JLARC Final Report: 2015 Tax Preference Performance Reviews

Report 15-5, January 2016

Warehouse and Grain Elevator Construction and Equipment | Sales & Use Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Est. Beneficiary Savings in 2015-17 Biennium |

|---|---|---|

| A sales and use tax remittance for amounts spent on construction, expansion, or equipment of warehouses, grain elevators, and cold storage facilities. | Sales and Use RCWs 82.08.820; 82.12.820 |

$10.5 million |

| Public Policy Objective |

|---|

| The Legislature stated the public policy objective for this preference was to stimulate interstate trade. JLARC staff infer the additional public policy objective of creating and retaining family wage jobs. |

| Recommendations |

|---|

| Legislative Auditor’s Recommendation: Review and Clarify

To provide more specificity about what trade and what kinds of jobs the Legislature has as its objectives, measurable targets for these objectives, and data collection mechanisms that can be used to assess performance in meeting these objectives. Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation without comment. |

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

These sales and use tax preferences provide a refund of a percentage of the state sales and use tax for:

1. Construction of a warehouse or grain elevator, including labor and materials.

Warehouses include retail distribution centers and cold storage warehouses. Construction can include an expansion of an existing warehouse by at least 200,000 square feet or an expansion of an existing grain elevator by at least one million bushels of storage capacity. Construction does not include renovation, remodeling, or repair.

2. Purchases of equipment used to handle and rack the stored materials, and labor and services for installing, repairing, cleaning, altering, or improving the equipment.

Material-handling and racking equipment must be used primarily to handle, store, organize, convey, package, or repackage finished goods. Examples include:

- Conveyers, carousels, lifts, cranes, hoists, mechanical arms;

- Automated handling, storage, and retrieval systems, including computers that control them; and

- Forklifts, shelves, racks, and pallets.

Repair and replacement parts are also eligible.

A business claiming an exemption must first pay the sales or use tax and then apply to the Department of Revenue (DOR) for a remittance of the refund. The percentage of the state sales or use tax remitted varies by the types of projects as shown in Exhibit 1 below. The local portion of the sales or use tax is not remitted.

| Type of Facility | Size Requirement | Construction Remittance | Equipment Remittance |

|---|---|---|---|

| Warehouse, Cold Storage, Retail Distribution | 200,000 square feet or more | 100 percent | 50 percent |

| Grain Elevator | 1 million up to 2 million bushels | 50 percent | 50 percent |

| 2 million bushels or more | 100 percent | 50 percent |

What businesses can use the preference?

Wholesalers, third-party warehousers that store goods for others, and retailers qualify if they own or operate the warehouse or grain elevator.

Owners of a warehouse or grain elevator who lease their facility can still receive the exemption, but only if they agree in a written contract to pass the benefit on to the lessee in the form of reduced rent payments.

What facilities qualify?

- Warehouses owned by wholesalers that distribute goods to other wholesalers or retailers and third-party warehouses, including warehouses that distribute finished goods directly to consumers;

- Distribution centers owned by retailers that store and distribute finished goods to their retail outlets;

- Cold storage warehouses used to store fresh and frozen perishable agricultural products; and

- Grain elevators used for the handling of storage and handling of grain in bulk.

What facilities do not qualify?

- Facilities that store agricultural products on the property of the producer;

- Facilities that store extracted products such as minerals, petroleum, and gas;

- Facilities that store marijuana and marijuana products; and

- Parking lots, landscaping, storage yards, and buildings where manufacturing takes place.

1996

The Legislature directed the Department of Revenue to form an advisory study committee to analyze the economic impact of the warehouse and distribution industry on Washington’s economy and the effect of taxes on this industry.

The statute required committee membership to include at least two members each from the House and Senate, and representatives from the warehouse and distribution industry, local government, and other interest groups. The report was due December 1, 1996.

In December, the Department of Revenue and the study advisory committee issued their report proposing sales and use tax exemptions for large warehouses (at least 100,000 square feet) and grain elevators (at least 750,000 bushel capacity) because large facilities had “the greatest potential to increase trade and create new family wage jobs.”

1997

In the next session, the Legislature followed many of the committee’s recommendations by adopting these tax preferences, effective May 20, 1997. The legislative fiscal committees were required to report to the Legislature about the effect of the legislation on the creation or retention of family-wage jobs and diversification of the state’s economy. The Legislature set the remittance percentages at the same levels as they are today.

2002

In a report mandated in the 1997 session, legislative fiscal committee staff found that the remittance program appeared to have “no significant effect on the underlying goal of the law” to improve interstate trade and employment in the wholesale or independent public warehousing sectors compared to national averages. However, the report noted that the small number of applicants in the first four years may explain the limited effect on Washington’s economy.

2005

Effective July 1, 2007, the Legislature expanded the remittance program for cold storage warehouses by lowering the size requirement from 200,000 to 25,000 square feet, and increasing the remittance from 50 percent to 100 percent for equipment.

2006

In the next year, the Legislature chose to end the 2005 special tax treatment for cold storage warehouses after five years, effective July 1, 2012.

2012

The 2005 special tax treatment for cold storage warehouses expired on July 1, 2012. Over the five-year period 2007 through 2012, a total of 26 cold storage warehouses under 200,000 square feet qualified, for a total of $4.9 million in remittance.

2014

The Legislature excluded facilities used for storage of marijuana or marijuana-infused products from the warehouse remittance program.

Exhibit 2 below provides a summary of tax treatment that benefits owners and operators of warehouses and grain elevators. Beneficiaries may also qualify for broader tax preferences that are not included in the list below.

| Year Enacted | Tax Treatment | Notes |

|---|---|---|

| 1933-1939 | Exemption of agricultural products from the property tax on inventories | Reviewed by JLARC in 2012 |

| 1939-1995 | Preferential business and occupation (B&O) tax rate for wholesale sales of grain | Reviewed by JLARC in 2015 |

| 1959 | Taxation of cold storage warehouse operations moved from the public utility tax (PUT) to the B&O tax – rate reduced from 1.8% to 0.44% | Change in tax classification |

| 1974 | Phase out of property tax on all business inventories, to be fully exempted by 1984 | Reviewed by JLARC in 2012 |

| 1986 | Taxation of warehouse operations for storing merchandise moved from the PUT to the B&O tax – rate reduced from 1.926% to 0.484% | Change in tax classification |

| 1997 | Remittance of state portion of sales and use tax on constructing and equipping warehouses (including cold storage) and grain elevators | The tax preferences under review |

| 1998 | Elimination of B&O tax on internal distributions from warehouse to retail outlet | Elimination of a tax |

| B&O tax exemption on wholesale sales of grain – the rate on this activity had been 0.01% | Reviewed by JLARC in 2015 | |

| 2007 | B&O tax exemption on wholesale sales of unprocessed milk – the rate on this activity had been 0.484%, the general wholesaling rate. | Reviewed by JLARC in 2015 |

| PUT deduction on shipments of agricultural commodities to interim storage facilities before transport to export facilities | Expedited Review in 2015 |

What are the public policy objectives that provide a justification for the tax preferences? Is there any documentation on the purpose or intent of the tax preferences?

The Legislature stated the public policy objective for these tax preferences in the original 1997 legislation. JLARC staff infer a second objective from study requirements in the same bill. These objectives are:

1. To stimulate interstate trade by providing tax incentives to lower the cost of doing business for owners and operators of warehouses and grain elevators. The intent section of the bill stated:

“It is the intent of the legislature to stimulate interstate trade by providing tax incentives to those persons in the warehouse and distribution industry engaged in highly competitive trade.”

2. To create and retain family-wage jobs. JLARC staff infer this objective from the Legislature’s 1997 assignment to fiscal committee staff:

“[The report] shall measure the effect on the creation or retention of family-wage jobs and the diversification of the state’s economy.”

What evidence exists to show that the tax preferences have contributed to the achievement of any of these public policy objectives?

Stimulating Interstate Trade

It is unclear whether the tax preference is meeting the objective.

The tax preferences lowered the cost of doing business for operating warehouses and grain elevators in Washington. However, it is unclear whether reducing costs for this industry had an effect on stimulating interstate trade. Some information is available to evaluate interstate trade in Washington, but it is not consistent over time and does not allow comparisons between states.

Also, while the legislation expressly identified interstate trade, the facilities covered by the preference may store products intended for foreign trade. Grain elevators and other beneficiaries may export finished goods or commodities to foreign countries.

Creating and Retaining Family Wage Jobs

It is unclear whether the tax preference is meeting the inferred objective.

Information about jobs and wages is available on a portion – but not all – of the businesses using the preference.

Between Calendar Years 2006 and 2013, a total of 73 firms used the preference. Of these, 47 firms (64 percent) could be matched to employment records from the Employment Security Department, the source of information about jobs and wages. Investment made by firms with matching employment records made up 56 percent of all investment. Firms did not match possibly because beneficiaries may be entities that do not report employment, or the facility is staffed by a third party company. The job and wage information below is based on this 64 percent of the beneficiary firms and equates to 44 percent of the total beneficiary investment.

The percent change in employment was measured for each facility for projects initiated in Calendar Years 2006 through 2013.

Over this eight-year period, the 47 firms where JLARC staff matched wage records claimed remittances for 54 facilities. As shown in Exhibit 3 below, beneficiaries claimed remittances for 27 construction or expansion projects and 27 projects involving equipment purchases, but not construction.

The change in the number of jobs differed for the two types of projects. Employment grew by 20 percent at constructed or expanded facilities but fell by 6 percent at sites where the project consisted of equipment purchases only. New equipment may make the warehouse more efficient and allow the business to reduce employment.

| Project Type | Number of Facilities | Jobs Before Remittance | Jobs After Remittance | Job Growth |

|---|---|---|---|---|

| Construction or Expansion | 27 | 5,107 | 6,147 | 20% |

| Equipment Only | 27 | 5,786 | 5,414 | -6% |

| Total | 54 | 10,893 | 11,561 | 6% |

Exhibit 4 below shows the change in employment by type of facility. There were net job increases for all three facility types. The greatest increase in the number of jobs was at cold storage facilities. The data includes cold storage warehouses constructed during the period between 2007 and 2012 when the Legislature reduced the size requirement for these facilities.

| Facility Type | Number of Facilities | Jobs Before Remittance | Jobs After Remittance | Percent Growth |

|---|---|---|---|---|

| Warehouse | 28 | 7,084 | 7,204 | 2% |

| Cold Storage | 19 | 3,530 | 3,981 | 13% |

| Grain Elevator | 7 | 279 | 376 | 35% |

| Total | 54 | 10,893 | 11,561 | 6% |

Wage information for the beneficiary firms with matching employment records shows mixed results in comparison to Washington’s average private sector wage. Statute does not define “family wage” for purposes of these tax preferences. Exhibit 5 below shows that wages in cold storage facilities were lower than the average private sector wage, while wages in warehouses and grain elevators were higher.

| Type of Facility | Employment | Annual Average Wage |

|---|---|---|

| Cold Storage | 3,740 | $31,899 |

| Warehouse | 6,131 | $55,395 |

| Grain Elevator | 150 | $85,299 |

| Washington Private Sector Average Wage | $52,800 |

To what extent will continuation of the tax preferences contribute to these public policy objectives?

Continuing the tax preferences would continue to lower the cost of doing business for owners and operators of warehouses and grain elevators. However, it is unclear whether the tax preferences are contributing to the public policy objectives of stimulating interstate trade and creating family wage jobs, and whether continuation would have an impact on achieving these objectives in the future.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

The beneficiaries of the tax preferences are owners or lessees that operate warehouses and grain elevators. They are not necessarily the owners of the stored product.

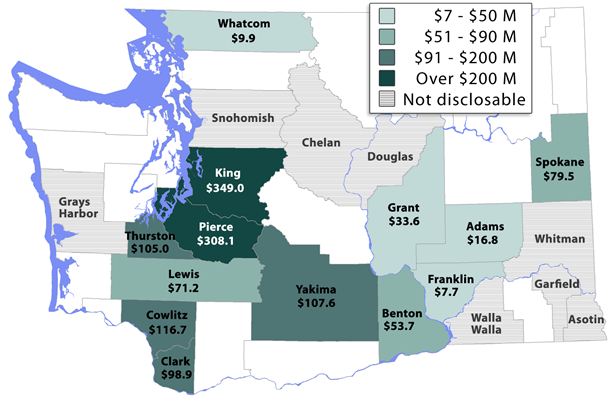

Over the 18 years that the preferences have been in place, 119 beneficiaries invested $1.5 billion in construction and equipment. Beneficiaries with facilities in the western Washington counties of King, Pierce and Thurston have invested $762 million. Information about firms in eight counties is not disclosable because there are fewer than three firms per county. Eighteen counties have had no beneficiaries. Exhibits 6 and 7 below show the level of investment by county for firms receiving the tax preference.

| Rank | County | Investment $M | Number of Firms |

|---|---|---|---|

| 1 | King | $349.0 | 28 |

| 2 | Pierce | $308.1 | 32 |

| 3 | Cowlitz | $116.7 | 9 |

| 4 | Yakima | $107.6 | 13 |

| 5 | Thurston | $105.0 | 4 |

| 6 | Clark | $98.9 | 6 |

| 7 | Spokane | $79.5 | 9 |

| 8 | Lewis | $71.2 | 6 |

| 9 | Benton | $53.7 | 6 |

| 10 | Grant | $33.6 | 6 |

| 11 | Adams | $16.8 | 4 |

| 12 | Whatcom | $9.9 | 3 |

| 13 | Franklin | $7.7 | 4 |

| 8 Counties – Not disclosable | $125.2 | 13 | |

| Total | $1,482.6 | 119 |

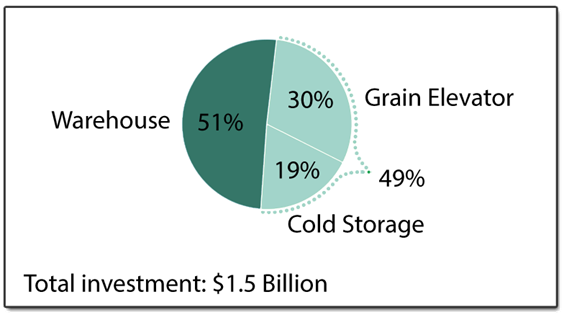

Exhibit 8 below shows that wholesale and retail warehouse owners and operators invested 51 percent of total beneficiary investment over the life of the program. Owners and operators of grain elevators and cold storage facilities invested 49 percent.

What are the past and future tax revenue and economic impacts of the tax preferences to the taxpayer and to the government if it is continued?

Exhibit 9 below shows that the actual amount of remittances claimed in Fiscal Year 2014 was $2.7 million. The estimated beneficiary savings for the 2015-17 Biennium is $10.5 million.

| Fiscal Year | Beneficiary Savings |

|---|---|

| 2012 | $7,092,000 |

| 2013 | $4,541,000 |

| 2014 | $2,665,000 |

| 2015 | $4,925,000 |

| 2016 | $5,158,000 |

| 2017 | $5,362,000 |

| 2015-17 Biennium | $10,520,000 |

Do other states have similar tax preferences and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

Nine other states provide sales tax exemptions or abatements targeted specifically for warehouse and distribution facilities.

- Sales tax preferences for warehouses meeting certain investment or job creation criteria: Alabama, Nevada, Tennessee, and West Virginia.

- Sales tax preferences limited to material handling and racking equipment: Georgia, Kansas, Michigan, Ohio, and Tennessee.

- Corporate income tax credits for sales and use taxes paid by a third-party developer for constructing and equipping a warehouse or distribution facility: Iowa.

- Sales tax exemption for equipment used in grain elevators: Kansas.

RCW 82.08.820

Exemptions - Remittance - Warehouse and grain elevators and distribution centers - Material-handling and racking equipment - Construction of warehouse or elevator - Information sheet - Rules - Records - Exceptions.

(1) Wholesalers or third-party warehousers who own or operate warehouses or grain elevators and retailers who own or operate distribution centers, and who have paid the tax levied by RCW 82.08.020 on:

(a) Material-handling and racking equipment, and labor and services rendered in respect to installing, repairing, cleaning, altering, or improving the equipment; or

(b) Construction of a warehouse or grain elevator, including materials, and including service and labor costs, are eligible for an exemption in the form of a remittance. The amount of the remittance is computed under subsection (3) of this section and is based on the state share of sales tax.

(2) For purposes of this section and RCW 82.12.820:

(a) "Agricultural products" has the meaning given in RCW 82.04.213;

(b) "Construction" means the actual construction of a warehouse or grain elevator that did not exist before the construction began. "Construction" includes expansion if the expansion adds at least two hundred thousand square feet of additional space to an existing warehouse or additional storage capacity of at least one million bushels to an existing grain elevator. "Construction" does not include renovation, remodeling, or repair;

(c) "Department" means the department of revenue;

(d) "Distribution center" means a warehouse that is used exclusively by a retailer solely for the storage and distribution of finished goods to retail outlets of the retailer. "Distribution center" does not include a warehouse at which retail sales occur;

(e) "Finished goods" means tangible personal property intended for sale by a retailer or wholesaler. "Finished goods" does not include:

(i) Agricultural products stored by wholesalers, third-party warehouses, or retailers if the storage takes place on the land of the person who produced the agricultural product;

(ii) Logs, minerals, petroleum, gas, or other extracted products stored as raw materials or in bulk; or

(iii) Marijuana, useable marijuana, or marijuana-infused products;

(f) "Grain elevator" means a structure used for storage and handling of grain in bulk;

(g) "Material-handling equipment and racking equipment" means equipment in a warehouse or grain elevator that is primarily used to handle, store, organize, convey, package, or repackage finished goods. The term includes tangible personal property with a useful life of one year or more that becomes an ingredient or component of the equipment, including repair and replacement parts. The term does not include equipment in offices, lunchrooms, restrooms, and other like space, within a warehouse or grain elevator, or equipment used for non-warehousing purposes. "Material-handling equipment" includes but is not limited to: Conveyers, carousels, lifts, positioners, pick-up-and-place units, cranes, hoists, mechanical arms, and robots; mechanized systems, including containers that are an integral part of the system, whose purpose is to lift or move tangible personal property; and automated handling, storage, and retrieval systems, including computers that control them, whose purpose is to lift or move tangible personal property; and forklifts and other off-the-road vehicles that are used to lift or move tangible personal property and that cannot be operated legally on roads and streets. "Racking equipment" includes, but is not limited to, conveying systems, chutes, shelves, racks, bins, drawers, pallets, and other containers and storage devices that form a necessary part of the storage system;

(h) "Person" has the meaning given in RCW 82.04.030;

(i) "Retailer" means a person who makes "sales at retail" as defined in chapter 82.04 RCW of tangible personal property;

(j) "Square footage" means the product of the two horizontal dimensions of each floor of a specific warehouse. The entire footprint of the warehouse must be measured in calculating the square footage, including space that juts out from the building profile such as loading docks. "Square footage" does not mean the aggregate of the square footage of more than one warehouse at a location or the aggregate of the square footage of warehouses at more than one location;

(k) "Third-party warehouser" means a person taxable under RCW 82.04.280(1)(d);

(l) "Warehouse" means an enclosed building or structure in which finished goods are stored. A warehouse building or structure may have more than one storage room and more than one floor. Office space, lunchrooms, restrooms, and other space within the warehouse and necessary for the operation of the warehouse are considered part of the warehouse as are loading docks and other such space attached to the building and used for handling of finished goods. Landscaping and parking lots are not considered part of the warehouse. A storage yard is not a warehouse, nor is a building in which manufacturing takes place; and

(m) "Wholesaler" means a person who makes "sales at wholesale" as defined in chapter 82.04 RCW of tangible personal property, but "wholesaler" does not include a person who makes sales exempt under RCW 82.04.330.

(3)(a) A person claiming an exemption from state tax in the form of a remittance under this section must pay the tax imposed by RCW 82.08.020. The buyer may then apply to the department for remittance of all or part of the tax paid under RCW 82.08.020. For grain elevators with bushel capacity of one million but less than two million, the remittance is equal to fifty percent of the amount of tax paid. For warehouses with square footage of two hundred thousand or more and for grain elevators with bushel capacity of two million or more, the remittance is equal to one hundred percent of the amount of tax paid for qualifying construction, materials, service, and labor, and fifty percent of the amount of tax paid for qualifying material-handling equipment and racking equipment, and labor and services rendered in respect to installing, repairing, cleaning, altering, or improving the equipment.

(b) The department must determine eligibility under this section based on information provided by the buyer and through audit and other administrative records. The buyer must on a quarterly basis submit an information sheet, in a form and manner as required by the department by rule, specifying the amount of exempted tax claimed and the qualifying purchases or acquisitions for which the exemption is claimed. The buyer must retain, in adequate detail to enable the department to determine whether the equipment or construction meets the criteria under this section: Invoices; proof of tax paid; documents describing the material-handling equipment and racking equipment; location and size of warehouses and grain elevators; and construction invoices and documents.

(c) The department must on a quarterly basis remit exempted amounts to qualifying persons who submitted applications during the previous quarter.

(4) Warehouses, grain elevators, and material-handling equipment and racking equipment for which an exemption, credit, or deferral has been or is being received under chapter 82.60, 82.62, or 82.63 RCW or RCW 82.08.02565 or 82.12.02565 are not eligible for any remittance under this section. Warehouses and grain elevators upon which construction was initiated before May 20, 1997, are not eligible for a remittance under this section.

(5) The lessor or owner of a warehouse or grain elevator is not eligible for a remittance under this section unless the underlying ownership of the warehouse or grain elevator and the material-handling equipment and racking equipment vests exclusively in the same person, or unless the lessor by written contract agrees to pass the economic benefit of the remittance to the lessee in the form of reduced rent payments.

[2014 c 140 § 23; 2011 c 174 § 206; (2011 c 174 § 205 expired July 1, 2012); 2006 c 354 § 12; (2006 c 354 § 11 expired July 1, 2012); 2005 c 513 § 11; 1997 c 450 § 2.]

RCW 82.12.820

Exemptions - Warehouse and grain elevators and distribution centers.

(1) Wholesalers or third-party warehousers who own or operate warehouses or grain elevators, and retailers who own or operate distribution centers, and who have paid the tax levied under RCW 82.12.020 on:

(a) Material-handling equipment and racking equipment and labor and services rendered in respect to installing, repairing, cleaning, altering, or improving the equipment; or

(b) Materials incorporated in the construction of a warehouse or grain elevator, are eligible for an exemption on tax paid in the form of a remittance or credit against tax owed. The amount of the remittance or credit is computed under subsection (2) of this section and is based on the state share of use tax.

(2)(a) A person claiming an exemption from state tax in the form of a remittance under this section must pay the tax imposed by RCW 82.12.020 to the department. The person may then apply to the department for remittance of all or part of the tax paid under RCW 82.12.020. For grain elevators with bushel capacity of one million but less than two million, the remittance is equal to fifty percent of the amount of tax paid. For warehouses with square footage of two hundred thousand or more and for grain elevators with bushel capacity of two million or more, the remittance is equal to one hundred percent of the amount of tax paid for qualifying construction materials, and fifty percent of the amount of tax paid for qualifying material-handling equipment and racking equipment.

(b) The department shall determine eligibility under this section based on information provided by the buyer and through audit and other administrative records. The buyer shall on a quarterly basis submit an information sheet, in a form and manner as required by the department by rule, specifying the amount of exempted tax claimed and the qualifying purchases or acquisitions for which the exemption is claimed. The buyer shall retain, in adequate detail to enable the department to determine whether the equipment or construction meets the criteria under this section: Invoices; proof of tax paid; documents describing the material-handling equipment and racking equipment; location and size of warehouses, if applicable; and construction invoices and documents.

(c) The department shall on a quarterly basis remit or credit exempted amounts to qualifying persons who submitted applications during the previous quarter.

(3) Warehouse, grain elevators, and material-handling equipment and racking equipment for which an exemption, credit, or deferral has been or is being received under chapter 82.60, 82.62, or 82.63 RCW or RCW 82.08.02565 or 82.12.02565 are not eligible for any remittance under this section. Materials incorporated in warehouses and grain elevators upon which construction was initiated prior to May 20, 1997, are not eligible for a remittance under this section.

(4) The lessor or owner of the warehouse or grain elevator is not eligible for a remittance or credit under this section unless the underlying ownership of the warehouse or grain elevator and material-handling equipment and racking equipment vests exclusively in the same person, or unless the lessor by written contract agrees to pass the economic benefit of the exemption to the lessee in the form of reduced rent payments.

(5) The definitions in RCW 82.08.820 apply to this section.

[2006 c 354 § 13; 2005 c 513 § 12; 2003 c 5 § 13; 2000 c 103 § 9; 1997 c 450 § 3.]

- Legislative Auditor Recommendation

- Commissioners’ Recommendation

- Letter from Commission Chair

- Agency Response

Legislative Auditor Recommendation: Review and Clarify

The Legislature should review and clarify the sales and use tax preferences for warehouses and grain elevators to provide 1) more specificity about what trade and what kinds of jobs the Legislature has as its objectives; 2) measurable targets for these objectives; and 3) data collection mechanisms that can be used to assess performance in meeting these objectives.

- Currently, inconsistent data makes it difficult to measure whether the preferences are “stimulating interstate trade;”

- Grain elevators and warehouse facilities may hold materials or commodities intended for foreign rather than interstate trade;

- If the creation of “family-wage” jobs is a public policy objective, the Legislature has not yet provided job-related targets, a definition of “family wage” jobs for these preferences, or a mechanism for collecting complete information on jobs, wages, and benefits. While some employment data is available through unemployment insurance records, JLARC staff were unable to identify records for 44 percent of the value of the preference;

- Available information on a subset of businesses using the preference shows mixed results in terms of jobs and wages. Businesses investing in construction or expansion of facilities showed an increase in the number of jobs, while there was a decline in job numbers for businesses investing only in equipment. Annual wages for jobs in warehouses and grain elevators exceeded the state average private sector wage, while wages were lower than that average for jobs in cold storage facilities.

The Legislative Auditor’s guidance document for drafting performance statements provides a framework for identifying policy objectives and linking these to performance metrics.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation without comment.