Actuarial assumptions

This page describes the actuarial assumptions used in the valuation process.

To calculate the contribution rates necessary to pre-fund the plan’s benefits, an actuary uses an actuarial cost method, asset valuation method, economic assumptions, and demographic assumptions. This section describes the actuarial assumptions we use in our valuation process. Please see Actuarial Methods for descriptions of our actuarial cost and asset valuation methods. Please see the Actuarial Methods and Assumptions section of the latest Actuarial Valuation Report for a list of frequently changing or new actuarial methods and assumptions.

Economic Assumptions

Economic assumptions affect expectations regarding the accumulation of assets and the growth of projected pension benefits. In the valuation process, assumptions are required for four economic variables:

- Expected investment rate of return.

- Inflation.

- General Salary growth.

- Membership growth for Plan 1 Funding.

The Pension Funding Council (PFC) adopts economic assumptions for all plans/systems, except LEOFF 2 which are adopted by their Board; these assumptions are then subject to revision by the Legislature. The PFC and LEOFF 2 Board adopted lower economic assumptions in 2021. The investment rate of return assumption decreased from 7.50 percent (7.40 percent for LEOFF 2) to 7.00 percent; the general salary increase assumption decreased from 3.50 percent to 3.25 percent. These lower economic assumptions were first reflected in the 2021 AVR. In 2025, the state Legislature passed Engrossed Second Substitute Bill (ESSB) 5357 (Chapter 381, Laws of 2025) modifying pension funding statute which sets the assumed investment rate of return to 7.25%, among other changes. This change in the assumed investment rate of return applies to all DRS plans, except for LEOFF 2.

The economic assumptions used in the Actuarial Valuation Report are shown in the following table.

Demographic Assumptions

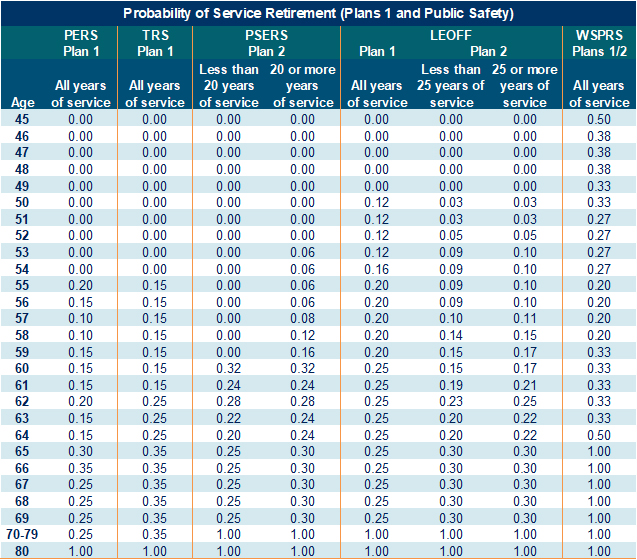

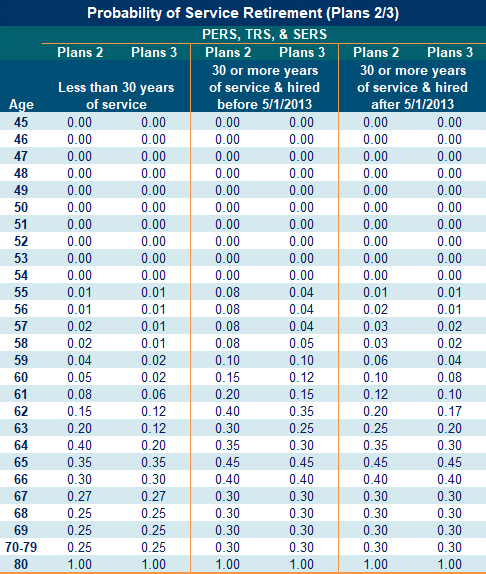

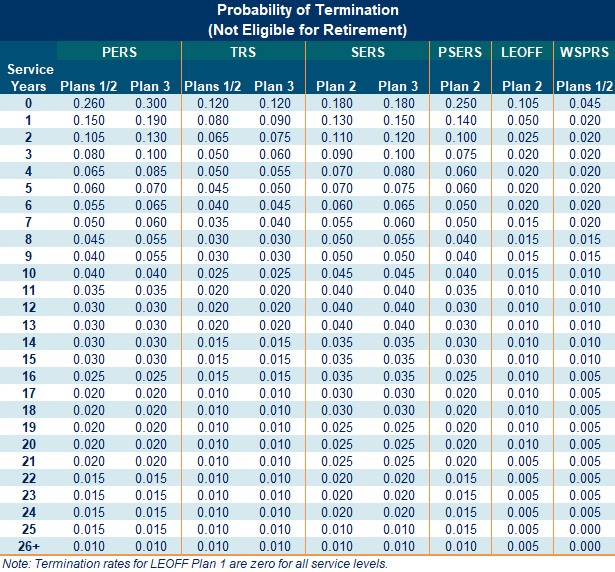

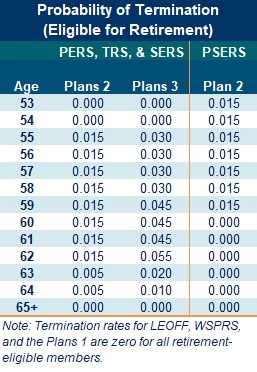

We use demographic assumptions to allow us to model the behavior of members over the next several years. These assumptions include rates of mortality, retirement, and termination. The demographic assumptions below were developed in the 2013-2018 Demographic Experience Study.

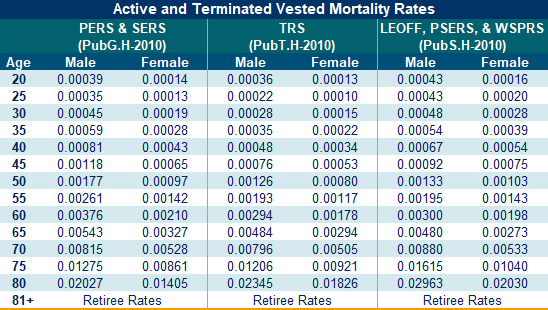

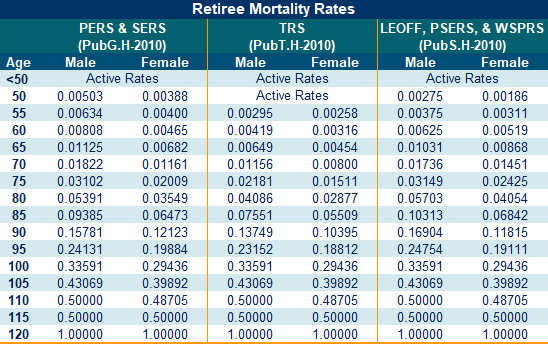

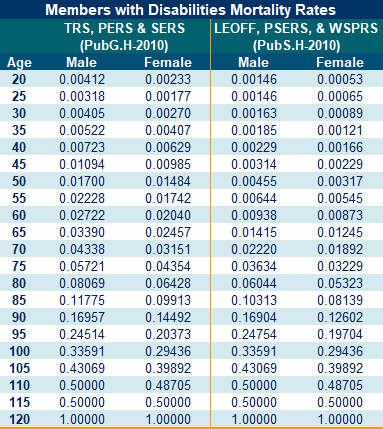

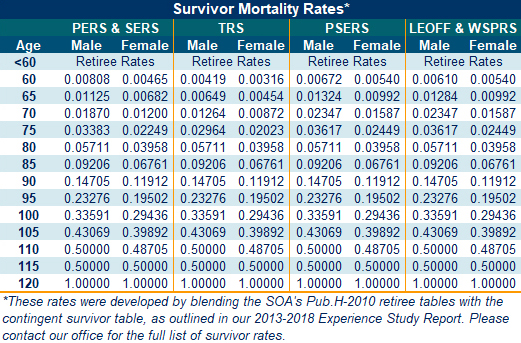

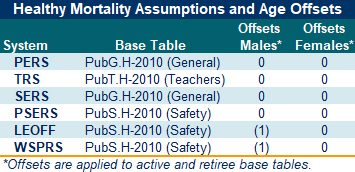

Mortality rates assumption

OSA developed rates of mortality for the retirement systems by taking the following steps.

- First, we used the Society of Actuaries' Pub.H-2010 mortality rates as our base table. These rates reflect national public retirement plan mortality data and were released in January 2019.

- Next, we applied age offsets for each system and plan, as appropriate, to better tailor the mortality rates to the demographics of each plan.

- Lastly, we applied the long-term MP-2017 generational improvement scale, also developed by the Society of Actuaries, to project mortality rates for every year after the 2010 base table. We use “generational” mortality, under which a member is assumed to receive additional mortality improvements in each future year, throughout their lifetime. The long-term MP-2017 rates predict approximately a one percent per year mortality improvement for both males and females over most ages.

- So, as an example, in 2020, the mortality rate for a 50-year old active PERS member would be (PubG.H-2010 rate) x (MP-2017 scale)^(2020-2010) or roughly 0.00177 * (100%-1%)^10 = 0.0016.

These mortality rates vary by member status (eg, active, retiree, or survivor) and can be viewed by using the drop-down below. Please note these rates do not incorporate any mortality improvement or age offsets. The complete list of rates can be found in the Pub-2010 Public Retirement Plans Mortality Tables Report on the Society of Actuaries website. See the 2013-2018 Demographic Experience Study for more details regarding the development of these rates.

Mortality rates assumption tables

Service retirement assumption

Termination rates assumption

Our termination rates assumption is subdivided based on whether the member is retirement-eligible. For retirement-eligible members who terminate, we assume they are delaying commencement of their retirement benefit until they are eligible to receive an unreduced benefit.

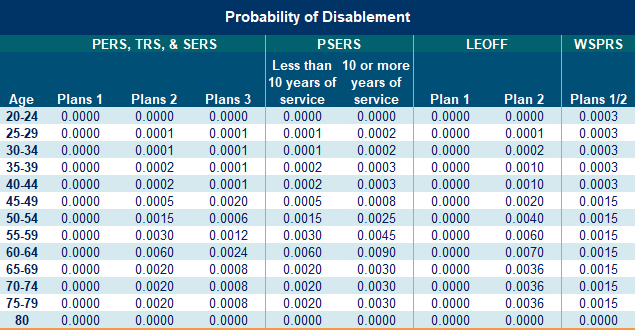

Disability rates assumption

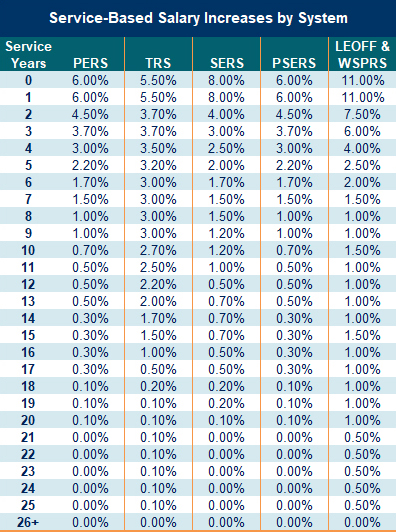

Service-Based salary increase assumption

Other demographic assumptions

In addition to the five demographic assumptions mentioned above, we also study a number of other assumptions such as the probability that a member who leaves employment withdraws their contribution and the probability that a member’s death is duty-related. For a list of these other assumptions and information pertaining to them, please see our 2013-2018 Demographic Experience Study webpage.

Miscellaneous Assumptions/Methods

We include the following miscellaneous assumptions and methods in this valuation.

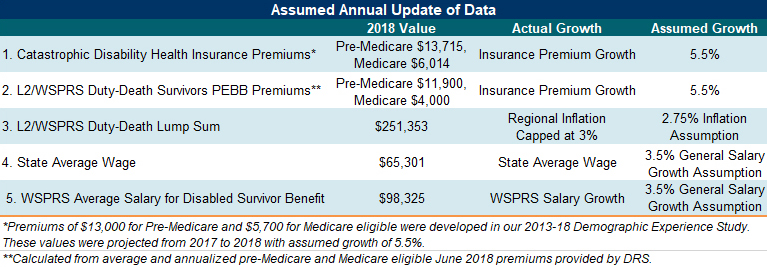

- LEOFF 2 members with catastrophic disabilities and survivors of duty-related deaths in LEOFF 2 and WSPRS receive reimbursement for health insurance premiums under RCWs 41.26.470(10), 41.26.510(5), and 43.43.285(2)(b). Survivors of duty-related death receive health insurance through the Public Employees Benefits Board (PEBB), while members with catastrophic disability retain prior employer coverage or join a plan on the open market. We make assumptions for the amount of annual premium reimbursement for each group. We assume the premiums will grow by 5.5% annually. We relied on the medical trend assumptions for UMP and insured plans from the 2019 PEBB OPEB Valuation report to develop the premium inflation assumption. Please see the table below for our premium assumptions.

- We apply assumed annual updates to certain data used within our software system. These data items will be re-evaluated alongside our 2019-24 Demographic Experience Study.

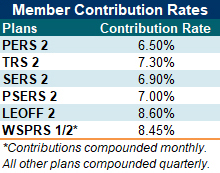

- We make an assumption to help us project the value of accumulated employee contributions with interest if a member elects a refund of contributions. We selected an assumption between contribution rates calculated in the 2018 valuation and our estimation of long-term rates. We will monitor this assumption and plan to update with the next experience study.

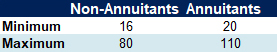

- Minimum and maximum allowable ages are set in the data as follows.

- We assume the gender of beneficiaries for active members will be of the opposite gender as the member. Upon retirement, members typically report the actual gender of their declared beneficiary, and we then use this gender. We will continue to monitor this assumption moving forward.

- Members who receive a disability benefit are not assumed to return to active duty in the future.

- All systems use a midyear decrement timing assumption.

- We assume all survivors of currently retired WSPRS Plan 1 members who did not select a retirement option will receive an initial survivor benefit of 50 percent of the member’s average final salary.

- We assume that future retirees will not elect a Joint and Survivor option, except for future WSPRS Plan 1 retirees, which we assume will elect the 100% Joint and Survivor retirement option (Option B). However, we update this information with actual Joint and Survivor information, if applicable, upon a member's retirement.

- All early retirement and joint and survivor factors are consistent with the DRS administrative factors effective December 1, 2022. Please see the DRS website for more information. Members retiring prior to 1996 use the 1998 joint and survivor factors to calculate the "pop-up" benefit in the event a spouse pre-deceases the member. Additional information can be found in RCW 41.40.188.

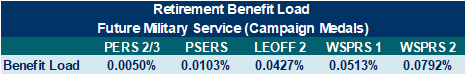

- We develop a load applied to the retirement benefits to model the costs of Interruptive Military Service Credit (IMSC) under SHB 2544, Laws of 2019. The load represents a percentage increase in benefits of granting future IMSC spread across all members. We modified our method of calculating the load from our original fiscal note, consistent with the data and methodology found in the 2022 Legislative Session fiscal note for SB 5726.

- We modified our assumptions to model the provisions of SHB 1701 that provided LEOFF 2 members enhanced benefits. We updated our retirement rates assumption by creating rates that vary by less than or at least 25 years of service. These rates are available in the drop-down menu under the Probability of Service Retirement subsection of this webpage. Additionally, we assumed all active members hired before February 1, 2021, will select the enhanced benefit multiplier if earning at least 15 years of service. All members earning less than 15 years of service will receive the lump sum benefit equal to $100 per month of service. Members hired after February 1, 2021, only have the option of the enhanced benefit multiplier.

- We modified our PSERS disability benefit assumptions to model the provisions of HB 1669 that provided an enhanced disability benefit for PSERS members who experience a qualifying catastrophic disability on the job. We assume of the members expected to experience a disability and select a disability retirement benefit, 60 percent would be line of duty and catastrophic. We further assumed 40 percent of the AFC annuity benefit provided under this bill would be paid through the retirement system.