Inconsistent decisions about whether a parcel is subject to the

assessment can lead to unequal treatment of landowners

DNR must determine which lands are forest land, but definitions remain unclear

While statute provides a broad definition of forest land, it also states that the

Department of Natural Resources (DNR) must use its judgment to determine which lands are

forest land and subject to the Forest Fire Protection Assessment (assessment).

The law gives DNR explicit authority to create rules implementing the assessment. DNR

has not issued administrative rules or published guidelines to clarify which parcels

should be assessed.

DNR reviewed parcels for eligibility until 2010

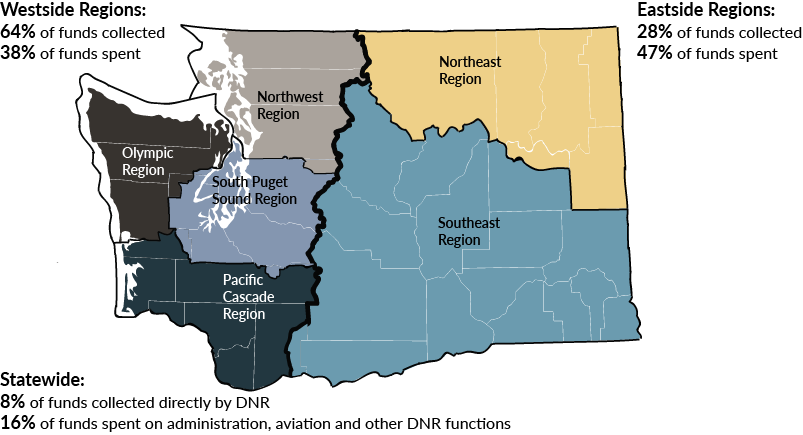

DNR previously directed staff in each of its six

regional offices to review 20 percent of the parcels in each county annually, so

that each parcel would be reviewed every five years. DNR staff used parcel boundaries

and ownership records from the county assessors, as well as aerial imagery and field

observations to make decisions about which parcels should be assessed.

Despite the requirement to complete reviews, DNR had no agency-wide training or

guidance for the staff who did the work.

- DNR did not specify how each region should perform the reviews.

- DNR had no criteria or guidelines for determining which parcels met the definition

of forest land. Policy stated only that cemeteries, air strips, gravel pits, and

swamps were exempt.

- DNR had no formal process to check the work of the staff performing the reviews.

In 2010, DNR stopped reviewing parcels after it received negative feedback regarding a

decision to assess 526 previously non-assessed parcels. The feedback raised concerns

about inconsistent determinations.

Determinations about eligibility for assessments can be inconsistent

In the absence of agency-wide guidance, regional staff developed their own informal

criteria, or used no criteria at all, to make determinations when parcels did not

clearly fall within or outside the statutory definition. As a result, determinations

were inconsistent, and remain so because there have been no updates.

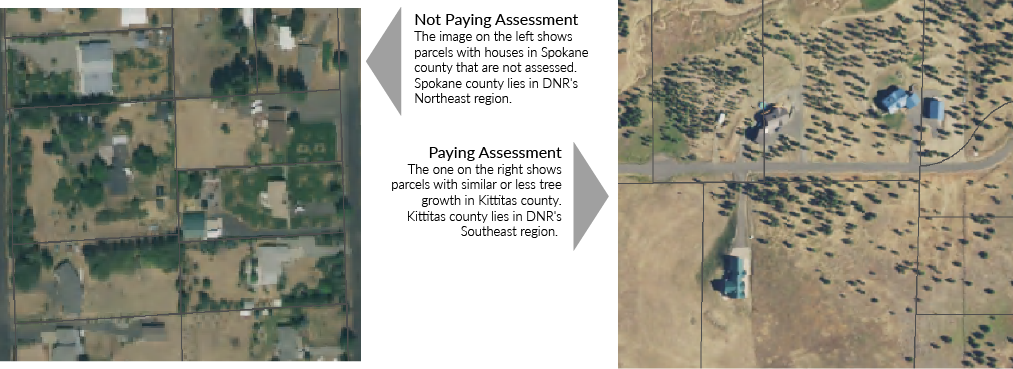

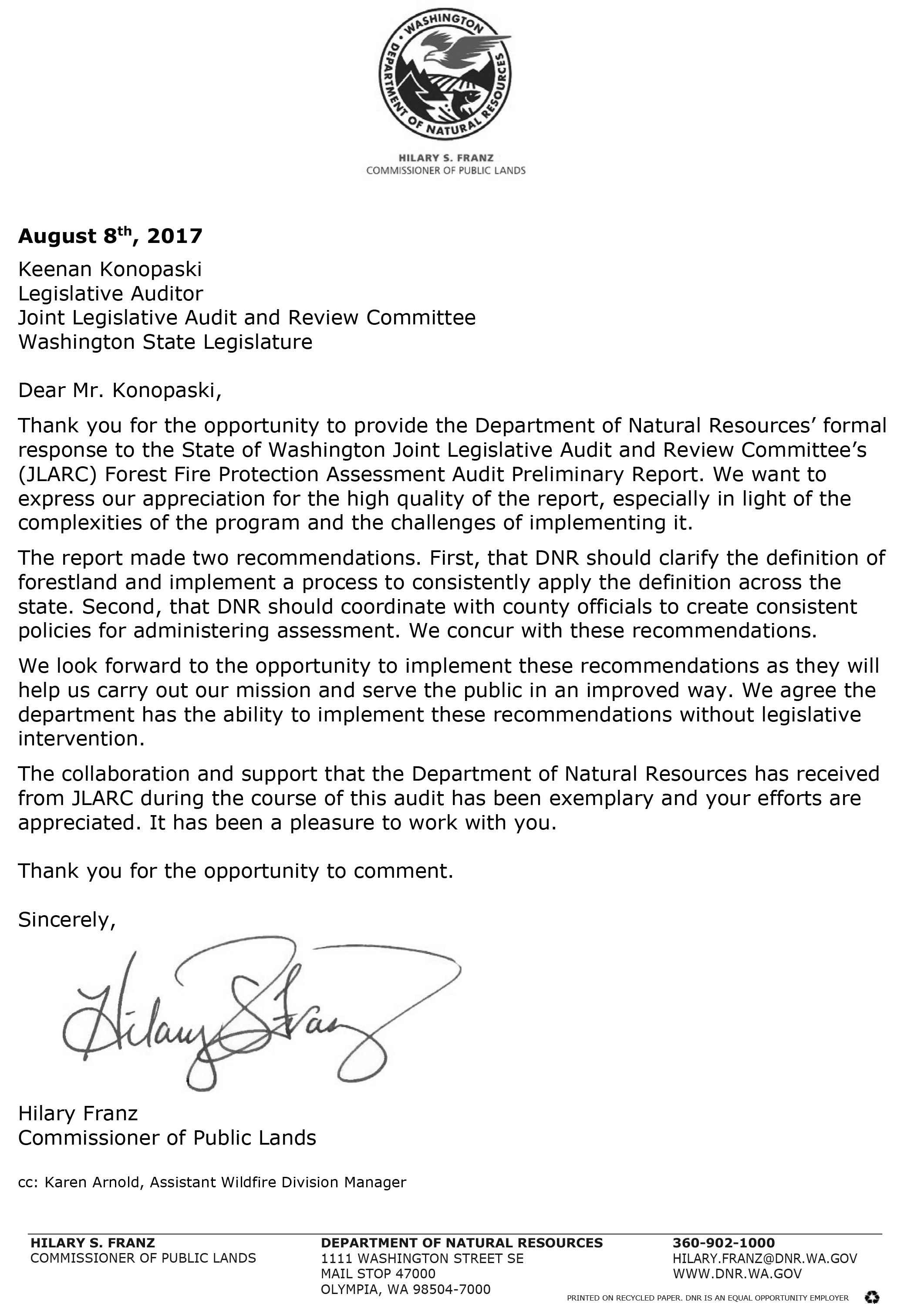

For example, similar parcels in different areas could be treated differently. The

exhibit below shows the different determinations for similar parcels in two DNR regions.

One pays the assessment, while the other does not.

Exhibit 3.1: Similar parcels in different counties had different determinations

Source: Parcel and assessment data provided by county assessors, imagery is 2015

National Agricultural Imagery Program mosaics.

Determinations may be inaccurate due to changes since the last reviews

DNR made its last parcel determinations in fall 2009. Since then, there have been

changes in the landscape, parcel boundaries, and ownership that impact whether a parcel

should be subject to the assessment. For example, a forested parcel may have been

cleared, divided into smaller parcels, and developed. Some county assessors reported

that the new parcels still carried the assessment, while others stated that they did

not, regardless of remaining tree coverage.

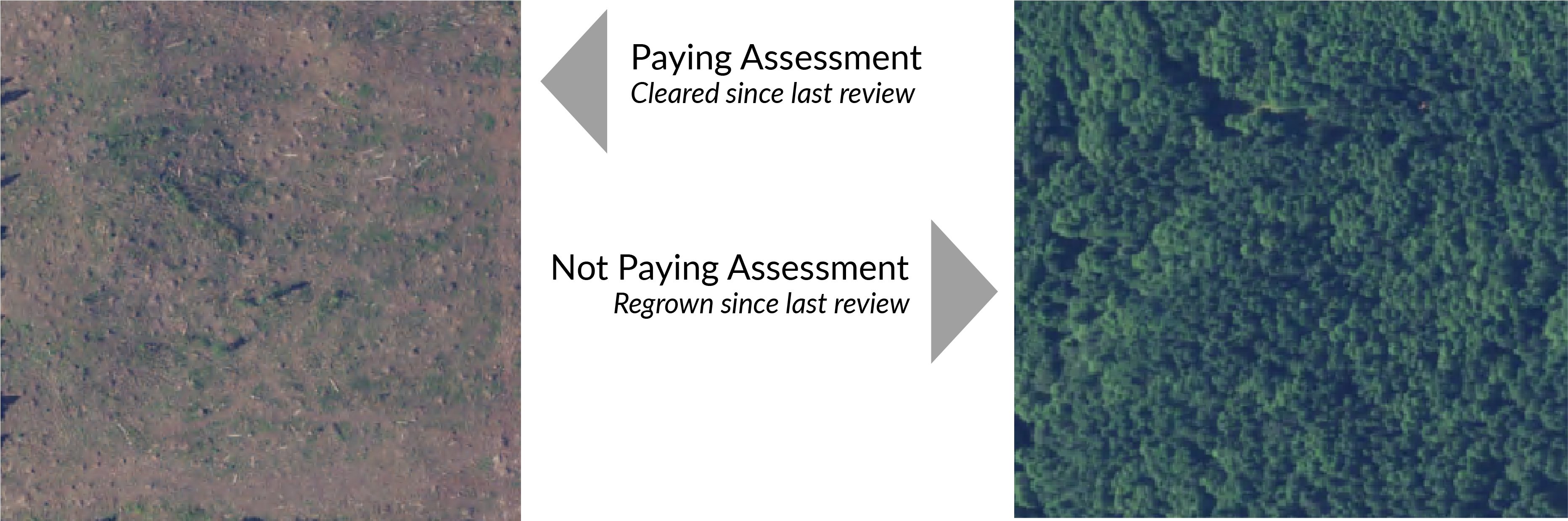

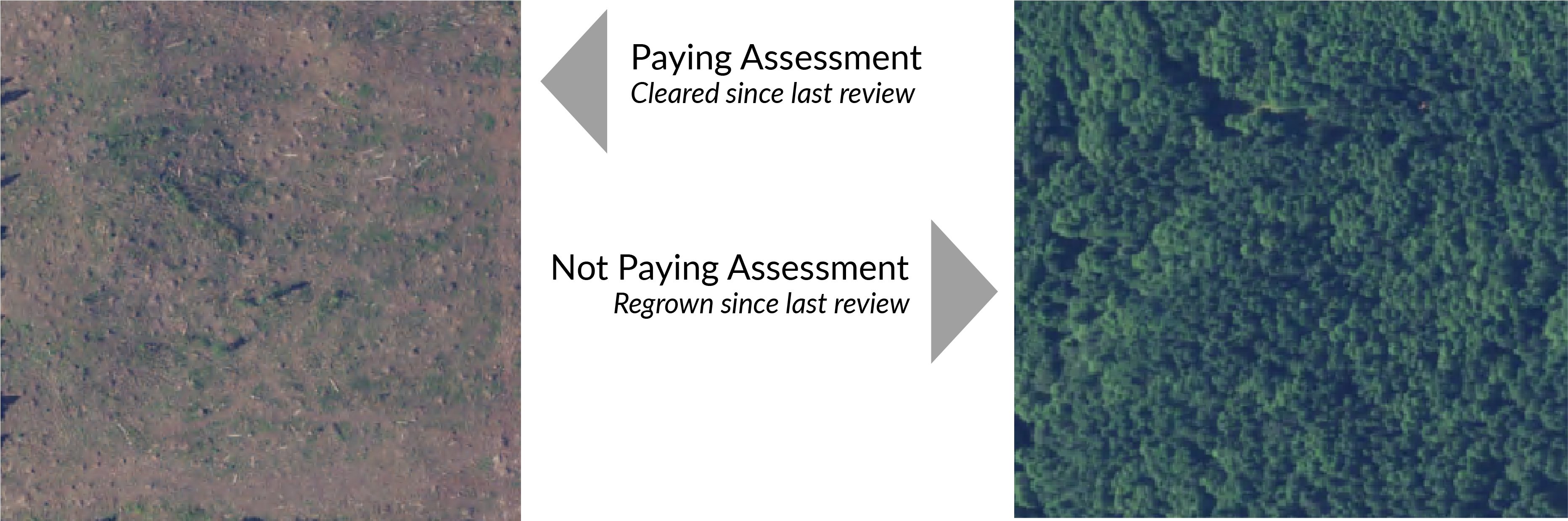

Logging and regrowth also have changed the landscape. In the exhibit below, the

recently logged parcel on the left is subject to the assessment, despite having no trees

and little other forest material. However, the parcel on the right is not subject to the

assessment, despite regrowth since the last determination.

When DNR stopped the reviews, staff expressed concern that the long interval between

reviews could lead to “inaccurate, inequitable FFPA assessment[s]” and "charging

citizens incorrectly." The scale of the problem is unclear because DNR cannot determine

how many parcels are affected without completing a full review statewide. However, JLARC staff

analysis identified nearly 5,500 parcels that are treated as forest land for

property tax purposes but do not pay the assessment.

Exhibit 3.2: Logging and regrowth affect accuracy of determination

Source: Parcel and assessment data provided by county assessors, imagery is 2015

National Agricultural Imagery Program mosaics.

DNR considered, but did not implement, program reform

After halting the reviews, in 2010 DNR created a staff work group to propose program

changes and parcel evaluation criteria. DNR disbanded the work group in January 2011

before it completed its work, citing workload priorities.

In 2014, DNR again assigned staff to develop recommendations for improving the process

and restarting reviews. Staff presented findings, recommendations, and a new review

process to executive management, but the program was not changed.

DNR has not designated forest protection zones statewide

In 1988, the Legislature passed a law requiring DNR to clarify its geographic areas of

responsibility by working with local fire districts to create “forest protection zones.”

DNR and the local fire districts must decide if any forest land in the zone would be

better protected by local fire districts. Those lands would not be subject to the

assessment.

DNR has created three forest protection zones — one each in King, Kitsap, and Pierce

counties. While DNR has updated the boundaries a number of times, it has not created

zones in the rest of the state. Forest land in a local fire protection district may be

subject to the assessment in a county without zones, while similar land in a zoned

county may not. DNR has no written policies or procedures for creating the zones.

Other states have developed means to improve consistency in identifying which parcels

to assess

DNR can learn from similar programs in Oregon, Idaho, and Montana. These states also

assess forest lands for fire protection through a combination of per-parcel and per-acre

charges. The other Western states have created systems, including administrative rules,

for classifying and reviewing forest land subject to the charges.

- Idaho has developed proprietary software that gathers data from county assessors to

help staff identify lands to review. The Idaho Department of Lands uses a five-year

review cycle so that 20 percent of assessed parcels are reviewed annually. The

Department of Lands also is creating a training program for staff that review parcels,

including photographs and examples to facilitate consistent decisions.

- Oregon divides responsibility for reviews by county. Each county has a

classification committee that is responsible for periodically reviewing parcels. The

detailed criteria for classifying lands are defined by administrative rule.

- In Montana, the state's wildfire agency has defined administrative rules with

criteria for classifying forest land.

Recommendation: DNR should clarify the definition of forest land and implement a

process to consistently apply the definition across the state

DNR should clarify the definition of forest land, either through administrative rule or

by proposing requested legislation. In doing so, DNR should identify how the process of

determining Forest Protection Zones is germane to the assessments, including whether

statutory changes are needed. DNR should design and implement a process to consistently

apply the definition to parcels across the state.

The Department of Natural Resources concurs with this recommendation. You can find additional details on the Recommendations tab.

Previous Section | Next

Section