2023 Reviews: Five of six Legislative Auditor recommendations require action

| The Legislative Auditor issued six tax preference reports in 2023. The preferences benefit businesses or individuals involved in:Each report includes one Legislative Auditor recommendation to the Legislature. All but one (rehabilitating historic properties) requires legislative action. |

This year's reviews include requirement for racial equity analysis

The 2021 Legislature charged JLARC with including a racial equity analysis in its audits and other reviews when it is relevant to the study's mandate and scope (RCW 44.28.076). We identified relevant questions for each of the tax preference reviews (see Study Questions).

Race and ethnicity data for the businesses using the preferences studied in 2023 was not available. In lieu of actual data, JLARC staff searched for other sources of data that could provide insight into who benefits from or is affected by each preference. Our secondary sources included surveys and U.S. Census Bureau data. Specific data sources are discussed in each report.

In 2022, the Department of Revenue asked beneficiaries of 48 tax preferences to submit race and ethnicity data on their annual tax performance reports. This includes beneficiaries that are specifically required to file an annual report and those who use preferences intended to improve industry competitiveness or create or retain jobs.

While this will improve the availability of data, JLARC staff anticipate that obtaining robust race and ethnicity data will continue to be a challenge for future reviews. Limitations include:

- The request to report information does not apply to all tax preferences JLARC is required to review.

- Race and ethnicity data is requested about employees, not business owners or other affected stakeholders.

- Businesses are asked to provide race and ethnicity of their employees statewide. Data will not be location specific.

- Businesses are not required to supply this information about their employees.

Obtaining race and ethnicity information from all preference users may require additional legislation. For example, the Legislature might require state agencies to collect the desired data. Such efforts will likely require balancing the interest in gathering race and ethnicity data with efforts to streamline and simplify taxpayer reports.

Five recommendations require legislative action

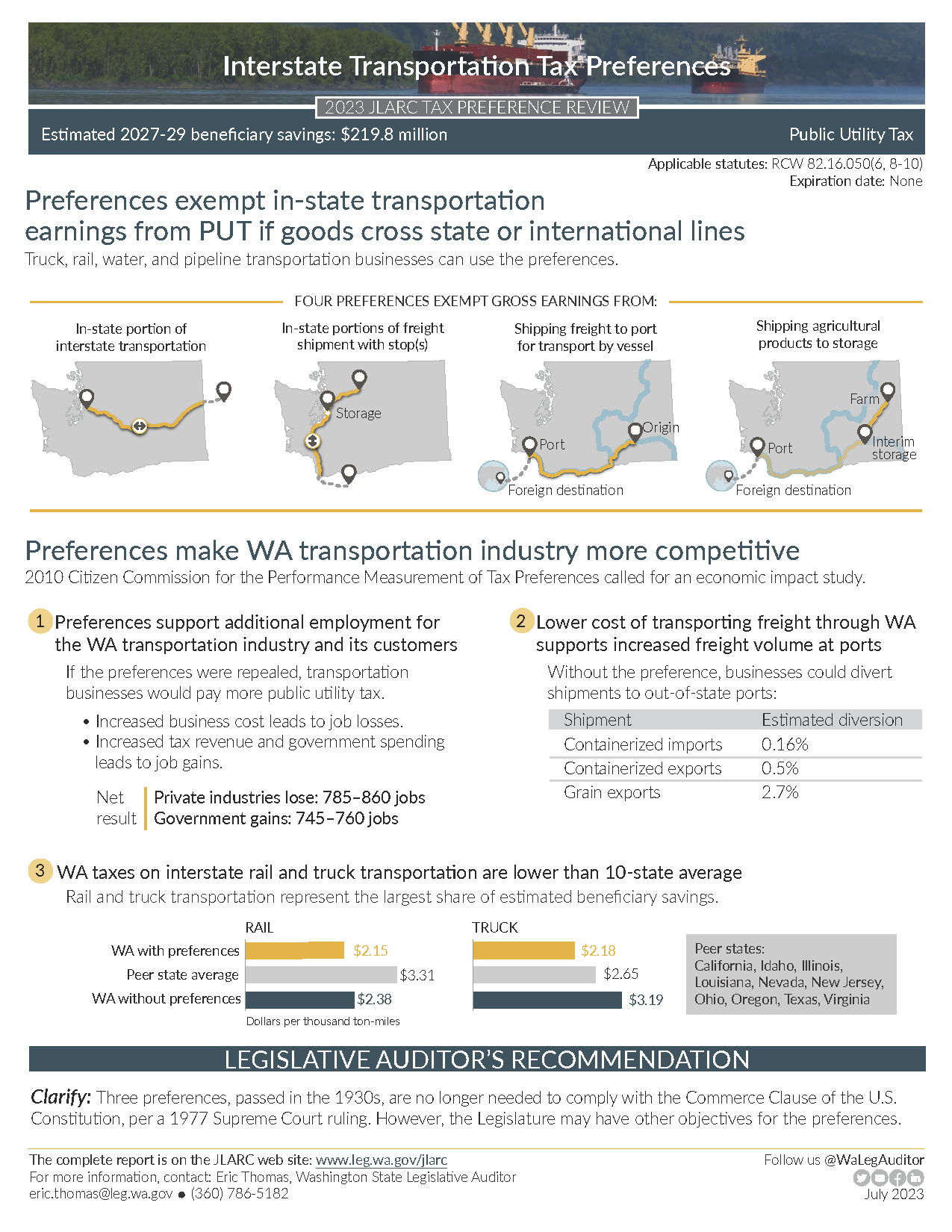

Interstate Transportation Tax Preferences

Interstate Transportation Tax Preferences

|

Conclusion: The four preferences make Washington’s commercial transportation industry more competitive. They support more freight traffic at ports and higher employment in transportation and freight-dependent industries. Tax type: Public utility tax Biennial beneficiary savings: $219.8 million (2027-29 biennium) Applicable statutes: RCW 82.16.050 subsections 6, 8, 9, and 10 Expiration date: None Legislative Auditor's Recommendation: Clarify because the preferences are no longer necessary to comply with the U.S. Constitution and the Legislature may have other objectives. Commissioners' Recommendation: Endorse with comment |

Summary

|

Video Summary |

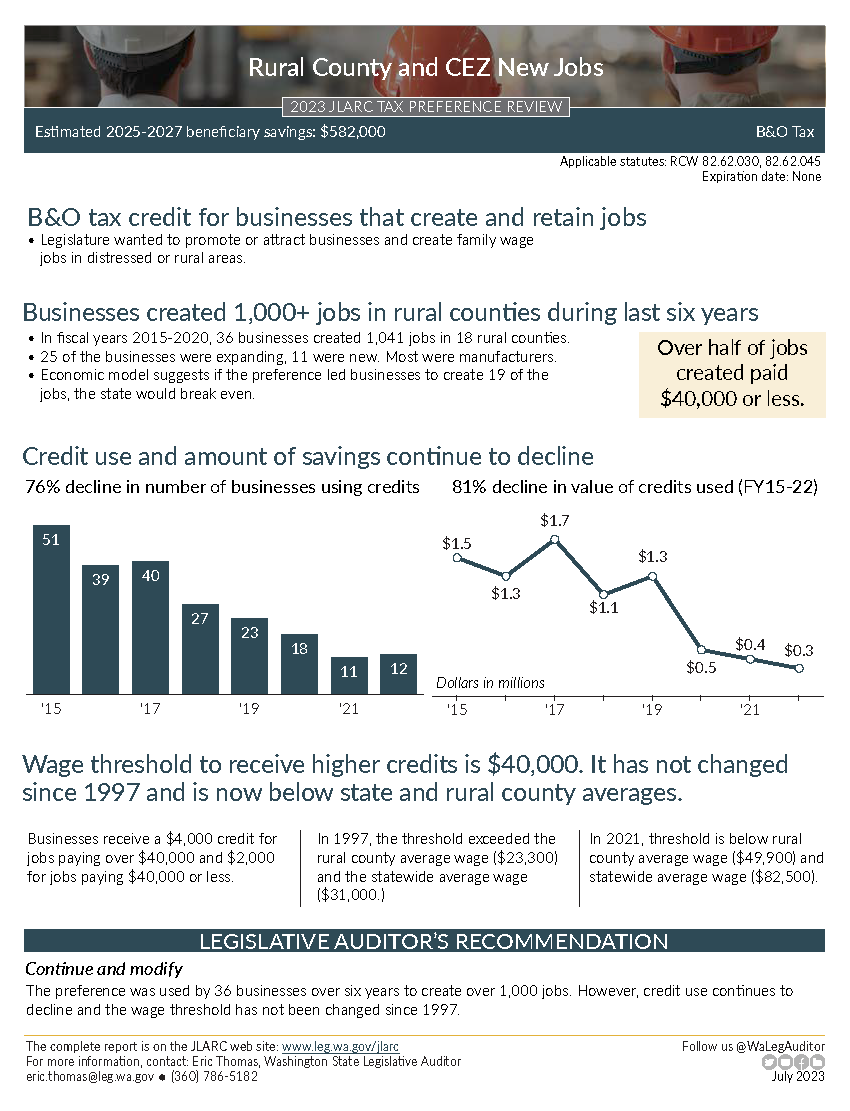

Rural County and CEZ New Jobs

Rural County and CEZ New Jobs

|

Conclusion: Beneficiaries created over 1,000 jobs in rural counties, but use continues to decline. The preference's wage threshold has not been updated since 1997. Tax type: Business and occupation tax Biennial beneficiary savings: $582,000 (2025-27 biennium) Applicable statutes: RCW 82.62.030 Expiration date: None Legislative Auditor's Recommendation: Continue and modify because the preference has been used by businesses that created jobs. However, the Legislature may want to consider increasing the wage threshold or modifying the preference to increase the number of businesses using it. Commissioners' Recommendation: Endorse with comment |

Summary

|

Video Summary |

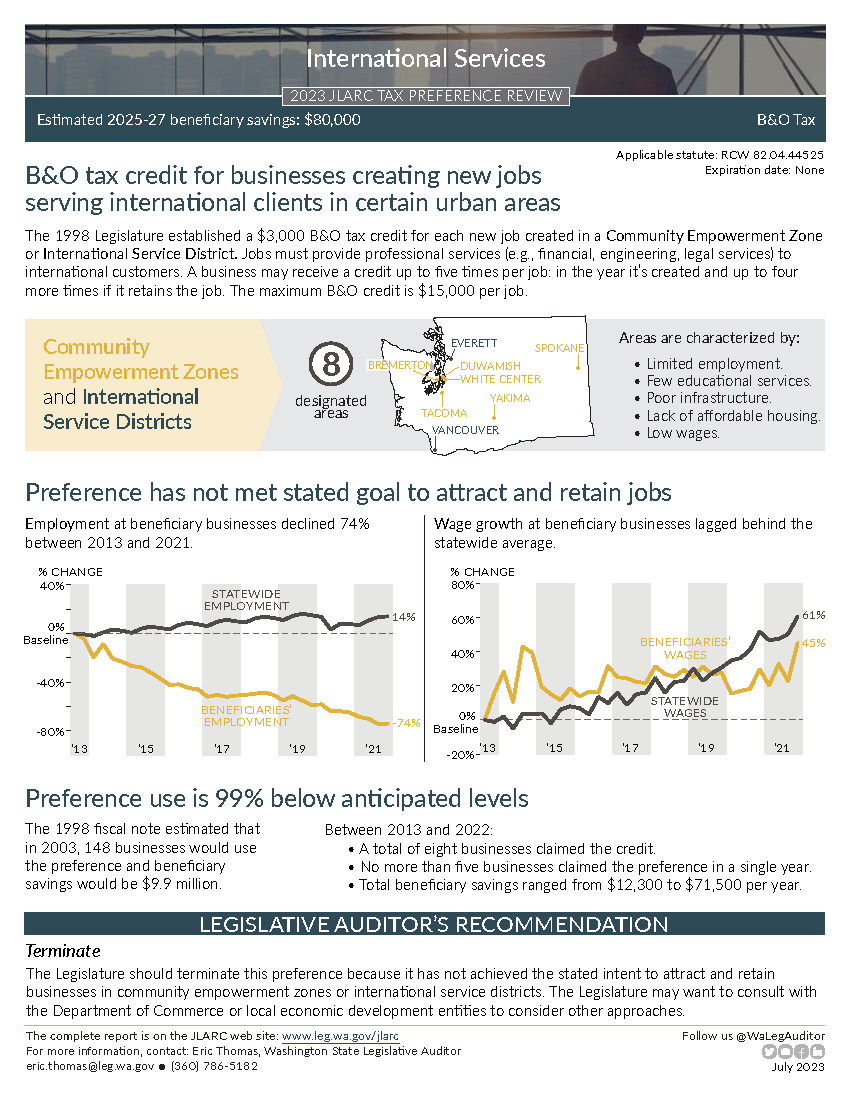

International Services

International Services

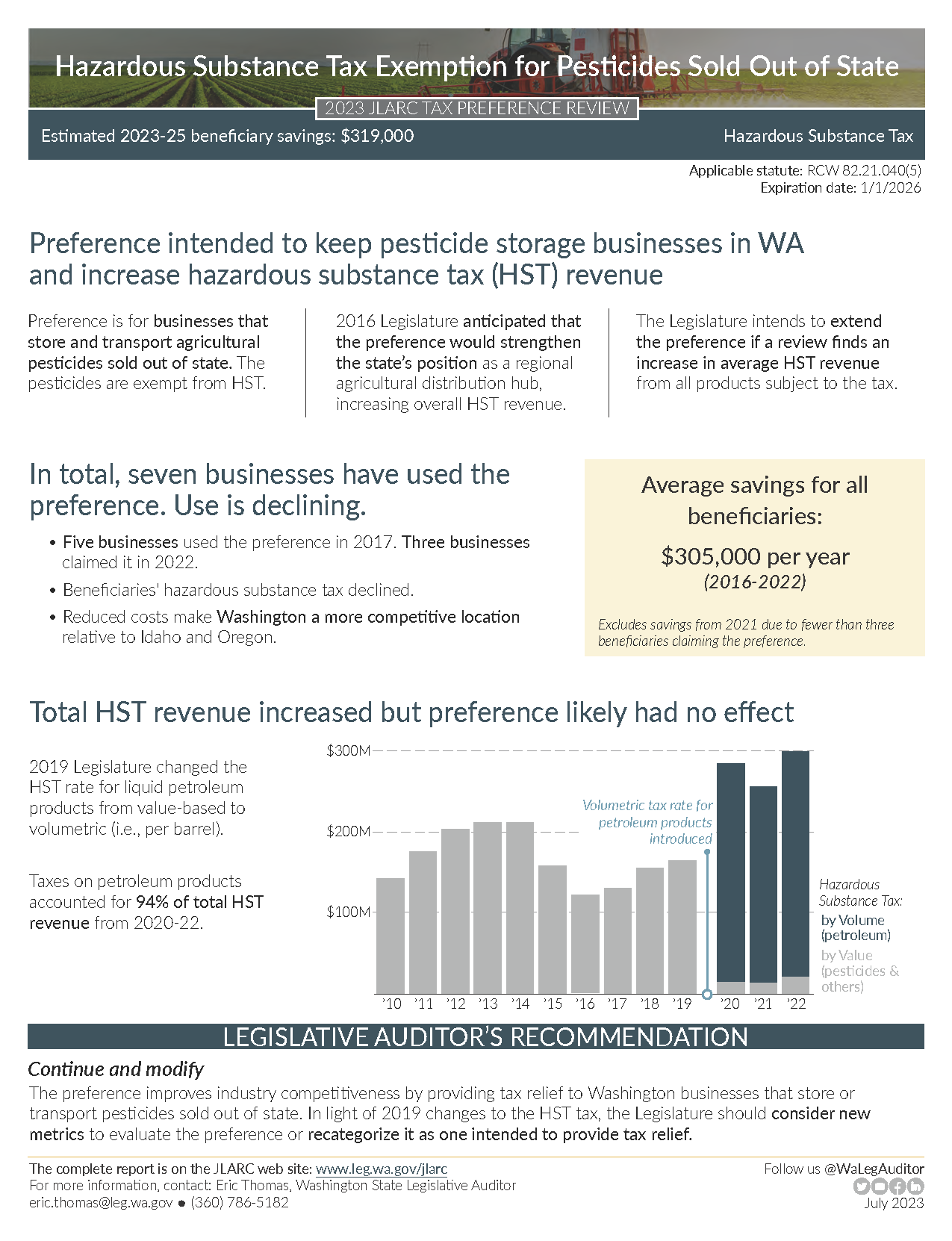

Hazardous Substance Tax Exemption for Pesticides Sold Out of State

Hazardous Substance Tax Exemption for Pesticides Sold Out of State

|

Conclusion: Preference is for businesses that store and transport agricultural pesticides sold out of state. Total hazardous substance tax revenue has increased, but likely not due to the preference. Tax type: Hazardous substance tax Biennial beneficiary savings: $319,000 (2023-25 biennium) Applicable statutes: RCW 82.21.040(5) Expiration date: 1/1/2026 Legislative Auditor's Recommendation: Continue and modify because the preference improves industry competitiveness. The Legislature should consider new metrics to evaluate the preference in light of 2019 changes to Hazardous Substance Tax or recategorize the preference. Commissioners' Recommendation: Endorse with comment |

Summary

|

Video Summary |

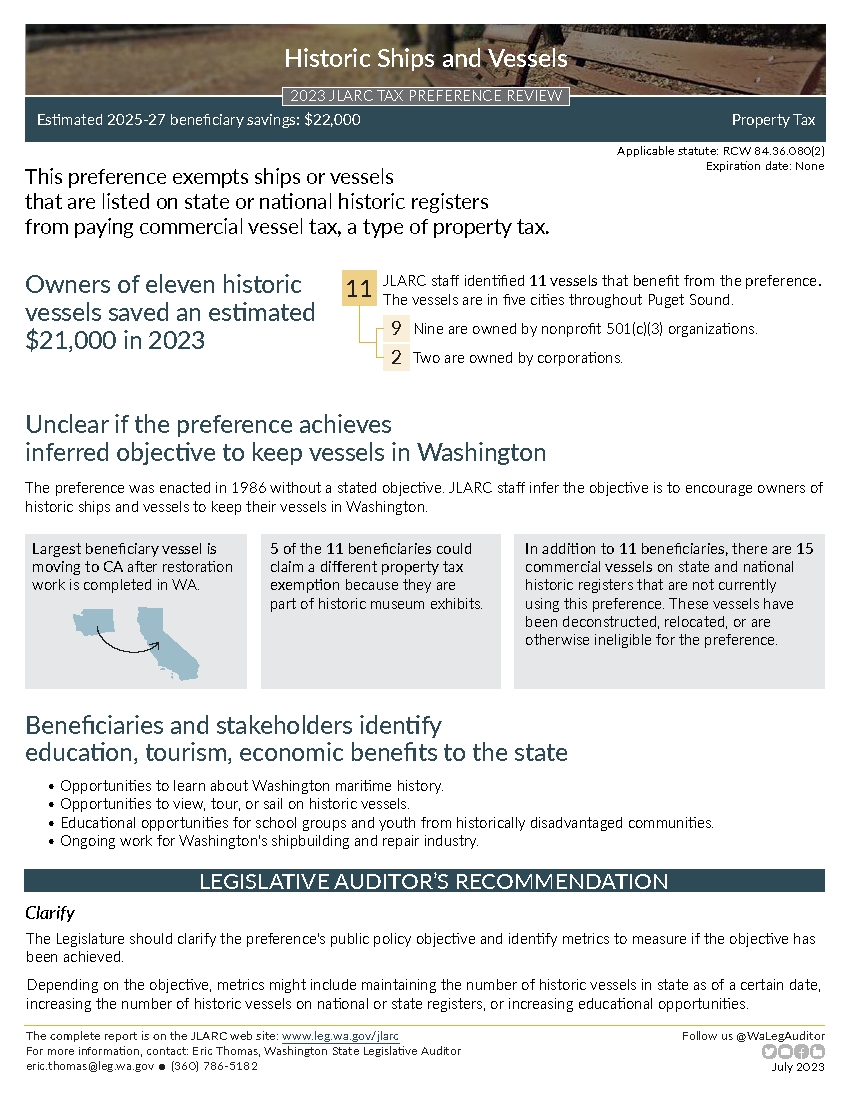

Historic Ships and Vessels

Historic Ships and Vessels

|

Conclusion: Owners of eleven historic vessels saved an estimated $21,000 in 2023. It is unclear if the preference met the inferred goal of keeping historic vessels in Washington. Tax type: Property tax Biennial beneficiary savings: $22,000 (2025-27 biennium) Applicable statutes: RCW 84.36.080(2) Expiration date: None Legislative Auditor's Recommendation: Clarify the objectives and identify performance metrics. Commissioners' Recommendation: Endorse with comment |

Summary

|

Video Summary |

One recommendation does not require legislative action

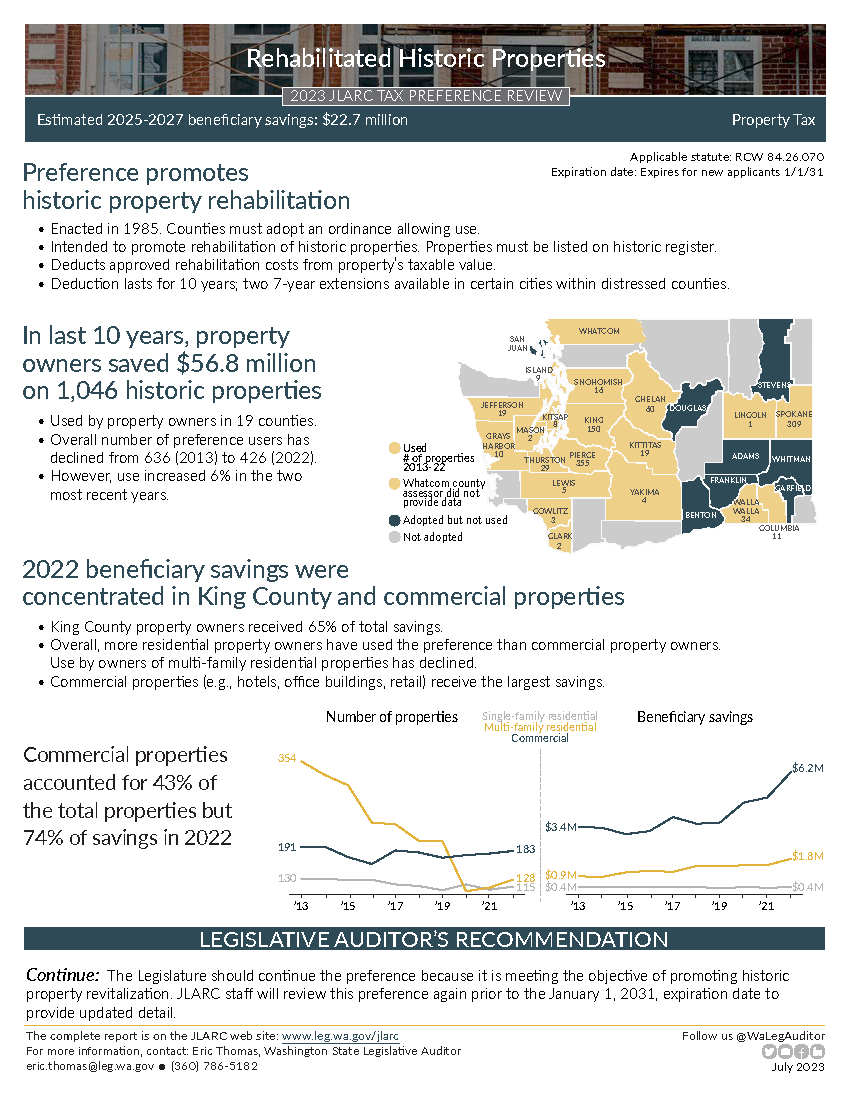

Rehabilitated Historic Properties

Rehabilitated Historic Properties

Conclusion: Property owners saved $56.8 million over the past 10 years, primarily in King County and for commercial properties. While preference use has declined, use increased 6% between 2020 and 2022. Tax type: Property tax Biennial beneficiary savings: $22.7 million (2025-27 biennium) Applicable statutes: RCW 84.26.070 Expiration date: 1/1/2031 Legislative Auditor's Recommendation: Continue because the preference is meeting its objective to promote historic property revitalization. JLARC staff will review the preference again before the January 1, 2031 expiration date and determine whether preference use has increased over time. Commissioners' Recommendation: Endorse with comment |

Summary

|

Video Summary |

The Citizen Commission for the Performance Measurement of Tax Preferences also considers preferences based on information provided by the Department of Revenue. View the 2023 Expedited Preference Review.

Committee Action to Distribute Report

On November 29, 2023 this report was approved for distribution by the Joint Legislative Audit and Review Committee.

Action to distribute this report does not imply the Committee agrees or disagrees with the Legislative Auditor recommendations.