Total hazardous substance tax revenue has increased, but likely not due to the preference

When creating the tax preference, the Legislature stated that the state's hazardous substance tax was driving businesses to store pesticides out of state, threatening Washington's position as an agricultural distribution hub for the Pacific Northwest, and leading to job and revenue losses.

The Legislature stated that the intent of this preference was to incentivize agricultural pesticide storage in Washington. It also stated it would extend the preference if a review found an increase in average HST revenue from all products subject to the tax.

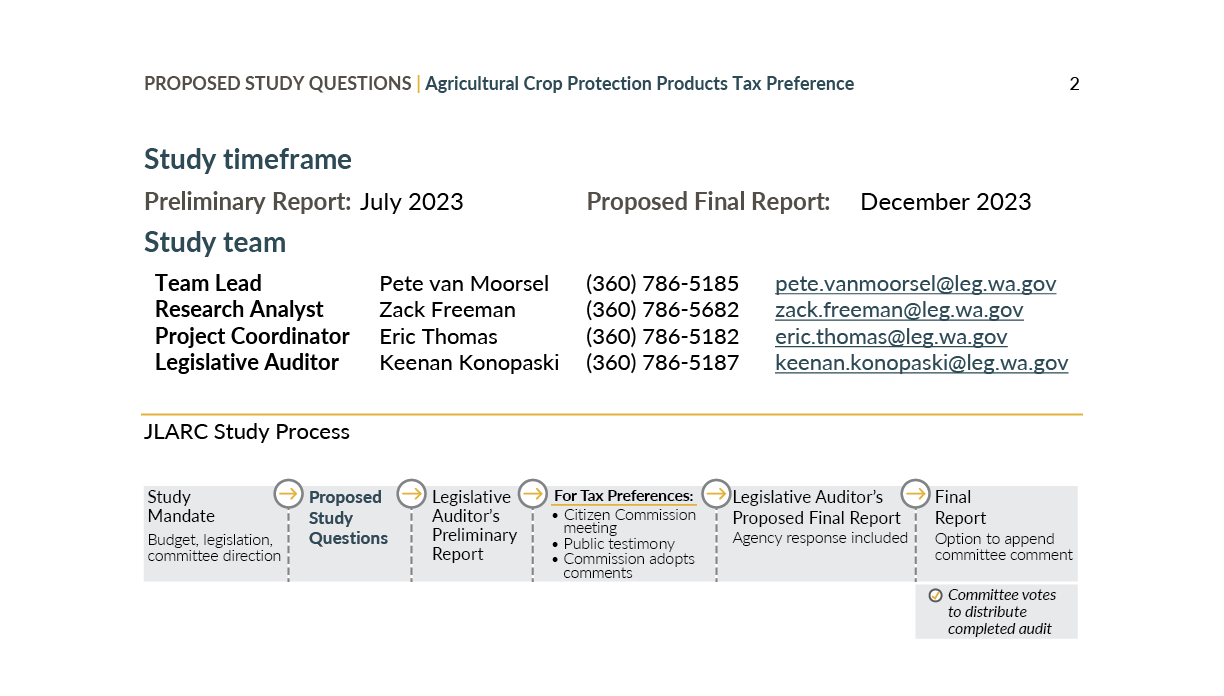

| Objectives | Results |

|---|---|

| To improve industry competitiveness by incentivizing pesticide storage in Washington when products are sold out of state. | Met. The preference provides tax relief to Washington businesses distributing pesticides to other states by reducing storage costs. This makes Washington a more competitive location for storing and distributing pesticides in the Pacific Northwest. |

| To increase total hazardous substance tax revenue. | Likely not met. This metric was established before the Legislature changed the tax rate for liquid petroleum products, leading to a significant increase in HST revenue. JLARC staff found that the preference likely had no effect on the revenue increase. |

Recommendations

Legislative Auditor's Recommendation: Continue and modify

The Legislature should continue and modify the preference. The preference improves industry competitiveness by providing tax relief to Washington businesses that store or transport pesticides sold out of state. The Legislature should consider new metrics to evaluate the preference in light of 2019 changes to hazardous substance tax or recategorize the preference as one intended to provide tax relief.

You can find more information in Recommendations.

Commissioners' Recommendation

Endorse the Legislative Auditor's recommendation with comment. The preference meets the goal as intended. Without this exemption, Washington-based distributors would be at a significant competitive disadvantage in the primary out-of-state markets in which these products are to be distributed since no similar tax is imposed or no credit is allowed for the Washington hazardous substance tax (HST) against similar taxes.

Committee Action to Distribute Report

On November 29, 2023 this report was approved for distribution by the Joint Legislative Audit and Review Committee.

Action to distribute this report does not imply the Committee agrees or disagrees with the Legislative Auditor recommendations.