JLARC staff continued to deliver during the pandemic, providing the Legislature with thorough answers to complex questions and informing legislative actions during the 2021 session

JLARC staff worked remotely again this past year and completed all study assignments on time, without interruption. We found new ways to engage with state agencies, collect and analyze data in a secure environment, and provide the Legislature with accurate, unbiased answers to inform decision making.

Our reports informed legislative and agency actions to increase government accountability and efficiency

The 2021 Legislature addressed six Legislative Auditor recommendations

- Four from tax preference reviews: Targeted Urban Area Exemption (2021), Farmworker Housing (2020), Customized Employment Training (2020), and Property Tax Exemption for Multifamily Housing in Urban Areas (2019).

- One from the First Responder Mapping System in K-12 Schools report (2020).

- One from the Alternative Public Works Contracting Procedures Sunset Review (2020).

State agencies took action on 97% of the recommendations issued in the last four years

Between 2017 and 2020, the Legislative Auditor issued 36 recommendations to state agencies to improve government efficiency, effectiveness, and accountability. To date, state agencies have implemented, partially implemented, or began acting on 89% of them. Another 8% were addressed with a different approach.

Staff issued 15 new reports in response to the Legislature's questions and won a national impact award

JLARC staff completed 5 performance audits, 7 tax preference reviews, and 3 data collection projects. Some highlights include:

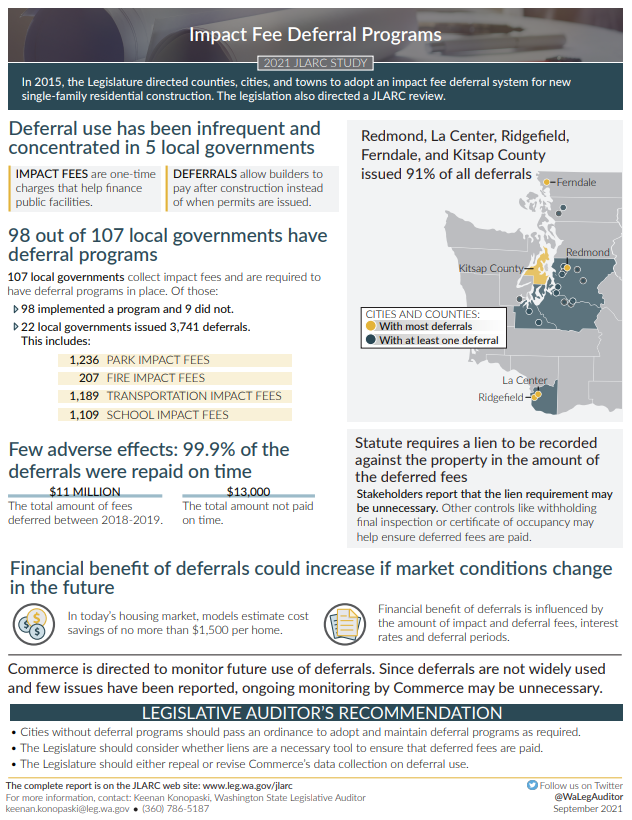

- A review of local government impact fee deferral programs found that program use has been concentrated in five local governments, with few adverse effects. The financial benefit of deferrals could increase if market conditions change in the future.

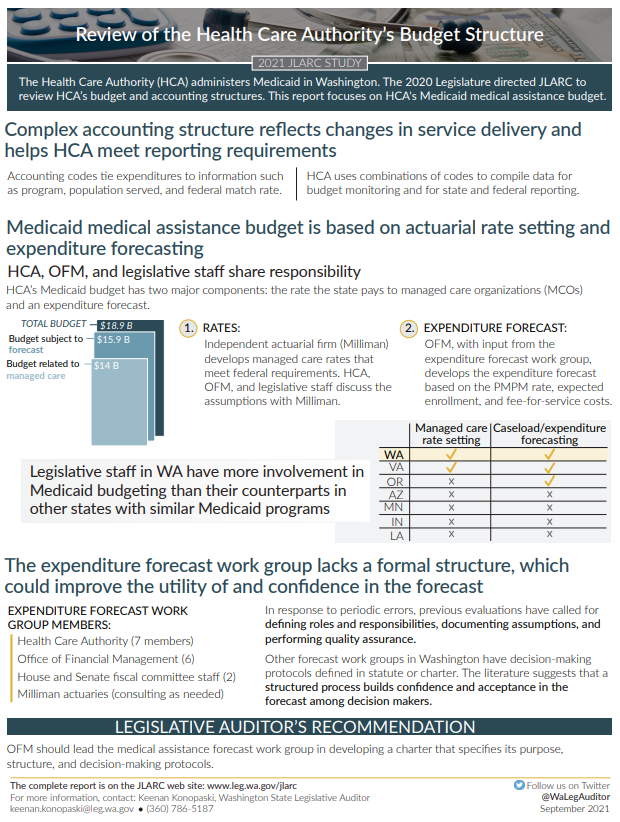

- A review of the Health Care Authority's budget structure found that the complexity of the agency's accounting structure reflects service delivery and helps to fulfill reporting requirements. The expenditure forecast work group lacks a formal structure that could improve its utility and confidence in its forecast.

- A review of a manufacturer's tax deferral program found that businesses would likely have built the facilities without the deferral. To increase manufacturing jobs or training, the Legislature should consider modifying the deferral program.

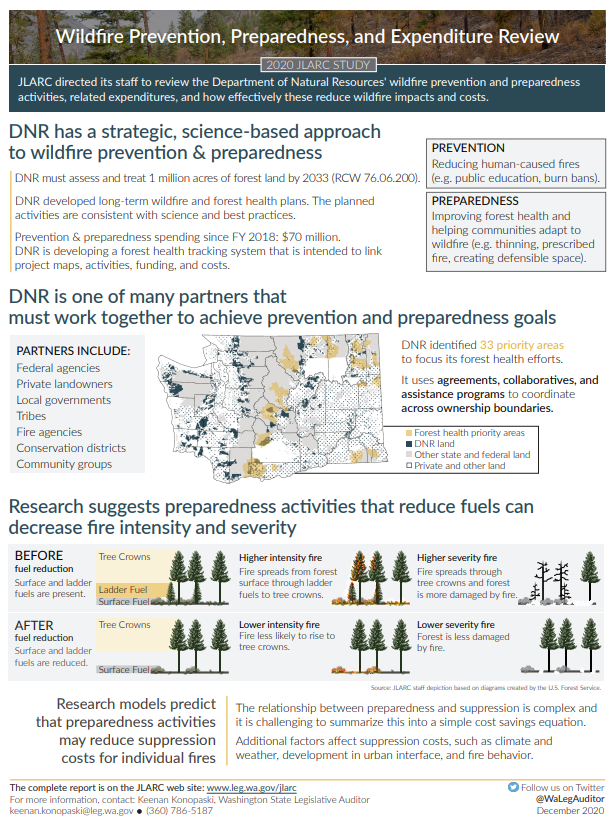

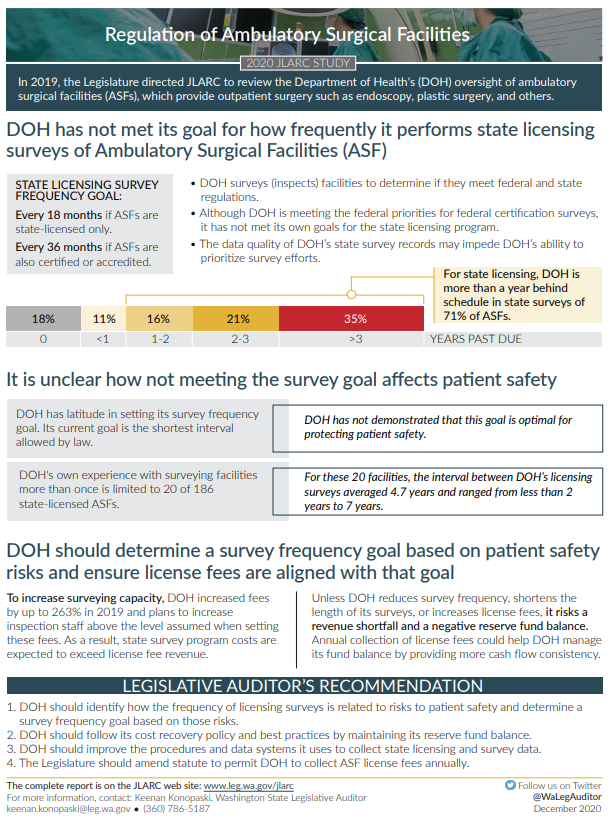

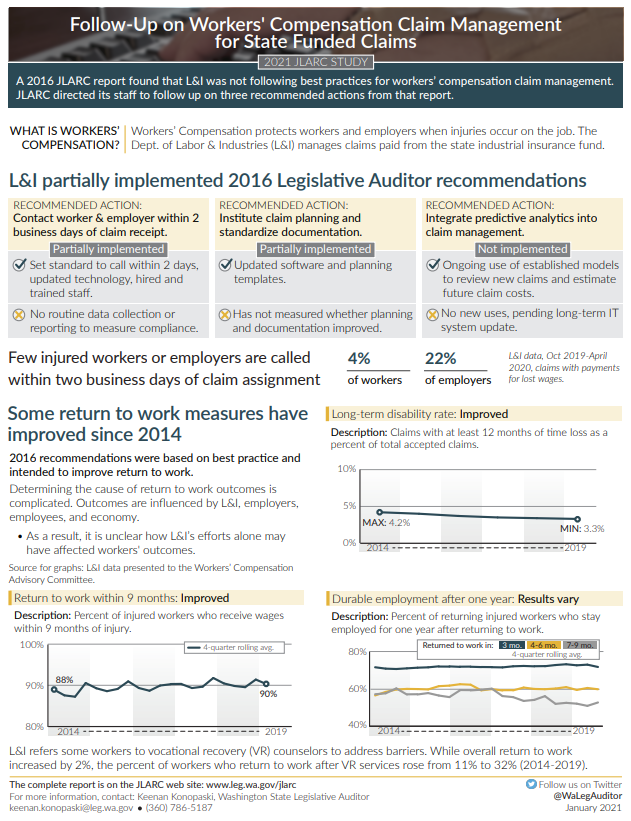

2021 performance audits answered complex questions about natural resources, health and human services, and government operations

JLARC staff reviewed seven tax preferences for health insurance, manufacturing, medical cannabis, and other industries. Four of the seven require action.

| Study Title | Legislative Auditor Recommendation | Commissioners' Recommendations |

|---|---|---|

| Health Benefit

Exchange |

Extend or eliminate the expiration date (structural purpose). | Endorsed with comment |

| Manufacturers'

Deferral |

Extend and modify | Endorsed |

| Reduced B&O Rate for Printing

and Publishing Newspapers |

Review | Endorsed with comment |

| Medical Cannabis Tax

Preferences |

Continue | Endorsed with comment |

| Targeted Urban Area

Exemption |

Review and consider whether to extend (Note: 2021 Legislature took action) | Endorsed |

| Credit for Renewable Energy Program

Payments |

Allow to expire | Endorsed with comment |

| Nonprofit Outpatient Dialysis

Facilities |

Clarify intent | Endorsed |

View more information about the Citizen Commission for Performance Measurement of Tax Preferences here.

Ongoing data collection projects provide information about public records, lodging tax expenditures, and how Washington compares to other states

RCW 40.14.026 requires agencies subject to the Public Records Act to report information about public records retention, management, and disclosure. JLARC staff collects this information and makes it available to the public.

In 2013, the Legislature directed the Joint Legislative Audit and Review Committee (JLARC) to collect and report information about local use of lodging tax revenue for tourism purposes (Ch. 196, Laws of 2013). This report currently summarizes lodging tax data for calendar years 2014 through 2020, as reported by cities, towns, and counties that received a distribution of lodging tax revenue.

JLARC staff prepared this reference guide for Washington legislators to illustrate how Washington compares to other states in five broad areas:

- Population size, economy, health and environment

- Government spending and debt

- Education costs and spending

- Taxes and revenue

- Public assistance, transportation, and public safety spending

This report uses information from national datasets. Our intent is to make these public data sources more accessible and interactive.

Sunset Review of Alternative Public Works Contracting Procedures received NCSL Impact Award

The Alternative Public Works Contracting Procedures Sunset Review received the Certificate of Impact Award from the National Conference of State Legislatures for demonstrating significant impacts to the Legislature and an audited agency. In response to the Legislative Auditor recommendations, the 2021 Legislature reauthorized the alternative public works statute and the Capital Projects Advisory Review Board proposed modifications to its data collection procedures.

Upcoming reports will cover transportation issues, mental and behavioral health consultation and referral lines, K-12 racial equity, and tax preferences

The 2021 Legislature assigned eight new studies to JLARC that we'll be working on over the next few years.

During 2022, we plan to issue reports on the contracting process for building hybrid-electric ferries, consultation and referral lines available to providers and families for mental and behavioral health, K-12 racial equity impacts during the pandemic, and tax preferences for seafood processors, nonprofit hospitals and more. You can see a full list of upcoming reports in our biennial work plan.

It is our pleasure to serve the Legislature by delivering objective and thorough research and analysis on complex and pressing issues. We look forward to continuing these efforts to make state government operations more efficient, effective, equitable, and accountable. Please consider following us on our website, TVW, YouTube, and Twitter.

Keenan Konopaski, Washington State Legislative Auditor