- About the Committee

- Audits this year

- JLARC Work leads to action

- Tax Preference Studies

- What's Coming in the Future

- View/Print entire report

The Legislature’s Performance Auditor

The Joint Legislative Audit and Review Committee (JLARC) is the Legislature’s performance auditor, working to make state government operations more effective, efficient, and accountable.

JLARC pursues its mission by conducting performance audits, program evaluations, sunset reviews, and other analyses at the direction of the Legislature. Based on these assignments, JLARC’s non-partisan staff auditors, under the direction of the Legislative Auditor, independently seek answers to audit questions and issue recommendations to improve performance.

During 2015, reports were presented by staff to the Committee covering topics ranging from public lands to injured worker insurance to tax preference. This annual report provides examples of that work and work JLARC will undertake in the coming years.

JLARC Members

| Senators | Representatives |

|---|---|

| Randi Becker | Jake Fey |

| John Braun, Chair | Larry Haler |

| Sharon Brown | Christine Kilduff |

| Annette Cleveland | Drew MacEwen |

| David Frockt | Ed Orcutt, Secretary |

| Bob Hasegawa | Gerry Pollet |

| Mark Mullet, Asst. Secretary | Derek Stanford, Vice Chair |

| Ann Rivers | Drew Stokesbary |

| Legislative Auditor | Deputy Legislative Auditor |

|---|---|

| Keenan Konopaski | John Woolley |

A special effort to make the Committee’s work easy to understand

To make our work more accessible, and recognizing that most people access information through the Web, our reports are now web-based and sized for all devices, including smart phones. The National Conference of State Legislatures (NCSL) recognized this leading-edge effort by awarding JLARC with a “Notable Document” award.

Selected Work

The Legislature should reauthorize the Medicaid Fraud False Claims Act

Medicaid is a joint federal-state program that pays health care providers for services to eligible low-income individuals and families. In some instances, providers file false claims, billing for services not provided or other fraudulent schemes to obtain payment to which they are not entitled.

One way Washington combats Medicaid fraud is through civil cases brought by the Attorney General and private individuals acting as whistleblowers under the authority of the state’s Medicaid Fraud False Claims Act (FCA). This act complements state criminal and federal Medicaid Fraud investigations. Washington’s FCA terminates June 30, 2016, unless reauthorized by the Legislature.

The Legislative Auditor recommends that the Legislature reauthorize the Medicaid Fraud False Claims Act because:

- The Act allows the state to pursue civil cases against Medicaid fraud that it would lack authority to pursue otherwise; and

- Medicaid fraud recoveries have increased since the Act was enacted in 2012.

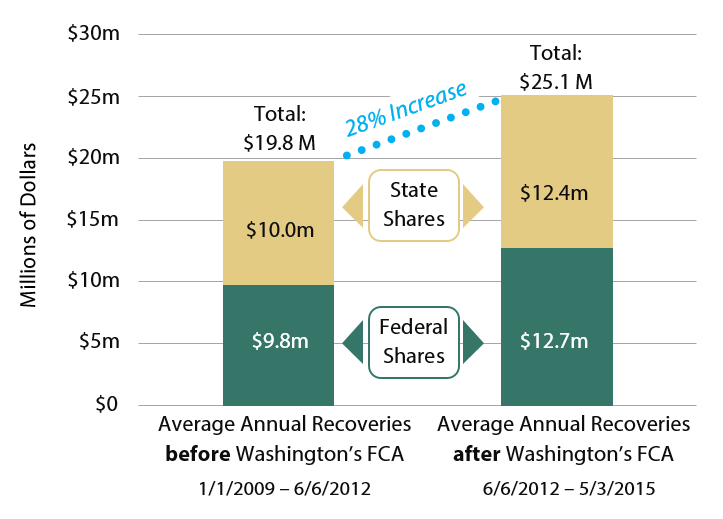

Average Annual Fraud recoveries have increased since Washington’s Medicaid Fraud False Claims Act was enacted

Source: JLARC staff analysis of AGO civil fraud recovery data.

Claims management by L&I is unbiased and decisions generally timely: improvement in outcomes possible with more focus on prompt and safe return to work

Workers’ compensation is a form of insurance that protects workers and employers when injuries or illnesses happen on the job. With few exceptions, employers in Washington must provide this coverage to their workers.

L&I claims management and dispute resolution processes and decisions appear unbiased, however L&I can improve its efforts to help workers return to work promptly and safely.

Legislative Auditor recommended:

- L&I should institute standards for early phone contact, claim management planning, and clear documentation in claims management.

- L&I should expand its pilot programs and enhance its claims management support systems (training, performance measures, and technology) with a focus on return to work.

- The Legislature should remove the requirement for L&I to approve certain decisions by employers who self-insure, to improve the timeliness of those claims processes.

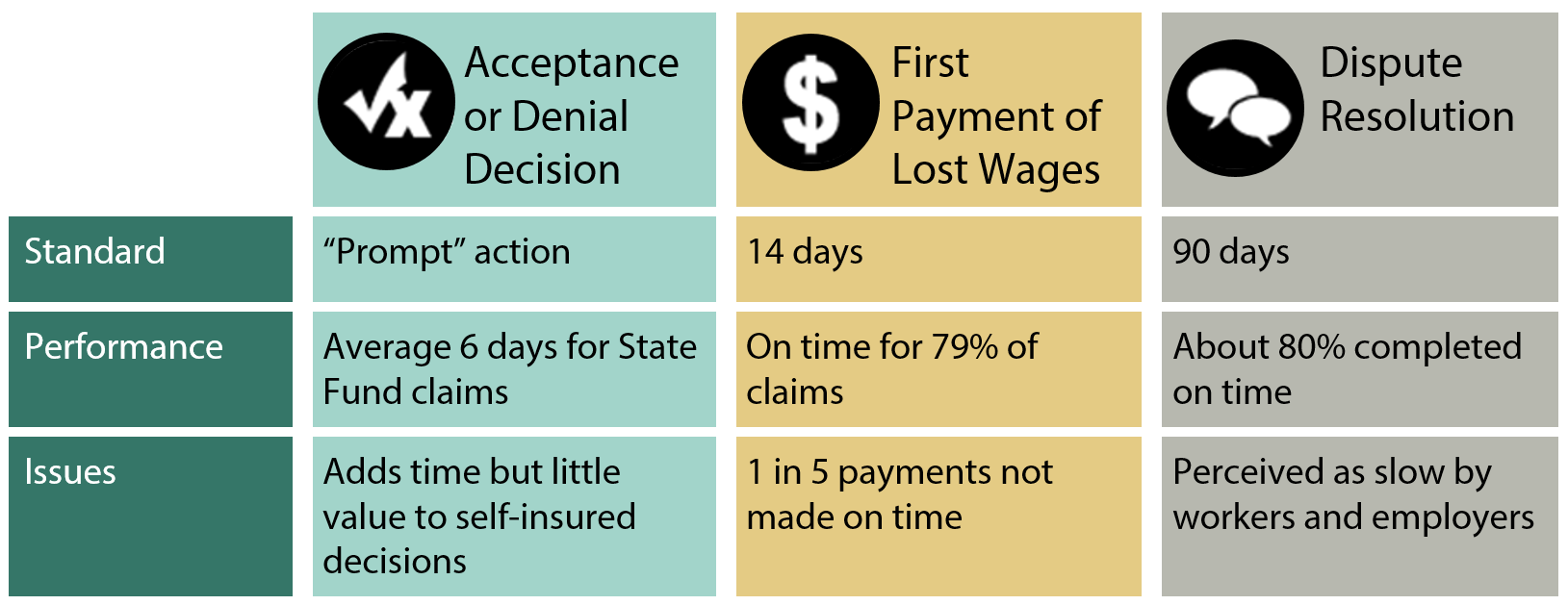

L&I has mixed results for timeliness standards

Source: JLARC staff presentation of consultants' observations of L&I actions 2010-2013.

Public lands reports: The Legislature gains better understanding of the future costs of state land purchases and how public land use impacts county economies

Washington acquired an additional 120,000 acres of land for recreation and habitat protection over the past 10 years. Five agencies currently report information about recreation and habitat land acquisitions to the Legislature: State Parks, DNR, WDFW, the Recreation and Conservation Office (RCO), and the Office of Financial Management (OFM).

Information about detailed outcomes and future costs varies by report and by agency, with key information about acquisitions, funding, and future costs either lacking or spread across several reports and websites.

The Legislative Auditor recommended that the five agencies develop a single, easily-accessible source for information about proposed recreation and habitat land acquisitions, including detailed outcomes and future costs.

With 77% of the increase taking place in seven counties, the Legislature directed JLARC to analyze the economic impact of public lands on county economies. The results? In general, the percentage of public lands did not negatively affect county economic growth over the past 20 years. However, specific purchases may have positive or negative impacts, driven largely by how the land is used, regardless of ownership. An example of how ownership can impact economic factors is shown below from a scenario of one specific acquisition.

View all JLARC reports and 2013-15 Work Plan on JLARC's website

Agencies Implement JLARC Recommendations

JLARC reports often contain recommendations to agencies to improve the efficiency and effectiveness of their operations. Between 2011 and 2014, JLARC issued 32 recommendations directly to state agencies. 94 percent of these recommendations have been implemented or are in the process of being implemented.

JLARC staff help other legislators and stakeholders understand our work

JLARC staff are often asked to make presentations to explain our work to other interested groups. Recent topics reviewed with other committees and stakeholder groups included the economic impact of public lands, tax preference performance, and calculating the costs of highway and bridge repair and maintenance.

In addition, JLARC staff were invited to present the results of our work to other organizations across the nation, including the Pew Center for the States, the National Conference of State Legislatures, and Regional Economic Modeling, Inc.

View all JLARC reports on JLARC's website

Ongoing Performance Review of Tax Preferences

In 2006, the Legislature charged JLARC and the Citizen Commission for Performance Measurement of Tax Preferences with reviewing the state’s tax preferences. Completed on a ten-year cycle, preferences include tax exemptions, tax deductions, and preferential tax rates.

JLARC’s 2015 reviews included information to the Legislature on a wide range of preferences including agriculture and the motion picture industry.

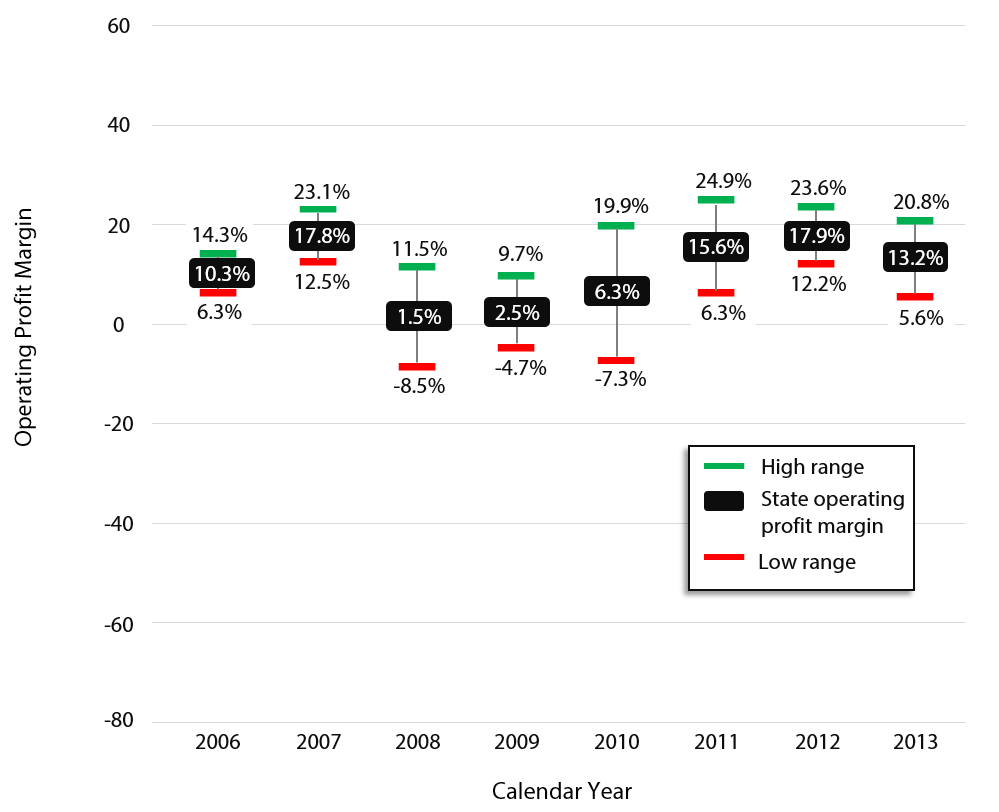

Agriculture Profit Margins Varied Since Tax Preference Enacted

One preference provided to farmers is a sales tax break on the purchase of replacement parts for their farm equipment: when enacted, the Legislature was concerned with increased prices for fuel and other inputs while profits were low. JLARC staff found that input costs, including fuel, rose 38% between 2006 and 2013. However, crop prices rose as well, ranging from an increase of 32% for potatoes to 63% for hay during this period. Profit margins during this time varied, from a high of 17.9% in 2012 to a low of 1.5% in 2008.

The Legislature provides a tax preference intended to stimulate filming and production of motion pictures in Washington: the purpose is to regain and revitalize the state’s competitive position and to provide family wage jobs. Possible impacts of the preference are mixed: Washington ranks in the top 1/3 among states in the concentration of motion picture employment but below the national average. Whether employment increased in the state hinges on how many film productions receiving assistance were produced here because of the preference – if over 45% of film project spending was caused by the incentive, then employment may have increased. When viewed through the lens of return on investment, even after taking into consideration the ripple effects of spending by the industry, for every one dollar of tax credit film spending generates only six cents of new tax revenue.

Uncertainty on Film Industry Competitive Position

View all work completed for the Citizen Commission on the Commission's website

What’s On the Horizon: 2015 and Beyond

At the Legislature’s direction, JLARC’s upcoming work will seek answers to topics such as:

Services for homeless youth

JLARC will review state-funded programs that serve unaccompanied homeless youth under the age of 18. The review will determine what performance measures exist, what statutory reporting requirements exist, and whether there is reliable data on ages of youth served, length of stay, and effectiveness of program exit and reentry.

Questions? Contact Rebecca Connolly: 360-786-5175; rebecca.connolly@leg.wa.gov

Puget Sound Partnership

The Legislature created the Puget Sound Partnership to coordinate and lead the effort to restore the Puget Sound by 2020. The Legislature directed JLARC to conduct two performance audits of the Partnership, the first in 2011 and this second audit in 2016.

Questions? Contact Melanie Stidham: 360-786-5190; melanie.stidham@leg.wa.gov

Forest fire protection assessments

JLARC will review the process DNR uses to determine forest fire assessments, the efficiency of the administrative process, assessment rates, the relationship between rates and protection and suppression expenditures, how other states assess for protection and suppression, and parcels assessed as forest lands that are developed and not covered by a fire protection district.

Questions? Contact Ryan McCord: 360-786-5186; ryan.mccord@leg.wa.gov

UW Alternative Public Works sunset review

The Legislature reauthorized in 2015 the University of Washington’s ability to use an alternative process for selecting contractors for certain types of public works projects. This review will build on JLARC’s previous work with a special focus on the reduction in the time to select and award contracts for Harborview and tracking the use of woman and minority-owned businesses.

Questions? Contact Steven Meyeroff: 360-786-5298; steven.meyeroff@leg.wa.gov

Use of Lodging Tax revenues by municipalities

The Legislature is interested in how municipalities use lodging tax revenues for tourism promotion. JLARC will continue managing the process of collecting information from municipalities and posting that information in an easily accessible web-based report.

Questions? Contact Suzanna Pratt: 360-786-5106; suzanna.pratt@leg.wa.gov