Preference is achieving the stated public policy objective

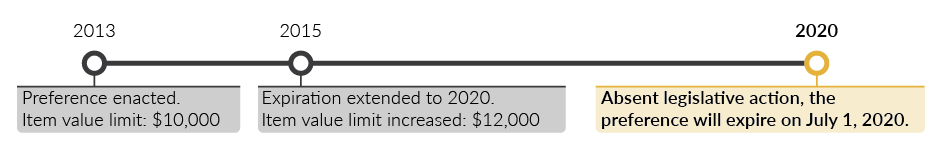

When this preference passed in 2013, the Legislature stated the public policy

objective was to provide use tax relief to individuals who support charitable

activities by purchasing or winning goods at fundraising events.

The preference is achieving the stated objective by exempting individuals from paying

use tax on their purchases or winnings valued at under $12,000.

Preference has direct and indirect beneficiaries but size of revenue impact

unknown

Direct beneficiaries of the preference are individuals who purchase or win

items valued at less than $12,000 at qualifying fundraising events held by nonprofit

organizations and libraries.

Indirect beneficiaries of the preference are Washington nonprofit

organizations and libraries holding fundraising events.

Beneficiaries not required to report to DOR

In 2015, the Legislature directed JLARC to evaluate this preference to measure its

effectiveness. While the public policy objective of providing use tax relief is being

achieved, no data exists to identify how much tax relief is being provided.

Direct beneficiaries of the use tax exemption are not required to report, file,

deduct, or otherwise document their use of the preference. Therefore, the number of

individuals benefiting from this preference and its value cannot be determined. It is

commonly known that many nonprofit organizations and libraries hold fundraising events

throughout the year, such as auctions, raffles, or book sales. These events are not

tracked by, or reported to, the Department of Revenue (DOR).

The nonprofit organizations and libraries holding qualifying fundraising events are

also not required to report sales from these events to DOR.

When the Legislature extended and expanded the preference in 2015, the fiscal note at

the time estimated a loss in state tax revenue of $15,000 per year for fiscal years

2018, 2019, and 2020. JLARC staff cannot validate the accuracy of this estimate.

❮ Previous

Next ❯