|

JLARC Final Report: 2017 Tax Preference Performance Reviews |

Report 17-07, December 2017

Automotive Adaptive Equipment For Veterans and Service Members With Disabilities | Sales and Use Tax

Click here for One Page Overview

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

A sales and use tax exemption for veterans or service members with disabilities for purchases, installations, or repairs of qualifying automotive adaptive equipment. The preference is scheduled to expire July 1, 2018. |

Sales and Use |

$194,000 |

| Public Policy Objective |

|---|

|

The Legislature stated the public policy objectives were to:

|

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation Clarify: The Legislature should clarify the preference because, while it provides financial relief and removes a perceived competitive disadvantage, the estimated beneficiary savings have exceeded the 2013 fiscal note estimate for the past three fiscal years. Commissioner Recommendation:The Commission endorses the Legislative Auditor’s recommendation with comment. The commission accepts JLARC staff’s clarify recommendation with the understanding that the tax preference should be continued. The clarification should be narrowly focused on updating the fiscal note estimate. The JLARC staff analysis indicates the preference’s objectives are being met and the benefits are being received by the intended recipients. Because beneficiary savings consistently exceed the fiscal note estimate, this reinforces the need to continue this tax preference. The higher-than-expected beneficiary savings may reflect the significant increase in the number of U.S. veterans with disabilities. |

- 1. What is the Preference?

- 2. Legal History

- 3. Other Relevant Background

- 4. Public Policy Objectives

- 5. Are Objectives Being Met?

- 6. Beneficiaries

- 7. Revenue and Economic Impacts

- 8. Other States with Similar Preference?

- 9. Applicable Statutes

Sales and use tax exemption for automotive adaptive equipment purchased by veterans and service members with disabilities

Purpose

The Legislature passed this preference with the stated purpose to:

- Provide financial relief for severely injured veterans and service members.

- Offset a competitive disadvantage for Washington businesses when compared to businesses in states without a sales and use tax.

Sales and use tax exemption for purchase, installation, and repair costs of automotive adaptive equipment

Veterans and service members with disabilities do not pay sales or use tax on equipment used to assist in entering, exiting, or safely operating a motor vehicle. This exemption also applies to installation and repair costs. The equipment is known as add-on automotive adaptive equipment, or AAE.

To qualify, the adaptive equipment must be:

- Prescribed by a physician.

- Paid for fully or in part by the U.S. Department of Veterans Affairs (VA) or another federal agency.

- Obtained through a direct payment between the federal government and the equipment seller.

- Installed by someone other than the automobile manufacturer.

Examples of AAE include vehicle ramps and steering devices, as shown in the pictures below, as well as other equipment listed in the Other Relevant Background tab.

Veterans’ and service members’ disabilities do not need to be connected to their military service to qualify for the preference.

The preference took effect August 1, 2013, and is set to expire July 1, 2018.

Inconsistent application of tax for adaptive equipment preceded sales and use tax preference

Before 2013, Washington law required that businesses charge sales tax on purchases of any automotive adaptive equipment (AAE) added to a vehicle. This meant that veterans and service members with disabilities were required to pay sales tax on their purchases of AAE, even if the federal government paid the seller for the equipment.

Federal law prohibits states from taxing the federal government. However, in this case, the veterans and service members are the purchasers, not the federal government.

2011 – 2012: DOR issued draft advisory requiring sales tax on AAE purchases

During a routine audit, the Department of Revenue (DOR) discovered that a business selling AAE to veterans with disabilities had not been charging sales tax. The audit found that the U.S. Department of Veteran’s Administration (VA) paid for the AAE on behalf of veterans with disabilities. The veterans had to apply for the funding, and were designated as the purchasers even though the VA paid for the equipment. As purchasers, the veterans were responsible for paying the sales tax owed.

Upon further investigation, DOR found other AAE businesses in Washington had not been consistently charging or collecting sales tax for similar transactions.

In October 2012, DOR posted a draft advisory to its web site regarding purchases of automotive adaptive equipment. The advisory specified that veterans and service members with disabilities were subject to sales tax on their AAE purchases, even if the federal government paid for the equipment.

2013: Legislature enacted this preference

The Legislature enacted this preference, providing veterans and service members with disabilities a sales and use tax exemption for purchases, installation, and repair of prescribed AAE.

The Legislature noted that veterans who have been severely injured often need customized, accessible transportation to be self-sufficient. The Legislature stated these individuals with disabilities:

- Are three times more likely to be at or below the national poverty level.

- Often cannot afford the sales or use tax owed on the extensive adaptive equipment they require.

- Sometimes purchase the equipment in neighboring states that do not impose a sales tax. This puts Washington businesses at a competitive disadvantage.

The preference is scheduled to expire July 1, 2018.

State law defines eligible equipment, while federal VA sets reimbursement criteria

Definitions and examples

Add-on automotive adaptive equipment (AAE): equipment installed in, and modifications made to, a motor vehicle that are necessary to assist physically challenged persons to enter, exit, or safely operate a vehicle. These do not include motor vehicles or equipment installed by the vehicle manufacturer. Add-on adaptive equipment may include:

- Chest and shoulder harnesses

- Digital driving systems

- Dual battery systems

- Hand controls

- Left foot gas pedals

- Lowered floors or raised roofs

- Parking brake extensions

- Power door openers

- Raised doors

- Ramps under vehicles lifts

- Reduced and zero effort steering and braking

- Steering devices

- Voice-activated controls

- Wheelchair lifts or restraints

Federal funding for AAE purchases

According to the U.S. Department of Veterans Affairs (VA), veterans and service members with disabilities are eligible for AAE for up to two vehicles in a four-year period. The VA establishes criteria for allowable AAE reimbursements, but there is no lifetime limit on AAE for qualified veterans and service members with disabilities.

Legislature stated public policy objectives in its intent statement

The Legislature stated its objectives were to:

- Provide specific financial relief for severely injured veterans and service members.

- Offset a competitive disadvantage for Washington’s automotive adaptive equipment businesses when compared to similar businesses in states without a sales and use tax.

The Legislature also stated its intent to reexamine the preference in five years.

Provide specific financial relief to veterans and service members with disabilities

The Legislature noted that severely injured veterans and service members:

- “…often need customized, accessible transportation to be self-sufficient and to maintain a high quality of life.”

- “Are three times more likely to be at or below the national poverty level.”

- “Often times cannot afford the tax due to the substantial amount of adaptive equipment required in such customized vehicles.”

The prime sponsor testified that the preference would be used by about 20 to 25 people each year.

Adaptive equipment costs vary depending on the level of disability:

- 2013 House Finance staff estimated the average cost for adaptive automotive equipment (AAE) was $9,000. This would make the combined state and local sales taxes $800 on average.

- Stakeholders indicated that simple hand controls to operate the gas and brake might cost $2,000. Additional state and local sales taxes would be $180 on average.

- Stakeholders also noted that a more extensive adaptation that provides wheelchair access to an automobile and voice command controls could cost over $40,000. State and local sales taxes would cost an additional $3,600 on average.

Offset a competitive disadvantage of Washington’s tax structure

The Legislature stated that the financial burden of owing sales tax had the “unintended effect” of encouraging veterans and service members with disabilities to purchase automotive adaptive equipment outside of Washington. Neighboring states, such as Oregon, have no sales tax. While Washington residents are required to pay use tax on items purchased in Oregon, compliance is low.

Reexamine preference performance and cost

The Legislature also stated it wanted to reexamine the preference in five years to:

- Determine if the preference mitigated the competitive disadvantage stemming from Washington’s tax structure.

- Compare the cost of the preference in foregone state revenue with what was “reasonably assumed” in the 2013 fiscal note estimate.

For the purposes of this review, JLARC staff used estimated beneficiary savings to determine foregone revenues.

Preference provides financial relief and removes competitive disadvantage, but estimated beneficiary savings exceed fiscal note estimate

Provides specific financial relief

The preference is providing financial relief to Washington’s veterans and service members with disabilities on their purchases of prescribed automotive adaptive equipment (AAE). Department of Revenue (DOR) records show that Washington businesses are selling tax-exempt AAE. The preference reduces the amount owed by veterans and service members with disabilities by an average of 9.0 percent of the equipment’s total cost.

Offsets a competitive disadvantage of Washington’s tax structure

The preference eliminates a perceived competitive disadvantage for Washington businesses. There is no data available to determine if Washington veterans and service members with disabilities are purchasing more equipment in state because of the preference.

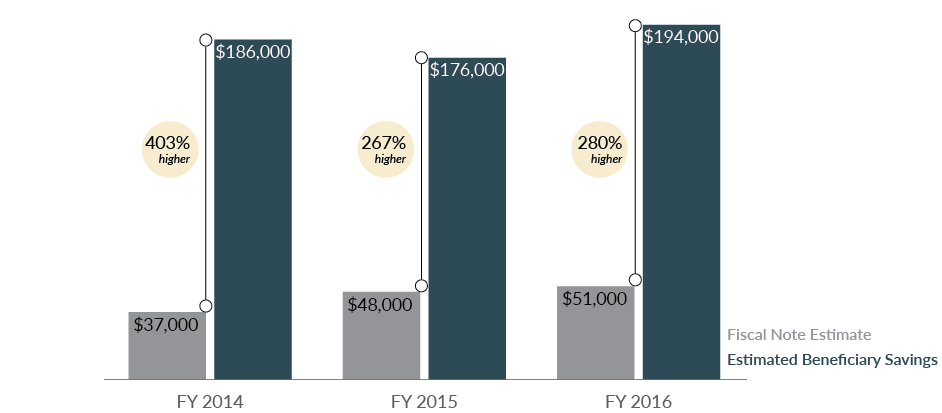

Estimated beneficiary savings exceed fiscal note estimate

JLARC staff did not quantify foregone revenue, which requires determining or assuming changes in taxpayer purchasing behavior. Instead, JLARC staff estimated the beneficiary savings for this preference based on qualifying sales and services reported to DOR by Washington’s AAE businesses from August 2013 through June 2016 .

JLARC staff found the estimated beneficiary savings from this preference exceed what was “reasonably assumed” in the 2013 fiscal note by at least 267 percent in each fiscal year since the preference was enacted.

The fiscal note estimate indicated an average of 20 taxpayers would qualify for the preference each year. The Department of Veterans Affairs reports that it processed 185 applications from Washington residents in Calendar Year 2016, and 75 in Calendar Year 2015.

Continuing the preference reduces costs to veterans and service members with disabilities and removes perceived competitive disadvantage

The preference is scheduled to expire on July 1, 2018. Continuing the tax preference will provide financial relief to Washington’s veterans and service members with disabilities who purchase AAE and related repair and installation services. It also removes a perceived competitive disadvantage for Washington businesses selling and servicing AAE.

Veterans and service members with disabilities and Washington businesses benefit from this preference

Tax preferences have direct beneficiaries (entities whose state tax liabilities are directly affected) and may have indirect beneficiaries (entities that may receive benefits from the preference, but are not the primary recipient of the benefit).

Direct Beneficiaries

Direct beneficiaries of the tax preference are veterans and service members with disabilities. The U.S. Department of Veterans Affairs reports that it processed 185 applications for automobile adaptive equipment (AAE) from Washington residents in Calendar Year 2016. There were 75 applications submitted in Calendar Year 2015.

Indirect Beneficiaries

Indirect beneficiaries of the tax preference are Washington businesses that sell and service AAE. In 2013 testimony, an AAE business owner indicated that there were four or five AAE businesses in Washington. More recent data shows that there still are four or five Washington businesses selling and servicing AAE.

Estimated beneficiary savings in Fiscal Year 2016 are $194,000

JLARC staff estimate the direct beneficiary savings at $194,000 in Fiscal Year 2016 and $194,000 for the 2017-19 biennium. The preference is currently scheduled to expire on July 1, 2018, midway through the 2017-19 Biennium.

JLARC staff estimated the beneficiary savings using qualifying sales reported to the Department of Revenue by businesses selling and servicing automobile adaptive equipment (AAE) to veterans and service members with disabilities.

| Biennium | Fiscal Year | Total Exempt | State Sales Tax | Local Sales Tax | Total Estimated Beneficiary Savings |

|---|---|---|---|---|---|

| 2013-15 (7/1/13-6/30/15) |

2014 | $2,073,000 |

$135,000 |

$51,000 |

$186,000 |

| 2015 | $1,954,000 |

$127,000 |

$49,000 |

$176,000 |

|

| 2015-17 (7/1/15-6/30/17) |

2016 | $2,152,000 |

$140,000 |

$54,000 |

$194,000 |

| 2017 | $2,152,000 |

$140,000 |

$54,000 |

$194,000 |

|

| 2017-19 (7/1/17-6/30/18) |

2018 | $2,152,000 |

$140,000 |

$54,000 |

$194,000 |

| 2019 | Preference expires effective July 1, 2018 | ||||

| Total 2017-19 Estimated Savings | $2,152,000 |

$140,000 |

$54,000 |

$194,000 |

|

Absent the tax preference, beneficiaries would pay sales or use tax

If the tax preference were terminated or allowed to expire as scheduled, veterans and service members with disabilities would pay sales or use tax on the cost of purchasing, repairing, and installing AAE on their vehicles. The preference reduces the amount they owe by an average of 9.0 percent of the total cost of their equipment.

Washington businesses may be at a competitive disadvantage with businesses in states that do not have a sales tax.

Washington and four other states exempt AAE purchases for veterans with disabilities, 32 other states exempt AAE purchases for all individuals with disabilities

JLARC staff reviewed the 45 states and the District of Columbia that impose sales and use taxes and found:

- Five states provide a specific exemption for veterans with disabilities who purchase automotive adaptive equipment (AAE). They are: Washington, Arkansas, Georgia, Massachusetts, and Tennessee.

- 32 states provide an exemption for all individuals with disabilities (not just veterans) who purchase AAE or mobility enhancing equipment that can be used in vehicles.

- For nine states and the District of Columbia, JLARC staff were unable to determine if a similar tax exemption is in place.

RCW 82.08.875

Exemptions—Automotive adaptive equipment. (Expires July 1, 2018.)

(1) The tax imposed by RCW 82.08.020 does not apply to sales to eligible purchasers of prescribed add-on automotive adaptive equipment, including charges incurred for labor and services rendered in respect to the installation and repairing of such equipment. The exemption provided in this section only applies if the eligible purchaser is reimbursed in whole or part for the purchase by the United States department of veterans affairs or other federal agency, and the reimbursement is paid directly by that federal agency to the seller.

(2) Sellers making tax-exempt sales under this section must:

(a) Obtain an exemption certificate from the eligible purchaser in a form and manner prescribed by the department. The seller must retain a copy of the exemption certificate for the seller's files. In lieu of an exemption certificate, a seller may capture the relevant data elements as allowed under the streamlined sales and use tax agreement;

(b) File their tax return with the department electronically; and

(c) Report their total gross sales on their return and deduct the exempt sales under subsection (1) of this section from their reported gross sales.

(3) For purposes of this section, the following definitions apply unless the context clearly requires otherwise:

(a) "Add-on automotive adaptive equipment" means equipment installed in, and modifications made to, a motor vehicle that are necessary to assist physically challenged persons to enter, exit, or safely operate a motor vehicle. The term includes but is not limited to wheelchair lifts, wheelchair restraints, ramps, under vehicle lifts, power door openers, power seats, lowered floors, raised roofs, raised doors, hand controls, left foot gas pedals, chest and shoulder harnesses, parking brake extensions, dual battery systems, steering devices, reduced and zero effort steering and braking, voice-activated controls, and digital driving systems. The term does not include motor vehicles and equipment installed in a motor vehicle by the manufacturer of the motor vehicle.

(b) "Eligible purchaser" means a veteran, or member of the armed forces serving on active duty, who is disabled, regardless of whether the disability is service connected as that term is defined by federal statute 38 U.S.C. Sec. 101, as amended, as of August 1, 2013.

(c) "Prescribed add-on automotive adaptive equipment" means add-on automotive adaptive equipment prescribed by a physician.

(4) This section expires July 1, 2018.

[ 2013 c 211 § 2.]

NOTES:

Findings—Intent—2013 c 211: "(1) The legislature finds that it is important to recognize the service of active duty military and veterans and to acknowledge the continued sacrifice of those veterans who have been catastrophically injured. The legislature further finds that many disabled veterans often need customized, accessible transportation to be self-sufficient and to maintain a high quality of life. The legislature further finds that individuals with a severe disability are three times more likely to be at or below the national poverty level. The legislature further finds that the federal government pays for the cost of mobility adaptive equipment for severely injured veterans; however, it does not cover the cost of sales or use tax owed on this equipment. The legislature further finds that this cost is then shifted onto the veterans, who often times cannot afford the tax due to the substantial amount of adaptive equipment required in such customized vehicles. The legislature further finds that this added financial burden has the unintended effect of causing some veterans to acquire their mobility adaptive equipment in neighboring states that do not impose a sales tax, thereby negatively impacting Washington businesses providing mobility enhancing equipment and services to Washington veterans.

(2) It is the legislature's intent to provide specific financial relief for severely injured veterans and to ameliorate a negative consequence of Washington's tax structure by providing a sales and use tax exemption for mobility adaptive equipment required to customize vehicles for disabled veterans. It is the further intent of the legislature to reexamine this exemption in five years to determine whether it has mitigated the competitive disadvantage stemming from Washington's tax structure on mobility businesses and to assess whether the cost of the exemption in terms of forgone state revenue is beyond what was reasonably assumed in the fiscal estimate for the legislation." [ 2013 c 211 § 1.]

Effective date—2013 c 211: "This act takes effect August 1, 2013." [ 2013 c 211 § 4201

RCW 82.12.875

Automotive adaptive equipment. (Expires July 1, 2018.)

(1) The tax imposed by RCW 82.12.020 does not apply to the use of prescribed add-on automotive adaptive equipment or to labor and services rendered in respect to the installation and repairing of such equipment. The exemption under this section only applies if the sale of the prescribed add-on automotive adaptive equipment or labor and services was exempt from sales tax under RCW 82.08.875 or would have been exempt from sales tax under RCW 82.08.875 if the equipment or labor and services had been purchased in this state.

(2) For purposes of this section, "prescribed add-on automotive adaptive equipment" has the same meaning as provided in RCW 82.08.875.

(3) This section expires July 1, 2018.

[ 2013 c 211 § 3.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor recommends clarifying the tax preference

The Legislature should clarify the sales and use tax exemption for veterans and service members with disabilities who purchase adaptive automotive equipment because the estimated beneficiary savings have exceeded the 2013 fiscal note estimate for the past three fiscal years.

The preference provides financial relief and removes a perceived competitive disadvantage. However, the Legislature intended to reexamine this preference after five years to assess if estimated beneficiary savings were beyond what was “reasonably assumed” in the fiscal note. The estimated beneficiary savings have exceeded the 2013 fiscal note estimate by at least 267 percent in each fiscal year since the preference was enacted.

Legislation required: Yes (preference expires on July 1, 2018).

Fiscal impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation with comment.

The commission accepts JLARC staff’s clarify recommendation with the understanding that the tax preference should be continued. The clarification should be narrowly focused on updating the fiscal note estimate. The JLARC staff analysis indicates the preference’s objectives are being met and the benefits are being received by the intended recipients. Because beneficiary savings consistently exceed the fiscal note estimate, this reinforces the need to continue this tax preference. The higher-than-expected beneficiary savings may reflect the significant increase in the number of U.S. veterans with disabilities.