JLARC Final Report: 2016 Tax Preference Performance Reviews

Report 17-02, January 2017

Rural Electric Cooperative Finance Organization | B&O Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

| A B&O tax deduction for cooperative finance organizations on any interest income earned from loans to rural electric cooperatives or other nonprofit or government utility service providers. The preference is scheduled to expire July 1, 2017. |

B&O RCW 82.04.43394 |

Unknown |

| Public Policy Objective |

|---|

| The Legislature stated the public policy objective was to provide tax relief for customers of rural electric cooperatives by providing this incentive to finance organizations that lend to rural electric cooperatives. |

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation

Modify the Preference: As currently structured, there is no guarantee that the savings realized by finance organizations will be passed on to Washington rural electric cooperatives and their customers, as the Legislature intended. Commissioner Recommendation:The Commission does not endorse the Legislative Auditor’s recommendation. The Legislature should continue the preference. The organization to which this exemption applies is a federally chartered organization created to provide cost effective financing to rural electric cooperatives. Savings due to the preference are likely passed on to all rural utility customers across the nation through electric rates. To assure that the benefit of the exemption is solely received by Washington based cooperatives, such cooperatives must bear the cost of this tax from which they are otherwise exempted by this law. Accordingly, such a clarification is unnecessary, would force the cooperative to amend its bylaws and rules for no reason, and will undoubtedly create undue confusion. |

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Reporting Issues

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

The Legislature established this tax preference to provide tax relief for customers of rural electric cooperatives.

A cooperative finance organization can deduct the interest income earned from loans to rural electric cooperatives or other nonprofit or governmental utility service providers organized under Washington law when calculating their taxable income for business and occupation (B&O) tax purposes.

The preference took effect October 1, 2013, and is scheduled to expire July 1, 2017.

A “cooperative finance organization” is a nonprofit organization with the primary purpose to provide, secure, or otherwise arrange financing for rural electric cooperatives.

A “rural electric cooperative” is a nonprofit, customer-owned organization that provides utility services to rural areas.

2009

Anderson Island residents are members of a rural electrical cooperative. In February, the single marine cable that connected Anderson Island’s utilities to the mainland failed. The cost to replace and lay two miles of cable to the island was about $9 million. The local cooperative noted it worked with the National Rural Utilities Cooperative Finance Corporation to ensure the work was financed and the repairs completed.

2013

The Legislature enacted this preference allowing cooperative finance organizations to deduct interest income received from loans made to member-owned electric cooperatives or other nonprofit or governmental utility service providers in rural areas. Representatives from the cooperative serving Anderson Island testified in House and Senate committee hearings that a cooperative finance organization helped them finance and complete the work necessary to repair their utility services. The Legislature scheduled the preference to expire July 1, 2017.

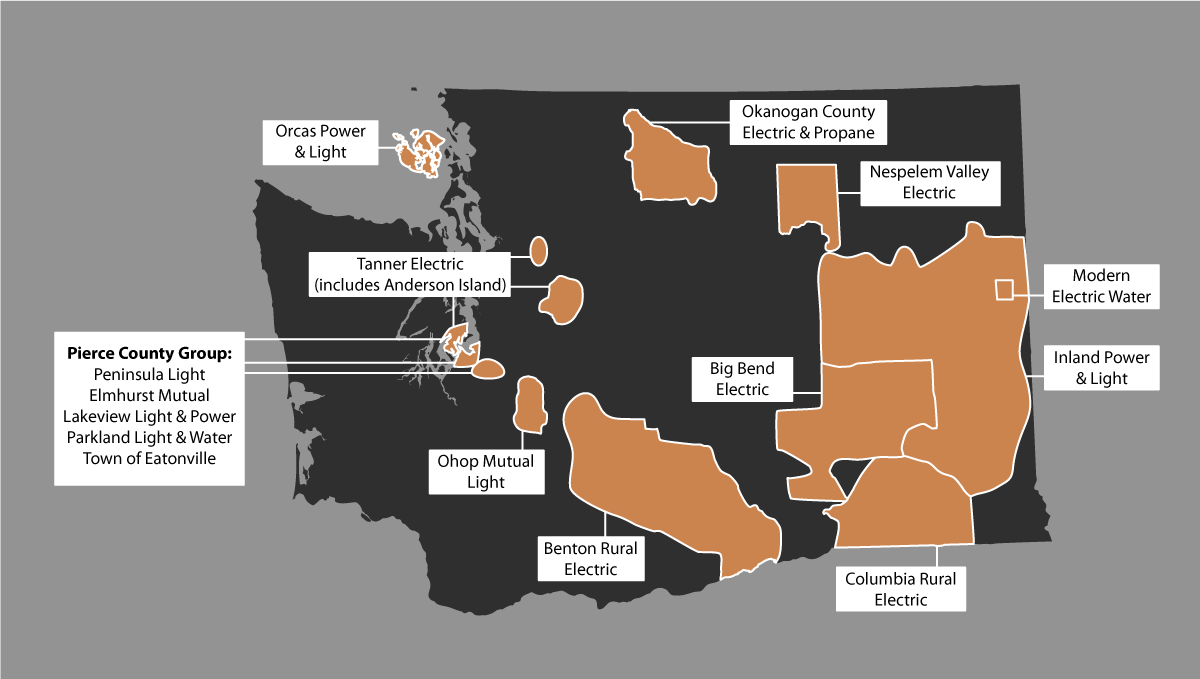

Rural Electric Cooperatives

The Washington Rural Electric Cooperative Association identified 15 rural electric cooperatives that are headquartered in Washington. These cooperatives provide electric service at cost to over 280,000 customers. They are managed by a locally elected board of directors, who set rates and policies for the utility. The Rural Electric Cooperative Association notes that these cooperatives deliver 11 percent of the total kilowatt hours sold in the U.S. each year.

National Rural Utilities Cooperative Finance Corporation

In 1969, cooperatives throughout the country formed the National Rural Utilities Cooperative Finance Corporation, a member-owned, nonprofit 501(c)(4) cooperative financing organization.

The Finance Corporation raises and loans funds to supplement the loan programs for electric cooperatives offered by the federal Rural Utilities Service. In 2012, the Finance Corporation’s outstanding loans and guarantees to cooperatives nationwide totaled $20.2 billion. The Finance Corporation is the only known beneficiary of the tax preference.

As of January 2016, Washington electric cooperatives had approximately $160 million in outstanding loans with the Finance Corporation.

What are the public policy objectives that provide a justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature stated the public policy objective for this preference was to provide tax relief for customers of rural electric cooperatives by providing this tax preference to finance organizations that lend to rural electric cooperatives. The Legislature also indicated its intent that the actual revenue impact of the preference substantially conforms with the fiscal estimate.

The Legislature stated these objectives in an intent section rather than in a tax preference performance statement.

Provide Tax Relief to Customers of Rural Electric Cooperatives

The prime sponsors of earlier House and Senate bills that would have provided the same preference noted the preference would save money for a particular cooperative finance organization making loans to Washington cooperatives, and that those savings would be returned to cooperative members. The National Rural Utilities Cooperative Finance Corporation was specifically mentioned in committee hearings.

A representative for the Washington Rural Electric Cooperative Association testified at House and Senate committee hearings that Washington “did not recognize” the Finance Corporation as a tax-exempt organization, unlike most other states, and that the Finance Corporation’s tax burden was an additional cost that was passed along to Washington cooperative members and customers.

The representative stated the preference would save the Finance Corporation between $160,000 to $167,000 each year, which would be passed on to Washington cooperatives and their members. He estimated the average rural electric cooperative customer would save $17.32 over a ten-year period or $1.73 per year.

Substantially Conform to 2013 Estimate

The Legislature also stated that it intended to provide the tax relief in a fiscally responsible manner, where the actual tax relief provided “substantially conforms” to the revenue loss estimated in the 2013 fiscal estimate.

What evidence exists to show that the tax preference has contributed to the achievement of any of these public policy objectives?

- There is no evidence that the preference is providing tax relief for customers of rural electric cooperatives.

- The Department of Revenue's (DOR) fiscal estimate for the preference was “confidential, but not zero,” so a comparison of the DOR estimate with the actual revenue impact is not feasible.

- The actual beneficiary savings exceeds what the Legislature heard in testimony.

Provide Tax Relief to Customers of Rural Electric Cooperatives

The preference is providing tax relief to a rural electric finance corporation. However, there is no evidence of corresponding tax relief for customers of Washington’s rural electric cooperatives.

To measure the effectiveness of this preference, the Legislature directed JLARC staff to:

. . . specifically evaluate customer rates charged by rural electric cooperatives that are repaying debt to the national rural utilities cooperative finance organization, or any similar financing organization, and the impact the business and occupation deduction . . . has had on those rates.

JLARC staff approached this task in two ways, examining:

- The electricity rates charged by Washington rural electric cooperatives; and

- The loan rates charged by a known finance organization to Washington rural electric cooperatives.

1) Unclear if Electricity Rates Impacted by Preference

JLARC staff contacted all 15 Washington rural electric cooperatives to determine if they had outstanding loans to a finance corporation and if their customer rates had changed since 2012 (the year prior to the tax preference taking effect).

Of the 15 cooperatives, nine reported having outstanding loans with one finance corporation, the National Rural Utilities Cooperative Finance Corporation. All nine also reported they had increased their electricity rates for kilowatt hour and/or their base rates at least once since 2012. Several cooperative representatives stated that changes in their electricity rates have little to do with their outstanding loans but are instead impacted by other factors, primarily the cost of electricity from electrical producers.

2) Not Possible to Quantify if Loan Rates Changed by Preference

JLARC staff asked the Finance Corporation specific questions regarding its loans to Washington cooperatives. The Corporation responded that it does not determine its loan rates on a state by state basis, but instead determines rates on a national level. It noted any cost savings the Finance Corporation recognizes may be passed on nationwide to cooperatives and their members in all the states where it provides loans, not just to Washington, which comprises 0.8 percent of its outstanding loan values. The Finance Corporation indicated it is impossible to quantify the exact benefit in the form of reduced loan rates to members in one state attributable to one item of reduced cost (the preference) due to the fact that it operates on a national level.

Substantially Conform to 2013 Fiscal Estimate?

DOR reported its 2013 fiscal estimate for this preference as “confidential, but not zero.” It is not feasible to compare the actual revenue impact of the preference with this DOR estimate.

To provide the Legislature with a comparison, JLARC staff turned to legislative testimony.

A representative of the Washington Rural Electric Cooperative Association testified that the preference would save the Finance Corporation between $160,000 and $167,000 per year, which would then be passed on to Washington cooperatives and their customers.

For our comparison, the National Rural Utilities Cooperative Finance Corporation voluntarily authorized JLARC staff to disclose information on its taxpayer savings as part of its performance audit of the tax preference.

The actual taxpayer savings exceed the estimate legislators heard in testimony by between 27 percent and 31 percent. The Legislature has not defined what it means by “substantially conforms,” to know if between 27 percent and 31 percent is an acceptable variation.

|

Fiscal Year |

Estimated Taxpayer Savings Based on Testimony |

Actual Taxpayer Savings |

% Actual Taxpayer Savings Exceeds Estimate Based on

Testimony |

|

2014 (Oct 2013 –June 2014) |

$123,000 |

$161,263

|

31% |

|

2015 |

$164,000 |

$208,658

|

27%

|

Source: JLARC staff analysis of 2013 testimony by representatives of rural electric cooperatives; JLARC staff analysis of Department of Revenue tax return deduction detail.

To what extent will continuation of the tax preference contribute to these public policy objectives?

Continuing the tax preference will continue to provide tax relief to direct beneficiaries. However, it is unclear if continuing the tax preference would provide any tax relief to customers of Washington rural electric cooperatives.

If the public policy objectives are not being fulfilled, what is the feasibility of modifying the tax preference for adjustment of the tax benefits?

The Legislature might consider modifying the preference to more directly pass along savings from the B&O tax deduction to Washington rural electric cooperative customers. The Legislature has structured some other tax preferences to accomplish something similar, for example:

- A public utility tax credit for utilities selling to aluminum smelters that requires the utility claiming the credit to reduce the price charged to aluminum smelters in an amount equal to the credit claimed. (Reviewed by JLARC staff in 2015.)

- A public utility tax credit for utilities equal to the amount that they pay to customers for the power customers produce through their own renewable energy systems. (JLARC staff are reviewing in 2016.)

Alternatively, the Legislature could target a public utility tax preference directly to the cooperatives and their customers.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

Direct Beneficiary

There was just one known direct beneficiary identified in testimony when this preference was enacted: the National Rural Utilities Cooperative Finance Corporation. JLARC staff found no evidence of any other direct beneficiaries. The preference would apply to other cooperative finance organizations meeting the statutory definition of having a primary purpose to provide, secure, or otherwise arrange financing for cooperatives.

Indirect Beneficiaries

Washington rural electric cooperatives could be indirect beneficiaries to the extent that the preference might have an impact in lowering their interest rates on loans from a direct beneficiary. Additionally, customers and members of Washington cooperatives may also be indirect beneficiaries to the extent that cooperatives pass along any savings in their loan rates to their customers in the form of lower or less increases in rates. Testimony for the bill establishing the preference estimated savings for customers of $1.73 per year.

To what extent is the tax preference providing unintended benefits to entities other than those the Legislature intended?

This preference may provide unintended benefits to rural electric cooperatives in other states, as well as their customers.

The Finance Corporation reports that it determines its loan rates at a national level. It notes that any cost savings the Corporation receives may be passed on nationwide to cooperatives and their customers in all the states where the Corporation makes loans. Over 99 percent of the loans made by the Finance Corporation are in states other than Washington.

When reviewing the tax return deduction reporting for this preference, JLARC staff found several businesses had incorrectly reported on the deduction line established for this preference by DOR (56 businesses in Fiscal Year 2014 and 34 in Fiscal Year 2015).

DOR reports that upon examination, most of the incorrect deductions reported were situations where businesses had valid deductions but reported them on the wrong deduction line.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

JLARC staff estimate the direct beneficiary saved $208,658 in Fiscal Year 2015, however JLARC staff have not received specific authorization to publish estimated beneficiary savings for the 2015-17 Biennium.

|

Fiscal Year |

Beneficiary Savings |

|

2014 (October 2013 – June 2014) |

$161,263

|

|

2015 |

$208,658

|

|

2016 |

Unknown

|

|

2017 |

Unknown

|

|

Preference

scheduled to expire July 1, 2017 |

|

|

2015-17

Biennium |

Unknown

|

DOR’s taxpayer confidentiality policy prohibits disclosure of tax return data if it is comprised of fewer than three taxpayers. However, in this case the one known beneficiary specifically authorized JLARC staff to publish its B&O tax savings for the period including October 2013 through December 2015.

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the preference was terminated, cooperative finance organizations would pay B&O tax on interest income they receive from loans made to Washington rural electric cooperatives. It is unclear to what extent the B&O tax increase would impact Washington cooperatives or their customers.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

Most states that impose a state income tax provide income tax exemptions for at least some nonprofit organizations in the same manner as allowed for federal income tax purposes.

Washington’s B&O tax, which is imposed on a business’s gross receipts or gross sales is unique among the states. Ohio imposes a commercial activity tax similar to Washington’s B&O tax and exempts interest income earned by nonprofit entities.

Representatives of rural cooperatives testified in 2013 that Washington, California, and Hawaii were the only states to tax interest income earned by cooperative finance organizations. As of March 2016, the Finance Corporation reports that California and Hawaii continue to tax the interest income.

Intent Statement

Intent—2013 2nd sp.s. c 13: "(1) The intent of part VI of this act is to provide tax relief for customers of rural electric cooperatives by providing a business and occupation tax deduction for interest income on loans made by certain finance organizations to rural electric cooperatives. It is the further intent of the legislature to provide this tax deduction in a fiscally responsible manner where the actual revenue impact of the legislation substantially conforms with the fiscal estimate provided in the legislation's fiscal note.

(2) To measure the effectiveness of this tax preference in meeting its policy objectives, the joint legislative audit and review committee shall specifically evaluate customer rates charged by rural electric cooperatives that are repaying debt to the national rural utilities cooperative finance organization, or any similar financing organization, and the impact the business and occupation deduction provided under part VI of this act has had on those rates." [2013 2nd sp.s. c 13 § 601.]

RCW 82.04.43394

Deductions—Cooperative finance organizations. (Expires July 1, 2017.)

(1) In computing tax there may be deducted from the measure of tax, amounts received by a cooperative finance organization where the amounts are derived from loans to rural electric cooperatives or other nonprofit or governmental providers of utility services organized under the laws of this state.

(2) For the purposes of this section, the following definitions apply:

(a) "Cooperative finance organization" means a nonprofit organization with the primary purpose of providing, securing, or otherwise arranging financing for rural electric cooperatives.

(b) "Rural electric cooperative" means a nonprofit, customer-owned organization that provides utility services to rural areas.

(3) This section expires July 1, 2017.

[2013 2nd sp.s. c 13 § 602.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor Recommendation

The Legislature should modify the B&O tax preference for rural electric cooperative finance organizations because, as currently structured, there is no guarantee that the savings realized by finance organizations will be passed on to Washington rural electric cooperatives and their customers, as the Legislature intended.

The Legislature stated its intent that the preference provide tax relief for customers of Washington’s rural electric cooperatives. This review found no evidence that this objective was being met. The review also provides two examples where the Legislature has structured a tax preference to ensure taxpayer savings are passed on to others. The one beneficiary has noted this may be difficult because it sets its loan rates nationally rather than state by state. Alternatively, the Legislature could target a preference directly to the cooperatives and their customers.

This preference is scheduled to expire July 1, 2017.

Legislation Required: Yes.

Fiscal Impact: Depends on modification.

The Commission does not endorse the Legislative Auditor’s recommendation and recommends that the Legislature continue the preference.

The organization to which this exemption applies is a federally chartered organization created to provide cost effective financing to rural electric cooperatives. Savings due to the preference are likely passed on to all rural utility customers across the nation through electric rates. To assure that the benefit of the exemption is solely received by Washington based cooperatives, such cooperatives must bear the cost of this tax from which they are otherwise exempted by this law. Accordingly, such a clarification is unnecessary, would force the cooperative to amend its bylaws and rules for no reason, and will undoubtedly create undue confusion.

Joint Department of Revenue and Office of Financial Management Response