JLARC Final Report: 2016 Tax Preference Performance Reviews

Report 17-02, January 2017

Solar Energy and Silicon Product Manufacturers | B&O Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

| A reduced business and occupation (B&O) tax rate of 0.275 percent to manufacturers of certain kinds of solar energy systems and their components. Without the preference, these manufacturers would pay a B&O tax rate of 0.484 percent.

The preference is scheduled to expire June 30, 2017. |

B&O Tax RCW 82.04.294 |

$1.1 million |

| Public Policy Objective |

|---|

| The Legislature stated in 2013 that the public policy objective was to maintain and grow jobs in the solar silicon industry. |

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation

Review and Clarify: The intent statement appears narrower than the types of businesses that qualify for the preference. In clarifying, the Legislature should provide a performance statement and relevant metrics such as a jobs target to measure the preference’s effectiveness. Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation without comment. |

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

The preference provides a reduced business and occupation (B&O) tax rate of 0.275 percent to manufacturers of certain kinds of solar energy systems and their components. Without the preference, these manufacturers would pay a B&O tax rate of 0.484 percent.

The Legislature’s objective with this preference is to maintain and grow jobs in the solar silicon industry.

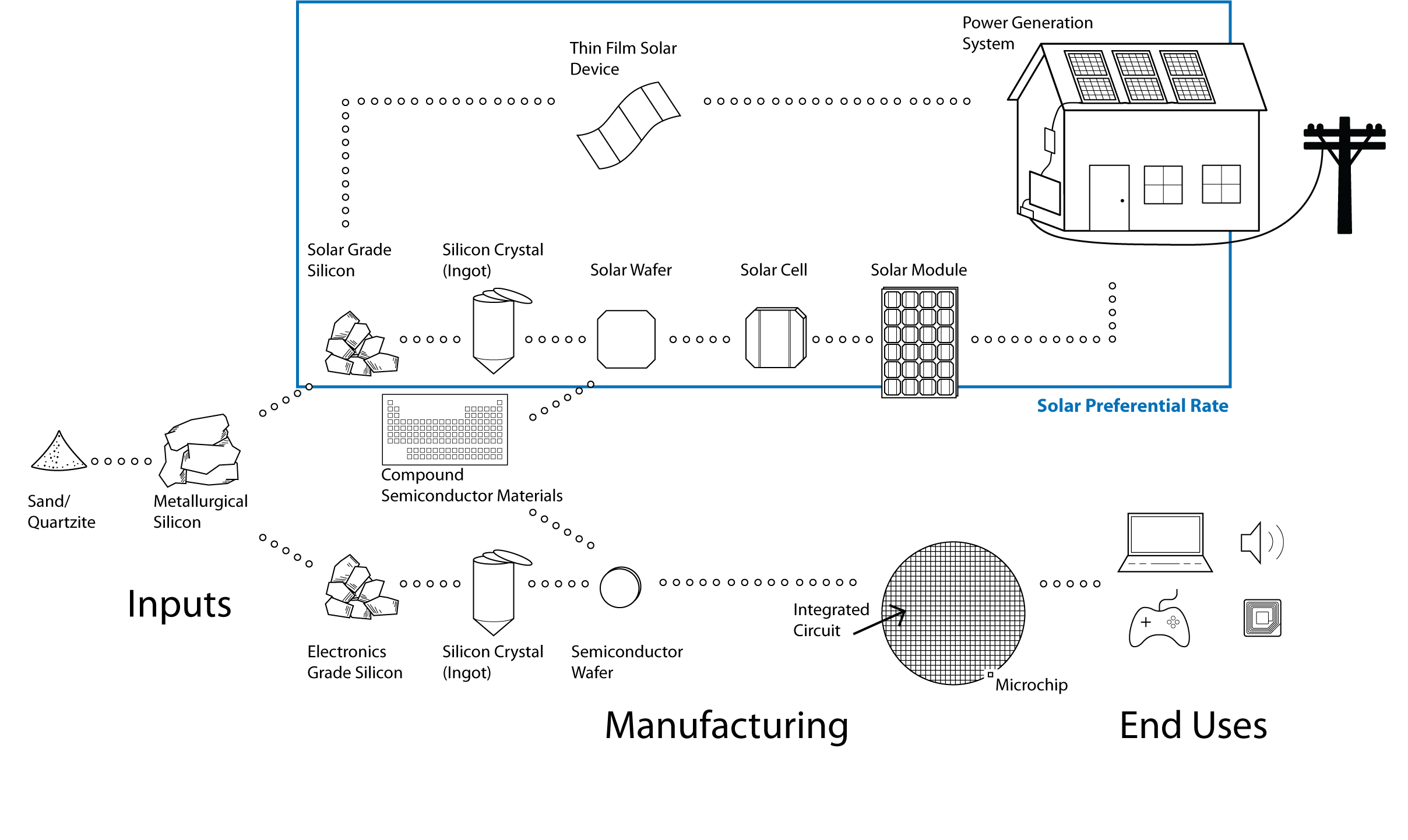

The preference applies to:

- Manufacturers of solar energy systems using photovoltaic modules or stirling converters. Solar energy systems are devices that rely on direct sunlight as an energy source to generate electricity, such as solar panels. A stirling converter is a device that produces electricity by converting heat from a solar source;

- Manufacturers of certain components of solar energy systems, specifically, solar grade silicon, silicon solar wafers, silicon solar cells, thin film solar devices, or compound semiconductor solar wafers for use exclusively in solar energy systems.

The preference also includes the wholesale sales of these systems or components by their manufacturers.

The tax preference expires June 30, 2017.

The exhibit below provides an overview of the solar energy system manufacturing process and shows the materials included in the preference. Stirling converters are not included in the exhibit because they are not currently being produced in Washington.

Businesses are required to file an Annual Survey for each year they take the preferential B&O tax rate. The Annual Surveys identify the amount of the preference claimed for the calendar year, as well as information about the number of employees, their wages and benefits, and their status as either full-time, part-time, or temporary workers.

Over time, Legislature has expanded products covered under the preference

The Legislature began the preference with coverage for businesses that manufacture either solar energy systems or silicon components of these systems. Over time, the Legislature added other solar-related products and materials. However, in its 2013 statement of the intent of the preference, the Legislature focused on jobs in the solar silicon industry.

2004

The Legislature considered two bills that provided several incentives to manufacturers of photovoltaic (PV) solar modules: a reduced B&O tax rate, a B&O tax exemption if the manufacturer is located in a county with an unemployment rate of more than 12 percent, a B&O tax credit for creating jobs, and sales, use, and property tax exemptions. According to testimony at a public hearing, the legislation was intended to encourage a certain manufacturer to locate in Ferry County. The bills were not enacted, and the manufacturer did not locate in Washington.

2005

The Legislature enacted two bills to encourage in-state production and use of solar energy: one lowered the costs of production, and the other lowered costs to consumers. The first bill, which is the focus of this review, provided a reduced B&O tax rate of 0.2904 percent for businesses manufacturing solar energy systems using photovoltaic modules and for businesses manufacturing silicon components of these systems. The reduced rate also applied to businesses making wholesale sales of the solar energy systems or silicon components they manufacture. The legislation required beneficiaries to file an Annual Report with the Department of Revenue detailing their employment information. The bill set an initial expiration date of June 30, 2014.

The Legislature’s intent section for the B&O preference discussed retaining and expanding solar electric industry businesses, attracting new ones, and creating jobs. Testimony noted that manufacturers were waiting to locate in Ferry or Garfield Counties and that others would locate and begin manufacturing in Washington, provided these incentives were passed.

The second bill passed by the Legislature lowered costs for consumers to purchase these systems, creating a cost-recovery incentive program to promote renewable energy systems using solar, wind, or anaerobic digesters. JLARC staff are separately reviewing this tax preference in 2016.

The manufacturers discussed in testimony did not locate in Washington.

2007

The Legislature clarified that the preferential B&O tax rate applied to manufacturing and wholesale sales of “solar grade silicon to be used exclusively in components of” solar energy systems rather than “silicon components” of these systems.

2009

As part of a bill that provided a number of tax incentives to various renewable or “green” industries, the Legislature made the following changes to this preference:

- Added a number of materials to the list of qualifying items manufactured or sold at wholesale, including: silicon solar wafers, silicon solar cells, thin film solar devices, or compound semiconductor solar wafers to be used exclusively in components of solar energy systems; and

- Reduced the B&O tax rate from 0.2904 to 0.275 percent for qualifying manufacturers or wholesalers, matching the rate provided to other solar technology preferences.

2011

The Legislature expanded the preference to include solar energy systems using stirling converters. A stirling converter is a device that produces electricity by converting heat from a solar source. Testimony by a representative for a company at a Senate Ways & Means hearing noted that stirling converters were newly developed technology not covered under the existing tax preference.

2012

JLARC staff reviewed the preference. The Legislative Auditor recommended the Legislature review and clarify the preference to determine if the progress toward its solar industry objectives was sufficient and to consider identifying targets for solar business retention, attraction, and job creation.

2013

The Legislature extended the expiration date of the preference to June 30, 2017. The Legislature stated that the objective of the preference is to maintain and grow jobs in the solar silicon industry. The bill did not include targets for solar business retention, attraction, or jobs. It directed JLARC staff to assess the actual fiscal impact of this tax preference in relation to the fiscal estimate and assess changes in employment for firms claiming the preference.

The legislation amended the reporting requirements for the preference to require an Annual Survey instead of an Annual Report. The Annual Survey includes a beneficiary’s tax savings from a preference and has different rules for the disclosure of taxpayer information.

The prime sponsor of the bill testified in a committee hearing that REC Silicon, a solar silicon manufacturer in Moses Lake, had recently had to reduce and lay off workers due to a fiercely competitive global market. The sponsor said that hopefully this extension would allow the company to weather the volatility and eventually hire back those workers and expand.

In the same bill, the Legislature expanded a different sales and use tax preference for semiconductor manufacturers to include some solar energy manufacturers. JLARC staff are reviewing the sales and use tax exemption in 2016.

Taxation of the Solar Energy Industry

The Legislature has provided several other tax preferences for various aspects of the solar industry, including:

- Sales and use tax exemptions for gases and chemicals used in the production of semiconductor materials, including many solar energy system components. JLARC staff are reviewing this preference in 2016. It is scheduled to expire in 2018;

- Sales and use tax exemptions for renewable energy machinery and equipment, including solar energy. The preference was reviewed by JLARC staff in 2011 and is scheduled for JLARC staff to review again in 2017. It is scheduled to expire in 2018;

- Sales and use tax exemptions for small solar energy machinery and equipment. The preference is scheduled for JLARC staff to review in 2017. It is scheduled to expire in 2020; and

- A public utility tax credit for utilities administering a cost recovery program for individuals, businesses, and local governments that produce energy using anaerobic digesters, solar power, and wind power. JLARC staff are reviewing this preference in 2016. The right to earn credits expires in 2020.

Solar energy manufacturers also likely qualify for sales and use tax exemptions for manufacturing machinery and equipment.

U.S. Trade Dispute with China

The intent section in the 2013 legislation noted reduced employment in the solar silicon industry due to global conditions.

The United States and China are in a trade dispute over the production of solar cells and other solar component products. In an investigation concluded in 2012, the federal Department of Commerce found that China had provided some subsidies to Chinese producers and exporters of solar cells that warranted a U.S. response, and that Chinese businesses had sold solar cells below cost into the U.S.

Following the investigation, the United States imposed tariffs on imports of solar cells made by Chinese producers and on imported solar panels made from these solar cells. The Chinese Ministry of Commerce then imposed tariffs on certain silicon exports from the United States, including solar silicon.

The solar silicon manufacturer in Moses Lake reported that it had initially been able to avoid the new tariffs using a set of trade rules that applied to materials Chinese businesses imported to use in domestic manufacturing for export. The manufacturer reports that the Chinese Ministry of Commerce suspended that option in September 2014. The manufacturer idled production at its facility in February of 2016, pending progress in resolution of the trade dispute. In May it announced plans to resume production, but noted that the trade negotiations were still ongoing.

What are the public policy objectives that provide a justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature stated in 2013 that the public policy objective was to maintain and grow jobs in the solar silicon industry. The intent statement for the bill noted recent employment reductions by solar silicon businesses due to global conditions.

This focus on jobs in the solar silicon industry is more narrow than the previous statement of legislative intent for the preference. The Legislature previously spoke more broadly of retaining, expanding, and attracting solar electric industry businesses and creating jobs.

The Legislature also specifically directed JLARC to assess changes in employment for firms claiming the preferential tax rate.

What evidence exists to show that the tax preference has contributed to the achievement of any of these public policy objectives?

Maintain and Grow Jobs in the Solar Silicon Industry

It is unclear whether the preference is achieving its objective of retaining and expanding jobs in the solar silicon industry. The Legislature did not set a target number of jobs to retain. The Legislature also did not define “solar silicon industry,” and the preference applies to businesses that do not produce or use silicon, such as manufacturers of photovoltaic cells made from other materials, and manufacturers of systems using stirling converters. Total employment for all businesses benefitting from the preference has fluctuated.

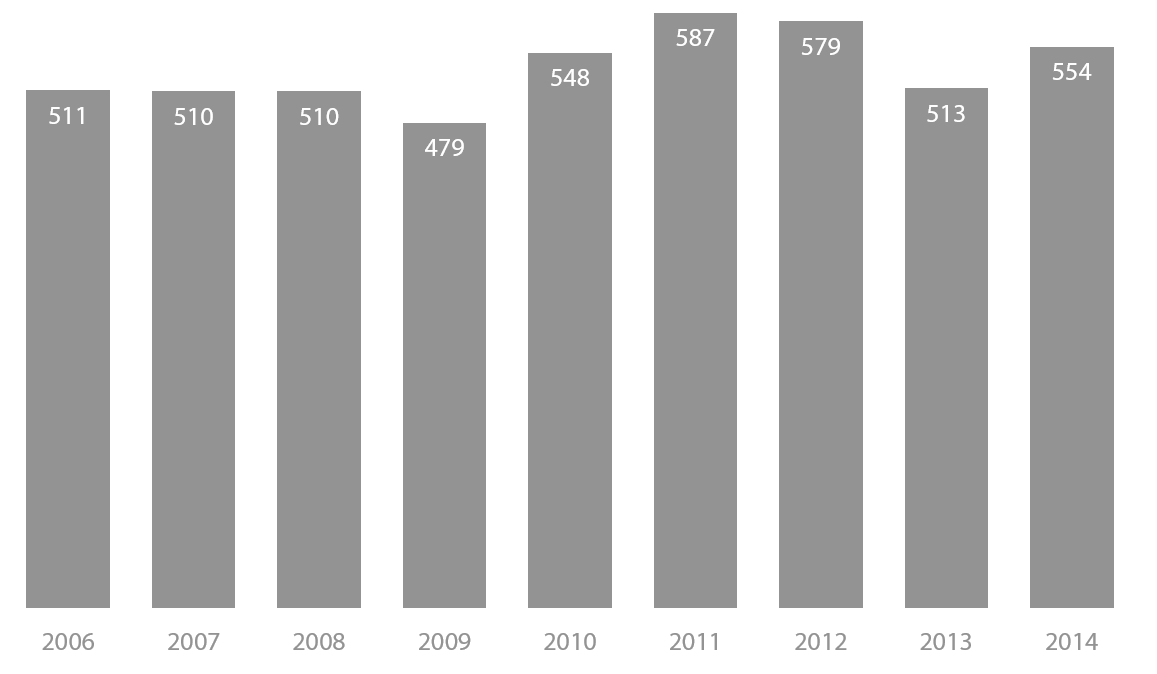

Beneficiaries report to the Department of Revenue on the number of their employees in Washington each year. The total number of reported employees decreased in 2012 and 2013 but increased to 554 in 2014.

In 2014, REC Silicon in Moses Lake accounted for 90 percent of the reported value of the preference. In 2012, the last year all beneficiaries filed publicly disclosable employment information, REC Silicon was responsible for 93 percent of reported jobs.

However, the job situation for this solar silicon manufacturer has changed. In February 2016, REC Silicon reported its plan to idle its production in Moses Lake, “dependent on the ongoing negotiations towards a resolution in the solar trade war and the general market development outside China.”

In May 2016, the company announced it would resume production. REC reported in its first quarter 2016 results that its access to Chinese markets continues to be restricted but it is having increased success in penetrating other markets.

Job Quality

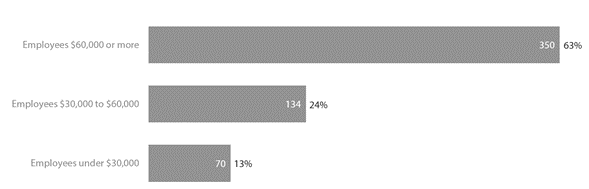

The Legislature has not established requirements or targets for the quality of the jobs it intends for the preference. In 2014, beneficiaries of the preference reported that 63 percent of employees earned $60,000 per year or more.

Of the 555 total employees in 2014, beneficiaries report 473 (85 percent) were enrolled in medical plans, 453 (82 percent) were enrolled in dental plans, and 448 (81 percent) were enrolled in retirement plans.

To what extent will continuation of the tax preference contribute to these public policy objectives?

It is unknown how much continuation of the preference will contribute to the objective of maintaining and growing jobs in the solar silicon industry. The largest beneficiary of the preference and the state’s one manufacturer of solar silicon, REC Silicon, idled its production for part of 2016 due to the trade dispute between the U.S. and China. The trade dispute and the company’s ability to access other markets likely have a larger role in determining future job prospects for the manufacturer than the tax preference.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

Direct Beneficiaries

Direct beneficiaries of the preference are businesses manufacturing certain solar energy systems and their components. Five qualifying businesses filed Annual Surveys for Calendar Year 2014.

|

Business |

Location |

Solar Product Manufactured |

Amount claimed |

|

REC Solar Grade Silicon LLC

|

Grant

County |

Solar

grade silicon |

$598,000 |

|

Itek Energy LLC |

Whatcom

County |

Solar

panels |

$48,000 |

|

Silicon Energy LLC |

Snohomish

County |

Solar

panels |

$5,000 |

|

Samson Solar LLC |

Kitsap

County |

Inverters |

Requested

Confidentiality |

|

APS America Corp. |

Kitsap

County |

Inverters

|

Requested

Confidentiality |

Indirect Beneficiaries

To the extent that manufacturers’ savings are passed on to customers or result in increased production, solar energy system consumers and other businesses in the manufacturing supply chain may be indirect beneficiaries.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

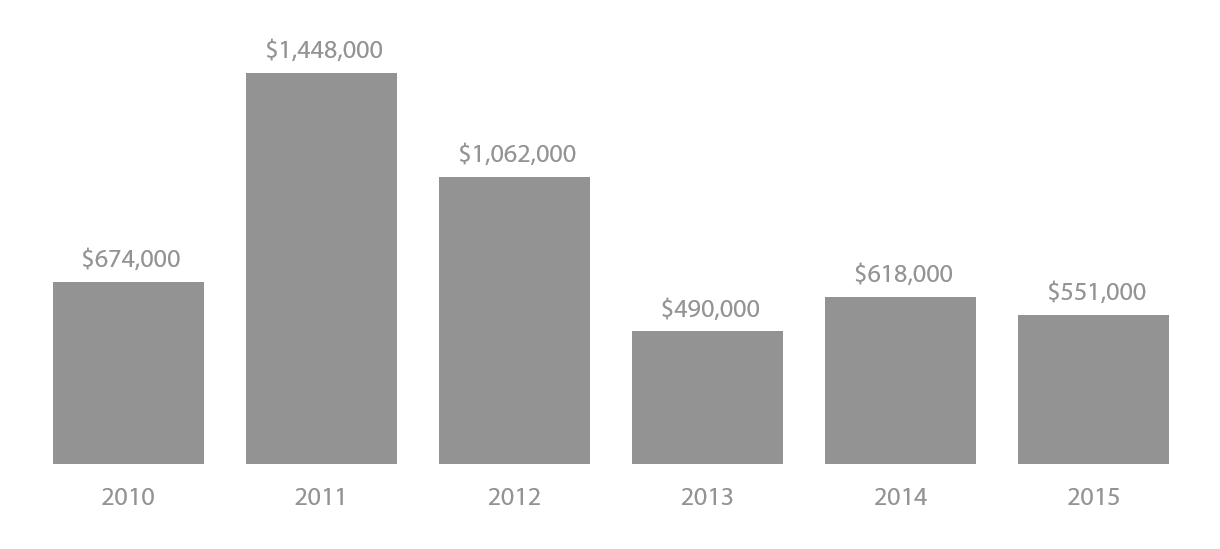

The actual amount of savings from the preferential rate in Fiscal Year 2015 was $551,000. JLARC staff estimate beneficiary savings for the 2015-17 Biennium will be $1.1 million.

This estimate does not include forecasted growth because the amount of beneficiary savings has fluctuated widely from year to year, and ongoing trade negotiations between the United States and China could affect the levels of business activity in Washington.

|

Fiscal Year |

Taxable Gross Income |

Estimated Beneficiary Savings |

|

2013 |

$234,590,000 |

$490,000

|

|

2014 |

$295,596,000 |

$618,000

|

|

2015 |

$263,520,000 |

$551,000

|

|

2016 |

$263,520,000 |

$551,000

|

|

2017 |

$263,520,000 |

$551,000

|

|

Preference expires

July 1, 2017 |

||

|

2015-17 Biennium |

$527,040,000 |

$1,102,000

|

Relation to the Fiscal Estimate

In the 2013 legislation, the Legislature directed JLARC to compare the actual fiscal impact of the preference to the fiscal estimate.

Fiscal estimates provided by the Department of Revenue (DOR) during the 2013 legislative session estimated extending the preference would result in a State General Fund loss of $974,000 in Fiscal Year 2015.

|

DOR Estimate for

Beneficiary Savings in 2015 |

2015 Actual Beneficiary

Savings |

Difference in

dollars |

Difference as

percentage of estimate |

|

$974,000 |

$551,000

|

$-423,000

|

-43%

|

The actual amount saved by beneficiaries in 2015 was 43 percent less than estimated. However, beneficiary savings has fluctuated over the years.

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the preference were terminated, the solar energy manufacturers currently benefiting would pay a greater amount of B&O tax. The effect on employment and the economy would depend on the extent to which these manufacturers could absorb this increased cost or pass it along to their customers. The manufacturers may have more difficulty passing along increased costs to their customers if prices for their products are set in national or international markets.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

No state has an identical tax preference due to the unique nature of Washington’s B&O tax. However, a number of other states offer incentives for solar energy manufacturers. States vary considerably in what activities qualify for the incentives, structure, and employment requirements.

Qualifying Activities

Other states offer a wide range of incentives for solar energy product manufacturers. Many include other renewable energy products such as wind and geothermal. Some also include manufacturers of products that increase energy efficiency.

Structure of Incentives

Texas provides a full exemption from franchise tax to companies solely engaged in manufacturing, selling, or installing qualifying solar or wind energy devices. Massachusetts provides an income tax deduction on income from patents deemed useful for alternative energy equipment, or property made subject to these patents. Other states, such as Arizona and Montana, offer income tax credits.

Some states base their incentive amounts on capital investments. For instance, Arizona, New Mexico, and South Carolina offer incentives as a percentage of a business’s qualifying investment. California offers a sales and use tax exemption on property used to design, manufacture, produce, or assemble alternative source products, which includes solar energy products.

Employment Requirements

Several states require businesses to meet employment targets.

- New Mexico requires one new full-time employee for every $500,000 of expenditures up to $30 million and one new full-time employee for every $1 million over $30 million, so that a business investing $50 million could be eligible for $2.5 million in incentives, and would be required to create 80 new jobs.

- South Carolina requires businesses to create one job per $1 million they invest, and jobs must pay at least 125 percent of the state’s average annual median wage. The same business investing $50 million would be eligible for $5 million in incentives and would be required to create 50 jobs.

- Virginia requires businesses to create at least 200 jobs for its grant program, which grants up to $9 million and requires at least $50 million in investment.

- Mississippi requires businesses to create 250 new jobs and invest $50 million in return for an exemption from all income, franchise, sales, and use taxes for ten years.

Intent Statement

Findings—Intent—2013 2nd sp.s. c 13:"(1) The legislature finds that to attract and maintain clean energy technology manufacturing businesses, a competitive business climate is crucial. The legislature further finds that specific tax preferences can facilitate a positive business climate in Washington. The legislature further finds that businesses in the solar silicon industry have had to reduce employment due to global conditions. Therefore, the legislature intends to extend a preferential business and occupation tax rate to manufacturers and wholesalers of specific solar energy material and parts to maintain and grow jobs in the solar silicon industry.

(2) The joint legislative audit and review committee, as part of its tax preference review process, must assess the actual fiscal impact of this tax preference in relation to the fiscal estimate for the tax preference and assess changes in employment for firms claiming the preferential tax rate." [2013 2nd sp.s. c 13 § 901.]

RCW 82.04.294

Tax on manufacturers or wholesalers of solar energy systems. (Expires June 30, 2017.)

(1) Upon every person engaging within this state in the business of manufacturing solar energy systems using photovoltaic modules or stirling converters, or of manufacturing solar grade silicon, silicon solar wafers, silicon solar cells, thin film solar devices, or compound semiconductor solar wafers to be used exclusively in components of such systems; as to such persons the amount of tax with respect to such business is, in the case of manufacturers, equal to the value of the product manufactured, or in the case of processors for hire, equal to the gross income of the business, multiplied by the rate of 0.275 percent.

(2) Upon every person engaging within this state in the business of making sales at wholesale of solar energy systems using photovoltaic modules or stirling converters, or of solar grade silicon, silicon solar wafers, silicon solar cells, thin film solar devices, or compound semiconductor solar wafers to be used exclusively in components of such systems, manufactured by that person; as to such persons the amount of tax with respect to such business is equal to the gross proceeds of sales of the solar energy systems using photovoltaic modules or stirling converters, or of the solar grade silicon to be used exclusively in components of such systems, multiplied by the rate of 0.275 percent.

(3) Silicon solar wafers, silicon solar cells, thin film solar devices, solar grade silicon, or compound semiconductor solar wafers are "semiconductor materials" for the purposes of RCW 82.08.9651 and 82.12.9651.

(4) The definitions in this subsection apply throughout this section.

(a) "Compound semiconductor solar wafers" means a semiconductor solar wafer composed of elements from two or more different groups of the periodic table.

(b) "Module" means the smallest nondivisible self-contained physical structure housing interconnected photovoltaic cells and providing a single direct current electrical output.

(c) "Photovoltaic cell" means a device that converts light directly into electricity without moving parts.

(d) "Silicon solar cells" means a photovoltaic cell manufactured from a silicon solar wafer.

(e) "Silicon solar wafers" means a silicon wafer manufactured for solar conversion purposes.

(f) "Solar energy system" means any device or combination of devices or elements that rely upon direct sunlight as an energy source for use in the generation of electricity.

(g) "Solar grade silicon" means high-purity silicon used exclusively in components of solar energy systems using photovoltaic modules to capture direct sunlight. "Solar grade silicon" does not include silicon used in semiconductors.

(h) "Stirling converter" means a device that produces electricity by converting heat from a solar source utilizing a stirling engine.

(i) "Thin film solar devices" means a nonparticipating substrate on which various semiconducting materials are deposited to produce a photovoltaic cell that is used to generate electricity.

(5) A person reporting under the tax rate provided in this section must file a complete Annual Survey with the department under RCW 82.32.585.

(6) This section expires June 30, 2017.

[2013 2nd sp.s. c 13 § 902; 2011 c 179 § 1; 2010 c 114 § 109; 2009 c 469 § 501; 2007 c 54 § 8; 2005 c 301 § 2.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

The Legislature should review and clarify the B&O tax preference for solar energy and silicon product manufacturers because the intent statement appears narrower than the types of businesses that qualify for the preference. In clarifying, the Legislature should provide a performance statement and relevant metrics such as a jobs target to measure the preference’s effectiveness.

- In 2013, the Legislature stated its intent for the preference was to “maintain and grow jobs in the solar silicon industry.” However, in addition to the state’s one solar silicon manufacturer, the preference also applies to manufacturers of solar energy systems and other components. These include some products that do not use solar silicon such as stirling converters. Is the Legislature’s concern focused narrowly on jobs for the solar silicon manufacturer or more broadly on the wider range of manufacturers that may benefit from the preference? An earlier statement of intent addressed solar electric industry businesses.

- It is unclear whether the preference is achieving its objective of retaining and expanding jobs in the solar silicon industry. Overall job numbers have fluctuated. The state’s solar silicon manufacturer has idled its facility for part of 2016 due to a trade dispute between the United States and China. The company has resumed production but notes that access to Chinese markets continues to be restricted.

- The Legislature has not yet provided targets on the number and quality of jobs it intends from the preference or other relevant metrics. To help future reviews, if there are job targets for multiple groups, the Legislature should consider specifying separate targets for each group.

- Testimony for the 2013 legislation suggested that the extension of the preference’s expiration date might help the solar silicon manufacturer weather the volatility of the trade dispute. The Legislature has at least one precedent (B&O tax preference for beef processors) of linking the expiration of a preference to the reopening of overseas markets.

The tax preference expires June 30, 2017.

Legislation Required: Yes

Fiscal Impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation without comment.

Joint Department of Revenue and Office of Financial Management Response