JLARC Proposed Final Report: 2015 Tax Preference Performance Reviews

Public Facilities Districts | Leasehold Excise Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Est. Beneficiary Savings in 2015-17 Biennium |

|---|---|---|

| A leasehold excise tax (LET) exemption to people and businesses that lease public property in a public facilities district (PFD). | Leasehold Excise RCW 82.29A.130(16) |

$0.9 million |

| Public Policy Objective |

|---|

| The Legislature did not state the public policy objective. JLARC staff infer the policy objective was to provide the same LET treatment to other county and city PFDs and facilities that the Legislature had provided to CenturyLink and Safeco Fields. |

| Recommendations |

|---|

Legislative Auditor’s Recommendation: Review and Clarify To provide a performance statement that includes a public policy objective and specifies metrics to determine if the objectives have been achieved, and to add reporting or other accountability requirements to provide better information on the use of the preference. Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation without comment. |

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objective

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statute

This preference exempts people and businesses that lease public property in a public facilities district (PFD) for 30 or more consecutive days from paying a leasehold excise tax. A “leasehold excise tax” (LET) is a tax that private parties pay in lieu of property tax to use or lease publicly owned property. (Please see the Other Relevant Background section for additional detail on the leasehold excise tax.)

Facilities that qualify for this preference include sports arenas, entertainment venues, conference and convention centers, and special events facilities located throughout the state. Examples of people or businesses that might lease these facilities include:

- A sports team that leases part of a facility for practices and games on an ongoing basis, or

- A concessionaire or retail establishment that occupies part of the facility on an ongoing basis.

Definitions

- “Leasehold excise tax” (LET) is a tax in-lieu-of property tax that is paid by private parties for use or lease of publicly owned property.

- A “leasehold interest” is a person or business’s right to possess, occupy, and use publicly owned property that is exempt from property tax.

- “Publicly owned” means owned by the federal, state, or a local government, or another public entity.

- “Public facilities districts” are municipal corporations that cities, towns, counties, or combinations of contiguous cities or counties create, in order to acquire, create, or operate certain public facilities. These public facilities may include convention centers, museums, and sports, recreation, and entertainment facilities.

Leases of public facilities in PFDs for periods less than 30 consecutive days are exempt from LET under a separate statute. JLARC staff reviewed this preference in 2012.

This preference does not apply to CenturyLink Field and Exhibition Center and Safeco Field. The Legislature created separate LET preferences specifically for those facilities. Summary information about these preferences was included in the 2014 Expedited Tax Preference Report.

All publicly owned property in Washington is constitutionally exempt from property taxation.

While the publicly owned property is exempt from property tax, questions remained on how to handle taxation when a private party leased that public land. The Legislature enacted the leasehold excise tax in 1976 to address the issue of how to tax benefits received by private lessees of property that is owned by the public.

When the Legislature initially enacted the leasehold excise tax (LET), it provided 11 exemptions from the tax for private leasehold interests in public property. The legislation did not provide any specific policy objectives for these exemptions. JLARC staff reviewed two of these initial exemptions in 2012: a LET exemption for private leases of publicly owned property when taxable rent was less than $250 per year and a LET exemption for leasehold interests for less than 30 contiguous days.

1988

The Legislature first authorized counties to create public facilities districts. The legislation related to construction and funding of the Washington State Convention and Trade Center in King County and also authorized a new public facilities district (PFD) in Spokane County for construction, financing, and ownership of a new public assembly facility (now Veterans Memorial Arena).

The Legislature did not provide a LET exemption for leasehold interests associated with these PFDs.

1995

The Legislature passed legislation to help fund construction of a baseball stadium (Safeco Field).

The legislation included a new LET exemption for businesses leasing space at Safeco. Specifically, the bill provided an exemption from LET for leasehold interests in public or entertainment areas in a baseball stadium meeting certain criteria and constructed on or after January 1, 1995.

1997

The Legislature authorized creation of a public development authority (PDA) to facilitate funding, construction, and operation of a stadium and exhibition center (CenturyLink Field). A PDA is similar to a PFD but is created by a city, town or county to carry out a single, specific project.

The legislation included a new LET exemption for businesses leasing space at CenturyLink. Specifically, the bill provided an exemption from LET for leasehold interests in public or entertainment areas of a stadium and exhibition center constructed on or after January 1, 1998.

1999

The Legislature expanded the potential use of PFDs by allowing cities with a population of less than 1 million or contiguous groups of cities or towns, or cities, towns, and counties to create PFDs for the purpose of financing, building, and operating “regional centers.” The legislation defined “regional centers” as convention, conference, or special event centers or any combination thereof, and related parking facilities, serving a regional population where the costs (including debt service) were at least $10 million.

At the time, Spokane was seeking to expand its PFD beyond a county PFD, and four other cities (Vancouver, Tacoma, Yakima, and Everett) were seeking to create regional centers.

The legislation created this LET exemption. The exemption applied to both the newly authorized city or city/county PFDs, and the county PFDs that had been authorized in statute since 1988. The preference has not been modified since.

Leasehold Excise Tax Basics

Private property is usually subject to property tax, and a private property owner may incorporate the amount of the tax when establishing a lease rate. Since publicly owned property is not subject to property tax, leasehold excise tax (LET) allows taxation of leases of public property so that parties leasing government-owned property do not realize an economic benefit over parties leasing private property.

Examples where a LET is applied include:

- Airline facilities at public airports;

- Use of state-owned tidelands managed by the Department of Natural Resources; and

- Businesses leasing properties owned by the University of Washington in Seattle’s downtown core.

The leasehold excise tax is calculated by applying the applicable tax rate to the contract rent paid for use of the public property or facility. The LET is generally paid by the person or business who leases government-owned real or personal property (the lessee), and is collected by the lessor of the property, who reports and pays the tax to DOR on a quarterly basis. Typically, buildings or other improvements have been added to the property. In such cases, the leasehold interest is in the public land or publicly owned structures, while any privately owned improvements are subject to regular property tax.

Currently, the total LET rate is 12.84 percent. LET revenues are distributed among the state, counties, and many cities. All 39 counties and most cities within them levy a local LET.

- Cities and counties may levy a local LET within their jurisdictions up to a maximum rate of 6 percent. The state rate is reduced by the amount of the local LET rate so that the total does not exceed 12.84 percent.

- The maximum city rate is 4 percent and is credited against the county rate.

- The maximum county rate is 6 percent in unincorporated areas and 2 percent in cities that levy the maximum rate.

Public Facilities District (PFD) Basics

The Legislature authorized PFDs in 1988 to help counties and cities finance, develop, and operate certain types of facilities such as sports, entertainment, special event, and convention centers. They are governed by RCW 35.57.010 (for cities) and RCW 36.100.010 (for counties).

PFDs are municipal corporations and independent taxing authorities created by ordinance or resolution by the legislative authority of a city, town, county, or combinations of contiguous cities or counties to perform a specific statutory purpose.

- City and town PFDs are authorized to build, own, and operate regional centers, which statute defines as convention, conference, or special events centers, or combinations thereof, and related parking facilities.

- County PFDs have slightly broader powers. They are authorized to build, own, and operate not only regional centers, but also sports facilities, entertainment facilities, convention facilities (including convention and trade centers) and (for districts formed after January 1, 2000) recreational facilities other than ski areas, along with contiguous parking facilities.

PFDs can generate funds by:

- Charging fees for use of its facilities;

- Leasing the facility or portions of it on a long-term (over 30 consecutive days) basis;

- Levying an admissions tax not exceeding five percent; and

- Imposing a vehicle parking tax not exceeding 10 percent.

- Certain PFDs are authorized to impose sales and use taxes.

- PFDs may also impose a lodging tax with voter approval.

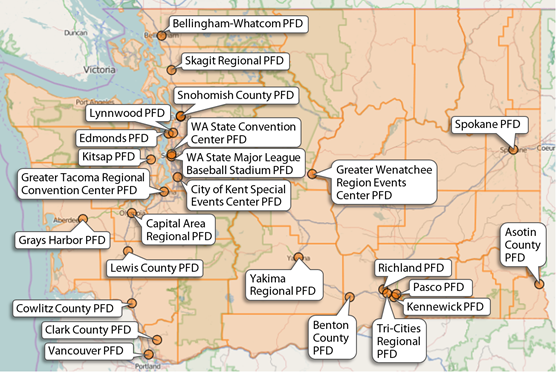

Washington’s Public Facility Districts

As of April 2015, there are 26 PFDs in Washington. They have helped to finance, build, own, and operate 29 facilities. Some PFDs do not have a facility themselves, but they support other PFD facilities. See Exhibit 1, below, and view an interactive version here.

What are the public policy objectives that provide justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature did not state a public policy objective for this leasehold excise tax exemption for public facilities districts.

JLARC staff infer the public policy objective may have been to provide the same leasehold excise tax (LET) treatment to other county and city PFDs and facilities that the Legislature had provided to CenturyLink and Safeco fields.

The Legislature has not stated if it has an underlying public policy objective for providing LET exemptions to all public facility districts, including CenturyLink and Safeco fields.

What evidence exists to show that the tax preference has contributed to the achievement of these public policy objectives?

The preference is meeting the inferred public policy objective of providing the same LET treatment to county and city PFD facilities that the Legislature provided to CenturyLink and Safeco fields.

If there is an underlying objective the Legislature may have for providing an LET exemption to all public facility districts, this would need to be identified before any additional analysis can be conducted.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

The beneficiaries of this preference are businesses or other groups that lease facilities or parts of facilities owned by city or county public facility districts for periods of 30 or more consecutive days. Examples include concessionaires, restaurants, or sports groups (professional, semi-professional, amateur, or youth) that lease space from the current 26 PFDs. There is no accountability reporting for the preference, so the number and type of beneficiaries is unclear.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

There is no accountability reporting required for this preference. JLARC staff estimated the beneficiary savings for this preference by contacting public facility districts and their associated facilities and requesting data on qualifying long-term leases.

JLARC staff estimate the beneficiary savings for this preference at $466,000 in Calendar Year 2014 and $934,000 in Calendar Years 2016 and 2017. See Exhibit 2, below.

| Calendar Year | Estimated Qualifying Leases | Total Beneficiary Savings |

|---|---|---|

| 2012 | $3,047,000 | $391,000 |

| 2013 | $3,182,000 | $409,000 |

| 2014 | $3,627,000 | $466,000 |

| 2015 | $3,637,000 | $467,000 |

| 2016 | $3,637,000 | $467,000 |

| 2017 | $3,637,000 | $467,000 |

| 2016-17 Total | $7,274,000 | $934,000 |

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the tax preference were terminated, people and businesses that lease facilities financed by public facility districts would be subject to leasehold excise tax. The current rate is 12.84 percent.

The effect of paying the LET on people and businesses that lease these facilities and on the overall economic well-being of the facilities and the PFDs depends on the extent to which the lessees could absorb the increased costs or pass them along to their customers.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

JLARC staff did not address this question due to the unique structure of Washington’s leasehold excise tax. Research by JLARC staff did not identify a tax in another state that functions like the LET.

RCW 82.29A.130(16)

Exemptions - Certain property.

The following leasehold interests shall be exempt from taxes imposed pursuant to RCW 82.29A.030 and 82.29A.040:

(1) All leasehold interests constituting a part of the operating properties of any public utility which is assessed and taxed as a public utility pursuant to chapter 84.12 RCW.

(2) All leasehold interests in facilities owned or used by a school, college or university which leasehold provides housing for students and which is otherwise exempt from taxation under provisions of RCW 84.26.050.

(3) All leasehold interests of subsidized housing where the fee ownership of such property is vested in the government of the United States, or the state of Washington or any political subdivision thereof but only if income qualification exists for such housing.

(4) All leasehold interests used for fair purposes of a nonprofit fair association that sponsors or conducts a fair or fairs which receive support from revenues collected pursuant to RCW 67.16.100 and allocated by the director of the department of agriculture where the fee ownership of such property is vested in the government of the United States, the state of Washington or any of its political subdivisions: PROVIDED, That this exemption shall not apply to the leasehold interest of any sublessee of such nonprofit fair association if such leasehold interest would be taxable if it were the primary lease.

(5) All leasehold interests in any property of any public entity used as a residence by an employee of that public entity who is required as a condition of employment to live in the publicly owned property.

(6) All leasehold interests held by enrolled Indians of lands owned or held by any Indian or Indian tribe where the fee ownership of such property is vested in or held in trust by the United States and which are not subleased to other than to a lessee which would qualify pursuant to this chapter, RCW 84.36.451.

(7) All leasehold interests in any real property of any Indian or Indian tribe, band, or community that is held in trust by the United States or is subject to a restriction against alienation imposed by the United States: PROVIDED, That this exemption shall apply only where it is determined that contract rent paid is greater than or equal to ninety percent of fair market rental, to be determined by the department of revenue using the same criteria used to establish taxable rent in *RCW 82.29A.020(2)(b).

(8) All leasehold interests for which annual taxable rent is less than two hundred fifty dollars per year. For purposes of this subsection leasehold interests held by the same lessee in contiguous properties owned by the same lessor shall be deemed a single leasehold interest.

(9) All leasehold interests which give use or possession of the leased property for a continuous period of less than thirty days: PROVIDED, That for purposes of this subsection, successive leases or lease renewals giving substantially continuous use of possession of the same property to the same lessee shall be deemed a single leasehold interest: PROVIDED FURTHER, That no leasehold interest shall be deemed to give use or possession for a period of less than thirty days solely by virtue of the reservation by the public lessor of the right to use the property or to allow third parties to use the property on an occasional, temporary basis.

(10) All leasehold interests under month-to-month leases in residential units rented for residential purposes of the lessee pending destruction or removal for the purpose of constructing a public highway or building.

(11) All leasehold interests in any publicly owned real or personal property to the extent such leasehold interests arises solely by virtue of a contract for public improvements or work executed under the public works statutes of this state or of the United States between the public owner of the property and a contractor.

(12) All leasehold interests that give use or possession of state adult correctional facilities for the purposes of operating correctional industries under RCW 72.09.100.

(13) All leasehold interests used to provide organized and supervised recreational activities for persons with disabilities of all ages in a camp facility and for public recreational purposes by a nonprofit organization, association, or corporation that would be exempt from property tax under RCW 84.36.030(1) if it owned the property. If the publicly owned property is used for any taxable purpose, the leasehold excise taxes set forth in RCW 82.29A.030 and 82.29A.040 shall be imposed and shall be apportioned accordingly.

(14) All leasehold interests in the public or entertainment areas of a baseball stadium with natural turf and a retractable roof or canopy that is in a county with a population of over one million, that has a seating capacity of over forty thousand, and that is constructed on or after January 1, 1995. "Public or entertainment areas" include ticket sales areas, ramps and stairs, lobbies and concourses, parking areas, concession areas, restaurants, hospitality and stadium club areas, kitchens or other work areas primarily servicing other public or entertainment areas, public rest room areas, press and media areas, control booths, broadcast and production areas, retail sales areas, museum and exhibit areas, scoreboards or other public displays, storage areas, loading, staging, and servicing areas, seating areas and suites, the playing field, and any other areas to which the public has access or which are used for the production of the entertainment event or other public usage, and any other personal property used for these purposes. "Public or entertainment areas" does not include locker rooms or private offices exclusively used by the lessee.

(15) All leasehold interests in the public or entertainment areas of a stadium and exhibition center, as defined in RCW 36.102.010, that is constructed on or after January 1, 1998. For the purposes of this subsection, "public or entertainment areas" has the same meaning as in subsection (14) of this section, and includes exhibition areas.

(16) All leasehold interests in public facilities districts, as provided in chapter 36.100 or 35.57 RCW.

- Legislative Auditor Recommendation

- Commissioners’ Recommendation

- Letter from Commission Chair

- Agency Response

Legislative Auditor Recommendation: Review and Clarify

The Legislature should review and clarify the public facilities districts preference to provide a performance statement that includes a public policy objective and specifies metrics to determine if the objectives have been achieved, and to add reporting or other accountability requirements to provide better information on use of the preference.

The Legislative Auditor’s guidance document for drafting performance statements provides a framework for identifying policy objectives and linking these to performance metrics.

The preference is achieving the inferred public policy objective of providing the same leasehold excise tax treatment to county and city public facilities district facilities that the Legislature provided to CenturyLink and Safeco fields. However, the Legislature may have an underlying objective for providing this same LET tax treatment to all of these public facilities.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation without comment.