The Citizen Commission selected the following tax preferences for a performance

review by JLARC staff in 2022:

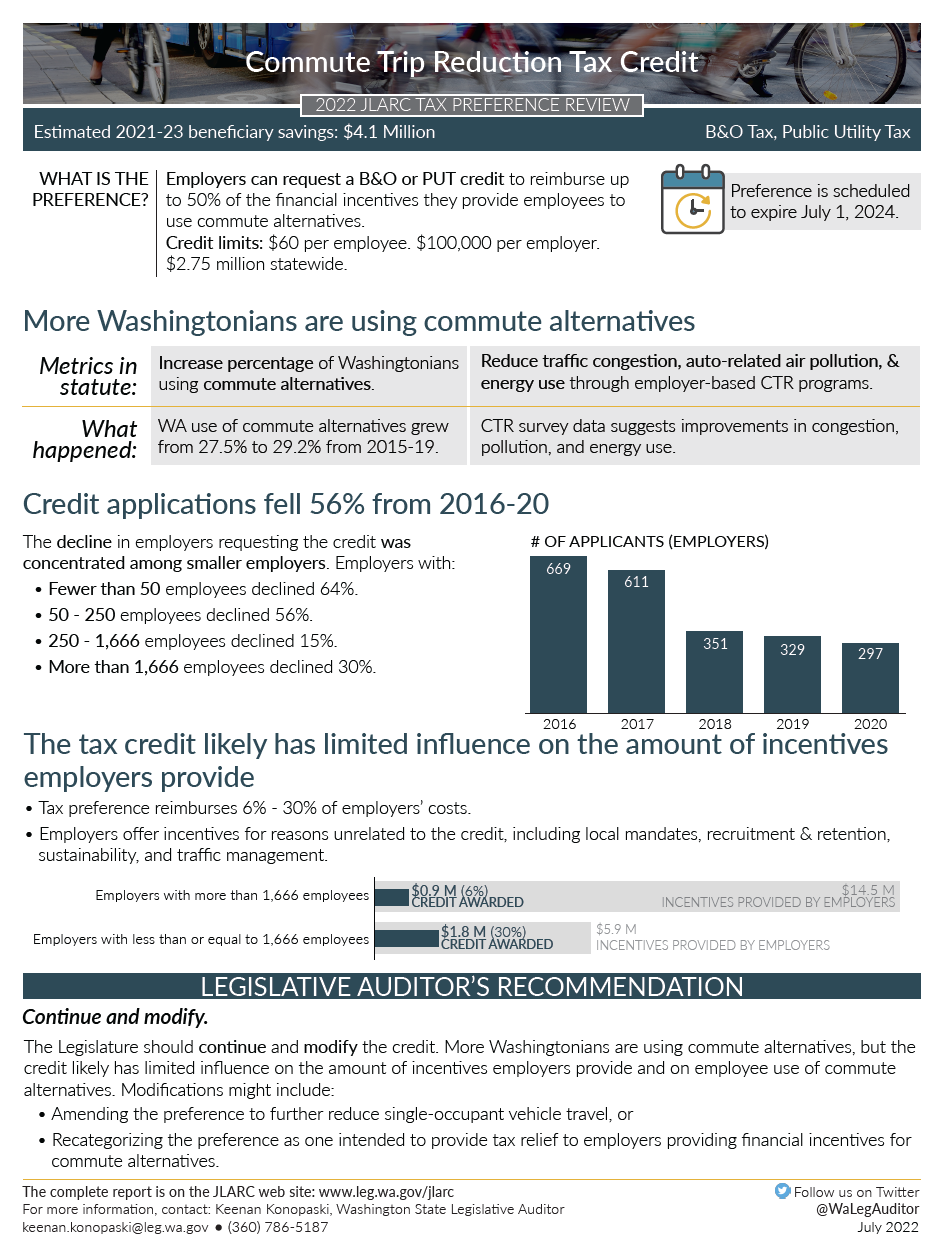

- Commute Trip Reduction Tax Credit (Multiple

Taxes)

| 82.70.020 | 2003

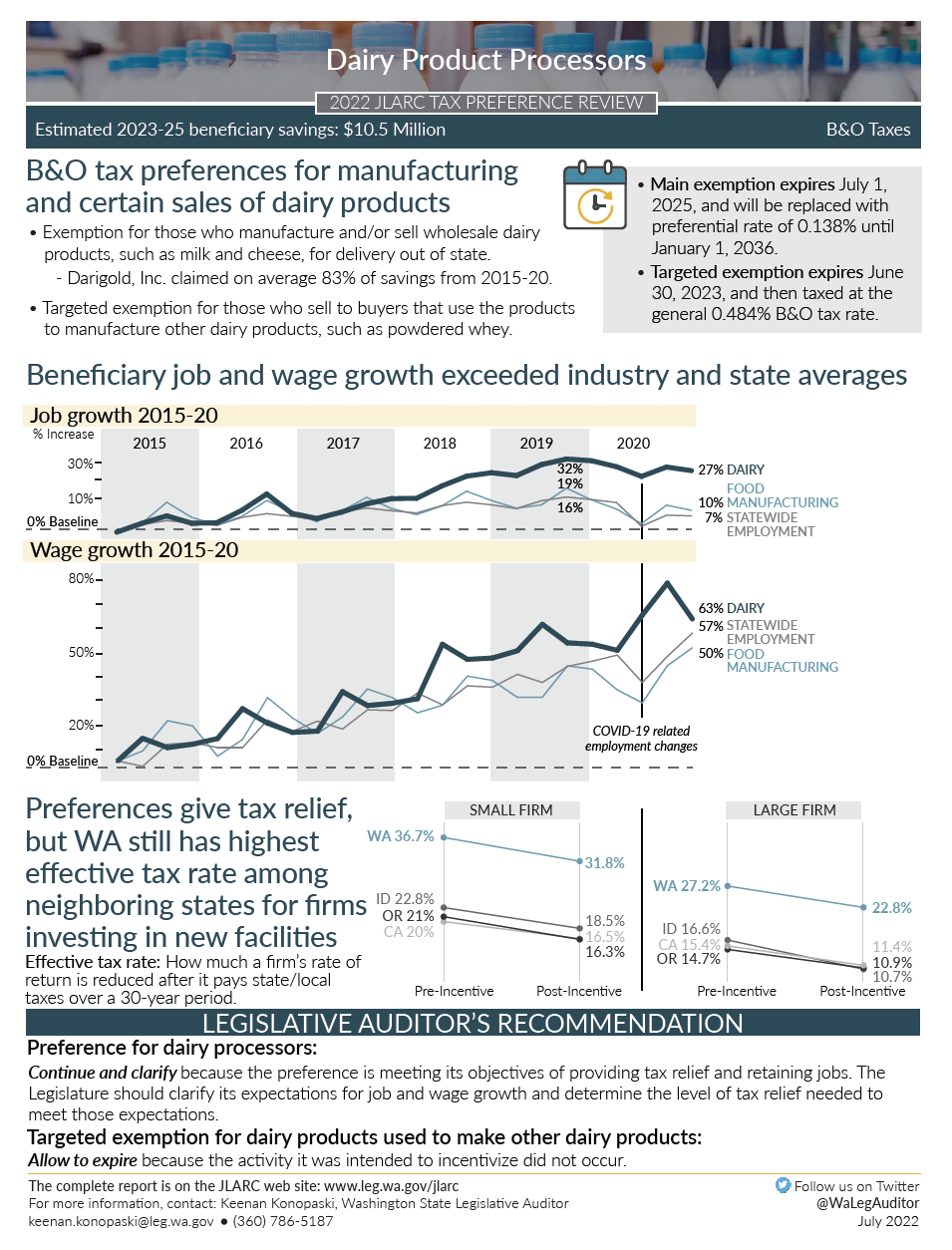

- B&O Tax Preferences for Food

Processors

| 82.04.4268(1)(a), 82.04.4268(1)(b),

82.04.260(1)(c)(i), 82.04.260(1)(c)(iii), 82.04.4269 82.04.260(1)(b), 82.04.4266,

82.04.260(1)(d) | 2005, 2006, and 2013

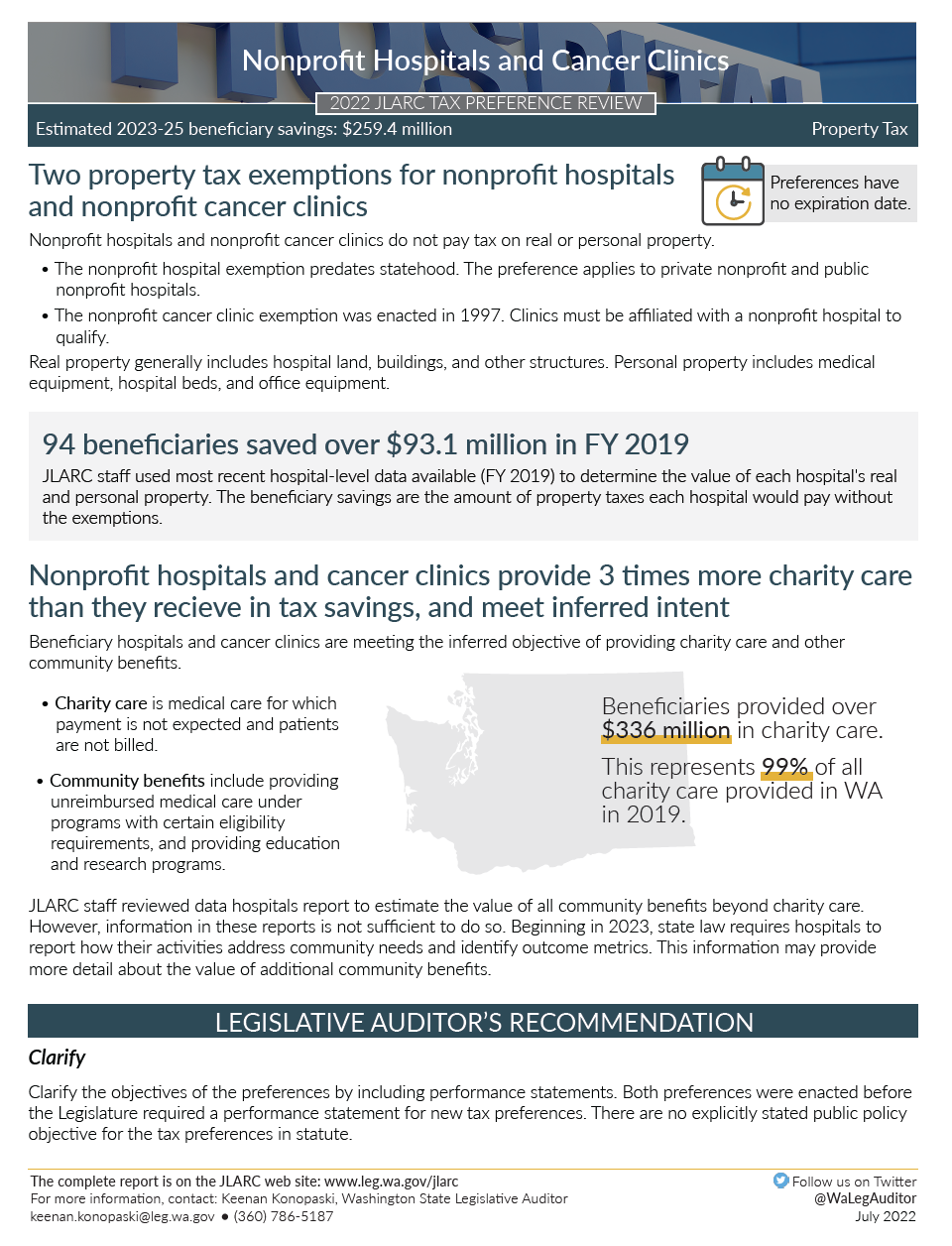

- Property Tax Exemptions for Nonprofit

Hospitals and Cancer Clinics

| 84.36.040(1)(e), 84.36.046 | 1886, 1997

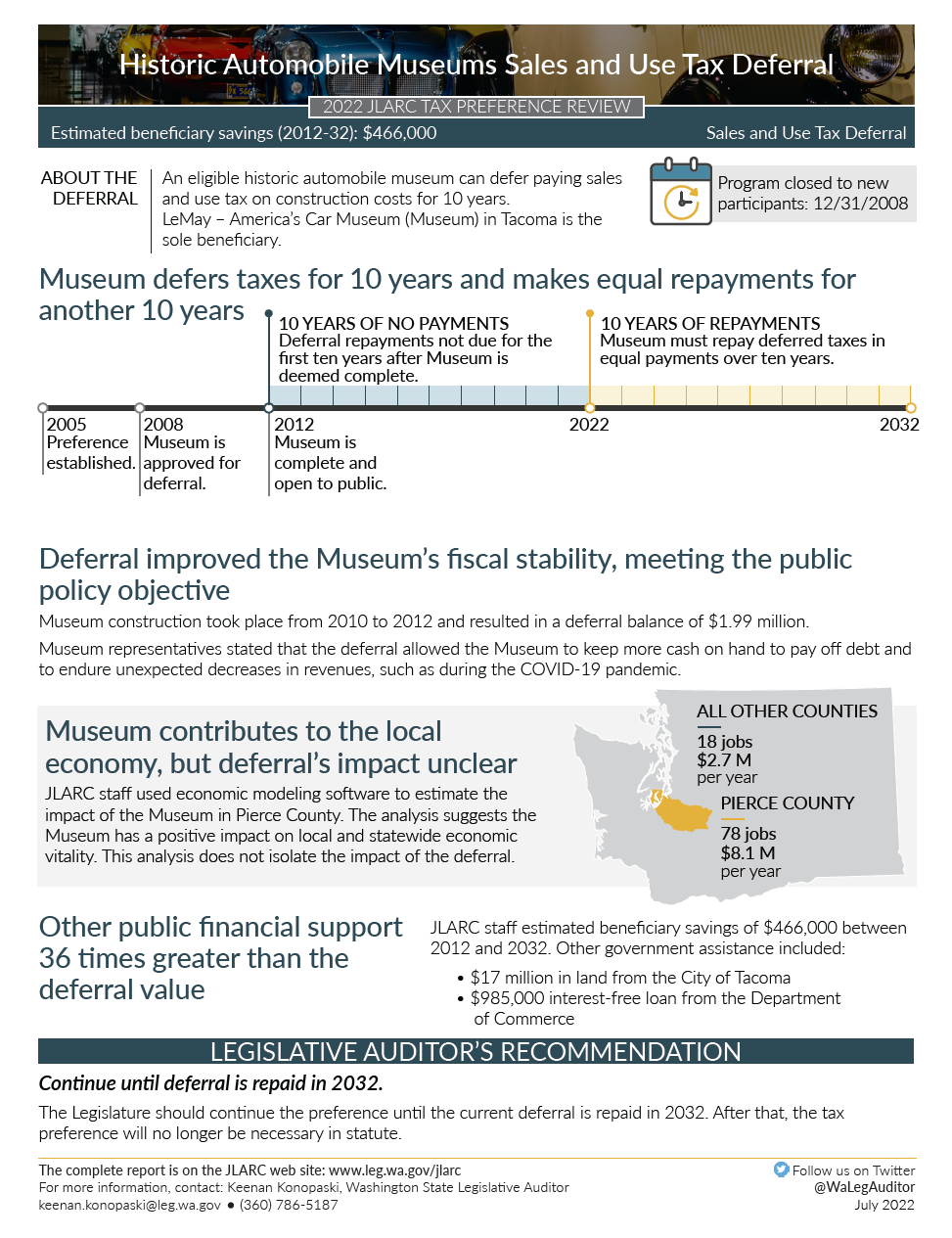

- Sales and Use Tax Deferral for Historic

Automobile Museums

| 82.32.580 | 2005

In addition, the Commission will consider the following tax preferences, using an

expedited process. The expedited process is primarily based on information published

by the Department of Revenue in its most recent statutorily required tax exemption

study. View the 2022 Expedited Preference Review.

| 2022: Not Subject to Full Review (33

Preferences) |

RCW |

Enacted |

| 1 |

Fish Cleaning (B&O Tax) |

82.04.2403 |

1994 |

| 2 |

Dried Pea Processors (B&O Tax) |

82.04.260(2) |

1967 |

| 3 |

Syrup Taxes Paid (B&O Tax) |

82.04.4486 |

2006 |

| 4 |

Restaurant Employee Meals (Sales and Use Tax) |

82.08.9995; 82.12.9995 |

2011 |

| 5 |

Restaurant Employee Meals (B&O Tax) |

82.04.750 |

2011 |

| 6 |

Catering (Litter Tax) |

82.19.050(5) |

2005 |

| 7 |

Football Stadium and Exhibition Center Parking (Sales

Tax) |

82.08.02875 |

1997 |

| 8 |

Differential Parimutuel Tax Rates (Parimutuel

Tax) |

67.16.105(2) |

1979 |

| 9 |

Football Stadiums (Leasehold Excise Tax) |

82.29A.130(15) |

1997 |

| 10 |

Football Stadiums (Sales and Use Tax) |

36.102.070 |

1997 |

| 11 |

Film and Video Production Equipment (Sales and Use

Tax) |

82.08.0315; 82.12.0315 |

1995 |

| 12 |

Tuna, Mackerel, and Jack Fish (Enhanced Food Fish

Tax) |

82.27.010 |

1995 |

| 13 |

Baseball Stadiums (Leasehold Excise Tax) |

82.29A.130(14) |

1995 |

| 14 |

Horse Race Tracks (Sales and Use Tax) |

82.66.040 |

1995 |

| 15 |

Amphitheater (Leasehold Excise Tax) |

82.29A.130(18) |

2005 |

| 16 |

Grocery Distribution Co-Ops (B&O Tax) |

82.04.298(2) |

2001 |

| 17 |

Grocery Co-Ops (Litter Tax) |

82.19.050(3) |

2001 |

| 18 |

Trail Grooming (Sales Tax) |

82.08.0203 |

2008 |

| 19 |

Audio or Video Programming (Sales and Use Tax) |

82.08.02081; 82.12.02081 |

2009 |

| 20 |

Amateur Radio Repeaters (Leasehold Excise Tax) |

82.29A.138 |

2007 |

| 21 |

Timber and Wood Products (B&O Tax) |

82.04.260(12) |

2006 |

| 22 |

Canned Salmon Services (B&O Tax) |

82.04.260(13) |

2006 |

| 23 |

Performing Arts (Property Tax) |

84.36.060(1)(b) |

1981 |

| 24 |

Seafood Processing (B&O Tax) |

82.04.120 |

1975 |

| 25 |

Baseball Stadiums (Sales and Use Tax) |

36.100.090 |

1995 |

| 26 |

Nonprofit Races (Parimutuel Tax) |

67.16.105(1) |

1979 |

| 27 |

Nonprofit Radio and TV Broadcast Facilities (Property

Tax) |

84.36.047 |

1977 |

| 28 |

Fish Tax Differential Rates (Enhanced Food Fish

Tax) |

82.27.020(4) |

1980 |

| 29 |

Meat Processors (B&O Tax) |

82.04.260(4) |

1967 |

| 30 |

Commercially Grown Fish or Shellfish (Enhanced Food

Fish Tax) |

82.27.030(2) |

1980 |

| 31 |

Flour and Oil Manufacturing (B&O Tax) |

82.04.260(1)(a) |

1949 |

| 32 |

Horse Racing (B&O Tax) |

82.04.350 |

1935 |

| 33 |

Radio and TV Broadcasting (B&O Tax) |

82.04.280(1)(f) |

1935 |

| 2022: Critical Part of the Tax Structure (9

Preferences) |

RCW |

Enacted |

| 1 |

Boxing and Wrestling Matches (B&O Tax) |

82.04.340 |

1935 |

| 2 |

Tax Paid in Other States (Enhanced Food Fish Tax) |

82.27.040 |

1980 |

| 3 |

Trademarked Syrup (Syrup Tax) |

82.64.030(3) |

1991 |

| 4 |

Imported Frozen or Packaged Fish (Enhanced Food Fish

Tax) |

82.27.030(1),(3) |

1980 |

| 5 |

Syrup Previously Taxed (Syrup Tax) |

82.64.030(1) |

1989 |

| 6 |

Syrup Exported (Syrup Tax) |

82.64.030(2) |

1989 |

| 7 |

Syrup Purchased Before Tax Imposed (Syrup Tax) |

82.64.030(4) |

1989 |

| 8 |

Racing Fuel (Fuel Tax) |

82.38.080(2)(c) |

1998 |

| 9 |

Food and Beverages Consumed On-Site (Litter Tax) |

82.19.050(4) |

2003 |

Commute Trip Reduction Tax Credit (B&O tax and

PUT)

Commute Trip Reduction Tax Credit (B&O tax and

PUT) Food Processors: Dairy, Fruit and Vegetable, and Seafood Processors (B&O

tax)

Food Processors: Dairy, Fruit and Vegetable, and Seafood Processors (B&O

tax) Nonprofit Hospitals and Cancer Clinics (Property tax)

Nonprofit Hospitals and Cancer Clinics (Property tax) Food Processors: Dairy products used as an ingredient or component to create other

dairy products (B&O tax)

Food Processors: Dairy products used as an ingredient or component to create other

dairy products (B&O tax) Historic Automobile Museums (Sales & Use tax)

Historic Automobile Museums (Sales & Use tax)