JLARC Final Report: 2015 Tax Preference Performance Reviews

Report 15-5, January 2016

Fuel Used on Farms | Sales and Use Tax

- Summary of this Review

- Details on this Preference

- Recommendations and Agency Response

- How We Do Reviews

- More about this Review

| The Preference Provides | Tax Type | Est. Beneficiary Savings in 2015-17 Biennium |

|---|---|---|

| A sales and use tax exemption for diesel, biodiesel, or aircraft fuel purchased by farm fuel users to use in growing, raising, or producing agricultural crops. | Sales & Use RCWs 82.08.855; 82.12.855 |

$53.2 million |

| Public Policy Objective |

|---|

The Legislature did not state the public policy objective. JLARC staff infer the policy objectives were:

|

| Recommendations |

|---|

| Legislative Auditor’s Recommendation: Review and Clarify

To provide a performance statement that specifies a public policy objective and provides a metric, such as a metric based on the price of diesel, to determine when the preference is necessary. Commissioner Recommendation: The Commission endorses the Legislative Auditor’s recommendation with comment. The Legislature is encouraged to clearly state the public policy of the preference and make sure it is designed effectively to achieve that purpose. Washington State agricultural producers compete with their counterparts in other states who are subject to different tax regimes. Research by JLARC staff shows other major agricultural states also provide tax exceptions for farm fuel. This was also confirmed by testimony from agricultural producers. This implies that the existing preference may be necessary to enable Washington State agricultural producers to compete effectively. Nevertheless, the preference was passed to alleviate the impact of rising diesel costs in 2006 without an explicit review clause. For tax preferences that are enacted to deal with potentially transitory market shocks, the legislature should consider a clause that triggers an automatic review should market conditions return to pre-shock levels. In addition, as currently designed and given the drop in fuel costs, this preference may be more than sufficient or inadequate to assure competitive equity. |

- What is the Preference?

- Legal History

- Other Relevant Background

- Public Policy Objectives

- Are Objectives Being Met?

- Beneficiaries

- Revenue and Economic Impacts

- Other States with Similar Preference?

- Applicable Statutes

Farm fuel users who purchase diesel, biodiesel, or aircraft fuel do not pay sales or use tax on these fuels if they are used for growing, raising, or producing agricultural crops. A “farm fuel user” is a farmer or a person who provides horticultural services to farmers, such as soil preparation, crop cultivation, or crop harvesting services. Aerial “crop dusters” are an example of persons providing horticultural services to farmers.

Without this preference, diesel, biodiesel, and aircraft fuel purchased or used by farmers and persons providing horticultural services would be subject to sales and use tax. These fuel purchases would not be subject to fuel tax because fuel used in agricultural production is generally not used on public roads.

The preference does not apply to fuel used to heat homes or water for humans, or fuel used in transporting people, equipment, or goods on public roads. The preference also does not apply to other fuels used on farms, such as gasoline, propane, natural gas, or butane.

To claim the tax exemption, farm fuel users print off a generic Farmers’ Certificate for Wholesale Purchases and Sales Tax Exemptions from the Department of Revenue website, check the box for farm fuel use (one of several sales tax exemptions available on the form), and provide it to the fuel retailer, who keeps the form to validate the tax exempt fuel sale.

For more information on Washington’s agricultural industry, please see JLARC’s Agricultural Overview.

Pre-2006

Farmers paid sales or use tax on diesel and biodiesel used in their farming activities. Aircraft fuel used by crop dusters was also subject to sales or use tax.

2006

The Legislature enacted this sales and use tax exemption for diesel fuel and aircraft fuel used by farm fuel users for agricultural use. Concerned that farmers get immediate tax relief, the bill included an emergency clause so it would become effective immediately, on March 6, 2006.

2007

The Legislature expanded the preference to include sales of biodiesel.

2014

The Legislature clarified that this preference does not apply to activities related to cultivating marijuana, usable marijuana, and marijuana-infused products.

Taxability of diesel, biodiesel, and aircraft fuel

In general, when people purchase fuel in Washington, they owe either a fuel tax or a sales and use tax, depending on whether the fuel will be used on public roads or for off-highway purposes.

- Fuel tax applies to fuel used by motor vehicles on public highways.

- Examples: Fuel used in cars, trucks, recreational vehicles, etc., that travel on public roads in the state

- Sales or use tax applies to fuel that is used in other capacities besides motor vehicles travelling on public roads.

- Examples: Fuel used in boats, aircraft, generators, manufacturing or logging machinery and equipment

Federal law requires diesel fuel used for off-road business purposes to be dyed. This diesel fuel may be called “red dyed fuel,” “dyed diesel,” or “farm fuel.”

Aircraft fuel used in-state is generally subject to sales and use tax and to an 11 cent per gallon aircraft fuel tax.

What are the public policy objectives that provide a justification for the tax preference? Is there any documentation on the purpose or intent of the tax preference?

The Legislature did not state the public policy objective when it enacted this preference in 2006.

Based on statements by the prime sponsor of the bill and industry proponents made during committee hearings, JLARC staff infer the public policy objectives were:

- To provide a price break to farmers when fuel costs increased.

- The prime sponsor and others testified that diesel fuel prices had doubled - from $1.50 to $3.00 a gallon in the prior year - and that the price increase had hit at planting and harvest time, when farmers use the most fuel. Industry representatives also stated that farmers cannot increase their prices to recover higher costs of production and that the fuel cost increases occurred at the same time as commodity (notably wheat) prices were dropping.

- To make Washington consistent with other states in its tax treatment of farm fuel.

- The prime sponsor and others testified that Washington was one of three states that taxed farm diesel.

What evidence exists to show that the tax preference has contributed to the achievement of any of these public policy objectives?

Provide a price break to farmers when fuel costs increased

It is unclear whether the preference is meeting the inferred objective.

Diesel is the main fuel used in agricultural production. A sharp increase in the cost of diesel was a key reason cited in 2006 for the tax preference.

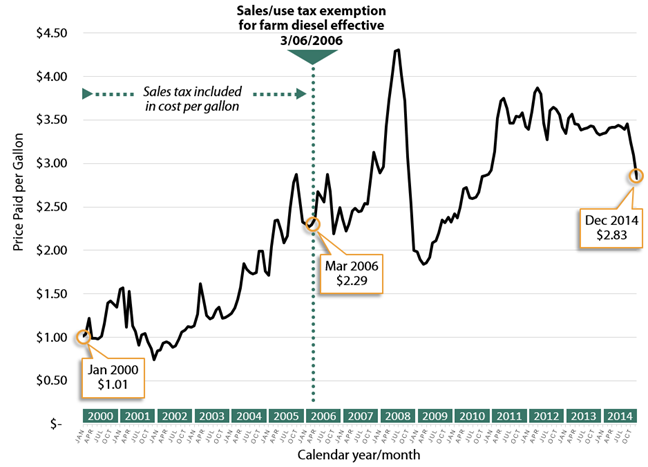

The retail price of diesel fuel in Washington continued to increase after the tax preference was enacted in 2006, spiking to a high of $4.31 in July 2008. Diesel prices dropped in late 2008 and early 2009 to below $2.00 a gallon, lower than when the preference was enacted in 2006. From mid-2009 until early 2011, diesel prices increased, then hovered around $3.50 per gallon from mid-2011 to mid-2014.

Midway through 2014, diesel prices fell below $3.00 per gallon, however as of March 2015 it is too early to determine if the trend will continue. See Exhibit 1, below.

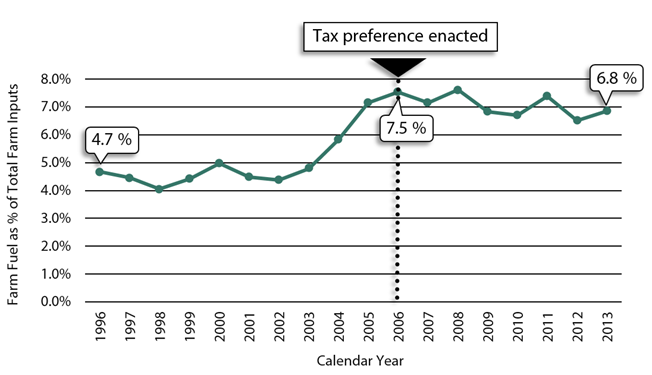

As a portion of all other farming input expenditures for Washington farmers, farm fuel expenditures increased from 4.8 percent in 2003 to 7.5 percent of total farm input expenditures when the preference was enacted in 2006. In the years since 2006, the percentage of total input expenditures attributable to farm fuel has varied around 7 percent. In this calculation, farm fuel includes not only diesel, but also gasoline, propane, natural gas, etc. See Exhibit 2, below. As of March 2015, data was not yet available to measure the impact on the decreased fuel prices seen in 2014.

Make Washington consistent with farm fuel tax treatment in other states

The preference does make the taxation of diesel fuel used on farms in Washington consistent with most other major agricultural states. Most major agricultural states provide sales and use tax exemptions for diesel used in agricultural production activities, as shown in Exhibit 5 in the Other States section.

To what extent will continuation of the tax preference contribute to these public policy objectives?

It is unclear whether continuation of the preference would contribute to the inferred public policy objective of providing a price break to farmers when fuel costs increased. Diesel prices have ranged above and below the price farmers paid at the time of enactment of the preference. The Legislature has not provided a metric such as a diesel price level for when the tax preference will no longer be needed.

Maintaining the preference will continue to contribute to the inferred public policy objective of making Washington consistent with other major agricultural states’ taxation of farm fuel.

Who are the entities whose state tax liabilities are directly affected by the tax preference?

Potential beneficiaries of this preference are farmers and businesses or people providing horticultural services to farmers.

- According to the USDA, there were 37,000 farms in Washington in 2013.

- It is unclear how many horticultural service providers operate in the state, though the USDA 2012 Census of Agriculture reported 5,890 farms paid over $182 million for horticultural services in 2012.

There is no accountability reporting requirement for use of the preference, so it is unclear how many of these potential beneficiaries actually use the preference.

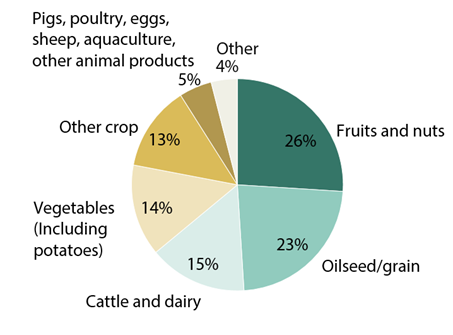

Individual beneficiary savings depend on the amount of fuel a farm fuel user purchases. Fuel usage varies depending on the type of farming activity conducted. According to USDA data, farms producing fruit or nuts and farms producing oilseed or grain accounted for 49 percent of the fuel purchases made by Washington farms in 2012. See Exhibit 3, below.

What are the past and future tax revenue and economic impacts of the tax preference to the taxpayer and to the government if it is continued?

There is no accountability reporting required for farmers and horticultural service providers using this preference. JLARC staff estimated the beneficiary savings for this preference using U.S. Energy Information Administration data on Washington farm fuel usage, Washington Department of Transportation data on annual average diesel prices, and Department of Revenue tax return data.

JLARC staff estimate the beneficiary savings for this preference at $24.7 million in Fiscal Year 2014 and $53.2 million in the 2015-17 Biennium. See Exhibit 4, below.

| Fiscal Year | Estimated Farm Fuel Expenditures | State Sales Tax | Local Sales Tax | Total Beneficiary Savings |

|---|---|---|---|---|

| 2012 | $203,483,000 | $13,226,000 | $3,312,000 | $16,538,000 |

| 2013 | $245,198,000 | $15,938,000 | $4,132,000 | $20,069,000 |

| 2014 | $301,297,000 | $19,584,000 | $5,146,000 | $24,730,000 |

| 2015 | $298,895,000 | $19,428,000 | $5,214,000 | $24,642,000 |

| 2016 | $308,129,000 | $20,028,000 | $5,375,000 | $25,403,000 |

| 2017 | $337,290,000 | $21,924,000 | $5,883,000 | $27,807,000 |

| 2015-17 Biennium | $645,419,000 | $41,952,000 | $11,258,000 | $53,210,000 |

If the tax preference were to be terminated, what would be the negative effects on the taxpayers who currently benefit from the tax preference and the extent to which the resulting higher taxes would have an effect on employment and the economy?

If the tax preference were terminated, beneficiaries would pay sales or use tax on diesel, biodiesel, and aircraft fuel used on the farm and in farm machinery and equipment.

The effect of these terminations on employment and the economy would depend on the extent to which the agricultural industry could absorb the increased costs or pass them along to their customers. Agricultural producers may not be able to pass along increased costs to their customers if the prices for their commodities are set in national or international markets. Horticultural service providers, who may also use the preference, may be able to pass along the increased costs to their agricultural customers.

Do other states have a similar tax preference and what potential public policy benefits might be gained by incorporating a corresponding provision in Washington?

JLARC staff reviewed the taxability of diesel fuel used on farms in the top ten major commodity producing states per 2012 USDA data, as well as the neighboring states of Idaho and Oregon.

Diesel fuel used on farms is exempt from sales tax in all the states reviewed except for Illinois, where sales tax applies to diesel used on farms but not to gasoline purchased in 100 gallon or greater quantities. In addition, California provides a sales tax exemption on just the state portion of sales tax, while local sales taxes apply. See Exhibit 5.

| State | 2012 U.S. Ag Ranking | % of U.S. Ag Commodity Production (2012) |

Farm Fuel Sales Tax Exemption? |

|---|---|---|---|

| Washington | 16 | 2.4% | Diesel, biofuel, aircraft fuel |

| California | 1 | 11.3% | Diesel, only on state sales tax portion |

| Iowa | 2 | 8.1% | Yes |

| Nebraska | 3 | 6.2% | Yes |

| Texas | 4 | 5.8% | Diesel, must apply to make exempt purchase |

| Minnesota | 5 | 5.2% | Yes |

| Illinois | 6 | 5.0% | Gas purchased in 100 gallon+ quantities, not on diesel |

| Kansas | 7 | 4.1% | Yes |

| Wisconsin | 8 | 3.1% | Yes |

| Indiana | 9 | 3.1% | Yes |

| North Carolina | 10 | 3.0% | Yes |

| Idaho | 21 | 1.9% | Yes |

| Oregon | 28 | 1.2% | No sales tax |

RCW 82.08.865

Exemptions - Diesel, biodiesel, and aircraft fuel for farm fuel users.

(1) The tax levied by RCW 82.08.020 does not apply to sales of diesel fuel, biodiesel fuel, or aircraft fuel, to a farm fuel user for agricultural purposes. This exemption applies to a fuel blend if all of the component fuels of the blend would otherwise be exempt under this subsection if the component fuels were sold as separate products. This exemption is available only if the buyer provides the seller with an exemption certificate in a form and manner prescribed by the department.

(2) The definitions in RCW 82.04.213 and this subsection apply to this section.

(a)(i) "Agricultural purposes" means the performance of activities directly related to the growing, raising, or producing of agricultural products.

(ii) "Agricultural purposes" does not include: (A) Heating space for human habitation or water for human consumption; or (B) transporting on public roads individuals, agricultural products, farm machinery or equipment, or other tangible personal property, except when the transportation is incidental to transportation on private property and the fuel used for such transportation is not subject to tax under chapter 82.38 RCW.

(b) "Aircraft fuel" is defined as provided in RCW 82.42.010.

(c) "Biodiesel fuel" is defined as provided in RCW 19.112.010.

(d) "Diesel fuel" is defined as provided in 26 U.S.C. 4083, as amended or renumbered as of January 1, 2006.

(e) "Farm fuel user" means: (i) A farmer; or (ii) a person who provides horticultural services for farmers, such as soil preparation services, crop cultivation services, and crop harvesting services.

[2010 c 106 § 218; 2007 c 443 § 1; 2006 c 7 § 1.]

RCW 82.12.865

Exemptions - Diesel, biodiesel, and aircraft fuel for farm fuel users.

(1) The provisions of this chapter do not apply with respect to the use of diesel fuel, biodiesel fuel, or aircraft fuel, by a farm fuel user for agricultural purposes. This exemption applies to a fuel blend if all of the component fuels of the blend would otherwise be exempt under this subsection if the component fuels were acquired as separate products.

(2) The definitions in RCW 82.08.865 apply to this section.

[2010 c 106 § 222; 2007 c 443 § 2; 2006 c 7 § 2.]

- Legislative Auditor Recommendation

- Commissioners’ Recommendation

- Letter from Commission Chair

- Agency Response

Legislative Auditor Recommendation: Review and Clarify

The Legislature should review and clarify the sales and use tax exemption for farm fuel to provide a performance statement that specifies a public policy objective and provides a metric, such as a metric based on the price of diesel, to determine when the preference is necessary.

Legislation Required: Yes.

Fiscal Impact: Depends on legislative action.

The Commission endorses the Legislative Auditor’s recommendation with comment.

The Legislature is encouraged to clearly state the public policy of the preference and make sure it is designed effectively to achieve that purpose.

Washington State agricultural producers compete with their counterparts in other states who are subject to different tax regimes. Research by JLARC staff shows other major agricultural states also provide tax exceptions for farm fuel. This was also confirmed by testimony from agricultural producers. This implies that the existing preference may be necessary to enable Washington State agricultural producers to compete effectively.

Nevertheless, the preference was passed to alleviate the impact of rising diesel costs in 2006 without an explicit review clause. For tax preferences that are enacted to deal with potentially transitory market shocks, the legislature should consider a clause that triggers an automatic review should market conditions return to pre-shock levels. In addition, as currently designed and given the drop in fuel costs, this preference may be more than sufficient or inadequate to assure competitive equity.