2020 Reviews: Four of eight preferences identified for further legislative review

In 2020, JLARC staff conducted eight tax preference reviews as part of its annual reporting cycle. These include preferences for agriculture, economic development, and hiring unemployed veterans. Of the eight preferences JLARC staff reviewed:

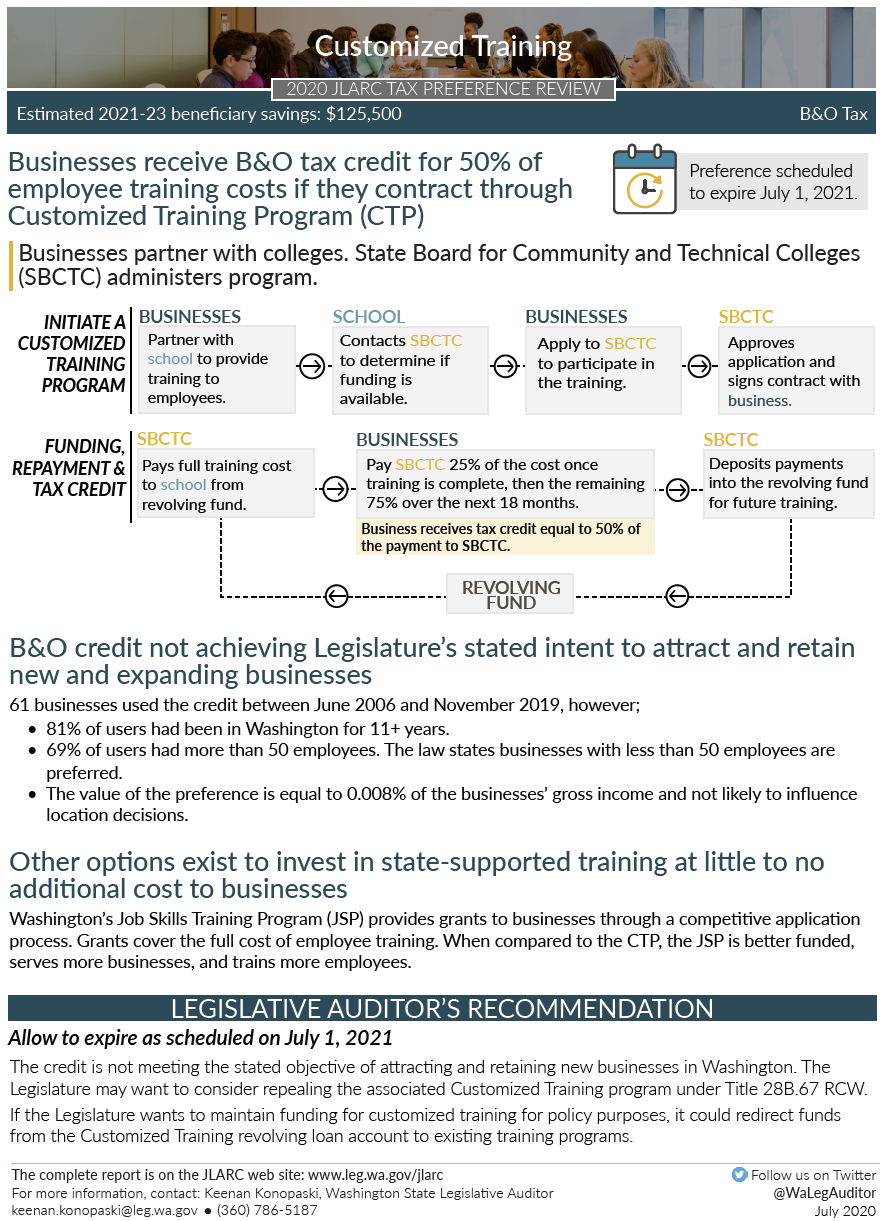

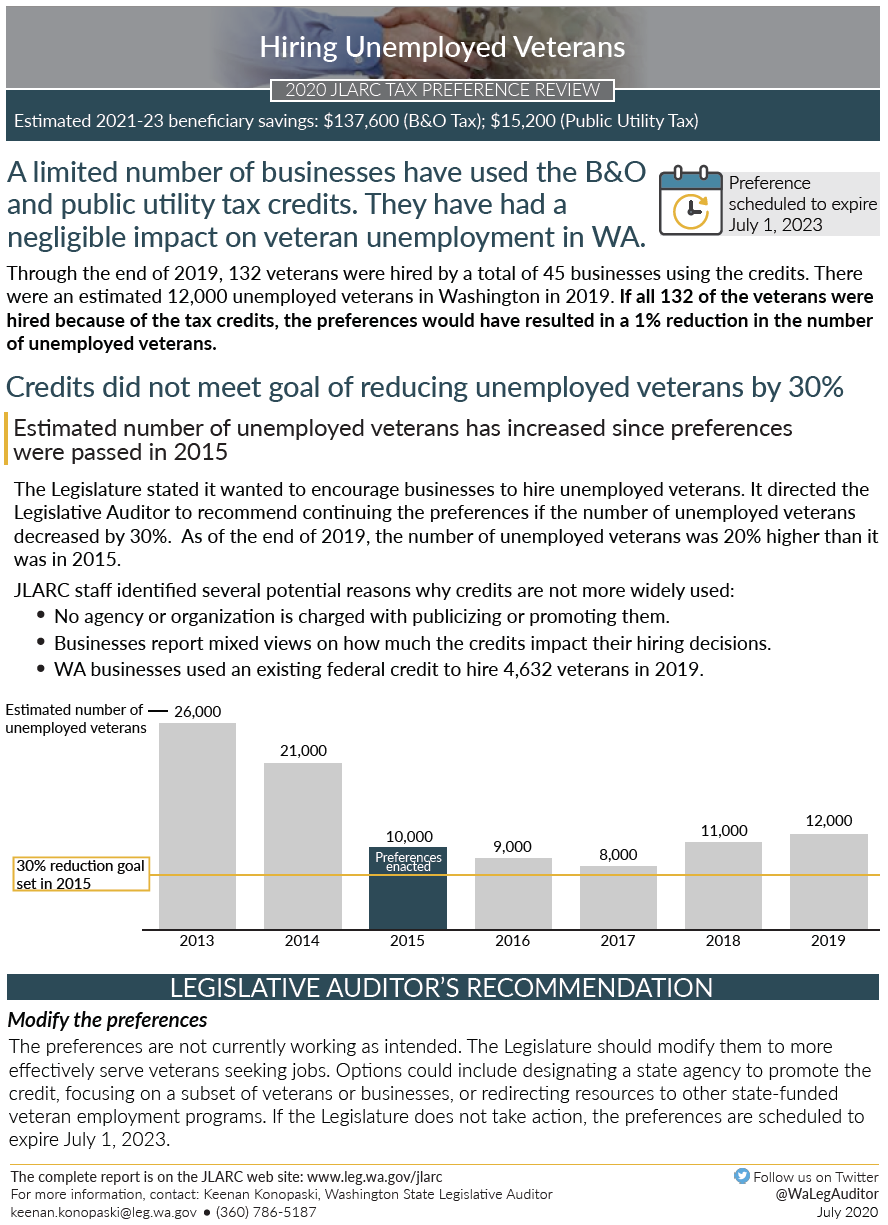

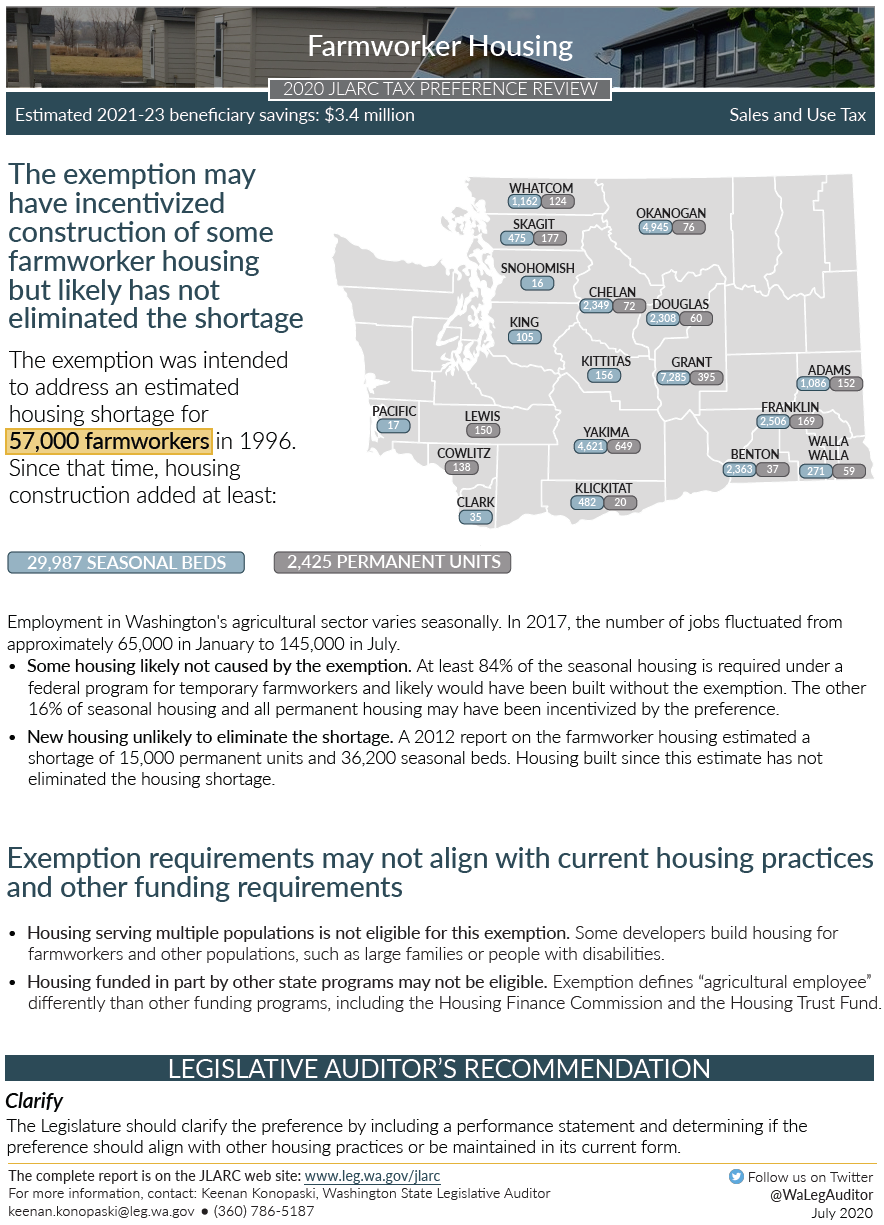

Two are not meeting their stated objectives

|

Legislative Auditor's Recommendation Commissioners' Recommendation |

Summary

|

Video Summary |

|

Legislative Auditor's Recommendation Commissioners' Recommendation |

Summary

|

Video Summary |

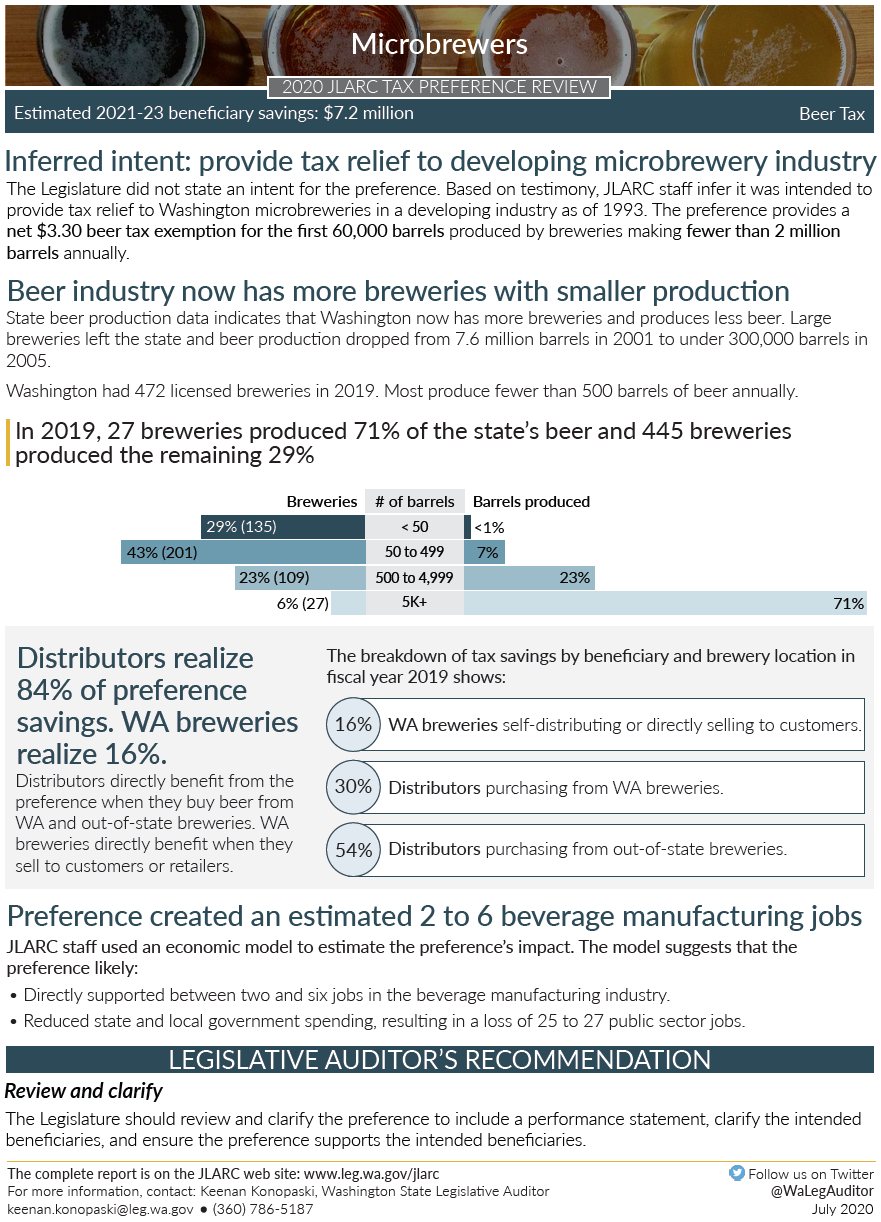

Two are for industries that have changed since the preferences were enacted

|

Legislative Auditor's Recommendation Commissioners' Recommendation |

Summary

|

Video Summary |

|

Legislative Auditor's Recommendation Commissioners' Recommendation |

Summary

|

Video Summary |

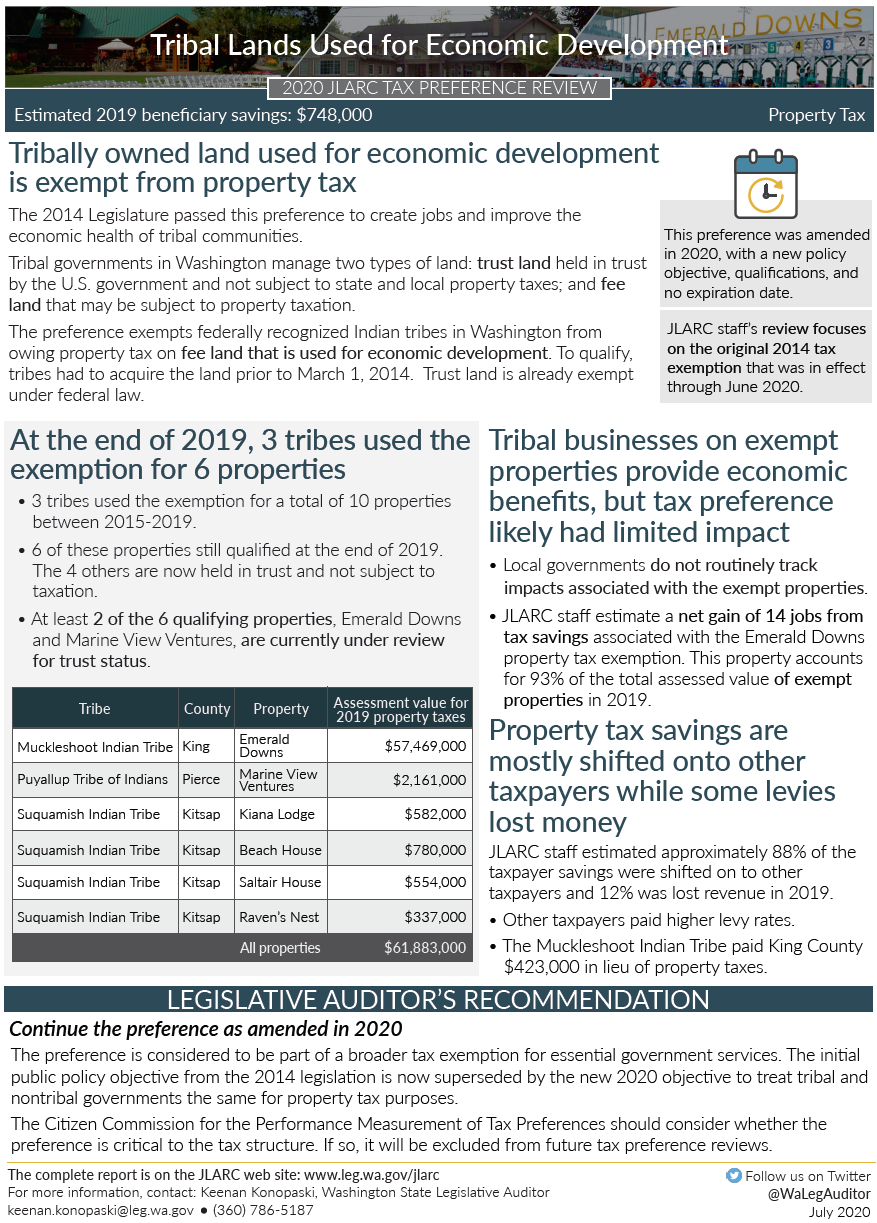

One likely had limited impact in its initial form, but it was changed to a different purpose last legislative session and made permanent

|

Legislative Auditor's Recommendation Commissioners' Recommendation |

Summary

|

Video Summary |

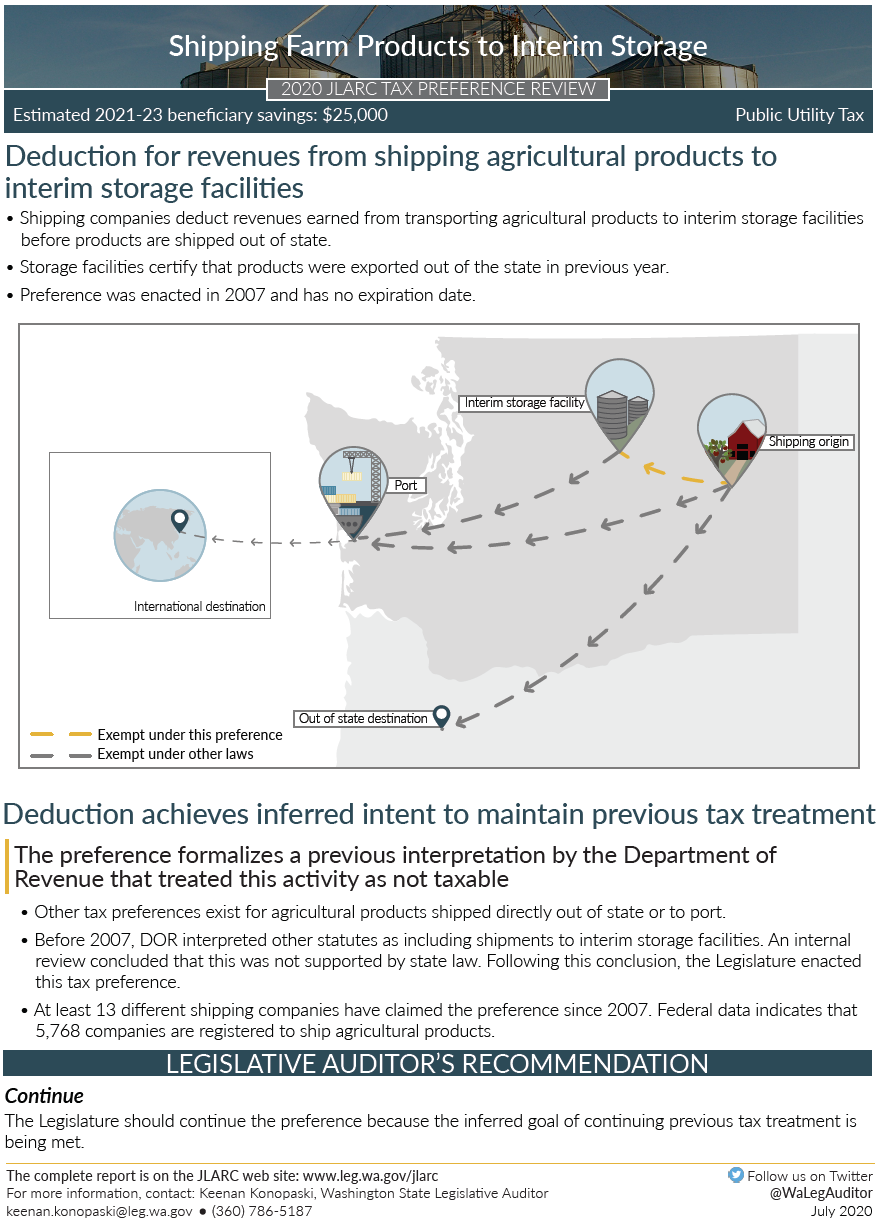

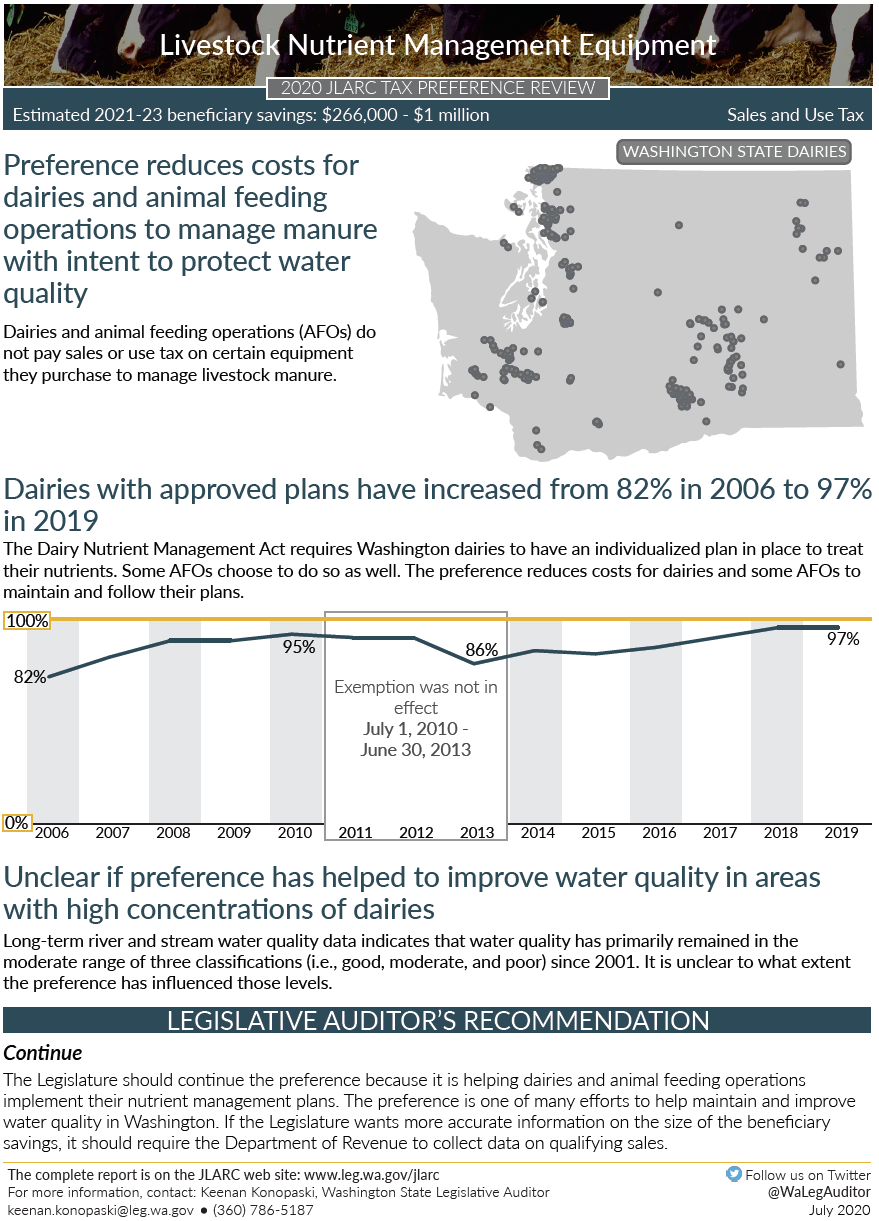

Two are meeting the Legislature's stated intent

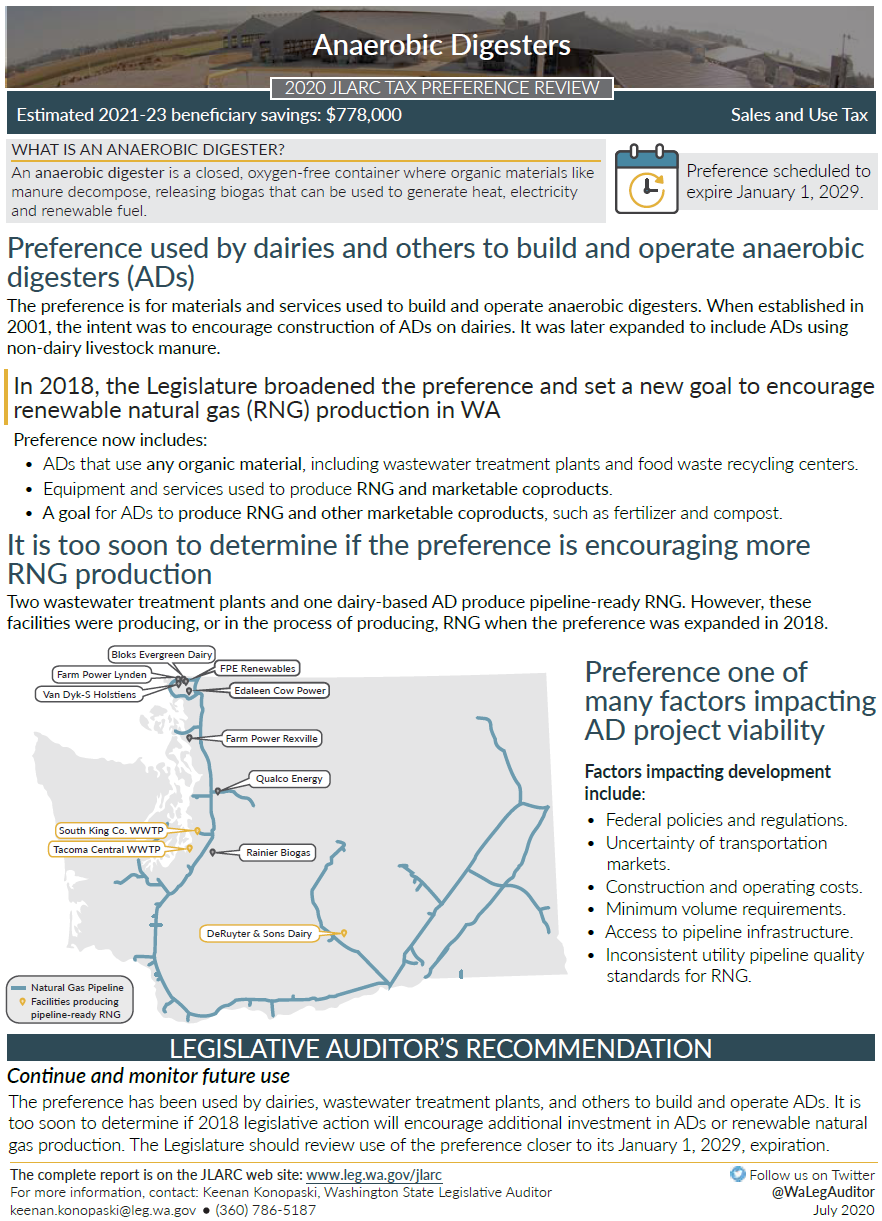

One was amended with a new goal. It is too soon to know its impact.

The Citizen Commission for Performance Measurement of Tax Preferences also considers preferences based on information provided by the Department of Revenue. View the 2020 expedited preference report here (PDF).

Committee Action to Distribute Report

On December 7, 2020 this report was approved for distribution by the Joint Legislative Audit and Review Committee.

Action to distribute this report does not imply the Committee agrees or disagrees with the Legislative Auditor recommendations.