JLARC Preliminary Report: 2015 Tax Preference Performance Reviews

Family Farm and Business Property | Estate Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Est. Beneficiary Savings in 2015-17 Biennium |

|---|---|---|

| When heirs are calculating the value of an estate for the estate tax, they may deduct the value of family-owned farms and business interests. | Estate Tax RCWs 83.100.046; 83.100.048 |

$3.2 million farm; business undetermined |

| Public Policy Objective |

|---|

The Legislature did not state the public policy objectives. JLARC staff infer the policy objectives were to reduce the likelihood of heirs being forced to sell the family farm or business in order to pay estate taxes. |

| Recommendations |

|---|

Legislative Auditor’s Recommendations:

|

- What is the Preference?

- Legal History

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

When heirs are calculating the value of an estate for the estate tax, they may deduct the value of family-owned farms and business interests.

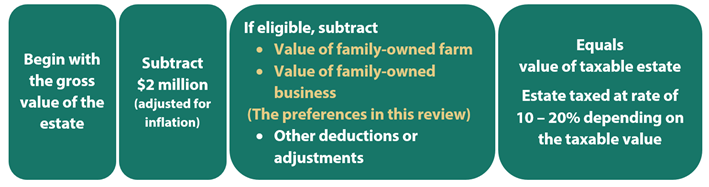

The estate tax is a tax on the transfer of property located in Washington at the time of death of the property owner. As described in Exhibit 1 below, the taxable estate is calculated by first subtracting from the gross estate a deduction of $2 million indexed to the rate of inflation (in 2015, the amount is $2,054,000). The estate may also qualify for additional deductions in specific circumstances. These other deductions include the value of qualifying family farm property and business interests. After these subtractions, the net is taxed at rates that vary from 10 percent to 20 percent depending on the taxable estate value. The tax is assessed on the estate itself rather than on the heirs to the estate.

The heirs may deduct the value of family-owned farms if:

- The decedent or family members managed the farm and used the land for farming for five of the previous eight years;

- The farm real property (e.g., land and buildings) is 25 percent or more of the taxable estate, and the farm real and personal property together is 50 percent or more of the decedent’s taxable estate; and

- On the date of the decedent’s death, the property was being used primarily for farming.

The heirs may deduct up to $2.5 million of the value of family-owned business interests if:

- The decedent or family owned and managed the operation of the business for five of the previous eight years;

- The business interests are more than 50 percent of the decedent’s taxable estate; and

- The value of the business interests is $6 million or less.

If heirs to a family-owned business interest sell the business or use the property for an unqualified purpose in the next three years, they owe a “recapture” tax. The “recapture” tax is equal to the amount of the estate tax deduction taken for the business, plus interest. There is no recapture tax for family-owned farms.

Exhibit 2 below summarizes the criteria for qualifying for the farm and business interests deductions.

| Requirement | Farms | Businesses |

|---|---|---|

| Value Limit? | No | $6 million or less |

| Deduction Limit? | No | $2.5 million or less |

| Qualifying Property Share of Estate | Real and personal property – 50% or more; and Real property only – 25% or more |

More than 50% |

| Decedent or Family Managed the Property |

5 out of the previous 8 years | 5 out of the previous 8 years |

| Recapture Tax? | No | Yes |

Washington adopted an inheritance tax in 1901 that contained no special provisions for family farms or businesses. Heirs owed inheritance tax at graduated rates that depended on their relationship to the decedent and the value of the property. For example, a child of the decedent would pay at a 1 percent rate on the taxable estate, while a distant relative or non-family member would pay rates from 6 to 12 percent depending on the value of the estate.

The inheritance tax differed from the current estate tax, which taxes the estate instead of the heirs.

1979

The first special treatment for family farm and business interests came in 1979. Similar to a federal estate tax provision, the Legislature allowed family farms or other business interests to be valued at current use rather than at highest and best use for inheritance tax purposes, with the reduction in value limited to $500,000 or less. This tax treatment was limited to certain circumstances:

- The family had to have managed operation of the farm or business for five out of the previous eight years;

- At least 50 percent of the real and personal property and 25 percent of the real property had to be used for farm or other business purposes; and

- If heirs sold the property or used the property for an unqualified purpose in the next 15 years, they owed a “recapture” tax.

Another provision phased out the tax on community property inherited by a surviving spouse.

1981

Voters approved Initiative 402, repealing the state inheritance tax effective January 1, 1982. The initiative reduced the amount of Washington tax paid on an estate and reduced the amount of revenue collected by the state.

In place of the inheritance tax, the act established a state tax on estates equal to the maximum amount of a federal estate tax credit. The operation of the new state initiative allowed a Washington estate to claim a credit against its federal tax equivalent to the amount of state estate tax paid.

The initiative retained the tax treatment allowing current use valuation of family farms and businesses rather than valuation at highest and best use. The federal law contained a recapture tax, but the new state law did not.

1988

The Legislature reinstated a “recapture” tax for family farm and closely held business property. The state “recapture” tax acted as a credit against the federal recapture tax, so that the recapture did not represent an increase in tax liability to Washington estates.

2001

Congress adopted legislation phasing out the federal estate tax by 2010 and eliminating the federal credit by 2005.

Earlier in the same year, the Legislature had adjusted Washington’s estate tax to match the amount of the federal tax credit in place at that time. As the credit phased out, Washington estates would owe more in state tax than they could receive in Federal credit.

2005

In February, the State Supreme Court in Hemphill v. Department of Revenue invalidated Washington’s estate tax to the extent it exceeded the federal credit. The Court reasoned that the 1981 initiative taxed estates only to the extent of the federal credit, and the federal credit was zero as of 2005.

Following the court decision, the Legislature enacted a “standalone” estate tax independent of the federal tax. The new law imposed a tax on the transfer of property located in Washington at the time of death at rates ranging from 10 to 19 percent of the taxable estate. The bill allowed all estates to subtract $2 million from the gross value of the estate.

The new tax included a full deduction for the value of property used primarily for farming on family-owned farms. There was no recapture tax if the heirs sold the farm. The Legislature did not provide a deduction for the value of family-owned business interests.

2013

In the second extraordinary session, the House amended an estate tax bill to allow a deduction for family-owned business interests. The deduction applied to business interests valued at $6 million or less and was capped at $2.5 million for each estate. The deduction took effect for deaths occurring on or after January 1, 2014. Unlike the farm deduction, heirs benefiting from the business interests deduction pay a recapture tax if they sell the business during the three years after acquiring the interests.

The House sponsor described the amendment as a revenue neutral compromise with the Senate in which the family-owned business deduction would pay for itself with a tax increase on larger estates. In the same amendment, the Legislature indexed the general $2 million estate tax provision to inflation and increased the top rates for taxable estates of over $4 million.

The underlying bill also retroactively closed an exemption for marital trusts resulting from the Supreme Court’s decision in Bracken v. Department of Revenue that was unrelated to the business deduction.

What are the public policy objectives that provide a justification for the tax preferences? Is there any documentation on the purpose or intent of the tax preferences?

The Legislature did not state the public policy objectives for the family-owned farm or family-owned business estate tax deductions.

JLARC staff infer from public records and 2013 floor debate that the public policy objective was to reduce the likelihood of heirs being forced to sell the family farm or business in order to pay estate taxes.

The statement for Initiative 402 in the 1981 voters’ pamphlet, co-authored by Senator Kent Pullen, Representative Mike Patrick, and the initiative committee, stated:

“A child has the right to continue a small family business or the family farm without having to sell the property to large corporations or foreign investors in order to pay inheritance tax. A tax that destroys these basic rights is unjust.”

In a 2013 House floor speech on the business interests deduction, a member described the amendment as helping the “many small businesses that have capital, buildings, and other assets, but not enough cash to pay the estate tax.”

What evidence exists to show that the tax preferences have contributed to the achievement of any of these public policy objectives?

For those estates that qualify, the preferences reduce the likelihood that heirs will be forced to sell the farm or business property in order to pay estate taxes.

While the farm and business deductions reduce the taxable estate, the estate may be liable for estate taxes on property or other assets not eligible for these deductions.

Who are the entities whose state tax liabilities are directly affected by the tax preferences?

The potential beneficiaries of the tax preferences are estates with land used for active family farming, and estates with business operations. As of March 2015 data was not yet available to identify the beneficiaries of the business deduction. The analysis below refers to the beneficiaries of the farm deduction.

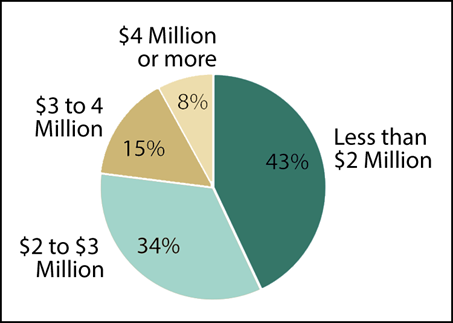

When heirs file a state tax return for the estate tax, they identify whether the estate is taking the deduction for family-owned farm property. Since Fiscal Year 2006, the first year for tax returns under Washington’s “standalone” estate tax, an average of eight estates a year have reported taking this deduction. The tax returns also list the value of the farm property. Exhibit 3 below shows the distribution of reported farm values for estates claiming this deduction.

To what extent are the tax preferences providing unintended benefits to entities other than those the Legislature intended?

For both deductions, the inferred public policy objective is to keep heirs from being forced to sell the family farm or business in order to pay the estate tax. Unlike the farm deduction, the business interests deduction contains a mechanism to recapture the tax if heirs sell the business.

If the Legislature intended to limit the farm deduction to beneficiaries who planned to keep the farm in the family, then the law may need to be restructured. As the law is currently structured, the heirs may choose to immediately sell the farm after inheriting the property, even if the estate has benefited from the farm deduction.

What are the past and future tax revenue and economic impacts of the tax preferences to the taxpayer and to the government if they are continued?

As of March 2015 data was not yet available to estimate beneficiary savings for the family business interests deduction. The first returns were due in October 1, 2014, and can be extended until April 1, 2015.

JLARC staff estimated the beneficiary savings for the farm deduction from Washington estate tax returns. Accounting for the graduated rates and the interaction of other statutory deductions, JLARC staff calculated the difference between the estate tax with and without the farm deduction.

JLARC staff estimate that the beneficiary savings from the farm deduction is $1.6 million in Fiscal Year 2014 and $3.2 million for the 2015-17 Biennium. The savings may vary considerably from year to year depending on the value of estates owing tax in that year. For example, in Fiscal Year 2013, savings from the farm deduction increased to $4.8 million from $1.4 million in the previous year. Taxpayer savings averaged $1.6 million a year for Fiscal Years 2006 through 2013.

| Fiscal Year | Farm Estate Tax Savings |

|---|---|

| 2012 | $1,422,000 |

| 2013 | $4,794,000 |

| 2014 | $1,600,000 |

| 2015 | $1,600,000 |

| 2016 | $1,600,000 |

| 2017 | $1,600,000 |

| 2015-17 Biennium | $3,200,000 |

If the tax preferences were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preferences and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the tax preferences were terminated, it is not certain that estates would pay more taxes. Beneficiaries may have other options to reduce their estate tax liability. Some beneficiaries may be able to claim other deductions available to them such as the marital deduction. Estate tax planning and gifting strategies may reduce the taxable estate. Washington has no gift tax.

In the absence of exercising these other options, it is possible that heirs would have to sell the family farm and business property in order to pay Washington’s estate tax.

Do other states have similar tax preferences and what potential public policy benefits might be gained by incorporating corresponding provisions in Washington?

Eighteen other states and the District of Columbia impose some form of taxes on the transfer of property at death, either estate or inheritances taxes or both.

Ten states, including Washington, allow some form of special treatment for family-owned farm or business property:

- Kentucky, New York, Rhode Island, Tennessee, and Vermont allow for current use valuation of farmland for estate tax purposes similar to federal provisions.

- Maryland, Minnesota, and Oregon allow a deduction or credit for the value of farmland within dollar limitations. Washington and Pennsylvania allow an unlimited deduction for farmland.

- Minnesota, Pennsylvania, and Washington allow a deduction for the value of business interests.

RCW 83.100.046

Deduction - Property used for farming - Requirements, conditions.

(1) For the purposes of determining the Washington taxable estate, a deduction is allowed from the federal taxable estate for:

(a) The value of qualified real property reduced by any amounts allowable as a deduction in respect of the qualified real property under 26 U.S.C. Sec. 2053(a)(4) of the federal internal revenue code, if the decedent was at the time of his or her death a citizen or resident of the United States.

(b) The value of any tangible personal property used by the decedent or a member of the decedent's family for a qualified use on the date of the decedent's death, reduced by any amounts allowable as a deduction in respect of the tangible personal property under 26 U.S.C. Sec. 2053(a)(4) of the federal internal revenue code, if all of the requirements of subsection (10)(f)(i)(A) of this section are met and the decedent was at the time of his or her death a citizen or resident of the United States.

(c) The value of real property that is not deductible under (a) of this subsection solely by reason of subsection (10)(f)(i)(B) of this section, reduced by any amounts allowable as a deduction in respect of the real property under 26 U.S.C. Sec. 2053(a)(4) of the federal internal revenue code, if the requirements of subsection (10)(f)(i)(C) of this section are met with respect to the property and the decedent was at the time of his or her death a citizen or resident of the United States.

(2) Property will be considered to have been acquired from or to have passed from the decedent if:

(a) The property is so considered under 26 U.S.C. Sec. 1014(b) of the federal internal revenue code;

(b) The property is acquired by any person from the estate; or

(c) The property is acquired by any person from a trust, to the extent the property is includible in the gross estate of the decedent.

(3) If the decedent and the decedent's surviving spouse at any time held qualified real property as community property, the interest of the surviving spouse in the property must be taken into account under this section to the extent necessary to provide a result under this section with respect to the property which is consistent with the result which would have obtained under this section if the property had not been community property.

(4) In the case of any qualified woodland, the value of trees growing on the woodland may be deducted if otherwise qualified under this section.

(5) If property is qualified real property with respect to a decedent, hereinafter in this subsection referred to as the "first decedent," and the property was acquired from or passed from the first decedent to the surviving spouse of the first decedent, active management of the farm by the surviving spouse must be treated as material participation by the surviving spouse in the operation of the farm.

(6) Property owned indirectly by the decedent may qualify for a deduction under this section if owned through an interest in a corporation, partnership, or trust as the terms corporation, partnership, or trust are used in 26 U.S.C. Sec. 2032A(g) of the federal internal revenue code. In order to qualify for a deduction under this subsection, the interest, in addition to meeting the other tests for qualification under this section, must qualify under 26 U.S.C. Sec. 6166(b)(1) of the federal internal revenue code as an interest in a closely held business on the date of the decedent's death and for sufficient other time, combined with periods of direct ownership, to equal at least five years of the eight-year period preceding the death.

(7)(a) If, on the date of the decedent's death, the requirements of subsection (10)(f)(i)(C)(II) of this section with respect to the decedent for any property are not met, and the decedent (i) was receiving old age benefits under Title II of the social security act for a continuous period ending on such date, or (ii) was disabled for a continuous period ending on this date, then subsection (10)(f)(i)(C)(II) of this section must be applied with respect to the property by substituting "the date on which the longer of such continuous periods began" for "the date of the decedent's death" in subsection (10)(f)(i)(C) of this section.

(b) For the purposes of (a) of this subsection, an individual is disabled if the individual has a mental or physical impairment which renders that individual unable to materially participate in the operation of the farm.

(8) Property may be deducted under this section whether or not special valuation is elected under 26 U.S.C. Sec. 2032A of the federal internal revenue code on the federal return. For the purposes of determining the deduction under this section, the value of property is its value as used to determine the value of the gross estate.

(9)(a) In the case of any qualified replacement property, any period during which there was ownership, qualified use, or material participation with respect to the replaced property by the decedent or any member of the decedent's family must be treated as a period during which there was ownership, use, or material participation, as the case may be, with respect to the qualified replacement property.

(b) Subsection (9)(a) of this section does not apply to the extent that the fair market value of the qualified replacement property, as of the date of its acquisition, exceeds the fair market value of the replaced property, as of the date of its disposition.

(c) For the purposes of this subsection (9), the following definitions apply:

(i)(A) "Qualified replacement property" means any real property:

(I) Which is acquired in an exchange which qualifies under 26 U.S.C. Sec. 1031 of the federal internal revenue code; or

(II) The acquisition of which results in the nonrecognition of gain under 26 U.S.C. Sec. 1033 of the federal internal revenue code.

(B) The term "qualified replacement property" only includes property which is used for the same qualified use as the replaced property was being used before the exchange.

(ii) "Replaced property" means the property was:

(A) Transferred in the exchange which qualifies under 26 U.S.C. Sec. 1031 of the federal internal revenue code; or

(B) Compulsorily or involuntarily converted within the meaning of 26 U.S.C. Sec. 1033 of the federal internal revenue code.

(10) For the purposes of this section, the following definitions apply:

(a) "Active management" means the making of the management decisions of a farm, other than the daily operating decisions.

(b) "Farm" includes stock, dairy, poultry, fruit, furbearing animal, and truck farms; plantations; ranches; nurseries; ranges; greenhouses or other similar structures used primarily for the raising of agricultural or horticultural commodities; and orchards and woodlands.

(c) "Farming purposes" means:

(i) Cultivating the soil or raising or harvesting any agricultural or horticultural commodity, including the raising, shearing, feeding, caring for, training, and management of animals on a farm;

(ii) Handling, drying, packing, grading, or storing on a farm any agricultural or horticultural commodity in its unmanufactured state, but only if the owner, tenant, or operator of the farm regularly produces more than one-half of the commodity so treated; and

(iii)(A) The planting, cultivating, caring for, or cutting of trees; or

(B) The preparation, other than milling, of trees for market.

(d)(i) "Member of the family" means, with respect to any individual, only:

(A) An ancestor of the individual;

(B) The spouse or state registered domestic partner of the individual;

(C) A lineal descendant of the individual, of the individual's spouse or state registered domestic partner, or of a parent of the individual; or

(D) The spouse or state registered domestic partner of any lineal descendant described in (d)(i)(C) of this subsection.

(ii) For the purposes of this subsection (10)(d), a legally adopted child of an individual must be treated as the child of such individual by blood.

(e) "Qualified heir" means, with respect to any property, a member of the decedent's family who acquired property, or to whom property passed, from the decedent.

(f)(i) "Qualified real property" means real property which was acquired from or passed from the decedent to a qualified heir of the decedent and which, on the date of the decedent's death, was being used for a qualified use by the decedent or a member of the decedent's family, but only if:

(A) Fifty percent or more of the adjusted value of the gross estate consists of the adjusted value of real or personal property which:

(I) On the date of the decedent's death, was being used for a qualified use by the decedent or a member of the decedent's family; and

(II) Was acquired from or passed from the decedent to a qualified heir of the decedent;

(B) Twenty-five percent or more of the adjusted value of the gross estate consists of the adjusted value of real property which meets the requirements of (f)(i)(A)(II) and (f)(i)(C) of this subsection; and

(C) During the eight-year period ending on the date of the decedent's death there have been periods aggregating five years or more during which:

(I) The real property was owned by the decedent or a member of the decedent's family and used for a qualified use by the decedent or a member of the decedent's family; and

(II) There was material participation by the decedent or a member of the decedent's family in the operation of the farm. For the purposes of this subsection (f)(i)(C)(II), material participation must be determined in a manner similar to the manner used for purposes of 26 U.S.C. Sec. 1402(a)(1) of the federal internal revenue code.

(ii) For the purposes of this subsection, the term "adjusted value" means:

(A) In the case of the gross estate, the value of the gross estate, determined without regard to any special valuation under 26 U.S.C. Sec. 2032A of the federal internal revenue code, reduced by any amounts allowable as a deduction under 26 U.S.C. Sec. 2053(a)(4) of the federal internal revenue code; or

(B) In the case of any real or personal property, the value of the property for purposes of chapter 11 of the federal internal revenue code, determined without regard to any special valuation under 26 U.S.C. Sec. 2032A of the federal internal revenue code, reduced by any amounts allowable as a deduction in respect of such property under 26 U.S.C. Sec. 2053(a)(4) of the federal internal revenue code.

(g) "Qualified use" means the property is used as a farm for farming purposes. In the case of real property which meets the requirements of (f)(i)(C) of this subsection, residential buildings and related improvements on the real property occupied on a regular basis by the owner or lessee of the real property or by persons employed by the owner or lessee for the purpose of operating or maintaining the real property, and roads, buildings, and other structures and improvements functionally related to the qualified use must be treated as real property devoted to the qualified use. For tangible personal property eligible for a deduction under subsection (1)(b) of this section, "qualified use" means the property is used primarily for farming purposes on a farm.

(h) "Qualified woodland" means any real property which:

(i) Is used in timber operations; and

(ii) Is an identifiable area of land such as an acre or other area for which records are normally maintained in conducting timber operations.

(i) "Timber operations" means:

(i) The planting, cultivating, caring for, or cutting of trees; or

(ii) The preparation, other than milling, of trees for market.

[2010 c 106 § 236; (2010 c 106 § 235 expired January 1, 2014); 2009 c 521 § 191; 2005 c 514 § 1201; 2005 c 516 § 4.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor Recommendation 1: Review and Clarify

The Legislature should review and clarify whether there are unintended beneficiaries of the estate tax deduction for family farms because the heirs may immediately sell the farm without penalty.

The deduction is meeting the inferred public policy objective of reducing the likelihood of heirs being forced to sell the property to pay estate taxes. If the Legislature intended to limit the preference to beneficiaries who planned to keep the farm in the family, then the law may need to be restructured. As the law is currently written, the heirs may choose to immediately sell the farm even if the estate has benefited from the farm deduction.

Legislation Required: Yes.

Fiscal Impact: Depends on the legislative action.

Legislative Auditor Recommendation 2: Continue

The Legislature should continue the estate tax deduction for family business interests because the tax preference is meeting the inferred public policy objective of reducing the likelihood of heirs being forced to sell the property to pay estate taxes.

The deduction is structured so that tax is recaptured if heirs sell the business within three years.

Legislation Required: No.

Fiscal Impact: None.

Available December 2015.

Available December 2015.

If applicable, will be available December 2015.