Chapter 82.82 RCW, RCW 82.82.020, RCW 43.31C.005

RCW 82.82.010.

Definitions.

The definitions in

this section apply throughout this chapter unless the context clearly requires

otherwise.

(1) "Applicant" means a person applying for a tax deferral under

this chapter.

(2) "Corporate headquarters" means a facility or facilities where

corporate staff employees are physically employed, and where the majority of the

company's management services are handled either on a regional or a national basis.

Company management services may include: Accounts receivable and payable, accounting,

data processing, distribution management, employee benefit plan, financial and

securities accounting, information technology, insurance, legal, merchandising,

payroll, personnel, purchasing procurement, planning, reporting and compliance,

research and development, tax, treasury, or other headquarters-related services.

"Corporate headquarters" does not include a facility or facilities used for

manufacturing, wholesaling, or warehousing.

(3) "Department" means the

department of revenue.

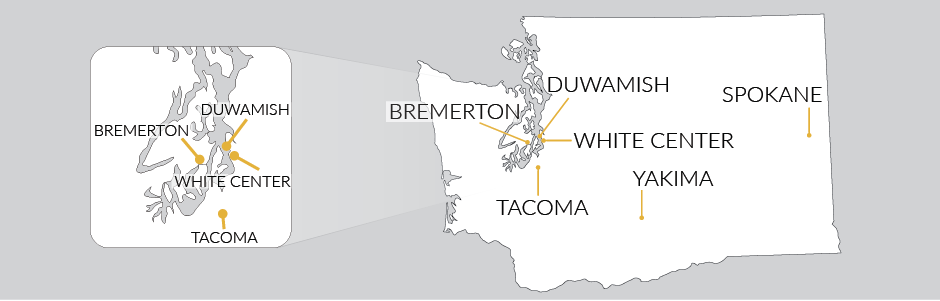

(4) "Eligible area" means a designated community

empowerment zone approved under RCW 43.31C.020. (5)(a) "Eligible investment project"

means an investment project in a qualified building or buildings in an eligible area,

as defined in subsection (4) of this section, which will have employment at the

qualified building or buildings of at least three hundred employees in qualified

employment positions, each of whom must earn for the year reported at least the

average annual wage for the state for that year as determined by the employment

security department.

(b) The lessor or owner of a qualified building or

buildings is not eligible for a deferral unless:

(i) The underlying ownership

of the building or buildings vests exclusively in the same person; or

(ii)(A)

The lessor by written contract agrees to pass the economic benefit of the deferral to

the lessee;

(B) The lessee that receives the economic benefit of the deferral

agrees in writing with the department to complete the annual survey required under RCW

82.82.020; and

(C) The economic benefit of the deferral passed to the lessee is

no less than the amount of tax deferred by the lessor and is evidenced by written

documentation of any type of payment, credit, or other financial arrangement between

the lessor or owner of the qualified building and the lessee.

(6) "Investment

project" means a capital investment of at least thirty million dollars in a qualified

building or buildings including tangible personal property and fixtures that will be

incorporated as an ingredient or component of such buildings during the course of

their construction, and including labor and services rendered in the planning,

installation, and construction of the project.

(7) "Manufacture" has the same

meaning as provided in RCW 82.04.120.

(8) "Operationally complete" means a date

no later than one year from the date the project is issued an occupancy permit by the

local permit issuing authority.

(9) "Person" has the same meaning as provided

in RCW 82.04.030.

(10) "Qualified building or buildings" means construction of

a new structure or structures or expansion of an existing structure or structures to

be used for corporate headquarters. If a building is used partly for corporate

headquarters and partly for other purposes, the applicable tax deferral is determined

by apportionment of the costs of construction under rules adopted by the department.

(11) "Qualified employment position" means a permanent full-time employee

employed in the eligible investment project during the entire tax year. The term

"entire tax year" means a full-time position that is filled for a period of twelve

consecutive months. The term "full-time" means at least thirty-five hours a week, four

hundred fifty-five hours a quarter, or one thousand eight hundred twenty hours a year.

(12) "Recipient" means a person receiving a tax deferral under this chapter.

(13) "Warehouse" means a building or structure, or any part thereof, in which

goods, wares, or merchandise are received for storage for compensation.

(14)

"Wholesale sale" has the same meaning as provided in RCW 82.04.060. [ 2008 c 15 § 1.]

[ 2008 c 15 § 1.]

*Reviser's note: RCW 82.82.020 was amended by 2017 c 135 § 43,

changing "annual survey" to "annual tax performance report," effective January 1, 2018.

Effective date—2008 c 15: "This act takes effect July 1, 2009." [ 2008 c 15 §

10.]

RCW 82.82.020

Application for deferral - Annual tax performance report.

(Effective January 1, 2018.)

(1) Application for deferral of taxes under this

chapter can be made at any time prior to completion of construction of a qualified

building or buildings, but tax liability incurred prior to the department's receipt of

an application may not be deferred. The application must be made to the department in a

form and manner prescribed by the department. The application must contain information

regarding the location of the investment project, the applicant's average employment in

the state for the prior year, estimated or actual new employment related to the project,

estimated or actual wages of employees related to the project, estimated or actual

costs, time schedules for completion and operation, and other information required by

the department. The department must rule on the application within sixty days.

(2) Applications for deferral of taxes under this section may not be made after

December 31, 2020.

(3) Each recipient of a deferral of taxes under this chapter

must file a complete annual tax performance report with the department under RCW

82.32.534. If the economic benefits of the deferral are passed to a lessee as provided

in RCW 82.82.010(5), the lessee must file a complete annual tax performance report, and

the applicant is not required to file the annual tax performance report.

(4) A

recipient who must repay deferred taxes under RCW 82.82.040 because the department has

found that an investment project is no longer an eligible investment project is no

longer required to file annual tax performance reports under RCW 82.32.534 beginning on

the date an investment project is used for nonqualifying purposes.

[

2017 c 135 § 43;2010 c 114 § 148;2008 c 15 § 2.]

NOTES:

Effective date - 2017 c 135: See note following RCW

82.32.534.

Application- Finding-Intent-2010 c 114: See notes following

RCW 82.32.585.

Effective date- 2008 c 15: See noted following RCW

82.82.010.

RCW 82.82.030

Deferral certificate.

(1) The department

must issue a sales and use tax deferral certificate for state and local sales and use

taxes due under chapters 82.08, 82.12, and 82.14 RCW on each eligible investment project

meeting the requirements of this chapter.

(2) No certificate may be issued for an

investment project that has already received a deferral under chapter 82.60 or 82.63 RCW

or this chapter, except that an investment project for qualified research and

development that has already received a deferral may also receive an additional deferral

certificate for adapting the investment project for use in pilot scale manufacturing.

(3) The department must keep a running total of all deferrals granted under this

chapter during each fiscal biennium.

(4) The number of eligible investment

projects for which the benefits of this chapter will be allowed is limited to two per

biennium. The department must approve deferral certificates for completed applications

on a first in-time basis. During any biennium, only one deferral certificate may be

issued per community empowerment zone.

[ 2008 c 15 § 3.]

NOTES:

Effective date—2008 c 15: See note following RCW 82.82.010.

RCW

82.82.040

Repayment of deferred taxes. (Effective January 1,

2018.)

(1) Except as provided in subsection (2) of this section and RCW

82.32.534, taxes deferred under this chapter need not be repaid.

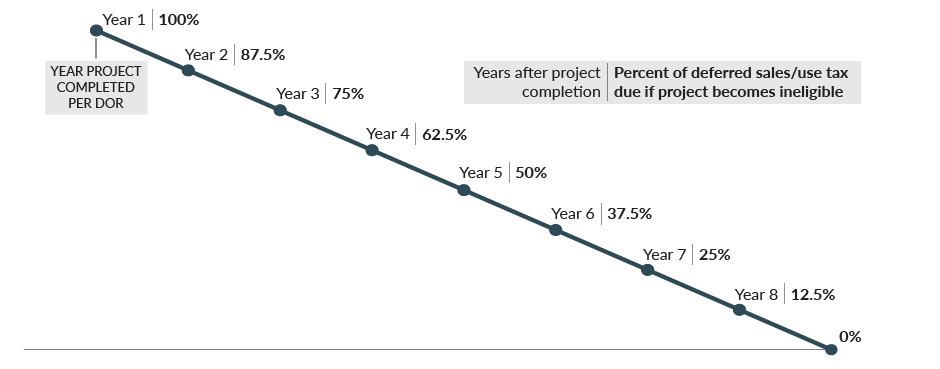

(2)(a) If, on

the basis of the tax performance report under RCW 82.32.534 or other information, the

department finds that an investment project is no longer an "eligible investment

project" under RCW 82.82.010 at any time during the calendar year in which the

investment project is certified by the department as having been operationally

completed, or at any time during any of the seven succeeding calendar years, a portion

of deferred taxes are immediately due according to the following schedule:

| Year in which use occurs |

% of deferred taxes due: |

| 1 |

100% |

| 2 |

87.5% |

| 3 |

75% |

| 4 |

62.5% |

| 5 |

50% |

| 6 |

37.5% |

| 7 |

25% |

| 8 |

12.5% |

(b) If the economic benefits of the deferral are passed to a lessee as provided in RCW

82.82.010(5), the lessee is responsible for payment to the extent the lessee has

received the economic benefit.

(3) The department must assess interest at the

rate provided for delinquent taxes under chapter 82.32 RCW, but not penalties,

retroactively to the date of deferral. The debt for deferred taxes will not be

extinguished by insolvency or other failure of the recipient. Transfer of ownership does

not terminate the deferral. The deferral is transferred, subject to the successor

meeting the eligibility requirements of this chapter, for the remaining periods of the

deferral.

[ 2017 c 135 § 44; 2010 c 114 § 149; 2008 c 15 § 5.]

NOTES:

Effective date—2017 c 135: See note following RCW 82.32.534.

Application—Finding—Intent—2010 c 114: See notes following RCW

82.32.585.

Effective date—2008 c 15: See note following RCW

82.82.010.

RCW 82.82.050

Qualified employment positions -

Requirements.

The qualified employment positions must be filled by the end of the

calendar year following the year in which the project is certified as operationally

complete. If a recipient does not meet the requirements for qualified employment

positions by the end of the second calendar year following the year in which the project

is certified as operationally complete, all deferred taxes are immediately due.

[

2008 c 15 § 6.]

NOTES:

Effective date—2008 c 15: See note

following RCW 82.82.010.

RCW 43.31C.005

Findings -

Declaration.

(1) The legislature finds that:

(a) There are geographic areas

within communities that are characterized by a lack of employment opportunities, an

average income level that is below the median income level for the surrounding

community, a lack of affordable housing, deteriorating infrastructure, and a lack of

facilities for community services, job training, and education;

(b) Strategies to

encourage reinvestment in these areas by assisting local businesses to become stronger

and area residents to gain economic power involve a variety of activities and

partnerships;

(c) Reinvestment in these areas cannot be accomplished with only

governmental resources and require a comprehensive approach that integrates various

incentives, programs, and initiatives to meet the economic, physical, and social needs

of the area;

(d) Successful reinvestment depends on a local government's ability

to coordinate public resources in a cohesive, comprehensive strategy that is designed to

leverage long-term private investment in an area;

(e) Reinvestment can strengthen

the overall tax base through increased tax revenue from expanded and new business

activities and physical property improvement;

(f) Local governments, in

cooperation with area residents, can provide leadership as well as planning and

coordination of resources and necessary supportive services to address reinvestment in

the area; and

(g) It is in the public interest to adopt a targeted approach to

revitalization and enlist the resources of all levels of government, the private sector,

community-based organizations, and community residents to revitalize an area.

(2)

The legislature declares that the purposes of the community empowerment zone act are

to:

(a) Encourage reinvestment through strong partnerships and cooperation between

all levels of government, community-based organizations, area residents, and the private

sector;

(b) Involve the private sector and stimulate private reinvestment through

the judicious use of public resources;

(c) Target governmental resources to those

areas of greatest need; and

(d) Include all levels of government, community

individuals, organizations, and the private sector in the policy-making

process.

[ 2000 c 212 § 1.]