008 |

|

75% |

7/01/2008 through 6/30/2009 |

|

100% |

7/01/2009 and after |

In legislative hearings, the Department of Revenue questioned the policy of crediting one tax against another, noting that this tended to hide the true incidence of the tax and increase the complexity of the tax system. Representatives of the Washington Restaurant Association noted that this structure maintained VRDE account funding, while also providing tax relief to the industry.

The fiscal note provided to the Legislature estimated that, when fully phased in, the total B&O credits taken would equal the amount of syrup tax collected in each fiscal year and that the B&O tax credit would fully reimburse all businesses for the amount of syrup tax they had paid.

2009

To consolidate accounting funds, the Legislature eliminated the VRDE account and several other dedicated accounts and directed all revenue sources that had previously funded them (including the syrup tax) to be deposited into the State General Fund.

Definitions

“Syrup” means a concentrated liquid that is added to carbonated water to produce a carbonated beverage.

“Carbonated beverage” includes any nonalcoholic liquid intended for human consumption that contains carbon dioxide, whether obtained by natural or artificial means.

2010 Carbonated Beverage Tax

In 2010, the Legislature enacted a temporary carbonated beverage tax of $0.02 per 12 ounces. The tax was part of a larger bill that imposed sales tax on candy and bottled water to help close a budget gap, and was to be in effect from June 1, 2010, to June 30, 2013.

In November 2010, Washington voters approved Initiative 1107, which repealed the carbonated beverage tax, the sales tax on candy and bottled water, and other tax changes made by the Legislature earlier that year. The carbonated beverage tax was only in effect from June 1 to November 30, 2010. The 2010 legislative action and initiative did not involve the syrup tax.

Other Tax Preferences Directed to Restaurants

Additional tax preferences are available to restaurants or food service businesses. Beneficiaries may also qualify for broader tax preferences.

|

Preference |

Tax Type |

Enacted |

JLARC Staff Review? |

|

Purchases of food or food

ingredients that become part of a meal sold by a restaurant |

Sales and use tax exemption |

1977 |

Exempted from JLARC review |

|

Free meals provided by

restaurants to their employees |

B&O tax exemption; Sales and use tax exemptions |

2011, clarified in 2015 |

Not yet reviewed by JLARC

staff |

|

Returnable containers for

beverages and food |

Sales and use tax exemption |

1974 |

Expedited review in 2010 |

|

Flavor-imparting items |

Sales and use tax exemptions |

2013; expires 2017 |

What are the public policy objectives that provide a justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature did not state the public policy objective for this preference when it was enacted in 2006.

JLARC staff infer the public policy objective was to provide tax relief to help the restaurant industry by offsetting their syrup tax liability while maintaining funding for the Violence Reduction and Drug Enforcement (VRDE) account.

These inferred objectives are based on statements made in 2006 committee hearings by the prime sponsor and Washington Restaurant Association representatives.

This preference was enacted prior to the Legislature’s requirement to provide a performance statement for each preference.

What evidence exists to show that the tax preference has contributed to the achievement of any of these public policy objectives?

In terms of providing tax relief, the preference is not providing tax relief to all the eligible businesses that pay syrup tax. The tax credit is consistently underutilized.

The objective to maintain funding for the Violence Reduction and Drug Enforcement (VRDE) account is no longer relevant due to policy decisions the Legislature has made. The Legislature has repealed the account and no longer dedicates syrup tax revenues to pay for violence reduction and drug enforcement.

Provide Tax Relief

When the Legislature enacted the preference in 2006, the fiscal note estimated that, when fully phased in, the tax credit would completely offset syrup tax revenues. The Department of Revenue (DOR) assumed that all businesses that could claim the credit would do so.

Instead, the tax credits claimed by qualifying businesses have consistently been less than the total syrup tax collected. In each fiscal year since 2010, about 40 percent of the syrup tax paid has not been claimed as a B&O tax credit.

|

Fiscal Year |

Syrup Tax Collected |

B&O Credit Claimed by Beneficiaries |

Difference (remains in general fund) |

% Syrup Tax Not Offset by Credit |

|

2010 |

$8.4 |

($4.9) |

$3.5 |

42% |

|

2011 |

$8.1 |

($5.1) |

$3.0 |

37% |

|

2012 |

$9.2 |

($5.2) |

$4.0 |

44% |

|

2013 |

$8.2 |

($5.0) |

$3.2 |

39% |

|

2014 |

$8.2 |

($5.1) |

$3.1 |

38% |

|

2015 |

$8.3 |

($5.0) |

$3.3 |

40% |

In Fiscal Year 2015, more than 2,300 businesses used the credit to offset $5 million worth of B&O tax. That is juxtaposed with over 14,000 restaurants in Washington.

Possible reasons for the gap between the total syrup tax paid and the B&O credit claimed by beneficiaries include:

- DOR has documented persistent errors with the B&O tax credit, with qualifying businesses often not claiming the credit and some non-qualifying businesses trying to use it. Both DOR and Washington Restaurant Association representatives suggest this could be a lack of awareness by restaurants that are eligible for the credit.

- Only businesses that sell carbonated beverages they make with syrup directly to customers are eligible to use the B&O tax credit. Those not qualifying to use the preference include individuals who purchase syrup to make carbonated beverages for their own consumption, and businesses that provide carbonated beverages free of charge to employees or others.

Maintain Funding for VRDE account

This inferred objective is no longer relevant because of policy decisions made by the Legislature.

In 2006, the Legislature made the policy decision to have no net increase in state funds from the syrup tax. The fiscal note for the 2006 legislation creating the preference assumed the tax credit would completely offset syrup tax revenues when fully phased in.

In 2009, the Legislature eliminated the VRDE account into which syrup tax revenues had been deposited. Since that time, syrup tax revenues have been deposited into the State General Fund and no longer dedicated to pay for violence reduction and drug enforcement.

To what extent will continuation of the tax preference contribute to these public policy objectives?

While continuing the preference will provide tax relief to some restaurants and other businesses that purchase syrup to make carbonated beverages they sell to customers, it is not meeting the inferred objective of fully offsetting the syrup tax paid by businesses.

The inferred objective of maintaining funding for the VRDE account is no longer relevant due to policy decisions by the Legislature.

If the public policy objectives are not being fulfilled, what is the feasibility of modifying the tax preference for adjustment of the tax benefits?

The Legislature could achieve the inferred public policy objective of providing tax relief to businesses paying the syrup tax by eliminating the syrup tax altogether. This would make the B&O tax credit against syrup tax paid unnecessary.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

Direct Beneficiaries

Direct beneficiaries are businesses that pay syrup tax and take a tax credit against B&O tax they owe. To be eligible for the credit, the businesses must use the syrup to make soft drinks that they sell to customers for immediate consumption.

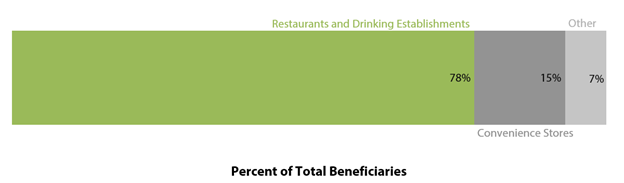

In Fiscal Year 2015, 2,326 businesses benefited from this preference.

The preference does not apply to all businesses that pay the syrup tax.

- Businesses that use syrup to make carbonated beverages for their own use or that are not sold directly to consumers are not eligible.

- Wholesalers that sell syrup to non-taxable entities, such as the federal government or tribal customers, must pay the tax on behalf of the non-taxable entities. The wholesalers are prohibited from using the credit because they only sell syrup, not the beverages made with the syrup.

Indirect Beneficiaries

Customers of businesses claiming the tax credit may be indirect beneficiaries to the extent the credit is passed on in the carbonated beverage prices charged by restaurants and others.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

JLARC staff identified the actual B&O credits claimed by direct beneficiaries for Fiscal Years 2014 and 2015 from Department of Revenue tax return data. The actual beneficiary savings for Fiscal Year 2015 was $5,004,000. JLARC staff estimate the beneficiary savings for the 2017-2019 Biennium at $10 million.

|

Fiscal Year |

B&O Tax Credit Claimed |

|

2014 |

$5,075,000

|

|

2015 |

$5,004,000

|

|

2016 |

$5,000,000

|

|

2017 |

$5,000,000

|

|

2018 |

$5,000,000

|

|

2019 |

$5,000,000

|

|

2017-19 Biennium |

$10,000,000 |

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the preference were terminated, current beneficiaries could no longer claim a B&O tax credit for syrup tax they paid. The median credit value taken in Fiscal Year 2015 was $419. All of the 2,326 businesses using the B&O tax credit used it for the full amount of syrup tax they paid.

The effect of such a termination on employment and the economy would depend on the extent to which certain businesses that sell carbonated beverages could absorb the increased B&O tax or pass it along to their customers.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

Two other states (Arkansas and West Virginia) and one city (Chicago) impose a tax on syrup used to make carbonated beverages. JLARC staff found no preferences (credits, exemptions, etc.) to reduce or eliminate the syrup tax in those three jurisdictions.

|

Jurisdiction |

Syrup Tax on. . . |

Who Pays? |

Rate |

Preference Provided? |

|

Washington |

Syrup used to make

carbonated beverages |

Retailers when they purchase

from wholesalers |

$1.00/gallon for syrup

|

Yes. B&O tax credit for full amount of syrup

tax paid |

|

Arkansas |

Syrups, powders, and other

base items used to make soft drinks |

Manufacturers, wholesalers,

distributors |

$2.00/gallon for syrup |

None found |

|

West Virginia |

Syrups and dry mixtures used

to make soft drinks |

Manufacturers, wholesalers,

distributors, retailers |

$0.80/gallon for syrup |

None found |

|

City of Chicago |

Syrup or concentrate used to

make soft drinks |

Retailers when they purchase

from wholesalers |

9% of syrup price |

None found |

RCW 82.04.4486

Credit—Syrup taxes paid by buyer.

(1) In computing the tax imposed under this chapter, a credit is allowed to a buyer of syrup to be used by the buyer in making carbonated beverages that are sold by the buyer if the tax imposed by RCW 82.64.020 has been paid in respect to the syrup. The amount of the credit shall be equal to twenty-five percent from July 1, 2006, through June 30, 2007, fifty percent from July 1, 2007, through June 30, 2008, seventy-five percent from July 1, 2008, through June 30, 2009, and one hundred percent after June 30, 2009, of the taxes imposed under RCW 82.64.020 in respect to the syrup purchased by the buyer.

(2) Credit under this section shall be earned, and claimed against taxes due under this chapter, for the tax reporting period in which the syrup was purchased by the person claiming credit under this section. The credit shall not exceed the tax otherwise due under this chapter for the tax reporting period. Unused credit may be carried over and used in subsequent tax reporting periods, except that no credit may be claimed more than twelve months from the end of the tax reporting period in which the credit was earned. No refunds shall be granted for credits under this section.

(3) No credit is available under this section for taxes paid under RCW 82.64.020 before July 1, 2006.

(4) For the purposes of this section, "carbonated beverage," "previously taxed syrup," and "syrup" have the same meanings as provided in RCW 82.64.010.

[ 2006 c 245 § 1.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor Recommendation

The Legislature should repeal the syrup tax and the associated B&O tax credit because:

- The syrup tax preference is not providing all of the intended tax relief for businesses that buy syrup; and

- The Legislature made policy decisions to eliminate the VRDE account and no longer dedicate syrup tax revenues to violence reduction and drug enforcement.

Eliminating the syrup tax would achieve the inferred objective of providing complete tax relief for businesses that buy syrup. This would be a more effective mechanism than the tax credit on syrup taxes paid, which is not providing tax relief to all businesses that pay syrup tax.

In 2006, the Legislature made the policy decision to have no net increase in state funds from the syrup tax. The fiscal note for the 2006 legislation to create the preference assumed the syrup tax credit would completely offset syrup tax revenues when fully phased in. The Legislature went a step further in 2009 and eliminated the VRDE account altogether. Syrup tax revenues are no longer dedicated to funding violence reduction and drug enforcement. Given these policy decisions by the Legislature, the syrup tax is no longer needed.

Legislation Required: Yes.

Fiscal Impact: Loss of about $3 million per fiscal year.

The Commission endorses the Legislative Auditor’s recommendation.

The Commission recommends repealing the B&O tax credit contingent upon also repealing the underlying syrup tax.

Joint Department of Revenue and Office of Financial Management Response