A Cost-of-Living Adjustment (COLA) is an increase to the pension benefit of a retiree or beneficiary (annuitant) that is meant to assist with rising inflation costs. Most pension plans in Washington State administered by the Department of Retirement Systems (DRS) provide a COLA. However, the timing, amount, and eligibility for these COLAs varies from plan to plan. This webpage is intended to provide readers with some education and context on COLAs, as it relates to the actuarial work the Office of the State Actuary (OSA) provides. Such topics include the funding of plan COLAs, summaries of participants receiving COLAs, and recent policy analysis OSA has conducted on this topic. This webpage is divided into the following sections, which readers can click further below to expand/collapse… - COLAs Available to DRS Members

- The Latest COLA Numbers

- COLA Policy History

- The Funding of COLAs

- Recent OSA Policy Analysis

There are a few different COLAs available to DRS members, which fall into two main categories – the Base COLAs and the Plans 1 COLAs (for Plan 1 members of PERS and TRS). These different COLAs are further explained in the “COLAs Available to DRS Members” expandable section below. Please note that this webpage is not meant to cover the administration or calculation of individual member’s COLAs. These tasks are the responsibility of the plan administrator, DRS, and any questions regarding these topics should be directed to them. Please refer to the

DRS COLA FAQ webpage for additional information, including how to contact them. Unless otherwise noted, the figures below are as of the

June 30, 2022, Actuarial Valuation Report (AVR). We intend to update these figures every other year.

|

COLAs Available to DRS Members

The Base COLA uses the Consumer Price Index (CPI), which is compiled by the US Bureau of Labor Statistics. Members of the following DRS plans receive a Base COLA:

-

Public Employees’ Retirement System (PERS) Plans 2 and 3.

-

Teachers’ Retirement System (TRS) Plans 2 and 3.

-

School Employees’ Retirement System (SERS) Plans 2 and 3.

-

Public Safety Employees’ Retirement System (PSERS) Plan 2.

-

Law Enforcement Officers’ and Fire Fighters’ Retirement System (LEOFF) Plans 1 and 2.

-

Washington State Patrol Retirement System (WSPRS) Plans 1 and 2.

-

Judicial Retirement System (JRS).

The Base COLA for all these plans uses the Seattle-Tacoma-Bellevue area CPI and is subject to a 3 percent annual maximum (see exceptions for LEOFF 1 in the next paragraph). If the applicable CPI for a particular year exceeds 3 percent, the excess is banked to be used in the future during times when the annual COLA would be less than 3 percent. This COLA is applied on July 1 for members who have been retired for at least one year.

The Base COLA for LEOFF Plan 1 uses the same CPI but is not subject to a 3 percent annual COLA maximum. This COLA is implemented on April 1 for LEOFF 1 members, as applicable.

For a list of historical CPI figures, please see our

Inflation Data webpage. For more information on COLA eligibility and the COLA Banking feature, please see the

DRS COLA FAQ webpage.

Plan 1 members of PERS and TRS may be eligible for the following COLAs, each of which are applied on July 1. For more information on all of these COLAs, including examples of how they are applied, please see the

DRS COLA FAQ webpage.

-

Adjusted Minimum Benefit – Also referred to as the Alternative Minimum, this COLA establishes a set minimum benefit amount for annuitants (see The Latest COLA Numbers section below). This minimum benefit increases each year by 3 percent and is subject to age and service eligibility requirements.

-

Minimum COLA – Also referred to as the Basic Minimum, this COLA provides an additional benefit amount per year of service worked to annuitants who fall below a designated benefit threshold (see The Latest COLA Numbers section). This COLA is not subject to age or service eligibility requirements.

-

Optional COLA – Provides the same COLA benefit received by members of Plans 2 and 3 (see Base COLA section above). Members can elect to receive this COLA at the time of retirement in exchange for an actuarially equivalent reduction in their pension benefit. This COLA is not subject to age or service eligibility requirements.

The Plans 1 COLAs are unique and were not part of the original plan design. Designing a pension plan includes many considerations such as retirement age, benefit amount, and whether to include COLAs. All of these considerations are made with the ultimate goal of balancing benefit adequacy and plan affordability.

PERS Plan 1 and TRS Plan 1 are among the oldest of the DRS plans and, at the time of their inception, inflation protection may not have been a concern or a need they were trying to address through the pension plan. The addition of the Plans 1 COLAs came later through legislation granting these benefit improvements. In contrast, most of the other plans were established decades later and included COLAs in their original plan design.

In the following sections we outline approximate headcounts and amounts of COLA increases. Actual eligible headcounts and COLA increase amounts are determined by DRS.

As of the

2022 AVR, there are approximately 146,000 annuitants receiving a Base COLA. On April 1, 2023, eligible members of LEOFF Plan 1 received an 8.81 percent COLA. On July 1, 2023, eligible members of all other plans received a COLA that was capped at 3 percent. The actual CPI increase was 8.81 percent, so the excess is banked to be used in the future during times when the annual CPI change is less than 3 percent.

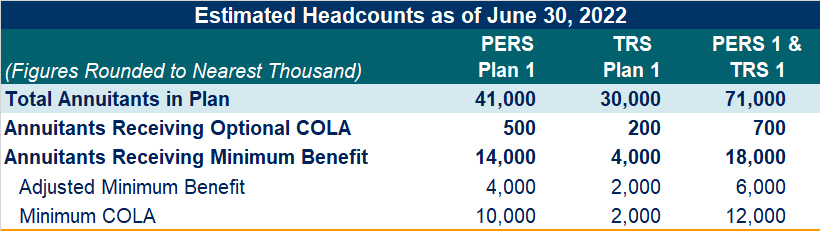

As of the 2022 AVR, we estimate that approximately 18,700 annuitants will be in receipt of a Plan 1 Minimum Benefit or Optional COLA on June 30, 2022. We expect additional PERS 1 and TRS 1 members to qualify for a minimum benefit in the future. The following table outlines PERS 1 and TRS 1 members receiving a COLA as of June 30, 2022.

On July 1, 2023, the following changes went into effect:

-

The annual Adjusted Minimum Benefit increased by 3 percent from approximately $25,700 to $26,400.

-

The annual Minimum COLA amount increased from $32.28 to $33.24 per year of service. The threshold below which a member’s benefit must fall in order to be eligible for this COLA increased from approximately $840 to $880 per year of service.

-

The Optional COLA increase members received was capped at 3 percent. The actual CPI increase was 8.81 percent, so the excess is banked to be used in the future during times when the annual CPI change is less than 3 percent.

There is not much of a history of COLA policy change for plans that have a Base COLA, since these plans were created with these COLAs built into their plan provisions. However, PERS and TRS Plans 1 were opened much earlier and have had an evolving history of COLA policies which is summarized in the timeline below.

1938 ➔ TRS Plan 1 opens.

1947 ➔ PERS Plan 1 opens.

1960’s ➔ The minimum benefit is introduced. This minimum does not increase automatically.

1977 ➔ PERS and TRS Plans 1 are closed to new members.

1987 ➔ The Optional COLA is introduced.

1989 ➔ The Age 65 COLA is introduced. (For more information on this COLA, please see the

DRS COLA FAQ webpage.)

1995 ➔ An automatic annual increase is added to the minimum benefit, resulting in the Minimum COLA. The Age 65 COLA is removed and replaced with the Uniform COLA. (For more information on these COLAs, please see the

DRS COLA FAQ webpage.)

2004 ➔ The Adjusted Minimum Benefit is introduced.

2006 ➔ The Adjusted Minimum Benefit is expanded, and a 3 percent COLA is added to it.

2011 ➔ The Adjusted Minimum Benefit is further expanded, and the Uniform COLA is removed.

2018 ➔ A one-time, permanent benefit increase of 1.5 percent up to $62.50 per month is provided to members not already receiving a minimum COLA benefit.

2020 ➔ A one-time, permanent benefit increase of 3 percent up to $62.50 per month is provided to members not already receiving a minimum COLA benefit.

2022/2023 ➔ A one-time, permanent benefit increase of 3 percent up to $110.00 per month is provided to members not already receiving a minimum COLA benefit.

For a more comprehensive history, see the issue papers described in Recent OSA Policy Analysis.

The pre-funding of members’ pension benefits, including expected future COLAs, is key to ensuring a retirement plan remains solvent, affordable, and maintains intergenerational equity (i.e., benefits are funded over a member’s career and are financed by their contributions and the taxpayers that receive their services). This pre-funding occurs during the time the member was actively working, with the intent being to fully fund the member’s expected future pension benefits by the time they retire. The manner in which these benefits and COLAs are pre-funded varies by plan.

The costs of Base COLAs are funded via a combination of member, employer, and State contributions (depending on the plan). The cost-sharing associated with funding these benefits is as follows:

-

PERS, TRS, SERS, and PSERS Plans 2 – 50 percent member (TRS 2 are subject to member maximum) and 50 percent employer.

-

PERS, TRS, and SERS Plans 3 – 100 percent employer.

-

LEOFF Plan 1 – No contributions required while the plan is fully funded.

-

LEOFF Plan 2 – 50 percent member, 30 percent employer, and 20 percent State.

-

WSPRS Plans 1 and 2 – 50 percent member (subject to member maximum) and 50 percent State.

-

JRS – 100 percent State.

The costs of the Plans 1 COLAs are funded differently, depending on the type of COLA:

-

Optional COLA – Funded by the member at the time of their retirement via an actuarially equivalent reduction in their initial benefit.

-

Adjusted Minimum Benefit and Minimum COLA – Funding commenced when the benefit was enacted. These benefits are primarily or fully funded via an increase in the employer add-on rate (known as an Unfunded Actuarially Accrued Liability or UAAL rate). This rate includes the expected cost of current and future members receiving an adjusted minimum benefit and minimum COLA. Any new COLA benefits will also be funded through an increase to this rate to cover the cost of the benefit improvement. All PERS, SERS, and PSERS employers contribute the PERS 1 UAAL rate, and all TRS employers contribute the TRS 1 UAAL rate. There is no increase to the member rate, as this rate is fixed at 6 percent for Plan 1 members of PERS and TRS.

Please see our

Education page, and in particular the

Contribution Rate Statutes page, for more information on pension funding.

Recent OSA Policy Analysis

Recent COLA analysis prepared by OSA has been focused on the Plans 1 COLAs. This analysis included looking at Plans 1 ad-hoc COLAs and minimum benefits through the lenses of benefit adequacy, purchasing power protection, reward-for-service, and intergenerational equity.

Much of this analysis was conducted for the Select Committee on Pension Policy (SCPP), who has studied Plans 1 COLA proposals over several interims. Recently, the Committee received a comprehensive briefing on the following:

In addition to the materials provided to the SCPP, OSA has produced several actuarial fiscal notes for legislation pertaining to Plans 1 COLAs. Below is a sample of the analysis conducted in recent legislative sessions. Please note the fiscal notes summarized below are based on the effective date of the bills and the actuarial valuation available at the time of their completion. If these fiscal notes were reproduced today using updated effective dates and actuarial valuations, the results will vary. For additional information such as the risks and budget impacts of the proposals at the time of their completion, please see the linked fiscal notes.

-

SB 5350 (Passed Law) – For all eligible PERS 1 and TRS 1 annuitants, this proposal enacts a one-time, permanent benefit increase of 3 percent on their first $44,000 of annual pension income (i.e., $110 per month cap). This bill increased PERS and TRS UAAL rates by 0.12 percent and 0.23 percent, respectively. During the 2023-25 Biennium, the bill requires the SCPP to study an ongoing COLA. [

Bill Information]

-

HB 1459 (Did Not Pass) – For all eligible PERS 1 and TRS 1 annuitants, this bill enacts an annual, automatic, CPI-based benefit increase of up to 3.0 percent per year on their first $44,000 of annual pension income (i.e., $110 per month cap); please see our actuarial fiscal note for additional context on the provisions of this bill. This bill was expected to increase Plan 1 UAAL rates in PERS and TRS by 0.97 percent and 1.97 percent, respectively. [

Bill Information]

-

SB 5676 (Passed Law) – For all eligible PERS 1 and TRS 1 annuitants, this proposal enacts a one-time, permanent benefit increase of 3 percent on their first $44,000 of annual pension income (i.e., $110 per month cap). This bill increased PERS and TRS UAAL rates by 0.14 percent and 0.27 percent, respectively. [

Bill Information]

-

HB 1565 (Did Not Pass) – For all eligible PERS 1 and TRS 1 retirees, this bill enacts a one-time permanent increase equal to 1.5 percent of their benefit; not to exceed a maximum of $22 per month. This bill was expected to increase Plan 1 UAAL rates in PERS and TRS by 0.04 percent and 0.07 percent, respectively. [

Bill Information]

-

EHB 1390 (Passed Law) – For all PERS 1 and TRS 1 annuitants not on a minimum benefit, this bill enacts a one-time permanent increase equal to 3.0 percent of their benefit not to exceed a maximum of $62.50 per month. This bill increased PERS and TRS UAAL rates by 0.11 percent and 0.23 percent, respectively. [

Bill Information]

-

SSB 6340.PL (Passed Law) – For all PERS 1 and TRS 1 annuitants not on a minimum benefit, this bill enacted a one-time permanent increase equal to 1.5 percent of their benefit not to exceed a maximum of $62.50 per month. This bill increased PERS and TRS UAAL rates by 0.10 percent and 0.21 percent, respectively. [

Bill Information]

|