Other Postemployment Benefits (OPEB) valuations

Actuarial valuation reports for Public Employees Benefits Board (PEBB) OPEB and Law Enforcement Officers and Fire Fighters (LEOFF) Plan 1 OPEB.

Public Employees Benefits Board (PEBB) OPEB valuations

Recent Publications:

- 2024 PEBB OPEB Actuarial Valuation Report

- 2023 PEBB OPEB Demographic Experience Study

- 2023 PEBB OPEB Actuarial Valuation Results

- 2022 PEBB OPEB Actuarial Valuation Report

The Historical PEBB OPEB Valuations are available here.

PEBB OPEB Background

1. What are Other Postemployment Benefits (OPEB) for PEBB?

OPEB are benefits provided to eligible retired employees (and their spouses) beyond those provided by their pension plans. Such benefits include medical, prescription drug, life, dental, vision, disability, and long-term care insurance. The Public Employees Benefits Board (PEBB) was created within the Washington State Health Care Authority (HCA) to administer all these benefits for public employees, retirees, and their families. PEBB employers provide monetary assistance, or subsidies, for medical, prescription drug, dental and vision insurance.

The OPEB relationship between PEBB employers and their employees and retirees is not formalized in a contract or plan document. Rather, the benefits are provided in accordance with a substantive plan. A substantive plan is one in which the plan terms are understood by the employers and plan members. This understanding is based on communications between the employers and plan members and the historical pattern of practice with regard to the sharing of benefit costs.

2. What are implicit and explicit subsidies?

The Health Care Authority (HCA) administers PEBB plan benefits. For medical insurance coverage, the HCA has two claims pools: one covering employees and non-Medicare eligible retirees, and the other covering retirees enrolled in Medicare Parts A and B. PEBB plan benefits provide two different subsidies for retirees: an explicit subsidy and an implicit subsidy.

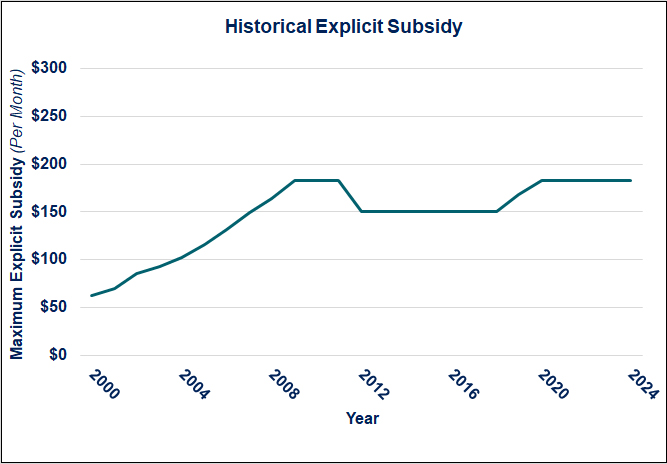

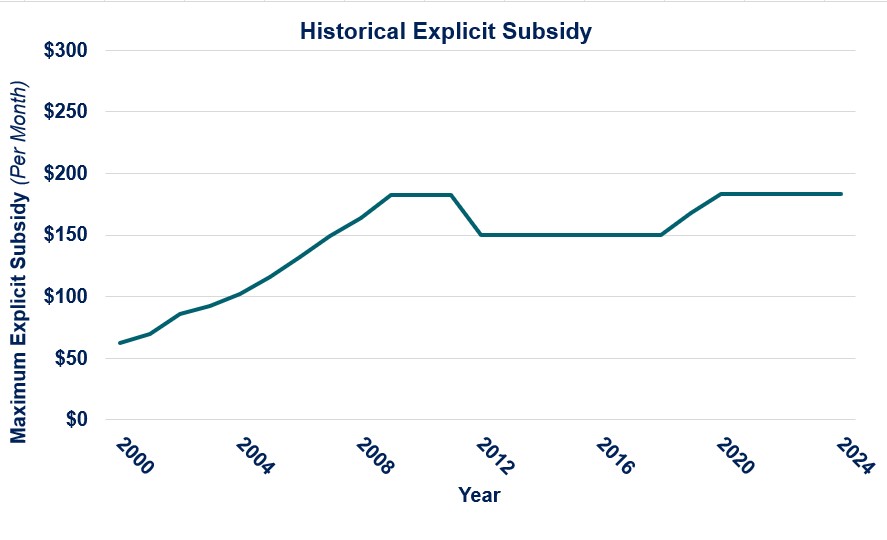

The explicit subsidy, permitted under the Revised Code of Washington (RCW) 41.05.085, is a capped dollar amount that lowers the monthly premium paid by members and their spouses over the age of 65 enrolled in Medicare Parts A and B. The explicit subsidy is the lesser of 50 percent of the monthly premium and the set dollar amount adopted by the Legislature. The following graph displays the historical maximum monthly explicit subsidy as of the 2024 PEBB OPEB report. This graph is for informational purposes and will not be updated with every valuation. Please see the most recent valuation for more recent explicit subsidy values and assumptions for growth in this subsidy.

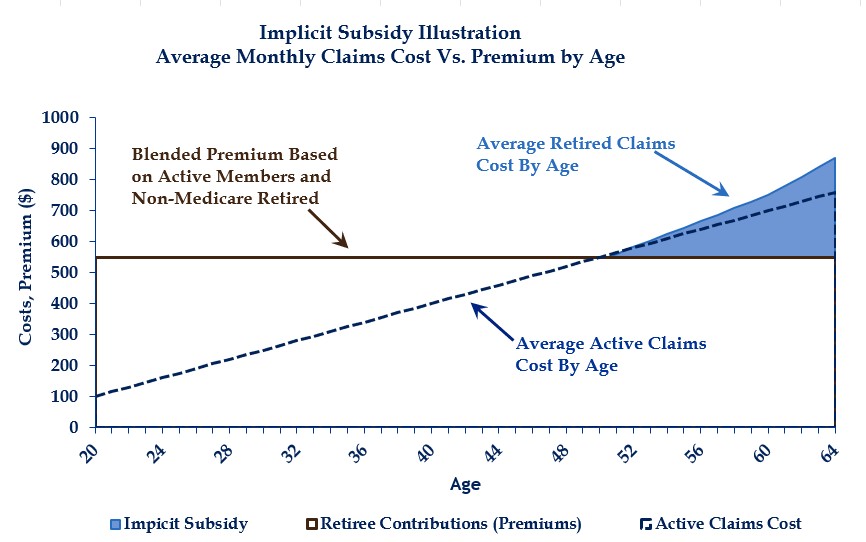

The implicit subsidy, set up under RCW 41.05.022, is more complex because it is not a direct reduction in a member’s premium. Claims experience for active employees and non-Medicare eligible retirees are pooled when determining non-Medicare premiums. Therefore, these retired members pay a premium based on a pool of members that, on average, are younger and healthier. There is an implicit subsidy from the employee group since the premiums paid by the non-Medicare retirees are lower than they would have been if the retirees were insured separately. The subsidies are valued using the difference between the age-based claims costs and the premiums paid by these retirees. For dental benefits, there is only one claim pool. All retirees, both Medicare and non-Medicare eligible, are pooled with active employees to determine a blended premium. Retirees pay the full premium so the only subsidy that exists is an implicit subsidy, since the premium retirees pay is lower due to being pooled with active employees.

3. What are GASB 75 financial reporting requirements for OPEB?

Governmental Accounting Standards Board Statement No. 75 (GASB 75) requires employers to disclose key financial measures for the plan, including the Total OPEB Liability (TOL), OPEB expense, and benefit payments (or employer contributions).

GASB 75 requires the use of the Entry Age Normal (EAN) actuarial cost method to measure the Actuarial Accrued Liability (AAL). The AAL under the EAN cost method is also referred to as TOL in GASB 75. In addition, the discount rate for OPEB plans without a dedicated trust fund is based on a 20-year municipal bond index, which means the discount rate will fluctuate from year-to-year.

4. What is the funding policy?

In Washington State, the implicit and explicit subsidies are funded on a pay-as-you-go basis, meaning that PEBB employers pay these costs as they occur.

5. Why do we consider the long-term outlook of these payments when performing an actuarial valuation?

It is important to look at the projections of the expected future subsidy payments (or benefit payments) in order to determine if the payments are manageable. Projections allow policy makers to determine the best funding policy for the state and their constituents while providing investors and stakeholders knowledge of what lies ahead.

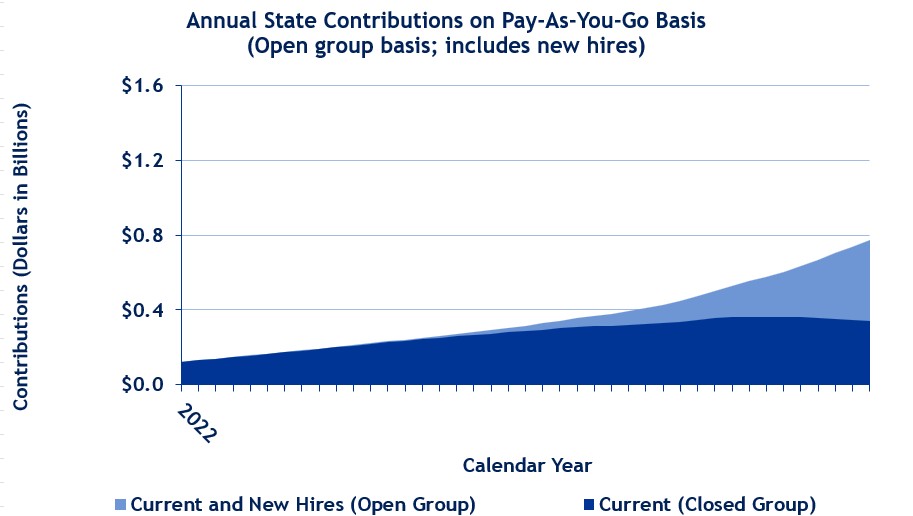

The following graph illustrates expected state subsidy payments for current hires as well as future new hires. This graph is for educational purposes and may not include the most recent actuarial valuation results. We intend to update this graph with the next PEBB OPEB Experience Study.

The above graph is for illustrative purposes only, so we made simplifying assumptions for these future hires. We prepared new hire cohorts for this graph based on the Public Employees' Retirement System (PERS) Plan 2/3 New Hire Profiles and assumed PERS growth. Further, we assumed that all members participate in the UMP medical and dental plans.

The projected subsidy payments could be higher or lower, based on actual growth of the explicit subsidy.

Law Enforcement Officers and Fire Fighters (LEOFF) Plan 1 OPEB Valuations

The most recent publication is the 2022 LEOFF 1 OPEB Actuarial Valuation Report.

Historical LEOFF 1 OPEB reports are on the Historical OPEB Valuations page.

LEOFF OPEB Background

1. What are Other Postemployment Benefits (OPEB) for LEOFF 1?

For purposes of the Law Enforcement Officers’ and Fire Fighters’ Retirement System Plan 1 (LEOFF 1), OPEB are benefits that are provided to retired employees beyond those provided by their pension plans. Such benefits include medical, prescription drug, life, dental, vision, disability, and Long-Term Care (LTC) insurance. LEOFF 1 employers pay 100 percent of “necessary medical services” for LEOFF 1 retirees.

2. What are necessary medical services?

The medical benefit, set up under the Revised Code of Washington (RCW) 41.26.150(1), provides free medical and LTC coverage for LEOFF 1 retirees. When a LEOFF 1 member retires, the employer they retire from is responsible for the full cost of postemployment medical benefits. Individual local disability boards administer the LEOFF 1 medical plan. Each board may interpret the language “necessary medical services” differently.

Summary of Minimum Medical Services

Each local government disability board has the discretionary power to determine which costs they will reimburse or not. However, there is a list of minimum services for which they must reimburse the retiree, as defined in RCW 41.26.030(20). These services are outlined below:

- Hospital board and room not to exceed semi-private, unless condition requires otherwise.

- Hospital services, other than board and room.

- Licensed physicians or surgeons.

- Licensed osteopaths.

- Licensed chiropractors.

- Charges of a registered graduate nurse.

- Physician-prescribed drugs and medications.

- Diagnostic X-ray and laboratory examinations.

- X-ray, radium, and radioactive isotopes therapy.

- Anesthesia and oxygen.

- Rental of durable medical and surgical equipment.

- Artificial limbs and eyes; and casts, splints, and trusses.

- Professional ambulance services to transport to or from a hospital.

- Dental charges resulting from accidental injury to the teeth if treatment starts within 90 days.

- Nursing home confinement or hospital extended care facility.

- Physical therapy by a registered physical therapist.

- Blood transfusions.

- Licensed optometrists.

The list above represents a summary of minimum services and does not determine the overall medical benefits for each individual. Ultimately, each disability board determines which services to reimburse.

Summary of Long-Term Care Coverage

There are also two types of LTC covered under LEOFF 1 OPEB:

- Institutional – Care provided in a nursing home or wing of a hospital designed to provide nursing care services or an assisted living facility, including:

- Skilled – includes nursing and rehabilitation services that can only be performed by skilled medical personnel; must be under orders of a physician and provided on a 24-hour basis.

- Intermediate – includes continuous treatment not meeting all the requirements for skilled care.

- Custodial – includes assistance in carrying out daily living activities.

- Non-Institutional – Includes all home health and adult day-care services.

3. How are these benefits funded?

Funding Policy

The LEOFF 1 medical expenses are funded on a pay-as-you-go basis, meaning that LEOFF 1 employers pay these costs as they are incurred. This generally means today’s taxpayers of cities with retired LEOFF 1 members are paying for benefits that were earned in the past. This funding policy is in conflict with the principle of intergenerational equity, where the goal is to fund a member’s benefit over their working lifetime.

Insurance

Insurance allows the LEOFF 1 employers to control the volatility in annual medical service costs. For example, if a LEOFF 1 employer only has one retiree, the ongoing annual costs will vary widely depending on whether that retiree had a relatively healthy year or, for example, entered LTC. When many employers group together in an insurance pool, they will be able to pay a steadier annual amount to offset medical service costs. The Legislature has approved this practice by codifying it in RCW 41.26.150(4).

LEOFF 1 employers may participate in insurance pools established by certain associations, and most LEOFF 1 employers have joined their respective association’s medical plans. The remaining LEOFF 1 employers that choose not to join have several other options. Some obtain coverage through union health and welfare plans (e.g., Teamsters), while others contract through individual insurance providers or self-insure.

4. What is an actuarial valuation?

An actuary performs an actuarial valuation to estimate what benefits will be paid throughout the future lifetimes of current members, and then discounts those payments back to the present. The result is the Present Value of Future Benefits (PVFB). For example, a dollar amount today, equal to the PVFB, could be invested during plan members’ lifetimes to pay all expected future benefits when the members are eligible. In this case, the benefit payments are the necessary medical service costs for the LEOFF 1 retirees.

When performing an actuarial valuation, an actuary needs inputs such as participant data, benefit provisions, and assumptions. Participant data includes age, membership service, employment status, etc. Benefit provisions include the structure of the benefits that the members receive—for example, the retiree medical benefits paid by employers. Assumptions include the discount rate, healthcare trends, decrement rates, medical and LTC costs, etc.

An actuary analyzes these inputs using an actuarial cost method. The chosen cost method allocates costs between past and future plan membership service before retirement. Distinct actuarial cost methods produce different results since each method allocates costs differently. The Entry Age Normal (EAN) cost method required under the Governmental Accounting Standards Board Statement No. 75 (GASB 75) allocates plan benefits so they are earned, or accrued, as a level percentage of pay throughout an employee’s working lifetime.

5. What Are GASB 75 Financial Reporting Requirements for OPEB?

GASB Statements 74/75 were issued in 2015 and require more extensive disclosures and supplementary information than the prior reporting requirements. Most of GASB 74 does not apply to LEOFF 1 retiree medical benefits, as these are not pre-funded through a qualifying trust. GASB 75 became effective for employer fiscal years beginning after June 15, 2017, and requires employers to disclose key plan measures relative to their plan members, including the Total OPEB Liability (TOL) and OPEB Expense.

GASB 75 requires the inclusion of specific tables and the use of the EAN actuarial cost method to measure the Actuarial Accrued Liability, referred to as the TOL. Also, the discount rate for plans without a dedicated trust fund will be based on a 20-year municipal bond index which fluctuates from year-to-year. The statewide LEOFF 1 OPEB liability is not reported; however, local employers are required to disclose their most recent GASB 75 liability. Listed below are the tables local employers are required to produce to be compliant with GASB 75.

On an annual basis, local employers of LEOFF 1 members are required to provide the following tables that summarize OPEB liabilities:

- Schedule of Changes in the TOL.

- OPEB Expense.

- Deferred Outflows and Inflows of Resources.

- Subsequent Recognition Years.

- Sensitivity of the TOL to Changes in Discount Rate and Healthcare Trend Assumptions.

- Summary of Plan Participants.

- Disclosure of Assumptions and Methodology.

The primary purpose of the LEOFF 1 OPEB actuarial valuation is to estimate the statewide liability. While this statewide obligation measure is not used for financial reporting, the valuation report shares some commonality with required local employer reporting as described in the following paragraphs.

The Schedule of Changes in the TOL reconciles the change in the TOL from the prior measurement date. Since a statewide valuation is not produced for LEOFF 1 OPEB every year, the statewide report performs a reconciliation of changes since the prior valuation.

The reconciliation is also used to calculate the components of the OPEB Expense. Since any remaining active LEOFF 1 members are assumed retired as of the measurement date, the amortization period is one year, and the OPEB Expense components match the TOL reconciliation described above. Under GASB 75, assumption changes and differences between expected and actual experience are amortized, or spread out, over a period equal to the average of the expected remaining service lives of all members that are provided with benefits through the OPEB plan.

LEOFF 1 does not have deferred outflows or inflows since all costs are recognized immediately. As such, the Deferred Outflows and Inflows of Resources and the Subsequent Recognition Years both would display all zeroes.

GASB 75 also requires an analysis of the impact of changing the Healthcare Trend and Discount Rate assumptions by 100 basis points. The statewide valuation performs this sensitivity analysis to show how the liability can change under a different set of assumptions.

The statewide valuation report provides a Summary of Plan Participants with details on the data used and the associated measurement date, as well as a description of Assumptions and Methodology used for the valuation.

Most Recent OPEB AMM Online Tools

Note: We’ve received questions related to running the macros found in these AMM Online Tools. Our office does not employ IT professionals and we encourage you to reach out to your internal IT department to enable these macros.

The PEBB OPEB AMM Online Tool for 2025

The LEOFF 1 AMM Online Tool for 2025 (available by end of February 2026)

Please see Historical OPEB Valuations for a prior version of these AMM Online Tools.

If you have any questions about reporting requirements under GASB 75, please reach out to Olivia Crouch, State Auditor’s Office, at croucho@sao.wa.gov.

If you have any questions about the actuarial assumptions, methods, or data used in the AMM Tools, please reach out to the Office of the State Actuary at state.actuary@leg.wa.gov.