JLARC Preliminary Report: 2015 Tax Preference Performance Reviews

Aluminum Industry Tax Preferences

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Est. Beneficiary Savings in 2015-17 Biennium |

|---|---|---|

| A reduced business and occupation (B&O) tax rate for manufacturers, wholesalers of aluminum that are also manufacturers, and processors for hire of aluminum. The Legislature reduced the rate from 0.484 percent to 0.2904 percent. | B&O RCW 82.04.2909 |

$2.4 million |

| A B&O tax credit for the amount of taxes paid on property owned by a direct service industrial customer and reasonably necessary for the purposes of an aluminum smelter. | Property RCW 82.04.4481 |

$2.9 million |

| A sales and use tax credit for the state portion (6.5 percent) of taxes paid for personal property, materials incorporated into structures, and labor and services performed on buildings and property at an aluminum smelter. Businesses take the credit against their B&O liability. | Sales and Use RCWs 82.08.805; 82.12.805 |

$1.5 million |

| A brokered natural gas use tax exemption for purchases of natural gas delivered through a pipeline and used by an aluminum smelter. | Use RCW 82.12.022(5) |

$0.5 million |

| A Public Utility Tax (PUT) credit for electric and gas sales made by light and power firms selling to aluminum smelters, provided the price charged is reduced by an amount equal to the credit claimed. | Public Utility RCW 82.16.0498 |

Not disclosable |

| A B&O tax credit for electric and gas sales to aluminum smelters made by non-light and power businesses, provided the price charged is reduced by an amount equal to the credit claimed. | B&O RCW 82.04.4482 |

$0 |

| Public Policy Objective |

|---|

The Legislature stated a public policy objective for the four preferences available to aluminum smelters (B&O preferential rate; B&O tax credit for property taxes paid; sales and use tax paid for building-related spending; and use tax exemption for purchases of natural gas):

JLARC staff infer two public policy objectives for the two preferences available for businesses selling power to aluminum smelters:

|

| Recommendations |

|---|

| Legislative Auditor's Recommendation: Review and Clarify

Because future reviews will be facilitated by:

Commissioner Recommendation: Available in October 2015. |

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

This review covers a package of six tax preferences related to the aluminum industry. For four preferences the aluminum smelters are the primary beneficiaries, and for two preferences the smelters are secondary beneficiaries.

Aluminum smelters as the primary beneficiary (each expire on January 1, 2027):

- A reduced business and occupation (B&O) rate for manufacturers, wholesalers of aluminum that are also manufacturers, and processors for hire of aluminum. The Legislature reduced the rate from 0.484 percent to 0.2904 percent;

- A B&O tax credit for the amount of property taxes paid on property owned by a direct service industrial customer and reasonably necessary for the purposes of an aluminum smelter. Unused credits may be carried over for one year;

- A sales and use tax credit for the state portion (6.5 percent) of taxes paid for personal property, materials incorporated into structures, and labor and services performed on buildings and property at an aluminum smelter. Businesses take the credit against their B&O liability; and

- A brokered natural gas use tax exemption for purchases of natural gas delivered through a pipeline and used by an aluminum smelter.

Preferences for entities selling electricity, natural gas, or manufactured gas (hereafter referred to as “gas”) where aluminum smelters are the secondary beneficiaries (no expiration date):

- A public utility tax (PUT) credit applies to electric or gas sales made by light and power firms selling to aluminum smelters. To qualify for the preference, the sale contract with the smelter must specify that the electricity or gas price charged will be reduced by an amount equal to the credit claimed; and

- A B&O tax credit applies to electric and natural gas sales to aluminum smelters made by energy brokers. To qualify for the preference, the sale contract with the smelter must specify that the electricity or natural gas price charged will be reduced by an amount equal to the credit claimed.

Statute defines “aluminum smelter” as the manufacturing facility of any direct service industrial customer that processes alumina into aluminum. A “direct service industrial customer” is an industrial customer that contracts for the purchase of power for direct consumption from the Bonneville Power Administration (BPA) as of May 8, 2001. Alumina is the starting material that is transformed into aluminum metal in the smelting process.

2004

The Legislature provided this package of tax preferences for the aluminum industry. Four directly benefit the aluminum industry: a reduced B&O rate, a B&O credit for property taxes, credits for sales and use tax paid for particular expenditures, and a use tax exemption on brokered natural gas. In addition, the Legislature enacted public utility tax (PUT) and B&O tax credits for light and power firms and energy brokers selling electricity or gas to an aluminum smelter in the state. The legislation included goals for the aluminum preferences.

The act took effect on July 1, and the four preferences that directly benefit aluminum smelters were scheduled to expire January 1, 2007, whereas the credits available to energy sellers and brokers did not include expiration dates.

2006

The Legislature extended the expiration date for the four preferences that directly benefit aluminum smelters to January 1, 2012.

2009

JLARC staff reviewed the four preferences that directly benefit aluminum smelters. The Legislative Auditor recommended continuation of the preferences because the public policy objective of preserving family wage jobs was being met and energy prices were higher and more volatile than when the incentives were originally enacted.

The Citizen Commission for Performance Measurement of Tax Preferences further recommended the Legislature consider establishing a final expiration date while also exploring other means of achieving family wage jobs in rural communities.

2010

The Legislature, citing the Legislative Auditor’s recommendation, passed a bill extending the expiration date for the four preferences that directly benefit aluminum smelters until 2017.

The bill included language calling for a JLARC review of aluminum smelter jobs, wages, hours, and benefits. The Legislature also asked for information about how smelter jobs compared to jobs in the surrounding communities.

2011

The Legislature repealed the additional JLARC review as part of a DOR-request technical corrections and clarification bill. This part of the bill was characterized as a repeal of redundant reporting requirements. As it was in the same section of statute, repealing the statute about the additional JLARC review also repealed the two goals the Legislature had established for the preferences.

Given the interest the Legislature expressed in 2010, this review includes information about smelter jobs and a comparison to jobs in their surrounding communities. Also, given the Legislature’s earlier expressed concern about high energy prices, this review includes information about energy prices.

2015

The Legislature extended the expiration date for the four preferences that directly benefit aluminum smelters to January 1, 2027. The Legislature explicitly identified “the preservation of employment positions within the Washington aluminum manufacturing industry” as the public policy objective for these four preferences.

1970s

Seven aluminum smelters operated at near capacity in Washington, producing approximately 1.3 million metric tons of aluminum each year during the decade. Smelters purchased approximately 2,000 megawatts of electricity directly from Bonneville Power Administration (BPA) at rates as low as $3 per megawatt hour and employed approximately 10,000 workers.

1980

The federal Nuclear Power Act authorized BPA to sign 20-year contracts with direct service industrial customers for industrial firm power.

2000

Out of concern over rising energy rates, Alcoa contemplated building its own power plant to fuel its Ferndale location.

2001

Power contracts expired during the peak of the 2000-01 energy crisis. The BPA initially signed new contracts with those companies that wanted them but only for 1,500 annual megawatts for the entire region. The BPA then bought the contracts out in the expectation that the cash would enable the smelters to survive until economic conditions improved.

Alcoa temporarily shut down its two facilities (Alcoa Intalco Works in Ferndale and Alcoa Wenatchee Works). All remaining aluminum companies shut down permanently, laid off employees, and sold properties.

2002

Alcoa Intalco Works in Ferndale reopened its smelter after being shut down for six months.

2004

Alcoa Wenatchee Works reopened its smelter after being closed for more than three years.

2008

The Chelan Public Utility District (PUD) entered into a long-term power supply contract with Alcoa. The terms of the contract included providing 26 percent of the power output from two production facilities to Alcoa in exchange for 26 percent of the capital, operation and maintenance, and debt services costs through 2028.

2012

After purchasing power from BPA through a series of short-term contracts (2-5 years), Alcoa Intalco Works in Ferndale signed a 10-year power supply agreement with BPA in December. Terms of the contract included that BPA will provide an average of 300 megawatts per year through September 2022 while Alcoa must employ a specified number of employees at the facility for the duration of the contract and make $35 million in capital improvements.

What are the public policy objectives that provide a justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature has established a specific public policy objective for four of the six aluminum preferences. The 2015 Legislature clearly stated the public policy objective of preserving employment in the aluminum manufacturing industry for the four preferences where the aluminum smelters are the primary beneficiaries.

When JLARC staff reviewed aluminum preferences in 2009, there were two public policy objectives in statute.

- Retain family wage jobs in rural areas; and

- Sustain the aluminum industry through a period of high energy prices.

These were later repealed. JLARC staff infer these two earlier public policy objectives may remain of interest to the Legislature for the two preferences available for businesses selling energy and gas to aluminum smelters.

Jobs

In 2015, the Legislature stated its public policy objective as promoting “the preservation of employment positions within the Washington aluminum manufacturing industry.” The Legislature did not establish a specific jobs target in the 2015 bill.

In 2004, the Legislature specified an employment target of retaining 75 percent of the jobs on the payroll of aluminum smelters as of January 1, 2004, adjusted for publically announced reductions before November 30, 2003. Employment Security Department data showed 1,055 jobs on the payroll as of January 1, 2004. The now-defunct Goldendale aluminum plant announced 100 layoffs before November 30 of that year, bringing the base to 955 jobs. Multiplying the base by 75 percent equals a target of 716 jobs.

The Legislature also indicated in 2004 that it wanted to preserve “family wage” jobs in rural areas. Both smelters currently operating in Washington are located in counties defined in statutes as rural—Whatcom and Chelan counties. Although “family wage” jobs are not defined in statute, it is assumed by JLARC staff that these provide wages and benefits comparable to other Washington production occupations.

Sustain the Aluminum Industry through a Period of High Energy Prices

The 2004 legislation noted that the aluminum industry is electricity intensive and was greatly affected by a dramatic increase in electricity prices that began in 2000. The bill said a goal of the preferences was to allow the aluminum industry to continue producing aluminum in this state so that the industry would be positioned to preserve and create jobs when an anticipated reduction of energy costs occurred.

A 2004 bill report indicated that the price of electricity was expected to drop after 2006. However, JLARC’s 2009 review noted that energy prices were higher and more volatile than when the preferences were originally enacted in 2004. The Legislature did not specify what would be an adequate reduction in energy prices.

What evidence exists to show that the tax preference has contributed to the achievement of any of these public policy objectives?

Jobs

It is unclear if the 2015 jobs objective is being achieved.

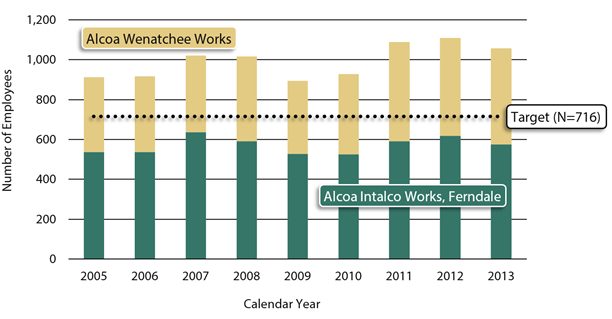

The 2015 legislation did not include an employment target. The target employment level for the industry established by the Legislature in 2004 was 716 jobs. Self-reported data submitted annually by the smelters to the Department of Revenue shows Alcoa Intalco Works in Ferndale and Alcoa Wenatchee Works reporting 576 and 482 employees, respectively, for total industry employment of 1,058 jobs in 2013. The number of employees at aluminum smelters has increased overall since the original enactment of the preferences in 2004. Exhibit 1 shows total employment in the industry in each calendar year compared to the 2004 target number of jobs. Throughout the life of the preferences, aluminum smelter employment has exceeded the 2004 employment goal.

The second aspect of the Legislature’s original employment objective was that the smelter jobs be “family wage jobs.” The Legislature did not specifically define that term for these preferences. Exhibit 2 below provides information on wages of smelter production workers. The exhibit focuses on production-related positions in the industry because these are the jobs highlighted when smelter representatives and other advocates testified in support of these preferences. Further, this job category constitutes the largest subset of aluminum smelter occupations (production-related employment ranges between 60 and 75 percent of all smelter employees).

Exhibit 2 below shows that since 2010 the wage range for smelter employees involved in production-related activities has consistently exceeded the median wage for all Washington production occupations. According to the Bureau of Labor Statistics (BLS), the median wage for all production occupations in Washington was $17.48 in 2013 whereas smelter employees in production-related positions earned between $20 and $30 per hour.

| Year | WA Aluminum Smelter Production Jobs Wage Range | Median Wage All WA Production Jobs |

|---|---|---|

| 2004 | $10.01 to $15.00 | $14.14 |

| 2005 | $15.01 to $20.00 | $14.91 |

| 2006 | $15.01 to $20.00 | $15.42 |

| 2007 | $15.01 to $20.00 | $15.63 |

| 2008 | $15.01 to $20.00 | $15.99 |

| 2009 | $15.01 to $20.00 | $16.56 |

| 2010 | $20.01 to $30.00 | $16.75 |

| 2011 | $20.01 to $30.00 | $17.39 |

| 2012 | $20.01 to $30.00 | $17.35 |

| 2013 | $20.01 to $30.00 | $17.48 |

In 2013, benefits offered by the two active aluminum smelters to all of their full time employees exceeded benefits offered by the Washington manufacturing industry as a whole. Exhibit 3 shows data for Calendar Year 2013.

| Alcoa Wenatchee Works | Alcoa Intalco Works, Ferndale | WA Manufacturing Employees (NAICS 31-33) | |||

|---|---|---|---|---|---|

| Hourly | Salaried | Hourly | Salaried | ||

| Medical Plans Offered | |||||

| Percent of full time employees eligible | 100% | 100% | 100% | 100% | 96.4% |

| Average percent premium paid by employee | 14% | 20% | 27% | 22% | 18.9% |

| Average monthly premium paid by employer | $895 | $726 | $648 | $696 | $564 |

| Dependents eligible? | Yes | Yes | Yes | Yes | Not Available |

| Dental Plans Offered | |||||

| Percent of full time employees eligible | 100% | 100% | 100% | 100% | Not Available |

| Average percent premium paid by employee | 0% | 29% | 30% | 38% | Not Available |

| Average monthly premium paid by employer | $71 | $55 | $41 | $36 | Not Available |

| Retirement Plans Offered | |||||

| Defined Benefits – percent of employees eligible (Available only to employees hired before March 1, 2006) | 100% | 100% | 100% | 100% | 17.2% |

| 401K – percent of employees eligible (Available to employees hired after March 1, 2006) | 100% | 100% | 100% | 100% | 88.3% |

Source: JLARC staff analysis of taxpayer self-reported information available in Annual Reports submitted to DOR; WA Benefits Survey 2013, Employment Security Department (Appendices 5, 7, and 8).

In 2010, the Legislature also expressed interest in knowing how wages and benefits of workers employed by the aluminum smelters compare with those of other employees in their respective communities. Exhibit 4 summarizes data on wages and health care coverage for both aluminum smelters and their counties of location. It indicates that aluminum smelter wages are higher than the 2013 average annual wage for all employees in Whatcom ($39,913) and Chelan ($32,268) counties. The percentage of aluminum smelter employees with health insurance coverage also exceeded the prevalence of health insurance coverage within their counties.

| Alcoa Intalco Works, Ferndale | Whatcom County | Alcoa Wenatchee Works | Chelan County | |

|---|---|---|---|---|

| Average Annual Wage | $52,811 | $39,913 | $52,145 | $32,268 |

| Health Insurance Coverage | 97% | 86.4% | 100% | 79.6% |

Testifying in 2010 and 2015 in support of the four tax preferences where aluminum smelters are direct beneficiaries, industry representatives pointed out that the types of jobs available at the smelters are good-paying jobs and do not require a college education. According to data provided to JLARC staff by the aluminum smelters, most jobs at the smelters do not require education beyond a high school diploma. Specifically, 85 and 77 percent of positions at Alcoa Intalco Works and Alcoa Wenatchee Works, respectively, require neither a college degree nor specialized training.

Sustain the Aluminum Industry through a Period of High Energy Prices

It is unclear whether the preferences are meeting the inferred objective for the PUT and B&O credits.

Currently Alcoa Intalco Works in Ferndale has a long-term contract to purchase power from BPA through 2022. Based on public testimony, JLARC staff learned Alcoa Wenatchee Works gets power from Chelan PUD. Both smelters also purchase power on the open market, where pricing is more variable than contract pricing.

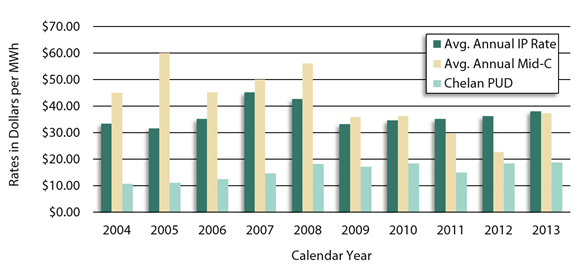

Aluminum smelters are not required to report the prices they pay for energy. To assess whether energy prices are high, JLARC staff reviewed three data sources for energy prices: the BPA average annual industrial power (IP) rate; the mid-Columbia index, which is an index of the wholesale market price of energy; and Chelan PUD’s annual reports. These indicators capture the average annual price per megawatt hour (MWh).

As Exhibit 5 below shows, the BPA and mid-Columbia indices show energy price increases in the years immediately after the preferences were enacted, followed by a decline. The average annual price from Chelan PUD is lower than the other two indices and increases over time.

The three indices show mixed results when comparing the most-recent year available to prices in 2004, the year the preferences were enacted:

- The BPA industrial power rate index (dark green bars) shows an increase from $33 per MWh in 2004 to $38 in 2013;

- The mid-Columbia index (gold bars) shows a price decline from $45 per MWh in 2004 to $37 in 2013; and

- Chelan PUD pricing (light green bars) shows increases in the price paid per MWh from $11 in 2004 to $19 in 2013, the most recent year available.

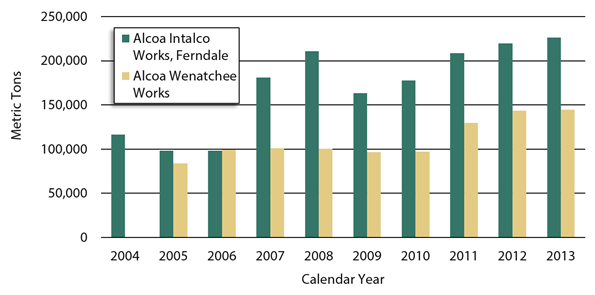

In the 2015 extension of the expiration date for the four tax preferences where smelters are the primary beneficiaries, the Legislature expressed interest in industry profitability and the change in commodity prices over time. JLARC staff reviewed aluminum production levels and aluminum prices since the preferences were enacted in 2004. As Exhibit 6 illustrates, overall aluminum production at the two smelters has increased since the incentives became law.

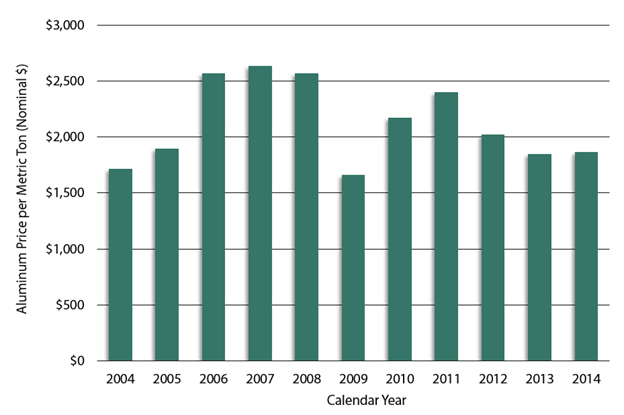

Exhibit 7 shows that average annual aluminum prices are volatile but higher in 2014 than 2004.

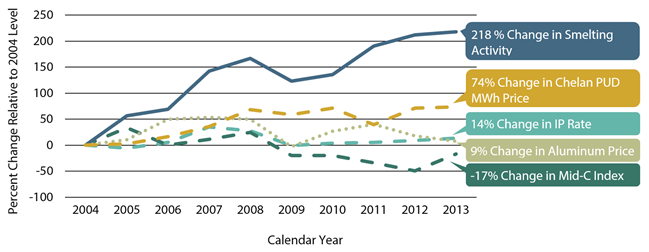

Inputs, demands, economic considerations, and global conditions involved in aluminum smelting are many and varied. Exhibit 8 below shows the percent change in each year compared to its value in 2004 for aluminum production, aluminum prices, and energy prices.

The Legislature has not identified metrics for determining when energy prices are still high, nor whether there are aluminum production levels or prices that may sustain the industry. Consequently, JLARC staff cannot draw a conclusion about how the changes in these measures in Exhibit 8 relate to the objective of sustaining the aluminum manufacturing industry in Washington.

Who are the entities whose state tax liabilities are directly affected by the tax preferences?

The beneficiaries of the four preferences where aluminum smelters are the primary beneficiary are Alcoa Intalco Works in Ferndale and Alcoa Wenatchee Works. DOR’s disclosure rules restrict reporting taxpayer savings when there are three or fewer beneficiaries. However, the aluminum smelters granted JLARC staff permission to disclose beneficiary savings for the purposes of this review.

Potential beneficiaries of the two energy tax credits are utilities or other businesses that sell electricity or natural gas to the smelters and discount the price they charge to the smelters by the amount of the credit. JLARC staff were not granted permission to disclose information about the beneficiaries of the energy PUT and B&O credits. As of March 2015, businesses are using the PUT credit but not the B&O energy credit.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

Exhibit 9 below shows the actual savings claimed by the aluminum smelters on their tax returns in fiscal years 2012 through 2014. JLARC staff estimate the beneficiary savings for the preferences where the aluminum smelters are the primary beneficiaries at $3.6 million in Fiscal Year 2014 and $7.3 million in the 2015-17 Biennium.

| Fiscal Year | Preferential Rate | B&O Tax Credit for Property Tax Paid | Sales and Use Tax Credits | Use Tax Exemption on Natural Gas | Total Beneficiary Savings |

|---|---|---|---|---|---|

| 2012 | $1,049,000 | $1,408,000 | $97,000 | $230,000 | $2,784,000 |

| 2013 | $1,080,000 | $1,450,000 | $318,000 | $249,000 | $3,097,000 |

| 2014 | $1,121,000 | $1,450,000 | $790,000 | $253,000 | $3,614,000 |

| 2015 | $1,157,000 | $1,450,000 | $713,000 | $260,000 | $3,580,000 |

| 2016 | $1,206,000 | $1,450,000 | $740,000 | $267,000 | $3,663,000 |

| 2017 | $1,206,000 | $1,450,000 | $740,000 | $267,000 | $3,663,000 |

| 2015-17 Biennium | $2,412,000 | $2,900,000 | $1,480,000 | $534,000 | $7,326,000 |

Source: JLARC staff analysis of Department of Revenue records; and industry-provided data.

Aluminum smelters are the secondary beneficiaries of the two preferences that apply to utilities or other businesses that sell electricity or natural gas to a smelter. Exhibit 10 below indicates no businesses are taking the B&O credit, and the use of the PUT credit is not disclosable.

| Fiscal Year | B&O Tax Credit | Public Utility Tax Credit |

|---|---|---|

| 2012 | $0 | Not disclosable |

| 2013 | $0 | Not disclosable |

| 2014 | $0 | Not disclosable |

| 2015 | $0 | Not disclosable |

| 2016 | $0 | Not disclosable |

| 2017 | $0 | Not disclosable |

| 2015-17 Biennium | $0 | Not disclosable |

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

As of March 2015, there are a total of eight active smelters remaining in the United States. In addition to the Ferndale and Wenatchee facilities, Alcoa owns smelters in Massena, New York, and Evansville, Indiana. The other four active smelters are owned by Century Aluminum (Hawesville and Sebree, Kentucky, and Mt. Holly, South Carolina) and Noranda Aluminum (New Madrid, Missouri).

Other states are not providing tax preferences like Washington’s direct B&O and use tax preferences. With the exception of South Carolina, the other states are, however, providing support for aluminum smelters in their states using other means, primarily

- Providing a break on electricity rates;

- Providing tax credits or grants for projects intended to make the smelters more efficient; or

- Providing tax credits or grants for the business to expand vertically to do more fabrication with the aluminum.

Indiana

Since 2006, Indiana has granted just over $2 million to Alcoa and its subsidiaries under its existing Economic Development for a Growing Economy tax credit and Skills Enhancement Fund. Several of these contracts were related to projects upgrading the Alcoa Warrick Power Plant, which supplies power to the smelter.

Kentucky

The Kentucky Economic Development Finance Authority granted $15 million in income tax credits and $1 million in sales and use tax credits to upgrade the smelter in Sebree to increase its energy efficiency and productivity.

Missouri

Between 2010 and 2012, Missouri awarded the Noranda smelter $2.5 million in tax credits, authorized under its existing Development Tax Credit program, to fund an expansion project. The state also awarded an Energy Efficiency Pilot Grant, Job Retention Training Program funds, and Community Development Block Grant funds for the project.

New York

The New York Power Authority contracted with Alcoa in 2009 to provide low-cost power for 30 years in exchange for employment level commitments and a $600 million modernization of its East Massena smelter. The contract has since been modified by lowering the employment commitment and waiving select utility bills to continue the contract.

RCW 82.04.2909 as amended by ESSB 6057 (2015)

B&O Rate Reduction for Aluminum Smelters

(1) Upon every person who is an aluminum smelter engaging within this state in the business of manufacturing aluminum; as to such persons the amount of tax with respect to such business is, in the case of manufacturers, equal to the value of the product manufactured, or in the case of processors for hire, equal to the gross income of the business, multiplied by the rate of .2904 percent.

(2) Upon every person who is an aluminum smelter engaging within this state in the business of making sales at wholesale of aluminum manufactured by that person, as to such persons the amount of tax with respect to such business is equal to the gross proceeds of sales of the aluminum multiplied by the rate of .2904 percent.

(3) A person reporting under the tax rate provided in this section must file a complete annual report with the department under RCW 82.32.534.

(4) This section expires January 1, 2027.

[2011 c 174 § 301. Prior: 2010 1st sp.s. c 2 § 1; 2010 c 114 § 108; 2006 c 182 § 1; 2004 c 24 § 3.]

RCW 82.04.4481 as amended by ESSB 6057 (2015)

Credit - Property taxes paid by aluminum smelter.

(1) In computing the tax imposed under this chapter, a credit is allowed for all property taxes paid during the calendar year on property owned by a direct service industrial customer and reasonably necessary for the purposes of an aluminum smelter.

(2) A person claiming the credit under this section is subject to all the requirements of chapter 82.32 RCW. A credit earned during one calendar year may be carried over to be credited against taxes incurred in the subsequent calendar year, but may not be carried over a second year. Credits carried over must be applied to tax liability before new credits. No refunds may be granted for credits under this section.

(3) Credits may not be claimed under this section for property taxes levied for collection in 2027 and thereafter.

(4) A person claiming the credit provided in this section must file a complete annual report with the department under RCW 82.32.534.

[2011 c 174 § 302. Prior: 2010 1st sp.s. c 2 § 2; 2010 c 114 § 118; 2006 c 182 § 2; 2004 c 24 § 8.]

RCW 82.08.805 as amended by ESSB 6057 (2015)

Exemptions - Personal property used at an aluminum smelter.

(1) A person who has paid tax under RCW 82.08.020 for personal property used at an aluminum smelter, tangible personal property that will be incorporated as an ingredient or component of buildings or other structures at an aluminum smelter, or for labor and services rendered with respect to such buildings, structures, or personal property, is eligible for an exemption from the state share of the tax in the form of a credit, as provided in this section. A person claiming an exemption must pay the tax and may then take a credit equal to the state share of retail sales tax paid under RCW 82.08.020. The person must submit information, in a form and manner prescribed by the department, specifying the amount of qualifying purchases or acquisitions for which the exemption is claimed and the amount of exempted tax.

(2) For the purposes of this section, "aluminum smelter" has the same meaning as provided in RCW 82.04.217.

(3) A person claiming the tax preference provided in this section must file a complete annual report with the department under RCW 82.32.534.

(4) Credits may not be claimed under this section for taxable events occurring on or after January 1, 2027.

[2011 c 174 § 303. Prior: 2010 1st sp.s. c 2 § 3; 2010 c 114 § 122; 2009 c 535 § 513; 2006 c 182 § 3; 2004 c 24 § 10.]

RCW 82.12.805 as amended by ESSB 6057 (2015)

Exemptions - Personal property used at an aluminum smelter.

(1) A person who is subject to tax under RCW 82.12.020 for personal property used at an aluminum smelter, or for tangible personal property that will be incorporated as an ingredient or component of buildings or other structures at an aluminum smelter, or for labor and services rendered with respect to such buildings, structures, or personal property, is eligible for an exemption from the state share of the tax in the form of a credit, as provided in this section. The amount of the credit equals the state share of use tax computed to be due under RCW 82.12.020. The person must submit information, in a form and manner prescribed by the department, specifying the amount of qualifying purchases or acquisitions for which the exemption is claimed and the amount of exempted tax.

(2) For the purposes of this section, "aluminum smelter" has the same meaning as provided in RCW 82.04.217.

(3) A person reporting under the tax rate provided in this section must file a complete annual report with the department under RCW 82.32.534.

(4) Credits may not be claimed under this section for taxable events occurring on or after January 1, 2027.

[2011 c 174 § 305. Prior: 2010 1st sp.s. c 2 § 4; 2010 c 114 § 128; 2009 c 535 § 620; 2006 c 182 § 4; 2004 c 24 § 11.]

RCW 82.12.022 as amended by ESSB 6057 (2015)

Natural or manufactured gas - Use tax imposed - Exemption.

(1) A use tax is levied on every person in this state for the privilege of using natural gas or manufactured gas within this state as a consumer.

(2) The tax must be levied and collected in an amount equal to the value of the article used by the taxpayer multiplied by the rate in effect for the public utility tax on gas distribution businesses under RCW 82.16.020. The "value of the article used" does not include any amounts that are paid for the hire or use of a gas distribution business as defined in RCW 82.16.010(2) in transporting the gas subject to tax under this subsection if those amounts are subject to tax under that chapter.

(3) The tax levied in this section does not apply to the use of natural or manufactured gas delivered to the consumer by other means than through a pipeline.

(4) The tax levied in this section does not apply to the use of natural or manufactured gas if the person who sold the gas to the consumer has paid a tax under RCW 82.16.020 with respect to the gas for which exemption is sought under this subsection.

(5)(a) The tax levied in this section does not apply to the use of natural or manufactured gas by an aluminum smelter as that term is defined in RCW 82.04.217 before January 1, 2027.

(b) A person claiming the exemption provided in this subsection (5) must file a complete annual report with the department under RCW 82.32.534.

(6) There is a credit against the tax levied under this section in an amount equal to any tax paid by:

(a) The person who sold the gas to the consumer when that tax is a gross receipts tax similar to that imposed pursuant to RCW 82.16.020 by another state with respect to the gas for which a credit is sought under this subsection; or

(b) The person consuming the gas upon which a use tax similar to the tax imposed by this section was paid to another state with respect to the gas for which a credit is sought under this subsection.

(7) The use tax imposed in this section must be paid by the consumer to the department.

(8) There is imposed a reporting requirement on the person who delivered the gas to the consumer to make a quarterly report to the department. Such report must contain the volume of gas delivered, name of the consumer to whom delivered, and such other information as the department may require by rule.

(9) The department may adopt rules under chapter 34.05 RCW for the administration and enforcement of sections 1 through 6, chapter 384, Laws of 1989.

[2011 c 174 § 304. Prior: 2010 1st sp.s. c 2 § 5; 2010 c 114 § 127; 2006 c 182 § 5; 2004 c 24 § 12; 1994 c 124 § 9; 1989 c 384 § 3.]

RCW 82.04.4482

Credit - Sales of electricity or gas to an aluminum smelter.

(1) A person who is subject to tax under this chapter on gross income from sales of electricity, natural gas, or manufactured gas made to an aluminum smelter is eligible for an exemption from the tax in the form of a credit, if the contract for sale of electricity or gas to the aluminum smelter specifies that the price charged for the electricity or gas will be reduced by an amount equal to the credit.

(2) The credit is equal to the gross income from the sale of the electricity or gas to an aluminum smelter multiplied by the corresponding rate in effect at the time of the sale under this chapter.

(3) The exemption provided for in this section does not apply to amounts received from the remarketing or resale of electricity originally obtained by contract for the smelting process.

[2004 c 24 § 9.]

RCW 82.16.0498

Credit - Sales of electricity or gas to an aluminum smelter.

(1) A person who is subject to tax under this chapter on gross income from sales of electricity, natural gas, or manufactured gas made to an aluminum smelter is eligible for an exemption from the tax in the form of a credit, if the contract for sale of electricity or gas to the aluminum smelter specifies that the price charged for the electricity or gas will be reduced by an amount equal to the credit.

(2) The credit is equal to the gross income from the sale of the electricity or gas to an aluminum smelter multiplied by the corresponding rate in effect at the time of the sale for the public utility tax under RCW 82.16.020.

(3) The exemption provided for in this section does not apply to amounts received from the remarketing or resale of electricity originally obtained by contract for the smelting process.

(4) For the purposes of this section, "aluminum smelter" has the same meaning as provided in RCW 82.04.217.

[2004 c 24 § 13.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor Recommendation 1: Review and Clarify

The Legislature should review and clarify the four tax preferences where aluminum smelters are the primary beneficiaries to specify jobs and commodity pricing metrics that can be used to determine if the objective has been achieved.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

Legislative Auditor Recommendation 2: Review and Clarify

The Legislature should review and clarify the two aluminum tax preferences available to energy sellers and brokers to provide performance statements that include public policy objectives and specify metrics to determine if the objectives have been achieved.

- If the Legislature retains its previous interest in family wage jobs in rural areas, then a jobs target and identification of how to assess “family wage jobs” would facilitate future reviews of the preferences and inform legislative decision-making.

- If the Legislature retains its previous interest in allowing the industry to continue to produce aluminum until energy costs decline, clarification on what criteria to use to assess energy price levels would facilitate future reviews and inform legislative decision-making. Different energy price indicators tell different stories about current energy price levels. Aluminum production levels and commodity price have both increased over the life of these tax preferences.

The Legislative Auditor’s guidance document for drafting performance statements provides a framework for identifying policy objectives and linking these to performance metrics.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

Legislative Auditor Recommendation 3

The Legislature may also want to consider adding a requirement for the beneficiaries of the aluminum preferences to disclose their beneficiary savings because otherwise the fiscal impact of the preferences may not be identified in the future.

The Legislature may want ongoing information about the cost to the state of the aluminum tax preferences. The combination of a small number of smelter and utility beneficiaries, current reporting requirements, and disclosure rules prevented this review from providing complete information on beneficiary savings. JLARC staff were able to disclose beneficiary savings information for the four smelter preferences only because the smelters gave us permission to do so. However, JLARC staff cannot disclose beneficiary savings information for the PUT credit because we did not receive permission to do so.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

Available December 2015.

Available December 2015.

If applicable, will be available December 2015.