Stated public policy objective met

The Legislature stated a policy objective when it passed this preference in 2013.

| Objective | Results |

|---|---|

| Provide use tax relief to individuals who purchase or win items at qualifying fundraising events. | Met. |

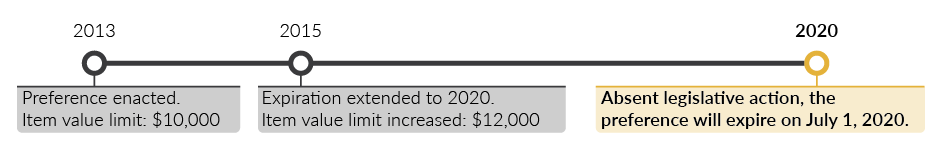

Absent legislative action, the preference will expire on July 1, 2020.

Recommendation

Legislative Auditor's Recommendation: Continue and clarify (structural purpose)

The Legislature should continue and clarify the preference because it is achieving its objective of providing use tax relief to individuals who purchase or win items at qualifying nonprofit or library fundraising events.

If the Legislature does continue this preference, it should consider making the preference permanent, adding a mechanism to allow the exempt value of items to increase with time, and recategorizing the preference as one intended to provide tax relief.

More information is available on the Recommendations Tab.

Commissioners' Recommendation

The Commission endorses the Legislative Auditor’s recommendation with comment. This is an important preference, not only from a policy perspective, but also from an administrative efficiency perspective. The Legislative Auditor restates the objective of the preference as providing tax relief to individuals who purchase or win items at qualifying fundraising events. However, while this is the direct effect of the preference, it is unlikely the true objective or purpose of the preference despite the tax performance statement. This exemption coupled with RCW 82.08.02573 avoids the requirement that would otherwise be placed on libraries and nonprofit organizations (hereinafter referred to collectively as “nonprofits”) to collect retail sales or use tax from donors that purchased or won such items in connection with the fundraising conducted by nonprofits. While donors do receive a tax benefit, this preference primarily benefits nonprofits in two separate ways. First, it allows nonprofits to avoid the administrative burdens associated with collecting and reporting use tax at fundraising events. Second, it avoids decreased donations from donors who would otherwise likely reduce the amount of their auction bids in order to pay the 8-10% use tax due on the donation/bid. The Citizen Commission would have the Legislature recognize the true beneficiaries of the preference and categorize the preference as one intended primarily to provide administrative relief and benefit to nonprofit organizations.

Committee Action to Distribute Report

On December 12, 2018 this report was approved for distribution by the Joint Legislative Audit and Review Committee.

Action to distribute this report does not imply the Committee agrees or disagrees with the Legislative Auditor recommendations.