|

JLARC Preliminary Report: 2017 Tax Preference Performance Reviews |

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

A public utility tax deduction for utilities with fewer than 17 customers per mile of power line and retail power rates above the statewide average. |

Public utility tax |

$1,680,000 |

| Public Policy Objective |

|---|

JLARC staff infer the public policy objective was to provide tax relief to utilities and their customers in rural areas where retail power rates exceed the statewide average. |

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation Continue: The Legislature should continue the preference because it is meeting its inferred objective of providing tax relief to rural utilities with higher electricity costs and their customers. In continuing the preference, the Legislature should consider stating the public policy objective in statute. Commissioner Recommendation: Available in October 2017. |

- 1. What is the Preference?

- 2. Legal History

- 3. Other Relevant Background

- 4. Public Policy Objectives

- 5. Are Objectives Being Met?

- 6. Beneficiaries

- 7. Revenue and Economic Impacts

- 8. Other States with Similar Preference?

- 9. Applicable Statutes

Public utility tax deduction for power purchased by utilities with rural service areas and high power rates

Purpose

The Legislature did not state a public policy objective for this preference.

Only electric utilities with few customers per mile and high power rates receive the preference

Electric utilities receive a deduction from the public utility tax if they have both:

- Fewer than 17 customers per mile of power line; and

- Retail power rates above the statewide average.

By definition, eligible utilities serve rural areas of the state.

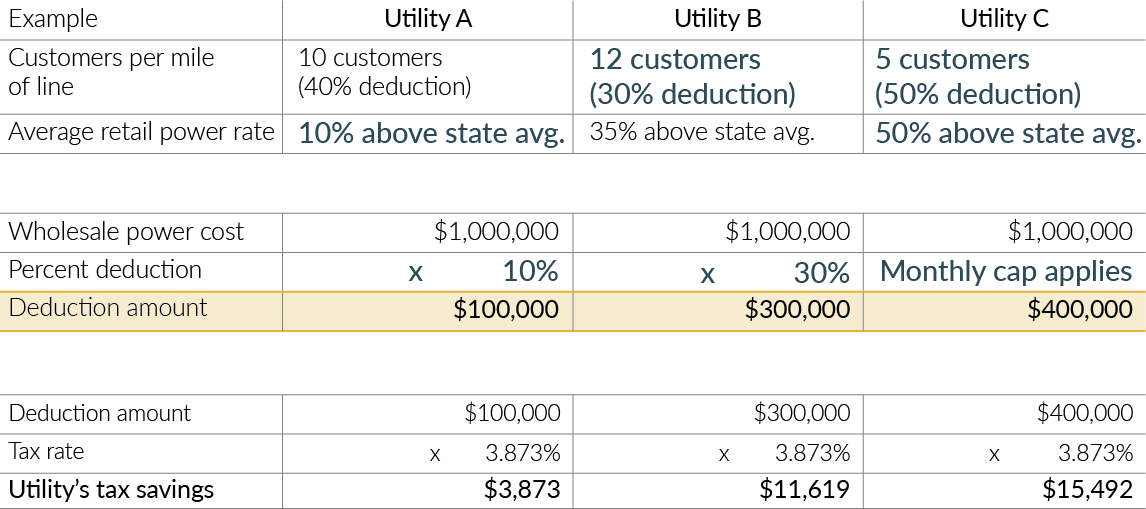

Deduction tied to customer density, retail power rate, and monthly cap of $400,000 per utility

The deduction is a percentage of the utility’s wholesale power costs. Utilities that claim the preference must use the lower of two percentages, based on either:

- Number of customers per mile of power line. The deduction ranges from 30 to 50 percent, depending on the number of customers per mile. Fewer customers means a higher deduction.

- Average retail power rate. The deduction is the percentage by which the utility’s rate exceeds the statewide average, as determined by the Department of Revenue.

A utility’s tax savings is the amount of the deduction multiplied by the tax rate (3.8734 percent). No utility may deduct more than $400,000 per month.

Preference has no expiration date

The preference has been in effect since 1994 and is not currently scheduled to expire.

Preference enacted in 1994 and increased in 1996

1994: Legislature enacted preference for rural electric utilities

The Legislature enacted this tax preference for electric utilities with few customers per mile of power line (customer density) and high power rates. At the time, electric utilities could deduct between 15 and 25 percent of the wholesale power cost based on customer density, or an amount based on its average retail rate. Utilities had to use the lowest percentage, and the monthly cap was $200,000.

The bill’s prime sponsor stated small utilities have higher capital costs and higher purchasing costs than large utilities, and that this preference “tries to balance the playing field slightly.”

Testimony from utilities indicated the cost of power from Bonneville Power Administration (BPA) was rapidly increasing. This increase was driving the utilities’ rates up. Utility representatives noted that customers who paid higher rates for their power also paid more public utility tax as a result. They stated that if they were successful in keeping their rates competitive with others in the state, the deduction would no longer apply.

1996: Legislature increased the amount of the preference

The Legislature amended the law to double both the calculation based on customer density and the monthly cap.

The prime sponsor of the bill and industry representatives stated that power rates were increasing and the industry was consolidating.

Other assistance is available to utilities. Rural customers tend to use more electricity.

BPA also provides assistance to utilities with fewer than 12 customers per mile of line

Utilities that purchase power from Bonneville Power Administration (BPA) may be eligible for a low-density discount. To qualify, utilities must:

- Pass the benefits on to their consumers;

- Have an average retail electricity rate over a set amount (5.125 cents per kilowatt-hour in fiscal year 2017); and

- Have fewer than 12 customers per mile of power line.

There are currently 19 utilities operating in Washington State that receive a low-density discount from BPA.

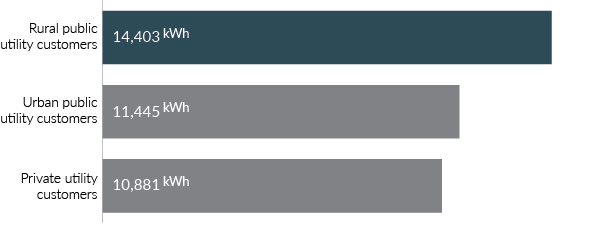

Rural residential customers use more electricity and have higher monthly bills than urban customers

The Northwest Power and Conservation Council published a report, Northwest Residential Electric Bills, in 2016. It compared use, rates, and overall monthly bills for customers of rural public, urban public, and private utilities. Some of the utilities that the Council considers to be rural may not qualify for the tax preference. This is because the Council used a definition for rural that was not based solely on density, and not all rural utilities have higher than average power rates.

The report noted that rural public utility customers tend to use more electricity for heat and hot water. Urban and private utility customers are more likely to use lower-priced natural gas. As a result, rural customers have higher average monthly electric bills, despite paying about the same rate per kilowatt-hour as urban customers and less than private utility customers.

The public utility tax

The public utility tax is a tax on gross receipts of public service businesses, including those that engage in transportation, communications, and the supply of energy, natural gas, and water. Income subject to the public utility tax is exempt from the business and occupation (B&O) tax. Rates vary based on the type of business.

Electric utilities that generate, produce, or distribute electricity pay a rate of 3.8734 percent of their gross receipts. They may deduct any sales to others for resale, or sales for export outside Washington State.

Legislature did not state public policy objective

The Legislature did not state a public policy objective for this preference.

Inferred objective: Provide tax relief to utilities and their customers in rural areas

JLARC staff infer the public policy objective was to provide tax relief to utilities and their customers in rural areas where retail power rates exceed the statewide average.

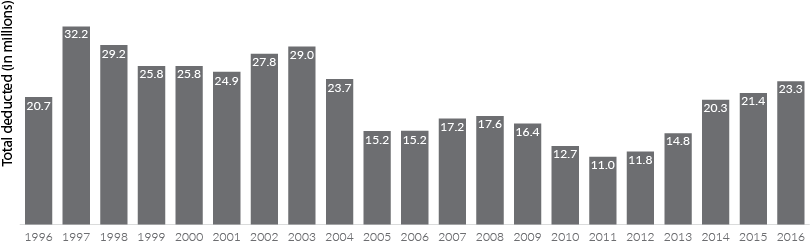

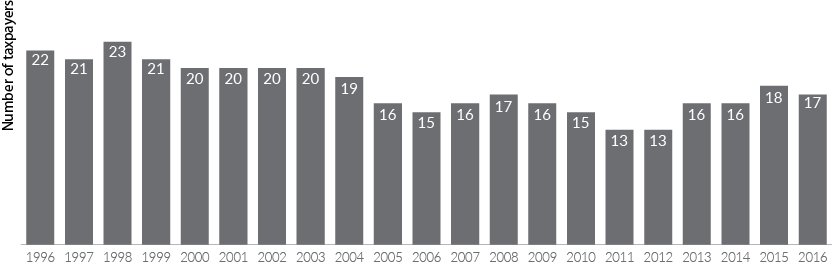

The preference provides tax relief to 17 rural utilities and their customers

The structure of the preference ensures that it benefits only utilities with an average retail cost that is higher than the state average. Over time, the number of beneficiaries and the amount of the deduction has fluctuated, indicating utilities use the preference in years when their retail rates are higher. In 2016, the preference provided tax relief to 17 rural utilities with an estimated 156,000 total customers. Three utilities claimed the maximum $400,000 deduction in at least one month during fiscal year 2016.

If the preference continues, eligible rural utilities and their customers will continue to receive tax relief.

Electric utilities in rural areas benefit from the preference

Tax preferences have direct beneficiaries (entities whose state tax liabilities are directly affected) and may have indirect beneficiaries (entities that may receive benefits from the preference, but are not the primary recipient of the benefit).

Direct beneficiaries

The direct beneficiaries of the preference are utilities that provide electricity service to customers in rural areas and that have higher than average power rates. In fiscal year 2016, there were 17 utilities reporting use of the deduction. Eight of those utilities were public utility districts and nine were cooperatives.

Indirect beneficiaries

Customers of eligible rural utilities are indirect beneficiaries because the utility’s tax savings reduce the customer’s cost of power. In fiscal year 2016, JLARC staff estimate the utilities using the deduction served approximately 156,000 customers.

Estimated direct beneficiary savings in 2017-19 Biennium are $1.66 million

Utilities report the amount of the deduction on a separate line on their tax returns. The tax preference resulted in estimated beneficiary savings of $904,000 in Fiscal Year 2016. JLARC staff estimate the savings will be $1.68 million in the 2017-19 Biennium.

| Biennium | Fiscal Year | Estimated Amount Deducted | Estimated Beneficiary Savings |

|---|---|---|---|

| 2013-15 7/1/13-6/30/15 |

2014 | $20,283,000 |

$786,000 |

| 2015 | $21,446,000 |

$831,000 |

|

| 2015-17 7/1/15-6/30/17 |

2016 | $23,348,000 |

$904,000 |

| 2017 | $21,692,000 |

$840,000 |

|

| 2017-19 Biennium 7/1/17-6/30/19 |

2018 | $21,692,000 |

$840,000 |

| 2019 | $21,692,000 |

$840,000 |

|

| 2017-19 Estimated Biennial Savings |

$1,680,000 |

Source: JLARC staff analysis of Department of Revenue taxpayer data.

Indirect beneficiary savings calculated

Based on 156,000 customers of beneficiary utilities, if fully passed on the preference is expected to save each customer an estimated $5.39 per year in the next biennium.

Absent the preference, utilities would pay more public utility tax

If the preference were terminated, the rural utilities that benefit from the preference would pay more public utility tax. The increased cost would likely be passed on to their customers.

States in BPA service territory have preferences for electric utilities, but none specific to rural utilities

JLARC staff reviewed taxes on electric utilities at the retail level for states in Bonneville Power Administration’s service territory, which consists of Washington, California, Montana, Oregon, Idaho, Utah, Nevada, and Wyoming.

- California and Montana each impose a tax based on the number of kilowatt-hours of electricity purchased rather than the amount paid by the customer. As a result, the tax passed on to customers does not vary based on the rates they pay for electricity, as it does in Washington. Neither state has a preference specific to all rural utilities, but Montana exempts electricity delivered to municipal utilities and rural electric cooperatives from tax.

- Oregon and Idaho both allow electric cooperatives to pay a gross receipts tax instead of some property taxes. There are no preferences specific to rural utilities, but cooperatives in both states may fully deduct their cost of power.

- Utah imposes a gross receipts tax on some nonprofit utilities instead of its franchise or income taxes. There are no preferences specific to rural utilities.

- Nevada imposes a tax on gross receipts called the Commerce Tax. There are no preferences specific to rural utilities, but governmental entities and tax-exempt organizations like cooperatives are exempt from paying the tax.

- Wyoming does not appear to impose taxes on utilities at the retail level.

RCW 82.16.053

Deductions in computing tax—Light and power businesses.

(1) In computing tax under this chapter, a light and power business may deduct from gross income the lesser of the amounts determined under subsections (2) through (4) of this section.

(2)(a) Fifty percent of wholesale power cost paid during the reporting period, if the light and power business has fewer than five and one-half customers per mile of line.

(b) Forty percent of wholesale power cost paid during the reporting period, if the light and power business has more than five and one-half but less than eleven customers per mile.

(c) Thirty percent of the wholesale power cost paid during the reporting period, if the light and power business has more than eleven but less than seventeen customers per mile of line.

(d) Zero if the light and power business has more than seventeen customers per mile of line.

(3) Wholesale power cost multiplied by the percentage by which the average retail electric power rates for the light and power business exceed the state average electric power rate. If more than fifty percent of the kilowatt-hours sold by a light and power business are sold to irrigators, then only sales to nonirrigators shall be used to calculate the average electric power rate for that light and power business. For purposes of this subsection, the department shall determine state average electric power rate each year based on the most recent available data and shall inform taxpayers of its determination.

(4) Four hundred thousand dollars per month.

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor recommends continuing the preference

The Legislature should continue the preference because it is meeting its inferred objective of providing tax relief to rural utilities with higher electricity costs and their customers. In continuing the preference, the Legislature should consider stating the public policy objective in statute.

The structure of the preference ensures it applies only when a utility is rural and has higher than average retail power rates.

Legislation required: Yes, if the Legislature chooses to state a public policy objective (preference has no expiration date).

Fiscal impact: Depends on legislative action.

Available December 2017.

Available December 2017.

If applicable, will be available December 2017.