2023 Reviews: Five of six Legislative Auditor recommendations require action

| The Legislative Auditor issued six tax preference reports in 2023. The preferences benefit businesses or individuals involved in:Each report includes one Legislative Auditor recommendation to the Legislature. All but one (rehabilitating historic properties) requires legislative action. |

This year's reviews include requirement for racial equity analysis

The 2021 Legislature charged JLARC with including a racial equity analysis in its audits and other reviews when it is relevant to the study's mandate and scope (RCW 44.28.076). We identified relevant questions for each of the tax preference reviews (see Study Questions).

Race and ethnicity data for the businesses using the preferences studied in 2023 was not available. In lieu of actual data, JLARC staff searched for other sources of data that could provide insight into who benefits from or is affected by each preference. Our secondary sources included surveys and U.S. Census Bureau data. Specific data sources are discussed in each report.

In 2022, the Department of Revenue asked beneficiaries of 48 tax preferences to submit race and ethnicity data on their annual tax performance reports. This includes beneficiaries that are specifically required to file an annual report and those who use preferences intended to improve industry competitiveness or create or retain jobs.

While this will improve the availability of data, JLARC staff anticipate that obtaining robust race and ethnicity data will continue to be a challenge for future reviews. Limitations include:

- The request to report information does not apply to all tax preferences JLARC is required to review.

- Race and ethnicity data is requested about employees, not business owners or other affected stakeholders.

- Businesses are asked to provide race and ethnicity of their employees statewide. Data will not be location specific.

- Businesses are not required to supply this information about their employees.

Obtaining race and ethnicity information from all preference users may require additional legislation. For example, the Legislature might require state agencies to collect the desired data. Such efforts will likely require balancing the interest in gathering race and ethnicity data with efforts to streamline and simplify taxpayer reports.

Five recommendations require legislative action

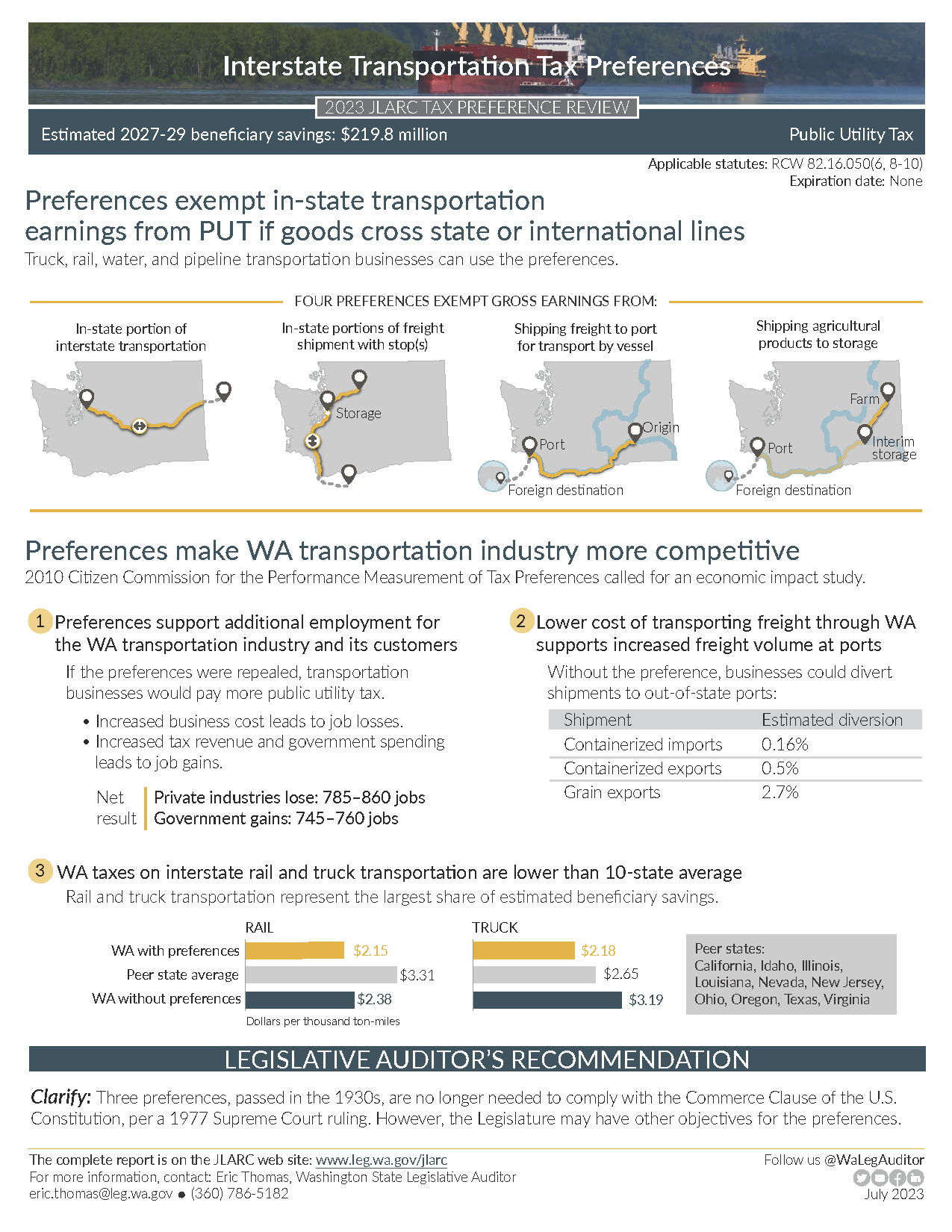

Interstate Transportation Tax Preferences

Interstate Transportation Tax Preferences

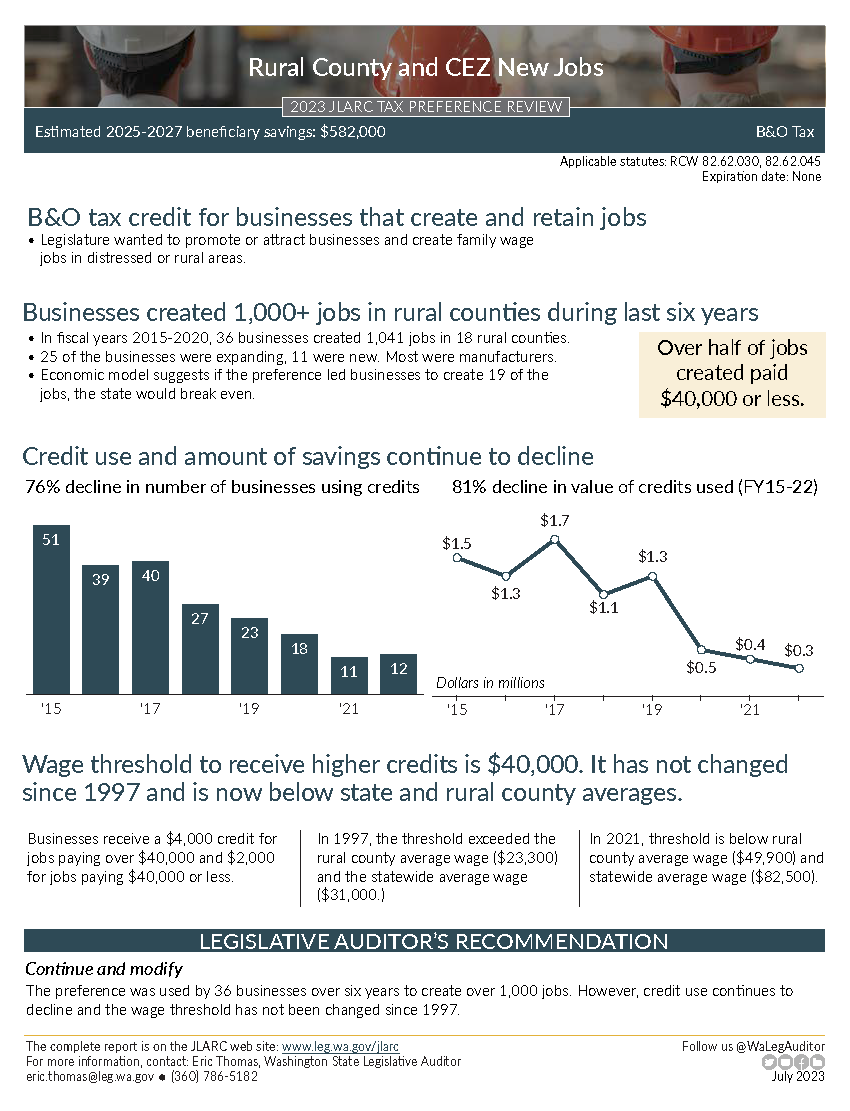

Rural County and CEZ New Jobs

Rural County and CEZ New Jobs

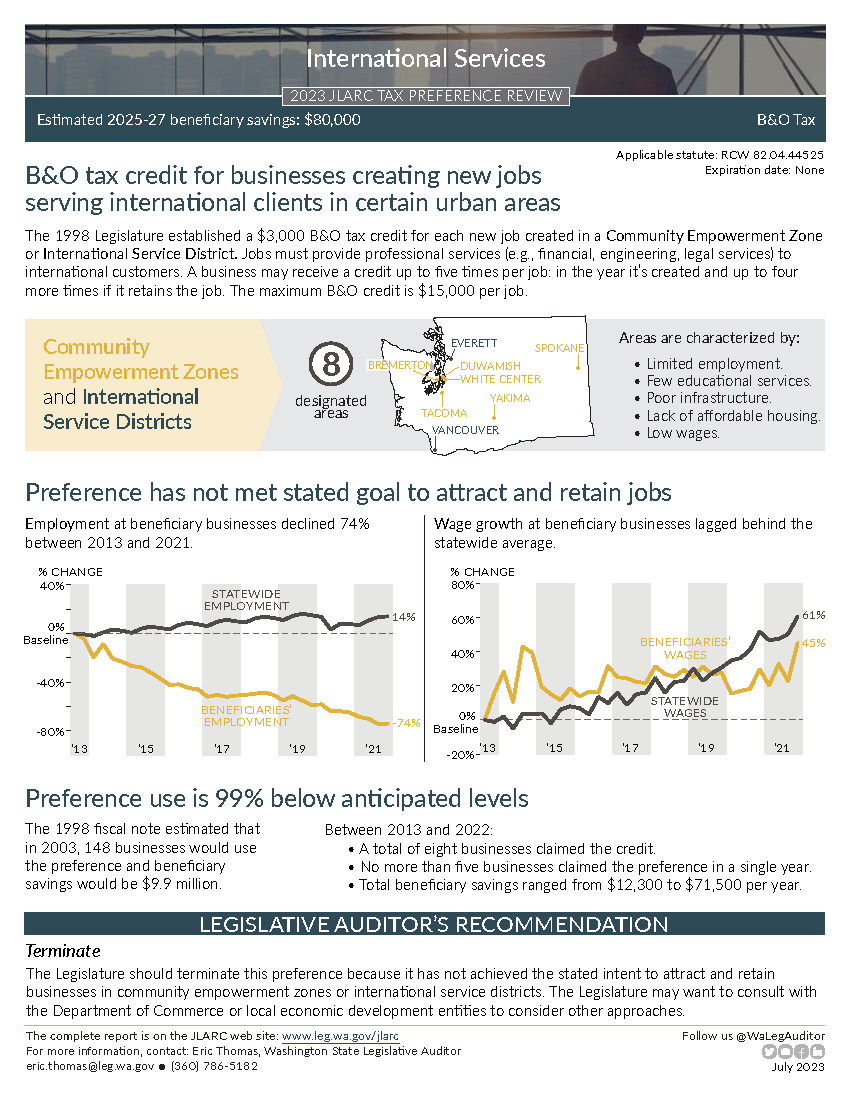

International Services

International Services

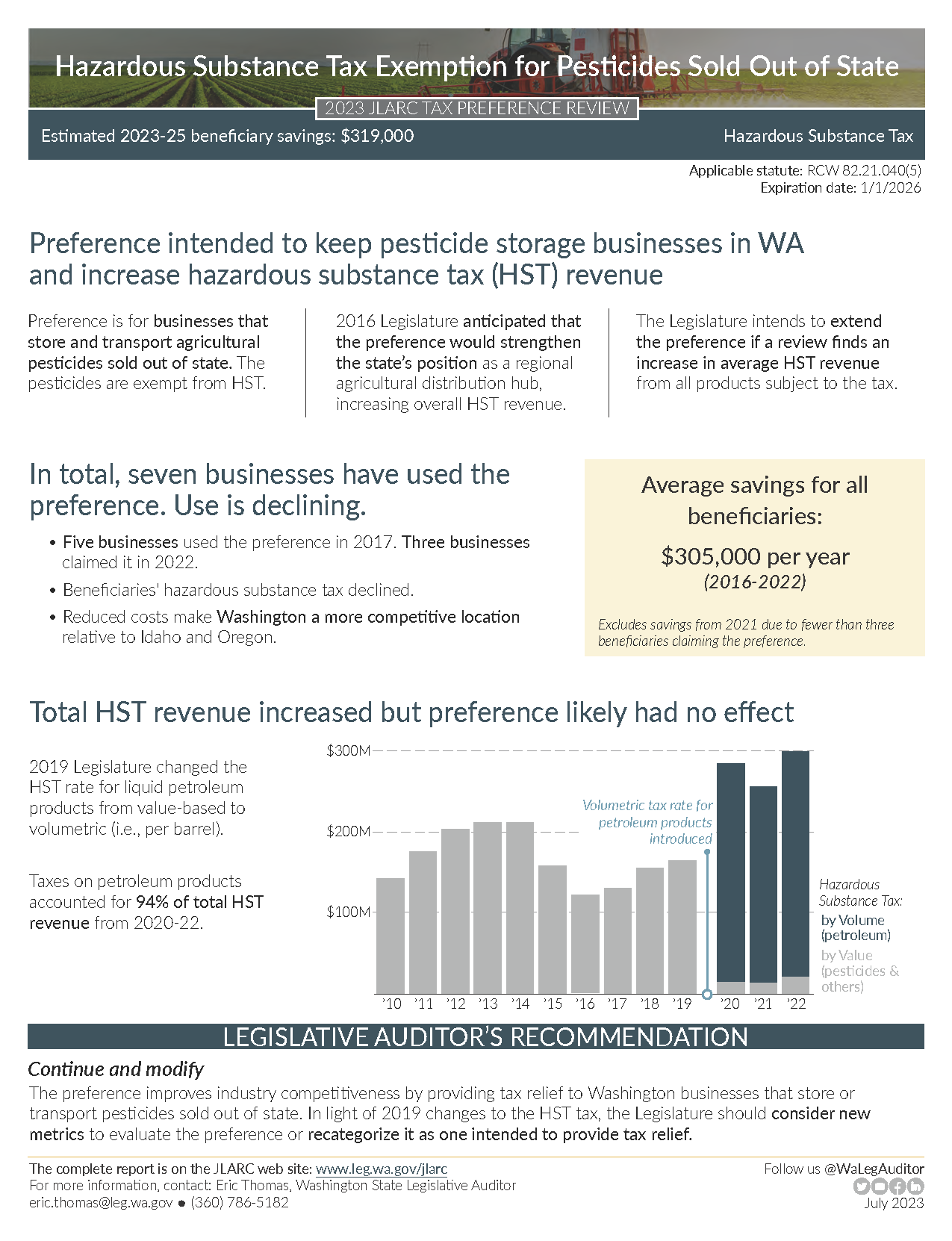

Hazardous Substance Tax Exemption for Pesticides Sold Out of State

Hazardous Substance Tax Exemption for Pesticides Sold Out of State

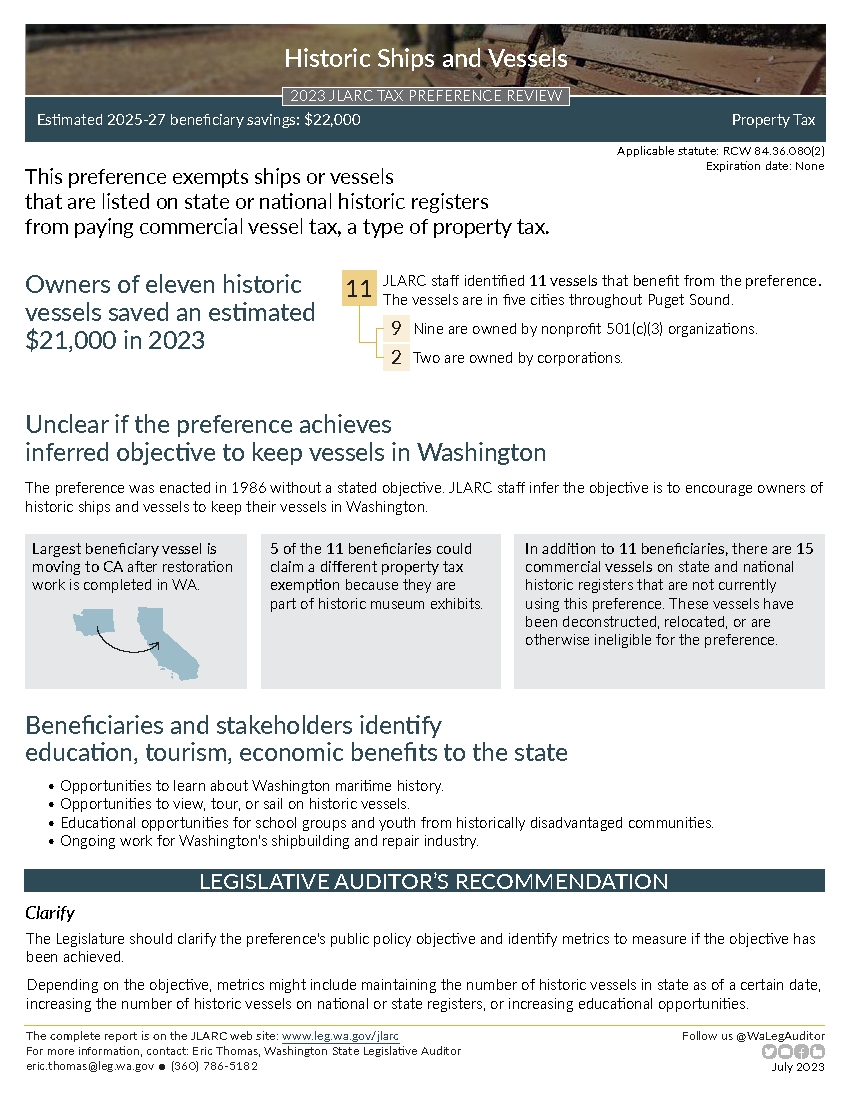

Historic Ships and Vessels

Historic Ships and Vessels

One recommendation does not require legislative action

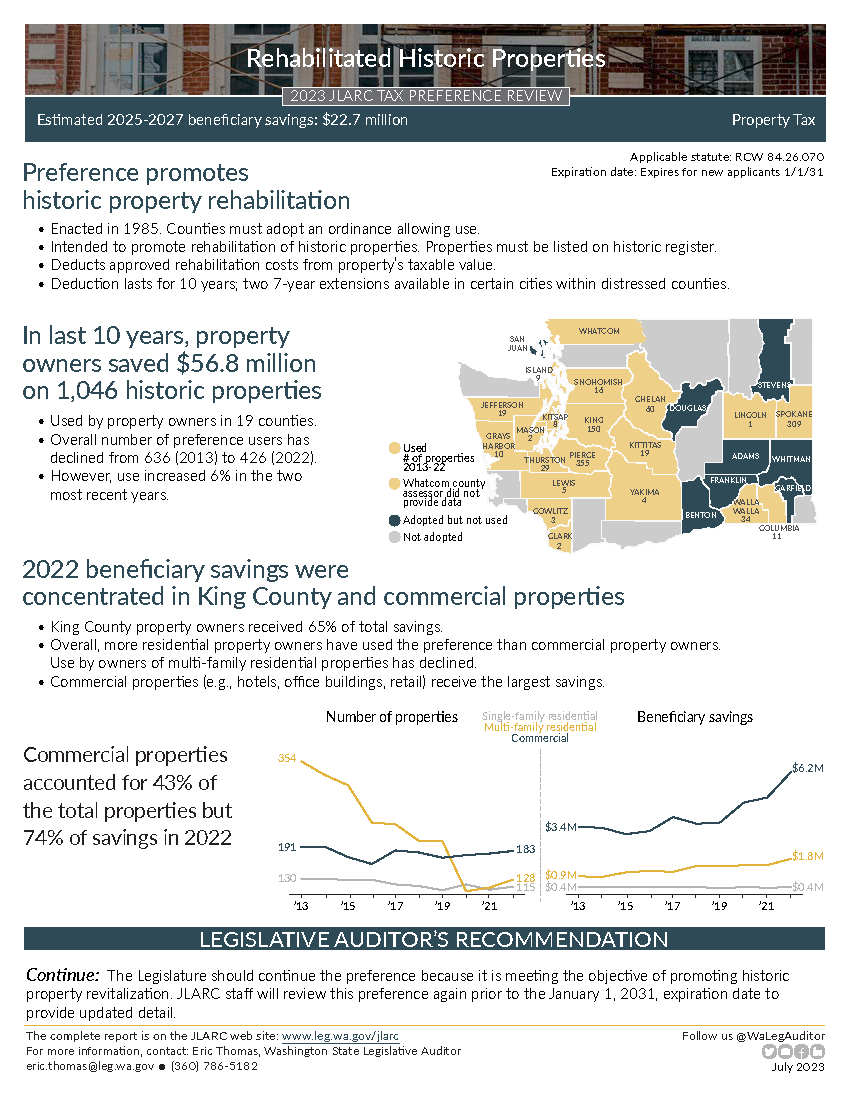

Rehabilitated Historic Properties

Rehabilitated Historic Properties

The Citizen Commission for the Performance Measurement of Tax Preferences also considers preferences based on information provided by the Department of Revenue. View the 2023 Expedited Preference Review.