2022 Reviews: Five of seven Legislative Auditor recommendations require action

| In 2022, the Legislative Auditor issued seven recommendations in four separate tax preference reports as part of JLARC's annual reporting cycle. The recommendations cover preferences for commute trip reduction, food processing, nonprofit hospitals and cancer clinics, and historic auto museums. |

Five recommendations require legislative action. All but two of the preferences meet their objectives.

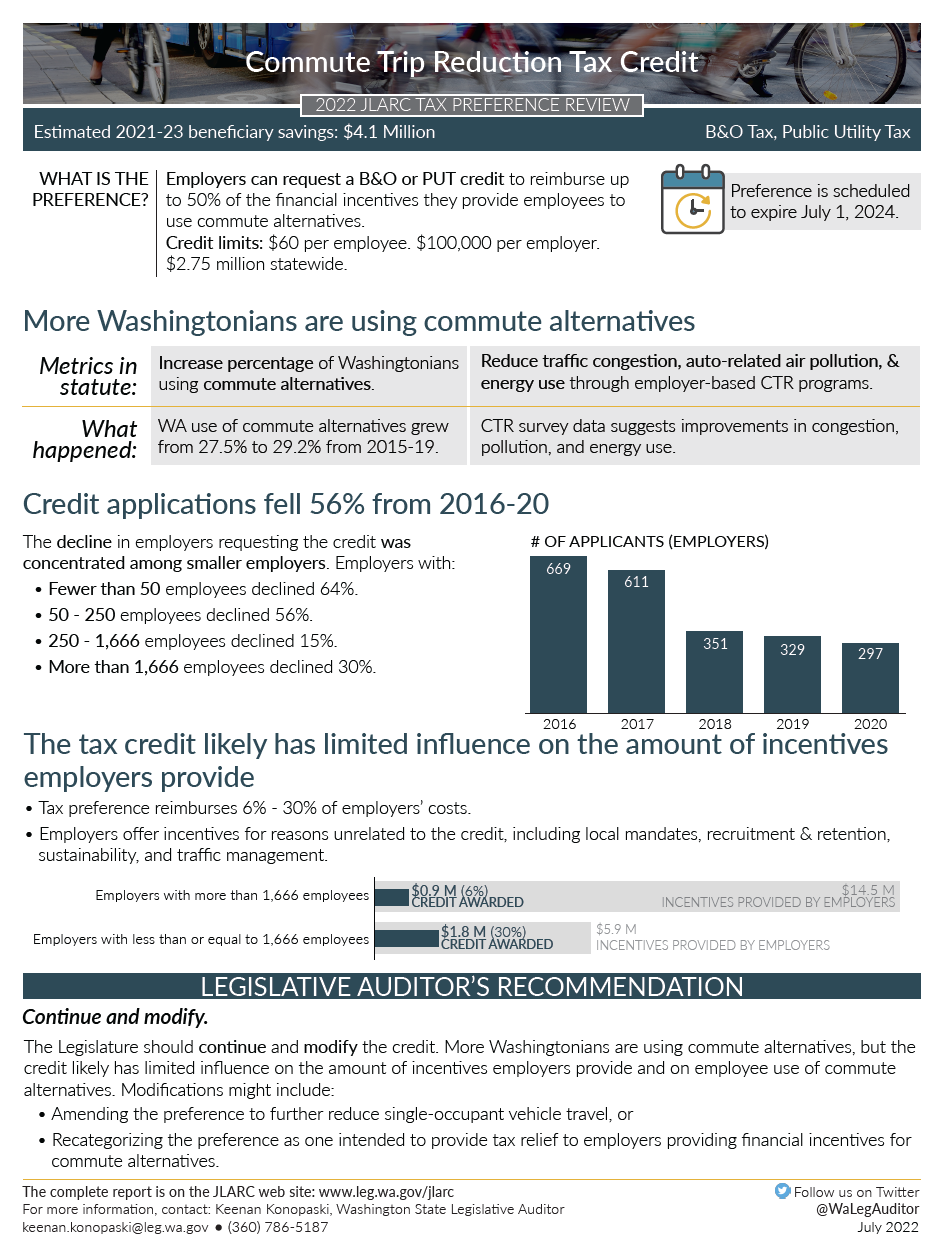

Commute Trip Reduction Tax Credit (B&O tax and

PUT)

Commute Trip Reduction Tax Credit (B&O tax and

PUT)

|

Conclusion: More Washingtonians are using commute alternatives. However, fewer employers are requesting the tax credit, and the credit likely has limited influence on the amount of financial incentives employers provide. Biennial beneficiary savings: $4.1 million Expiration date: 7/1/2024 Legislative Auditor's Recommendation: Continue and modify because the credit likely has limited influence on the amount of incentives employers provide and on employee use of commute alternatives. Commissioners' Recommendation: Endorsed with comment |

Summary

|

Video Summary |

Food Processors: Dairy, Fruit and Vegetable, and Seafood Processors (B&O

tax)

Food Processors: Dairy, Fruit and Vegetable, and Seafood Processors (B&O

tax)

|

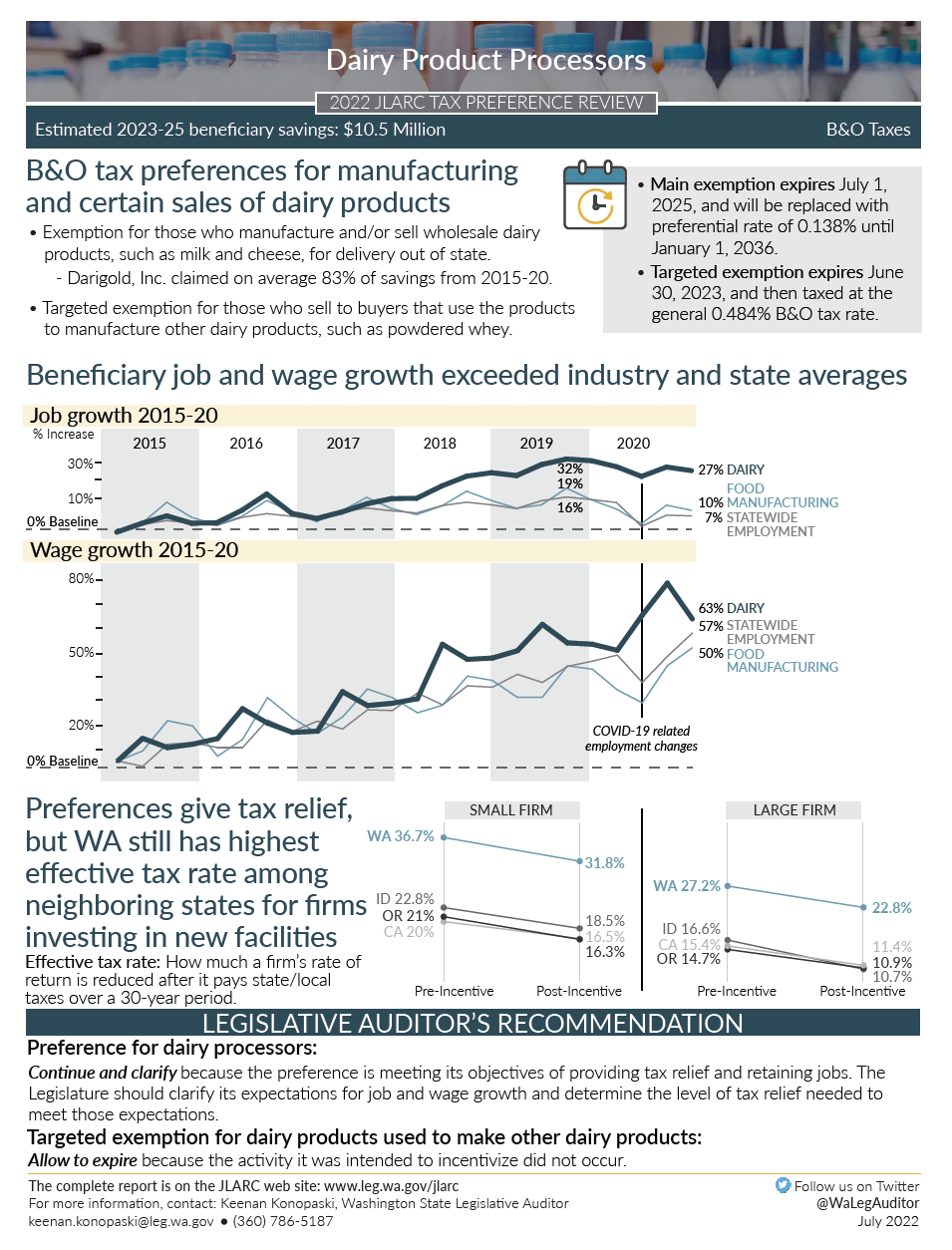

Conclusion: Dairy and fruit and vegetable beneficiaries had job and wage increases that exceeded industry and state averages. Seafood beneficiaries saw a decline in both. The preferences reduced the effective tax rates, but rates remain higher than neighboring states. Biennial beneficiary savings: Dairy: $10.5 million, Fruit & Vegetable: $22.7 million, Seafood: $4.9 million Expiration date: Exemptions expire 6/30/2025 and will be replaced with preferential rates. Legislative Auditor's Recommendation:

Commissioners' Recommendation:

|

Summary

|

Video Summary |

Nonprofit Hospitals and Cancer Clinics (Property tax)

Nonprofit Hospitals and Cancer Clinics (Property tax)

|

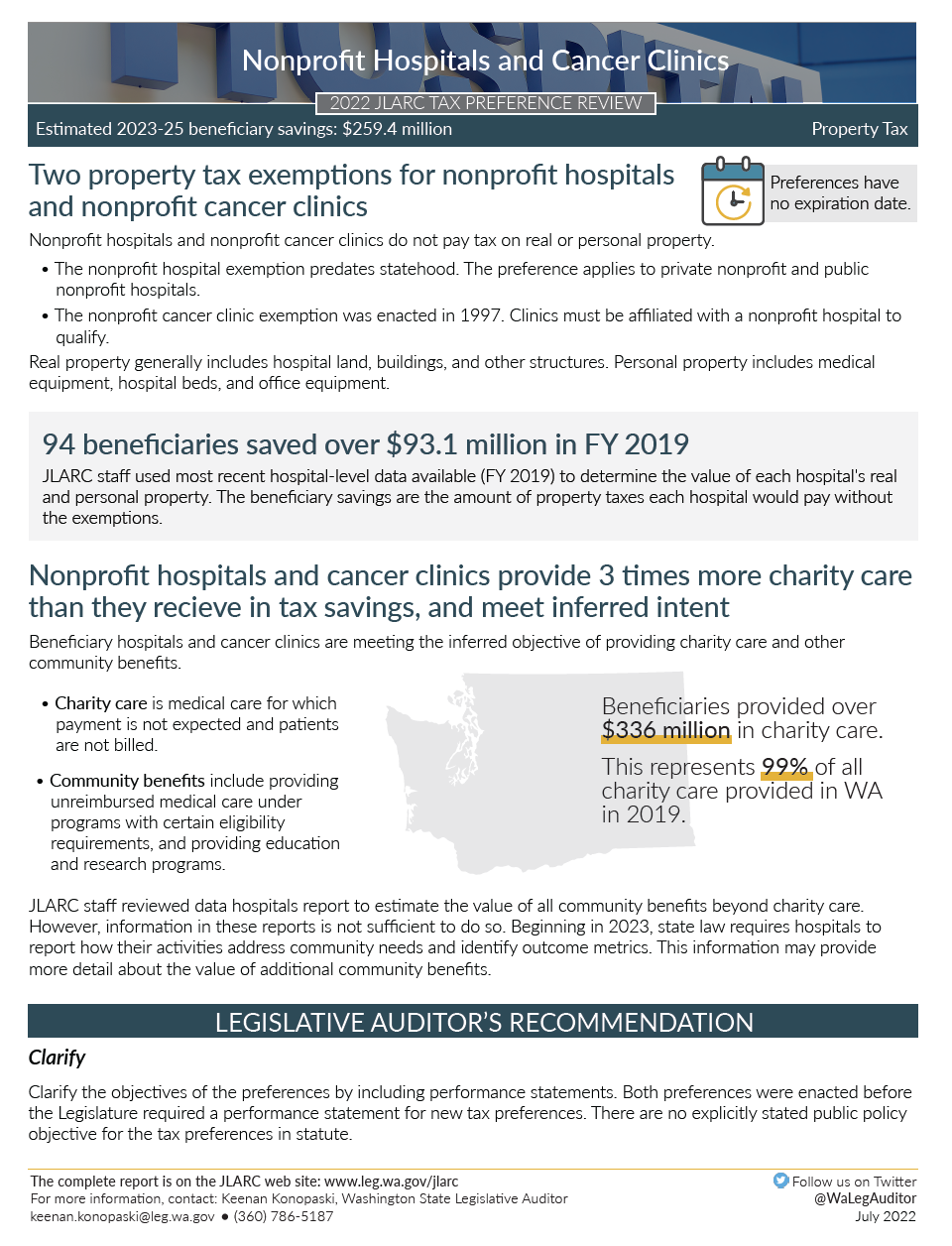

Conclusion: Property tax exemptions for nonprofit hospitals and cancer clinics meet the inferred intent of encouraging charity care and community benefits. Beneficiaries provide 99% of charity care statewide, and the value of charity care exceeds tax savings. Biennial beneficiary savings: $259.4 million Expiration date: None Legislative Auditor's Recommendation: Clarify the objectives by including performance statements. Commissioners' Recommendation: Endorsed with comment |

Summary

|

Video Summary |

Two recommendations do not require legislative action

Food Processors: Dairy products used as an ingredient or component to create other

dairy products (B&O tax)

Food Processors: Dairy products used as an ingredient or component to create other

dairy products (B&O tax)

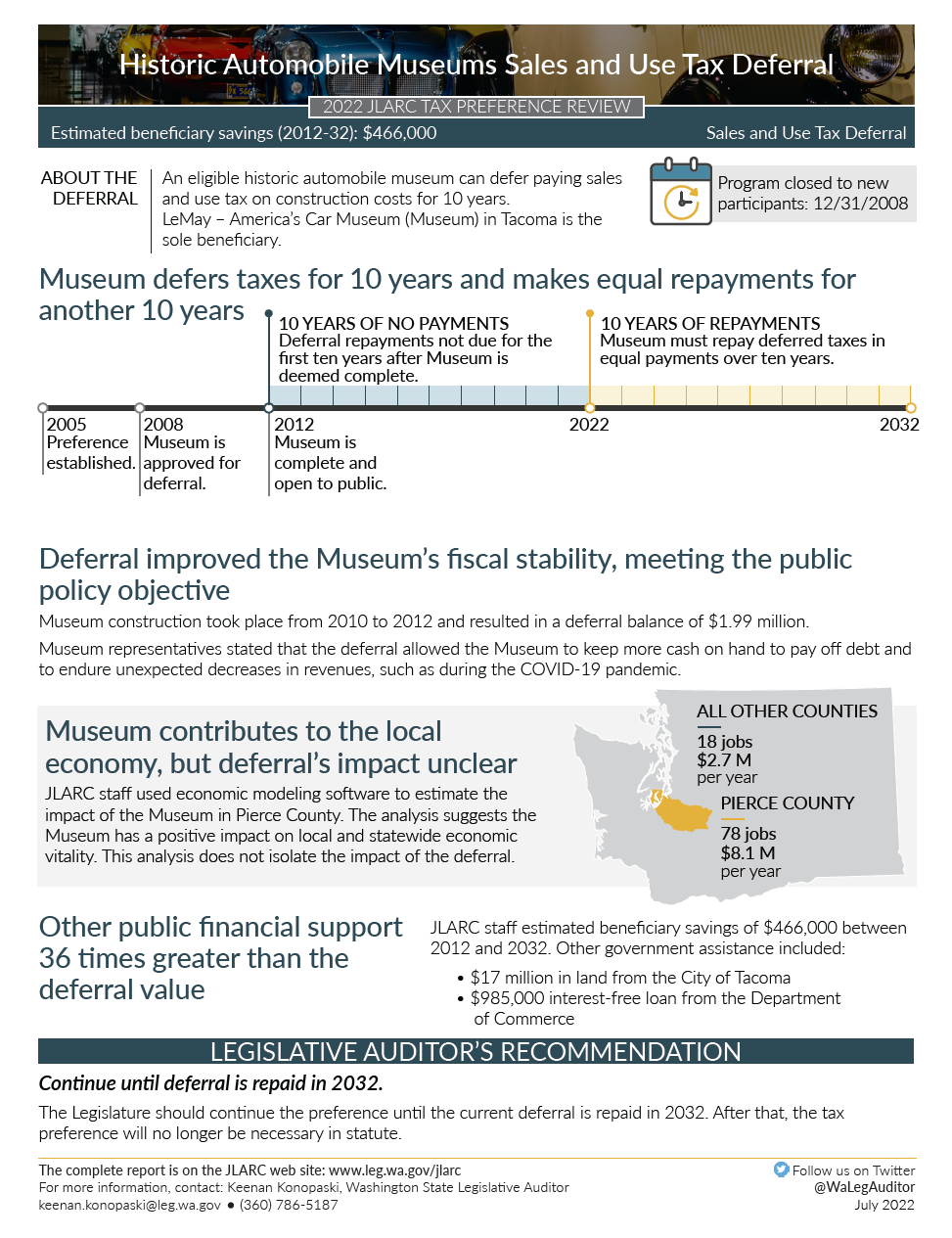

Historic Automobile Museums (Sales & Use tax)

Historic Automobile Museums (Sales & Use tax)

The Citizen Commission for Performance Measurement of Tax Preferences also considers preferences based on information provided by the Department of Revenue. View the 2022 Expedited Preference Review.