Executive Summary

B&O tax credit for businesses that create new professional service jobs in certain urban areas. Jobs must serve international customers.

Estimated Biennial Beneficiary Savings $80,000 (2025-27 biennium) |

|

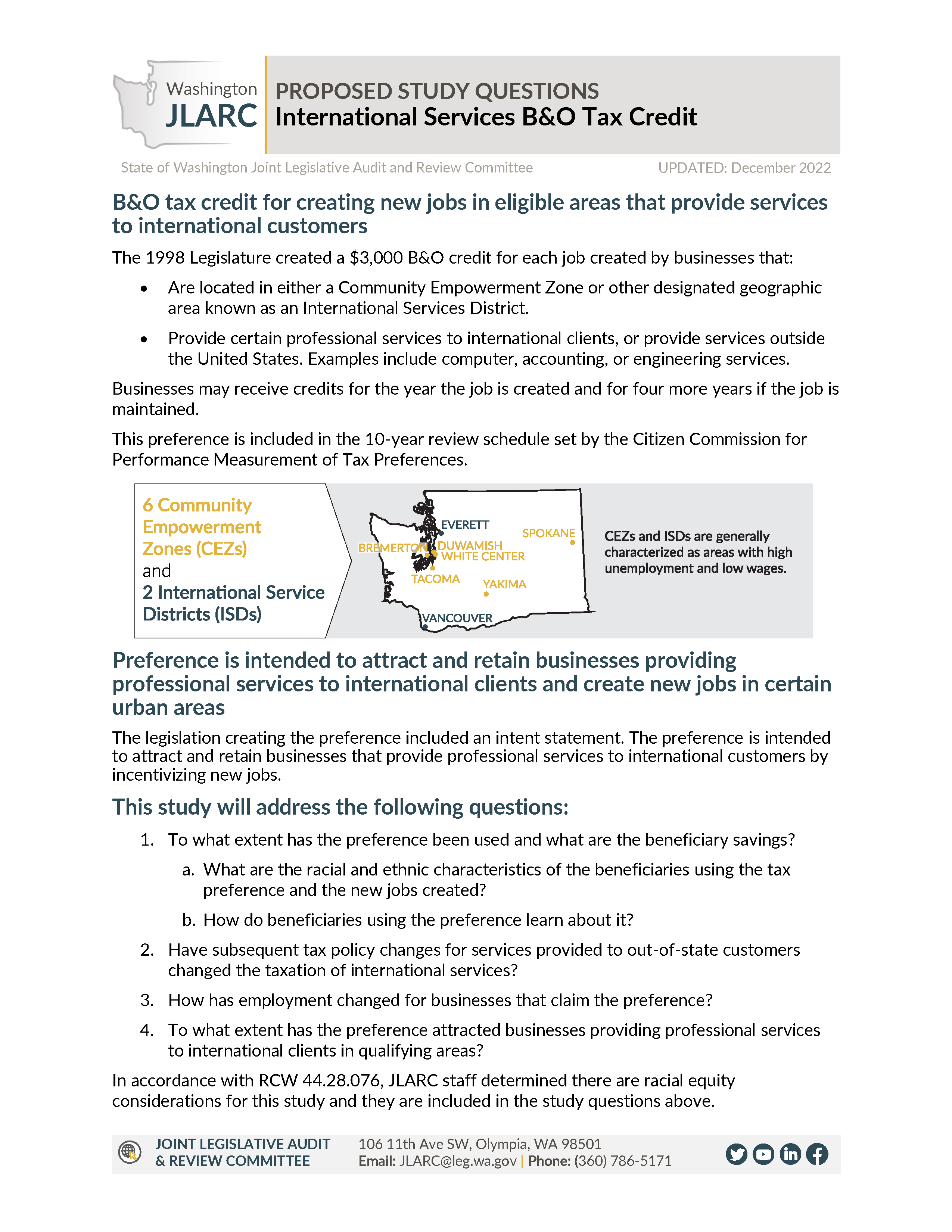

The 1998 Legislature created a $3,000 business and occupation (B&O) tax credit to businesses for each job created in Washington that:

- Is located in a community empowerment zone (CEZ)Urban areas designated by the Department of Commerce in the early 1990s, characterized by limited employment opportunities, low incomes, a lack of affordable housing, deteriorating infrastructure, and limited community service, job training, or education facilities. or an international service district (ISD)A contiguous group of census tracts with unemployment and poverty characteristics similar to CEZs, in a county meeting certain population definitions, and designated by December 31, 1998..

- Provides certain professional services to international clients or provides services outside the United States. Eligible professional services include, but are not limited to, financial or management services, accounting or legal services, or engineering services.

Businesses may receive credits for the year the job was created and for four more years if the job is retained. The maximum amount of the tax credit is $15,000 per job.

The preference took effect July 1, 1998. It does not have an expiration date.

Stated public policy objective of creating and retaining jobs not achieved

The 1998 Legislature stated that the preference was intended to attract and retain businesses that provide professional services to international customers. To concentrate the preference's impact, the Legislature limited it to businesses that create new jobs in CEZs or ISDs. The Legislature stated that both of these urban areas are "characterized by unemployment and poverty."

A 1998 fiscal note estimated that in 2003, 148 businesses would claim the preference and the total beneficiary savings would be $9.9 million. To date, no more than five businesses have claimed the preference in a single year, and beneficiary savings have not exceeded $71,500 per year.

| Objectives (stated) | Results |

|---|---|

| Attract and retain businesses to CEZs or ISDs that provide professional services to international customers. | Not achieved. Employment at beneficiary businesses declined 74% between 2013 and 2021, and wage growth lagged behind statewide averages. |

Recommendations

Legislative Auditor's Recommendation: Terminate

The Legislature should terminate this preference because it has not achieved the stated intent to attract and retain businesses in community empowerment zones or international service districts that provide professional services to international customers.

The Legislature may want to consult with the Department of Commerce and local economic development entities to consider other approaches to encourage business development in CEZs.

You can find more information in Recommendations.

Commissioners' Recommendation

Endorse Legislative Auditor's recommendation without comment.

Committee Action to Distribute Report

On November 29, 2023 this report was approved for distribution by the Joint Legislative Audit and Review Committee.

Action to distribute this report does not imply the Committee agrees or disagrees with the Legislative Auditor recommendations.