RCW 82.04.4277

Deductions—Health and social welfare organizations—Mental health or chemical

dependency services. (Effective January 1, 2018, until January 1, 2020.)

(1) A health or social welfare organization may deduct from the measure of tax

amounts received as compensation for providing mental health services or chemical

dependency services under a government-funded program.

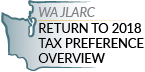

(2) A behavioral health organization may deduct from the measure of tax amounts

received from the state of Washington for distribution to a health or social welfare

organization that is eligible to deduct the distribution under subsection (1) of this

section.

(3) A person claiming a deduction under this section must file a complete annual tax

performance report with the department under RCW 82.32.534.

(4) The definitions in this subsection apply throughout this section unless the

context clearly requires otherwise.

(a) "Chemical dependency" has the same meaning as provided in *RCW 70.96A.020 through

March 31, 2018, and the same meaning as provided in RCW 71.05.020 beginning April 1,

2018.

(b) "Health or social welfare organization" has the meaning provided in RCW

82.04.431.

(c) "Mental health services" and "behavioral health organization" have the meanings

provided in RCW 71.24.025.

(5) This section expires January 1, 2020.

[ 2017 c 323 § 528; 2017 c 135 § 14; 2016 sp.s. c 29 § 532; 2014 c 225 § 104; 2011

1st sp.s. c 19 § 1.]

NOTES:

Reviser's note: *(1) RCW 70.96A.020 was repealed by 2016 sp.s. c 29 § 301, effective

April 1, 2018.

(2) This section was amended by 2017 c 135 § 14 and by 2017 c 323 § 528, each without

reference to the other. Both amendments are incorporated in the publication of this

section under RCW 1.12.025(2). For rule of construction, see RCW 1.12.025(1).

Tax preference performance statement exemption—Automatic expiration date

exemption—2017 c 323: See note following RCW 82.04.040.

Effective date—2017 c 135: See note following RCW 82.32.534.

Effective dates—2016 sp.s. c 29: See note following RCW 71.05.760.

Short title—Right of action—2016 sp.s. c 29: See notes following RCW 71.05.010.

Effective date—2014 c 225: See note following RCW 71.24.016.

Application—2011 1st sp.s. c 19: "This act applies to amounts received by a taxpayer

on or after August 1, 2011." [ 2011 1st sp.s. c 19 § 4.]

RCW 82.04.431

"Health or social welfare organization" defined—Conditions for exemption—"Health or

social welfare services" defined.

(1) The term "health or social welfare organization" means an organization, including

any community action council, which renders health or social welfare services as

defined in subsection (2) of this section, which is a domestic or foreign

not-for-profit corporation under chapter 24.03 RCW and which is managed by a governing

board of not less than eight individuals none of whom is a paid employee of the

organization or which is a corporation sole under chapter 24.12 RCW. Health or social

welfare organization does not include a corporation providing professional services as

authorized in chapter 18.100 RCW. In addition a corporation in order to be exempt

under RCW 82.04.4297 must satisfy the following conditions:

(a) No part of its income may be paid directly or indirectly to its members,

stockholders, officers, directors, or trustees except in the form of services rendered

by the corporation in accordance with its purposes and bylaws;

(b) Salary or compensation paid to its officers and executives must be only for

actual services rendered, and at levels comparable to the salary or compensation of

like positions within the public service of the state;

(c) Assets of the corporation must be irrevocably dedicated to the activities for

which the exemption is granted and, on the liquidation, dissolution, or abandonment by

the corporation, may not inure directly or indirectly to the benefit of any member or

individual except a nonprofit organization, association, or corporation which also

would be entitled to the exemption;

(d) The corporation must be duly licensed or certified where licensing or

certification is required by law or regulation;

(e) The amounts received qualifying for exemption must be used for the activities for

which the exemption is granted;

(f) Services must be available regardless of race, color, national origin, or

ancestry; and

(g) The director of revenue must have access to its books in order to determine

whether the corporation is exempt from taxes within the intent of RCW 82.04.4297 and

this section.

(2) The term "health or social welfare services" includes and is limited to:

(a) Mental health, drug, or alcoholism counseling or treatment;

(b) Family counseling;

(c) Health care services;

(d) Therapeutic, diagnostic, rehabilitative, or restorative services for the care of

the sick, aged, or physically, developmentally, or emotionally-disabled

individuals;

(e) Activities which are for the purpose of preventing or ameliorating juvenile

delinquency or child abuse, including recreational activities for those purposes;

(f) Care of orphans or foster children;

(g) Day care of children;

(h) Employment development, training, and placement;

(i) Legal services to the indigent;

(j) Weatherization assistance or minor home repair for low-income homeowners or

renters;

(k) Assistance to low-income homeowners and renters to offset the cost of home

heating energy, through direct benefits to eligible households or to fuel vendors on

behalf of eligible households;

(l) Community services to low-income individuals, families, and groups, which are

designed to have a measurable and potentially major impact on causes of poverty in

communities of the state; and

(m) Temporary medical housing, as defined in RCW 82.08.997, if the housing is

provided only:

(i) While the patient is receiving medical treatment at a hospital required to be

licensed under RCW 70.41.090 or at an outpatient clinic associated with such hospital,

including any period of recuperation or observation immediately following such medical

treatment; and

(ii) By a person that does not furnish lodging or related services to the general

public.

[ 2011 1st sp.s. c 19 § 3; 2008 c 137 § 1; 1986 c 261 § 6; 1985 c 431 § 3; 1983 1st

ex.s. c 66 § 1; 1980 c 37 § 80; 1979 ex.s. c 196 § 6.]

NOTES:

Application—2011 1st sp.s. c 19: See note following RCW 82.04.4277.

Effective date—2008 c 137: See note following RCW 82.08.997.

Intent—1980 c 37: See note following RCW 82.04.4281.

Effective date—1979 ex.s. c 196: See note following RCW 82.04.240.

RCW 71.24.025 (as amended by 2018 2ESHB 1388, effective July 1, 2018)

Definitions.

Unless the context clearly requires otherwise, the definitions in this section apply

throughout this chapter.

(1) "Acutely mentally ill" means a condition which is limited to a short-term severe

crisis episode of:

(a) A mental disorder as defined in RCW 71.05.020 or, in the case of a child, as

defined in RCW 71.34.020;

(b) Being gravely disabled as defined in RCW 71.05.020 or, in the case of a child, a

gravely disabled minor as defined in RCW 71.34.020; or

(c) Presenting a likelihood of serious harm as defined in RCW 71.05.020 or, in the

case of a child, as defined in RCW 71.34.020.

(2) "Alcoholism" means a disease, characterized by a dependency on alcoholic

beverages, loss of control over the amount and circumstances of use, symptoms of

tolerance, physiological or psychological withdrawal, or both, if use is reduced or

discontinued, and impairment of health or disruption of social or economic

functioning.

(3) "Approved substance use disorder treatment program" means a program for persons

with a substance use disorder provided by a treatment program licensed or certified by

the department as meeting standards adopted under this chapter.

(4) "Authority" means the Washington state health care authority.

(5) "Available resources" means funds appropriated for the purpose of providing

community mental health programs, federal funds, except those provided according to

Title XIX of the Social Security Act, and state funds appropriated under this chapter

or chapter 71.05 RCW by the legislature during any biennium for the purpose of

providing residential services, resource management services, community support

services, and other mental health services. This does not include funds appropriated

for the purpose of operating and administering the state psychiatric hospitals.

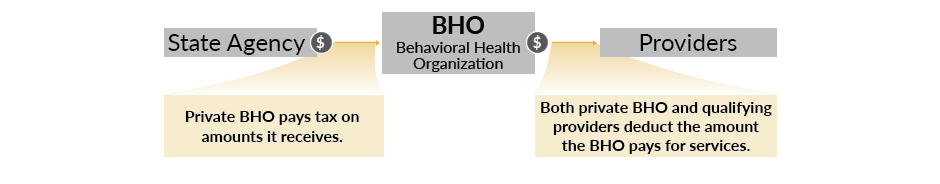

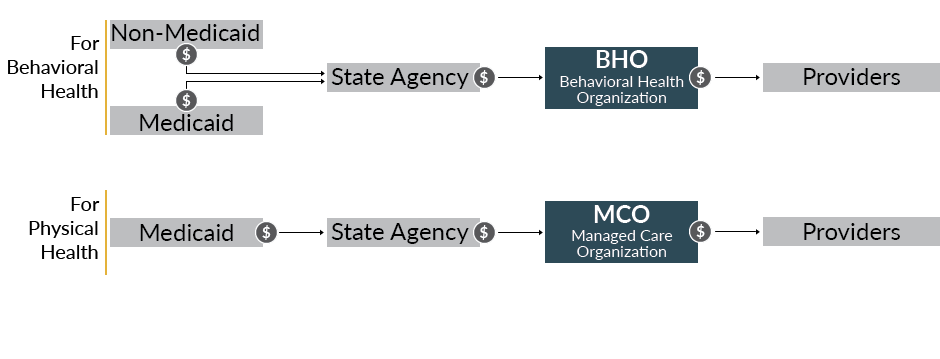

(6) "Behavioral health organization" means any county authority or group of county

authorities or other entity recognized by the director in contract in a defined

region.

(7) "Behavioral health program" means all expenditures, services, activities, or

programs, including reasonable administration and overhead, designed and conducted to

prevent or treat chemical dependency and mental illness.

(8) "Behavioral health services" means mental health services as described in this

chapter and chapter 71.36 RCW and substance use disorder treatment services as

described in this chapter.

(9) "Child" means a person under the age of eighteen years.

(10) "Chronically mentally ill adult" or "adult who is chronically mentally ill"

means an adult who has a mental disorder and meets at least one of the following

criteria:

(a) Has undergone two or more episodes of hospital care for a mental disorder within

the preceding two years; or

(b) Has experienced a continuous psychiatric hospitalization or residential treatment

exceeding six months' duration within the preceding year; or

(c) Has been unable to engage in any substantial gainful activity by reason of any

mental disorder which has lasted for a continuous period of not less than twelve

months. "Substantial gainful activity" shall be defined by the authority by rule

consistent with Public Law 92-603, as amended.

(11) "Clubhouse" means a community-based program that provides rehabilitation

services and is licensed or certified by the department.

(12) "Community mental health service delivery system" means public, private, or

tribal agencies that provide services specifically to persons with mental disorders as

defined under RCW 71.05.020 and receive funding from public sources.

(13) "Community support services" means services authorized, planned, and coordinated

through resource management services including, at a minimum, assessment, diagnosis,

emergency crisis intervention available twenty-four hours, seven days a week,

prescreening determinations for persons who are mentally ill being considered for

placement in nursing homes as required by federal law, screening for patients being

considered for admission to residential services, diagnosis and treatment for children

who are acutely mentally ill or severely emotionally disturbed discovered under

screening through the federal Title XIX early and periodic screening, diagnosis, and

treatment program, investigation, legal, and other nonresidential services under

chapter 71.05 RCW, case management services, psychiatric treatment including

medication supervision, counseling, psychotherapy, assuring transfer of relevant

patient information between service providers, recovery services, and other services

determined by behavioral health organizations.

(14) "Consensus-based" means a program or practice that has general support among

treatment providers and experts, based on experience or professional literature, and

may have anecdotal or case study support, or that is agreed but not possible to

perform studies with random assignment and controlled groups.

(15) "County authority" means the board of county commissioners, county council, or

county executive having authority to establish a community mental health program, or

two or more of the county authorities specified in this subsection which have entered

into an agreement to provide a community mental health program.

(16) "Department" means the department of health.

(17) "Designated crisis responder" means a mental health professional designated by

the county or other authority authorized in rule to perform the duties specified in

this chapter.

(18) "Director" means the director of the authority.

(19) "Drug addiction" means a disease characterized by a dependency on psychoactive

chemicals, loss of control over the amount and circumstances of use, symptoms of

tolerance, physiological or psychological withdrawal, or both, if use is reduced or

discontinued, and impairment of health or disruption of social or economic

functioning.

(20) "Early adopter" means a regional service area for which all of the county

authorities have requested that the authority purchase medical and behavioral health

services through a managed care health system as defined under RCW 71.24.380(6).

(21 "Emerging best practice" or "promising practice" means a program or practice

that, based on statistical analyses or a well established theory of change, shows

potential for meeting the evidence-based or research-based criteria, which may include

the use of a program that is evidence-based for outcomes other than those listed in

subsection (20) of this section.

(22) "Evidence-based" means a program or practice that has been tested in

heterogeneous or intended populations with multiple randomized, or statistically

controlled evaluations, or both; or one large multiple site randomized, or

statistically controlled evaluation, or both, where the weight of the evidence from a

systemic review demonstrates sustained improvements in at least one outcome.

"Evidence-based" also means a program or practice that can be implemented with a set

of procedures to allow successful replication in Washington and, when possible, is

determined to be cost-beneficial.

(23) "Licensed physician" means a person licensed to practice medicine or osteopathic

medicine and surgery in the state of Washington.

(24) "Licensed or certified service provider" means an entity licensed or certified

according to this chapter or chapter 71.05 RCW or an entity deemed to meet state

minimum standards as a result of accreditation by a recognized behavioral health

accrediting body recognized and having a current agreement with the department, or

tribal attestation that meets state minimum standards, or persons licensed under

chapter 18.57, 18.57A, 18.71, 18.71A, 18.83, or 18.79 RCW, as it applies to registered

nurses and advanced registered nurse practitioners.

(25) "Long-term inpatient care" means inpatient services for persons committed for,

or voluntarily receiving intensive treatment for, periods of ninety days or greater

under chapter 71.05 RCW. "Long-term inpatient care" as used in this chapter does not

include: (a) Services for individuals committed under chapter 71.05 RCW who are

receiving services pursuant to a conditional release or a court-ordered less

restrictive alternative to detention; or (b) services for individuals voluntarily

receiving less restrictive alternative treatment on the grounds of the state

hospital.

(26) "Mental health services" means all services provided by behavioral health

organizations and other services provided by the state for persons who are mentally

ill.

(27) Mental health "treatment records" include registration and all other records

concerning persons who are receiving or who at any time have received services for

mental illness, which are maintained by the department of social and health services

or the authority, by behavioral health organizations and their staffs, or by treatment

facilities. "Treatment records" do not include notes or records maintained for

personal use by a person providing treatment services for the department of social and

health services, behavioral health organizations, or a treatment facility if the notes

or records are not available to others.

(28) "Mentally ill persons," "persons who are mentally ill," and "the mentally ill"

mean persons and conditions defined in subsections (1), (10), (36), and (37) of this

section.

(29) "Recovery" means the process in which people are able to live, work, learn, and

participate fully in their communities.

(30) "Registration records" include all the records of the department of social and

health services, the authority, behavioral health organizations, treatment facilities,

and other persons providing services for the department of social and health services,

the authority, county departments, or facilities which identify persons who are

receiving or who at any time have received services for mental illness.

(31) "Research-based" means a program or practice that has been tested with a single

randomized, or statistically controlled evaluation, or both, demonstrating sustained

desirable outcomes; or where the weight of the evidence from a systemic review

supports sustained outcomes as described in subsection (20) of this section but does

not meet the full criteria for evidence-based.

(32) "Residential services" means a complete range of residences and supports

authorized by resource management services and which may involve a facility, a

distinct part thereof, or services which support community living, for persons who are

acutely mentally ill, adults who are chronically mentally ill, children who are

severely emotionally disturbed, or adults who are seriously disturbed and determined

by the behavioral health organization to be at risk of becoming acutely or chronically

mentally ill. The services shall include at least evaluation and treatment services as

defined in chapter 71.05 RCW, acute crisis respite care, long-term adaptive and

rehabilitative care, and supervised and supported living services, and shall also

include any residential services developed to service persons who are mentally ill in

nursing homes, residential treatment facilities, assisted living facilities, and adult

family homes, and may include outpatient services provided as an element in a package

of services in a supported housing model. Residential services for children in

out-of-home placements related to their mental disorder shall not include the costs of

food and shelter, except for children's long-term residential facilities existing

prior to January 1, 1991.

(33) "Resilience" means the personal and community qualities that enable individuals

to rebound from adversity, trauma, tragedy, threats, or other stresses, and to live

productive lives.

(34) "Resource management services" mean the planning, coordination, and

authorization of residential services and community support services administered

pursuant to an individual service plan for: (a) Adults and children who are acutely

mentally ill; (b) adults who are chronically mentally ill; (c) children who are

severely emotionally disturbed; or (d) adults who are seriously disturbed and

determined solely by a behavioral health organization to be at risk of becoming

acutely or chronically mentally ill. Such planning, coordination, and authorization

shall include mental health screening for children eligible under the federal Title

XIX early and periodic screening, diagnosis, and treatment program. Resource

management services include seven day a week, twenty-four hour a day availability of

information regarding enrollment of adults and children who are mentally ill in

services and their individual service plan to designated crisis responders, evaluation

and treatment facilities, and others as determined by the behavioral health

organization.

(35) "Secretary" means the secretary of the department of health.

(36) "Seriously disturbed person" means a person who:

(a) Is gravely disabled or presents a likelihood of serious harm to himself or

herself or others, or to the property of others, as a result of a mental disorder as

defined in chapter 71.05 RCW;

(b) Has been on conditional release status, or under a less restrictive alternative

order, at some time during the preceding two years from an evaluation and treatment

facility or a state mental health hospital;

(c) Has a mental disorder which causes major impairment in several areas of daily

living;

(d) Exhibits suicidal preoccupation or attempts; or

(e) Is a child diagnosed by a mental health professional, as defined in chapter 71.34

RCW, as experiencing a mental disorder which is clearly interfering with the child's

functioning in family or school or with peers or is clearly interfering with the

child's personality development and learning.

(37) "Severely emotionally disturbed child" or "child who is severely emotionally

disturbed" means a child who has been determined by the behavioral health organization

to be experiencing a mental disorder as defined in chapter 71.34 RCW, including those

mental disorders that result in a behavioral or conduct disorder, that is clearly

interfering with the child's functioning in family or school or with peers and who

meets at least one of the following criteria:

(a) Has undergone inpatient treatment or placement outside of the home related to a

mental disorder within the last two years;

(b) Has undergone involuntary treatment under chapter 71.34 RCW within the last two

years;

(c) Is currently served by at least one of the following child-serving systems:

Juvenile justice, child-protection/welfare, special education, or developmental

disabilities;

(d) Is at risk of escalating maladjustment due to:

(i) Chronic family dysfunction involving a caretaker who is mentally ill or

inadequate;

(ii) Changes in custodial adult;

(iii) Going to, residing in, or returning from any placement outside of the home, for

example, psychiatric hospital, short-term inpatient, residential treatment, group or

foster home, or a correctional facility;

(iv) Subject to repeated physical abuse or neglect;

(v) Drug or alcohol abuse; or

(vi) Homelessness.

(38) "State minimum standards" means minimum requirements established by rules

adopted and necessary to implement this chapter by:

(a) The authority for:

(i)Delivery of mental health and substance use disorder services; and

(ii) Community support services and resource management services;

(b) The department of health for:

(i) Licensed or certified services providers for the provision of mental health and

substance use disorder services; and

(ii) Residential services.

(39) "Substance use disorder" means a cluster of cognitive, behavioral, and

physiological symptoms indicating that an individual continues using the substance

despite significant substance-related problems. The diagnosis of a substance use

disorder is based on a pathological pattern of behaviors related to the use of the

substances.

(40) "Tribal authority," for the purposes of this section and RCW 71.24.300 only,

means: The federally recognized Indian tribes and the major Indian organizations

recognized by the director insofar as these organizations do not have a financial

relationship with any behavioral health organization that would present a conflict of

interest.

[ 2016 sp.s. c 29 § 502; 2016 sp.s. c 29 § 501; 2016 c 155 § 12. Prior: 2014 c 225 §

10; 2013 c 338 § 5; 2012 c 10 § 59; 2008 c 261 § 2; 2007 c 414 § 1; 2006 c 333 § 104;

prior: 2005 c 504 § 105; 2005 c 503 § 2; 2001 c 323 § 8; 1999 c 10 § 2; 1997 c 112 §

38; 1995 c 96 § 4; prior: 1994 sp.s. c 9 § 748; 1994 c 204 § 1; 1991 c 306 § 2; 1989 c

205 § 2; 1986 c 274 § 2; 1982 c 204 § 3.]

NOTES:

Reviser's note: The definitions in this section have been alphabetized pursuant to

RCW 1.08.015(2)(k).

Effective dates—2016 sp.s. c 29: See note following RCW 71.05.760.

Short title—Right of action—2016 sp.s. c 29: See notes following RCW 71.05.010.

Effective date—2014 c 225: See note following RCW 71.24.016.

Application—2012 c 10: See note following RCW 18.20.010.

Intent—Findings—2008 c 261: See note following RCW 71.24.320.

Finding—Purpose—Intent—Severability—Part headings not law—Effective dates—2006 c 333:

See notes following RCW 71.24.016.

Findings—Intent—Severability—Application—Construction—Captions, part headings,

subheadings not law—Adoption of rules—Effective dates—2005 c 504: See notes following

RCW 71.05.027.

Alphabetization—Correction of references—2005 c 504: See note following RCW

71.05.020.

Correction of references—Savings—Severability—2005 c 503: See notes following RCW

71.24.015.

Purpose—Intent—1999 c 10: "The purpose of this act is to eliminate dates and

provisions in chapter 71.24 RCW which are no longer needed. The legislature does not

intend this act to make, and no provision of this act shall be construed as, a

substantive change in the service delivery system or funding of the community mental

health services law." [ 1999 c 10 § 1.]

Alphabetization of section—1999 c 10 § 2: "The code reviser shall alphabetize the

definitions in RCW 71.24.025 and correct any cross-references." [ 1999 c 10 § 14.]

Effective date—1995 c 96: See note following RCW 71.24.400.

Severability—Headings and captions not law—Effective date—1994 sp.s. c 9: See RCW

18.79.900 through 18.79.902.

Conflict with federal requirements—1991 c 306: See note following RCW 71.24.015.

Effective date—1986 c 274 §§ 1, 2, 3, 5, and 9: See note following RCW 71.24.015.

❮ Previous

Next ❯