JLARC Briefing Report: K-12 Higher Ed Part-Time Employees Health Benefits Exchange Phase I

Legislative Auditor's Conclusion:

Many part-time K-12 and higher education employees would likely pay more if insured through the Health Benefit Exchange

Age, income, and other access to insurance are key factors

|

- Impact of shifting part-time employees?

- K-12 employees likely to pay more

- Higher ed employees likely to pay more

- Cost factors: age, residence, income, other coverage

- Precise cost estimate limited by data

- Exchange: A marketplace for health plans

- Policy issues beyond costs

- Does JLARC want a more precise cost estimate?

Legislature asks what information is available on impacts of shifting part-time K-12 and higher education employees to the Health Benefit Exchange

The 2013 Legislature directed JLARC to estimate the cost impacts of shifting part-time K-12 and state higher education employees from their current health benefit plans to plans the employees would purchase on Washington’s Health Benefit Exchange (3ESSB 5034 and JLARC).

As many as 33,000 part time K-12 and higher education employees may be shifted

This report reviews the available information on the potential shift of 20,000 part-time K-12 employees and as many as 13,000 part-time higher education employees to the Health Benefit Exchange. The actual number would ultimately be the Legislature’s policy decision.

Employees working 3/4 time or more are generally considered full-time under the federal Affordable Care Act.

- K-12: 20,000 K-12 employees worked less than 3/4 time in the 2013-2014 school year and received health benefits through their school districts, according to the Office of the Insurance Commissioner.

- Part-time K-12 employees hold positions such as teaching assistants, bus drivers, janitors, nurses, and counselors.

- Higher education: According to the Health Care Authority, an estimated 13,000 higher education employees worked at least half-time but less than 3/4 time in 2014 and were eligible for health benefits through the Public Employees Benefits Board (PEBB). However, it is unknown how many received health benefits through PEBB. This figure excludes employees who work less than half-time and graduate students because they generally are not covered by PEBB.

- Part-time higher education employees hold positions such as faculty, cafeteria workers, janitors, and counselors.

The state would save money by shifting part-time employees to the Exchange, but cost impacts to employees are hard to quantify

The state allocates funds for health benefits for K-12 and higher education employees.

- For all part-time K-12 employees, this is based on the percentage of time an employee works. For example, for a K-12 employee working 40 percent time, the school district receives 40 percent of the state allocation of a full-time employee. The state and school districts contributed $144 million for part-time K-12 employee health insurance for the 2013-2014 school year. In 2014, an estimated $131 million was allocated in both state and local (non-state) funds for higher education employees who work half-time or more. If part-time higher education employees were shifted to the Exchange, these funds would not be allocated.

K-12 employees’ age and household income indicate many face higher premiums without federal subsidies

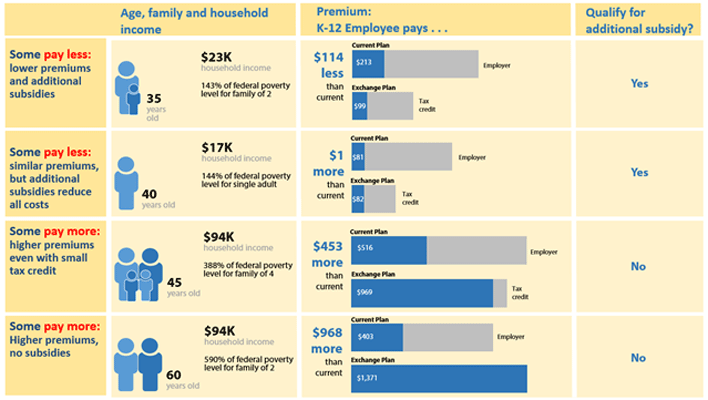

The cost of insurance through the Exchange varies based on age, tobacco use, and location. Eligibility for federal subsidies is based on income, dependents, and a spouse’s access to family coverage. Depending on employees’ eligibility for federal subsidies, some could pay less for insurance while others could pay more. However, even those who receive subsidies could pay more for insurance purchased on the Exchange, as illustrated in Exhibit 1.

JLARC staff used Census data to estimate the effect of these factors for part-time K-12 employees. The currently available data indicates that more than half of part-time K-12 employees would likely pay more on the Exchange.

The state would need more information to develop a more precise and comprehensive estimate of how costs would change for all part-time employees. The limitations of the currently available data are discussed in the tab “Precise Cost Estimate Limited by Data.”

The effect of a move to the Exchange varies based on financial and family circumstances

The following hypothetical scenarios show how increased premiums and federal subsidies could affect some employees’ health insurance costs. These examples compare employees’ current coverage to Exchange plans in King County with comparable coverage. In the first two examples, employees qualify for additional subsidies that provide cost sharing assistance for out of pocket expenses.

As described in JLARC’s 2015 report on K-12 Health Benefits, available here, there is wide variation in employees’ costs among districts, positions, and by the amount of time worked. These examples are intended to be illustrative, and are based on the average costs for all part-time K-12 employees that work less than � time.

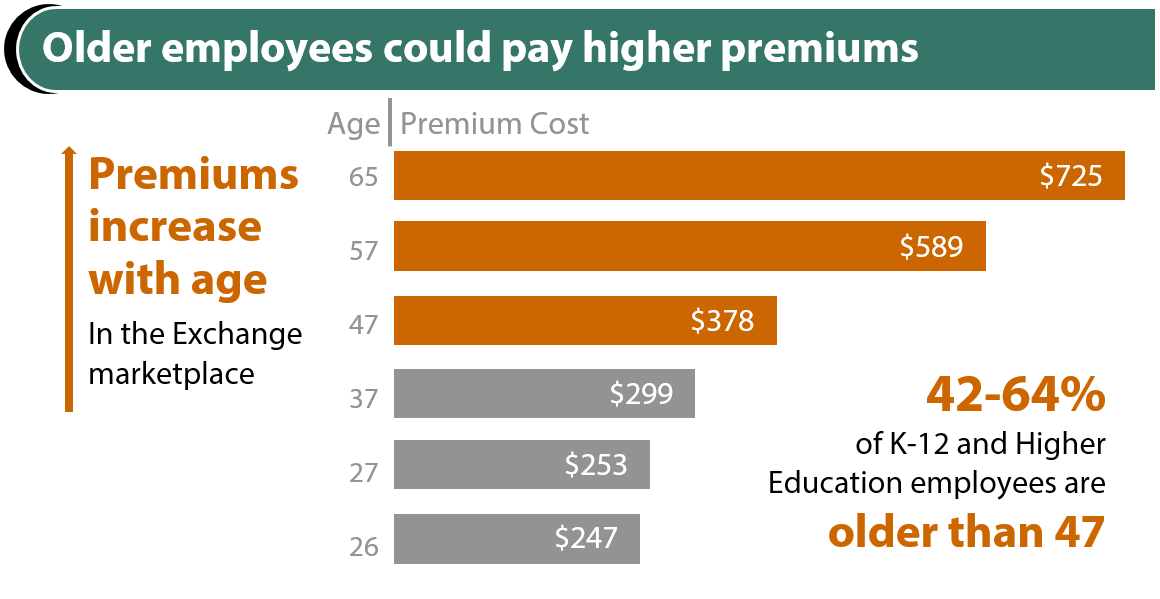

More than half of part-time K-12 employees are over 47 and would experience premium increases

Premiums for individual plans on the Exchange increase as people age. Premiums may also be higher based on the number of dependents covered and where the employee lives. Exhibit 2 shows premiums for an employee-only gold-level plan that is available statewide, which is equivalent to the plans offered by many districts.

Source: JLARC staff analysis of Washington Health Benefit Exchange data and American Community Survey data. Premiums reflect lowest cost gold plan in Rating Area 1 (King County). Exchange staff note that most current Exchange enrollees select silver or bronze plans.

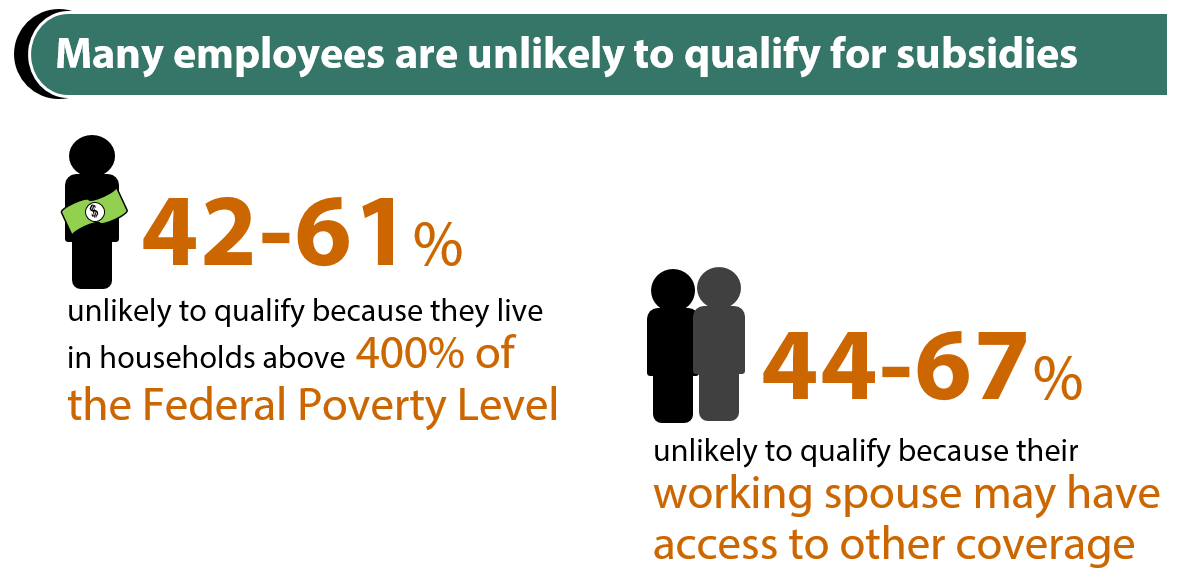

Many employees are likely to be ineligible for subsidies based on income and access to other coverage

|

Information

needed |

American Community Survey estimates of

part-time K-12 employees |

|

Household income and dependents |

44 to 51 percent are likely ineligible

for federal subsidies because their income is above 400 percent of the

federal poverty level. |

|

Spouse’s access to care |

Between 58 and 66 percent have spouses who work. At least some of these employees may have

access to coverage through their spouse.

A spouse’s access to coverage may make an employee ineligible for a

subsidy. |

Source: Census data, American Community Survey, 2011-13. Estimates are provided as ranges based on the upper and lower bounds of the 95 percent confidence interval.

Higher education employees’ age and household income indicate higher premiums and fewer federal subsidies

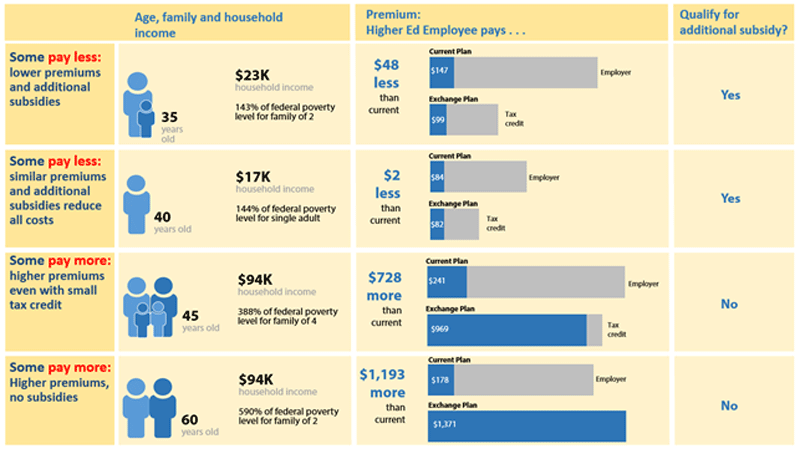

The cost of insurance through the Exchange varies based on age, tobacco use, and location. Eligibility for federal subsidies is based on income, dependents, and a spouse’s access to family coverage. Depending on employees’ eligibility for federal subsidies, some could pay less for insurance while others could pay more for insurance purchased on the Exchange. However, even those who receive subsidies could pay more, as illustrated in Exhibit 3.

JLARC staff used Census data to estimate the effect of these factors for part-time higher education employees. The currently available data indicates that more than half of part-time higher education employees would likely pay more on the Exchange.

The state would need more information to develop a more precise and comprehensive estimate of how costs would change for all part-time employees. The limitations of the currently available data are discussed in the tab “Precise Cost Estimate Limited by Data.”

The effect of a move to the Exchange varies based on financial and family circumstances

The following hypothetical scenarios show how increased premiums and federal subsidies could affect some employees’ health insurance costs. These examples compare employees’ current coverage to Exchange plans in King County with comparable coverage. In the first two examples, employees qualify for additional subsidies that provide cost sharing assistance for out of pocket expenses. These examples are intended to be illustrative and are not representative of the part-time higher education employee population.

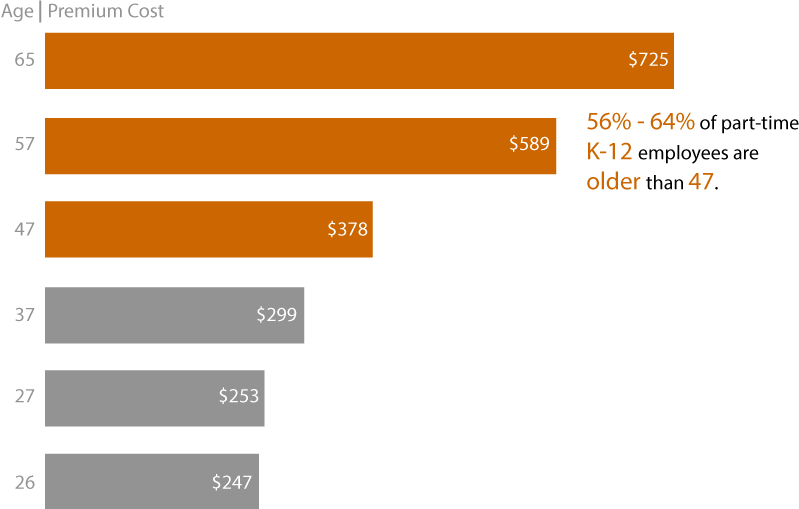

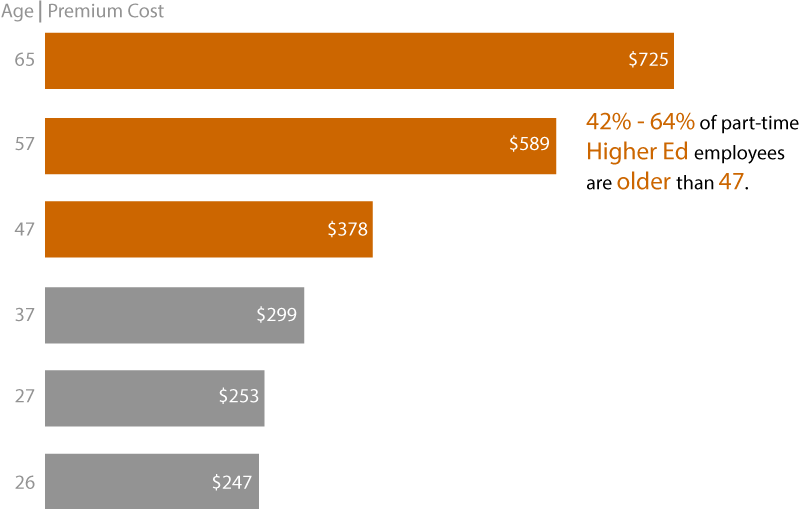

Higher education employees who are over 47 would experience greater premium increases

Premiums for individual plans on the Exchange increase as people age. Premiums may also be higher based on the number of dependents covered and where the employee lives. Exhibit 4 shows premiums for an employee-only gold-level plan that is available statewide, which is equivalent to the plans PEBB offers.

Source: JLARC staff analysis of Washington Health Benefit Exchange data and American Community Survey data. Premiums reflect lowest cost gold plan in King County. Exchange staff note that most current Exchange enrollees select silver or bronze plans.

Employees who have higher incomes or working spouses are likely to be ineligible for subsidies

|

Information needed |

American Community Survey estimates of part-time higher

education employees |

|

Household income and

dependents |

Statewide, between 42 and 61 percent are likely ineligible for

federal subsidies because their income is above 400 percent of the federal

poverty level. |

|

Spouse’s access to care |

Between 44 and 67 percent have spouses who work. At least some of these employees may have

access to coverage through their spouse.

A spouse’s access to coverage may make an employee ineligible for a

subsidy. |

Source: Census data, American Community Survey, 2011-13. Estimates are provided as ranges based on the upper and lower bounds of the 95 percent confidence interval.

Estimating cost requires personal information

Estimating the cost impact to employees who would be moved to the Exchange requires information about personal characteristics. This information can be used to estimate whether they would be eligible for federal subsidies, including tax credits.

The amount that enrollees pay for premiums on the Exchange is influenced by three characteristics.

Age: Older people can be charged up to three times more for premiums than younger people.

Tobacco use: Insurers can charge tobacco users up to 50 percent more than those who do not use tobacco.

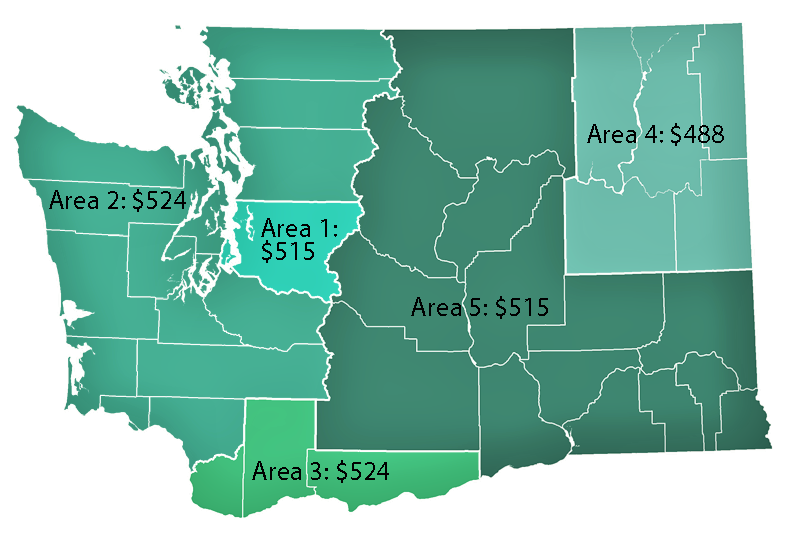

Where they live: For a comparable plan, premiums vary by location (Exhibit 5). For example, a 35-year old with a child would pay $524/month in Clark County but $488/month in Spokane for the same plan, a seven percent difference.

Personal information needed to determine eligibility for subsidies

Subsidies can reduce premiums and out of pocket costs for those eligible to receive them.

|

Information needed to determine eligibility |

Why it is important |

|

Household income and family size |

Federal subsidies are based on the federal poverty level. The federal poverty level is calculated

based on total household income and family size. |

|

Spouse’s access to care |

If an employee’s spouse has access to family coverage, the

employee is not eligible for federal subsidies or tax credits on the Exchange. |

|

Where they live |

Federal subsidies and tax credits are based on the cost of

coverage in geographic areas. |

Precise cost estimate limited by data

Data availability limits ability to provide precise cost estimate

JLARC staff reviewed the data needed to develop precise estimates, and found that much of the data is not collected by school districts or the state as shown in the table below.

Some of the information needed to estimate employee’s costs is available to the state but incomplete. Other data is unavailable.

|

Part-time

K-12 |

Part-time

higher ed |

|

|

Factors that affect premiums |

|

|

|

Age |

ü |

ü |

|

Where they live |

Incomplete |

ü |

|

Factors that affect eligibility for subsidies |

|

|

|

Household income |

û |

û |

|

Dependents |

Incomplete |

Incomplete |

|

Spouse’s access to coverage |

û |

Incomplete |

Best available descriptive employee data is based on Census Bureau survey results

The estimates and models of employee characteristics are based on data from the American Community Survey (ACS). The ACS is a national survey administered by the US Census Bureau that provides detailed demographic, housing, social, and economic data. Data used in this report was collected annually between 2011 and 2013. This is a time period before key provisions of the federal Affordable Care Act took effect, such as the mandate for individuals to purchase health insurance and for large employers to offer coverage for their employees. The data is self-reported and is not verified.

People who work part-time in K-12 or in higher education and also work other jobs may not be captured in the ACS summary of characteristics for part-time K-12 employees:

- Employees who work part-time in K-12 or in higher education and also work in another job for a total number of hours over 3/4 time will be counted in the ACS as full-time workers rather than as part-time K-12 employees; and

- Employees who work a greater number of hours in another occupation (e.g., retail) and also work part-time in K-12 or in higher education will be counted in the ACS under the other occupation.

There is no way to know how many employees fall into these two groups. Receipt of additional income from a second job may decrease an employee’s likelihood of qualifying for federal subsidies.

The number of employees ineligible for subsidies or experiencing higher premiums could increase, depending on the overlap among the factors

There can be overlap among the factors that influence employees’ premium rates and eligibility for subsidies. For example, an employee may be below 400 percent of the federal poverty level (making them potentially eligible for subsidies) but also have an employed spouse with access to family insurance (making them ineligible). The data does not show how much overlap exists. Therefore, more people could be ineligible for subsidies than estimated in this report.

Descriptive employee data reflects entire part-time K-12 population, not just those who received insurance coverage from their district

The ACS provides descriptive data for about 34,000 part-time K-12 employees, but does not identify whether they have health insurance coverage that is provided by their employer, or if it is received from their spouse’s employer. The Office of the Insurance Commissioner identifies approximately 20,000 part-time K-12 employees who received insurance coverage from their school district. As a result, the ACS descriptive data may not accurately reflect those who may be shifted to the Exchange.

Information on part-time higher education employees is incomplete and is an estimate

The estimate of 13,000 part-time higher education employees is based on a preliminary analysis by the Health Care Authority (HCA), which operates PEBB.

- HCA cautions that this figure is a preliminary analysis, and that its analysis planned for 2016 will be more comprehensive.

- The HCA estimate does not identify how many employees have insurance through PEBB.

- Likewise, the ACS provides descriptive data about all 13,000 employees, but does not identify whether they have health insurance coverage that is provided by their employer, or if it is received from their spouse’s employer.

Data availability limits ability to provide precise cost estimate

JLARC staff reviewed the data needed to develop precise estimates, and found that much of the data is not collected by school districts or the state as shown in the table below.

Some of the information needed to estimate employee’s costs is available to the state but incomplete. Other data is unavailable.

|

Part-time

K-12 |

Part-time

higher ed |

|

|

Factors that affect premiums |

|

|

|

Age |

ü |

ü |

|

Where they live |

Incomplete |

ü |

|

Factors that affect eligibility for subsidies |

|

|

|

Household income |

û |

û |

|

Dependents |

Incomplete |

Incomplete |

|

Spouse’s access to coverage |

û |

Incomplete |

Best available descriptive employee data is based on Census Bureau survey results

The estimates and models of employee characteristics are based on data from the American Community Survey (ACS). The ACS is a national survey administered by the US Census Bureau that provides detailed demographic, housing, social, and economic data. Data used in this report was collected annually between 2011 and 2013. This is a time period before key provisions of the federal Affordable Care Act took effect, such as the mandate for individuals to purchase health insurance and for large employers to offer coverage for their employees. The data is self-reported and is not verified.

People who work part-time in K-12 or in higher education and also work other jobs may not be captured in the ACS summary of characteristics for part-time K-12 employees:

- Employees who work part-time in K-12 or in higher education and also work in another job for a total number of hours over 3/4 time will be counted in the ACS as full-time workers rather than as part-time K-12 employees; and

- Employees who work a greater number of hours in another occupation (e.g., retail) and also work part-time in K-12 or in higher education will be counted in the ACS under the other occupation.

There is no way to know how many employees fall into these two groups. Receipt of additional income from a second job may decrease an employee’s likelihood of qualifying for federal subsidies.

The number of employees ineligible for subsidies or experiencing higher premiums could increase, depending on the overlap among the factors

There can be overlap among the factors that influence employees’ premium rates and eligibility for subsidies. For example, an employee may be below 400 percent of the federal poverty level (making them potentially eligible for subsidies) but also have an employed spouse with access to family insurance (making them ineligible). The data does not show how much overlap exists. Therefore, more people could be ineligible for subsidies than estimated in this report.

Descriptive employee data reflects entire part-time K-12 population, not just those who received insurance coverage from their district

The ACS provides descriptive data for about 34,000 part-time K-12 employees, but does not identify whether they have health insurance coverage that is provided by their employer, or if it is received from their spouse’s employer. The Office of the Insurance Commissioner identifies approximately 20,000 part-time K-12 employees who received insurance coverage from their school district. As a result, the ACS descriptive data may not accurately reflect those who may be shifted to the Exchange.

Information on part-time higher education employees is incomplete and is an estimate

The estimate of 13,000 part-time higher education employees is based on a preliminary analysis by the Health Care Authority (HCA), which operates PEBB.

- HCA cautions that this figure is a preliminary analysis, and that its analysis planned for 2016 will be more comprehensive.

- The HCA estimate does not identify how many employees have insurance through PEBB.

- Likewise, the ACS provides descriptive data about all 13,000 employees, but does not identify whether they have health insurance coverage that is provided by their employer, or if it is received from their spouse’s employer.

Premiums for health insurance through the Exchange is market rate and may be subsidized for some people

The 2011 Legislature created the Washington Health Benefit Exchange (the Exchange) as part of its implementation of the federal Affordable Care Act. The Exchange is a public-private partnership that allows people to compare and purchase health insurance.

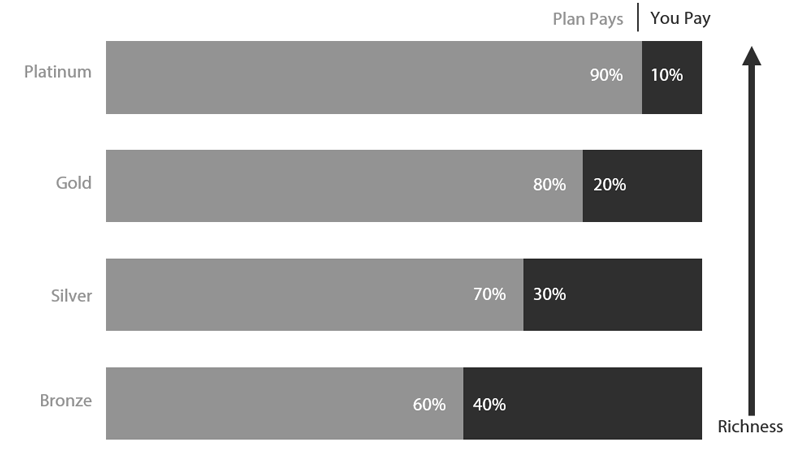

The Exchange offers a marketplace for insurance plans that are sold to individuals. Plans are sold in coverage levels (e.g., silver, gold). These coverage levels are based on the differing amounts paid by the enrollee and the plan (Exhibit 6) and do not reflect the quality of care that individuals will receive. Insurance carriers design the plans and set premium rates.

Any plan offered by the Exchange must cover ten essential health benefits (Exhibit 7).

- prevention and wellness,

- outpatient care,

- laboratory services,

- emergency care,

- hospitalization,

- maternity and newborn care,

- pediatric care (medical, dental and vision),

- mental health and substance use disorder services,

- prescription medications,

- rehabilitation and habilitation

Adult vision and dental are not included as essential benefits.

People who purchase insurance on the Exchange may be eligible for income-based federal subsidies

Federal subsidies, which include tax credits and cost-sharing adjustments, reduce premiums and out of pocket costs. They are not available to everyone (Exhibit 8).

|

Tax Credits |

Cost-sharing adjustments |

|

Reduce

monthly premiums |

Reduce

out-of-pocket costs (e.g., deductibles, copayments) |

|

Applies

to any Exchange plan |

Applies

to Silver plans only |

|

Available

to people with household income 100-400% of federal poverty level ·

$11,670-$46,680 for an individual ·

$23,850-$95,400 for a family of four |

Available

to people with household income less than 250% of federal poverty level ·

$29,425 for an individual ·

$60,625 for a family of four |

|

Paid

to the insurer or adjusted on tax returns |

Automatically

applied, but only when the enrollee uses covered health care services |

Not all part-time employees can purchase insurance on the Exchange

Under Health Care Authority rules, part-time higher education employees who are eligible for PEBB and do not have access to other employer-based group medical insurance may not waive benefits. JLARC staff did not review whether there are similar policies that also prohibit this in the 295 school districts.

Some K-12 employees may be able to waive their district coverage and purchase coverage elsewhere. An employee’s decision to waive coverage and purchase on the Exchange could depend on whether health insurance is less costly on the Exchange because of subsidies. However, if their school district employer offers coverage that is “affordable”, they generally will not qualify for such subsidies.

“Affordable” is defined as costing less than 9.5 percent of the employee’s annual household income and includes an adequacy test, which means the plan must cover 60 percent of out-of-pocket expenses.

Beyond the fiscal impact to employees, there are policy issues the Legislature may want to be aware of if it considers moving part-time employees to the Exchange

JLARC staff have identified three issues that the Legislature may wish to consider.

Reimbursement issues

In 2013, legislators considered a bill that would have moved a number of part-time public employees to the Exchange (ESSB 5905). The legislation included a “compensation arrangement” to reimburse a portion of the premium or out-of-pocket cost of part-time public employees who purchased plans on the Exchange.

Since then, the IRS has ruled that the Affordable Care Act does not allow such arrangements. Specifically, an employer may not provide a payment to an employee and direct that the payment be used to purchase health insurance through the federal or state exchanges.

Personnel issues

Recruitment and retention: Officials from the University of Washington, State Board of Community and Technical Colleges, and the Office of the Superintendent of Public Instruction informed JLARC staff that they believe PEBB or district benefits are key to attracting and retaining staff in hard to fill positions. It is unclear how changing benefits would impact recruitment and retention.

Equity: Employees with similar job titles and responsibilities would have dissimilar benefits. For example, a groundskeeper at Washington State University who works part-time would be treated differently than a part-time groundskeeper at capital campus. One would purchase coverage through the Exchange while the other would retain coverage through PEBB.

Retirement and pensions: The Health Care Authority noted that part-time K-12 and higher education employees who are eligible for coverage as employees may participate in PEBB upon retirement if they reapply when coverage ends. Employees would lose access to this benefit as well as their eligibility for premium subsidies for coverage.

Insurance issues

Adult vision, dental, life, and disability insurance coverage: Current coverage for these part-time employees includes adult vision and dental services. These services are not among the ten essential benefits that must be included in health plans sold on the Exchange. Employees would need to purchase separate insurance plans if they wished to continue receiving vision and dental coverage. Part-time higher education employees would also lose employer-paid life and disability insurance that is available to employees eligible for PEBB. This is likely true for many K-12 employees as well.

Impact to risk pools: It is unclear how moving part-time employees from existing coverage to the Exchange would affect school district and PEBB risk pools and rates.

McCleary decision

If the Legislature makes changes to the K-12 health benefits system, there may be implications related to the State Supreme Court’s decision in the McCleary case. The McCleary decision indicated that employee benefits are part of compensation. The Court noted compensation is related to recruiting and retaining competent K-12 staff.

The Committee can decide whether to pursue this question in greater detail

The Legislature has options to obtain a more precise estimate than the initial observations in this report. A more detailed estimate would require modeling or collecting personal information not currently available to the state.

JLARC staff have identified two potential approaches.

A social science research firm estimated a cost between $30,000 and $40,000 to conduct a study using Census data, national survey data, and administrative data. This approach will most likely use the same survey data that JLARC staff used, and would be supplemented with additional, national-level survey data collected prior to the implementation of the Affordable Care Act. For example, a national survey, the Medical Expenditure Panel Survey, collected data on survey respondents’ spouses’ access to health insurance. The most recent data set available is from 2012, and is not specific to Washington. The result may identify the overlap among factors that affect insurance costs. Since the approach requires additional assumptions, there is risk it could increase the margin of error.

A health care actuary estimated a cost of $630,000 to conduct a study. They would collect employee-level data for part-time higher education and K-12 employees and compare coverage provided by plans sold on the Exchange with those offered by districts and PEBB. This could be done statewide or by job classes. The actuary proposed to survey affected employees and gather personal information about the key factors that affect cost: Household income, other employment, number of children, and spousal access to coverage. Since the survey approach requires individuals to voluntarily provide personal information, there is risk that it could yield an inadequate response rate.

Agency response(s) will be included in the final report, planned for Mmmm YYYY.

Contact

Authors of this Study

Eric Thomas, Research Analyst, 360-786-5182

John Bowden, Research Analyst, 360-786-5298

John Woolley, Audit Coordinator

Keenan Konopaski, Legislative Auditor

Joint Legislative Audit and Review Committee

Eastside Plaza Building #4, 2nd Floor

1300 Quince Street SE

PO Box 40910

Olympia, WA 98504-0910

Phone: 360-786-5171

FAX: 360-786-5180

Email: JLARC@leg.wa.gov

Audit Authority

The Joint Legislative Audit and Review Committee (JLARC) works to make state government operations more efficient and effective. The Committee is comprised of an equal number of House members and Senators, Democrats and Republicans.

JLARC's non-partisan staff auditors, under the direction of the Legislative Auditor, conduct performance audits, program evaluations, sunset reviews, and other analyses assigned by the Legislature and the Committee.

The statutory authority for JLARC, established in Chapter 44.28 RCW, requires the Legislative Auditor to ensure that JLARC studies are conducted in accordance with Generally Accepted Government Auditing Standards, as applicable to the scope of the audit. This study was conducted in accordance with those applicable standards. Those standards require auditors to plan and perform audits to obtain sufficient, appropriate evidence to provide a reasonable basis for findings and conclusions based on the audit objectives. The evidence obtained for this JLARC report provides a reasonable basis for the enclosed findings and conclusions, and any exceptions to the application of audit standards have been explicitly disclosed in the body of this report.

JLARC Members on Publication Date

Senators

Randi Becker

John Braun, Chair

Sharon Brown

Annette Cleveland

David Frockt

Jeanne Kohl-Welles

Mark Mullet, Assistant Secretary

Ann Rivers

Representatives

Jake Fey

Larry Haler

Christine Kilduff

Drew MacEwen

Ed Orcutt, Secretary

Gerry Pollet

Derek Stanford, Vice Chair

Drew Stokesbary

Scope & Objectives

Why a JLARC Study of Health Care Options for Part-Time K-12 and Higher Ed Employees?

The 2013-15 Operating Budget (3ESSB 5034) directed the Joint Legislative Audit and Review Committee (JLARC) to study the potential for using the Washington Health Benefit Exchange to provide health insurance for part-time K-12 public school employees and the cost of stand-alone dental plans. The Committee included part-time higher education employees and adopted a two-phase approach to the study.

How are Part-Time K-12 and Higher Ed Employees Currently Covered for Health Insurance?

Part-Time K-12 Employees: The state provides funds to local school districts for K-12 employees’ health benefits. Benefits, eligibility, and employee cost-sharing are locally negotiated at each of the 295 school districts. As such, how part-time employees are covered varies across school districts.

Part-Time Higher Ed Employees: The state covers part-time Higher Education employees through the Public Employees Benefit Board if they work at least 80 hours per month for more than six months. The state does not provide coverage for employees who do not meet the minimum number of hours. The state pays the same monthly contribution for part-time employees as full-time employees.

What is the Washington Health Benefit Exchange?

The 2011 Legislature created the Washington Health Benefit Exchange (the Exchange) as part of the implementation of the federal Affordable Care Act. The Exchange is a public-private partnership created to allow people to compare qualified health insurance options and purchase health insurance.

People who purchase insurance on the Exchange may be eligible for federal subsidies, including tax credits and cost-sharing assistance for premiums depending on their incomes.

Study Scope

JLARC staff will conduct this study in two phases:

- Phase One will review what data is available and what analysis staff can complete to understand the coverage and cost of existing benefit packages for part-time employees, as well as the feasibility of having part-time K-12 and higher education employees use the Exchange to purchase insurance. This will include the cost of stand-alone dental plans.

- Depending on the information gathered in Phase 1, Phase 2 of the study would develop detailed cost comparisons between existing plans and the Exchange.

Study Objectives (Phase One)

The study will determine:

- What data is available about current part-time employees’ health care coverage?

- What data is available about part-time employees and their families to determine coverage options through the Health Benefit Exchange?

- What data is needed to compare the costs and coverage part-time employees currently receive and what they might receive through the Exchange?

- If there are data gaps, how can they be addressed?

- Possible administrative, legal, and policy issues associated with changing benefits to the Washington Health Benefit Exchange.

JLARC staff will develop more specific objectives for Phase Two at the completion of Phase One.

Timeframe for the Study

Staff will present the Phase One report at the JLARC meeting in December 2015. In that same timeframe, JLARC staff are also conducting a separately mandated study on school districts’ health benefits purchasing and options for a consolidated purchasing system for K-12 employees.