JLARC Final Report: 2015 Tax Preference Performance Reviews

Report 15-5, January 2016

Farm Machinery Replacement Parts | Sales and Use

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Est. Beneficiary Savings in 2015-17 Biennium |

|---|---|---|

A sales and use tax exemption for eligible farmers on purchases of:

|

Sales & Use RCWs 82.08.855; 82.12.855 |

$62.2 million |

| Public Policy Objective |

|---|

The Legislature did not state the public policy objective. JLARC staff infer the policy objectives were:

|

| Recommendations |

|---|

Legislative Auditor’s Recommendation: Review and Clarify

Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation with comment. The Legislature is encouraged to clearly state the public policy of the preference and make sure it is designed effectively to achieve that purpose. Washington State agricultural producers compete with their counterparts in other states who are subject to different tax regimes. Research by JLARC staff shows other major agricultural states also provide tax exceptions for machinery parts. This was also confirmed by testimony from agricultural producers. This implies that the existing preference may be necessary to enable Washington State agricultural producers to compete effectively. However, as currently designed, this preference may be more than sufficient or inadequate to assure competitive equity. |

- What is the Preference?

- Legal History

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

Eligible farmers do not have to pay sales and use taxes on purchases of:

- Replacement parts for qualifying farm machinery and equipment (M&E);

- Labor and services to install these replacement parts; and

- Labor and services to repair qualifying farm M&E, as long as no items other than replacement parts are installed in or become a component of the machinery and equipment.

“Replacement parts” are defined as replacing an existing part or are essential to maintain the working condition of a piece of qualifying farm M&E.

Qualifying as an Eligible Farmer

In order to qualify for this preference, a farmer must meet the following criteria:

- The farmer must be engaged in the business of growing, raising, or producing agricultural products to be sold. People producing agricultural products for their own consumption do not qualify;

- The farmer must be producing these products on the farmer’s own lands or on lands in which the farmer has a present right of possession (for example, a lease); and

- The value of the products the farmer grows must have been at least $10,000 in the preceding year.

There are three different ways to meet the $10,000 threshold:

- The farmer can have gross sales or harvested value of the agricultural products that was at least $10,000 in the preceding year; or

- If the farmer did not sell products in the preceding year, the farmer can meet the requirement if the estimated value of the farmer’s products was at least $10,000; or

- If a farmer changed identity or there was a change in the form of ownership of an entity that was an eligible farmer, with no beneficial change in ownership, an entity can meet the threshold if the combined gross sales, harvested value, or estimated value of the products by both entities was at least $10,000 in the preceding year.

A person does not have to meet the $10,000 requirement if the person is new to farming or newly returned to farming. A “farmer” can be an individual or one of many different types of business entities, organizations, or other structures.

Qualifying Farm Machinery and Equipment

Statute also identifies what equipment does and does not qualify.

| Qualifying | Not Qualifying |

|---|---|

|

|

For more information on Washington’s agricultural industry, please see JLARC’s Agricultural Overview.

Pre-2006

All farmers paid sales tax on repair and replacement parts for farm machinery and equipment (M&E), as well as on installation and repair labor and services.

2006

The Legislature enacted this sales and use tax exemption for replacement and repair parts purchased by farmers for qualifying farm M&E. The exemption only applied to parts, not to labor or services to repair or install, or to repair parts for farm vehicles. Farmers with at least $10,000 in gross sales from agricultural products they grew, raised, or produced in the previous year were eligible.

To use the exemption, eligible farmers had to apply to the Department of Revenue (DOR) for a specific Repair Parts for Farm Machinery and Equipment (FRP) exemption certificate. As part of the application, farmers were required to provide a copy of their Schedule F 1040 IRS form to document they met the $10,000 threshold. Eligible farmers had to reapply to DOR to renew their certificate every four years.

2007

The Legislature expanded the preference and relaxed eligibility requirements by:

- Extending the exemption to apply to labor and services to install replacement parts and repair qualifying farm M&E;

- Extending the exemption to apply to parts and repair work on farm vehicles;

- Changing eligibility requirements so that farmers with a harvested value (but no sales) of $10,000 or more could apply for an exemption certificate; and

- Allowing applicants to sign an affidavit certifying they met eligibility requirements, rather than sending in a Schedule F copy to DOR.

2014

The Legislature repealed the requirement that farmers apply to DOR to use the preference and eliminated the FRP exemption certificate.

Beginning June 12, 2014, farmers instead self-generate a multi-purpose Farmers’ Certificate for Wholesale Purchases and Sales Tax Exemptions form, check off the box provided for replacement parts, and provide it to the vendor or repair facility when making such tax-exempt purchases. The Farmers’ Certificate exemption form is used for a number of different sales tax exemptions and wholesale purchase exemptions. The form is completed by the farmer/buyer and kept by the vendor to document the tax exempt transaction. It is not submitted to DOR.

What are the public policy objectives that provide a justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature did not state the public policy objective when this preference was first enacted in 2006 or when it was expanded in 2007. Additionally, no objective was stated in 2014 when the Legislature removed the requirement for farmers to apply to the Department of Revenue to use the preference.

1. Based on statements in 2006 by the prime sponsor of the bill and industry proponents in committee hearings, JLARC staff infer the public policy objective was to help farmers repair and maintain farm M&E during a time when crop prices were stagnant and farming input costs (notably fuel) were increasing.

When the bill was being considered, the prime sponsor testified in committee hearings that:

“This bill will help them (farmers) maintain their equipment so they can keep farming. This will help keep down unemployment and might just help them stay in business just a little while longer until hopefully we get the price of our commodities turned around and people back in a profitable mode instead of where we are now, fighting the banker just to stay in business.”

2. JLARC staff infer the expansion in 2007 was a reaction to exempt more items, since estimated use and revenue loss of the preference was less than projected in the 2006 fiscal note. When the preference was expanded in 2007, the prime sponsor of the bill noted that the estimated use of the exemption was less than DOR had anticipated – 3,000 farmers out of potentially 30,000 had applied for an exemption certificate in the months after the preference was enacted

3. The Legislature did not state why it removed the requirement for farmers to apply for a specific exemption certificate in 2014. The change was included in a larger bill addressing numerous tax statutes, under a subheading “Simplifying Exemption Certificate Requirements for Farmers.” Based on this, JLARC staff infer the objective was to simplify reporting for farmers.

What evidence exists to show that the tax preference has contributed to the achievement of any of these public policy objectives?

1. Help farmers during a time when crop prices were stagnant and input costs were increasing

It is unclear whether the preference is meeting the inferred objective.

Testimony for the legislation highlighted a need for assistance at a difficult economic time for farmers. To assess how the conditions at that time compare to current conditions, JLARC staff reviewed changes in four indicators:

- Prices for major Washington crops;

- Farm input costs;

- Net farm income; and

- Farm profit margins.

Washington Commodity Prices Higher in 2013 than in 2006

Crop prices have fluctuated in the years since the Legislature enacted the preference but are higher in 2013 than in 2006.

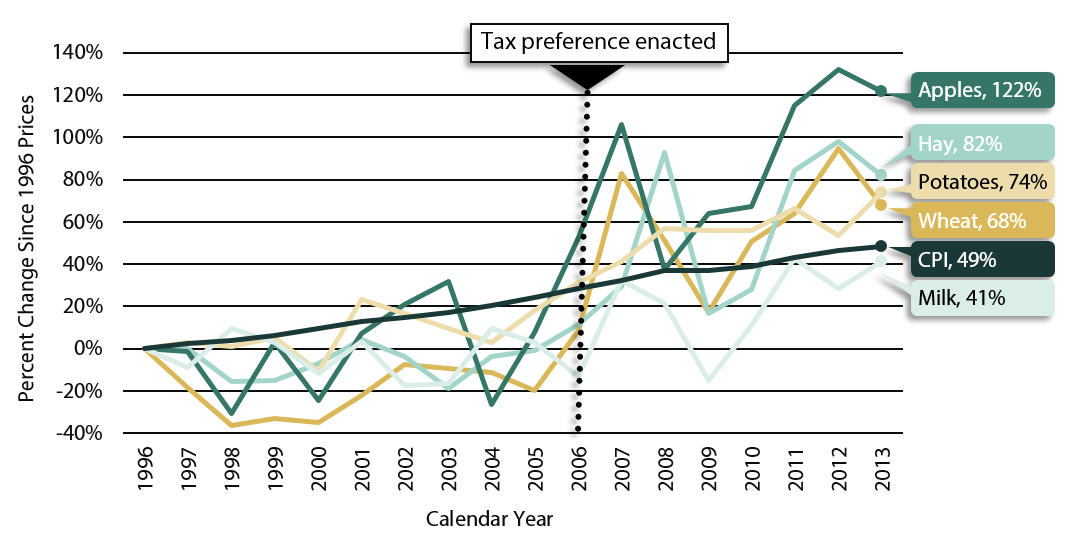

The state Department of Agriculture (WSDA) lists Washington’s top five commodities as apples, wheat, milk, potatoes, and hay. The combined total value of production for these crops in 2012 equaled 60 percent of the total value of production for all crops grown in the state. A measure of the commodity price for each of these illustrates the trend in Washington’s major commodity prices before and after the preference was enacted.

Exhibit 1 below shows the percentage change in annual average prices relative to 1996 for the top five Washington commodities. Crop prices increased in the years following enactment of the preference, then declined. Prices began increasing again in 2010 and were higher in 2013 in comparison to 2006. Except for milk, price changes for Washington’s top commodities were above price changes in the overall Consumer Price Index for the same time period.

The U.S. Department of Agriculture (USDA) has forecast 2014 commodity prices to be down 13.8 percent from 2013’s forecast, which would make 2014 the lowest year since 2010.

Washington Farm Input Costs Higher in 2013 than in 2006

According to USDA data, Washington farmers’ costs for inputs increased 38 percent from 2006 to 2013. These input costs include expenditures for: feed, seed, breeding livestock and poultry, fertilizer, pesticides, fuel, electricity, contract labor, hired and custom work, marketing, storage, transportation, repairs and maintenance, and other miscellaneous costs.

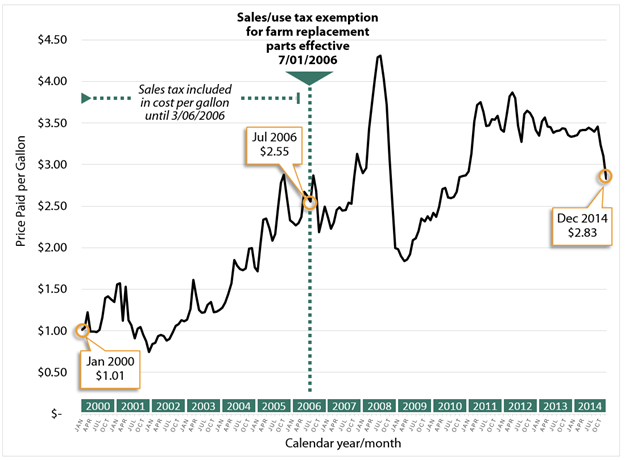

One input specifically called out in the testimony for the 2006 legislation is diesel fuel. In 2006, the bill sponsor and other proponents noted fuel prices had increased dramatically in the prior year.

The retail price of diesel fuel in Washington continued to increase after the tax preference was enacted in 2006, spiking to a high of $4.31 in 2008. Diesel prices dropped in late 2008 and early 2009 to below $2.00 a gallon, lower than when the preference was enacted in 2006. From mid-2009 until early 2011, diesel prices increased, then hovered around $3.50 per gallon from mid-2011 to mid-2014.

Midway through 2014, diesel prices fell below $3.00 per gallon, however it is too early to determine if the trend will continue. See Exhibit 2, below.

Washington Net Farm Income Higher in 2013 than in 2006

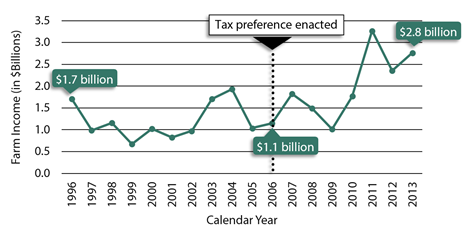

An indicator that incorporates both crop prices and input costs is net farm income. The net farm income for Washington farms is detailed annually by the USDA. On the income side, the USDA calculation includes all income from crop and livestock production, revenue from services provided, and government payments. Costs subtracted include costs for inputs, taxes, and payments for goods, services, and employees.

From 1996 through 2013, net farm income in Washington has varied from year to year, but overall increased. See Exhibit 3, below.

Washington Farm Operating Profit Margins Are Higher in 2013 than in 2006

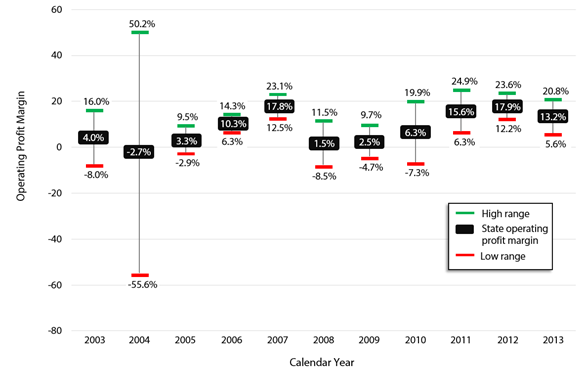

Another indicator that incorporates both crop prices and input costs is the farm operating profit margin. The USDA Agricultural Resource Management Survey (ARMS) calculates national and state-specific farm financial statistics, including an estimate of the farm operating profit margin.

The farm operating profit margin is intended to measure profitability as a percentage of gross farm income, which captures the value of crop and livestock production, government payments, and other sources of farm revenue.

This indicator was suggested to JLARC staff by agricultural economists because it accounts for many factors, including: unpaid labor and management services provided by farmers; rental payments by tenant farmers to farm owners; rental payments received by farm owners; and interest expenses.

The USDA’s Economic Research Service (ERS) annually calculates the estimated overall operating profit margin for the entire farm industry in Washington, based on a statistical sample of farms in the state. The USDA ERS also provides statistics that allowed JLARC staff to identify ranges in the accuracy of the estimated operating profit margin for each year. This range varies each year, depending on economic circumstances in the state’s agriculture industry and outside influences, such as market disruptions and survey response rates.

Since the operating profit margin is a statistical estimate for the entire Washington farm industry, it is possible that an individual farm’s operating profit margin could be lower or higher. The range shown for each year indicates that there is a 95 percent chance that the farm industry operating profit margin falls within this range. After consulting with a USDA agricultural economist, JLARC staff developed the 95 percent confidence range for each year’s estimated Washington operating profit margin.

Washington-specific detail from 2003 through 2013 reflects that the estimated farm operating profit margin has varied. In most years, the Washington farm operating profit margin has been positive. During the last three years, there is a 95 percent chance that the estimated farm profit margin ranged between 5.6 percent and 24.9 percent, compared to an estimate of between 6.3 to 14.3 percent in 2006, the year the preference was enacted. See Exhibit 4, below.

The USDA Economic Research Service forecast in April 2015 that farm operating profit margin ratios on a national level would drop from 20 percent in 2013 to 10 percent in 2015. Forecast data is not available at the state level.

2. Expand use of the preference because use was lower than projected

It is unclear whether the preference is meeting the inferred objective.

The Legislature revisited the preference a year after enacting it. Initially, the 2006 bill exempted used farm M&E, farm vehicles, replacement parts, and labor charges. However, the bill that passed was limited to replacement and repair parts for farm machinery and equipment (M&E) due to concern about the estimated fiscal impact.

In 2007, the prime sponsor noted that the applications for the exemption certificate were lower than expected. The 2006 fiscal note had anticipated 30,000 applicants. DOR reported receiving just 3,000 applications. The prime sponsor noted that since the actual use and fiscal impact to the general fund were less than estimated, the exemption could be expanded to some of the items that had originally been considered in 2006, including repair labor and services, and parts for farm vehicles. Another reason stated for the initial low participation was the requirement that applicants provide documentation to prove they met the income threshold. The Legislature changed this in 2007 to allow a signed statement instead.

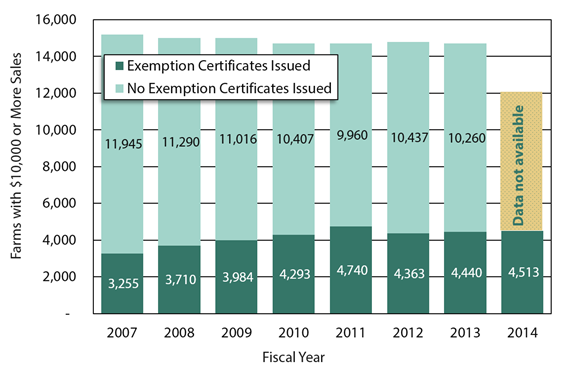

From July 2006 through June 2014, the largest number of active exemption certificates for any one year was 4,740 (in Fiscal Year 2011) or 32 percent of farmers with $10,000 or more in sales.

Exhibit 5, below, details the number of exemption certificates issued for fiscal years beginning in 2007, compared to the potential number eligible—farms with $10,000 or more in sales.

3. Simplifying reporting requirements for farmers

This inferred public policy objective has been achieved. The Legislature repealed the requirement that farmers apply to DOR to use the preference and eliminated the certificate that had been expressly for this preference. Farmers can now self-generate the more general certificate for wholesale purchases and sales tax exemptions to use this exemption.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

Potential beneficiaries of the tax preference are farmers who meet a $10,000 minimum income or harvest values in the prior year, or who are new to farming or newly returned to it.

According to the WSDA, there were 37,000 farms in Washington in 2013. However, the majority of farms reported sales amounts below $10,000, leaving an estimated 14,700 that would likely qualify to use the preference. Only about one-third applied for exemption certificates between 2007 and 2013.

Because of 2014 legislative changes that removed the requirement for DOR to issue exemptions certificates, there is no longer information available on the number of beneficiaries.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

While farmers had to previously register to receive an exemption certificate, the farmers did not have to report on the extent of their use of the sales tax preference. There is also no reporting requirement for the businesses that make tax exempt sales of farm machinery repair or replacement parts and associated services. It is not possible to measure the value of the preference using DOR tax return data.

JLARC staff estimated the beneficiary savings for this preference using USDA 2012 Census of Agriculture data regarding Washington farm purchases of repairs, parts, and maintenance services. Additional information on the percent of recent goods and services that qualified for the exemption was obtained from a Washington farm implement dealer and repair facility.

When this preference was first enacted in 2006, the fiscal note estimated the state and local revenue loss associated with the preference would be $18.2 million in the 2009-11 Biennium. When the preference was expanded in 2007 to cover labor and services and repair of additional items, the fiscal note calculated the additional revenue loss at $10.0 million in the 2009-11 Biennium, for an estimated combined revenue loss of $28.2 in the 2009-11 Biennium.

JLARC staff estimate the beneficiary savings at $28.9 million in Fiscal Year 2014 and $62.2 million in the 2015-17 Biennium. See Exhibit 6, below.

| Fiscal Year | Qualifying Parts and Services | State Sales Tax | Local Sales Tax | Total Beneficiary Savings |

|---|---|---|---|---|

| 2012 | $334,667,000 | $21,753,000 | $5,446,000 | $27,199,000 |

| 2013 | $343,736,000 | $22,343,000 | $5,792,000 | $28,135,000 |

| 2014 | $353,051,000 | $22,948,000 | $6,029,000 | $28,977,000 |

| 2015 | $362,618,000 | $23,570,000 | $6,325,000 | $29,895,000 |

| 2016 | $372,444,000 | $24,209,000 | $6,496,000 | $30,705,000 |

| 2017 | $382,567,000 | $24,865,000 | $6,673,000 | $31,538,000 |

| 2015-17 Biennium |

$754,981,000 | $49,074,000 | $13,169,000 | $62,243,000 |

It is unclear whether eliminating the requirement for farmers to apply for an exemption certificate will increase farmers’ use of this preference in the future. JLARC staff did not assume any increase in use above normal growth factors for repair and maintenance expenditures.

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the preference were terminated, farmers would pay sales or use tax on purchases of repair or replacement parts for farm equipment and vehicles, installation labor, and repair services.

The effect of these terminations on employment and the economy would depend on the extent to which the agricultural industry could absorb the increased costs or pass them along to their customers. Farmers may not be able to pass along increased costs to their customers if the prices for their commodities are set in national or international markets.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

JLARC staff looked at the top ten agricultural production states in 2012, as well as the neighboring states of Idaho and Oregon to see if these states offered similar preferences. Together, these states accounted for over 60 percent of total U.S. agricultural commodity production in 2012. All of the states reviewed provided a full or partial sales tax exemption for new or used purchases of farm machinery and equipment (M&E) when used in agricultural production.

As reflected in Exhibit 7, below, all these states provide sales tax exemptions for farm machinery and equipment repair parts. Nebraska exempted farm M&E repair parts beginning in November 2014. Iowa is the only one of the states reviewed that taxes labor and repair services associated with farm M&E repairs. Minnesota imposed a temporary sales tax on farm repair parts from July 1, 2013, through April 1, 2014.

Exhibit 7 also shows which states require a special application for such exemptions. Washington did until June 2014. California, Texas, and North Carolina still do. Washington is the only state of those reviewed with a sales tax on farm machinery and equipment. California provides a state sales tax exemption, but local sales taxes apply.

| State | 2012 U.S. Ag Ranking | % of U.S. Ag Commodity Production (2012) | Exempt from Sales Tax? | Special Exemption Certificate Required? | |

|---|---|---|---|---|---|

| Replacement Parts | Repair Service and Labor | ||||

| Washington | 16 | 2.4% | Yes | Yes | No. Yes from 7/01/2006 to 6/10/2014 |

| California | 1 | 11.3% | State portion exempt only when used at least 50% in ag production | Yes | Yes |

| Iowa | 2 | 8.1% | Yes | No, taxable effective 7/01/1988 | No |

| Nebraska | 3 | 6.2% | Yes, effective 10/01/14 | Yes | No |

| Texas | 4 | 5.8% | Yes | Yes | Yes |

| Minnesota | 5 | 5.2% | Yes, except tires | Yes, taxable from 7/01/13 to 4/01/14 | No |

| Illinois | 6 | 5.0% | Yes | Yes | No |

| Kansas | 7 | 4.1% | Yes | Yes | No |

| Wisconsin | 8 | 3.1% | Yes | Yes | No |

| Indiana | 9 | 3.1% | Yes | Yes | No |

| North Carolina | 10 | 3.0% | Yes | Yes | Yes |

| Idaho | 21 | 1.9% | Yes | Yes, if itemized | No |

| Oregon | 28 | 1.2% | No state sales tax | No state sales tax | No state sales tax |

RCW 82.08.855

Exemptions — Replacement parts for qualifying farm machinery and equipment.

(1) The tax levied by RCW 82.08.020 does not apply to the sale to an eligible farmer of:

(a) Replacement parts for qualifying farm machinery and equipment;

(b) Labor and services rendered in respect to the installing of replacement parts; and

(c) Labor and services rendered in respect to the repairing of qualifying farm machinery and equipment, provided that during the course of repairing no tangible personal property is installed, incorporated, or placed in, or becomes an ingredient or component of, the qualifying farm machinery and equipment other than replacement parts.

(2)(a) Notwithstanding anything to the contrary in this chapter, if a single transaction involves services that are not exempt under this section and services that would be exempt under this section if provided separately, the exemptions provided in subsection (1)(b) and (c) of this section apply if: (i) The seller makes a separately itemized charge for labor and services described in subsection (1)(b) or (c) of this section; and (ii) the separately itemized charge does not exceed the seller's usual and customary charge for such services.

(b) If the requirements in (a)(i) and (ii) of this subsection (2) are met, the exemption provided in subsection (1)(b) or (c) of this section applies to the separately itemized charge for labor and services described in subsection (1)(b) or (c) of this section.

(3)(a) A purchaser claiming an exemption under this section must keep records necessary for the department to verify eligibility under this section. Sellers making tax-exempt sales under this section must obtain an exemption certificate from the purchaser in a form and manner prescribed by the department. In lieu of an exemption certificate, a seller may capture the relevant data elements as allowed under the streamlined sales and use tax agreement. The seller must retain a copy of the certificate or the data elements for the seller's files.

(b)(i) For a person who is an eligible farmer as defined in subsection (4)(b)(iv) of this section, the exemption is conditioned upon:

(A) The eligible farmer having gross sales or a harvested value of agricultural products grown, raised, or produced by that person of at least ten thousand dollars in the first full tax year in which the person engages in business as a farmer; or

(B) The eligible farmer, during the first full tax year in which that person engages in business as a farmer, growing, raising, or producing agricultural products having an estimated value at any time during that year of at least ten thousand dollars, if the person will not sell or harvest an agricultural product during the first full tax year in which the person engages in business as a farmer.

(ii) If a person fails to meet the condition provided in (b)(i)(A) or (B) of this subsection, the person must repay any taxes exempted under this section. Any taxes for which an exemption under this section was claimed are due and payable to the department within thirty days of the end of the first full tax year in which the person engages in business as a farmer. The department must assess interest on the taxes for which the exemption was claimed as provided in chapter 82.32 RCW, retroactively to the date the exemption was claimed, and accrues until the taxes for which the exemption was claimed are paid. Penalties may not be imposed on any tax required to be paid under this subsection (3) (b)(ii) if full payment is received by the due date.

(4) The definitions in this subsection apply throughout this section unless the context clearly requires otherwise.

(a) "Agricultural products" has the meaning provided in RCW 82.04.213.

(b) "Eligible farmer" means:

(i) A farmer as defined in RCW 82.04.213 whose gross sales or harvested value of agricultural products grown, raised, or produced by that person was at least ten thousand dollars for the immediately preceding tax year;

(ii) A farmer as defined in RCW 82.04.213 whose agricultural products had an estimated value of at least ten thousand dollars for the immediately preceding tax year, if the person did not sell or harvest an agricultural product during that year;

(iii) A farmer as defined in RCW 82.04.213 who has merely changed identity or the form of ownership of an entity that was an eligible farmer, where there was no change in beneficial ownership, and the combined gross sales, harvested value, or estimated value of agricultural products by both entities met the requirements of (b)(i) or (ii) of this subsection for the immediately preceding tax year;

(iv) A farmer as defined in RCW 82.04.213, who does not meet the definition of "eligible farmer" in (b)(i), (ii), or (iii) of this subsection, and who did not engage in farming for the entire immediately preceding tax year, because the farmer is either new to farming or newly returned to farming; or

(v) Anyone who otherwise meets the definition of "eligible farmer" in this subsection except that they are not a "person" as defined in RCW 82.04.213.

(c) "Farm vehicle" has the same meaning as in RCW46.04.181.

(d) "Harvested value" means the number of units of the agricultural product that were grown, raised, or produced, multiplied by the average sales price of the agricultural product. For purposes of this subsection (4)(d), "average sales price" means the average price per unit of agricultural product received by farmers in this state as reported by the United States department of agriculture's national agricultural statistics service for the twelve-month period that coincides with, or that ends closest to, the end of the relevant tax year, regardless of whether the prices are subject to revision. If the price per unit of an agricultural product received by farmers in this state is not available from the national agricultural statistics service, average sales price may be determined by using the average price per unit of agricultural product received by farmers in this state as reported by a recognized authority for the agricultural product.

(e) "Qualifying farm machinery and equipment" means machinery and equipment used primarily by an eligible farmer for growing, raising, or producing agricultural products. "Qualifying farm machinery and equipment" does not include:

(i) Vehicles as defined in RCW46.04.670, other than farm tractors as defined in RCW 46.04.180, farm vehicles, and other farm implements. For purposes of this subsection (4)(e)(i), "farm implement" means machinery or equipment manufactured, designed, or reconstructed for agricultural purposes and used primarily by an eligible farmer to grow, raise, or produce agricultural products, but does not include lawn tractors and all-terrain vehicles;

(ii) Aircraft;

(iii) Hand tools and hand-powered tools; and

(iv) Property with a useful life of less than one year.

(f)(i) "Replacement parts" means those parts that replace an existing part, or which are essential to maintain the working condition, of a piece of qualifying farm machinery or equipment.

(ii) Paint, fuel, oil, hydraulic fluids, antifreeze, and similar items are not replacement parts except when installed, incorporated, or placed in qualifying farm machinery and equipment during the course of installing replacement parts as defined in (f)(i) of this subsection or making repairs as described in subsection (1)(c) of this section.

(g) "Tax year" means the period for which a person files its federal income tax return, irrespective of whether the period represents a calendar year, fiscal year, or some other consecutive twelve-month period. If a person is not required to file a federal income tax return, "tax year" means a calendar year.

[2014 c 97 § 601; 2007 c 332 § 1; 2006 c 172 § 1.]

RCW 82.12.855

Exemptions — Replacement parts for qualifying farm machinery and equipment.

(1) The provisions of this chapter do not apply in respect to the use by an eligible farmer of:

(a) Replacement parts for qualifying farm machinery and equipment;

(b) Labor and services rendered in respect to the installing of replacement parts; and

(c) Labor and services rendered in respect to the repairing of qualifying farm machinery and equipment, provided that during the course of repairing no tangible personal property is installed, incorporated, or placed in, or becomes a component of, the qualifying farm machinery and equipment other than replacement parts.

(2)(a) Notwithstanding anything to the contrary in this chapter, if a single transaction involves services that are not exempt under this section and services that would be exempt under this section if provided separately, the exemptions provided in subsection (1)(b) and (c) of this section apply if: (i) The seller makes a separately itemized charge for labor and services described in subsection (1)(b) or (c) of this section; and (ii) the separately itemized charge does not exceed the seller's usual and customary charge for such services.

(b) If the requirements in (a)(i) and (ii) of this subsection (2) are met, the exemption provided in subsection (1)(b) or (c) of this section applies to the separately itemized charge for labor and services described in subsection (1)(b) or (c) of this section.

(3) The definitions and recordkeeping requirements in RCW 82.08.855 apply to this section.

(4) If a person is an eligible farmer as defined in RCW 82.08.855(4)(b)(iv) who cannot prove income because the person is new to farming or newly returned to farming, the exemption under this section will apply only if one of the conditions in RCW 82.08.855 (3)(b)(i) (A) or (B) is met. If neither of those conditions are met, any taxes for which an exemption under this section was claimed and interest on such taxes must be paid. Amounts due under this subsection shall be in accordance with RCW 82.08.855(3)(b)(ii).

(5) Except as provided in subsection (4) of this section, the department may not assess the tax imposed under this chapter against a person who no longer qualifies as an eligible farmer with respect to the use of any articles or services exempt under subsection (1) of this section, if the person was an eligible farmer when the person first put the articles or services to use in this state.

[2014 c 97 § 603; 2007 c 332 § 2; 2006 c 172 § 2.]

- Legislative Auditor Recommendation

- Commissioners’ Recommendation

- Letter from Commission Chair

- Agency Response

Legislative Auditor Recommendation: Review and Clarify

The Legislature should review and clarify the sales and use tax exemption for farm machinery and equipment repair parts and services because:

- It is unclear whether the combined circumstance of stagnant crop prices and rising input costs still applies, and what changes in prices and costs would be appropriate for continuing the preference relative to farm profits;

- It is unclear what participation level of eligible farmers and total fiscal impact of the preference the Legislature intended; and

- The Legislature may want to consider adding reporting or other accountability requirements that would provide better information on the use of this preference.

Between 2006 (when this preference was first enacted) and 2013, Washington farm input costs increased 38 percent. During the same period, Washington net farm income increased 141 percent. Also from 2006 to 2013, the price received for Washington’s top five agricultural commodities increased as follows: potatoes (32 percent); apples (45 percent); wheat (55 percent); and milk and hay (both 63 percent). Washington farm operating profit margin percentages changed from 4 percent in 2003 to 13 percent in 2013.

While participation levels for the preference have been less than one-third of eligible farms, the fiscal impact may be greater than originally estimated. With the elimination of the separate exemption certificate and no accountability reporting on the use of the preference, it will be difficult for the Legislature to examine participation, use of the preference, and fiscal impact in the future.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation with comment.

The Legislature is encouraged to clearly state the public policy of the preference and make sure it is designed effectively to achieve that purpose.

Washington State agricultural producers compete with their counterparts in other states who are subject to different tax regimes. Research by JLARC staff shows other major agricultural states also provide tax exceptions for machinery parts. This was also confirmed by testimony from agricultural producers. This implies that the existing preference may be necessary to enable Washington State agricultural producers to compete effectively. However, as currently designed, this preference may be more than sufficient or inadequate to assure competitive equity.