Custom Farming

82.04.625

Exemptions—Custom farming services. (Expires December 31, 2020)

(1) This chapter does not apply to any:

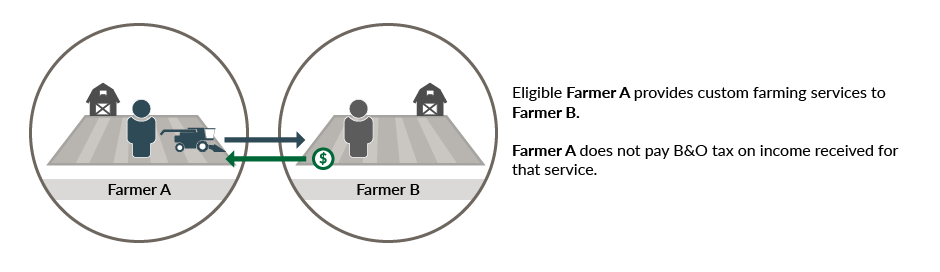

(a) Person performing custom farming services for a farmer, when the person

performing the custom farming services is: (i) An eligible farmer; or (ii) at least

fifty percent owned by an eligible farmer; or

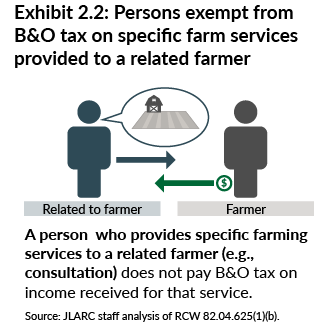

(b) Person performing farm management services, contract labor services, services

provided with respect to animals that are agricultural products, or any combination of

these services, for a farmer or for a person performing custom farming services, when

the person performing the farm management services, contract labor services, services

with respect to animals, or any combination of these services, and the farmer or

person performing custom farming services are related.

(2) The definitions in this subsection apply throughout this section.

(a)(i) "Custom farming services" means the performance of specific farming

operations through the use of any farm machinery or equipment, farm implement, or

draft animal, together with an operator, when: (i) [(A)] The specific farming

operation consists of activities directly related to the growing, raising, or

producing of any agricultural product to be sold or consumed by a farmer; and (ii)

[(B)] the performance of the specific farming operation is for, and under a contract

with, or the direction or supervision of, a farmer. "Custom farming services" does not

include the custom application of fertilizers, chemicals, or biologicals, or any

services related to the growing, raising, or producing of marijuana.

(ii) For the purposes of this subsection (2)(a), "specific farming operation"

includes specific planting, cultivating, or harvesting activities, or similar specific

farming operations. The term does not include veterinary services as defined in RCW

18.92.010; farrier, boarding, training, or appraisal services; artificial insemination

or stud services, agricultural consulting services; packing or processing of

agricultural products; or pumping or other waste disposal services.

(b) "Eligible farmer" means a person who is eligible for an exemption certificate

under RCW 82.08.855 at the time that the custom farming services are rendered,

regardless of whether the person has applied for an exemption certificate under RCW

82.08.855.

(c) "Farm management services" means the consultative decisions made for the

operations of the farm including, but not limited to, determining which crops to

plant, the choice and timing of application of fertilizers and chemicals, the

horticultural practices to apply, the marketing of crops and livestock, and the care

and feeding of animals. "Farm management services" does not include any services

related to the growing, raising, or producing of marijuana.

(d) "Related" means having any of the relationships specifically described in

section 267(b) (1), (2), and (4) through (13) of the internal revenue code, as amended

or renumbered as of January 1, 2007.

2014 c 140 § 10;2007 c 334 § 1.

Hauling agricultural products or machinery

RCW 82.16.300

Exemptions—Custom farming services. (Expires December 31, 2020)

(1) This chapter shall not apply to any person hauling agricultural products or farm

machinery or equipment for a farmer or for a person performing custom farming

services, when the person providing the hauling and the farmer or person performing

custom farming services are related.

(2) The exemption provided by this section shall not apply to the hauling of any

substances or articles manufactured from agricultural products. For the purposes of

this subsection, "manufactured" has the same meaning as "to manufacture" in RCW

82.04.120.

(3) The definitions in RCW 82.04.213 and 82.04.625 apply to this section.

2007 c 334 § 2.]

❮ Previous

Next ❯

A person who performs specific

farming services does not pay B&O tax if they are

A person who performs specific

farming services does not pay B&O tax if they are