|

JLARC Preliminary Report: 2017 Tax Preference Performance Reviews |

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

A B&O tax exemption for gross income earned by state-chartered credit unions. |

B&O |

$47.9 million |

| Public Policy Objective |

|---|

The Legislature did not state a public policy objective. JLARC staff infer two:

|

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation Clarify: The Legislature should clarify the preference to identify public policy objectives because none are stated in statute. As part of the clarification, the Legislature should provide a performance statement that provides targets and metrics to measure whether the objectives have been achieved. Commissioner Recommendation: Available in October 2017. |

- 1. What is the Preference?

- 2. Legal History

- 3. Other Relevant Background

- 4. Public Policy Objectives

- 5. Are Objectives Being Met?

- 6. Beneficiaries

- 7. Revenue and Economic Impacts

- 8. Other States with Similar Preference?

- 9. Applicable Statutes

B&O tax exemption for state-chartered credit unions

Purpose

The Legislature did not state a public policy objective when passing this preference.

State-chartered credit unions do not pay B&O tax on their gross income

This preference provides a business and occupation (B&O) tax exemption for the gross income earned by state-chartered credit unions.

Credit unions are nonprofit, cooperative organizations that provide services similar to banks. Credit unions may be chartered under state or federal law. Although similar in powers, the two charter types differ in several ways.

Credit unions are owned and controlled by their members. In Washington, credit union membership is statutorily limited to “groups” that share at least one of the following characteristics:

- A common bond of occupation or association.

- Located within a well-defined neighborhood, community, or rural district.

The preference was enacted in 1970 and does not have an expiration date.

Tax exemptions in place for federal and state credit unions, other banking institutions now taxed

The first credit unions established in the United States in the early 1900s were state-chartered. State-chartered credit unions were not explicitly exempted from federal income tax.

In 1917, a U.S. Attorney General administrative ruling exempted state credit unions from federal income tax. The ruling held that the credit unions closely resembled cooperative banks and similar institutions that Congress had expressly exempted from taxation in 1913 and 1916.

For additional detail on the legal history of this preference, click here to see the 2011 JLARC tax preference performance review.

2011: JLARC reviewed this preference

JLARC staff reviewed the state-chartered B&O tax preference as part of its 2011 tax preference performance reviews. Since the public policy objective was not stated, JLARC staff inferred two objectives: 1) to remove an incentive for state-chartered credit unions to switch to federal charters so they would remain under state regulation, and 2) to support credit unions because they were originally formed to serve low-income groups.

The Legislative Auditor recommended the Legislature continue the preference because it removes an incentive for state-chartered credit unions to switch to a federal charter and leave the state’s regulatory system. The Citizen Commission endorsed the recommendation.

The preference has no expiration date.

Credit unions, banks, and savings and loan institutions have similarities and differences

How are credit unions, banks, and savings and loan institutions alike?

Credit unions, banks, and savings and loan institutions all:

- Operate under federal or state charters.

- Are insured for up to $250,000 of their deposits by one of two federal agencies: the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA).

- Are subject to periodic regulatory and federal insurance examination.

How do credit unions, banks, and savings and loan institutions differ?

There are distinct differences in the scope, ownership, and governance of these financial institutions.

| Credit Unions | Banks | Savings and Loans | |

|---|---|---|---|

| Scope | Membership limited to groups with “common bonds,” such as occupations, associations, or to groups within a well-defined geographic area. | Community, regional, or national. Available to anyone. | Focus on residential mortgages to promote affordable home ownership. Available to anyone. |

| Ownership | Members of the credit union own these nonprofit cooperatives. Each member gets one vote. | Private investors own these for-profit corporations. | Two options:

|

| Governance | Board of directors elected by and from its members. | Board of directors chosen by stockholders. | Elected board of directors. |

Taxes owed by state credit unions differ from federal credit unions, banks, and savings and loans

Washington’s tax laws are different for state-chartered credit unions, federally chartered credit unions, and banks and savings and loans.

| Tax Type | Type of Financial Institution | ||

|---|---|---|---|

| WA State-Chartered Credit Unions | Federally Chartered Credit Unions | Banks and Savings and Loan Institutions | |

| WA B&O Tax | Exempt (Due to this preference). | Exempt. | Owe, except first mortgage interest income is exempt. |

| WA Sales and Use Tax | Owe, except items acquired from a federal or out-of-state credit union during a merger or conversion are exempt from use tax. | Exempt. | Owe. |

| WA Property Tax (real and personal) | Owe. | Owe. | Owe. |

| Federal Income Tax | Exempt. | Exempt. | Owe, except when a bank has Subchapter S status. This means the shareholders report their share of the corporation’s income or losses on their individual income tax returns. |

Legislature did not state public policy objectives

The Legislature did not state public policy objectives when it provided this B&O tax exemption for state-chartered credit unions.

Two inferred objectives: Keep under state regulation and support low-income groups

This preference was passed before the Legislature required a performance statement for new preferences.

In its 2011 review of this tax preference, JLARC staff inferred two objectives based on historical documents. Because the preference has not changed since, JLARC staff infer the same two public policy objectives:

- To keep state chartered credit unions under state regulation by removing a potential incentive for them to switch to a federal charter in order to avoid paying B&O tax.

- To continue support for credit unions, which were originally formed to provide financial services for low-income groups underserved by commercial banks.

Inferred objective: Keep state-chartered credit unions under state regulation

JLARC staff infer the original public policy objective was to give state-chartered credit unions the same B&O tax exemption as federally chartered credit unions. This would keep the state-chartered credit unions under state regulation by removing a potential incentive for state credit unions to switch to federal charters to avoid paying B&O tax.

Inferred objective: Support serving low-income populations

Laws and past statements suggest credit unions have an underlying purpose to serve low-income populations.

- Washington's 1933 statute defined state-chartered credit unions as nonprofit cooperatives formed for the purpose of “promoting thrift among its members and creating a source of credit for them at legitimate rates of interest for provident, productive and educational purposes.”

- The 1934 Federal Credit Union Act states “Congress finds the . . . American credit union movement began as a cooperative effort to service the productive and provident credit needs of individuals of small means.”

- In 1970, Governor Dan Evans stated he supported a B&O tax exemption for state-chartered credit unions because credit unions “primarily provide financial assistance to low-income people.”

Tax preference incentivizes credit unions to remain under state regulation, but objective of serving low-income is unclear

This tax preference is achieving one inferred objective, but the second inferred objective is unclear.

Preference provides an incentive to remain under state regulation

The preference provides state-chartered credit unions with the same exemption from paying B&O tax as federally chartered credit unions. Before this preference, state-chartered credit unions may have switched to federal charters to avoid paying B&O tax on their gross income. Switching would have removed them from state regulation.

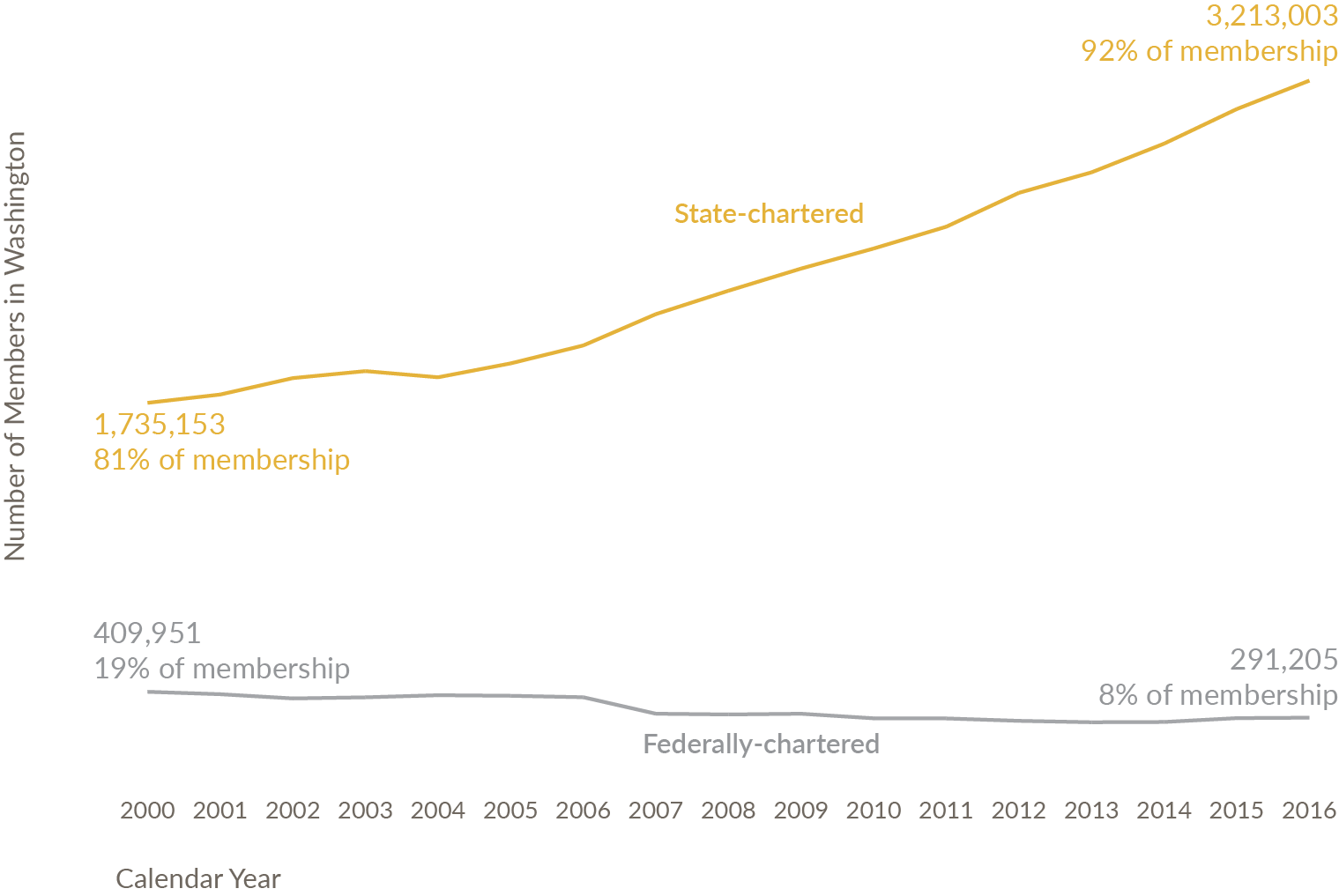

In Washington, state credit union membership has increased while federal credit union membership has decreased

In Washington, 92 percent of credit union members belong to state-chartered credit unions. Since 2000:

- State-chartered credit union membership increased to over 3.2 million.

- Federally chartered credit union membership dropped to 291,000 members.

While the total number of state-chartered credit unions declined recently (65 state credit unions in 2011 compared to 55 as of September 30, 2016), the Department of Financial Institutions (DFI) indicates this is due to mergers and acquisitions, not closures or switches to federal charters. As of September 2016, there were a total of 55 state credit unions in Washington and 36 federal credit unions.

Credit union membership trends in Washington contrast with national trends. As of September 30, 2016, there were 56.2 million federal credit union members nationally, compared to 49.9 million state-chartered credit union members.

Source: JLARC staff analysis of National Credit Union Administration data, January 2000 - September 30, 2016.

State charters differ in several ways from federal charters

Credit unions headquartered in Washington may choose to charter with the federal or state regulator. The Department of Financial Institutions (DFI) and other industry sources identified several advantages to state charters, including:

- A more local or “state” perspective on financial issues not necessarily shared at the federal level.

- An interest in ensuring local credit unions are successful and strengthen local economies.

- A broader field of membership than traditionally allowed under federal charters. A “field of membership” is the legal definition of who is eligible to join the credit union. Washington credit union membership is open to those who share “a common bond of occupation or association, or groups within a well-defined neighborhood, community, or district.” For some state-chartered credit unions, the field of membership extends to any person that lives in or works in Washington or certain areas in surrounding states.

- Local regulators that respond to local citizens’ values and concerns and state legislative mandates.

Recent changes may diminish advantages to state-chartered credit unions

According to the DFI and other industry sources, some of the advantages Washington state-chartered credit unions have over federal charters may be diminishing.

- Field of membership: In October 2016, the National Credit Union Administration (NCUA) Board approved new, more flexible field-of-membership rules for federally chartered credit unions. As a result, the field of membership for federally chartered credit unions may begin to expand like state-chartered credit unions.

- More flexible rules for business loans: Effective January 1, 2017, the NCUA amended member business and commercial loan rules to ease regulatory burdens and allow federally chartered credit unions to better serve small business members. Previously, Washington state-chartered credit unions had more flexible rules for business loans than federally chartered credit unions.

- Additionally, federal charters have the following differences over state charters:

- Locating in multiple states: Federally chartered credit unions have a national charter and are authorized to cross state lines. Washington state-chartered credit unions are more limited in their ability to provide interstate branching. As of December 2015, Washington credit unions had interstate branching agreements with 17 states, including Oregon and Idaho.

- No state fees or sales and use taxes: The state collects regulatory fees as well as sales and use tax from state-chartered credit unions on purchases of goods (like office equipment) and certain services. Federally chartered credit unions do not pay the state fees or sales and use taxes, but do pay federal fees.

Unclear how low-income should be served

It is unclear whether the Legislature had specific goals for low-income services by state credit unions. While legal and historical documents suggest that credit unions serve low-income populations, this is not explicitly stated as a primary focus in state law or regulation.

The broad field of membership available to state-chartered credit unions does not restrict them to primarily serving low-income populations. Credit unions may continue to serve low-income populations, but it is not required to be their sole focus.

JLARC staff could not identify information that measured how low-income populations were served across all state-chartered credit unions, nor whether that service differed for federal credit unions or banks.

Low income is defined in statute as the greater of: 80 percent or less of the median income in the metropolitan area where they live or 80 percent or less of the national median average.

Of the 55 state-chartered credit unions in Washington as of September 30, 2016:

- 16 are designated as low-income credit unions, which means over 50 percent of their members are low income.

- These 16 credit unions make up 27 percent of all state-chartered credit union members in Washington.

State-chartered credit unions and their members benefit from the preference

Tax preferences have direct beneficiaries (entities whose state tax liabilities are directly affected) and may have indirect beneficiaries (entities that may receive benefits from the preference, but are not the primary recipient of the benefit).

Direct beneficiaries

Direct beneficiaries are the 55 Washington state-chartered credit unions with a membership of over 3.2 million. The top five credit unions based on membership numbers make up 52 percent of all state credit union members in Washington.

Boeing Employees Credit Union (BECU) is the largest credit union in Washington, with 31 percent of all state credit union members. BECU is the second largest state-chartered credit union in the country.

| State Credit Union | Membership (as of September 30, 2016) | Percent of Total State Credit Union Members in Washington |

|---|---|---|

| Boeing Employees | 988,691 | 31% |

| Washington State Employees | 247,720 | 8% |

| Spokane Teachers | 160,723 | 5% |

| GESA | 143,324 | 4% |

| HAPO Community | 140,665 | 4% |

| Total Top Five | 1,681,123 | 52% |

| All Other State-Chartered Credit Unions | 1,530,616 | 48% |

| Total Membership | 3,211,739 |

Indirect beneficiaries

JLARC staff did not identify any indirect beneficiaries.

Estimated beneficiary savings in 2017-19 Biennium are $47.9 million

JLARC staff estimate the direct beneficiary savings for Fiscal Year 2016 was $23.9 million. The estimated beneficiary savings for the 2017-19 Biennium is $47.9 million.

| Biennium | Fiscal Year | State Chartered Credit Union Gross Income | Estimated Direct Beneficiary Savings |

|---|---|---|---|

| 2013-15 7/1/13-6/30/15 |

2014 | $1,870,543,000 |

$28,058,000 |

| 2015 | $1,561,336,000 |

$23,420,000 |

|

| 2015-17 7/1/15-6/30/17 |

2016 | $1,596,611,000 |

$23,949,000 |

| 2017 | $1,596,611,000 |

$23,949,000 |

|

| 2017-19 7/1/17-6/30/19 |

2018 | $1,596,611,000

|

$23,949,000 |

| 2019 | $1,596,611,000 |

$23,949,000 |

|

| Total 2017-19 Estimated Savings | $3,193,222,000 |

$47,898,000 |

Utah’s experience offers insights into whether Washington state-chartered credit unions might switch to federal if taxed

If the exemption were terminated, state-chartered credit unions would pay B&O tax on parts of their gross income. It is unclear if this might encourage some state-chartered credit unions to consider switching to a federal charter or the extent to which this might happen.

Since 2010, three credit unions changed charters in Washington. Two switched from federal to state charters, and one switched from a state to a federal charter.

- In 2010, Puget Sound switched from a state to a federal charter and OUR Community switched from a federal to a state charter.

- In 2012, SnoCope converted from a federal to a state charter.

The Department of Financial Institutions notes that the advantages of a Washington state charter may have narrowed recently as federal rules for federal credit unions were updated.

In 2003, Utah lawmakers passed a bill to tax and limit expansion of Utah’s largest state-chartered credit unions.

The uncodified provisions of the bill created a task force to determine if the Legislature should impose state corporate income taxes on Utah state-chartered credit unions when their membership exceeded a certain amount. The task force also was to decide if all state-chartered credit unions should pay a “competitive equity assessment” if they wanted a waiver from limits on business loans they grant.

According to the Utah Department of Financial Institutions (DFI), the law never took effect because the credit unions targeted by the law converted to federal charters. The Utah DFI noted that within six months of the law’s passage, 14 state-chartered credit unions converted their charters to federal.

JLARC staff identified only a few states that tax state-chartered credit union income

Forty-seven states, including Washington, authorize state-chartered credit unions. Delaware, South Dakota, Wyoming, and the District of Columbia do not.

Two of the 47 states (Arkansas and Hawaii) have a state-chartered credit union act, but do not have any state-chartered credit unions.

In the other 45 states, most have a corporate net income tax as their primary business tax. Credit unions are typically exempt from state net income taxes due to their nonprofit status.

JLARC staff obtained information from three states that tax the income of state-chartered credit unions in some way:

- Indiana and Nebraska impose a financial institutions tax on financial institutions, including state-chartered credit unions.

- Oklahoma imposes a bank privilege tax on financial institutions, including state-chartered credit unions.

RCW 82.04.405

Exemptions—Credit unions.

This chapter shall not apply to the gross income of credit unions organized under the laws of this state, any other state, or the United States.

[ 1998 c 311 § 4; 1970 ex.s. c 101 § 3.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor recommends clarifying the tax preference

The Legislature should clarify the B&O tax exemption for state-chartered credit unions to identify public policy objectives because none are stated in statute. As part of the clarification, the Legislature should provide a performance statement that provides targets and metrics to measure whether the public policy objectives have been achieved.

The preference has incentivized credit unions to remain under state regulations, but the inferred objective of serving low-income populations is unclear.

The Legislature may want to consider if a public policy objective to serve low-income populations is consistent with other state-chartered credit union policy objectives, such as providing a broad field of membership.

Legislation required: Yes (preference has no expiration date).

Fiscal impact: Depends on legislative action.

Available December 2017.

Available December 2017.

If applicable, will be available December 2017.