Chapter 84.14 RCW

New and rehabilitated multiple-unit dwellings in urban centers

Tax preference performance statement—2014 c 96:

This section is the tax preference performance statement for the tax preference

contained in RCW 84.14.040 and 84.14.060. This performance statement is only intended to

be used for subsequent evaluation of the tax preference. It is not intended to create a

private right of action by any party or be used to determine eligibility for

preferential tax treatment.

(1) The legislature categorizes this tax preference as one intended to induce certain

designated behavior by taxpayers, as indicated in RCW 82.32.808(2)(a).

(2) It is the legislature's specific public policy objective to stimulate the

construction of new multifamily housing in urban growth areas located in unincorporated

areas of rural counties where housing options, including affordable housing options, are

severely limited. It is the legislature's intent to provide the value of new housing

construction, conversion, and rehabilitation improvements qualifying under chapter 84.14

RCW an exemption from ad valorem property taxation for eight to twelve years, as

provided for in RCW 84.14.020, in order to provide incentives to developers to construct

new multifamily housing thereby increasing the number of affordable housing units for

low to moderate-income residents in certain rural counties.

(3) If a review finds that at least twenty percent of the new housing is developed and

occupied by households making at or below eighty percent of the area median income, at

the time of occupancy, adjusted for family size for the county where the project is

located or where the housing is intended exclusively for owner occupancy, the household

may earn up to one hundred fifteen percent of the area median income, at the time of

sale, adjusted for family size for the county where the project is located, then the

legislature intends to extend the expiration date of the tax preference.

(4) In order to obtain the data necessary to perform the review in subsection (3) of

this section, the joint legislative audit and review committee may refer to data

provided by counties in which beneficiaries are utilizing the preference, the office of

financial management, the department of commerce, the United States department of

housing and urban development, and other data sources as needed by the joint legislative

audit and review committee." [ 2014 c 96 § 1.]

RCW 84.14.005

Findings

The legislature finds:

(1) That in many of Washington's urban centers there is insufficient availability of

desirable and convenient residential units, including affordable housing units, to meet

the needs of a growing number of the public who would live in these urban centers if

these desirable, convenient, attractive, affordable, and livable places to live were

available;

(2) That the development of additional and desirable residential units, including

affordable housing units, in these urban centers that will attract and maintain a

significant increase in the number of permanent residents in these areas will help to

alleviate the detrimental conditions and social liability that tend to exist in the

absence of a viable mixed income residential population and will help to achieve the

planning goals mandated by the growth management act under RCW 36.70A.020; and

(3) That planning solutions to solve the problems of urban sprawl often lack incentive

and implementation techniques needed to encourage residential redevelopment in those

urban centers lacking a sufficient variety of residential opportunities, and it is in

the public interest and will benefit, provide, and promote the public health, safety,

and welfare to stimulate new or enhanced residential opportunities, including affordable

housing opportunities, within urban centers through a tax incentive as provided by this

chapter.

[ 2007 c 430 § 1; 1995 c 375 § 1.]

RCW 84.14.007:

Purpose

It is the purpose of this chapter to encourage increased residential opportunities,

including affordable housing opportunities, in cities that are required to plan or

choose to plan under the growth management act within urban centers where the governing

authority of the affected city has found there is insufficient housing opportunities,

including affordable housing opportunities. It is further the purpose of this chapter to

stimulate the construction of new multifamily housing and the rehabilitation of existing

vacant and underutilized buildings for multifamily housing in urban centers having

insufficient housing opportunities that will increase and improve residential

opportunities, including affordable housing opportunities, within these urban centers.

To achieve these purposes, this chapter provides for special valuations in residentially

deficient urban centers for eligible improvements associated with multiunit housing,

which includes affordable housing. It is an additional purpose of this chapter to allow

unincorporated areas of rural counties that are within urban growth areas to stimulate

housing opportunities and for certain counties to stimulate housing opportunities near

college campuses to promote dense, transit-oriented, walkable college communities.

[ 2014 c 96 § 2; 2012 c 194 § 1; 2007 c 430 § 2; 1995 c 375 § 2.]

RCW 84.14.010

Definitions

The definitions in this section apply throughout this chapter unless the context

clearly requires otherwise.

(1) "Affordable housing" means residential housing that is rented by a person or

household whose monthly housing costs, including utilities other than telephone, do not

exceed thirty percent of the household's monthly income. For the purposes of housing

intended for owner occupancy, "affordable housing" means residential housing that is

within the means of low or moderate-income households.

(2) "Campus facilities master plan" means the area that is defined by the University of

Washington as necessary for the future growth and development of its campus facilities

for campuses authorized under RCW 28B.45.020.

(3) "City" means either (a) a city or town with a population of at least fifteen

thousand, (b) the largest city or town, if there is no city or town with a population of

at least fifteen thousand, located in a county planning under the growth management act,

or (c) a city or town with a population of at least five thousand located in a county

subject to the provisions of RCW 36.70A.215.

(4) "County" means a county with an unincorporated population of at least three hundred

fifty thousand.

(5) "Governing authority" means the local legislative authority of a city or a county

having jurisdiction over the property for which an exemption may be applied for under

this chapter.

(6) "Growth management act" means chapter 36.70A RCW.

(7) "High cost area" means a county where the third quarter median house price for the

previous year as reported by the Washington center for real estate research at

Washington State University is equal to or greater than one hundred thirty percent of

the statewide median house price published during the same time period.

(8) "Household" means a single person, family, or unrelated persons living

together.

(9) "Low-income household" means a single person, family, or unrelated persons living

together whose adjusted income is at or below eighty percent of the median family income

adjusted for family size, for the county where the project is located, as reported by

the United States department of housing and urban development. For cities located in

high-cost areas, "low-income household" means a household that has an income at or below

one hundred percent of the median family income adjusted for family size, for the county

where the project is located.

(10) "Moderate-income household" means a single person, family, or unrelated persons

living together whose adjusted income is more than eighty percent but is at or below one

hundred fifteen percent of the median family income adjusted for family size, for the

county where the project is located, as reported by the United States department of

housing and urban development. For cities located in high-cost areas, "moderate-income

household" means a household that has an income that is more than one hundred percent,

but at or below one hundred fifty percent, of the median family income adjusted for

family size, for the county where the project is located.

(11) "Multiple-unit housing" means a building having four or more dwelling units not

designed or used as transient accommodations and not including hotels and motels.

Multifamily units may result from new construction or rehabilitated or conversion of

vacant, underutilized, or substandard buildings to multifamily housing.

(12) "Owner" means the property owner of record.

(13) "Permanent residential occupancy" means multiunit housing that provides either

rental or owner occupancy on a nontransient basis. This includes owner-occupied or

rental accommodation that is leased for a period of at least one month. This excludes

hotels and motels that predominately offer rental accommodation on a daily or weekly

basis.

(14) "Rehabilitation improvements" means modifications to existing structures, that are

vacant for twelve months or longer, that are made to achieve a condition of substantial

compliance with existing building codes or modification to existing occupied structures

which increase the number of multifamily housing units.

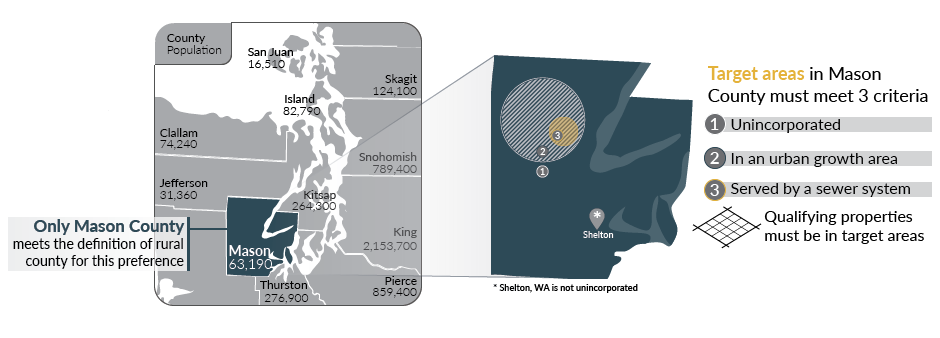

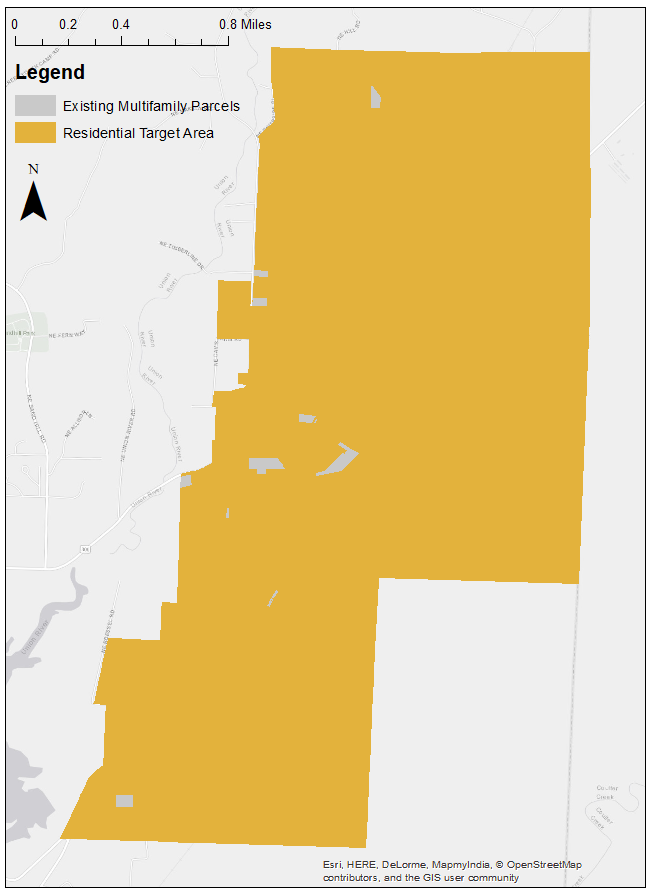

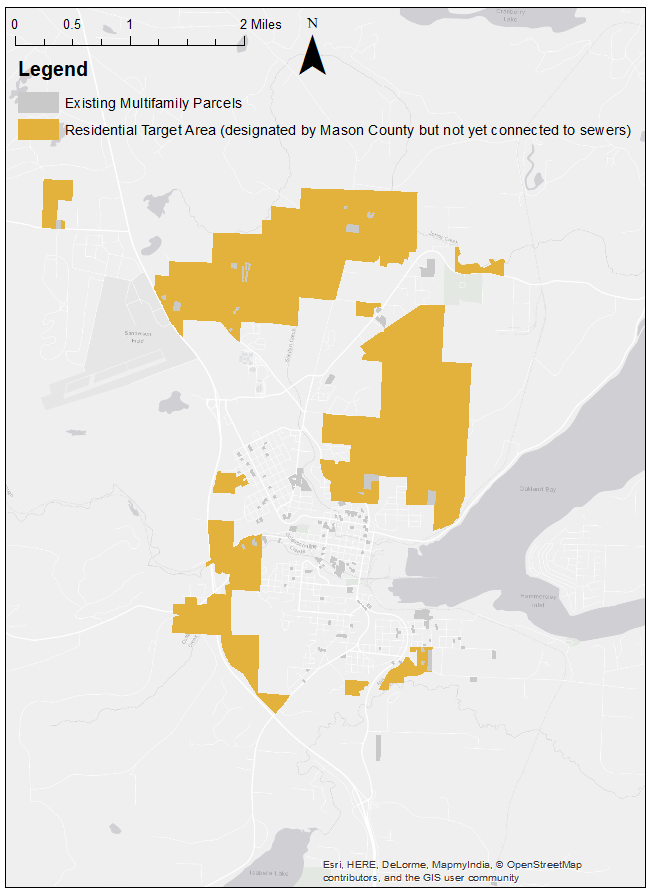

(15) "Residential targeted area" means an area within an urban center or urban growth

area that has been designated by the governing authority as a residential targeted area

in accordance with this chapter. With respect to designations after July 1, 2007,

"residential targeted area" may not include a campus facilities master plan.

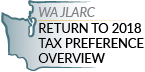

(16) "Rural county" means a county with a population between fifty thousand and

seventy-one thousand and bordering Puget Sound.

(17) "Substantial compliance" means compliance with local building or housing code

requirements that are typically required for rehabilitation as opposed to new

construction.

(18) "Urban center" means a compact identifiable district where urban residents may

obtain a variety of products and services. An urban center must contain:

(a) Several existing or previous, or both, business establishments that may include but

are not limited to shops, offices, banks, restaurants, governmental agencies;

(b) Adequate public facilities including streets, sidewalks, lighting, transit,

domestic water, and sanitary sewer systems; and

(c) A mixture of uses and activities that may include housing, recreation, and cultural

activities in association with either commercial or office, or both, use.

[ 2017 c 52 § 16; 2014 c 96 § 3. Prior: 2012 c 194 § 2; prior: 2007 c 430 § 3; 2007 c

185 § 1; 2002 c 146 § 1; 2000 c 242 § 1; 1997 c 429 § 40; 1995 c 375 § 3.]

NOTES:

Effective date—2007 c 185: "This act is necessary for the immediate preservation of the

public peace, health, or safety, or support of the state government and its existing

public institutions, and takes effect July 1, 2007." [ 2007 c 185 § 3.]

Severability—1997 c 429: See note following RCW 36.70A.3201.

RCW 84.14.020

Exemption—Duration—Valuation

(1)(a) The value of new housing construction, conversion, and rehabilitation

improvements qualifying under this chapter is exempt from ad valorem property taxation,

as follows:

(i) For properties for which applications for certificates of tax exemption eligibility

are submitted under chapter 84.14 RCW before July 22, 2007, the value is exempt for ten

successive years beginning January 1 of the year immediately following the calendar year

of issuance of the certificate; and

(ii) For properties for which applications for certificates of tax exemption

eligibility are submitted under chapter 84.14 RCW on or after July 22, 2007, the value

is exempt:

(A) For eight successive years beginning January 1st of the year immediately following

the calendar year of issuance of the certificate; or

(B) For twelve successive years beginning January 1st of the year immediately following

the calendar year of issuance of the certificate, if the property otherwise qualifies

for the exemption under chapter 84.14 RCW and meets the conditions in this subsection

(1)(a)(ii)(B). For the property to qualify for the twelve-year exemption under this

subsection, the applicant must commit to renting or selling at least twenty percent of

the multifamily housing units as affordable housing units to low and moderate-income

households, and the property must satisfy that commitment and any additional

affordability and income eligibility conditions adopted by the local government under

this chapter. In the case of projects intended exclusively for owner occupancy, the

minimum requirement of this subsection (1)(a)(ii)(B) may be satisfied solely through

housing affordable to moderate-income households.

(b) The exemptions provided in (a)(i) and (ii) of this subsection do not include the

value of land or nonhousing-related improvements not qualifying under this chapter.

(2) When a local government adopts guidelines pursuant to RCW 84.14.030(2) and includes

conditions that must be satisfied with respect to individual dwelling units, rather than

with respect to the multiple-unit housing as a whole or some minimum portion thereof,

the exemption may, at the local government's discretion, be limited to the value of the

qualifying improvements allocable to those dwelling units that meet the local

guidelines.

(3) In the case of rehabilitation of existing buildings, the exemption does not include

the value of improvements constructed prior to the submission of the application

required under this chapter. The incentive provided by this chapter is in addition to

any other incentives, tax credits, grants, or other incentives provided by law.

(4) This chapter does not apply to increases in assessed valuation made by the assessor

on nonqualifying portions of building and value of land nor to increases made by lawful

order of a county board of equalization, the department of revenue, or a county, to a

class of property throughout the county or specific area of the county to achieve the

uniformity of assessment or appraisal required by law.

(5) At the conclusion of the exemption period, the new or rehabilitated housing cost

shall be considered as new construction for the purposes of chapter 84.55 RCW.

[ 2007 c 430 § 4; 2002 c 146 § 2; 1999 c 132 § 1; 1995 c 375 § 5.]

RCW 84.14.030

Application—Requirements.

An owner of property making application under this chapter must meet the following

requirements:

(1) The new or rehabilitated multiple-unit housing must be located in a residential

targeted area as designated by the city or county;

(2) The multiple-unit housing must meet guidelines as adopted by the governing

authority that may include height, density, public benefit features, number and size of

proposed development, parking, income limits for occupancy, limits on rents or sale

prices, and other adopted requirements indicated necessary by the city or county. The

required amenities should be relative to the size of the project and tax benefit to be

obtained;

(3) The new, converted, or rehabilitated multiple-unit housing must provide for a

minimum of fifty percent of the space for permanent residential occupancy. In the case

of existing occupied multifamily development, the multifamily housing must also provide

for a minimum of four additional multifamily units. Existing multifamily vacant housing

that has been vacant for twelve months or more does not have to provide additional

multifamily units;

(4) New construction multifamily housing and rehabilitation improvements must be

completed within three years from the date of approval of the application;

(5) Property proposed to be rehabilitated must fail to comply with one or more

standards of the applicable state or local building or housing codes on or after July

23, 1995. If the property proposed to be rehabilitated is not vacant, an applicant must

provide each existing tenant housing of comparable size, quality, and price and a

reasonable opportunity to relocate; and

(6) The applicant must enter into a contract with the city or county approved by the

governing authority, or an administrative official or commission authorized by the

governing authority, under which the applicant has agreed to the implementation of the

development on terms and conditions satisfactory to the governing authority.

[ 2012 c 194 § 3; 2007 c 430 § 5; 2005 c 80 § 1; 1997 c 429 § 42; 1995 c 375 § 6.]

NOTES:

Severability—1997 c 429: See note following RCW 36.70A.3201.

84.14.040

Designation of residential targeted area—Criteria—Local designation—Hearing—Standards,

guidelines.

(1) The following criteria must be met before an area may be designated as a

residential targeted area:

(a) The area must be within an urban center, as determined by the governing

authority;

(b) The area must lack, as determined by the governing authority, sufficient available,

desirable, and convenient residential housing, including affordable housing, to meet the

needs of the public who would be likely to live in the urban center, if the affordable,

desirable, attractive, and livable places to live were available;

(c) The providing of additional housing opportunity, including affordable housing, in

the area, as determined by the governing authority, will assist in achieving one or more

of the stated purposes of this chapter; and

(d) If the residential targeted area is designated by a county, the area must be

located in an unincorporated area of the county that is within an urban growth area

under RCW 36.70A.110 and the area must be: (i) In a rural county, served by a sewer

system and designated by a county prior to January 1, 2013; or (ii) in a county that

includes a campus of an institution of higher education, as defined in RCW 28B.92.030,

where at least one thousand two hundred students live on campus during the academic

year.

(2) For the purpose of designating a residential targeted area or areas, the governing

authority may adopt a resolution of intention to so designate an area as generally

described in the resolution. The resolution must state the time and place of a hearing

to be held by the governing authority to consider the designation of the area and may

include such other information pertaining to the designation of the area as the

governing authority determines to be appropriate to apprise the public of the action

intended.

(3) The governing authority must give notice of a hearing held under this chapter by

publication of the notice once each week for two consecutive weeks, not less than seven

days, nor more than thirty days before the date of the hearing in a paper having a

general circulation in the city or county where the proposed residential targeted area

is located. The notice must state the time, date, place, and purpose of the hearing and

generally identify the area proposed to be designated as a residential targeted

area.

(4) Following the hearing, or a continuance of the hearing, the governing authority may

designate all or a portion of the area described in the resolution of intent as a

residential targeted area if it finds, in its sole discretion, that the criteria in

subsections (1) through (3) of this section have been met.

(5) After designation of a residential targeted area, the governing authority must

adopt and implement standards and guidelines to be utilized in considering applications

and making the determinations required under RCW 84.14.060. The standards and guidelines

must establish basic requirements for both new construction and rehabilitation, which

must include:

(a) Application process and procedures;

(b) Requirements that address demolition of existing structures and site utilization;

and

(c) Building requirements that may include elements addressing parking, height,

density, environmental impact, and compatibility with the existing surrounding property

and such other amenities as will attract and keep permanent residents and that will

properly enhance the livability of the residential targeted area in which they are to be

located.

(6) The governing authority may adopt and implement, either as conditions to eight-year

exemptions or as conditions to an extended exemption period under RCW

84.14.020(1)(a)(ii)(B), or both, more stringent income eligibility, rent, or sale price

limits, including limits that apply to a higher percentage of units, than the minimum

conditions for an extended exemption period under RCW 84.14.020(1)(a)(ii)(B). For any

multiunit housing located in an unincorporated area of a county, a property owner

seeking tax incentives under this chapter must commit to renting or selling at least

twenty percent of the multifamily housing units as affordable housing units to low and

moderate-income households. In the case of multiunit housing intended exclusively for

owner occupancy, the minimum requirement of this subsection (6) may be satisfied solely

through housing affordable to moderate-income households.

[ 2014 c 96 § 4; 2012 c 194 § 4; 2007 c 430 § 6; 1995 c 375 § 7.]

NOTES: Tax preference performance statement -- 2014 c 96

RCW 84.14.050

Application—Procedures.

An owner of property seeking tax incentives under this chapter must complete the

following procedures:

(1) In the case of rehabilitation or where demolition or new construction is required,

the owner must secure from the governing authority or duly authorized representative,

before commencement of rehabilitation improvements or new construction, verification of

property noncompliance with applicable building and housing codes;

(2) In the case of new and rehabilitated multifamily housing, the owner must apply to

the city or county on forms adopted by the governing authority. The application must

contain the following:

(a) Information setting forth the grounds supporting the requested exemption including

information indicated on the application form or in the guidelines;

(b) A description of the project and site plan, including the floor plan of units and

other information requested;

(c) A statement that the applicant is aware of the potential tax liability involved

when the property ceases to be eligible for the incentive provided under this

chapter;

(3) The applicant must verify the application by oath or affirmation; and

(4) The application must be accompanied by the application fee, if any, required under

RCW 84.14.080. The governing authority may permit the applicant to revise an application

before final action by the governing authority.

[ 2012 c 194 § 5; 2007 c 430 § 7; 1999 c 132 § 2; 1997 c 429 § 43; 1995 c 375 § 8.]

NOTES:

Severability—1997 c 429: See note following RCW 36.70A.3201.

RCW 84.14.060

Approval—Required findings

(1) The duly authorized administrative official or committee of the city or county may

approve the application if it finds that:

(a) A minimum of four new units are being constructed or in the case of occupied

rehabilitation or conversion a minimum of four additional multifamily units are being

developed;

(b) If applicable, the proposed multiunit housing project meets the affordable housing

requirements as described in RCW 84.14.020;

(c) The proposed project is or will be, at the time of completion, in conformance with

all local plans and regulations that apply at the time the application is approved;

(d) The owner has complied with all standards and guidelines adopted by the city or

county under this chapter; and

(e) The site is located in a residential targeted area of an urban center or urban

growth area that has been designated by the governing authority in accordance with

procedures and guidelines indicated in RCW 84.14.040.

(2) An application may not be approved after July 1, 2007, if any part of the proposed

project site is within a campus facilities master plan, except as provided in RCW

84.14.040(1)(d).

(3) An application may not be approved for a residential targeted area in a rural

county on or after January 1, 2020.

[ 2014 c 96 § 5; 2012 c 194 § 6. Prior: 2007 c 430 § 8; 2007 c 185 § 2; 1995 c 375 §

9.]

NOTES:

Tax preference performance statement—2014 c 96: See note following RCW 84.14.040.

Effective date—2007 c 185: See note following RCW 84.14.010.

RCW 84.14.070

Processing—Approval—Denial—Appeal

(1) The governing authority or an administrative official or commission authorized by

the governing authority must approve or deny an application filed under this chapter

within ninety days after receipt of the application.

(2) If the application is approved, the city or county must issue the owner of the

property a conditional certificate of acceptance of tax exemption. The certificate must

contain a statement by a duly authorized administrative official of the governing

authority that the property has complied with the required findings indicated in RCW

84.14.060.

(3) If the application is denied by the authorized administrative official or

commission authorized by the governing authority, the deciding administrative official

or commission must state in writing the reasons for denial and send the notice to the

applicant at the applicant's last known address within ten days of the denial.

(4) Upon denial by a duly authorized administrative official or commission, an

applicant may appeal the denial to the governing authority within thirty days after

receipt of the denial. The appeal before the governing authority must be based upon the

record made before the administrative official with the burden of proof on the applicant

to show that there was no substantial evidence to support the administrative official's

decision. The decision of the governing body in denying or approving the application is

final.

[ 2012 c 194 § 7; 1995 c 375 § 10.]

RCW 84.14.080

Fees

The governing authority may establish an application fee. This fee may not exceed an

amount determined to be required to cover the cost to be incurred by the governing

authority and the assessor in administering this chapter. The application fee must be

paid at the time the application for limited exemption is filed. If the application is

approved, the governing authority shall pay the application fee to the county assessor

for deposit in the county current expense fund, after first deducting that portion of

the fee attributable to its own administrative costs in processing the application. If

the application is denied, the governing authority may retain that portion of the

application fee attributable to its own administrative costs and refund the balance to

the applicant.

[ 1995 c 375 § 11.]

RCW 84.14.090\:

Filing requirements for owner upon completion—Determination by city or county—Notice

of intention by city or county not to file—Extension of deadline—Appeal

(1) Upon completion of rehabilitation or new construction for which an application for

a limited tax exemption under this chapter has been approved and after issuance of the

certificate of occupancy, the owner must file with the city or county the following:

(a) A statement of the amount of rehabilitation or construction expenditures made with

respect to each housing unit and the composite expenditures made in the rehabilitation

or construction of the entire property;

(b) A description of the work that has been completed and a statement that the

rehabilitation improvements or new construction on the owner's property qualify the

property for limited exemption under this chapter;

(c) If applicable, a statement that the project meets the affordable housing

requirements as described in RCW 84.14.020; and

(d) A statement that the work has been completed within three years of the issuance of

the conditional certificate of tax exemption.

(2) Within thirty days after receipt of the statements required under subsection (1) of

this section, the authorized representative of the city or county must determine whether

the work completed, and the affordability of the units, is consistent with the

application and the contract approved by the city or county and is qualified for a

limited tax exemption under this chapter. The city or county must also determine which

specific improvements completed meet the requirements and required findings.

(3) If the rehabilitation, conversion, or construction is completed within three years

of the date the application for a limited tax exemption is filed under this chapter, or

within an authorized extension of this time limit, and the authorized representative of

the city or county determines that improvements were constructed consistent with the

application and other applicable requirements, including if applicable, affordable

housing requirements, and the owner's property is qualified for a limited tax exemption

under this chapter, the city or county must file the certificate of tax exemption with

the county assessor within ten days of the expiration of the thirty-day period provided

under subsection (2) of this section.

(4) The authorized representative of the city or county must notify the applicant that

a certificate of tax exemption is not going to be filed if the authorized representative

determines that:

(a) The rehabilitation or new construction was not completed within three years of the

application date, or within any authorized extension of the time limit;

(b) The improvements were not constructed consistent with the application or other

applicable requirements;

(c) If applicable, the affordable housing requirements as described in RCW 84.14.020

were not met; or

(d) The owner's property is otherwise not qualified for limited exemption under this

chapter.

(5) If the authorized representative of the city or county finds that construction or

rehabilitation of multiple-unit housing was not completed within the required time

period due to circumstances beyond the control of the owner and that the owner has been

acting and could reasonably be expected to act in good faith and with due diligence, the

governing authority or the city or county official authorized by the governing authority

may extend the deadline for completion of construction or rehabilitation for a period

not to exceed twenty-four consecutive months.

(6) The governing authority may provide by ordinance for an appeal of a decision by the

deciding officer or authority that an owner is not entitled to a certificate of tax

exemption to the governing authority, a hearing examiner, or other city or county

officer authorized by the governing authority to hear the appeal in accordance with such

reasonable procedures and time periods as provided by ordinance of the governing

authority. The owner may appeal a decision by the deciding officer or authority that is

not subject to local appeal or a decision by the local appeal authority that the owner

is not entitled to a certificate of tax exemption in superior court under RCW 34.05.510

through 34.05.598, if the appeal is filed within thirty days of notification by the city

or county to the owner of the decision being challenged.

[ 2012 c 194 § 8; 2007 c 430 § 9; 1995 c 375 § 12.]

RCW 84.14.100

Report—Filing

(1) Thirty days after the anniversary of the date of the certificate of tax exemption

and each year for the tax exemption period, the owner of the rehabilitated or newly

constructed property must file with a designated authorized representative of the city

or county an annual report indicating the following:

(a) A statement of occupancy and vacancy of the rehabilitated or newly constructed

property during the twelve months ending with the anniversary date;

(b) A certification by the owner that the property has not changed use and, if

applicable, that the property has been in compliance with the affordable housing

requirements as described in RCW 84.14.020 since the date of the certificate approved by

the city or county;

(c) A description of changes or improvements constructed after issuance of the

certificate of tax exemption; and

(d) Any additional information requested by the city or county in regards to the units

receiving a tax exemption.

(2) All cities or counties, which issue certificates of tax exemption for multiunit

housing that conform to the requirements of this chapter, must report annually by

December 31st of each year, beginning in 2007, to the department of commerce. The report

must include the following information:

(a) The number of tax exemption certificates granted;

(b) The total number and type of units produced or to be produced;

(c) The number and type of units produced or to be produced meeting affordable housing

requirements;

(d) The actual development cost of each unit produced;

(e) The total monthly rent or total sale amount of each unit produced;

(f) The income of each renter household at the time of initial occupancy and the income

of each initial purchaser of owner-occupied units at the time of purchase for each of

the units receiving a tax exemption and a summary of these figures for the city or

county; and

(g) The value of the tax exemption for each project receiving a tax exemption and the

total value of tax exemptions granted.

[ 2012 c 194 § 9; 2007 c 430 § 10; 1995 c 375 § 13.]

RCW 84.14.110

Cancellation of exemption—Notice by owner of change in use—Additional

tax—Penalty—Interest—Lien—Notice of cancellation—Appeal—Correction of tax rolls

(1) If improvements have been exempted under this chapter, the improvements continue to

be exempted for the applicable period under RCW 84.14.020, so long as they are not

converted to another use and continue to satisfy all applicable conditions. If the owner

intends to convert the multifamily development to another use, or if applicable, if the

owner intends to discontinue compliance with the affordable housing requirements as

described in RCW 84.14.020 or any other condition to exemption, the owner must notify

the assessor within sixty days of the change in use or intended discontinuance. If,

after a certificate of tax exemption has been filed with the county assessor, the

authorized representative of the governing authority discovers that a portion of the

property is changed or will be changed to a use that is other than residential or that

housing or amenities no longer meet the requirements, including, if applicable,

affordable housing requirements, as previously approved or agreed upon by contract

between the city or county and the owner and that the multifamily housing, or a portion

of the housing, no longer qualifies for the exemption, the tax exemption must be

canceled and the following must occur:

(a) Additional real property tax must be imposed upon the value of the nonqualifying

improvements in the amount that would normally be imposed, plus a penalty must be

imposed amounting to twenty percent. This additional tax is calculated based upon the

difference between the property tax paid and the property tax that would have been paid

if it had included the value of the nonqualifying improvements dated back to the date

that the improvements were converted to a nonmultifamily use;

(b) The tax must include interest upon the amounts of the additional tax at the same

statutory rate charged on delinquent property taxes from the dates on which the

additional tax could have been paid without penalty if the improvements had been

assessed at a value without regard to this chapter; and

(c) The additional tax owed together with interest and penalty must become a lien on

the land and attach at the time the property or portion of the property is removed from

multifamily use or the amenities no longer meet applicable requirements, and has

priority to and must be fully paid and satisfied before a recognizance, mortgage,

judgment, debt, obligation, or responsibility to or with which the land may become

charged or liable. The lien may be foreclosed upon expiration of the same period after

delinquency and in the same manner provided by law for foreclosure of liens for

delinquent real property taxes. An additional tax unpaid on its due date is delinquent.

From the date of delinquency until paid, interest must be charged at the same rate

applied by law to delinquent ad valorem property taxes.

(2) Upon a determination that a tax exemption is to be canceled for a reason stated in

this section, the governing authority or authorized representative must notify the

record owner of the property as shown by the tax rolls by mail, return receipt

requested, of the determination to cancel the exemption. The owner may appeal the

determination to the governing authority or authorized representative, within thirty

days by filing a notice of appeal with the clerk of the governing authority, which

notice must specify the factual and legal basis on which the determination of

cancellation is alleged to be erroneous. The governing authority or a hearing examiner

or other official authorized by the governing authority may hear the appeal. At the

hearing, all affected parties may be heard and all competent evidence received. After

the hearing, the deciding body or officer must either affirm, modify, or repeal the

decision of cancellation of exemption based on the evidence received. An aggrieved party

may appeal the decision of the deciding body or officer to the superior court under RCW

34.05.510 through 34.05.598.

(3) Upon determination by the governing authority or authorized representative to

terminate an exemption, the county officials having possession of the assessment and tax

rolls must correct the rolls in the manner provided for omitted property under RCW

84.40.080. The county assessor must make such a valuation of the property and

improvements as is necessary to permit the correction of the rolls. The value of the new

housing construction, conversion, and rehabilitation improvements added to the rolls is

considered as new construction for the purposes of chapter 84.55 RCW. The owner may

appeal the valuation to the county board of equalization under chapter 84.48 RCW and

according to the provisions of RCW 84.40.038. If there has been a failure to comply with

this chapter, the property must be listed as an omitted assessment for assessment years

beginning January 1 of the calendar year in which the noncompliance first occurred, but

the listing as an omitted assessment may not be for a period more than three calendar

years preceding the year in which the failure to comply was discovered.

[ 2012 c 194 § 10; 2007 c 430 § 11; 2002 c 146 § 3; 2001 c 185 § 1; 1995 c 375 §

14.]

NOTES:

Application—2001 c 185 §§ 1-12: "Sections 1 through 12 of this act apply for [to] taxes

levied in 2001 for collection in 2002 and thereafter." [ 2001 c 185 § 18.]

❮ Previous

Next ❯