|

JLARC Preliminary Report: 2017 Tax Preference Performance Reviews |

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Estimated Biennial Beneficiary Savings |

|---|---|---|

A sales and use tax exemption for vessel deconstruction services when done at either a qualified vessel deconstruction facility or over the water in an area permitted under federal law. The preference is scheduled to expire on January 1, 2025. |

Sales and Use |

$246,000 |

| Public Policy Objective |

|---|

The Legislature stated the public policy objective was to decrease the number of abandoned and derelict vessels by providing incentives to increase vessel deconstruction. |

| Recommendations |

|---|

|

Legislative Auditor’s Recommendation The Legislature should review and clarify the preference because:

When reviewing the preference, the Legislature may want to consider:

Commissioner Recommendation: Available in October 2017. |

- 1. What is the Preference?

- 2. Legal History

- 3. Other Relevant Background

- 4. Public Policy Objectives

- 5. Are Objectives Being Met?

- 6. Beneficiaries

- 7. Revenue and Economic Impacts

- 8. Other States with Similar Preference?

- 9. Applicable Statutes

Sales and use tax exemption aims to reduce the number of abandoned or derelict vessels

Purpose

The Legislature passed this preference to reduce the number of abandoned or derelict vessels in Washington by:

- Lowering the cost of vessel deconstruction services.

- Encouraging businesses to invest in vessel deconstruction facilities.

Preference provides sales and use tax exemption for vessel deconstruction

Public and private entities may act to remove abandoned or derelict vessels. Sometimes they must contract with a business to permanently dismantle the vessel (vessel deconstruction).

The entities do not pay sales and use tax on vessel deconstruction services if the work is done at either:

- A qualified vessel deconstruction facility.

- Over the water in an area permitted under federal law.

The Department of Natural Resources (DNR) is one of the largest buyers of these services in Washington. A DNR program can also reimburse other authorized public entities when they remove vessels.

Not all vessel removals require deconstruction

“Vessel deconstruction” means permanently dismantling a vessel. Some abandoned or derelict vessels can be removed without deconstruction. The removal may still involve storing, towing, and transporting intact vessels.

Statute defines vessel deconstruction activities

Entities can claim the preference for vessel deconstruction when they:

- Abate and remove hazardous materials, such as fuel, lead, and oils.

- Remove mechanical, hydraulic, or electronic components.

- Remove vessel machinery and equipment.

- Cut apart and/or dispose of vessel infrastructure.

Entities cannot claim the preference for other removal activities:

- Modifying or repairing a vessel.

- Hauling vessels out of water or off land.

- Towing, storage, fees to dispose at a landfill, and legal notices.

The tax preference became effective October 1, 2014, and is set to expire January 1, 2025.

Between 2002 and 2014, Legislature took steps to address abandoned or derelict vessels

Until 2002, Washington had no state-coordinated, comprehensive approach to the problem of abandoned or derelict vessels in Washington waters and shorelines.

- The Department of Natural Resources (DNR) addressed the problem on its 2.6 million acres of aquatic lands. DNR relied on vessel owners’ cooperation, legal action such as trespass and nuisance abatement, and federal action, which was limited in both scope and the ability to remove vessels.

- Cities, ports, and other authorized entities addressed the vessels in their jurisdictions.

2002: Legislature enacted the Derelict Vessel Removal Program (DVRP)

The Legislature enacted the Derelict Vessel Removal Program (DVRP) in response to the growing number of vessels grounded or submerged on publicly or privately owned lands.

The law:

- Stated such derelict vessels created public nuisances and safety hazards, were unsightly, and threatened the environment.

- Put DNR in charge of the DVRP.

- Defined abandoned or derelict vessel.

- Listed specific procedures for taking custody of vessels.

- Created an account funded by annual recreational vessel registration fees to help offset vessel removal and disposal costs for “authorized public entities.”

- Took effect January 1, 2003.

The DVRP gives funding and expertise to authorized public entities that remove and dispose of abandoned or derelict vessels. The entities are DNR, the Department of Fish and Wildlife, the Parks and Recreation Commission, metropolitan park districts, port districts, cities, and counties. DNR removes vessels from its lands and helps other authorized public entities upon request.

Annual recreational vessel registration fees funded DVRP. Until 2006, authorized public entities could receive up to 75 percent reimbursement for costs, depending on the account’s balance. In 2006, the reimbursement rate increased to 90 percent.

2013: Legislature enacted changes to DVRP

Based on proposed legislation from DNR, the Legislature addressed several issues regarding derelict vessel removal and funding. Among other things, the legislation:

- Increased vessel owner accountability.

- Developed a voluntary vessel turn-in program (VTIP). Under VTIP, owners can turn in boats under 45 feet long that could become derelict. Biennial funding for this program is statutorily limited to not exceed $200,000.

- Directed DNR to work with stakeholders to evaluate the DVRP and suggest legislative changes if needed.

DNR’s 2013-15 budget for the DVRP was $7 million. This total included a one-time $4.5 million appropriation to remove several large abandoned vessels that were threatening navigation and the environment.

2014: Legislature enacted this preference and set additional requirements for vessel owners

The Legislature responded to suggestions from DNR and a stakeholder workgroup by enacting this sales and use tax exemption for vessel deconstruction services. The same bill set requirements for vessel owners:

- Required owners and purchasers of vessels over 65 feet and more than 40 years old to ensure the vessel is seaworthy and to obtain marine liability insurance.

- Required marinas, ports, and their tenants to be insured. Allowed private marinas to contract with DNR to remove nuisance vessels.

- Required certain commercial vessels to pay a new annual derelict vessel removal fee of $1 per foot to help fund the vessel removal account. The Legislature stated:

- Fees paid by recreational vessel owners were insufficient to fund the account.

- Using General Fund revenue was an unfair burden on the non-boating public.

- Enacted new penalties for failing to register a vessel that is subject to a watercraft excise tax.

The preference will expire January 1, 2025. The performance statement, which includes public policy objectives, expires six years earlier, on January 1, 2019.

Derelict Vessel Removal Program prioritizes vessels for removal and partially reimburses authorized public entities

The Department of Natural Resources (DNR) manages the Derelict Vessel Removal Program (DVRP). DVRP reimburses authorized entities for removing abandoned or derelict vessels. Costs can include vessel deconstruction. Statute provides key definitions, some of which are noted below.

Derelict Vessel Removal Program (DVRP) prioritizes vessels for removal

DNR maintains an inventory of abandoned or derelict vessels that need removal. As of October 2016, the list included 172 vessels. DNR adds vessels to the list when they are reported as abandoned or derelict.

Statute directs DNR to prioritize vessels for removal. DNR assigns a priority level based on criteria including:

- Vessel condition and size.

- Proximity to navigation channels, or sensitive areas or populations.

- Potential for harmful encounters.

- Toxicity or hazard potential.

A vessel’s priority can change with the condition of the vessel or its environment.

| Priority 1 | Emergencies |

| Priority 2 | Non-emergency existing threats to human health, safety, and environment |

| Priority 3 | Vessels impacting habitat and not already covered in a prior category |

| Priority 4 | Minor navigation or economic impact |

| Priority 5 | Other abandoned or derelict vessels |

| Priority 6 | Vessels abandoned in boatyards |

Voluntary turn-in program for vessels that are at risk of becoming derelict

The voluntary Vessel Turn-In Program (VTIP) allows DNR to dismantle and dispose of vessels that are at high risk for becoming abandoned or derelict, but do not yet meet the definition.

State law limits program funding to $200,000 per biennium. DNR prioritizes vessels for removal under this program separately from the DVRP list.

DVRP funded through fees and leases

The DVRP budget of $2.46 million (2015-17 Biennium) comes from two accounts and is used to:

- Remove derelict vessels.

- Reimburse authorized public entities for up to 90 percent of their vessel cleanup expenses, including vessel deconstruction work.

- Fund the voluntary vessel turn-in program (VTIP).

| Account | 2015-17 Amount | Fund Source |

|---|---|---|

| Derelict Vessel Removal Account | $1.93 million

|

|

| Aquatic Lands Enhancement Account | $528,900

|

Revenue from state-owned aquatic leases. |

DNR did not have funds to reimburse all authorized entities for vessel cleanup costs through the end of the 2015-17 Biennium.

- As of January 1, 2017, DNR was unable to pay 21 reimbursement requests from authorized public entities totaling over $300,000.

- As of August 2016, DNR had spent $150,000 of the $200,000 allotment for VTIP to remove 34 vessels. DNR withheld the remaining $50,000 to help cover DRVP program costs due.

DNR staff note that for vessels that require deconstruction work, approximately 50 percent of vessel removal costs are related to the vessel deconstruction.

DNR conducts most removals in DVRP

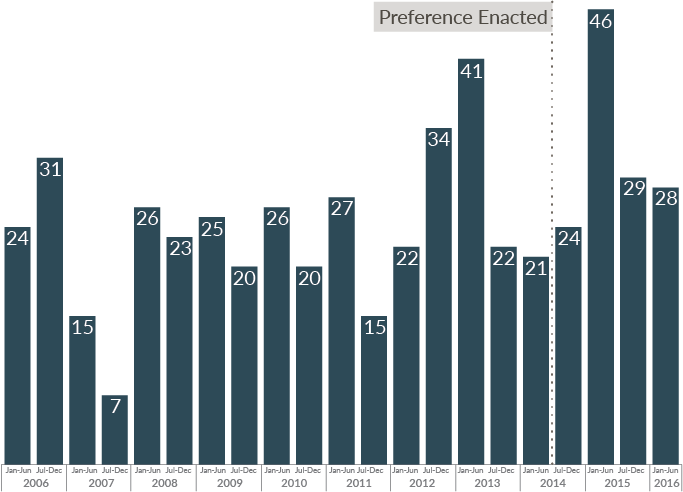

The number of abandoned or derelict vessels removed by DNR has increased over time. But, the number of removals by other authorized public entities, as tracked by DNR, has decreased.

DNR notes there are many possible reasons that DVRP removals are increasing overall, but removals by other entities are decreasing. DNR identified several issues that could affect the removal numbers, including:

- DVRP Resources: One-time funding in the 2013-15 budget for large vessel removals allowed DNR to use all of their normal allocation for other vessels. Further, the DVRP has had a slight increase in funding and staffing since 2006, allowing for more projects to be worked on simultaneously.

- Tracking: All of the vessels removed under the VTIP program are now reflected in DNR’s removal numbers. VTIP started in 2014. These vessels are not yet considered abandoned or derelict.

- Authorized Entity Funding and Policy: Many other authorized public entities ran out of funding in 2008, which affected their ability to fund removals up-front (DVRP is a reimbursement program). Also, entities may have tightened their moorage agreements to discourage dilapidated vessels from mooring in their jurisdictions.

Key definitions

Vessel: Any type of watercraft or other mobile artificial contrivance, powered or not, intended to transport people or goods on water or for floating marine construction or repair. A vessel cannot be more than 200 feet long.

Abandoned vessel: A vessel that has been left, moored, or anchored in the same area without the express consent, or in violation of rules of, the owner or operator of the aquatic lands. The vessel must be left for 30 or more consecutive days or for more than 90 out of any 360 days to be considered abandoned. The vessel’s owner must be either not known, not locatable, or known and unwilling to take control of the vessel.

Aquatic lands: Tidelands, shorelands, harbor areas, and the beds of navigable waters, regardless of ownership.

Derelict vessel: A vessel that:

- Has been moored, anchored, or left in state waters or on public property illegally; or

- Has been left on private property without the owner’s authorization: and

- Is sunk or in danger of sinking;

- Is obstructing a waterway; or

- Is endangering life or property.

The vessel’s owner must be known and locatable, and exert control of the vessel.

Qualified vessel deconstruction facility: Structures, including those that float, permitted under section 402 of the federal Clean Water Act for vessel deconstruction.

Legislature stated public policy objective in the performance statement

The Legislature stated that it aimed to decrease abandoned or derelict vessels, and provided metrics for this review.

Stated objective: Decrease abandoned or derelict vessels by removing them from Washington waters

The Legislature categorized this preference as “intended to induce certain designated behaviors by taxpayers.” In its tax preference performance statement, the Legislature stated that the public policy objective was to:

. . . . decrease the number of abandoned and derelict vessels by providing incentives to increase vessel deconstruction in Washington. . . .This incentive will lower the costs associated with vessel deconstruction and encourage businesses to make investment in vessel deconstruction facilities.

Legislature provided metrics for JLARC review

The Legislature directed JLARC to review the preference by December 1, 2018, and provided the following metrics for evaluation. In short, if either an increase in capacity or a reduction in the average cost led to more derelict vessels being removed from Washington waters, then the Legislative Auditor should recommend extending the preference.

While the tax preference does not expire until January 1, 2025, the performance statement identifying the objectives and metrics expires six years earlier, on January 1, 2019.

| If Either… | Resulted in… | Then: |

|---|---|---|

| An increase in available capacity to deconstruct derelict vessels

OR A reduction in the average cost to deconstruct vessels |

An increase in the number of derelict

vessels removed from Washington waters (compared to before June 12, 2014) |

The Legislative Auditor should recommend extending the January 1, 2025, expiration date |

Vessel removals have varied without a clear trend, and it is unclear if changes are related to the tax preference or other factors

The Legislature stated that the public policy objective was to decrease the number of abandoned and derelict vessels by removing them from Washington’s waters. It intended to do so by lowering the cost of deconstruction activities and encouraging businesses to invest in deconstruction facilities.

Stated objective: Decrease abandoned or derelict vessels by removing them from Washington waters

Department of Natural Resources (DNR) data shows that:

- The number of vessels removed has varied without a clear trend since 2006.

- The average number of removals per half-year has increased slightly – from 29.5 every six months in the two fiscal years before the preference to 31.8 after the preference took effect.

However, it is unclear whether the preference caused the increase:

- The preference lowers deconstruction costs, but not all vessel removals require deconstruction. Between October 2014 and September 2016, deconstruction work at approved sites was involved in 78 of the 205 vessels removed through the DVRP.

JLARC staff were unable to obtain records on how many vessels were removed or deconstructed outside of the DVRP.

No evidence of increase in vessel deconstruction facilities or capacity in Washington

Removals have increased slightly, but there is no evidence that the preference has increased capacity for vessel deconstruction work in Washington. Not all removals involve deconstruction. JLARC staff interviewed DNR staff, and representatives of two large businesses that deconstruct vessels and a small boatyard. They all noted:

- They have seen no increase in vessel deconstruction work at their facilities or elsewhere since the preference was enacted.

- They have seen no increase in the available capacity to deconstruct abandoned or derelict vessels or an increase in the number of businesses doing this work.

- Abandoned and derelict vessel deconstruction is a very minor part of their business activity, and the work is too sporadic to build a successful business model.

Deconstruction costs decreased by the amount of sales tax

The preference decreases costs to deconstruct vessels by the applicable sales tax rate for where the work is performed (9.0 percent on average). It is unclear if the cost reduction caused or contributed to the slight increase in vessel removals.

DNR representatives stated that the sales tax savings was intended to increase the amount of removal and deconstruction work the agency could complete within DVRP budget limits.

Other factors may have contributed to the number of vessels removed

JLARC staff identified factors that, along with the lowered costs for deconstruction, may have contributed to the increase in vessel removals.

Public funds available for removal: In the 2013-15 Biennium, the DVRP received a one-time $4.5 million appropriation to remove several large vessels.

Cost of removal: If costs are lower, more vessels can be removed within DVRP funding limits.

Size and condition of the vessel: DVRP records from the 2015-17 Biennium indicate that the removal cost varies by vessel size.

| 2015-17 Biennium (through July 2016) | Vessels Under 35 ft | Vessels 35 – 65 ft | Vessels Over 65 ft |

|---|---|---|---|

| Average Removal Cost | $6,200

|

$14,500

|

$290,000

|

DNR and industry sources note that commercial and submerged vessels are complicated and expensive to remove. For example, businesses must use a lift to remove vessels over 35 feet long from the water. Currently, there are no lifts on Washington’s outer Pacific Coast. Removing large derelict vessels located far from lifts increases removal costs.

Unclear whether continuing tax preference beyond expiration date will achieve public policy objectives.

The preference is scheduled to expire on July 1, 2025.

Continuing the preference:

- Would provide tax relief to DNR, other authorized public entities, and any other businesses or individuals that contract for vessel deconstruction work. The preference decreased vessel deconstruction costs by 9.0 percent on average.

- May or may not impact the number of abandoned or derelict vessels removed.

- Industry representatives note the preference has not changed the number of deconstruction businesses or the state’s capacity to deconstruct vessels.

Public and private entities that use vessel deconstruction services benefit from the preference

Tax preferences have direct beneficiaries (entities whose state tax liabilities are directly affected) and may have indirect beneficiaries (entities that may receive benefits from the preference, but are not the primary recipient of the benefit).

Direct beneficiaries

Direct beneficiaries of the tax preference are authorized public entities, private organizations (e.g., businesses, marinas), or individuals that use a qualified vessel deconstruction service to dismantle and remove a vessel. Direct beneficiaries do not pay sales or use tax on deconstruction services. Absent the preference, they would pay sales tax of 9.0 percent on average. Authorized public entities include:

- Department of Natural Resources.

- Department of Fish and Wildlife.

- Parks and Recreation Commission and city parks departments.

- Port districts.

- Cities, counties, or towns that own, manage, or have jurisdiction over aquatic lands where abandoned or derelict vessels are located.

Industry representatives stated that most deconstruction work is contracted by DNR or other authorized public entities (estimated at 95 percent). DNR appears to be the largest beneficiary.

Indirect beneficiaries

Indirect beneficiaries of the preference are businesses that deconstruct vessels. They may see an increase in vessel deconstruction work directed to them because of the preference.

Estimated beneficiary savings in 2017-19 Biennium are $246,000

JLARC staff estimate a minimum direct beneficiary savings of $42,000 in Fiscal Year 2016 and $246,000 for the 2017-19 Biennium. This estimate is likely low, as other vessel deconstruction work that is not paid for through the DVRP program is not included in this estimate. The preference is currently scheduled to expire January 1, 2025.

| Biennium | Fiscal Year | Qualifying Deconstruction Work (per DNR) |

Estimated Beneficiary Savings |

|---|---|---|---|

| 2013-15 7/1/13-6/30/15 |

2015 (beginning Oct. 1, 2014) |

$2,267,000

|

$205,000

|

| 2015-17 7/1/15-6/30/17 |

2016 | $445,000

|

$42,000

|

| 2017 | $1,356,000

|

$123,000

|

|

| 2017-19 7/1/17-6/30/19 |

2018 | $1,356,000

|

$123,000

|

| 2019 | $1,356,000

|

$123,000

|

|

| 2017-19 Estimated Biennial Savings |

$2,712,000

|

$246,000

|

Absent the tax preference, beneficiaries would pay sales or use tax, but economic impact is unlikely

If the tax preference were terminated or allowed to expire as scheduled, the authorized public entities and others that purchase vessel deconstruction work would pay sales or use tax on the deconstruction work as they did before October 1, 2014.

It is unlikely that termination or expiration of the preference would impact employment or the economy because there is no evidence that this preference has resulted in an increase in vessel deconstruction capacity.

JLARC staff did not identify any other states that provide a sales and use tax exemption for vessel deconstruction services

JLARC staff reviewed statutes for 29 states that border a coast, the Great Lakes, or other waterway.

Most of these 29 states have a formal process to deal with abandoned or derelict vessels. Many require that owners (if known) be responsible for removal and disposal costs. None appears to have a sales and use tax exemption for vessel deconstruction. JLARC staff identified six states with a dedicated funding source for removal efforts.

- California has a grant program for local public agencies statewide. It covers both surrendered or abandoned vessels and a voluntary vessel turn-in program.

- Hawaii allows funds from a special boating fund to be used to remove abandoned or derelict vessels.

- Michigan has a fund for abandoned vessels, off-road vehicles, and snowmobiles.

- Mississippi has a special derelict vessel fund.

- Oregon provides an account ($150,000 per biennium) funded in part by registration fees to pay up to 90 percent of the costs associated with derelict vessel removal.

- Rhode Island has an account funded by a special abandoned or derelict vessel fee to cover removal work.

RCW 82.08.9996

Exemptions—Vessel deconstruction.

(1) The tax levied by RCW 82.08.020 does not apply to sales of vessel deconstruction performed at:

(a) A qualified vessel deconstruction facility; or

(b) An area over water that has been permitted under section 402 of the clean water act of 1972 (33 U.S.C. Sec. 1342) for vessel deconstruction.

(2) The definitions in this subsection apply throughout this section unless the context clearly requires otherwise.

(a)(i) "Vessel deconstruction" means permanently dismantling a vessel, including: Abatement and removal of hazardous materials; the removal of mechanical, hydraulic, or electronic components or other vessel machinery and equipment; and either the cutting apart or disposal, or both, of vessel infrastructure. For the purposes of this subsection, "hazardous materials" includes fuel, lead, asbestos, polychlorinated biphenyls, and oils.

(ii) "Vessel deconstruction" does not include vessel modification or repair.

(b) "Qualified vessel deconstruction facility" means structures, including floating structures, that are permitted under section 402 of the clean water act of 1972 (33 U.S.C. Sec. 1342) for vessel deconstruction.

(3) Sellers making tax-exempt sales under this section must obtain from the purchaser an exemption certificate in a form and manner prescribed by the department. The seller must retain a copy of the certificate for the seller's files. In lieu of an exemption certificate, a seller may capture the relevant data elements as allowed under the streamlined sales and use tax agreement.

[ 2014 c 195 § 301.]

NOTES:

Reviser's note: Section 301, chapter 195, Laws of 2014 expires January 1, 2025, pursuant to the automatic expiration date established in RCW 82.32.805(1)(a).

Effective date—2014 c 195 §§ 301 and 302: "Sections 301 and 302 of this act take effect October 1, 2014." [ 2014 c 195 § 304.]

Intent—2014 c 195 §§ 301 and 302: "(1) This section is the tax preference performance statement for the tax preference contained in sections 301 and 302 of this act. This performance statement is only intended to be used for subsequent evaluation of this tax preference. It is not intended to create a private right of action by any party or be used to determine eligibility for preferential tax treatment.

(2) The legislature categorizes this tax preference as intended to induce certain designated behavior by taxpayers as indicated in RCW 82.32.808(2)(a).

(3) It is the legislature's specific public policy objective to decrease the number of abandoned and derelict vessels by providing incentives to increase vessel deconstruction in Washington by lowering the cost of deconstruction. It is the legislature's intent to provide businesses engaged in vessel deconstruction a sales and use tax exemption for sales of vessel deconstruction. This incentive will lower the costs associated with vessel deconstruction and encourage businesses to make investments in vessel deconstruction facilities. Pursuant to chapter 43.136 RCW, the joint legislative audit and review committee must review the sales tax exemptions provided under sections 301 and 302 of this act by December 1, 2018.

(4) If a review finds that the increase in available capacity to deconstruct derelict vessels or a reduction in the average cost to deconstruct vessels has resulted in an increase of the number of derelict vessels removed from Washington's waters as compared to before June 12, 2014, then the legislature intends for the legislative auditor to recommend extending the expiration date of the tax preference.

(5) In order to obtain the data necessary to perform the review in subsection (3) of this section, the joint legislative audit and review committee should refer to data kept and maintained by the department of natural resources.

(6) This section expires January 1, 2019." [ 2014 c 195 § 303.]

Findings—Intent—2014 c 195: See notes following RCW 79.100.170 and 79.100.180.

RCW 82.12.9996

Exemptions—Vessel deconstruction.

(1) This chapter does not apply to the use of vessel deconstruction services performed at:

(a) A qualified vessel deconstruction facility; or

(b) An area over water that has been permitted under section 402 of the federal clean water act of 1972 (33 U.S.C. Sec. 1342) for vessel deconstruction.

(2) The definitions in RCW 82.08.9996(2) apply to this section.

[ 2014 c 195 § 302.]

- Legislative Auditor Recommendation

- Letter from Commission Chair

- Commissioners’ Recommendation

- Agency Response

Legislative Auditor recommends reviewing and clarifying the tax preference

When it enacted this preference, the Legislature directed the Legislative Auditor to recommend extending the expiration date if either:

- an increase in the capacity to deconstruct derelict vessels, or

- a reduction in the average cost to deconstruct vessels

resulted in an increase in the number of derelict vessels removed compared to before June 12, 2014.

Based on this directive, the Legislature should review and clarify this tax preference because:

- The average cost for deconstruction is lower, but it is unclear if it led to changes in vessel removals. Not all vessel removals require deconstruction.

- Other factors may impact vessel removals as much or more so than the reduced deconstruction costs. Factors may include available DVRP funds, removal costs, and size and condition of the vessel.

- The performance statement that details the public policy objective and metrics is set to expire six years before the preference expires.

When reviewing the preference, the Legislature may want to consider one of the following two options:

- Adopt a metric other than the number of vessels removed to measure if the public policy objective has been achieved. While removals continue to occur, there is no evidence that the capacity to deconstruct vessels has increased. It is also unclear whether the removals were impacted by the reduction in deconstruction costs or by other contributing factors, such as vessel size and condition or available budget funds. Also, removing one large, potentially damaging vessel may be more beneficial to the state than removing ten smaller ones that pose no immediate threat.

- Re-categorize the purpose of this preference as one intended to provide tax relief, rather than one intended to induce a certain behavior (RCW 82.32.808(2)(e)). The tax relief category reflects the Legislature’s stated goal of reducing the average cost to deconstruct vessels and would eliminate the need to identify a new metric.

Legislation required: Yes (preference expires January 1, 2025. The performance statement expires six years earlier, on January 1, 2019).

Fiscal impact: Depends on legislative action.

Available December 2017.

Available December 2017.

If applicable, will be available December 2017.