Tax preference performance statement—2014 c 96:

This section is the tax preference performance statement for the tax preference contained in RCW 84.14.040 and

84.14.060. This performance statement is only intended to be used for subsequent

evaluation of the tax preference. It is not intended to create a private right of

action by any party or be used to determine eligibility for preferential tax

treatment.

(1) The legislature categorizes this tax preference as one intended to induce certain

designated behavior by taxpayers, as indicated in RCW 82.32.808(2)(a).

(2) It is the legislature's specific public policy objective to stimulate the

construction of new multifamily housing in urban growth areas located in

unincorporated areas of rural counties where housing options, including affordable

housing options, are severely limited. It is the legislature's intent to provide the

value of new housing construction, conversion, and rehabilitation improvements

qualifying under chapter 84.14 RCW an exemption from ad valorem property taxation for

eight to twelve years, as provided for in RCW 84.14.020, in order to provide

incentives to developers to construct new multifamily housing thereby increasing the

number of affordable housing units for low to moderate-income residents in certain

rural counties.

(3) If a review finds that at least twenty percent of the new housing is developed

and occupied by households making at or below eighty percent of the area median

income, at the time of occupancy, adjusted for family size for the county where the

project is located or where the housing is intended exclusively for owner occupancy,

the household may earn up to one hundred fifteen percent of the area median income, at

the time of sale, adjusted for family size for the county where the project is

located, then the legislature intends to extend the expiration date of the tax

preference.

(4) In order to obtain the data necessary to perform the review in subsection (3) of

this section, the joint legislative audit and review committee may refer to data

provided by counties in which beneficiaries are utilizing the preference, the office

of financial management, the department of commerce, the United States department of

housing and urban development, and other data sources as needed by the joint

legislative audit and review committee." [ 2014 c 96 § 1.]

RCW 84.14.005: Findings.

The legislature finds:

(1) That in many of Washington's urban centers there is insufficient availability of

desirable and convenient residential units, including affordable housing units, to

meet the needs of a growing number of the public who would live in these urban centers

if these desirable, convenient, attractive, affordable, and livable places to live

were available;

(2) That the development of additional and desirable residential units, including

affordable housing units, in these urban centers that will attract and maintain a

significant increase in the number of permanent residents in these areas will help to

alleviate the detrimental conditions and social liability that tend to exist in the

absence of a viable mixed income residential population and will help to achieve the

planning goals mandated by the growth management act under RCW 36.70A.020; and

(3) That planning solutions to solve the problems of urban sprawl often lack

incentive and implementation techniques needed to encourage residential redevelopment

in those urban centers lacking a sufficient variety of residential opportunities, and

it is in the public interest and will benefit, provide, and promote the public health,

safety, and welfare to stimulate new or enhanced residential opportunities, including

affordable housing opportunities, within urban centers through a tax incentive as

provided by this chapter.

[ 2007 c 430 § 1; 1995 c 375 § 1.]

RCW 84.14.007: Purpose.

It is the purpose of this chapter to encourage increased residential opportunities,

including affordable housing opportunities, in cities that are required to plan or

choose to plan under the growth management act within urban centers where the

governing authority of the affected city has found there is insufficient housing

opportunities, including affordable housing opportunities. It is further the purpose

of this chapter to stimulate the construction of new multifamily housing and the

rehabilitation of existing vacant and underutilized buildings for multifamily housing

in urban centers having insufficient housing opportunities that will increase and

improve residential opportunities, including affordable housing opportunities, within

these urban centers. To achieve these purposes, this chapter provides for special

valuations in residentially deficient urban centers for eligible improvements

associated with multiunit housing, which includes affordable housing. It is an

additional purpose of this chapter to allow unincorporated areas of rural counties

that are within urban growth areas to stimulate housing opportunities and for certain

counties to stimulate housing opportunities near college campuses to promote dense,

transit-oriented, walkable college communities.

[ 2014 c 96 § 2; 2012 c 194 § 1; 2007 c 430 § 2; 1995 c 375 § 2.]

RCW 84.14.010: Definitions.

The definitions in this section apply throughout this chapter unless the context

clearly requires otherwise.

(1) "Affordable housing" means residential housing that is rented by a person or

household whose monthly housing costs, including utilities other than telephone, do

not exceed thirty percent of the household's monthly income. For the purposes of

housing intended for owner occupancy, "affordable housing" means residential housing

that is within the means of low or moderate-income households.

(2) "Campus facilities master plan" means the area that is defined by the University

of Washington as necessary for the future growth and development of its campus

facilities for campuses authorized under RCW 28B.45.020.

(3) "City" means either (a) a city or town with a population of at least fifteen

thousand, (b) the largest city or town, if there is no city or town with a population

of at least fifteen thousand, located in a county planning under the growth management

act, or (c) a city or town with a population of at least five thousand located in a

county subject to the provisions of RCW 36.70A.215.

(4) "County" means a county with an unincorporated population of at least three

hundred fifty thousand.

(5) "Governing authority" means the local legislative authority of a city or a county

having jurisdiction over the property for which an exemption may be applied for under

this chapter.

(6) "Growth management act" means chapter 36.70A RCW.

(7) "High cost area" means a county where the third quarter median house price for

the previous year as reported by the Washington center for real estate research at

Washington State University is equal to or greater than one hundred thirty percent of

the statewide median house price published during the same time period.

(8) "Household" means a single person, family, or unrelated persons living

together.

(9) "Low-income household" means a single person, family, or unrelated persons living

together whose adjusted income is at or below eighty percent of the median family

income adjusted for family size, for the county where the project is located, as

reported by the United States department of housing and urban development. For cities

located in high-cost areas, "low-income household" means a household that has an

income at or below one hundred percent of the median family income adjusted for family

size, for the county where the project is located.

(10) "Moderate-income household" means a single person, family, or unrelated persons

living together whose adjusted income is more than eighty percent but is at or below

one hundred fifteen percent of the median family income adjusted for family size, for

the county where the project is located, as reported by the United States department

of housing and urban development. For cities located in high-cost areas,

"moderate-income household" means a household that has an income that is more than one

hundred percent, but at or below one hundred fifty percent, of the median family

income adjusted for family size, for the county where the project is located.

(11) "Multiple-unit housing" means a building having four or more dwelling units not

designed or used as transient accommodations and not including hotels and motels.

Multifamily units may result from new construction or rehabilitated or conversion of

vacant, underutilized, or substandard buildings to multifamily housing.

(12) "Owner" means the property owner of record.

(13) "Permanent residential occupancy" means multiunit housing that provides either

rental or owner occupancy on a nontransient basis. This includes owner-occupied or

rental accommodation that is leased for a period of at least one month. This excludes

hotels and motels that predominately offer rental accommodation on a daily or weekly

basis.

(14) "Rehabilitation improvements" means modifications to existing structures, that

are vacant for twelve months or longer, that are made to achieve a condition of

substantial compliance with existing building codes or modification to existing

occupied structures which increase the number of multifamily housing units.

(15) "Residential targeted area" means an area within an urban center or urban growth

area that has been designated by the governing authority as a residential targeted

area in accordance with this chapter. With respect to designations after July 1, 2007,

"residential targeted area" may not include a campus facilities master plan.

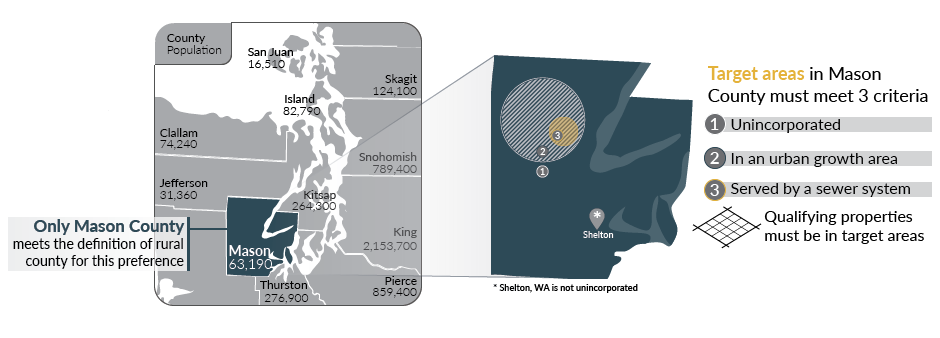

(16) "Rural county" means a county with a population between fifty thousand and

seventy-one thousand and bordering Puget Sound.

(17) "Substantial compliance" means compliance with local building or housing code

requirements that are typically required for rehabilitation as opposed to new

construction.

(18) "Urban center" means a compact identifiable district where urban residents may

obtain a variety of products and services. An urban center must contain:

(a) Several existing or previous, or both, business establishments that may include

but are not limited to shops, offices, banks, restaurants, governmental agencies;

(b) Adequate public facilities including streets, sidewalks, lighting, transit,

domestic water, and sanitary sewer systems; and

(c) A mixture of uses and activities that may include housing, recreation, and

cultural activities in association with either commercial or office, or both, use.

[ 2017 c 52 § 16; 2014 c 96 § 3. Prior: 2012 c 194 § 2; prior: 2007 c 430 § 3; 2007 c

185 § 1; 2002 c 146 § 1; 2000 c 242 § 1; 1997 c 429 § 40; 1995 c 375 § 3.]

NOTES:

Effective date—2007 c 185: "This act is necessary for the immediate preservation of

the public peace, health, or safety, or support of the state government and its

existing public institutions, and takes effect July 1, 2007." [ 2007 c 185 § 3.]

Severability—1997 c 429: See note following RCW 36.70A.3201.

RCW 84.14.020: Exemption—Duration—Valuation.

(1)(a) The value of new housing construction, conversion, and rehabilitation

improvements qualifying under this chapter is exempt from ad valorem property

taxation, as follows:

(i) For properties for which applications for certificates of tax exemption

eligibility are submitted under chapter 84.14 RCW before July 22, 2007, the value is

exempt for ten successive years beginning January 1 of the year immediately following

the calendar year of issuance of the certificate; and

(ii) For properties for which applications for certificates of tax exemption

eligibility are submitted under chapter 84.14 RCW on or after July 22, 2007, the value

is exempt:

(A) For eight successive years beginning January 1st of the year immediately

following the calendar year of issuance of the certificate; or

(B) For twelve successive years beginning January 1st of the year immediately

following the calendar year of issuance of the certificate, if the property otherwise

qualifies for the exemption under chapter 84.14 RCW and meets the conditions in this

subsection (1)(a)(ii)(B). For the property to qualify for the twelve-year exemption

under this subsection, the applicant must commit to renting or selling at least twenty

percent of the multifamily housing units as affordable housing units to low and

moderate-income households, and the property must satisfy that commitment and any

additional affordability and income eligibility conditions adopted by the local

government under this chapter. In the case of projects intended exclusively for owner

occupancy, the minimum requirement of this subsection (1)(a)(ii)(B) may be satisfied

solely through housing affordable to moderate-income households.

(b) The exemptions provided in (a)(i) and (ii) of this subsection do not include the

value of land or nonhousing-related improvements not qualifying under this

chapter.

(2) When a local government adopts guidelines pursuant to RCW 84.14.030(2) and

includes conditions that must be satisfied with respect to individual dwelling units,

rather than with respect to the multiple-unit housing as a whole or some minimum

portion thereof, the exemption may, at the local government's discretion, be limited

to the value of the qualifying improvements allocable to those dwelling units that

meet the local guidelines.

(3) In the case of rehabilitation of existing buildings, the exemption does not

include the value of improvements constructed prior to the submission of the

application required under this chapter. The incentive provided by this chapter is in

addition to any other incentives, tax credits, grants, or other incentives provided by

law.

(4) This chapter does not apply to increases in assessed valuation made by the

assessor on nonqualifying portions of building and value of land nor to increases made

by lawful order of a county board of equalization, the department of revenue, or a

county, to a class of property throughout the county or specific area of the county to

achieve the uniformity of assessment or appraisal required by law.

(5) At the conclusion of the exemption period, the new or rehabilitated housing cost

shall be considered as new construction for the purposes of chapter 84.55 RCW.

[ 2007 c 430 § 4; 2002 c 146 § 2; 1999 c 132 § 1; 1995 c 375 § 5.]

RCW 84.14.030: Application—Requirements.

An owner of property making application under this chapter must meet the following

requirements:

(1) The new or rehabilitated multiple-unit housing must be located in a residential

targeted area as designated by the city or county;

(2) The multiple-unit housing must meet guidelines as adopted by the governing

authority that may include height, density, public benefit features, number and size

of proposed development, parking, income limits for occupancy, limits on rents or sale

prices, and other adopted requirements indicated necessary by the city or county. The

required amenities should be relative to the size of the project and tax benefit to be

obtained;

(3) The new, converted, or rehabilitated multiple-unit housing must provide for a

minimum of fifty percent of the space for permanent residential occupancy. In the case

of existing occupied multifamily development, the multifamily housing must also

provide for a minimum of four additional multifamily units. Existing multifamily

vacant housing that has been vacant for twelve months or more does not have to provide

additional multifamily units;

(4) New construction multifamily housing and rehabilitation improvements must be

completed within three years from the date of approval of the application;

(5) Property proposed to be rehabilitated must fail to comply with one or more

standards of the applicable state or local building or housing codes on or after July

23, 1995. If the property proposed to be rehabilitated is not vacant, an applicant

must provide each existing tenant housing of comparable size, quality, and price and a

reasonable opportunity to relocate; and

(6) The applicant must enter into a contract with the city or county approved by the

governing authority, or an administrative official or commission authorized by the

governing authority, under which the applicant has agreed to the implementation of the

development on terms and conditions satisfactory to the governing authority.

[ 2012 c 194 § 3; 2007 c 430 § 5; 2005 c 80 § 1; 1997 c 429 § 42; 1995 c 375 §

6.]

NOTES:

Severability—1997 c 429: See note following RCW 36.70A.3201.

84.14.040: Designation of residential targeted area—Criteria—Local

designation—Hearing—Standards, guidelines.

(1) The following criteria must be met before an area may be designated as a

residential targeted area:

(a) The area must be within an urban center, as determined by the governing

authority;

(b) The area must lack, as determined by the governing authority, sufficient

available, desirable, and convenient residential housing, including affordable

housing, to meet the needs of the public who would be likely to live in the urban

center, if the affordable, desirable, attractive, and livable places to live were

available;

(c) The providing of additional housing opportunity, including affordable housing, in

the area, as determined by the governing authority, will assist in achieving one or

more of the stated purposes of this chapter; and

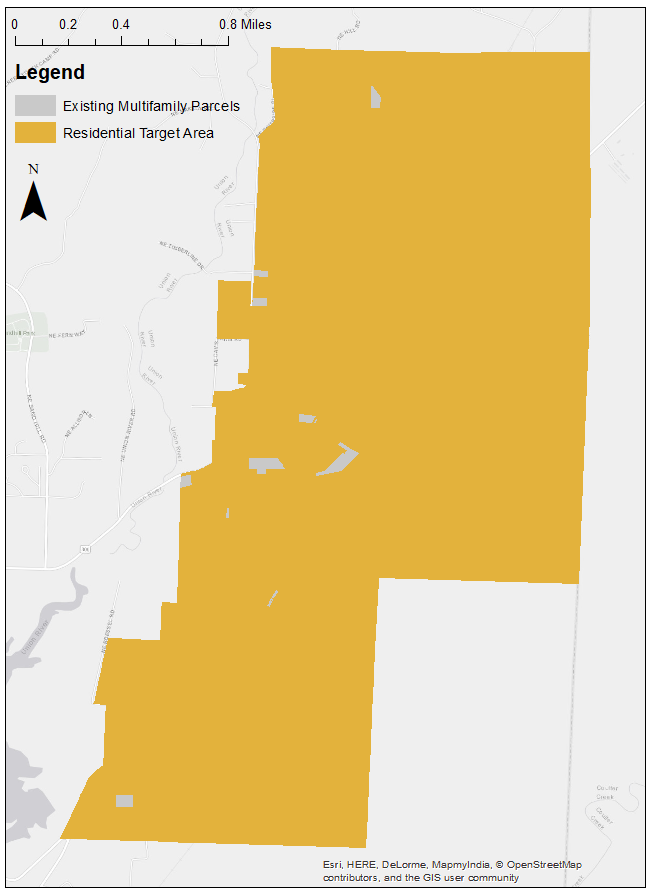

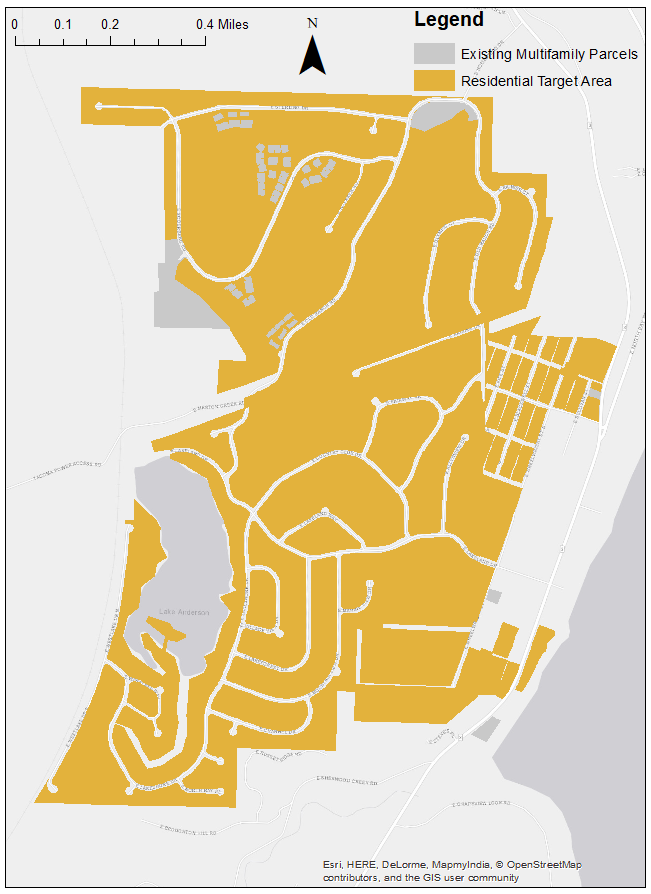

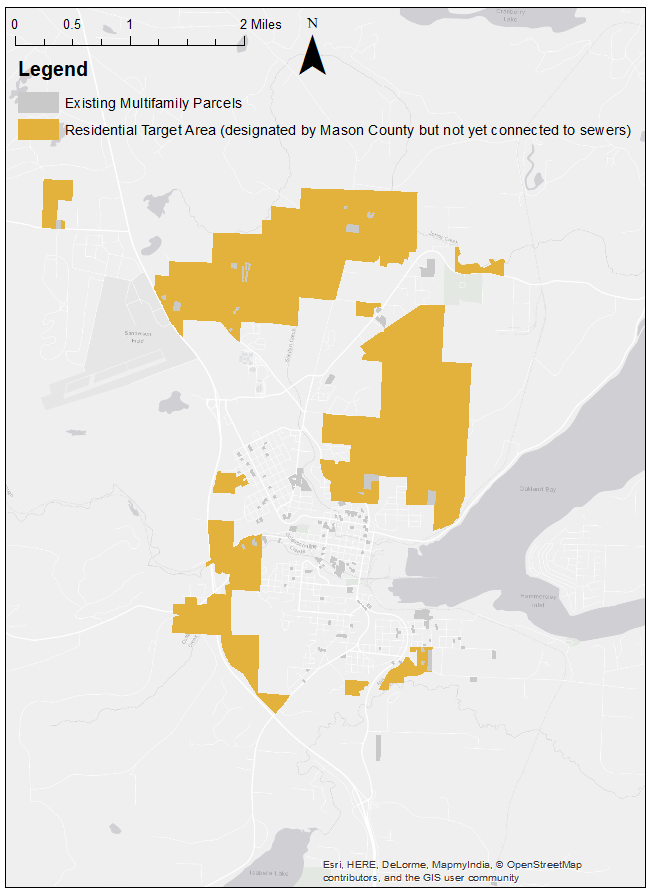

(d) If the residential targeted area is designated by a county, the area must be

located in an unincorporated area of the county that is within an urban growth area

under RCW 36.70A.110 and the area must be: (i) In a rural county, served by a sewer

system and designated by a county prior to January 1, 2013; or (ii) in a county that

includes a campus of an institution of higher education, as defined in RCW 28B.92.030,

where at least one thousand two hundred students live on campus during the academic

year.

(2) For the purpose of designating a residential targeted area or areas, the

governing authority may adopt a resolution of intention to so designate an area as

generally described in the resolution. The resolution must state the time and place of

a hearing to be held by the governing authority to consider the designation of the

area and may include such other information pertaining to the designation of the area

as the governing authority determines to be appropriate to apprise the public of the

action intended.

(3) The governing authority must give notice of a hearing held under this chapter by

publication of the notice once each week for two consecutive weeks, not less than

seven days, nor more than thirty days before the date of the hearing in a paper having

a general circulation in the city or county where the proposed residential targeted

area is located. The notice must state the time, date, place, and purpose of the

hearing and generally identify the area proposed to be designated as a residential

targeted area.

(4) Following the hearing, or a continuance of the hearing, the governing authority

may designate all or a portion of the area described in the resolution of intent as a

residential targeted area if it finds, in its sole discretion, that the criteria in

subsections (1) through (3) of this section have been met.

(5) After designation of a residential targeted area, the governing authority must

adopt and implement standards and guidelines to be utilized in considering

applications and making the determinations required under RCW 84.14.060. The standards

and guidelines must establish basic requirements for both new construction and

rehabilitation, which must include:

(a) Application process and procedures;

(b) Requirements that address demolition of existing structures and site utilization;

and

(c) Building requirements that may include elements addressing parking, height,

density, environmental impact, and compatibility with the existing surrounding

property and such other amenities as will attract and keep permanent residents and

that will properly enhance the livability of the residential targeted area in which

they are to be located.

(6) The governing authority may adopt and implement, either as conditions to

eight-year exemptions or as conditions to an extended exemption period under RCW

84.14.020(1)(a)(ii)(B), or both, more stringent income eligibility, rent, or sale

price limits, including limits that apply to a higher percentage of units, than the

minimum conditions for an extended exemption period under RCW 84.14.020(1)(a)(ii)(B).

For any multiunit housing located in an unincorporated area of a county, a property

owner seeking tax incentives under this chapter must commit to renting or selling at

least twenty percent of the multifamily housing units as affordable housing units to

low and moderate-income households. In the case of multiunit housing intended

exclusively for owner occupancy, the minimum requirement of this subsection (6) may be

satisfied solely through housing affordable to moderate-income households.

[ 2014 c 96 § 4; 2012 c 194 § 4; 2007 c 430 § 6; 1995 c 375 § 7.]

NOTES: Tax preference performance statement -- 2014 c 96

RCW 84.14.050: Application—Procedures.

An owner of property seeking tax incentives under this chapter must complete the

following procedures:

(1) In the case of rehabilitation or where demolition or new construction is

required, the owner must secure from the governing authority or duly authorized

representative, before commencement of rehabilitation improvements or new

construction, verification of property noncompliance with applicable building and

housing codes;

(2) In the case of new and rehabilitated multifamily housing, the owner must apply to

the city or county on forms adopted by the governing authority. The application must

contain the following:

(a) Information setting forth the grounds supporting the requested exemption

including information indicated on the application form or in the guidelines;

(b) A description of the project and site plan, including the floor plan of units and

other information requested;

(c) A statement that the applicant is aware of the potential tax liability involved

when the property ceases to be eligible for the incentive provided under this

chapter;

(3) The applicant must verify the application by oath or affirmation; and

(4) The application must be accompanied by the application fee, if any, required

under RCW 84.14.080. The governing authority may permit the applicant to revise an

application before final action by the governing authority.

[ 2012 c 194 § 5; 2007 c 430 § 7; 1999 c 132 § 2; 1997 c 429 § 43; 1995 c 375 §

8.]

NOTES:

Severability—1997 c 429: See note following RCW 36.70A.3201.

RCW 84.14.060: Approval—Required findings.

(1) The duly authorized administrative official or committee of the city or county

may approve the application if it finds that:

(a) A minimum of four new units are being constructed or in the case of occupied

rehabilitation or conversion a minimum of four additional multifamily units are being

developed;

(b) If applicable, the proposed multiunit housing project meets the affordable

housing requirements as described in RCW 84.14.020;

(c) The proposed project is or will be, at the time of completion, in conformance

with all local plans and regulations that apply at the time the application is

approved;

(d) The owner has complied with all standards and guidelines adopted by the city or

county under this chapter; and

(e) The site is located in a residential targeted area of an urban center or urban

growth area that has been designated by the governing authority in accordance with

procedures and guidelines indicated in RCW 84.14.040.

(2) An application may not be approved after July 1, 2007, if any part of the

proposed project site is within a campus facilities master plan, except as provided in

RCW 84.14.040(1)(d).

(3) An application may not be approved for a residential targeted area in a rural

county on or after January 1, 2020.

[ 2014 c 96 § 5; 2012 c 194 § 6. Prior: 2007 c 430 § 8; 2007 c 185 § 2; 1995 c 375 §

9.]

NOTES:

Tax preference performance statement—2014 c 96: See note following RCW 84.14.040.

Effective date—2007 c 185: See note following RCW 84.14.010.

RCW 84.14.070: Processing—Approval—Denial—Appeal.

(1) The governing authority or an administrative official or commission authorized by

the governing authority must approve or deny an application filed under this chapter

within ninety days after receipt of the application.

(2) If the application is approved, the city or county must issue the owner of the

property a conditional certificate of acceptance of tax exemption. The certificate

must contain a statement by a duly authorized administrative official of the governing

authority that the property has complied with the required findings indicated in RCW

84.14.060.

(3) If the application is denied by the authorized administrative official or

commission authorized by the governing authority, the deciding administrative official

or commission must state in writing the reasons for denial and send the notice to the

applicant at the applicant's last known address within ten days of the denial.

(4) Upon denial by a duly authorized administrative official or commission, an

applicant may appeal the denial to the governing authority within thirty days after

receipt of the denial. The appeal before the governing authority must be based upon

the record made before the administrative official with the burden of proof on the

applicant to show that there was no substantial evidence to support the administrative

official's decision. The decision of the governing body in denying or approving the

application is final.

[ 2012 c 194 § 7; 1995 c 375 § 10.]

RCW 84.14.080: Fees.

The governing authority may establish an application fee. This fee may not exceed an

amount determined to be required to cover the cost to be incurred by the governing

authority and the assessor in administering this chapter. The application fee must be

paid at the time the application for limited exemption is filed. If the application is

approved, the governing authority shall pay the application fee to the county assessor

for deposit in the county current expense fund, after first deducting that portion of

the fee attributable to its own administrative costs in processing the application. If

the application is denied, the governing authority may retain that portion of the

application fee attributable to its own administrative costs and refund the balance to

the applicant.

[ 1995 c 375 § 11.]

RCW 84.14.090: Filing requirements for owner upon completion—Determination by city

or county—Notice of intention by city or county not to file—Extension of

deadline—Appeal.

(1) Upon completion of rehabilitation or new construction for which an application

for a limited tax exemption under this chapter has been approved and after issuance of

the certificate of occupancy, the owner must file with the city or county the

following:

(a) A statement of the amount of rehabilitation or construction expenditures made

with respect to each housing unit and the composite expenditures made in the

rehabilitation or construction of the entire property;

(b) A description of the work that has been completed and a statement that the

rehabilitation improvements or new construction on the owner's property qualify the

property for limited exemption under this chapter;

(c) If applicable, a statement that the project meets the affordable housing

requirements as described in RCW 84.14.020; and

(d) A statement that the work has been completed within three years of the issuance

of the conditional certificate of tax exemption.

(2) Within thirty days after receipt of the statements required under subsection (1)

of this section, the authorized representative of the city or county must determine

whether the work completed, and the affordability of the units, is consistent with the

application and the contract approved by the city or county and is qualified for a

limited tax exemption under this chapter. The city or county must also determine which

specific improvements completed meet the requirements and required findings.

(3) If the rehabilitation, conversion, or construction is completed within three

years of the date the application for a limited tax exemption is filed under this

chapter, or within an authorized extension of this time limit, and the authorized

representative of the city or county determines that improvements were constructed

consistent with the application and other applicable requirements, including if

applicable, affordable housing requirements, and the owner's property is qualified for

a limited tax exemption under this chapter, the city or county must file the

certificate of tax exemption with the county assessor within ten days of the

expiration of the thirty-day period provided under subsection (2) of this section.

(4) The authorized representative of the city or county must notify the applicant

that a certificate of tax exemption is not going to be filed if the authorized

representative determines that:

(a) The rehabilitation or new construction was not completed within three years of

the application date, or within any authorized extension of the time limit;

(b) The improvements were not constructed consistent with the application or other

applicable requirements;

(c) If applicable, the affordable housing requirements as described in RCW 84.14.020

were not met; or

(d) The owner's property is otherwise not qualified for limited exemption under this

chapter.

(5) If the authorized representative of the city or county finds that construction or

rehabilitation of multiple-unit housing was not completed within the required time

period due to circumstances beyond the control of the owner and that the owner has

been acting and could reasonably be expected to act in good faith and with due

diligence, the governing authority or the city or county official authorized by the

governing authority may extend the deadline for completion of construction or

rehabilitation for a period not to exceed twenty-four consecutive months.

(6) The governing authority may provide by ordinance for an appeal of a decision by

the deciding officer or authority that an owner is not entitled to a certificate of

tax exemption to the governing authority, a hearing examiner, or other city or county

officer authorized by the governing authority to hear the appeal in accordance with

such reasonable procedures and time periods as provided by ordinance of the governing

authority. The owner may appeal a decision by the deciding officer or authority that

is not subject to local appeal or a decision by the local appeal authority that the

owner is not entitled to a certificate of tax exemption in superior court under RCW

34.05.510 through 34.05.598, if the appeal is filed within thirty days of notification

by the city or county to the owner of the decision being challenged.

[ 2012 c 194 § 8; 2007 c 430 § 9; 1995 c 375 § 12.]

RCW 84.14.100: Report—Filing.

(1) Thirty days after the anniversary of the date of the certificate of tax exemption

and each year for the tax exemption period, the owner of the rehabilitated or newly

constructed property must file with a designated authorized representative of the city

or county an annual report indicating the following:

(a) A statement of occupancy and vacancy of the rehabilitated or newly constructed

property during the twelve months ending with the anniversary date;

(b) A certification by the owner that the property has not changed use and, if

applicable, that the property has been in compliance with the affordable housing

requirements as described in RCW 84.14.020 since the date of the certificate approved

by the city or county;

(c) A description of changes or improvements constructed after issuance of the

certificate of tax exemption; and

(d) Any additional information requested by the city or county in regards to the

units receiving a tax exemption.

(2) All cities or counties, which issue certificates of tax exemption for multiunit

housing that conform to the requirements of this chapter, must report annually by

December 31st of each year, beginning in 2007, to the department of commerce. The

report must include the following information:

(a) The number of tax exemption certificates granted;

(b) The total number and type of units produced or to be produced;

(c) The number and type of units produced or to be produced meeting affordable

housing requirements;

(d) The actual development cost of each unit produced;

(e) The total monthly rent or total sale amount of each unit produced;

(f) The income of each renter household at the time of initial occupancy and the

income of each initial purchaser of owner-occupied units at the time of purchase for

each of the units receiving a tax exemption and a summary of these figures for the

city or county; and

(g) The value of the tax exemption for each project receiving a tax exemption and the

total value of tax exemptions granted.

[ 2012 c 194 § 9; 2007 c 430 § 10; 1995 c 375 § 13.]

RCW 84.14.110: Cancellation of exemption—Notice by owner of change in use—Additional

tax—Penalty—Interest—Lien—Notice of cancellation—Appeal—Correction of tax rolls.

(1) If improvements have been exempted under this chapter, the improvements continue

to be exempted for the applicable period under RCW 84.14.020, so long as they are not

converted to another use and continue to satisfy all applicable conditions. If the

owner intends to convert the multifamily development to another use, or if applicable,

if the owner intends to discontinue compliance with the affordable housing

requirements as described in RCW 84.14.020 or any other condition to exemption, the

owner must notify the assessor within sixty days of the change in use or intended

discontinuance. If, after a certificate of tax exemption has been filed with the

county assessor, the authorized representative of the governing authority discovers

that a portion of the property is changed or will be changed to a use that is other

than residential or that housing or amenities no longer meet the requirements,

including, if applicable, affordable housing requirements, as previously approved or

agreed upon by contract between the city or county and the owner and that the

multifamily housing, or a portion of the housing, no longer qualifies for the

exemption, the tax exemption must be canceled and the following must occur:

(a) Additional real property tax must be imposed upon the value of the nonqualifying

improvements in the amount that would normally be imposed, plus a penalty must be

imposed amounting to twenty percent. This additional tax is calculated based upon the

difference between the property tax paid and the property tax that would have been

paid if it had included the value of the nonqualifying improvements dated back to the

date that the improvements were converted to a nonmultifamily use;

(b) The tax must include interest upon the amounts of the additional tax at the same

statutory rate charged on delinquent property taxes from the dates on which the

additional tax could have been paid without penalty if the improvements had been

assessed at a value without regard to this chapter; and

(c) The additional tax owed together with interest and penalty must become a lien on

the land and attach at the time the property or portion of the property is removed

from multifamily use or the amenities no longer meet applicable requirements, and has

priority to and must be fully paid and satisfied before a recognizance, mortgage,

judgment, debt, obligation, or responsibility to or with which the land may become

charged or liable. The lien may be foreclosed upon expiration of the same period after

delinquency and in the same manner provided by law for foreclosure of liens for

delinquent real property taxes. An additional tax unpaid on its due date is

delinquent. From the date of delinquency until paid, interest must be charged at the

same rate applied by law to delinquent ad valorem property taxes.

(2) Upon a determination that a tax exemption is to be canceled for a reason stated

in this section, the governing authority or authorized representative must notify the

record owner of the property as shown by the tax rolls by mail, return receipt

requested, of the determination to cancel the exemption. The owner may appeal the

determination to the governing authority or authorized representative, within thirty

days by filing a notice of appeal with the clerk of the governing authority, which

notice must specify the factual and legal basis on which the determination of

cancellation is alleged to be erroneous. The governing authority or a hearing examiner

or other official authorized by the governing authority may hear the appeal. At the

hearing, all affected parties may be heard and all competent evidence received. After

the hearing, the deciding body or officer must either affirm, modify, or repeal the

decision of cancellation of exemption based on the evidence received. An aggrieved

party may appeal the decision of the deciding body or officer to the superior court

under RCW 34.05.510 through 34.05.598.

(3) Upon determination by the governing authority or authorized representative to

terminate an exemption, the county officials having possession of the assessment and

tax rolls must correct the rolls in the manner provided for omitted property under RCW

84.40.080. The county assessor must make such a valuation of the property and

improvements as is necessary to permit the correction of the rolls. The value of the

new housing construction, conversion, and rehabilitation improvements added to the

rolls is considered as new construction for the purposes of chapter 84.55 RCW. The

owner may appeal the valuation to the county board of equalization under chapter 84.48

RCW and according to the provisions of RCW 84.40.038. If there has been a failure to

comply with this chapter, the property must be listed as an omitted assessment for

assessment years beginning January 1 of the calendar year in which the noncompliance

first occurred, but the listing as an omitted assessment may not be for a period more

than three calendar years preceding the year in which the failure to comply was

discovered.

[ 2012 c 194 § 10; 2007 c 430 § 11; 2002 c 146 § 3; 2001 c 185 § 1; 1995 c 375 §

14.]

NOTES:

Application—2001 c 185 §§ 1-12: "Sections 1 through 12 of this act apply for [to]

taxes levied in 2001 for collection in 2002 and thereafter." [ 2001 c 185 § 18.]

❮ Previous

Next ❯