JLARC Proposed Final Report: Workers’ Compensation Claims Management

(Updated 12/2/2015)

Legislative Auditor's Conclusion:

Claims management by L&I is unbiased and decisions are generally timely. Outcomes could be improved if systems were more focused on prompt and safe return to work.

In 2011, the Legislature directed JLARC staff to conduct a performance audit of workers’ compensation claims management at the Department of Labor & Industries (L&I). JLARC staff hired a consulting firm with expertise evaluating workers’ compensation programs to assist with the audit. The consultants’ review focused largely on claims management between 2010 and 2013. (See Technical Appendix under the Report details tab.)

Workers’ compensation is a form of insurance that protects workers and employers when injuries or illnesses happen on the job. With few exceptions, employers in Washington must provide this coverage to their workers.

Between 2010 and 2013, an average of 125,000 claims were accepted for compensation each year. Of these:

- L&I directly managed an average of 87,000 claims (State Fund claims).

- Self-insured employers managed another 38,000 claims with L&I oversight.

L&I can improve its efforts to help workers return to work promptly and safely

Workers in 20 percent of State Fund claims are away from work while recovering from a work-related illness or injury. Research has shown that having the injured worker return to work as soon as safely possible is in the best interest of both the worker and the employer. L&I can improve its efforts to help workers return to work promptly and safely.

Legislative Auditor recommendations for return to work:

- L&I should institute standards for early phone contact, claim management planning, and clear documentation in claims management.

- L&I should expand its pilot programs and enhance its claims management support systems (training, performance measures, and technology) with a focus on return to work.

The Department of Labor and Industries indicated they concur with the Legislative Auditor's recommendations.

L&I has mixed results for statutory timeliness standards

Three timeliness measures affect many workers and employers in the State Fund. Between 2010 and 2013, L&I met standards for timely dispute resolution and made 79 percent of initial lost wage payments on time. L&I also met standards for timely decisions to accept or deny State Fund claims. As required by statute, L&I issues a formal order when self-insured employers have already agreed to accept claims. This process adds time but little value.

Legislative Auditor recommendation for timeliness:

- The Legislature should allow self-insured employers to issue formal orders when accepting claims, and L&I should incorporate a review of those orders in its audits of self-insured employers.

L&I makes unbiased decisions and uses a variety of communication tools

L&I claims management and dispute resolution processes and decisions appear unbiased. This conclusion focused solely on L&I’s decisions for managing claims and disputes and did not assess whether the underlying workers’ compensation laws favor some parties over others.

Official publications and web sites are accurate and professional. While L&I relies heavily on letters to document and communicate information specific to a claim, it also uses phone calls and online tools.

- Workers’ Comp in WA

- The Goal: Return to Work

- Improving Return to Work: Claims Management

- Improving Return to Work: Tools & Systems

- Mixed Results for Timeliness

- Claims Management Decisions Appear Fair

- L&I Communication

- Technical Appendix: Consultant Report

The Department of Labor & Industries is responsible for managing the workers’ compensation system

Workers’ compensation is a form of insurance that protects workers and employers when injuries or illnesses happen on the job. It covers expenses such as medical costs, lost wages, and vocational retraining services. In exchange for these benefits, workers cannot sue their employers for work-related injuries and illnesses.

Claims management responsibilities vary among workers’ compensation options

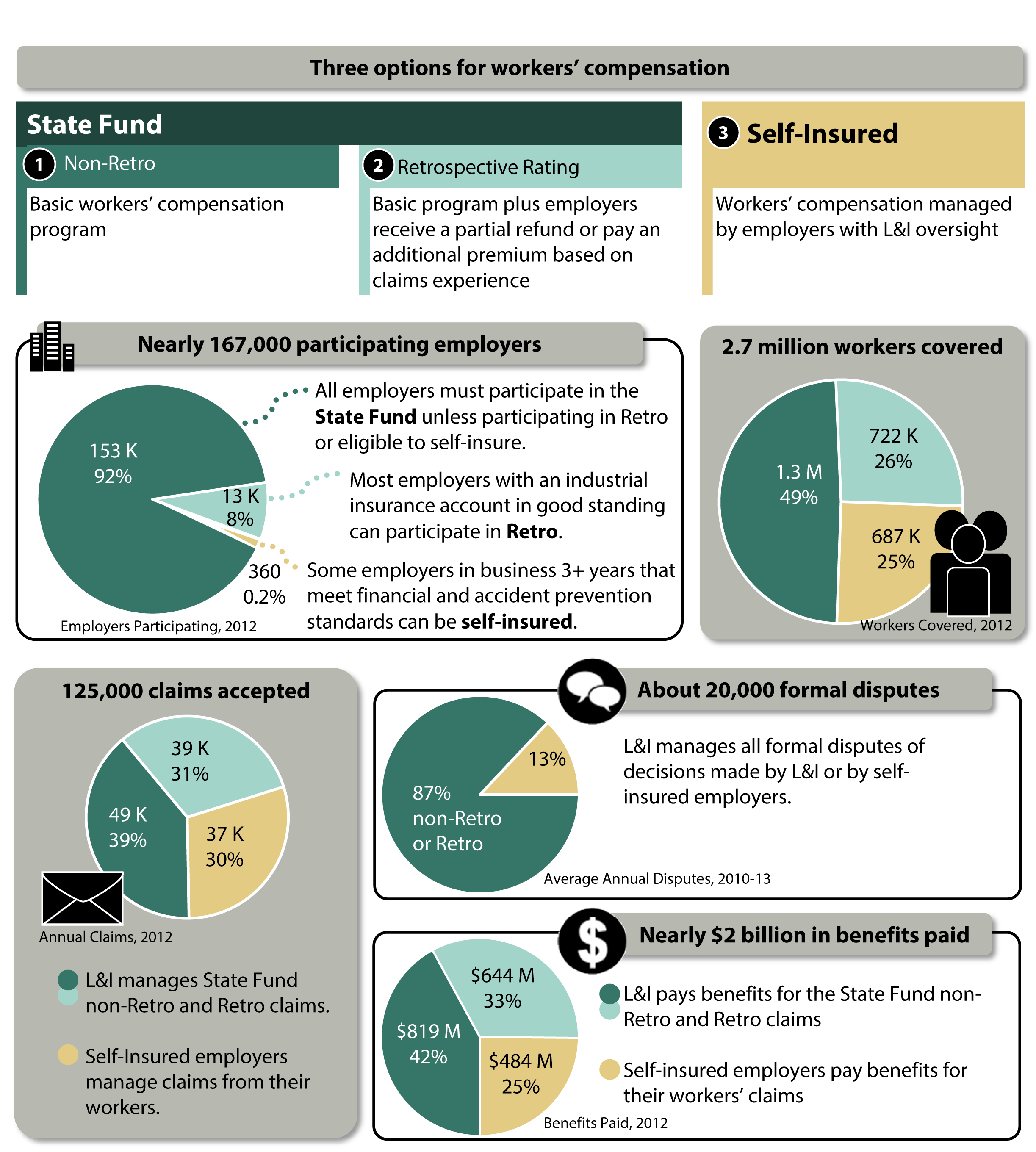

In Washington, employers must provide coverage for their employees through the State Fund or Self-Insurance. Most employers covered by the State Fund may participate in the optional Retrospective Rating program (Retro) if their industrial insurance account is in good standing.

- The Department of Labor and Industries (L&I) directly manages claims in the State Fund for both Retro and non-Retro employers.

- L&I oversees claims management by employers for Self-Insured claims.

- Both State Fund and Self-Insured employers pay L&I’s administrative costs.

All injured workers are entitled to the same benefits.

- For the State Fund (Retro and non-Retro), premiums cover the costs of benefits to injured workers. Both employers and workers pay premiums to L&I.

- Self-Insured employers pay benefits to employees directly.

Exhibit 1 summarizes worker and employer participation, L&I responsibilities, and benefits paid.

The primary goal of workers’ compensation claims management is prompt and safe return to work, but Washington claims last longer than average

Claims management aims to help the worker recover, mitigate economic impacts, and return to work promptly and safely. It involves the claim manager, worker, employer, medical professionals, vocational specialists, and others.

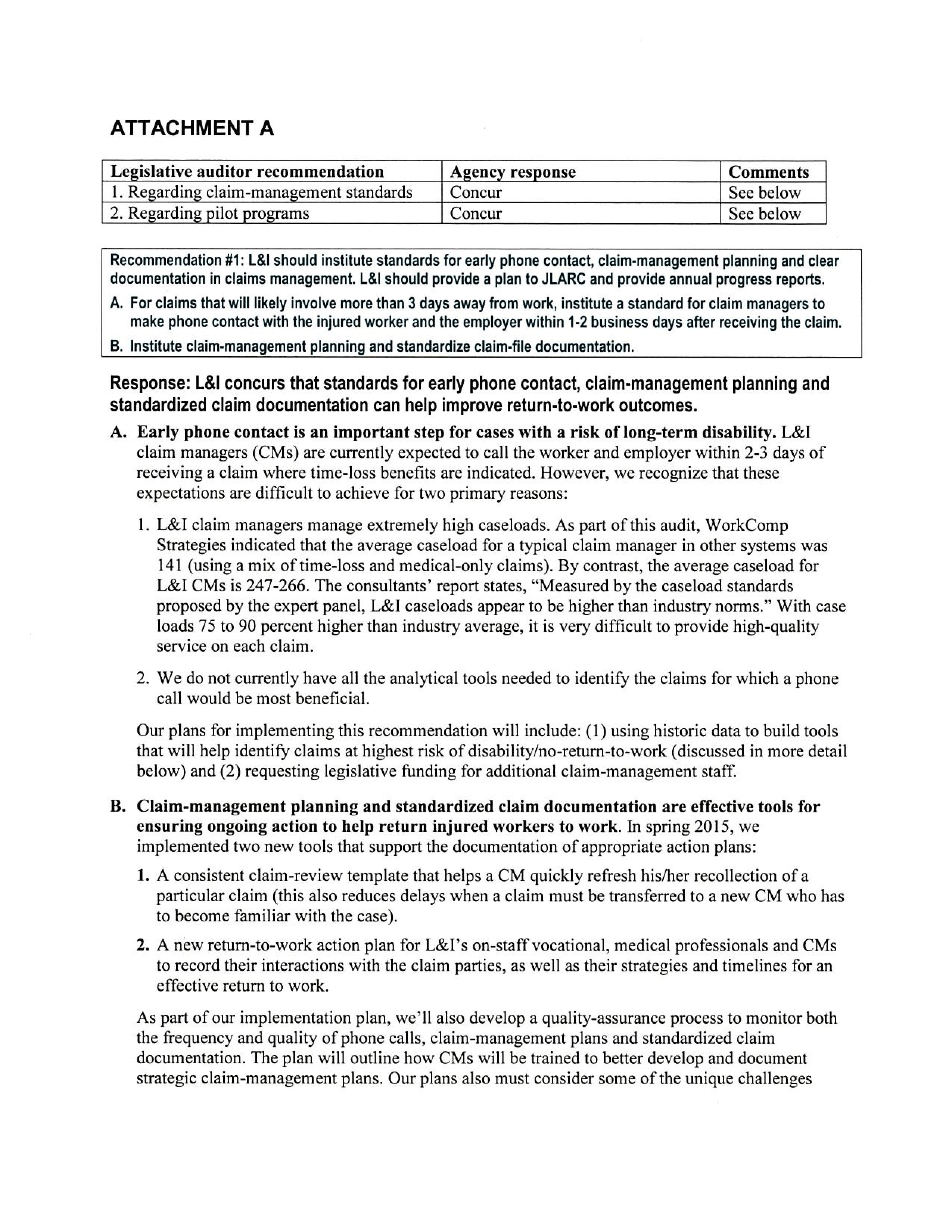

Exhibit 2 shows a simplified view of claims management with a goal of achieving return to work.

Source: JLARC staff depiction of process describe in consultant report.

Prompt and safe return to work benefits both injured workers and employers

There are many ways that a worker can return to work. Usually, the worker will return to the same job with the same employer. Other return-to-work options, such as changing the job’s duties or performing a different job temporarily, help the worker continue working during recovery. In a few cases, return to work means finding a new job with a new employer.

Like most workers’ compensation systems, L&I aims to help injured workers heal and return to work promptly.

- Prompt return to work benefits employers by stabilizing the workforce and limiting the effect of the claim on future premiums.

- Workers also benefit from a prompt return to work. Several studies have estimated that once a worker is off the job 6 months, the chance of returning to work is 50 percent. At 12 months, the chance declines to less than 10 percent. Prolonged absences from work are related to poor mental and physical health, increased risk for additional injury, and income loss.

Relatively few claims in Washington involve extended time away from work, but they are open longer than the national average

Whether a claim involves time away from work depends on many factors, including the injury and the type of work. For example, an office worker may be back on the job quickly after breaking an ankle, while a professional dancer may not. Some employers may be able to offer different jobs or modified duties to injured workers so that they return to work sooner.

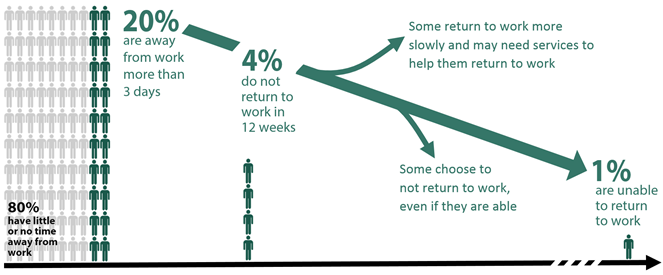

As shown in Exhibit 3, 20 percent of the 87,000 State Fund claims accepted by L&I each year involve more than 3 days away from work. Many of these workers will receive payments from L&I for a portion of their lost wages while they are away from work. In about 1 percent of claims, the worker is unable to return to gainful employment and may be eligible for permanent disability payments (a “pension”).

Claim duration and the number of workers receiving a pension in Washington is higher than the national average.

- Between 2010 and 2013, the estimated average amount of time an injured worker was away from work and receiving payments for lost wages in Washington was 40 weeks. In contrast, the National Council on Compensation Insurance estimated the national average to be 20 weeks.

- In 2013, L&I projected that about 43.7 workers out of every 100,000 would ultimately receive a pension. In contrast, the National Council on Compensation Insurance projected the average across 38 other states to be 2.3 per 100,000.

The longer a person is away from work, the higher the claim costs will be.

- The average cost for a claim that involves little to no time away is $1,300.

- The average cost for a claim that involves fewer than 12 weeks away from work is $11,000.

- The average cost for a claim that results in a pension is $760,000.

Longer average duration of Washington claims appears related to statute and claims management practices

The consultants’ work and other studies show that the reason Washington has longer durations and more pensions than the national average is unrelated to the nature of injuries or demographics. Rather, it appears to be linked to a combination of factors including the statutory framework and claims management practices.

- One statutory factor is the “employability standard.” In accordance with RCW Title 51, Chapter 32, L&I ends payments when the worker returns to work, the medical provider releases the worker for full duty, or L&I assesses that the worker is “employable.” This “employability” standard has been the subject of much debate and case law interpretation. The consultants found that the standard is difficult to apply, atypical among workers’ compensation systems, and results in a relatively high number of workers being considered unemployable.

- The list of priorities for the services L&I uses to help workers return to work, which is included in RCW 51.32.095, is another factor. The first four priorities encourage return to work with the same employer. The worker may perform the same job, with or without modifications, or a new job. The last option is short-term retraining for a new job. Applying these priorities well involves selecting the right service to be applied at the right time. Often this involves coordination with several service providers. This complex process takes time, which can extend claim duration.

- Statute does not include time limits, which may extend the duration of claims. Some states limit the number of weeks that benefits are paid or stop benefits when the worker reaches maximum medical improvement.

L&I can improve its claims management by instituting standards for early phone contact, planning, and clear documentation

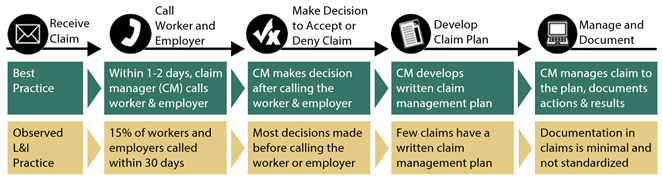

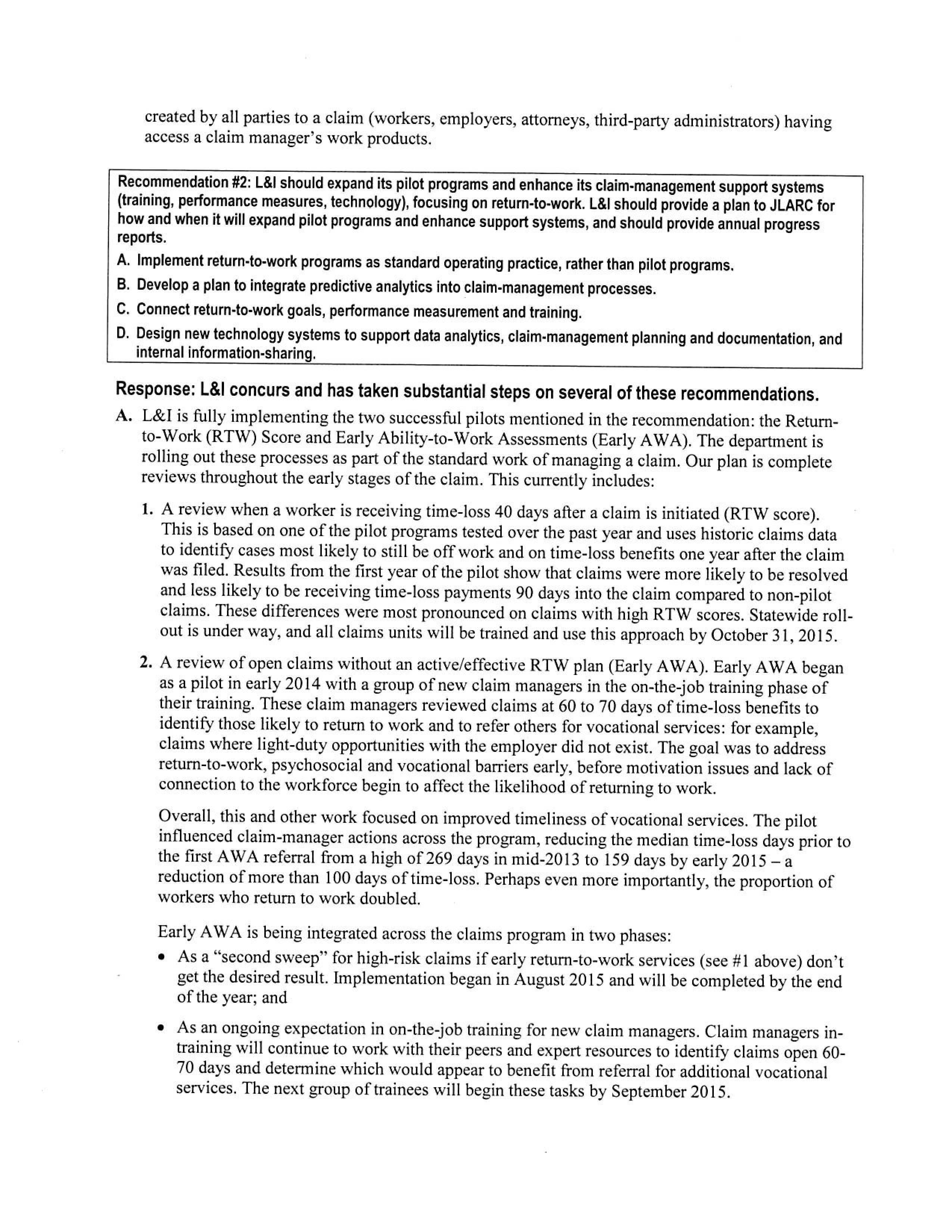

About 20 percent of claims in the State Fund involve more than 3 days away from work. Industry best practices for these types of claims include early phone contact with workers and employers, claim management planning, and clear documentation. These efforts can identify issues that complicate claims management and prolong the time away from work. In the claims reviewed for this study, L&I claims managers did not appear to consistently follow these practices (Exhibit 4).

Early phone contact from the claim manager would set a foundation for managing injuries that require time away from work

For the subset of claims that will likely involve more than 3 days away from work, industry best practice recommends that claim managers contact workers and employers within 1-2 business days after receiving the claim. Initial phone conversations by claim managers can help build relationships, improve stakeholder communications, provide insights into case risks and issues, and set expectations for return to work. The call also helps the claim manager gather the information needed to evaluate the claim and begin planning.

When a claim will involve payments for lost wages, L&I expects the claim manager to contact the worker and employer. L&I measures whether the claim manager attempted a call within 30 days, and does not distinguish between attempted and actual contact. Only 15 percent of the files reviewed by the consultants contained evidence that actual contact with the employer and the injured worker occurred within the first 30 days. There was no recorded evidence of actual contact at any time in 55 percent of the files.

L&I attempted a more expansive version of early contact in response to a 1998 JLARC study recommendation, but stopped after some employers reported that it was unnecessary for claims in which the worker was back on the job quickly. The consultants suggest that not all claims require early contact. Best practices focus on claims where the nature and extent of the injury or illness, the type of work, and worker and employer characteristics indicate early contact will be beneficial. Such indicators are based on data analytics.

A lack of a planning and documentation can hinder return to work and proactive claims management

Workers’ compensation best practices call for a written claim management plan and careful documentation.

- A written claim management plan describes a pathway for returning to work, timing of interventions (e.g., vocational services and return-to-work programs), targeted outcomes, and expected dates to evaluate progress. A plan also establishes expectations with the injured worker and the employer about the steps to recovery and desired outcomes, and identifies barriers to success. The initial plan should be updated as the claim progresses.

- Documentation identifies the actions taken to advance the claim toward the desired outcomes, provides information for coordination among L&I staff, and provides a mechanism for supervisors to review claim handling or transfer claims.

The consultants’ review of individual claim files found that only 16 percent of the files included a robust record of planning and actions by the claim manager. Many files contained only brief notations that offered little explanation about the general direction of the claim or any anticipated actions or challenges.

Legislative Auditor Recommendation: L&I should institute standards for early phone contact, claim management planning, and clear documentation in claims management.

The Department of Labor and Industries concurs with this Legislative Auditor recommendation.

L&I can improve its return-to-work efforts by expanding pilot programs and enhancing support systems

L&I has many services and programs that focus on helping workers return to work. Best practices indicate that these should be provided as early as possible and should be standard practice for claims management. Relevant training, performance systems, and technology are necessary claims management support systems that can be enhanced to focus on return to work.

L&I has programs for early return to work and vocational services that are not yet standard practice for claims management

Industry best practices recommend that return-to-work programs and vocational services be offered early in the claims management process for claims that involve time away from work. L&I introduced pilot programs after the 2010-2013 study period to deliver some services earlier in the life of a claim. The agency has not yet implemented these practices as a standard part of its claims management approach.

An L&I pilot program uses predictive scoring for referrals to the Early Return to Work (ERTW) program

The Early Return to Work (ERTW) program offers assistance and financial incentives to employers so that the worker can safely return to work during the healing process. Workers might do the same job with changed duties or other modifications, or might do a different job temporarily.

- Between 2010 and 2013, claim managers could refer a claim to the ERTW program at their discretion, based primarily on professional judgment. The referral was not required.

- In a pilot program launched in late 2013, L&I began using claim data analytics to determine which claims should be referred to the ERTW program. The analysis produces a score for each claim. The score is based on 11 variables that are reliable predictors that a claim could have a long duration unless early intervention takes place. L&I does the analysis 40 days after receiving the claim if it has paid benefits for lost wages. The Department indicates that it plans to make the analysis standard practice in 2015 and require referrals to the ERTW program as indicated by the score.

The Early Ability to Work Assessment pilot program aims to start vocational services sooner in the claim process.

Vocational services help workers find new work options through job modifications, skill assessments, job placement, and counseling. Vocational services start with an ability to work assessment, which is a formal evaluation that determines if the injured worker is likely to be employable in the open job market. Completing the assessment can take 5 to 6 months and involves the worker, vocational counselors, and medical professionals.

- Between 2010 and 2013, claim managers delayed the ability to work assessment until the worker was at or near maximum healing. As a result, over half of these assessment were not started for 8 months following the injury. The worker was off the job during this time.

- Currently, L&I does not require claim managers to wait for maximum healing. The Department also is testing a process that would start the assessment after 60 to 70 days (but before the worker has reached maximum healing) and involve closer coordination among the medical provider, physical therapist, and vocational counselor. Unlike the standard assessment, the early assessment focuses on providing services, eliminating barriers, and maintaining worker motivation so that the worker can safely return to work.

L&I training, performance measurement, and technology systems could better support a focus on return to work

The L&I support systems are designed around the process of claims management, rather than return-to-work outcomes.

- Between 2010 and 2013, L&I training for claim managers focused on new hires, with an emphasis on legal issues and procedures. Continuing education and development related to claims management was less structured. L&I recently has begun formal instruction to teach all claim managers skills and strategies to improve return-to-work outcomes.

- L&I has established return-to-work goals and performance measures in its strategic plan and expectations for executive management. It does not have return-to-work goals in its measures of claim managers’ activity. Further, while L&I measures numerous details of the workflows and functional responsibilities, the measures do not connect claims management activities to return-to-work goals. As a result, claims management focuses more on process steps than return-to-work outcomes.

- The current technology environment is complex, involving two primary and multiple secondary computer systems. Claim managers need highly specialized knowledge to use the tools. These systems do not integrate planning, documentation, and use of data analytics in day-to-day claims management. Further, L&I staff do not use the systems to record thorough internal notes and plans about the direction of the claim or potential barriers, creating a gap in L&I’s ability to manage complex claims. L&I received funding in the 2015-17 biennial budget for the first phase of a project to replace the system.

Legislative Auditor Recommendation: L&I should expand its pilot programs and enhance its claims management support systems (training, performance measures, and technology) with a focus on return to work.

The Department of Labor and Industries concurs with this Legislative Auditor recommendation.

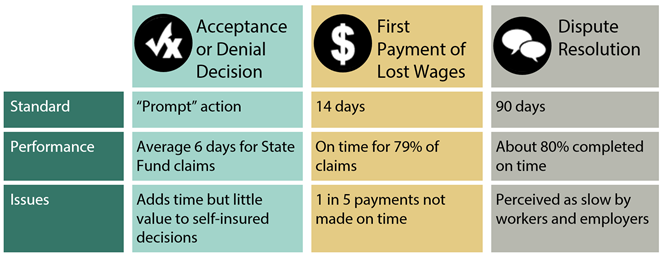

L&I has mixed results for timeliness standards

Three timeliness measures affect many workers and employers in the State Fund: Time for initial acceptance or denial decision; time to first payment of lost wages; and time for dispute resolution (Exhibit 5).

L&I makes timely acceptance or denial decisions for State Fund claims

After receiving a claim, an L&I claim manager must decide whether to accept or deny it. On average, the decision is made within 6 days.

Acceptance or denial decisions for self-insured claims take longer, due in part to the L&I review required by statute

The decisions to accept or deny claims by workers whose employers are self-insured take considerably more time: an average of 66 days. This includes 30 to 45 days for L&I to review the employer’s decision and issue the official acceptance or denial order, as required by RCW 51.14.130.

The L&I approval step delays decisions and may not add value for acceptance decisions. The order from L&I rarely contradicts the employer’s decision: L&I agrees with the employer for 99 percent of acceptance decisions and 98 percent of denials. L&I reports that in many cases, if the self-insured employer has accepted the claim, that employer will pay benefits without waiting for the Department’s order.

Allowing self-insured employers to issue the formal decision (order) when accepting claims could eliminate 30 to 45 days from the process and give workers an earlier opportunity to dispute decisions. L&I can maintain its oversight function by reviewing a sample of the orders through its existing audits of self-insured employers’ claims management processes and decisions.

Legislative Auditor recommendation: The Legislature should allow self-insured employers to issue formal orders when accepting claims, and L&I should incorporate a review of those orders in its audits of self-insured employers.

L&I makes most initial payments for lost wages on time

A common performance metric for workers’ compensation systems is how quickly workers receive the first payment for lost wages.

RCW 51.32.210 requires that L&I make the first payment of lost wages within 14 days of receipt of a payable claim. L&I defines this as the date that it knows the claim will involve time away from work. This date can be after L&I first receives notice of the claim. Between 2010 and 2013, L&I made 79 percent of first payments within 14 days. Missing or incomplete information can cause payment delays.

L&I resolves disputes in a timely manner

Statute allows workers, employers, and care providers to dispute L&I decisions. The complainant can submit the dispute to L&I or appeal the decision directly to the Board of Industrial Insurance Appeals (BIIA), which is a separate state agency. Disputes submitted to L&I are called “protests,” while those submitted to BIIA are called “appeals.” BIIA allows L&I to review its original decision before BIIA proceeds with an appeal. If L&I reviews its decision, statute requires that it complete the review within 90 days, although an additional 90 days is available for good cause.

There are no other statutory timeframes for dispute resolution, so the consultants compared L&I’s dispute resolution to the 90-day standard for reviewing appealed decisions. By this measure, L&I resolves disputes in a timely manner: about 80 percent of protests are resolved within 90 days. The average time to resolution is 55 days.

While L&I meets this timeliness standard, the consultants’ survey of employers and workers found that 64 percent of workers and 52 percent of employers thought the dispute process was slow. This survey included only claims with more than $5,000 in medical costs and provides information about worker and employer perceptions in more complex claims. The consultants noted that this may be a matter of establishing expectations for dispute timeliness rather than speeding up the actual dispute resolution process.

The time it takes for providers to file claims affects timeliness of L&I claims management

In Washington, most claims are submitted by a medical provider after he or she evaluates the worker’s injury or illness. Workers and employers often report additional information. Between 2010 and 2013, L&I received claims an average of 12 days after the injury.

L&I has two programs that help reduce the number of days between a worker’s injury or illness and L&I’s receipt of the claim:

- FileFast allows workers and providers to file claims online or by phone. L&I states that online filing through FileFast can speed claims receipt by 5 days compared to paper reports.

- Centers for Occupational Health and Education (COHE) are care providers that specialize in occupational health. The staff are familiar with L&I requirements and can file the claims quickly and completely. A study of 4 of the 6 COHE providers found that they submitted about 80 percent of claims within 2 business days, compared to about 28 percent for non-COHE providers.

L&I manages claims in an unbiased manner

The consultants reviewed files and data for State Fund (non-Retro and Retrospective Rating) and Self-Insured claims, as well as L&I procedures for managing State Fund claims. The analysis considered measures such as the time needed to make decisions or close a claim, the actual decisions made, and the rate of denial.

The consultants found no evidence of bias in favor of certain worker characteristics (e.g., gender or age), employer characteristics (e.g., type or size), or coverage program (i.e., State Fund, Retro, or Self-Insured).

The reviewers noted that differences among the groups were based on legitimate factors, such as nature of the injury or size of the employer. For example, the nature of some injuries will require more time away from work than other injuries, and workers whose employers were large enough to offer light duty options may return to work more quickly than other workers.

This conclusion focused solely on L&I’s decisions for managing claims and did not assess whether the underlying workers’ compensation laws favor some parties over others.

State Fund non-Retro and Retrospective Rating program claims treated equally

L&I handles non-Retro and Retro claims in the same manner. Retrospective rating plan refunds do not appear to be affected by differences in L&I claims management organization or delivery. Retro employers, both those participating as an individual employer or as part of a group, benefit from their own improved safety, return to work efforts, and other actions to help control costs and improve overall outcomes.

L&I resolves disputes in an unbiased manner

Workers, employers, and care providers can dispute a claim manager’s decision to L&I. The consultants reviewed the formal disputes that L&I managed for State Fund (non-Retro and Retrospective Rating) and Self-Insured. The outcomes and reversal rates from L&I dispute resolution appear unbiased and consistent across gender, age, employer characteristics, and coverage program.

This conclusion focused solely on L&I’s decisions for managing disputes and did not assess whether the underlying workers’ compensation laws favor some parties over others.

Using phone calls and online tools, in addition to letters, improves stakeholder satisfaction

L&I uses a variety of tools to communicate with workers, employers, and providers. These include letters, phone calls, online systems, and web pages. Some tools are used for communicating claim-specific information, while others provide more general information.

Letters intended to communicate claim-specific information can sometimes contribute to confusion

L&I sends thousands of letters each work day to workers, employers, and providers involved in claims. These letters:

- Provide consistent information and create an official record of claims management and decisions.

- Generally meet plain-talk standards, but workers still reported confusion in the consultants’ survey. L&I documents show that medical providers may not know what information they need to provide to claim managers.

Phone calls can help communicate claim information and improve satisfaction

Claim managers can use phone calls to ensure letters were received, answer questions, clarify next steps, and provide direct opportunities to help in resolving issues. Personal contact allows for less formal interaction and use of qualified translators when needed.

Industry best practice recommends that claim managers make initial phone contact within a few days when workers will miss more than 3 days of work. Additional phone calls to those workers and others can be made as needed. An L&I survey shows that the percent of workers satisfied with L&I is higher when claim managers call workers: 74 percent of workers who received a call from the claim manager gave L&I a “good” rating compared to 53 percent of workers who did not.

L&I has well-received online tools and web sites

The Claim & Account Center is a web-based tool that workers, employers, and care providers use to access the details of a claim and leave messages for the claim manager. In a survey conducted for L&I, 33 percent of workers and 57 percent of employers reported using the Center. Further, 61 percent of workers and 77 percent of employers found it easy to use.

Web sites, as well as other official publications, are written in an accurate and professional way that is suitable for the intended audience.

The consultants’ full report is available

As part of workers’ compensation reform legislation passed in 2011, the Washington Legislature directed JLARC to conduct a performance audit of the state’s workers’ compensation claims management system. JLARC staff hired WorkComp Strategies LLC, a consulting firm with expertise evaluating workers’ compensation programs, to assist with the audit.

The consultants’ approach included analysis of L&I claims data, individual claim file reviews, surveys involving injured workers and employers (based on claims over $5,000 in medical costs), interviews with stakeholders and industry experts, and a comparative analysis of data from other jurisdictions.

The consultants’ full report, as well as the individual chapters and appendices, is available through the links below:

Full report

This link provides all sections including the executive summary and appendices.

Executive Summary

This link provides a brief overview of findings and methods

Main Report

Chapter 1 – Claims Management Organization

Chapter 2 – Claims Management Performance

Chapter 5 – Overall System Performance

Chapter 6 – Opportunities for Improvement

Appendices

Appendix 1 – Self-Insurance Regulation, Washington and comparisons

Appendix 2 – Disability Management context, best practices

Appendix 4 – Highlights from File Review – key decisions

Appendix 6 – WorkComp Strategies Survey Results (Employers)

Appendix 7 – WorkComp Strategies Survey Results (Workers)

Legislative Auditor makes three recommendations

Two Legislative Auditor recommendations would improve return to work. Prompt return to work benefits both employers and workers, and is a goal set forth in Washington’s workers’ compensation statutes. A third recommendation would promote more timely decisions.

Recommendation #1:

L&I should institute standards for early phone contact, claim management planning, and clear documentation in claims management. L&I should provide a plan to JLARC for how and when it will achieve the standards and provide annual progress reports describing actions taken to complete the plan.

For the subset of claims that will likely involve more than 3 days away from work, institute a standard for claim managers to make phone contact with the injured worker and the employer within 1-2 business days after receiving the claim.

Based on research supporting the importance of making phone contact within 1-2 business days, L&I should implement strategies for separating claims based on the level of contact needed: one level for claims that can be easily and swiftly resolved; and a more proactive level of contact for those with a higher risk of extended time away from work. Contacting the employer immediately may not be necessary if the accident report and contact with the worker indicate that prompt return to work is likely.

Institute claim management planning and standardize claim file documentation.

The initial phone call and claim information should provide the basis for a claim management plan that includes an individual return to work plan, timing of planned interventions, targeted outcomes, and planned dates to evaluate progress. Claim managers should document the actions taken to advance the claim toward the desired outcomes.

| Legislation Required: | No |

| Fiscal Impact: | JLARC staff assume the plan to achieve standards and progress reports can be completed within existing resources. Implementation may require other resources. |

| Implementation Date: | The plan is due April 1, 2016. Annual progress reports should be provided by October 10 of each year. |

| Agency Response: | Concur - see link here |

Recommendation #2:

L&I should expand its pilot programs and enhance its claims management support systems (training, performance measures, and technology) with a focus on return to work. L&I should provide a plan to JLARC for how and when it will expand pilot programs and enhance support systems and should provide annual progress reports describing actions taken to complete the plan.

Implement return-to-work programs as standard operating practice rather than pilot programs

Employing vocational services to achieve return to work as quickly and safely as possible is a principle that L&I recognizes. L&I has made positive steps with its pilot programs for the use of score-based referrals to the Early Return to Work program and Early Ability to Work Assessment, and initial results are promising. L&I should make return-to-work programs like these standard practice for all claims involving time away from work, while continuing to measure outcomes and adjust procedures.

Develop a plan to integrate predictive analytics into claims management processes

Other workers’ compensation systems use mathematical and statistical models (data analytics) to help identify claims that could have a long duration and high costs. If these claims are identified early, claim managers can focus their efforts and interventions to improve outcomes on the more challenging claims. L&I has started to use data analytics for early return-to-work referrals, but it should expand its use to improve outcomes, balance caseload, and plan interventions.

Connect return-to-work goals, performance measurement, and training

Return to work is one of L&I’s strategic goals. Both the agency and executive managers have performance measures that are designed to assess the Department’s progress toward improving return to work. Units responsible for claims management have a multitude of measures and reports, but these do not clearly relate to return-to-work goals. The return-to-work performance measures should extend to work units and individual claim managers so that it is clear how standard work practices contribute to the agency’s return-to-work goal. Claim managers should receive ongoing training in activities that will lead to better claim outcomes (e.g., communication techniques and claims management skills). L&I has recently implemented a training program for claim managers that appears well-designed for this purpose. This training should become standardized across all claim units and follow-up training should be conducted.

Design new technology systems to support data analytics, claim management planning and documentation, and internal information sharing

L&I received funding in the 2015-17 budget to begin updating its core technology system. The Department reports that this is the first step in a process designed to rebuild technology support for all of its business processes, including claims management. L&I should ensure that future systems integrate the claims management process with data analytics, support planning and documentation, and provide tools for claim managers such as planning templates, dashboards, and alerts. Further, the system should support appropriate internal information sharing about potential barriers to return to work and solutions.

| Legislation Required: | No |

| Fiscal Impact: | JLARC staff assume the plan and progress report can be completed within existing resources. Implementation may require other resources. |

| Implementation Date: | The plan is due April 1, 2016. Annual progress reports should be provided by October 10 of each year. |

| Agency Response: | Concur - see link here |

A third Legislative Auditor recommendation would improve the timeliness of acceptance decisions for workers of self-insured employers.

Recommendation #3:

The Legislature should allow self-insured employers to issue formal orders when accepting claims, and L&I should incorporate a review of those orders in its audits of self-insured employers.

Self-insured employers receive claims from workers, make the initial decision to accept or deny the claim, and request L&I approval. L&I makes the official decision (an “order”). The L&I approval step delays decisions and may not add value for acceptance decisions, known as “allowance orders.” The consultants reviewed a sample of 111 claims and found that L&I accepted 110 of the claims (99 percent). The one exception involved a denial that was later overturned and accepted.

Allowing self-insured employers to issue the formal decision when accepting claims could eliminate 30 to 45 days from the process for certain claims. This would require a statutory change to RCW 51.14.130. L&I should maintain its oversight function by reviewing a sample of the orders through its existing audits of self-insured employers’ claims management processes and decisions.

| Legislation Required: | Yes |

| Fiscal Impact: | JLARC staff assume this can be completed within existing resources. |

| Implementation Date: | July 1, 2017 |

Consultants’ report offers additional opportunities for improvement

The consultants’ report (see Technical Appendix under the report details tab) offers additional management suggestions to L&I.

Contact

Authors of this Study

John Bowden, Research Analyst, 360-786-5298

Rebecca Connolly, Research Analyst, 360-786-5175

Valerie Whitener, Audit Coordinator

Keenan Konopaski, Legislative Auditor

Joint Legislative Audit and Review Committee

Eastside Plaza Building #4, 2nd Floor

1300 Quince Street SE

PO Box 40910

Olympia, WA 98504-0910

Phone: 360-786-5171

FAX: 360-786-5180

Email: JLARC@leg.wa.gov

Audit Authority

The Joint Legislative Audit and Review Committee (JLARC) works to make state government operations more efficient and effective. The Committee is comprised of an equal number of House members and Senators, Democrats and Republicans.

JLARC's non-partisan staff auditors, under the direction of the Legislative Auditor, conduct performance audits, program evaluations, sunset reviews, and other analyses assigned by the Legislature and the Committee.

The statutory authority for JLARC, established in Chapter 44.28 RCW, requires the Legislative Auditor to ensure that JLARC studies are conducted in accordance with Generally Accepted Government Auditing Standards, as applicable to the scope of the audit. This study was conducted in accordance with those applicable standards. Those standards require auditors to plan and perform audits to obtain sufficient, appropriate evidence to provide a reasonable basis for findings and conclusions based on the audit objectives. The evidence obtained for this JLARC report provides a reasonable basis for the enclosed findings and conclusions, and any exceptions to the application of audit standards have been explicitly disclosed in the body of this report.

JLARC Members on Publication Date

Senators

Randi Becker

John Braun, Chair

Sharon Brown

Annette Cleveland

David Frockt

Jeanne Kohl-Welles

Mark Mullet, Assistant Secretary

Ann Rivers

Representatives

Jake Fey

Larry Haler

Christine Kilduff

Drew MacEwen

Ed Orcutt, Secretary

Gerry Pollet

Derek Stanford, Vice Chair

Drew Stokesbary

Scope & Objectives

What Is Workers’ Compensation Insurance?

Workers’ compensation laws protect workers and employers from financial and other hardships that result from work-related injuries and illnesses. Workers’ compensation insurance pays for eligible medical expenses, a portion of lost wages, permanent disability awards, and vocational services when a worker becomes injured or ill on the job. It also pays ongoing benefits to a surviving spouse or dependents when a work-related injury or illness results in death. In exchange for these benefits, workers cannot sue their employers for work-related injuries and illnesses, and employers are protected from potentially costly lawsuits.

In Washington, workers’ compensation is provided by a state-operated insurance program known as the “State Fund,” or by self-insured employers. Currently, over 3 million workers in Washington have workers’ compensation insurance, with 170,000 employers. Over 146,000 new workers’ compensation claims were filed by injured and ill workers in Fiscal Year 2012.

Why a JLARC Audit of Workers’ Compensation Claims Management?

The 2011 Legislature enacted a number of major reforms to the state’s workers’ compensation system (EHB 2123). The Legislature also directed the Joint Legislative Audit and Review Committee (JLARC) to conduct a performance audit of the state’s workers’ compensation claims management system.

Claims management refers to a series of decisions the state Department of Labor and Industries (L&I) and others make to help a worker recover from a work-related injury or illness, mitigate the economic impacts of that injury or illness, and assist in the worker’s return to work.

This Scope and Objectives is derived from two documents presented previously to JLARC: a briefing in June 2012, and a study design briefing report in December 2012.

Study Scope

This performance audit will focus on the workers’ compensation claims management system at L&I. JLARC will assess the overall promptness, fairness, and efficiency of claims management and will determine whether any changes are necessary to improve system results.

Study Objectives

The Legislature directed JLARC to address the following six topics:

- Fairness and timeliness of decision-making;

- Fairness, timeliness, and effectiveness of complaint and dispute resolution;

- Timeliness, responsiveness, and accuracy of communication with employers and workers;

- Efficiency of current claims management organization and service delivery models;

- Differences in claims organization and service delivery for retrospective rating plan participants and non-participants and how those differences might impact rating plan refunds. The retrospective rating plan is a program available to State Fund employers that allows participants to earn a partial refund on insurance premiums if they reduce injuries and lower claim costs; and

- Whether current initiatives improve service delivery, meet the needs of current and future workers and employers, improve public education and outreach, and are otherwise measurable.

JLARC’s study design includes an extensive list of research questions in each of these six topic areas to ensure a rigorous evaluation of the system. See the December 2012 JLARC briefing report for examples of specific research questions in each topic area.

Timeframe for the Study

This fall, JLARC will hire one or more consultants to assist with the fieldwork for this study. Staff will present a briefing report on the consultant(s) hired and the work to be done at the JLARC meeting in December 2013. The study will be completed in June 2015.