|

JLARC Final Report: 2017 Tax Preference Performance Reviews |

Report 17-07, December 2017

Sales of Manufactured and Mobile Home Communities | Real Estate Excise Tax

Click here for One Page Overview

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

An exemption for sellers from real estate excise tax when they sell a mobile or manufactured home community to an organization for the purpose of preserving the community. |

Real Estate Excise Tax |

$96,000 |

| Public Policy Objective |

|---|

The Legislature stated the public policy objectives were to encourage and facilitate preservation of existing manufactured and mobile home communities, and involve community tenants or eligible organizations representing their interests in preservation. |

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation Continue: The Legislature should continue the preference because it is meeting its stated public policy objective of facilitating the preservation of existing manufactured and mobile home communities. Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation without comment. |

- 1. What is the Preference?

- 2. Legal History

- 3. Other Relevant Background

- 4. Public Policy Objectives

- 5. Are Objectives Being Met?

- 6. Beneficiaries

- 7. Revenue and Economic Impacts

- 8. Other States with Similar Preference?

- 9. Applicable Statutes

Real estate excise tax exemption for qualifying sales of manufactured and mobile home communities

Purpose

The Legislature passed the preference to:

- Encourage and facilitate preservation of existing manufactured and mobile home communities.

- Involve tenants and organizations that represent tenants’ interests in preserving the communities where they live.

Preference exempts sellers from real estate excise tax when property is sold to an eligible organization

The preference exempts sellers from real estate excise tax when they sell a manufactured/mobile home community to an eligible organization “for the purpose of preserving the property as a manufactured/mobile home community.”

- Real estate excise tax is a tax on the sale of real estate. It is based on the full selling price, and is typically paid by the seller of the property. The state tax rate is 1.28 percent. City and county rates vary for a combined state and local rate of up to 2.78 percent.

Statute specifies that qualifying sales must remain as a manufactured home community

To qualify for the exemption, the seller must transfer the community in a single purchase. The purchaser must preserve the property as a manufactured or mobile home community and be one of the following eligible organizations:

- Qualified formal organization of tenants in the community.

- Local government.

- Local housing authority.

- Nonprofit community or neighborhood-based organization.

- Federally recognized Indian tribe in the state of Washington.

- Regional or statewide nonprofit housing assistance organization.

Exemption scheduled to expire in December 2018

The preference was enacted in 2008 and is currently scheduled to expire on December 31, 2018.

Preference to facilitate sales that preserve manufactured or mobile home communities

1993: Legislature required owners to give tenants a chance to purchase their community

The Legislature enacted a set of requirements for sales of mobile home communities. One provision stated that before an owner could sell a community, it must give the tenant organization an opportunity to buy it. The requirements were part of a larger bill that amended the rights and duties of landlords and tenants in mobile home communities.

2000: State Supreme Court invalidated 1993 act

The state Supreme Court held that the provision giving tenants the right to purchase parks before other buyers violated the Washington state constitution by taking private property for private use.

2008: Legislature created this preference to preserve existing mobile home communities

The Legislature passed legislation which:

- Required a 14-day notice of sale.

- Encouraged owners to negotiate in good faith with tenants.

- Created an exemption from the real estate excise tax for qualifying sales to tenant organizations or other organizations representing tenants’ interests.

The prime sponsor of the companion bill cited concerns about the number of communities that had closed since 2006, the difficulty of moving homes when communities close, and the number of tenants who were low-income or senior citizens on a fixed income.

The preference is scheduled to expire on December 31, 2018.

Commerce is involved when communities close and offers relocation assistance to some tenants.

Manufactured or mobile home communities are properties that have common areas and at least two spaces rented out for manufactured or mobile homes. Tenants rent spaces from the community owner.

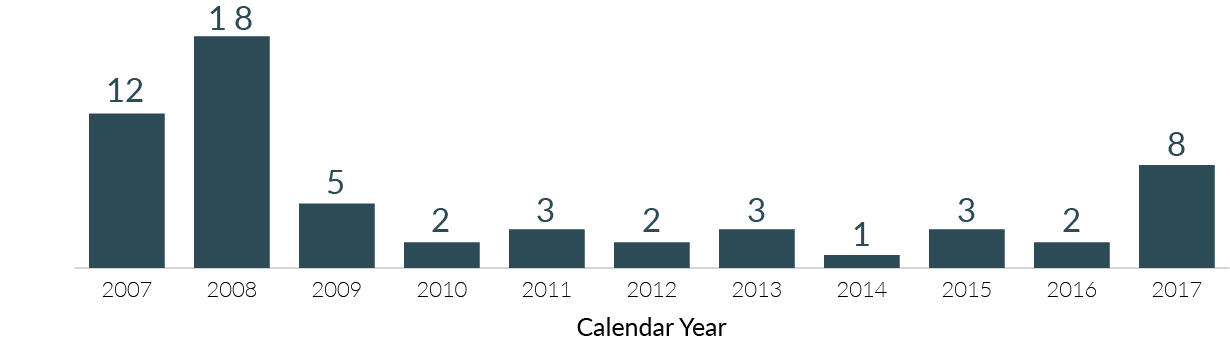

Since 2007 Commerce has received notices of 59 community closures

Since 1989, separate legislation requires owners to notify tenants and the Department of Commerce at least 12 months before closing a community. Closures are planned across the state, and agencies and housing advocates state that closures rise and fall with the local economy.

Some of the communities that will close in 2017 are planned for market rate apartments or hotels. Others will be used to expand schools and hospitals. According to Manufactured Home Communities of Washington, no new communities are being developed.

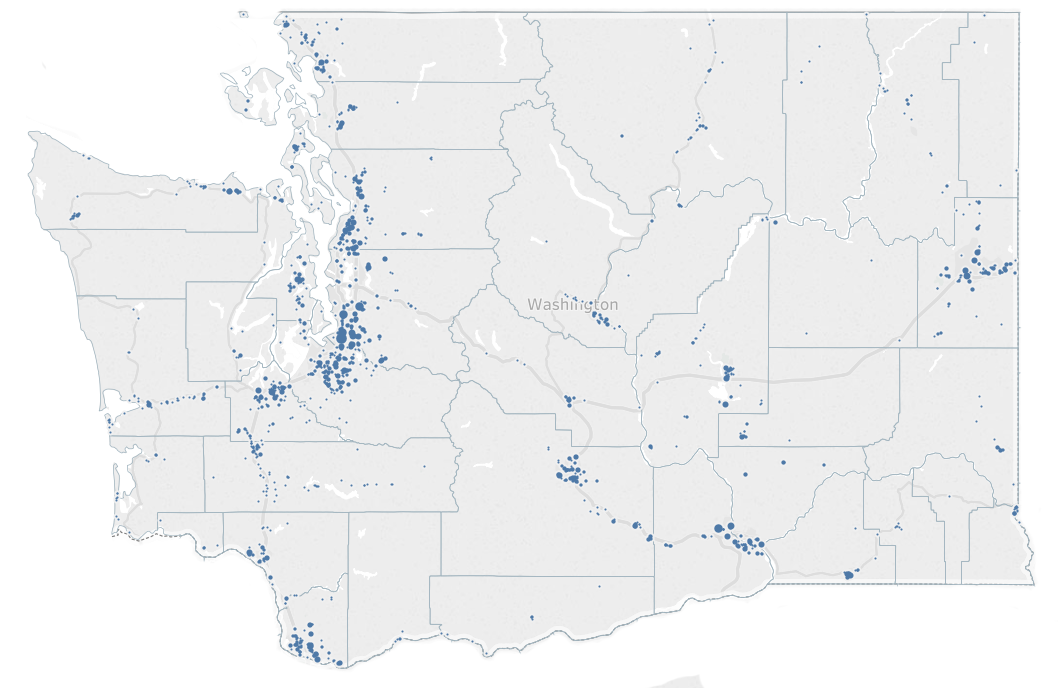

In May 2016, there were 1,377 registered mobile and manufactured home communities in Washington, with a total of 69,279 spaces for homes.

Commerce program may reimburse low-income tenants for relocation expenses

When communities close, the tenants must either move, or demolish and dispose of a manufactured or mobile home that they own.

The Department of Commerce may reimburse low-income tenants for eligible expenses through the Mobile and Manufactured Home Relocation Assistance Program. A tenant may receive up to $7500 for a single-section home or up to $12,000 for a multi-section home. Eligible expenses include the costs of relocation, demolition, disposal, and purchase of a newer manufactured or mobile home.

To qualify, a tenant must:

- Own the home and live in it at the time a closure notice is issued.

- Meet low-income requirements.

- Initially pay for any costs related to relocation, demolition, disposal, or purchasing a newer manufactured or mobile home before requesting reimbursement.

In January 2017, Commerce reported that since 2006:

- Communities with 2,322 spaces have closed.

- Commerce has provided assistance to 475 tenants – an average of $8,153 each.

Commerce does not have information about the remaining tenants because they may not have applied to the program or qualified for assistance.

Legislature stated public policy objectives in its intent statement

The Legislature stated that the public policy objectives for this preference were to:

- Encourage and facilitate preservation of existing manufactured and mobile home communities.

- Involve community tenants or eligible organizations representing their interests in preservation.

Preference facilitates sales that preserve communities by increasing tenants’ purchasing power

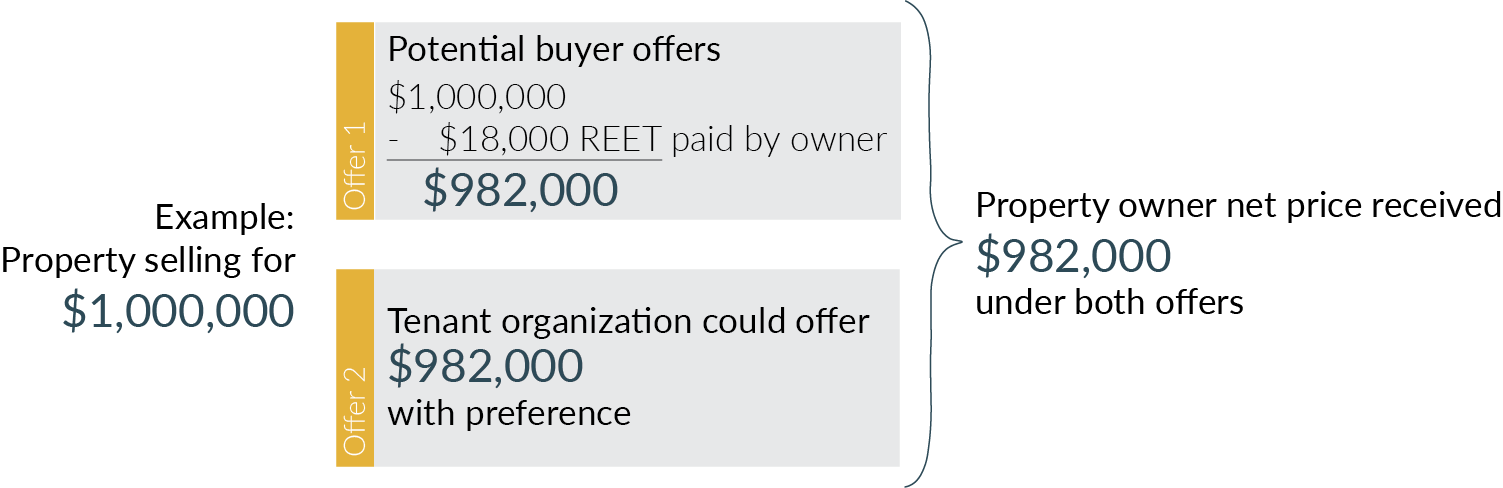

The preference facilitates sales by increasing the potential purchasing power of tenant organizations relative to other potential buyers.

For example, if an owner considered selling a property for $1 million, the real estate excise tax would be approximately $18,000. The net price received by the owner would be $982,000.

With the preference, tenants could provide a competing offer of $982,000 without impacting the net price the seller would receive, or consider offering more.

Department of Commerce staff, Housing Finance Commission staff, and housing advocates all noted that the preference is an important negotiation tool. They stated they believe owners express more interest in selling to tenants once they explain the preference.

Tenant organizations purchased 10 communities since the preference was enacted

As of March 2017, JLARC staff identified 10 communities purchased by tenant organizations since the preference was enacted, with a total of 480 spaces for homes. It is unclear whether the sales would have occurred without the preference.

Continuing the preference would facilitate sales of communities to tenants and other eligible organizations

The preference is scheduled to expire on December 31, 2018. If the preference were continued, tenants and eligible organizations could continue to offer community owners a tax benefit for selling the property to them.

Owners receive the preference when they sell to eligible organizations to preserve the community

Tax preferences have direct beneficiaries (entities whose state tax liabilities are directly affected) and indirect beneficiaries (entities that may receive benefits from the preference, but are not the primary recipient of the benefit).

Direct beneficiaries

The direct beneficiaries of the preference are owners who sell their manufactured or mobile home communities to eligible organizations. JLARC staff estimate there have been ten qualifying sales since the preference was enacted.

Indirect beneficiaries

Indirect beneficiaries of the preference include organizations that help community tenants stay in their housing. The preference may help them be competitive with other potential buyers while staying at a lower price point. The Legislature noted its intent to involve these organizations in the preservation of manufactured and mobile home communities.

Estimated beneficiary savings in 2017-19 Biennium are $96,000

JLARC staff estimate the average beneficiary savings for each sale is $32,000. The number of sales has fluctuated between one and four sales per year, so staff assume two qualifying sales per year in the future.

| Biennium | Fiscal Year | Number of qualifying sales | Estimated Beneficiary Savings |

|---|---|---|---|

| 2013-15 7/1/13-6/30/15 |

2014 | 1 | $32,000 |

| 2015 | 4 | $85,000 |

|

| 2015-17 7/1/15-6/30/17 |

2016 | 2 | $118,000 |

| 2017 (projected) | 2 | $64,000 |

|

| 2017-19 7/1/17-6/30/19 |

2018 (projected) | 2 | $64,000 |

| 2019 (projected) (preference scheduled to expire 12/31/2018) |

1 (half year) | $32,000 |

|

| 2017-19 Estimated Biennial Savings | $96,000 |

Absent the preference, sellers would pay real estate excise tax regardless of the buyer.

If the preference were terminated, owners of manufactured and mobile home communities would pay real estate excise tax when selling their properties regardless of the buyer. As a result, organizations working to preserve these communities would lose a competitive advantage the preference may provide to them over other buyers.

JLARC staff identified three states with capital gains exclusions

JLARC staff identified three states Oregon, Vermont, and Montana that offer a capital gains exclusion for similar qualifying sales. None offer an exemption from real estate excise tax.

- Since 2005, Oregon law has provided an income tax deduction from capital gains on sales of a manufactured dwelling park to a corporate entity formed by tenants, a nonprofit, or a housing authority.

- Since 1997, Vermont law has provided an income tax credit of 7 percent of the taxpayer’s taxable gains from a qualified sale of a mobile home park to leaseholders in the park or a nonprofit representing them.

- Since 2009, Montana law has provided an exclusion from income tax on the gains from a qualified sale of a mobile home park to a residents’ association, nonprofit or housing authority. The exclusion is 100% of gains for parks with 50 or fewer lots and 50% of gains for parks with more than 50 lots.

Findings—Intent—2008 c 116 (reviser’s note to RCW 59.20.300):

"(1) The legislature finds that:

(a) Manufactured/mobile home communities provide a significant source of homeownership opportunities for Washington residents. However, the increasing closure and conversion of manufactured/mobile home communities to other uses, combined with increasing mobile home lot rents, low vacancy rates in existing manufactured/mobile home communities, and the extremely high cost of moving homes when manufactured/mobile home communities close, increasingly make manufactured/mobile home community living insecure for manufactured/mobile home tenants.

(b) Many tenants who reside in manufactured/mobile home communities are low-income households and senior citizens and are, therefore, those residents most in need of reasonable security in the siting of their manufactured/mobile homes because of the adverse impacts on the health, safety, and welfare of tenants forced to move due to closure, change of use, or discontinuance of manufactured/mobile home communities.

(c) The preservation of manufactured/mobile home communities:

(i) Is a more economical alternative than providing new replacement housing units for tenants who are displaced from closing manufactured/mobile home communities;

(ii) Is a strategy by which all local governments can meet the affordable housing needs of their residents;

(iii) Is a strategy by which local governments planning under RCW 36.70A.040 may meet the housing element of their comprehensive plans as it relates to the provision of housing affordable to all economic sectors; and

(iv) Should be a goal of all housing authorities and local governments.

(d) The loss of manufactured/mobile home communities should not result in a net loss of affordable housing, thus compromising the ability of local governments to meet the affordable housing needs of its residents and the ability of these local governments planning under RCW 36.70A.040 to meet affordable housing goals under chapter 36.70A RCW.

(e) The closure of manufactured/mobile home communities has serious environmental, safety, and financial impacts, including:

(i) Homes that cannot be moved to other locations add to Washington's landfills;

(ii) Homes that are abandoned might attract crime; and

(iii) Vacant homes that will not be reoccupied need to be tested for asbestos and lead, and these toxic materials need to be removed prior to demolition.

(f) The self-governance aspect of tenants owning manufactured/mobile home communities results in a lesser usage of police resources as tenants experience fewer societal conflicts when they own the real estate as well as their homes.

(g) Housing authorities, by their creation and purpose, are the public body corporate and politic of the city or county responsible for addressing the availability of safe and sanitary dwelling accommodations available to persons of low income, senior citizens, and others.

(2) It is the intent of the legislature to encourage and facilitate the preservation of existing manufactured/mobile home communities in the event of voluntary sales of manufactured/mobile home communities and, to the extent necessary and possible, to involve manufactured/mobile home community tenants or an eligible organization representing the interests of tenants, such as a nonprofit organization, housing authority, or local government, in the preservation of manufactured/mobile home communities." [ 2008 c 116 § 1.]

RCW 82.45.010

"Sale" defined.

(1) As used in this chapter, the term "sale" has its ordinary meaning and includes any conveyance, grant, assignment, quitclaim, or transfer of the ownership of or title to real property, including standing timber, or any estate or interest therein for a valuable consideration, and any contract for such conveyance, grant, assignment, quitclaim, or transfer, and any lease with an option to purchase real property, including standing timber, or any estate or interest therein or other contract under which possession of the property is given to the purchaser, or any other person at the purchaser's direction, and title to the property is retained by the vendor as security for the payment of the purchase price. The term also includes the grant, assignment, quitclaim, sale, or transfer of improvements constructed upon leased land.

(2)(a) The term "sale" also includes the transfer or acquisition within any twelve-month period of a controlling interest in any entity with an interest in real property located in this state for a valuable consideration.

(b) For the sole purpose of determining whether, pursuant to the exercise of an option, a controlling interest was transferred or acquired within a twelve-month period, the date that the option agreement was executed is the date on which the transfer or acquisition of the controlling interest is deemed to occur. For all other purposes under this chapter, the date upon which the option is exercised is the date of the transfer or acquisition of the controlling interest.

(c) For purposes of this subsection, all acquisitions of persons acting in concert must be aggregated for purposes of determining whether a transfer or acquisition of a controlling interest has taken place. The department must adopt standards by rule to determine when persons are acting in concert. In adopting a rule for this purpose, the department must consider the following:

(i) Persons must be treated as acting in concert when they have a relationship with each other such that one person influences or controls the actions of another through common ownership; and

(ii) When persons are not commonly owned or controlled, they must be treated as acting in concert only when the unity with which the purchasers have negotiated and will consummate the transfer of ownership interests supports a finding that they are acting as a single entity. If the acquisitions are completely independent, with each purchaser buying without regard to the identity of the other purchasers, then the acquisitions are considered separate acquisitions.

(3) The term "sale" does not include:

(a) A transfer by gift, devise, or inheritance.

(b) A transfer by transfer on death deed, to the extent that it is not in satisfaction of a contractual obligation of the decedent owed to the recipient of the property.

(c) A transfer of any leasehold interest other than of the type mentioned above.

(d) A cancellation or forfeiture of a vendee's interest in a contract for the sale of real property, whether or not such contract contains a forfeiture clause, or deed in lieu of foreclosure of a mortgage.

(e) The partition of property by tenants in common by agreement or as the result of a court decree.

(f) The assignment of property or interest in property from one spouse or one domestic partner to the other spouse or other domestic partner in accordance with the terms of a decree of dissolution of marriage or state registered domestic partnership or in fulfillment of a property settlement agreement.

(g) The assignment or other transfer of a vendor's interest in a contract for the sale of real property, even though accompanied by a conveyance of the vendor's interest in the real property involved.

(h) Transfers by appropriation or decree in condemnation proceedings brought by the United States, the state or any political subdivision thereof, or a municipal corporation.

(i) A mortgage or other transfer of an interest in real property merely to secure a debt, or the assignment thereof.

(j) Any transfer or conveyance made pursuant to a deed of trust or an order of sale by the court in any mortgage, deed of trust, or lien foreclosure proceeding or upon execution of a judgment, or deed in lieu of foreclosure to satisfy a mortgage or deed of trust.

(k) A conveyance to the federal housing administration or veterans administration by an authorized mortgagee made pursuant to a contract of insurance or guaranty with the federal housing administration or veterans administration.

(l) A transfer in compliance with the terms of any lease or contract upon which the tax as imposed by this chapter has been paid or where the lease or contract was entered into prior to the date this tax was first imposed.

(m) The sale of any grave or lot in an established cemetery.

(n) A sale by the United States, this state or any political subdivision thereof, or a municipal corporation of this state.

(o) A sale to a regional transit authority or public corporation under RCW 81.112.320 under a sale/leaseback agreement under RCW 81.112.300.

(p) A transfer of real property, however effected, if it consists of a mere change in identity or form of ownership of an entity where there is no change in the beneficial ownership. These include transfers to a corporation or partnership which is wholly owned by the transferor and/or the transferor's spouse or domestic partner or children of the transferor or the transferor's spouse or domestic partner. However, if thereafter such transferee corporation or partnership voluntarily transfers such real property, or such transferor, spouse or domestic partner, or children of the transferor or the transferor's spouse or domestic partner voluntarily transfer stock in the transferee corporation or interest in the transferee partnership capital, as the case may be, to other than (i) the transferor and/or the transferor's spouse or domestic partner or children of the transferor or the transferor's spouse or domestic partner, (ii) a trust having the transferor and/or the transferor's spouse or domestic partner or children of the transferor or the transferor's spouse or domestic partner as the only beneficiaries at the time of the transfer to the trust, or (iii) a corporation or partnership wholly owned by the original transferor and/or the transferor's spouse or domestic partner or children of the transferor or the transferor's spouse or domestic partner, within three years of the original transfer to which this exemption applies, and the tax on the subsequent transfer has not been paid within sixty days of becoming due, excise taxes become due and payable on the original transfer as otherwise provided by law.

(q)(i) A transfer that for federal income tax purposes does not involve the recognition of gain or loss for entity formation, liquidation or dissolution, and reorganization, including but not limited to nonrecognition of gain or loss because of application of 26 U.S.C. Sec. 332, 337, 351, 368(a)(1), 721, or 731 of the internal revenue code of 1986, as amended.

(ii) However, the transfer described in (q)(i) of this subsection cannot be preceded or followed within a twelve-month period by another transfer or series of transfers, that, when combined with the otherwise exempt transfer or transfers described in (q)(i) of this subsection, results in the transfer of a controlling interest in the entity for valuable consideration, and in which one or more persons previously holding a controlling interest in the entity receive cash or property in exchange for any interest the person or persons acting in concert hold in the entity. This subsection (3) (q)(ii) does not apply to that part of the transfer involving property received that is the real property interest that the person or persons originally contributed to the entity or when one or more persons who did not contribute real property or belong to the entity at a time when real property was purchased receive cash or personal property in exchange for that person or persons' interest in the entity. The real estate excise tax under this subsection (3)(q)(ii) is imposed upon the person or persons who previously held a controlling interest in the entity.

(r) A qualified sale of a manufactured/mobile home community, as defined in RCW 59.20.030, that takes place on or after June 12, 2008, but before December 31, 2018.

[ 2014 c 58 § 24; 2010 1st sp.s. c 23 § 207. Prior: 2008 c 116 § 3; 2008 c 6 § 701; 2000 2nd sp.s. c 4 § 26; 1999 c 209 § 2; 1993 sp.s. c 25 § 502; 1981 c 93 § 1; 1970 ex.s. c 65 § 1; 1969 ex.s. c 223 § 28A.45.010; prior: 1955 c 132 § 1; 1953 c 94 § 1; 1951 2nd ex.s. c 19 § 1; 1951 1st ex.s. c 11 § 7. Formerly RCW 28A.45.010, 28.45.010.]

RCW 59.20.030

Definitions.

For purposes of this chapter:

(1) "Abandoned" as it relates to a mobile home, manufactured home, or park model owned by a tenant in a mobile home park, mobile home park cooperative, or mobile home park subdivision or tenancy in a mobile home lot means the tenant has defaulted in rent and by absence and by words or actions reasonably indicates the intention not to continue tenancy;

(2) "Eligible organization" includes local governments, local housing authorities, nonprofit community or neighborhood-based organizations, federally recognized Indian tribes in the state of Washington, and regional or statewide nonprofit housing assistance organizations;

(3) "Housing authority" or "authority" means any of the public body corporate and politic created in RCW 35.82.030;

(4) "Landlord" means the owner of a mobile home park and includes the agents of a landlord;

(5) "Local government" means a town government, city government, code city government, or county government in the state of Washington;

(6) "Manufactured home" means a single-family dwelling built according to the United States department of housing and urban development manufactured home construction and safety standards act, which is a national preemptive building code. A manufactured home also: (a) Includes plumbing, heating, air conditioning, and electrical systems; (b) is built on a permanent chassis; and (c) can be transported in one or more sections with each section at least eight feet wide and forty feet long when transported, or when installed on the site is three hundred twenty square feet or greater;

(7) "Manufactured/mobile home" means either a manufactured home or a mobile home;

(8) "Mobile home" means a factory-built dwelling built prior to June 15, 1976, to standards other than the United States department of housing and urban development code, and acceptable under applicable state codes in effect at the time of construction or introduction of the home into the state. Mobile homes have not been built since the introduction of the United States department of housing and urban development manufactured home construction and safety act;

(9) "Mobile home lot" means a portion of a mobile home park or manufactured housing community designated as the location of one mobile home, manufactured home, or park model and its accessory buildings, and intended for the exclusive use as a primary residence by the occupants of that mobile home, manufactured home, or park model;

(10) "Mobile home park," "manufactured housing community," or "manufactured/mobile home community" means any real property which is rented or held out for rent to others for the placement of two or more mobile homes, manufactured homes, or park models for the primary purpose of production of income, except where such real property is rented or held out for rent for seasonal recreational purpose only and is not intended for year-round occupancy;

(11) "Mobile home park cooperative" or "manufactured housing cooperative" means real property consisting of common areas and two or more lots held out for placement of mobile homes, manufactured homes, or park models in which both the individual lots and the common areas are owned by an association of shareholders which leases or otherwise extends the right to occupy individual lots to its own members;

(12) "Mobile home park subdivision" or "manufactured housing subdivision" means real property, whether it is called a subdivision, condominium, or planned unit development, consisting of common areas and two or more lots held for placement of mobile homes, manufactured homes, or park models in which there is private ownership of the individual lots and common, undivided ownership of the common areas by owners of the individual lots;

(13) "Notice of sale" means a notice required under RCW 59.20.300 to be delivered to all tenants of a manufactured/mobile home community and other specified parties within fourteen days after the date on which any advertisement, multiple listing, or public notice advertises that a manufactured/mobile home community is for sale;

(14) "Park model" means a recreational vehicle intended for permanent or semi-permanent installation and is used as a primary residence;

(15) "Qualified sale of manufactured/mobile home community" means the sale, as defined in RCW 82.45.010, of land and improvements comprising a manufactured/mobile home community that is transferred in a single purchase to a qualified tenant organization or to an eligible organization for the purpose of preserving the property as a manufactured/mobile home community;

(16) "Qualified tenant organization" means a formal organization of tenants within a manufactured/mobile home community, with the only requirement for membership consisting of being a tenant;

(17) "Recreational vehicle" means a travel trailer, motor home, truck camper, or camping trailer that is primarily designed and used as temporary living quarters, is either self-propelled or mounted on or drawn by another vehicle, is transient, is not occupied as a primary residence, and is not immobilized or permanently affixed to a mobile home lot;

(18) "Tenant" means any person, except a transient, who rents a mobile home lot;

(19) "Transient" means a person who rents a mobile home lot for a period of less than one month for purposes other than as a primary residence;

(20) "Occupant" means any person, including a live-in care provider, other than a tenant, who occupies a mobile home, manufactured home, or park model and mobile home lot.

[ 2008 c 116 § 2; 2003 c 127 § 1; 1999 c 359 § 2; 1998 c 118 § 1; 1993 c 66 § 15; 1981 c 304 § 4; 1980 c 152 § 3; 1979 ex.s. c 186 § 1; 1977 ex.s. c 279 § 3.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor recommends continuing the tax preference

The Legislature should continue the real estate excise tax exemption on qualifying sales of manufactured and mobile home communities because it is meeting its stated public policy objective of facilitating their preservation. However, such communities continue to be sold and closed across the state. In extending the preference, the Legislature should consider adding a performance statement creating metrics for future reviews.

Legislation required: Yes (preference expires on December 31, 2018).

Fiscal impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation without comment.