|

JLARC Proposed Final Report: 2017 Tax Preference Performance Reviews |

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preferences Provide | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

A sales and use tax exemption for:

A leasehold excise tax (LET) exemption for private use of publicly owned property for installing, maintaining, or operating EV charging stations. The preferences are scheduled to expire on January 1, 2020. |

Sales and Use Leasehold Excise RCW 82.29A.125 |

Sales and Use Tax for EV Batteries: Limited use and impact Sales and Use Tax for EV Charging Stations: range between $1.8 - $3.4 million LET for EV Charging Stations: Unknown |

| Public Policy Objective |

|---|

The Legislature stated the public policy objectives:

|

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation Before the January 1, 2020, expiration date, the Legislature should:

Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation with comment. The Legislature should set clearer targets to measure the impact of this preference. The JLARC staff presentation relating to this preference suggested it is achieving its policy goals of building out electric vehicle (EV) infrastructure and encouraging consumers to transition to EVs. At the same time, the evidence suggests the preference’s impact is concentrated in a few geographic areas within the state. This is an important finding because the continued growth of EVs will require more widely dispersed charging stations. Finally, because public and private entities are showing interest in providing charging stations, reporting standards for both entities will be important in evaluating this preference in the future. |

- 1. What are the Preferences?

- 2. Legal History

- 3. Other Relevant Background

- 4. Public Policy Objectives

- 5. EV battery sales and use tax exemption

- 6. Charging station sales and use tax exemption

- 7. Charging station infrastructure leasehold excise tax exemption

- 8. Applicable Statutes

Tax preferences intended to encourage electric vehicle use and establish more electric vehicle charging stations

Purpose

The Legislature passed these preferences with the stated intent to:

- Encourage electric vehicle (EV) use; and

- Establish convenient, cost-effective EV charging infrastructure.

Preference 1: EV battery sales and use tax exemption

An exemption for EV battery purchases, installation, and repair services.

Preference 2: Charging station sales and use tax exemption

An exemption for EV charging stations and component parts, or labor and services to install, repair, or improve them.

Preference 3: Charging station infrastructure leasehold excise tax exemption

An exemption for entities that lease publicly owned land for installing, maintaining, or operating EV charging stations.

- What is leasehold excise tax? Parties pay leasehold excise tax when they use public property. The tax is based on the amount of the lease or rent. If there is no contract for renting or leasing, the Department of Revenue determines the “taxable rent” upon which the tax will be determined.

Preferences scheduled to expire in 2020

The preferences took effect July 26, 2009, and are set to expire January 1, 2020.

Legislature passed preferences to encourage use of electric vehicles and development of charging stations

2009: Legislature passed preferences

The Legislature passed these preferences to help the state transition to electric vehicles (EV). The bill included a sales and use tax exemption for EV batteries, a sales and use tax exemption for EV charging stations, and a leasehold excise tax (LET) exemption for operating EV charging stations on public land.

The preferences have not changed since they were passed in 2009. They are scheduled to expire in 2020.

There are a number of other legislative efforts, both at the state and federal level, to expand use of electric vehicles in Washington

The Legislature has taken many actions to encourage the use of clean alternative fuels and vehicles, including electric vehicles (EV).

A report to the Legislature

In 2015, the Joint Transportation Committee (JTC) of the Legislature released a report stating that widespread EV adoption depends in part on “a robust publicly available charging network.” The report also noted that many parts of the state remain inaccessible to EV drivers who depend on public charging stations.

Subsequent to the JTC report, the Legislature passed two bills in 2015 to increase and expand EV charging stations in Washington.

- The Utilities and Transportation Commission (UTC) was directed to adopt policies and consider developing incentives to encourage utilities to build EV infrastructure such as charging stations.

As of March 2017, the UTC had adopted draft policies. Currently, utilities may petition the UTC for up to a 2 percent additional return on capital investments if they install charging stations for ratepayers’ benefit. A report to the Legislature on this incentive program is due December 2017.

Three Washington utilities – Avista Corporation, Seattle City Light, and Puget Sound Energy – have developed projects to encourage residential and business customers to install Level 2 or 3 charging stations. While only the Avista project is related to the UTC incentive program, they share similar research goals, including how charging affects load and the power grid, and how it can be supported in the future. - The Department of Transportation was directed to develop a pilot program to support EV charging stations with public and private financing.

The Legislature provided $1 million for grants to cities, counties, transit agencies, or tribes to work with private charging networks to install charging stations along key highways. As of March 2017, WSDOT plans to have contracts beginning after July 1, 2017.

Other incentives

Two other tax preferences are designed to encourage use of clean alternative fuel vehicles, including electric vehicles.

| Preference | Type | Description | Began | Expiration Date | JLARC Review |

|---|---|---|---|---|---|

| Alternative Fuel Vehicles (AFV) | Sales and use | Exempts up to $32,000 of sale or lease price for eligible new passenger vehicles exclusively powered by clean alternative fuel and plug-in hybrids | 2009, amended in 2015 and 2016 | Earliest of when total number of AFVs titled in Washington after July 15, 2015, reaches 7,500 or July 1, 2019 | Full review in 2017 |

| Clean Alternative Fuel Commercial Vehicle Credit | B&O; Public utility | B&O tax or PUT credits for businesses that purchase a clean alternative fuel commercial vehicle or modify a vehicle to use such fuel | 2015, amended in 2016 and 2017 | Credits may be earned through January 1, 2021, and must be used by January 1, 2022 | Scheduled for 2020 |

Alternative fuel and hybrid electric vehicles with an EPA fuel economy rating of at least 50 MPG also are exempt from state emissions control inspections.

At the federal level, an income tax credit for alternative fuel infrastructure recently expired

Consumers who purchased qualified residential fueling equipment before the December 31, 2016, expiration date were eligible for a tax credit of up to $1,000.

A credit was available for commercial installations made between January 1, 2015, and December 31, 2016, and covered 30 percent of the infrastructure costs, up to $30,000.

Different charging levels

There are three ways electric vehicles can be charged. Level 2 and Level 3 chargers are eligible for the sales and use tax and/or leasehold excise tax preferences.

| Level 1 | Level 2 | Level 3 (fast charging) |

|

|---|---|---|---|

|

|

|

|

| Availability | Standard wall outlet |

|

Commercial or high-traffic location (e.g., near highways) |

| Cost to install | None – cable provided with vehicles | $1,000 - $3,000 for home outlets

$4,500 - $6,500 for public stations |

$90,000 or more |

| Recharging speed | Overnight | 4 to 7 hours | Under 30 minutes |

Legislature stated public policy objectives for preferences in 2009

The Legislature stated its objectives for the electric vehicle (EV) sales and use tax exemptions and the leasehold excise tax exemption:

- Encourage transition to greater use of electric vehicles; and

- Develop convenient, cost-effective electric vehicle infrastructure in Washington.

The Legislature also stated:

- Developing EV charging stations was a critical step in creating jobs, fostering economic growth, reducing greenhouse gas emissions, reducing reliance on foreign fuels, and reducing pollution in Puget Sound linked to gas-powered vehicles.

- Limited driving distance between battery chargers was a key obstacle to broad EV adoption.

Exemption for battery sales, installation, and repair has limited use

Less than three firms report qualified sales under this preference for sales, installation, and repair of electric vehicle batteries. This means the preference has limited impact on the objective of encouraging more electric vehicle (EV) use.

“Lease and swap” approach not used

When the Legislature considered this preference in 2009, one of the approaches discussed by the industry to increase the distance EVs might travel was a “lease and swap” of batteries.

In a “lease and swap,” drivers would lease batteries from private companies, swapping out depleted batteries for charged batteries at automated stations. This approach is not used in Washington or elsewhere.

Limited use for the sale of batteries

Less than three taxpayers report making qualified sales of batteries.

Beneficiary savings cannot be disclosed

The preference’s limited use indicates that current or future beneficiary savings associated with the preference are small compared to the other two preferences. Department of Revenue tax return data reflects less than three taxpayers reported qualifying sales for Fiscal Year 2016. No qualifying sales were reported in Fiscal Years 2014 or 2015.

JLARC staff found no other state with a sales and use tax exemption specifically for EV batteries or services to install, repair, or replace them.

Exemption for charging stations is used, but it’s unclear if growth meets the Legislature’s goal for expanded charging infrastructure

When the Legislature considered this preference in 2009, one of the approaches discussed by the industry to increase the distance EVs might travel was providing a network of rapid charging EV battery stations. This would allow EV drivers to quickly recharge their batteries.

This preference was structured to encourage increasing the number of these charging stations and is being used.

More EV charging equipment and stations added since preferences enacted

Since 2009, the number of EV charging stations has increased in Washington. Most of the growth has been in Level 2 chargers rather than Level 3. However, JLARC staff do not assert that there is a causal relationship between the increase in charging stations and the tax preference.

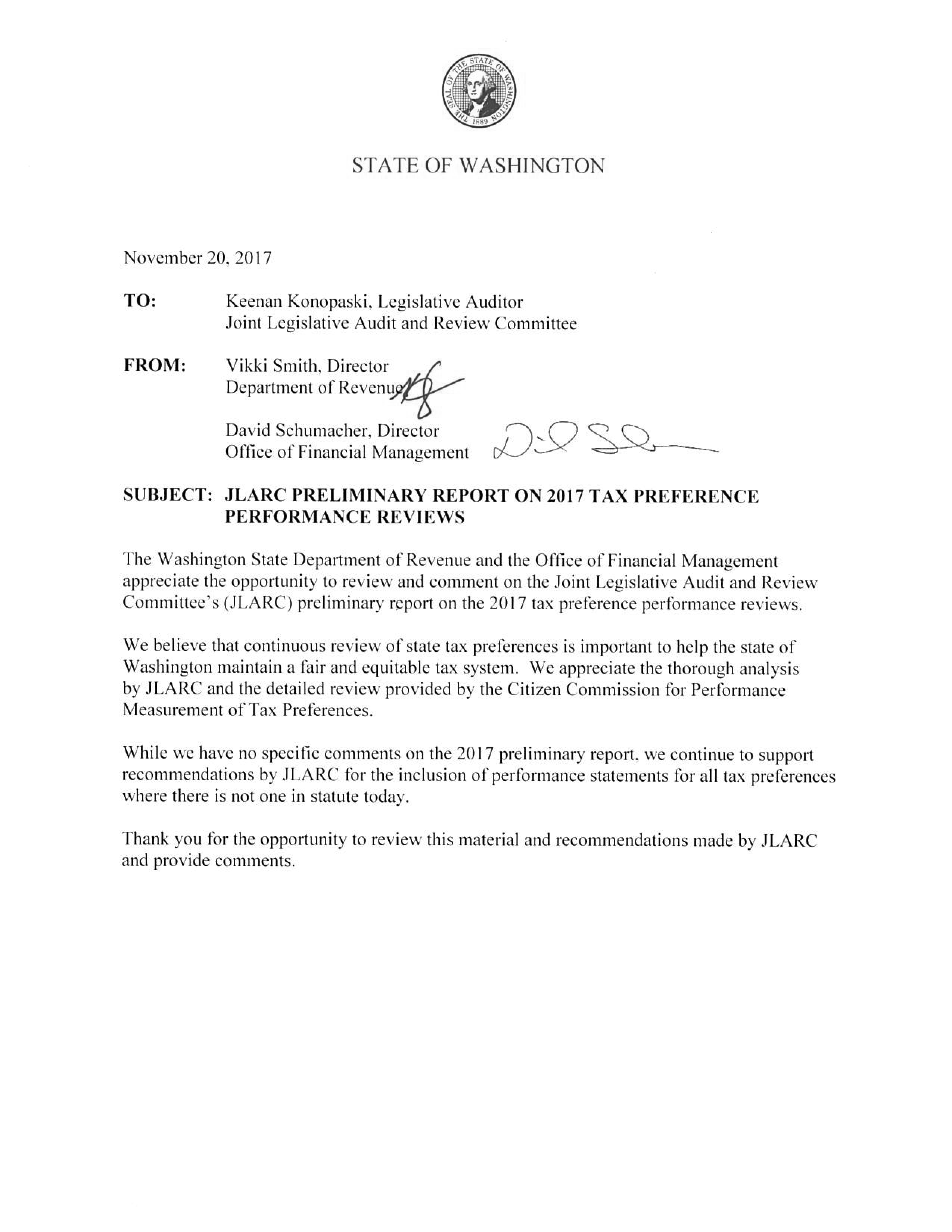

Publicly available charging stations

As of March 2017, the U.S. Department of Energy reported there were 669 open publicly available charging stations with 1,717 outlets in Washington. Of these, 1,663 opened after the preference took effect in July 2009.

Private charging stations

Individuals and businesses also may purchase and install private charging equipment at their homes and workplaces. Data is not available on the number of these installations.

The graphic below estimates the number of private charging units if between 25 and 75 percent of Washington EV owners installed such equipment at their homes.

Continuing this preference will continue to lower costs

The tax preference provides cost savings to individuals, businesses, government entities, and others on purchases of EV charging station components, as well as any charging station construction, installation, or repair services.

Several recent studies note that EV charging station businesses that rely solely on direct revenue from charging vehicles are not currently financially feasible.

Preferences benefit individuals, businesses, government entities that build or install EV charging stations at public and private locations

Tax preferences have direct beneficiaries (entities whose state tax liabilities are directly affected) and may have indirect beneficiaries (entities that may receive benefits from the preference, but are not the primary recipient of the benefit.)

Direct Beneficiaries

The direct beneficiaries are those who purchase EV charging components or build, install, or repair EV charging stations for public or private use.

Indirect Beneficiaries

Indirect beneficiaries are EV drivers who benefit because they may have greater access to charging stations throughout the state.

Estimated beneficiary savings in 2017-19 Biennium range between $1.8 and $3.4 million

JLARC staff estimated the direct beneficiary savings by calculating the number of and costs associated with three different EV charger type and site location combinations:

- Level 2 and 3 publicly available charging stations installed in Washington per U.S. Department of Energy (USDOE) data, with a range of possible costs per installation.

- Level 2 EV charging stations installed at private residences or businesses in Washington. JLARC staff used data from the Department of Licensing on all newly titled or title transfers for EVS for Fiscal Years 2014 through nearly half of Fiscal Year 2017. Staff then estimated a range of the number of Level 2 charging equipment installed at private residences or businesses from 25 percent to 75 percent.

| Biennium | FY | Range of Public Stations | Range of Private Stations | Total savings range (public + private) | ||

|---|---|---|---|---|---|---|

| Low Estimate | High Estimate | 25% Owners | 75% Owners | |||

| 2013-15 7/1/13-6/30/15 |

2014 | $327,000 | $333,000 | $247,000 | $740,000 | $574,000 - $1,073,000 |

| 2015 | $185,000 | $188,000 | $268,000 | $803,000 | $453,000 - $991,000 | |

| 2015-17 7/1/15-6/30/17 |

2016 | $554,000 | $650,000 | $219,000 | $658,000 | $773,000 - 1,308,000 |

| 2017 | $505,000 | $584,000 | $368,000 | $1,105,000 | $873,000 – 1,609,000 | |

| 2017-19 7/1/17-6/30/19 |

2018 | $512,000 | $590,000 | $368,000 | $1,105,000 | $880,000 - $1,695,000 |

| 2019 | $520,000 | $595,000 | $368,000 | $1,105,000 | $888,000 - $1,700,000 | |

| 2017-19 Biennium | $1,032,000 | $1,185,000 | $736,000 | $2,210,000 | $1,768,000 - $3,395,000 | |

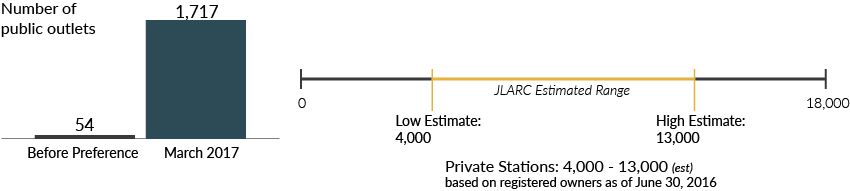

Other states and utilities offer a variety of incentives to encourage EV use and charging equipment installations

Washington is the only state with a sales and use tax exemption to promote and encourage electric vehicle charging stations. However, other states offer a number of related incentives.

State or local government programs to incentivize installation of charging equipment generally:

- Benefit both residential and commercial locations.

- Include a variety of incentives, such as rebates, income tax credits, and grants.

- Have time limits or are provided on a first-come-first-served basis and capped.

Utility-sponsored programs to incentivize EVSE installation generally:

- Benefit residential and sometimes commercial customers.

- Provide funding or rebates for a percentage of costs or an amount below a cap.

- Sometimes only available to participants who agree to time-of-use rates.

- Limited to a certain number of participants or for a limited time.

Extent of use and contribution to objectives is unknown

It is unknown to what extent the leasehold excise tax (LET) exemptions for private use of publicly owned property to operate EV charging stations is being used or whether it has had any impact toward achieving the public policy objectives.

No data available to assess leasehold excise tax exemption for private use of public property

Qualifying EV charging stations can be located at sites owned by state, local, or the federal government.

However, there is no requirement for these government entities or beneficiaries to report their use of the preference. The result is that no records are available to help inform how much the preference is used or the circumstances for its use.

Therefore, it is unknown how much the leasehold excise tax exemption is being used or whether it has had any impact toward achieving the objectives.

Preference benefits businesses that build, install, or operate EV charging stations on public property

Tax preferences have direct beneficiaries (entities whose state tax liabilities are directly affected) and may have indirect beneficiaries (entities that may receive benefits from the preference, but are not the primary recipient of the benefit.)

Direct beneficiaries are businesses that lease or use publicly owned property to operate EV charging stations. While there may be direct beneficiaries, no data is available to identify them.

Indirect beneficiaries are EV drivers, who benefit because they may have greater access to charging stations throughout the state.

JLARC staff did not identify a method to determine the beneficiary savings for the preference.

There are no records documenting use of this preference. The Department of Revenue’s 2016 Tax Exemption study identified the taxpayer savings for this preference as “indeterminate.” The preference is currently set to expire January 1, 2020.

Absent this tax preference, impact on use of publicly owned property uncertain

Any businesses that lease or use publicly owned property to locate or operate EV charging equipment or stations would owe leasehold excise tax on the lease amount or value of the arrangement. It is unknown how this would impact such arrangements.

No other states offer a similar tax preference

JLARC staff identified two states, Arizona and Florida, with a tax similar to Washington’s leasehold excise tax. Neither state has an exemption for electric vehicle charging infrastructure.

RCW 82.08.8182

Exemptions—Electric vehicle batteries and infrastructure. (Expires January 1, 2020.)

(1) The tax imposed by RCW 82.08.020 does not apply to:

(a) The sale of batteries for electric vehicles;

(b) The sale of or charge made for labor and services rendered in respect to installing, repairing, altering, or improving electric vehicle batteries;

(c) The sale of or charge made for labor and services rendered in respect to installing, constructing, repairing, or improving electric vehicle infrastructure; and

(d) The sale of tangible personal property that will become a component of electric vehicle infrastructure during the course of installing, constructing, repairing, or improving electric vehicle infrastructure.

(2) Sellers may make tax exempt sales under this section only if the buyer provides the seller with an exemption certification in a form and manner prescribed by the department. The seller must retain a copy of the certificate for the seller's files.

(3) The definitions in this subsection apply throughout this section unless the context clearly requires otherwise.

(a) "Battery charging station" means an electrical component assembly or cluster of component assemblies designed specifically to charge batteries within electric vehicles, which meet or exceed any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(b) "Battery exchange station" means a fully automated facility that will enable an electric vehicle with a swappable battery to enter a drive lane and exchange the depleted battery with a fully charged battery through a fully automated process, which meets or exceeds any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(c) "Electric vehicle infrastructure" means structures, machinery, and equipment necessary and integral to support an electric vehicle, including battery charging stations, rapid charging stations, and battery exchange stations.

(d) "Rapid charging station" means an industrial grade electrical outlet that allows for faster recharging of electric vehicle batteries through higher power levels, which meets or exceeds any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(4) This section expires January 1, 2020.

[ 2009 c 459 § 4.]

RCW 82.12.816

Exemptions—Electric vehicle batteries and infrastructure. (Expires January 1, 2020.)

(1) The tax imposed by RCW 82.12.020 does not apply to the use of:

(a) Electric vehicle batteries;

(b) Labor and services rendered in respect to installing, repairing, altering, or improving electric vehicle batteries; and

(c) Tangible personal property that will become a component of electric vehicle infrastructure during the course of installing, constructing, repairing, or improving electric vehicle infrastructure.

(2) The definitions in this subsection apply throughout this section unless the context clearly requires otherwise.

(a) "Battery charging station" means an electrical component assembly or cluster of component assemblies designed specifically to charge batteries within electric vehicles, which meet or exceed any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(b) "Battery exchange station" means a fully automated facility that will enable an electric vehicle with a swappable battery to enter a drive lane and exchange the depleted battery with a fully charged battery through a fully automated process, which meets or exceeds any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(c) "Electric vehicle infrastructure" means structures, machinery, and equipment necessary and integral to support an electric vehicle, including battery charging stations, rapid charging stations, and battery exchange stations.

(d) "Rapid charging station" means an industrial grade electrical outlet that allows for faster recharging of electric vehicle batteries through higher power levels, which meets or exceeds any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(3) This section expires January 1, 2020.

[ 2009 c 459 § 5.]

RCW 82.29A.1282

Exemptions—Electric vehicle infrastructure. (Expires January 1, 2020.)

(1) Leasehold excise tax may not be imposed on leases to tenants of public lands for purposes of installing, maintaining, and operating electric vehicle infrastructure.

(2) The definitions in this subsection apply throughout this section unless the context clearly requires otherwise.

(a) "Battery charging station" means an electrical component assembly or cluster of component assemblies designed specifically to charge batteries within electric vehicles, which meet or exceed any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(b) "Battery exchange station" means a fully automated facility that will enable an electric vehicle with a swappable battery to enter a drive lane and exchange the depleted battery with a fully charged battery through a fully automated process, which meets or exceeds any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(c) "Electric vehicle infrastructure" means structures, machinery, and equipment necessary and integral to support an electric vehicle, including battery charging stations, rapid charging stations, and battery exchange stations.

(d) "Rapid charging station" means an industrial grade electrical outlet that allows for faster recharging of electric vehicle batteries through higher power levels, which meets or exceeds any standards, codes, and regulations set forth by chapter 19.28 RCW and consistent with rules adopted under RCW 19.27.540.

(3) This section expires January 1, 2020.

[ 2009 c 459 § 3.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor recommends clarifying the three preferences

Before the January 1, 2020, expiration date, the Legislature should:

- Review and clarify the electric vehicle battery tax preference to determine if the use matches legislative expectations for the preference.

It appears that the original intent of the preference was to incentivize a “lease and swap” approach for electric vehicle batteries. While this approach is not being used, the preference is being used on a limited basis (less than three firms making qualified sales) for battery sales. The Legislature should clarify if that use matches legislative expectations for the preference. - Review and clarify the electric vehicle charging station components, construction, installation, and repair tax preference to set a target for the number of new EV charging stations.

The Legislature could consider a metric for the number of stations that would be sufficient to achieve the public policy objectives. Metrics might be a number of charging stations per registered electric vehicles, or ensuring the geographic availability of charging infrastructure throughout the state. - Clarify the leasehold excise tax preference for private use of publicly owned property for electric vehicle infrastructure to require direct beneficiaries to report their use of the preference.

If the Legislature wants information on use of this preference and some estimation of the beneficiary savings, an application or other reporting requirements to identify use of the preference is needed. This would likely require information and compliance from both government entities that own the property and the businesses that lease or use the property.

Legislation required: Yes (preferences expire on January 1, 2020).

Fiscal impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation with comment.

The Legislature should set clearer targets to measure the impact of this preference. The JLARC staff presentation relating to this preference suggested it is achieving its policy goals of building out electric vehicle (EV) infrastructure and encouraging consumers to transition to EVs. At the same time, the evidence suggests the preference’s impact is concentrated in a few geographic areas within the state. This is an important finding because the continued growth of EVs will require more widely dispersed charging stations. Finally, because public and private entities are showing interest in providing charging stations, reporting standards for both entities will be important in evaluating this preference in the future.