|

JLARC Preliminary Report: 2017 Tax Preference Performance Reviews |

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

A preferential business and occupation tax rate (0.138 percent) for manufacturers that create liquid fuel from wood biomass. |

Business and Occupation Tax |

$0 in 2017-19 biennium. |

| Public Policy Objective |

|---|

JLARC staff infer the public policy objectives are to:

|

| Recommendations |

|---|

Legislative Auditor’s Recommendation Terminate: The Legislature should terminate the tax preference because the preference is not being used and other tax preferences directed at wood biomass fuel manufacturing are no longer in effect. Commissioner Recommendation: Available in October 2017. |

- 1. What is the Preference?

- 2. Legal History

- 3. Other Relevant Background

- 4. Public Policy Objectives

- 5. Are Objectives Being Met?

- 6. Beneficiaries

- 7. Revenue and Economic Impacts

- 8. Other States with Similar Preference?

- 9. Applicable Statutes

Preferential B&O tax rate for manufacturers that create liquid fuel from wood biomass

Purpose

The Legislature did not state a public policy objective when passing this preference.

Preference provides a preferential B&O tax rate for businesses that make wood biomass fuel

Manufacturers can make liquid fuel from organic matter called wood biomass.

- With the preference, manufacturers of wood biomass fuel pay a business and occupation (B&O) tax rate of 0.138 percent.

- Without the preference, they would pay the general manufacturing B&O tax rate of 0.484 percent.

Statute limits eligibility

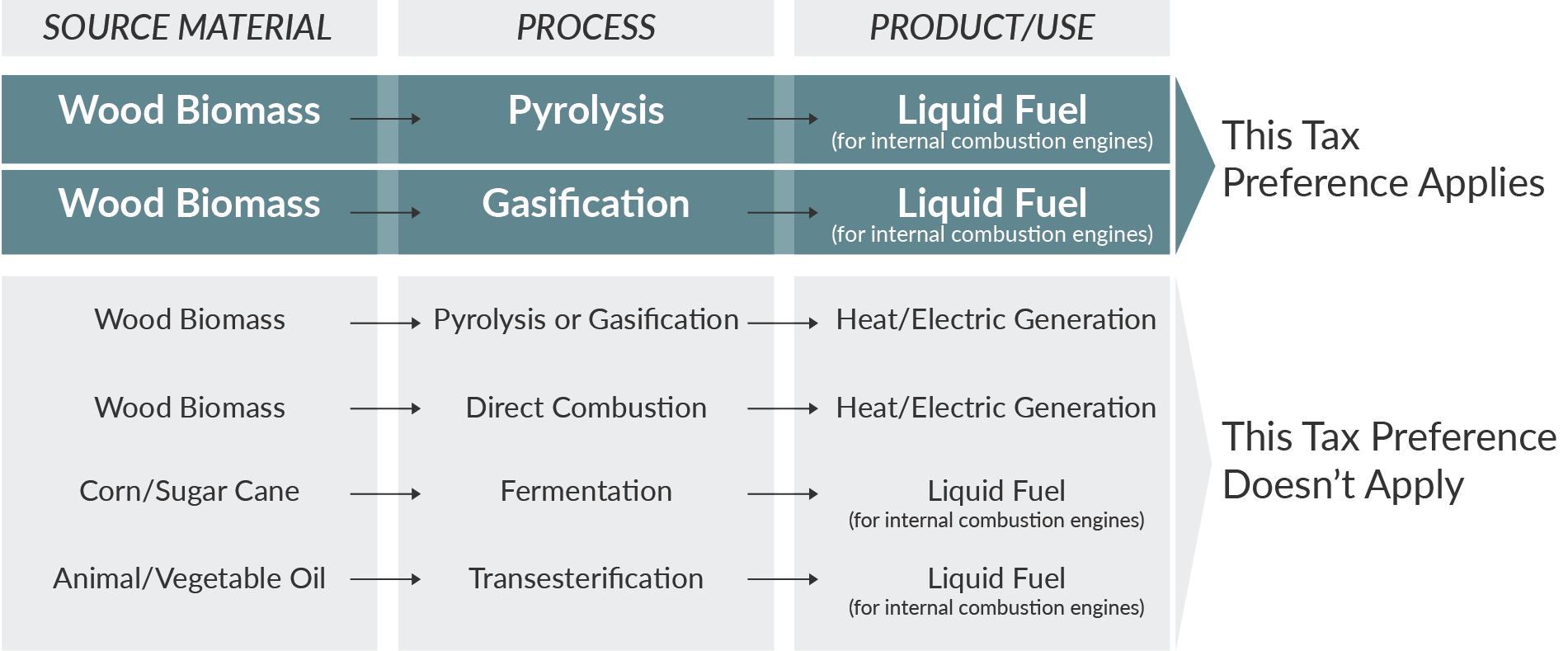

Manufacturers have many ways to change organic matter into energy. The tax preference applies only if the manufacturer creates liquid fuel that meets the following three criteria:

- Made from wood biomass that has not been treated with chemical preservatives such as creosote. Biomass is wood, forest, or field residue (e.g., wood chips, bark) or crops grown specifically for fuel production.

- Manufactured through pyrolysis or gasification, which decompose biomass in high-heat, low-oxygen environments. Both processes create oils and gases that can be refined into fuel.

- Created for use in internal combustion engines, such as those in motor vehicles and airplanes.

Manufacturing processes that use different sources, different processes, or yield other products are not eligible for the preference.

Exemption has no expiration date

The preference took effect July 1, 2003. It has no expiration date.

Preference is one of six passed in 2003 and the only one still in effect

2003: Legislature passed six preferences to benefit wood biomass fuel production

The Legislature initially created five preferences for biodiesel and alcohol fuels. Testimony for the biodiesel legislation suggested that the Legislature enact similar preferences for wood biomass fuel. The Legislature responded with a bill that created six preferences to benefit wood biomass fuel production:

- B&O tax rate for manufacturing (this preference).

- B&O deduction for retail sale or distribution (expired 2009).

- Sales and use tax exemption (expired 2009).

- Property tax exemption (expired 2015).

- Leasehold excise tax exemption (expired 2015).

The bill included a sixth preference, a retail sales and use tax deferral. However, because the Legislature extended a different sales and use tax deferral program, this preference did not become law.

This preference is the only one with no expiration date. More detail on the preferences is in Relevant Background.

2008: JLARC review found four preferences were not used

In 2008, JLARC staff performed a full review of the four wood biomass tax preferences with expiration dates (B&O deduction for retail sales, sales and use tax, property tax, and leasehold excise tax). The review found no manufacturers used the preferences.

- The Legislative Auditor recommended that the Legislature continue the tax preferences and review them for effectiveness in the future if they were used.

- The Citizen Commission for the Performance Measurement of Tax Preferences did not endorse the Legislative Auditor’s recommendation. Instead, the Commission recommended allowing the preferences to expire in 2009 unless there was evidence that taxpayers planned to use them.

2009 – 2010: Two preferences expired, two were extended

Both the B&O deduction for retail sales and the sales and use tax exemption expired in 2009. In 2010, the property and leasehold excise tax exemptions were extended through 2015.

2013: Expedited review indicated this preference and others remained unused

The JLARC expedited review report included this preference. The review cited information from the 2012 Department of Revenue (DOR) tax exemption study that found no wood biomass fuel manufacturers operating in Washington. The expedited review also included the property and leasehold tax exemptions, citing JLARC’s 2008 review in reporting that they were not being used.

Related preferences have expired

The Legislature has enacted other preferences to encourage businesses to manufacture biomass or biofuel.

Related biomass and biofuel preferences: 11 of 12 are no longer in effect

In addition to the wood biomass fuel manufacturing tax preference, the Legislature enacted 12 other biofuel-related preferences:

- Four additional wood-biomass-fuel tax preferences, passed in 2003, which either have expired or can no longer be claimed.

- Five biodiesel and alcohol fuel tax preferences, passed in 2003, which either have expired or can no longer be claimed.

- Three tax preferences related to biomass and hog fuel, passed in 2009. Two of these preferences have expired, while one remains in effect.

| Preference | RCW | Description | Enacted | Extended | Expired |

|---|---|---|---|---|---|

| Wood Biomass Fuel Sales (B&O) | 82.04.4335 | Amounts received from the retail sale, or for the distribution, of wood biomass fuel may be deducted from the B&O Tax. | 2003 | NA | July 1, 2009 |

| Wood Biomass Fuel Machinery & Equipment (Sales & Use) | 82.08.960 | Sales of machinery and equipment for the retail sale of wood biomass fuel are exempt from sales and use tax. | 2003 | NA | July 1, 2009 |

| Wood Biomass Fuel Production Facilities (Property) | 84.36.640 | Real and personal property used for manufacturing wood biomass fuel are exempt from property taxation for 6 years after the facility becomes operational. | 2003 | 2010 | No Claims after Dec. 31, 2015 |

| Wood Biomass Fuel Production Facilities (Leasehold Excise) | 82.29A.135 | Leasehold interests in property used for manufacturing wood biomass fuel are exempt from LET for 6 years after the facility becomes operational. | 2003 | 2010 | No Claims after Dec. 31, 2015 |

| Preference | RCW | Description | Enacted | Extended | Expired |

|---|---|---|---|---|---|

| Alcohol, Biodiesel Fuel Manufacturing (B&O) | 82.04.260(1)(e) | Manufacturers pay a B&O tax rate of 0.138% for manufacturing alcohol fuel, biodiesel fuel, or biodiesel feedstock. | 2003 | NA | July 1, 2009 |

| Biodiesel Sales (B&O) | 82.04.4334 | Amounts received from retail sale or for distribution of biodiesel fuel or E85 alcohol fuel may be deducted from B&O Tax. | 2003 | 2007 | July 1, 2015 |

| Biodiesel Fuel Production Facilities (Property) | 84.36.635 | Real and personal property used to manufacture alcohol fuel, biodiesel fuel, or biodiesel feedstock are exempt from property taxation for 6 years after the facility becomes operational. | 2003 | 2010 | No Claims after Dec. 31, 2015 |

| Biodiesel Fuel Production Facilities (Leasehold Excise) | 82.29A.135 | Leasehold interests in property used to manufacture biodiesel fuel are exempt from LET for 6 years after the facility becomes operational. | 2003 | 2010 | No Claims after Dec. 31, 2015 |

| Biodiesel M&E (Sales and Use) | 82.08.955 | Sales of machinery and equipment for retail sale of a biodiesel or alcohol fuel blend are exempt from sales and use tax. | 2003 | 2007 | July 1, 2015 |

| Preference | RCW | Description | Enacted | Extended | Expired |

|---|---|---|---|---|---|

| Forest Derived Biomass (Sales and Use) | 82.08.957 | Sales of forest derived biomass used for production of electricity, steam, heat, or biofuel are exempt from sales and use tax. | 2009 | NA | June 30, 2013 |

| Hog Fuel (Sales and Use) | 82.08.956 | Sales of hog fuel used to produce electricity, steam, heat, or biofuel are exempt from sales and use tax. | 2009 | 2013 Scheduled expiration: June 30, 2024 | NA |

| Forest Derived Biomass (B&O) | 82.04.4494 | Harvesters of forest derived biomass are allowed a credit against B&O tax per harvested green ton sold, transferred, or used for production of electricity, steam, heat, or biofuel | 2009 | NA | June 30, 2015 |

Challenges and opportunities exist for commercial wood biomass fuel manufacturing

The Congressional Research Service noted that transportation logistics are a challenge to using pyrolysis or gasification to create biomass fuel. This challenge includes:

- Transporting the source material (e.g., wood chips, sawdust, bark) to the processing facility, or

- Transporting a mobile processing facility to where the source material is located.

However, wood biomass is abundant in Washington:

- A 2005 Department of Ecology and Washington State University report showed that Washington produces over 16.4 million tons of underutilized biomass each year. The majority is timber and field residue.

- Forest thinning also could provide residue: the U.S. Forest Service stated that 8.4 billion dry tons of material need to be removed from America’s national forests to reduce the risk of fire hazard, insect infestation, and disease.

- The Forest Service also reports that biomass is a renewable resource, can contribute to a reduction in greenhouse gas emissions, and can grow in marginal soils that will not support agriculture.

JLARC staff infer three objectives for the preference

The Legislature did not state a public policy objective for this preference. The preference was passed before the Legislature’s requirement to provide a performance statement for each preference.

For this review, JLARC staff infer three public policy objectives from testimony to legislative committees about the package of biomass fuel preferences:

- Encourage the production of wood biomass fuel in Washington. The bill’s sponsor stated that the preference would support the creation of alternative fuels that lessen the dependence on foreign oil.

- Reduce air pollution and greenhouse gas emissions by promoting the production of wood biomass fuel. Supporters of the bill testified that the preference would help to support a carbon-neutral source of fuel.

- Increase demand for wood biomass. Supporters of the bill testified that increased demand for forest residue could help to partially offset the costs of forest thinning and wildfire prevention.

Preferences are not being used

JLARC staff reviewed tax return data and interviewed staff from three state agencies, but identified no beneficiaries that currently claim the tax preference. DOR tax exemption studies also have not identified beneficiaries for the related leasehold excise tax or property tax exemptions. More detail is on the Beneficiaries Tab.

Other preferences have expired, so changing this tax preference may not meet the inferred public policy objectives

The Legislature passed this tax preference as part of a package of preferences for wood biomass fuel manufacturers. The other tax preferences have since expired.

Changing the sole remaining tax preference may not by itself result in achievement of the inferred public policy objectives.

No beneficiaries identified through analysis of tax data and interviews with agencies

Beneficiaries of the preference would be firms that manufacture wood biomass fuel as defined in statute.

JLARC staff conclude no businesses are using the preference:

- JLARC staff reviewed tax return data from 2008 through 2015 and found no businesses claiming the preference.

- Staff from the Departments of Revenue, Natural Resources, and Commerce stated that they were unaware of any beneficiaries.

- DOR’s 2016 Tax Exemption study found no beneficiaries of the related leasehold excise tax or property tax exemptions for wood biomass fuel manufacturing facilities.

- JLARC staff found no beneficiaries for the other wood biomass fuel tax preferences when they were in effect.

JLARC staff are unable to determine why no beneficiaries claim the tax preference. Staff from the Departments of Commerce and Natural Resources note that several factors may contribute:

- Low oil prices and the excess global oil supply place a downward pressure on prices of alternative fuels if they are to compete with fossil fuels.

- The technology to produce commercial quantities of liquid wood biomass fuel through pyrolysis or gasification is improving, but may not yet be economically viable.

Because it is not being used, there are no economic impacts

Based on tax return data that show no beneficiaries, JLARC staff estimate that there are no beneficiary savings and no tax revenue or economic impacts of the tax preference.

While states offer incentives for alternative fuels or renewable energy, none has an identical preference

The tax treatment of the production, delivery, sale, and use of alternative fuels varies widely across states. For example:

- Oregon provides a property tax exemption for property used to produce biofuels, and a personal income tax credit of $10 per ton of biomass collected or produced, up to $200 per person per year.

- Maine offered an income tax credit of $0.05 per gallon of biofuel production, including some wood biomass fuel produced through pyrolysis. The tax preference was repealed in 2015 because it was not being used.

JLARC staff identified three states that offer tax preferences that specifically mention pyrolysis or gasification:

- Michigan provides a property tax exemption for property used for gasification to generate electricity or heat.

- Missouri provides a property tax exemption and an income tax credit to employers that generate renewable energy, including pyrolysis for converting waste material to energy.

- Texas provides a property tax exemption for renewable energy systems that convert solar energy into thermal, mechanical, or electrical energy. This includes systems that use gasification and pyrolysis.

RCW 82.04.260

Tax on manufacturers and processors of various foods and by-products—Research and development organizations—Travel agents—Certain international activities—Stevedoring and associated activities—Low-level waste disposers—Insurance producers, surplus line brokers, and title insurance agents—Hospitals—Commercial airplane activities—Timber product activities—Canned salmon processors.

(1) Upon every person engaging within this state in the business of manufacturing:

(a) Wheat into flour, barley into pearl barley, soybeans into soybean oil, canola into canola oil, canola meal, or canola by-products, or sunflower seeds into sunflower oil; as to such persons the amount of tax with respect to such business is equal to the value of the flour, pearl barley, oil, canola meal, or canola by-product manufactured, multiplied by the rate of 0.138 percent;

(b) Beginning July 1, 2025, seafood products that remain in a raw, raw frozen, or raw salted state at the completion of the manufacturing by that person; or selling manufactured seafood products that remain in a raw, raw frozen, or raw salted state at the completion of the manufacturing, to purchasers who transport in the ordinary course of business the goods out of this state; as to such persons the amount of tax with respect to such business is equal to the value of the products manufactured or the gross proceeds derived from such sales, multiplied by the rate of 0.138 percent. Sellers must keep and preserve records for the period required by RCW 82.32.070 establishing that the goods were transported by the purchaser in the ordinary course of business out of this state;

(c)(i) Beginning July 1, 2025, dairy products; or selling dairy products that the person has manufactured to purchasers who either transport in the ordinary course of business the goods out of state or purchasers who use such dairy products as an ingredient or component in the manufacturing of a dairy product; as to such persons the tax imposed is equal to the value of the products manufactured or the gross proceeds derived from such sales multiplied by the rate of 0.138 percent. Sellers must keep and preserve records for the period required by RCW 82.32.070 establishing that the goods were transported by the purchaser in the ordinary course of business out of this state or sold to a manufacturer for use as an ingredient or component in the manufacturing of a dairy product.

(ii) For the purposes of this subsection (1)(c), "dairy products" means:

(A) Products, not including any marijuana-infused product, that as of September 20, 2001, are identified in 21 C.F.R., chapter 1, parts 131, 133, and 135, including by-products from the manufacturing of the dairy products, such as whey and casein; and

(B) Products comprised of not less than seventy percent dairy products that qualify under (c)(ii)(A) of this subsection, measured by weight or volume.

(iii) The preferential tax rate provided to taxpayers under this subsection (1)(c) does not apply to sales of dairy products on or after July 1, 2023, where a dairy product is used by the purchaser as an ingredient or component in the manufacturing in Washington of a dairy product;

(d)(i) Beginning July 1, 2025, fruits or vegetables by canning, preserving, freezing, processing, or dehydrating fresh fruits or vegetables, or selling at wholesale fruits or vegetables manufactured by the seller by canning, preserving, freezing, processing, or dehydrating fresh fruits or vegetables and sold to purchasers who transport in the ordinary course of business the goods out of this state; as to such persons the amount of tax with respect to such business is equal to the value of the products manufactured or the gross proceeds derived from such sales multiplied by the rate of 0.138 percent. Sellers must keep and preserve records for the period required by RCW 82.32.070 establishing that the goods were transported by the purchaser in the ordinary course of business out of this state.

(ii) For purposes of this subsection (1)(d), "fruits" and "vegetables" do not include marijuana, useable marijuana, or marijuana-infused products;

(e) Until July 1, 2009, alcohol fuel, biodiesel fuel, or biodiesel feedstock, as those terms are defined in RCW 82.29A.135; as to such persons the amount of tax with respect to the business is equal to the value of alcohol fuel, biodiesel fuel, or biodiesel feedstock manufactured, multiplied by the rate of 0.138 percent; and

(f) Wood biomass fuel as defined in RCW 82.29A.135; as to such persons the amount of tax with respect to the business is equal to the value of wood biomass fuel manufactured, multiplied by the rate of 0.138 percent.

(2) Upon every person engaging within this state in the business of splitting or processing dried peas; as to such persons the amount of tax with respect to such business is equal to the value of the peas split or processed, multiplied by the rate of 0.138 percent.

(3) Upon every nonprofit corporation and nonprofit association engaging within this state in research and development, as to such corporations and associations, the amount of tax with respect to such activities is equal to the gross income derived from such activities multiplied by the rate of 0.484 percent.

(4) Upon every person engaging within this state in the business of slaughtering, breaking and/or processing perishable meat products and/or selling the same at wholesale only and not at retail; as to such persons the tax imposed is equal to the gross proceeds derived from such sales multiplied by the rate of 0.138 percent.

(5) Upon every person engaging within this state in the business of acting as a travel agent or tour operator; as to such persons the amount of the tax with respect to such activities is equal to the gross income derived from such activities multiplied by the rate of 0.275 percent.

(6) Upon every person engaging within this state in business as an international steamship agent, international customs house broker, international freight forwarder, vessel and/or cargo charter broker in foreign commerce, and/or international air cargo agent; as to such persons the amount of the tax with respect to only international activities is equal to the gross income derived from such activities multiplied by the rate of 0.275 percent.

(7) Upon every person engaging within this state in the business of stevedoring and associated activities pertinent to the movement of goods and commodities in waterborne interstate or foreign commerce; as to such persons the amount of tax with respect to such business is equal to the gross proceeds derived from such activities multiplied by the rate of 0.275 percent. Persons subject to taxation under this subsection are exempt from payment of taxes imposed by chapter 82.16 RCW for that portion of their business subject to taxation under this subsection. Stevedoring and associated activities pertinent to the conduct of goods and commodities in waterborne interstate or foreign commerce are defined as all activities of a labor, service or transportation nature whereby cargo may be loaded or unloaded to or from vessels or barges, passing over, onto or under a wharf, pier, or similar structure; cargo may be moved to a warehouse or similar holding or storage yard or area to await further movement in import or export or may move to a consolidation freight station and be stuffed, unstuffed, containerized, separated or otherwise segregated or aggregated for delivery or loaded on any mode of transportation for delivery to its consignee. Specific activities included in this definition are: Wharfage, handling, loading, unloading, moving of cargo to a convenient place of delivery to the consignee or a convenient place for further movement to export mode; documentation services in connection with the receipt, delivery, checking, care, custody and control of cargo required in the transfer of cargo; imported automobile handling prior to delivery to consignee; terminal stevedoring and incidental vessel services, including but not limited to plugging and unplugging refrigerator service to containers, trailers, and other refrigerated cargo receptacles, and securing ship hatch covers.

(8) Upon every person engaging within this state in the business of disposing of low-level waste, as defined in RCW 43.145.010; as to such persons the amount of the tax with respect to such business is equal to the gross income of the business, excluding any fees imposed under chapter 43.200 RCW, multiplied by the rate of 3.3 percent.

If the gross income of the taxpayer is attributable to activities both within and without this state, the gross income attributable to this state must be determined in accordance with the methods of apportionment required under RCW 82.04.460.

(9) Upon every person engaging within this state as an insurance producer or title insurance agent licensed under chapter 48.17 RCW or a surplus line broker licensed under chapter 48.15 RCW; as to such persons, the amount of the tax with respect to such licensed activities is equal to the gross income of such business multiplied by the rate of 0.484 percent.

(10) Upon every person engaging within this state in business as a hospital, as defined in chapter 70.41 RCW, that is operated as a nonprofit corporation or by the state or any of its political subdivisions, as to such persons, the amount of tax with respect to such activities is equal to the gross income of the business multiplied by the rate of 0.75 percent through June 30, 1995, and 1.5 percent thereafter.

(11)(a) Beginning October 1, 2005, upon every person engaging within this state in the business of manufacturing commercial airplanes, or components of such airplanes, or making sales, at retail or wholesale, of commercial airplanes or components of such airplanes, manufactured by the seller, as to such persons the amount of tax with respect to such business is, in the case of manufacturers, equal to the value of the product manufactured and the gross proceeds of sales of the product manufactured, or in the case of processors for hire, equal to the gross income of the business, multiplied by the rate of:

(i) 0.4235 percent from October 1, 2005, through June 30, 2007; and

(ii) 0.2904 percent beginning July 1, 2007.

(b) Beginning July 1, 2008, upon every person who is not eligible to report under the provisions of (a) of this subsection (11) and is engaging within this state in the business of manufacturing tooling specifically designed for use in manufacturing commercial airplanes or components of such airplanes, or making sales, at retail or wholesale, of such tooling manufactured by the seller, as to such persons the amount of tax with respect to such business is, in the case of manufacturers, equal to the value of the product manufactured and the gross proceeds of sales of the product manufactured, or in the case of processors for hire, be equal to the gross income of the business, multiplied by the rate of 0.2904 percent.

(c) For the purposes of this subsection (11), "commercial airplane" and "component" have the same meanings as provided in RCW 82.32.550.

(d) In addition to all other requirements under this title, a person reporting under the tax rate provided in this subsection (11) must file a complete annual report with the department under RCW 82.32.534.

(e)(i) Except as provided in (e)(ii) of this subsection (11), this subsection (11) does not apply on and after July 1, 2040.

(ii) With respect to the manufacturing of commercial airplanes or making sales, at retail or wholesale, of commercial airplanes, this subsection (11) does not apply on and after July 1st of the year in which the department makes a determination that any final assembly or wing assembly of any version or variant of a commercial airplane that is the basis of a siting of a significant commercial airplane manufacturing program in the state under RCW 82.32.850 has been sited outside the state of Washington. This subsection (11)(e)(ii) only applies to the manufacturing or sale of commercial airplanes that are the basis of a siting of a significant commercial airplane manufacturing program in the state under RCW 82.32.850.

(12)(a) Until July 1, 2024, upon every person engaging within this state in the business of extracting timber or extracting for hire timber; as to such persons the amount of tax with respect to the business is, in the case of extractors, equal to the value of products, including by-products, extracted, or in the case of extractors for hire, equal to the gross income of the business, multiplied by the rate of 0.4235 percent from July 1, 2006, through June 30, 2007, and 0.2904 percent from July 1, 2007, through June 30, 2024.

(b) Until July 1, 2024, upon every person engaging within this state in the business of manufacturing or processing for hire: (i) Timber into timber products or wood products; or (ii) timber products into other timber products or wood products; as to such persons the amount of the tax with respect to the business is, in the case of manufacturers, equal to the value of products, including by-products, manufactured, or in the case of processors for hire, equal to the gross income of the business, multiplied by the rate of 0.4235 percent from July 1, 2006, through June 30, 2007, and 0.2904 percent from July 1, 2007, through June 30, 2024.

(c) Until July 1, 2024, upon every person engaging within this state in the business of selling at wholesale: (i) Timber extracted by that person; (ii) timber products manufactured by that person from timber or other timber products; or (iii) wood products manufactured by that person from timber or timber products; as to such persons the amount of the tax with respect to the business is equal to the gross proceeds of sales of the timber, timber products, or wood products multiplied by the rate of 0.4235 percent from July 1, 2006, through June 30, 2007, and 0.2904 percent from July 1, 2007, through June 30, 2024.

(d) Until July 1, 2024, upon every person engaging within this state in the business of selling standing timber; as to such persons the amount of the tax with respect to the business is equal to the gross income of the business multiplied by the rate of 0.2904 percent. For purposes of this subsection (12)(d), "selling standing timber" means the sale of timber apart from the land, where the buyer is required to sever the timber within thirty months from the date of the original contract, regardless of the method of payment for the timber and whether title to the timber transfers before, upon, or after severance.

(e) For purposes of this subsection, the following definitions apply:

(i) "Biocomposite surface products" means surface material products containing, by weight or volume, more than fifty percent recycled paper and that also use nonpetroleum-based phenolic resin as a bonding agent.

(ii) "Paper and paper products" means products made of interwoven cellulosic fibers held together largely by hydrogen bonding. "Paper and paper products" includes newsprint; office, printing, fine, and pressure-sensitive papers; paper napkins, towels, and toilet tissue; kraft bag, construction, and other kraft industrial papers; paperboard, liquid packaging containers, containerboard, corrugated, and solid-fiber containers including linerboard and corrugated medium; and related types of cellulosic products containing primarily, by weight or volume, cellulosic materials. "Paper and paper products" does not include books, newspapers, magazines, periodicals, and other printed publications, advertising materials, calendars, and similar types of printed materials.

(iii) "Recycled paper" means paper and paper products having fifty percent or more of their fiber content that comes from postconsumer waste. For purposes of this subsection (12)(e)(iii), "postconsumer waste" means a finished material that would normally be disposed of as solid waste, having completed its life cycle as a consumer item.

(iv) "Timber" means forest trees, standing or down, on privately or publicly owned land. "Timber" does not include Christmas trees that are cultivated by agricultural methods or short-rotation hardwoods as defined in RCW 84.33.035.

(v) "Timber products" means:

(A) Logs, wood chips, sawdust, wood waste, and similar products obtained wholly from the processing of timber, short-rotation hardwoods as defined in RCW 84.33.035, or both;

(B) Pulp, including market pulp and pulp derived from recovered paper or paper products; and

(C) Recycled paper, but only when used in the manufacture of biocomposite surface products.

(vi) "Wood products" means paper and paper products; dimensional lumber; engineered wood products such as particleboard, oriented strand board, medium density fiberboard, and plywood; wood doors; wood windows; and biocomposite surface products.

(f) Except for small harvesters as defined in RCW 84.33.035, a person reporting under the tax rate provided in this subsection (12) must file a complete annual survey with the department under RCW 82.32.585.

(13) Upon every person engaging within this state in inspecting, testing, labeling, and storing canned salmon owned by another person, as to such persons, the amount of tax with respect to such activities is equal to the gross income derived from such activities multiplied by the rate of 0.484 percent.

(14)(a) Upon every person engaging within this state in the business of printing a newspaper, publishing a newspaper, or both, the amount of tax on such business is equal to the gross income of the business multiplied by the rate of 0.35 percent until July 1, 2024, and 0.484 percent thereafter.

(b) A person reporting under the tax rate provided in this subsection (14) must file a complete annual report with the department under RCW 82.32.534.

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor recommends terminating the tax preference

The Legislature should terminate the tax preference because the preference is not being used and other tax preferences directed at wood biomass fuel manufacturing are no longer in effect.

The preference was initially enacted in 2003 with other wood biomass fuel tax preferences. While this package of preferences was in effect, none appears to have been claimed. Because only one tax preference directed toward manufacturers of wood biomass fuel remains, it may not provide sufficient incentive to meet the inferred public policy objectives.

Legislation required: Yes (preference has no expiration date).

Fiscal impact: Depends on legislative action.

Available December 2017.

Available December 2017.

If applicable, will be available December 2017.